Small Mo: XPENG-W and NIO-SW have the opportunity to "reverse the adversity"! BYD may still have expected differences.

Recently, the stock of new energy vehicles rebounded, and Morgan Stanley attributed part of the reason to the monthly data returning to seasonal trends and Tesla's price increase. However, overall, the demand for the new energy vehicle industry is not good, and competition is intensifying, making it difficult to sustain a large market at the sector level. Market expectations for individual stocks are also relatively consistent, and with the recent recovery in stock prices, valuations are not cheap. Therefore, the market's attention is not very high.

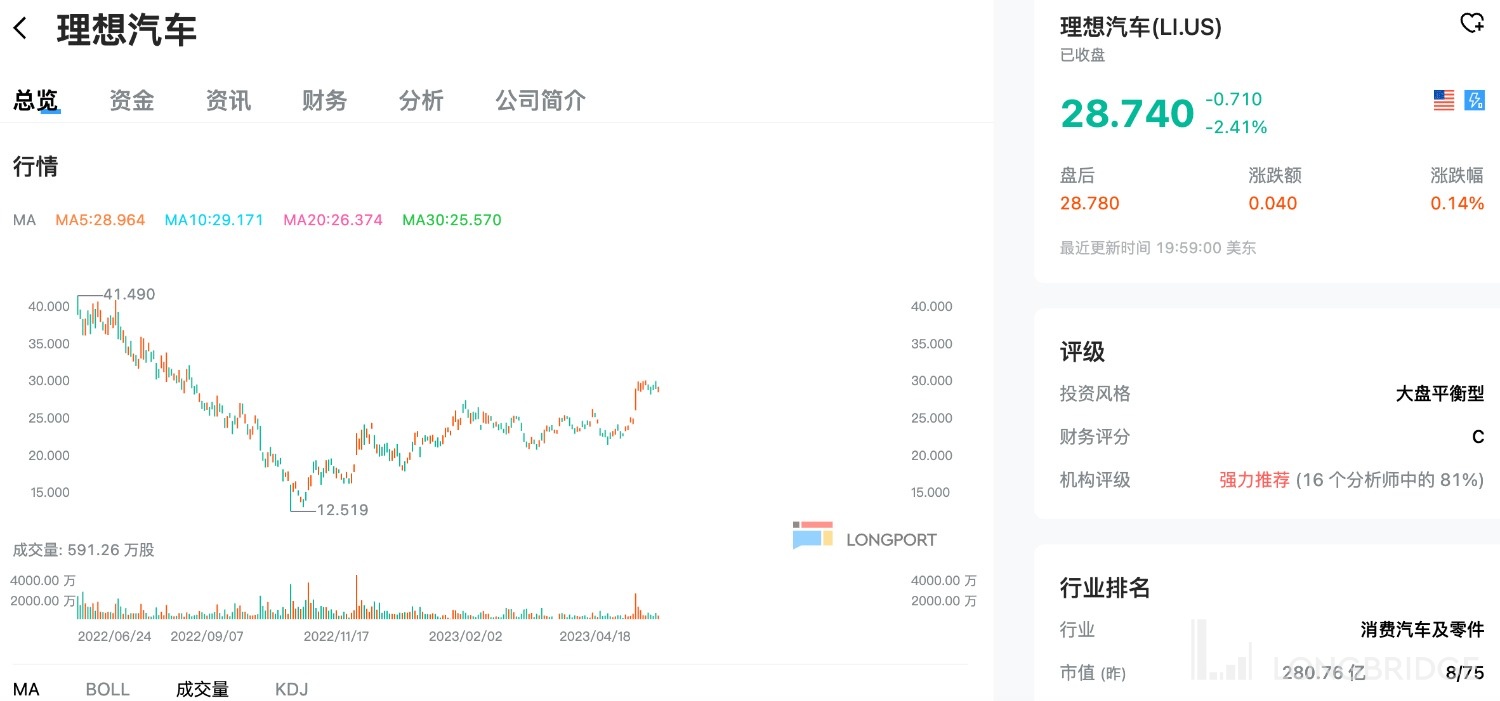

Since May, the overall new energy vehicle stocks have rebounded slightly: industry leader Tesla has risen by more than 13%, Li Auto's US stocks have risen by more than 22%, NIO-SW has risen by more than 11%, and XPENG-W has fallen by more than 4%; Hong Kong stocks BYD have risen by more than 4%.

Despite the good stock price performance, JPMorgan acknowledges that investors are very optimistic about the medium- to long-term development trend of electrification in their communications with new energy vehicle companies. However, the bank notes that short-term industry issues are also prominent:

The macroeconomic recovery is not as expected, and there is no demand;

The supply side competition is still very fierce. Many car companies will still launch new products and lower prices to grab market share this year. If everyone's annual targets are added up, it will definitely exceed the current market capacity, and there is no time point for industry clearance in the short term;

There is no major action on the policy side, and the effect may not be significant.

In summary, the demand for the new energy vehicle industry is not good, competition is intensifying, and it is difficult to sustain a large market at the sector level. The market expectations for individual stocks are also relatively consistent. Coupled with the fact that valuations are not cheap after the recent stock price recovery, the market attention is not very high.

JPMorgan also attributes the recent stock price rebound to the return of monthly data to seasonal trends and Tesla's price increase, and gives different opinions on Tesla, Weilai, and BYD.

(For details on Tesla, please see "Tesla, which suddenly raised prices at the beginning of the month, may reduce prices again this summer?!")

XPENG-W, NIO-SW: The possibility of "adversity reversal" still exists

Does domestic new energy vehicle brands have the opportunity to reverse adversity? JPMorgan says these companies may have!

-

NIO Inc. USD OV: Some investors are very worried that the company will enter the road of expanding production, burning money, introducing mid-to-low-end brands and unable to charge, and are very worried about whether subsequent profits may further deteriorate, and the company is in crisis. Currently, there is still RMB 30 billion in cash on the books, and the local government is backing it. What needs to be paid attention to in the future is the product mix (there is a big difference in the market's opinion on this), and the volume of the 866 model.

-

XPENG-W: The market feedback of the new model G6 and the situation of scattered orders at the auto show are still relatively prominent among the new products. Some investors are worried that this car relies on low prices to boost sales, but consumers in the price range of around RMB 200,000 are more sensitive to cost-effectiveness, and the sales situation needs to be continuously observed in the future. If sales pick up, the company may have the possibility of further financing to enter the finals.

-

GREATWALL MOTOR: The main focus is on the price positioning of the new model Xiaolong. It is necessary to continue to observe the sales situation. Investors who are optimistic and pessimistic about product strength coexist. However, the company's bigger problem is that it has many products that are dragging it down, and the quality of profits is poor. This is also a point that long-term investors are concerned about the company's performance. Similar issues of "dragging behind" also exist in Geely Automobile. The feedback from the Jike new product market is very good, and many people are also asking about the possibility of a turnaround. However, it can be observed that the market is less interested in Geely than in GREATWALL MOTOR, because the market is not very optimistic about the new product Galaxy L7, and if Jike is spun off and listed, it would be better to just buy Jike directly, which would further reduce the interest in Geely.

BYD may still have expected differences

JPMorgan Chase said that BYD's high-frequency data is good, and the company's full-year guidance is relatively aggressive. In the current new energy vehicle market environment, this is the most certain and relatively "consistently optimistic" "configuration ticket". Nevertheless, after communication, the market still has some expected differences worth paying attention to, which may be the driving force for the stock price in the future:

-

The company's guidance for a full-year volume of 3-3.6 million units is still relatively low compared to foreign expectations, which is about 2.5-2.8 million units.

-

Foreign expectations for profitability are relatively low.

-

The export volume this year may exceed expectations, and the full-year volume may reach more than 300,000 units. The monthly data tracked at present is very good, and it may further increase in the future. Some investors are very worried that BYD's entry into the European market is still very short, and it needs to rebuild channels and pay marketing expenses. Moreover, European vehicle regulations are high, and it will be difficult to promote further if there are product problems in the future.

In this regard, JPMorgan Chase's Southeast Asia and Europe teams also provided feedback. BYD's feedback in the local market is very good because the mileage of cars in the same price range is not as good. In the future, it is necessary to pay attention to tracking the local European market, considering whether the actual price after sea transportation, marketing, and value-added tax is economical, and the situation of continuous export volume increase. The bank is generally optimistic.

- The impact of Buffett's stock sale on the stock price has been proven to be small, and many investors are no longer paying attention to the exchange's announcement of Buffett's reduction. The impact on emotional and trading aspects is definitely not significant.