US Stock Options | Amazon Forward Call Trading Surges, Zoom and Pfizer Options Trading Quadruples

On Tuesday, tech stocks led the decline. The trading volume of call options for Amazon with a strike price of $95 and an expiration date of September 15 surged. The trading volume of Palantir options tripled. Call options for Alibaba accounted for over 70% of the trading volume. Microsoft and Alphabet-C call options accounted for over 60% of the trading volume.

On Tuesday, May 23, US stocks fell, with technology stocks under pressure, and the S&P 500 and Nasdaq both down more than 1%.

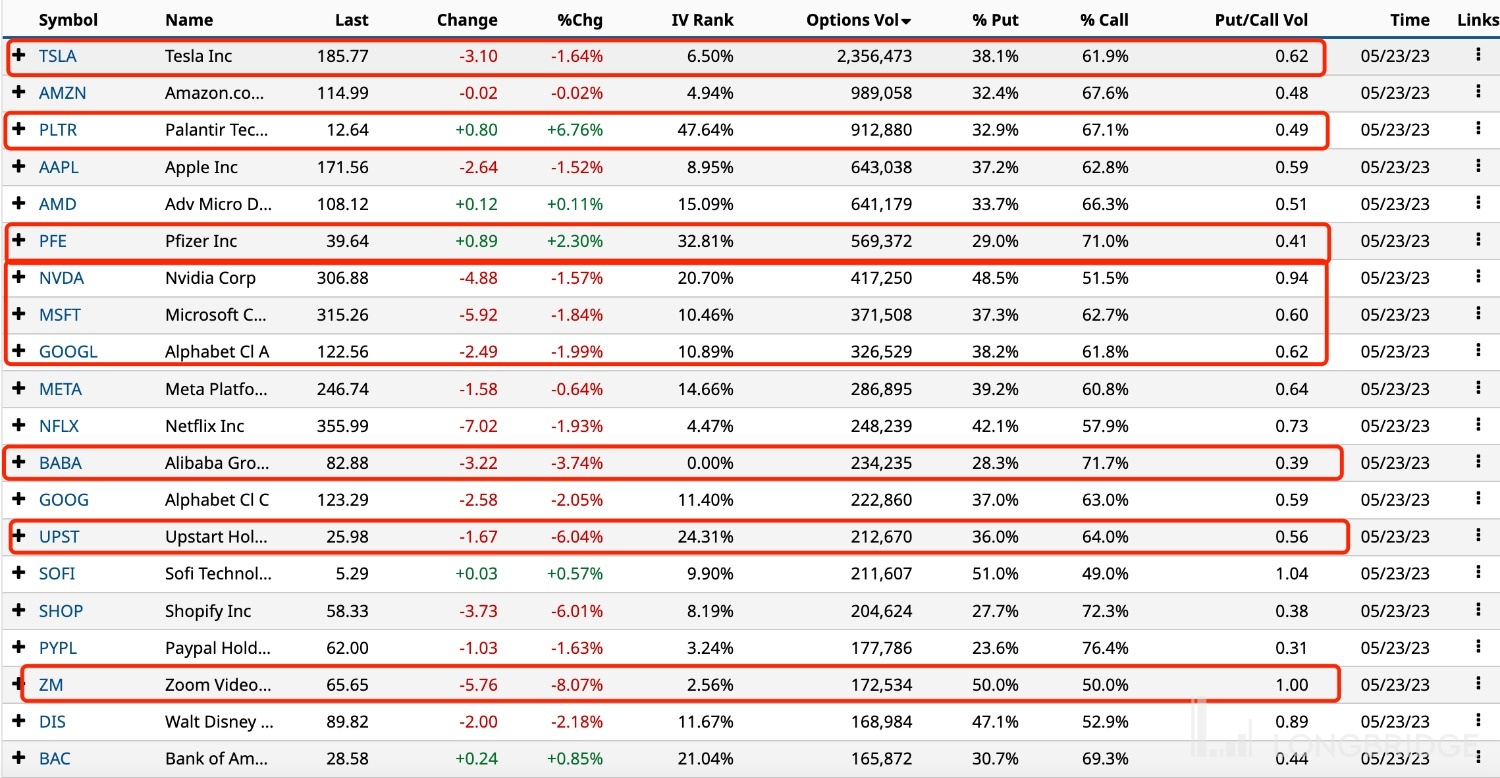

Top 10 US stock options trading

On Tuesday, technology stocks led the decline, ushering in a long-awaited correction.

Top 10 US stock options trading: Tesla, Amazon, Palantir Tech Tech, Apple, AMD, Pfizer, Nvidia, Microsoft, Alphabet-C A, Meta, Netflix, Alibaba.

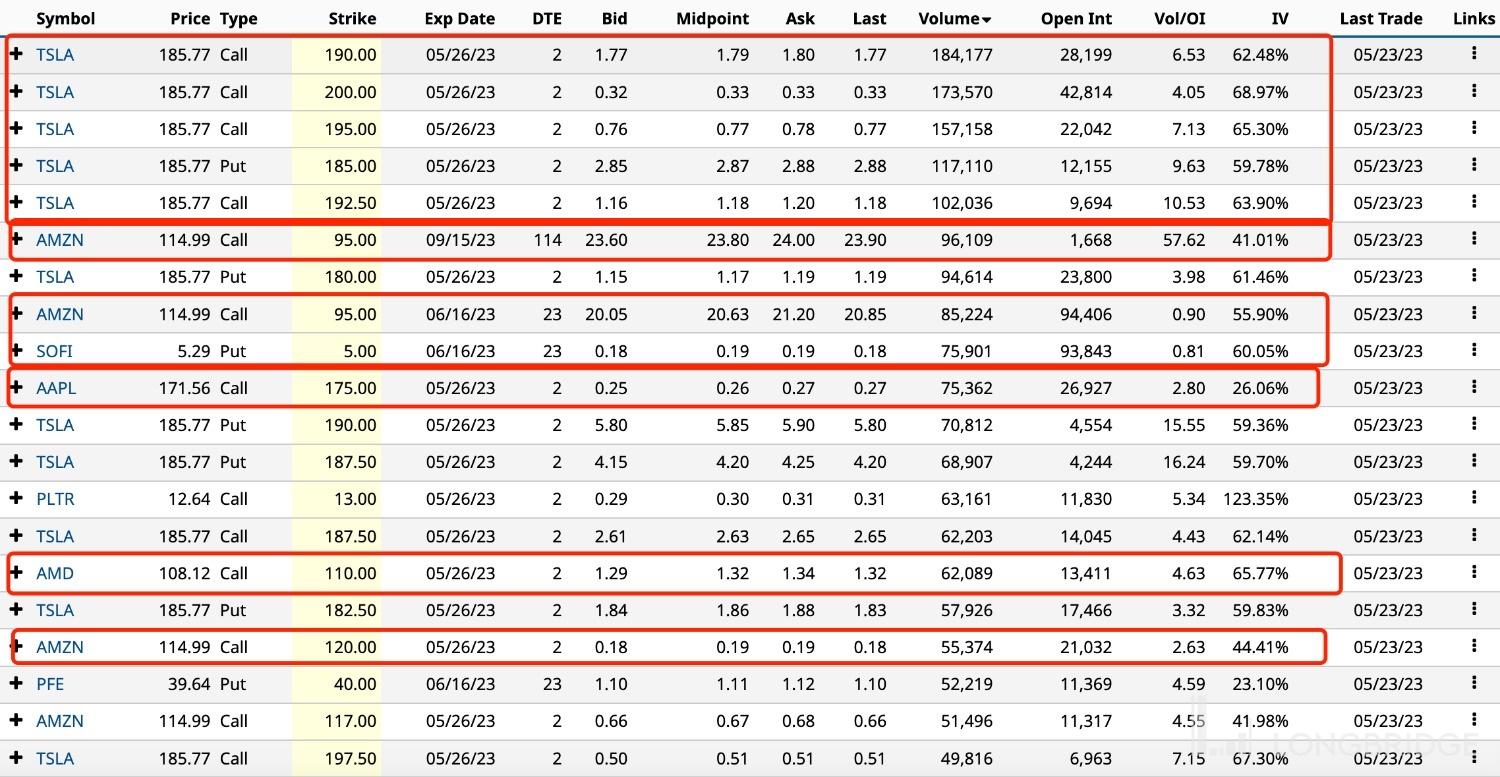

Tesla fell 1.64%, with options trading of 2.36 million contracts, and the proportion of call options trading was 61.9%. Call options with strike prices of $190, $200, and $195 were the most active.

Amazon fell slightly, with options trading of 990,000 contracts, and the proportion of call options trading was 67.6%. Call options with a strike price of $95 and an expiration date of September 15 surged.

Palantir Tech Tech rose nearly 7%, with options trading of 910,000 contracts, three times the daily average, and the proportion of call options trading was 67%.

Apple fell 1.52%, with options trading of 640,000 contracts, and the proportion of call options trading was 62.8%. Call options with a strike price of $175 were the most active.

AMD rose slightly, with options trading of 640,000 contracts, and the proportion of call options trading was 66.3%. Call options with a strike price of $110 were the most active.

Pfizer rose 2.3%, with options trading of 570,000 contracts, more than four times the daily average, and the proportion of call options trading was 71%.

Nvidia fell 1.57%, with options trading of 420,000 contracts, and the proportion of call options trading was 51.5%.

Microsoft and Alphabet-C both fell nearly 2%, with options trading of 370,000 and 330,000 contracts, respectively, and the proportion of call options trading was both over 60%.

Alibaba fell nearly 4%, with options trading of 230,000 contracts, and the proportion of call options trading was over 70%.

Upstart fell more than 6%, with options trading of 210,000 contracts, twice the daily average, and the proportion of call options trading was 64%.

Zoom fell sharply by 8%, with options trading of 170,000 contracts, four times the daily average, and the proportion of call options trading was 50%.