CICC: US stocks temporarily avoid sharpness in the short term, and turn to growth stocks after the mid-term recession trade is realized!

CICC is not pessimistic about the prospects of US stocks! In the short term, if there are issues with banks and debt ceiling upgrades, risk appetite will be under pressure; in the medium term, if monetary shift is to be achieved at the cost of profit decline, the NASDAQ Composite Index may have better returns.

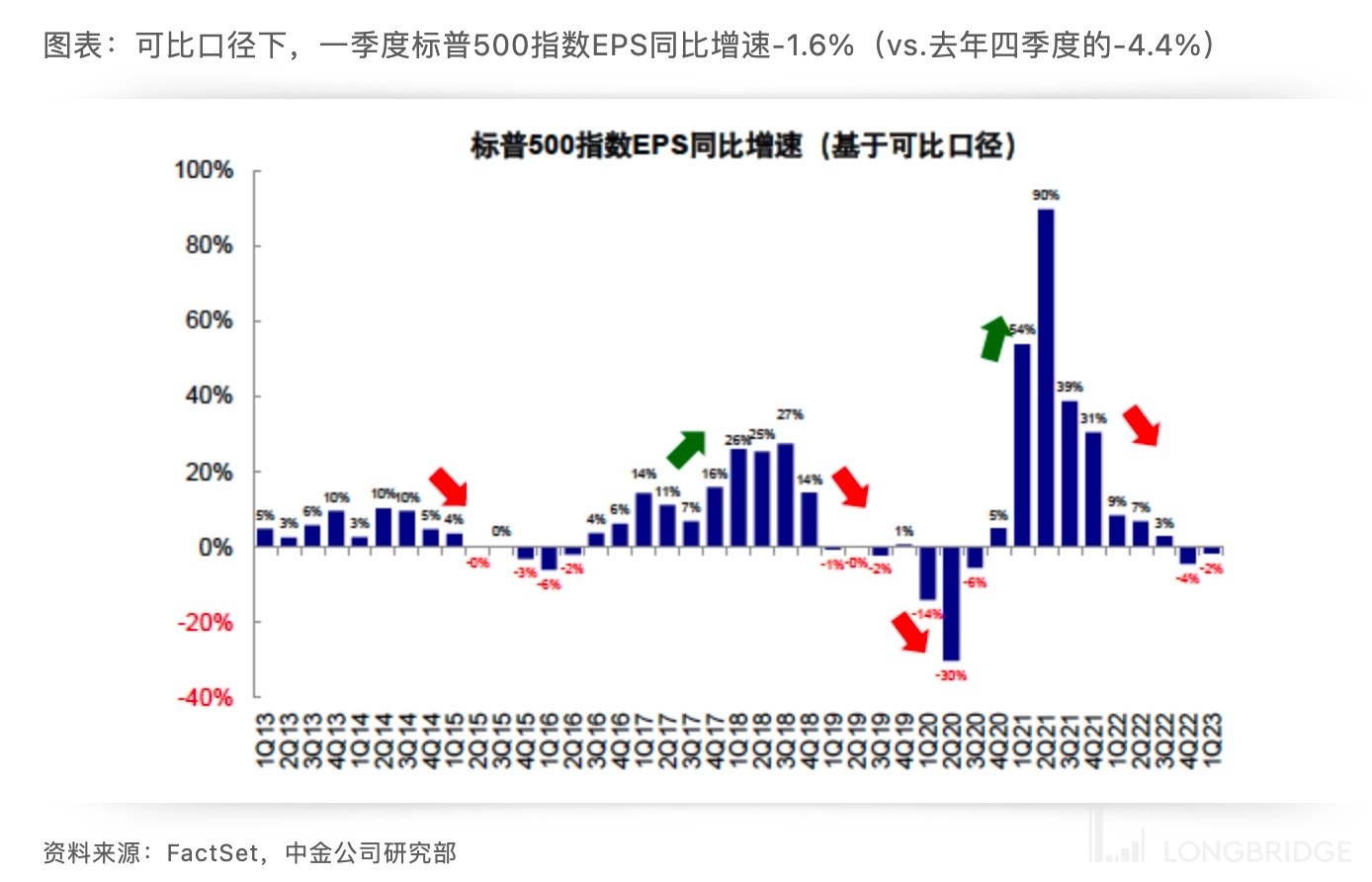

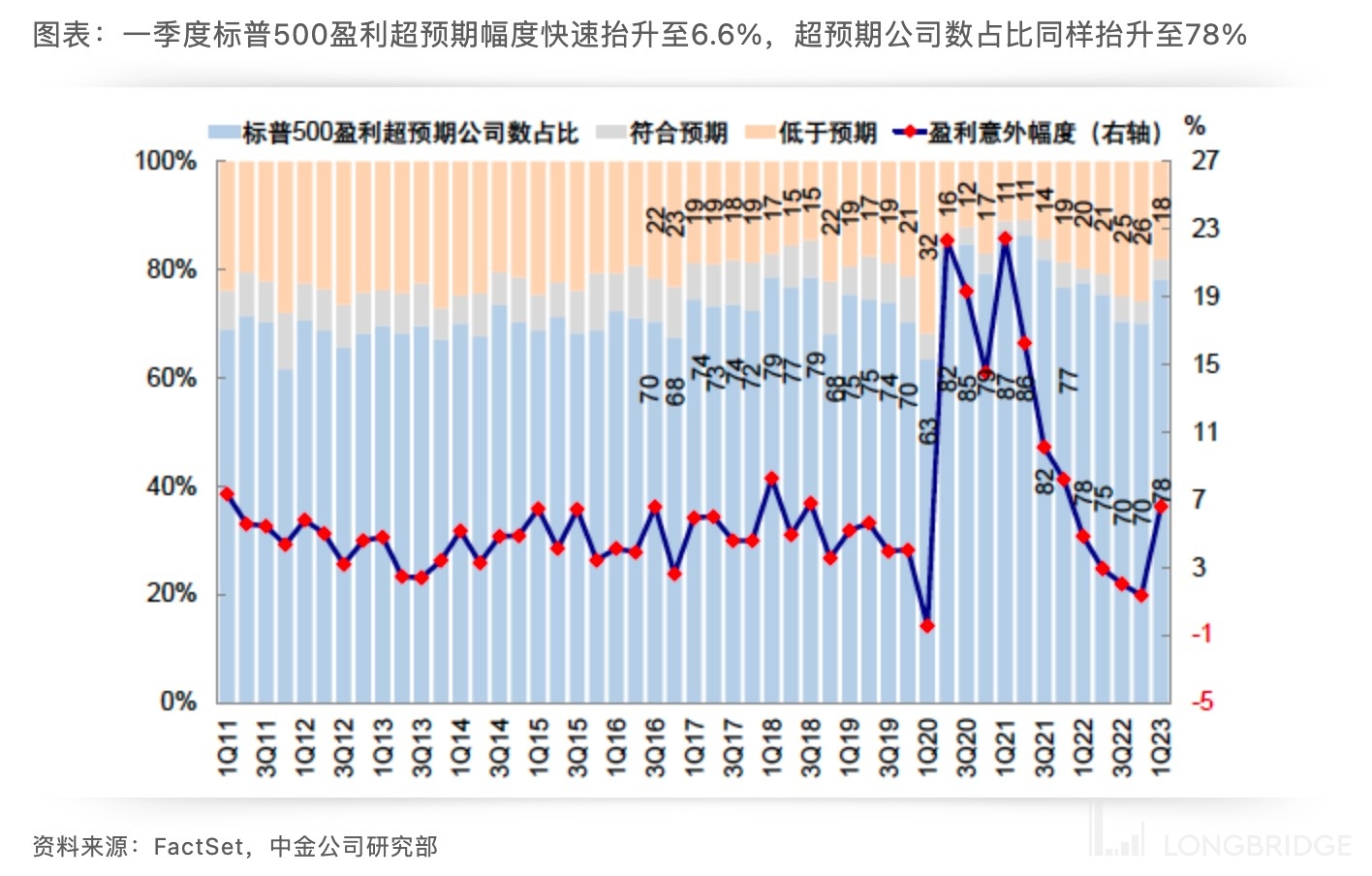

The Q1 2023 performance of the US stock market has been largely disclosed, and the profit growth rate is still negative.

In the early Q1, major macroeconomic data in the United States were generally better than expected. While triggering discussions about whether the US economy is in decline, it also pushed up inflation and interest rate expectations. However, in the context of continued monetary tightening, risks of European and American banks continue to be exposed, and concerns about the pressure faced by the banking industry in the post-rate hike cycle of the Federal Reserve are also increasing.

From tight monetary to tight credit, under the sustained growth pressure, what is the prospect of US stock market profitability? What impact will it have on the future trend of the US stock market?

Analysts Li Hemin and Liu Gang of CICC noticed that the current valuation of the US stock market is still relatively high (S&P 500 dynamic valuation is 18 times, higher than the average of 16 times since 1990), and the equity risk premium is relatively low (the current S&P 500 equity risk premium is 2.1%, still at a relatively low level in history), while profits may continue to be under pressure (the current market expects the S&P 500 profit growth rate in 2023 to be 1.7%, or further fall to -5.6%), maintaining the judgment of "suppressing before rising".

In the short term, if bank problems and debt ceilings escalate, risk appetite will be under pressure; if risks are eased, excessive loose expectations may face a backlash. Of course, this view may be too conservative, for example, the market may have limited decline, but waiting for risks to settle is also a strategy.

However, in the medium term, based on the judgment that inflation in the second half of the year can gradually fall back and bank problems are not systemic risks, the bank is not pessimistic about the prospects of the US stock market, but only expects to achieve monetary shift at the cost of weakening profitability, and the NASDAQ Composite Index may have better returns at that time.

In short: avoid sharp edges in the short term, and turn to growth stocks after the recession trade is realized in the medium term.