Four months fell more than 40%! Will PDD have a surprise in the first quarter performance?

PDD will release its Q1 financial report on May 26th (Friday). According to Bloomberg analysts, PDD's Q1 2023 revenue is expected to be 32.32 billion yuan, with an adjusted net profit of 5.966 billion yuan. Currently, there are 55 analysts who have given a "buy" rating, with an average target price of $105.36.

PDD will release its Q1 financial report on May 26th (Friday).

Compared to its peak in January 2023, PDD's stock price has fallen for four consecutive months, with a pullback of over 40%.

Q1 Financial Forecast

According to Bloomberg analysts, PDD's Q1 2023 revenue is expected to be RMB 32.32 billion, with an adjusted net profit of RMB 5.966 billion. In the same period last year, PDD's revenue was RMB 23.8 billion, with an adjusted net profit of RMB 4.2 billion.

The average target price is $105.36.

PDD Q4 2022

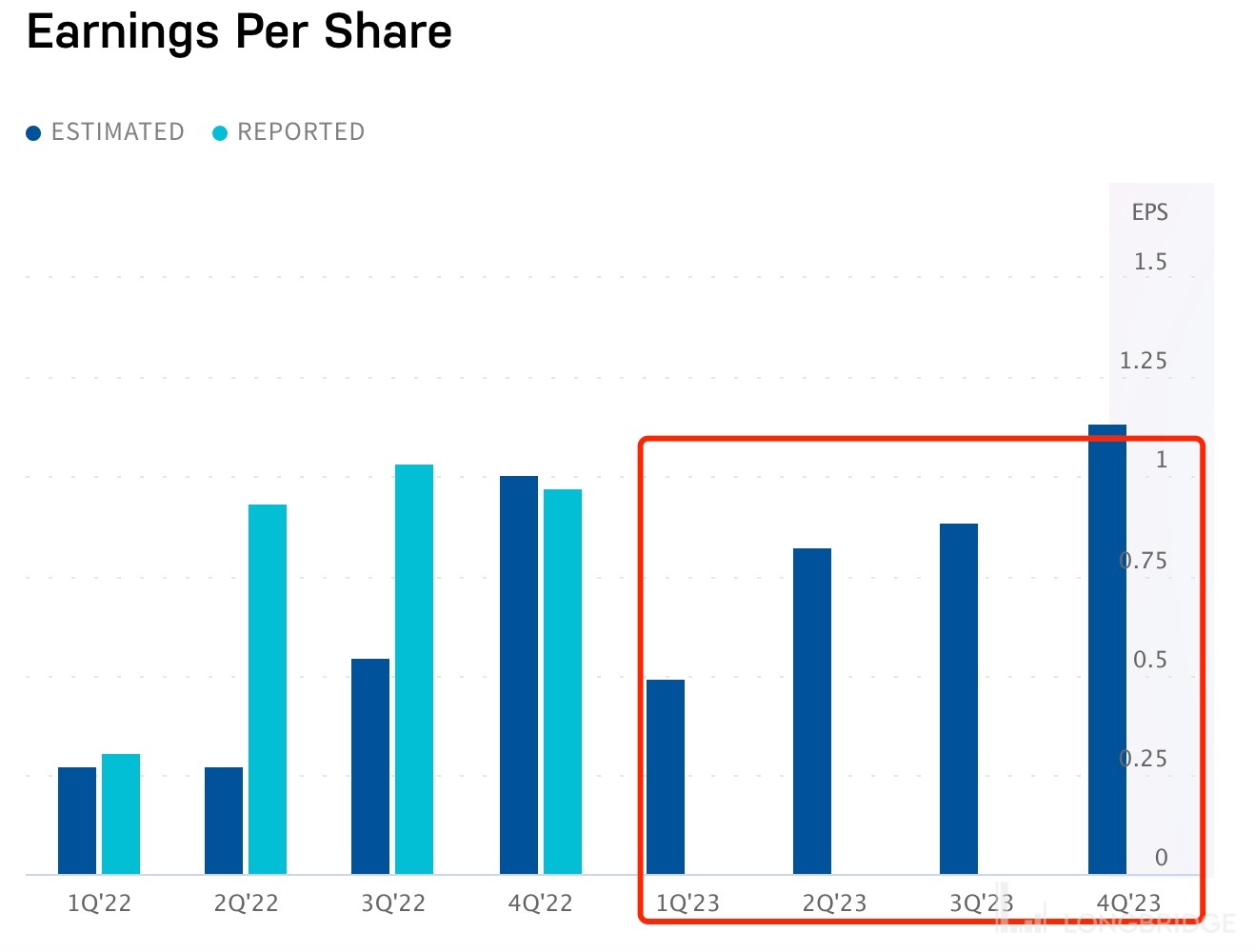

According to Zacks Investment Research, based on the forecasts of two analysts, PDD's Q1 earnings per share are generally expected to be $0.49, compared to $0.3 in the same period last year.

Expected YoY Growth of 24.1% in Q1 PDD GMV

According to data from the company and models, excluding 1P business (PDD's own procurement and sales of goods, similar to JD's self-operated business), PDD's total GMV in Q1 2023 may be RMB 750.9 billion, with a YoY growth of 24.1%, compared to RMB 26.99 billion in March 2023, with a YoY growth of 34.7%.

If PDD's grocery contribution to GMV is included, the total GMV in Q1 2023 may be RMB 777.9 billion, with a YoY growth of 24.5% and a QoQ growth of 24.1% in Q4 2022. The GMV data mentioned above does not include any sales from its overseas business.

How is Temu progressing?

PDD's overseas journey continues to advance.

In April, its cross-border e-commerce brand TEMU officially launched in multiple European countries. Two days after its launch in the UK, TEMU simultaneously launched in Germany, the Netherlands, Italy, France, and Spain. Previously, TEMU had already launched in the US, Canada, New Zealand, Australia, and other countries.

TEMU's tentacles have now reached nearly half of the global e-commerce market, covering four continents and ten countries overseas, and this is only 7 months after PDD's official overseas launch.

According to a report by mobile intelligence company Sensor Tower, in the month ending March 26th, TEMU has become the most downloaded app in the US app store (only counting Apple and Alphabet-C's official app stores). It has been at the top of the free shopping app rankings in the US for 170 days, and for 120 days, 20 days, and 39 days in Canada, Australia, and New Zealand, respectively. In addition, the repurchase rate of TEMU has reached about 10%, with an average transaction amount of about $25.

Investment Advice

Cinda Securities stated that as a platform e-commerce leader with relatively reasonable valuation and strong growth, PDD is expected to benefit from economic recovery and achieve better performance growth in 2023. At the same time, its global e-commerce business Temu has broad prospects for going global, and it is a key company that the institution focuses on in the e-commerce industry.

Cinda Securities emphasized that overall, in the e-commerce industry, PDD is still the most promising in terms of performance growth certainty.

According to a report by Morgan Stanley, PDD benefits from the long-term consumption trend of "low price" in the minds of users. Although the same industry subsidy plan may intensify competition and may affect short-term profit margins, the group's market share is unlikely to be challenged. In addition, expanding the coverage of branded products will help support the company's growth and make it a structural growth stock in China's e-commerce industry. The bank has upgraded its rating to buy and raised its target price to $113.