Financial report is out | XPENG-W drops more than 5% in pre-market trading! Q1 revenue almost halved, Q2 guidance significantly below expectations.

XPENG-W's Q1 revenue was RMB 4.03 billion (USD 590 million), a YoY decrease of 45.9% and a QoQ decrease of 21.5%. XPENG-W is expected to deliver 21,000 to 22,000 vehicles in Q2, with a market estimate of 27,800.

XPENG-W has released its Q1 financial report. XPENG-W's Q1 revenue was RMB 4.03 billion ($590 million), a year-on-year decrease of 45.9% and a quarter-on-quarter decrease of 21.5%. XPENG-W expects to deliver 21,000 to 22,000 vehicles in Q2, with a market estimate of 27,800.

In pre-market trading, XPENG-W fell 5.5%.

Q2 Guidance

For Q2 2023, XPENG-W expects:

‧ Vehicle deliveries to be between 21,000 and 22,000, a year-on-year decrease of about 36.1% to 39.0%.

‧ Total revenue to be between RMB 4.5 billion and RMB 4.7 billion, a year-on-year decrease of about 36.8% to 39.5%.

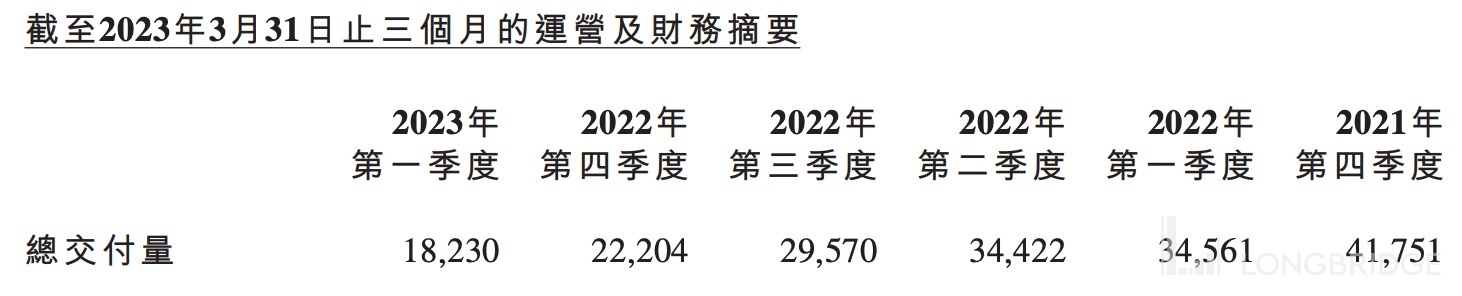

Q1 Operating Data

The total number of vehicles delivered in Q1 was 18,230, a decrease of 17.9% from Q4 2022.

As of March 31, 2023, XPENG-W's physical sales network has reached 425 stores, covering 145 cities.

As of March 31, 2023, XPENG-W's self-operated charging station network has reached 1,016 charging stations, including 816 XPENG-W self-operated super charging stations and 200 destination charging stations.

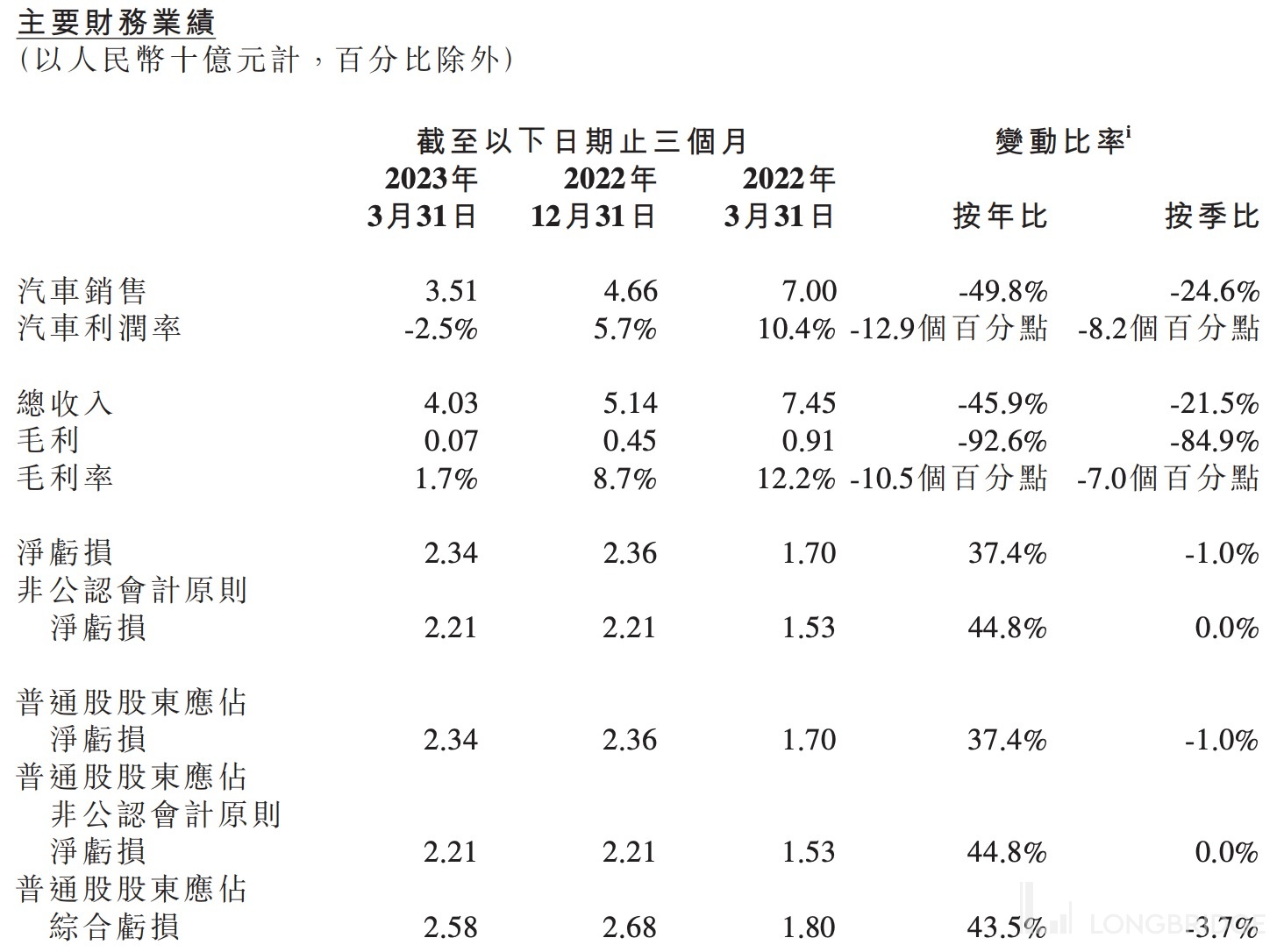

Q1 Financial Data

XPENG-W's Q1 revenue was RMB 4.03 billion ($590 million), a year-on-year decrease of 45.9% and a quarter-on-quarter decrease of 21.5%.

Revenue from vehicle sales was RMB 3.51 billion ($510 million), a year-on-year decrease of 49.8% and a quarter-on-quarter decrease of 24.6%.

The gross profit margin for Q1 was 1.7%, compared to 12.2% for the same period in 2022 and 8.7% for Q4 2022.

The net loss for Q1 was RMB 2.34 billion ($340 million), compared to RMB 1.70 billion for the same period in 2022 and RMB 2.36 billion for Q4 2022.

The non-GAAP net loss for Q1 was RMB 2.21 billion ($320 million), compared to RMB 1.53 billion for the same period in 2022 and RMB 2.21 billion for Q4 2022.

As of March 31, 2023, cash and cash equivalents, restricted cash, short-term investments, and time deposits were RMB 34.12 billion ($4.97 billion), with significant year-on-year and quarter-on-quarter decreases. In the first quarter, the basic and diluted net loss per American depositary share was RMB 2.71 yuan (USD 0.40), while the basic and diluted net loss per ordinary share was RMB 1.36 yuan (USD 0.20).

Executive's words

Mr. He Xiaopeng, Chairman and CEO of XPENG-W, expressed great confidence in building a positive cycle of product sales, team morale, customer satisfaction, and brand reputation in the next few quarters.

The first new model using SEPA2.0 technology architecture, G6, will be officially launched in June 2023. It is believed that G6 will become one of the most popular new energy SUVs in China, with a price range between RMB 200,000 and RMB 300,000.

Dr. Gu Hongdi, Honorary Vice Chairman and Co-President of XPENG-W, said that looking ahead, we will take the rapid expansion of sales and market share as the company's primary strategic goal. With the rapid growth of sales driven by G6 and other new products, we expect a significant improvement in operating cash flow.