MEITUAN-W enters "Hong Kong", no new story

"In Hong Kong, MEITUAN-W cannot rely solely on price." Price wars are a Pandora's box. Once opened, competition will become a simple cash flow game, and the scale of Foodpanda and Deliveroo is clearly incomparable to that of MEITUAN-W. MEITUAN-W's entry into the Hong Kong market may have another layer of meaning - a practical exercise in going global in Hong Kong.

On May 22nd, at 8am, MEITUAN-W's new brand "KeeTa" launched on time in Hong Kong, with the first pilot areas being Mong Kok and Tai Kok Tsui. The official statement said that related services will gradually cover the whole of Hong Kong by the end of this year.

"Although I don't care about subsidies, my colleagues and I were still persuaded by the 300 yuan new customer reward and 50 yuan new user reward all morning." Amy (pseudonym) is a mainland Chinese working in Hong Kong. She is already accustomed to the so-called new user and new customer rewards, but still cannot resist the invitation from her colleagues.

Prior to this, news of MEITUAN-W's entry into Hong Kong had already spread, and the news of recruiting full-time riders for a monthly salary of HKD 35,000 had attracted attention. With the launch of KeeTa, it indicates that MEITUAN-W has entered a new stage in terms of performance and merchant pool layout. In order to ensure a foothold in Hong Kong, the platform has also launched subsidies that look impressive, gathering users in a typical internet way.

MEITUAN-W's entry into Hong Kong will seriously impact the two local food delivery platforms, Foodpanda and Deliveroo. It is reported that a spokesperson for Deliveroo Hong Kong previously mentioned that after seven years of development in Hong Kong, they are optimistic about the food and daily necessities delivery market, and view competition as a driving force for innovation, while also launching discount activities to respond to challenges from MEITUAN-W. Another local food delivery platform, Foodpanda, also announced that it will launch a new membership system "one dollar per month" trial plan and discounts for self-pickup to as low as 60% off.

"The price war is a Pandora's box. Once opened, competition will become a simple cash flow game, and the scale of Foodpanda and Deliveroo is clearly incomparable to MEITUAN-W."

Keeta has no new story

Mong Kok and Tai Kok Tsui are the first two stations for MEITUAN-W to land in Hong Kong, which inevitably reminds people of Baidu Takeout during the food delivery war - focusing on commercial districts and office areas.

There is no need to mention the prosperity of Mong Kok, but the west side of Tai Kok Tsui is a relatively special area. The area is full of restaurants, with high residential density. Due to the development of the real estate market, the old and new street blocks are laid out in a scattered manner, forming a mixture of old district culture and Chinese flavor. Although Tai Kok Tsui is not large, the supply-side merchants and demand-side users are relatively rich, making it easy for KeeTa to achieve a breakthrough.

Ten years ago, MEITUAN-W attracted users with subsidies, and ten years later, KeeTa still raised the banner of subsidies, launching a subsidy policy called the "One Billion Reward Plan" as soon as it went online. From a product perspective, the main interface of the KeeTa APP is completely different from that of the MEITUAN-W APP, with subsidies prominently displayed on the homepage, followed by a horizontal list of categories, and then single item recommendations. It is currently unclear whether the platform has launched the value-added service on the push page at the bottom, but one thing is certain, it will definitely happen in the future.

KeeTa's new user acquisition includes two dimensions: a 50 yuan referral reward for the referrer and a 300 yuan new user red envelope for the new user. It can be seen that it is completely copied from the domestic market. The so-called 300 yuan subsidy is actually a "marketing term", and it is difficult to fully enjoy the corresponding value in the actual use process.

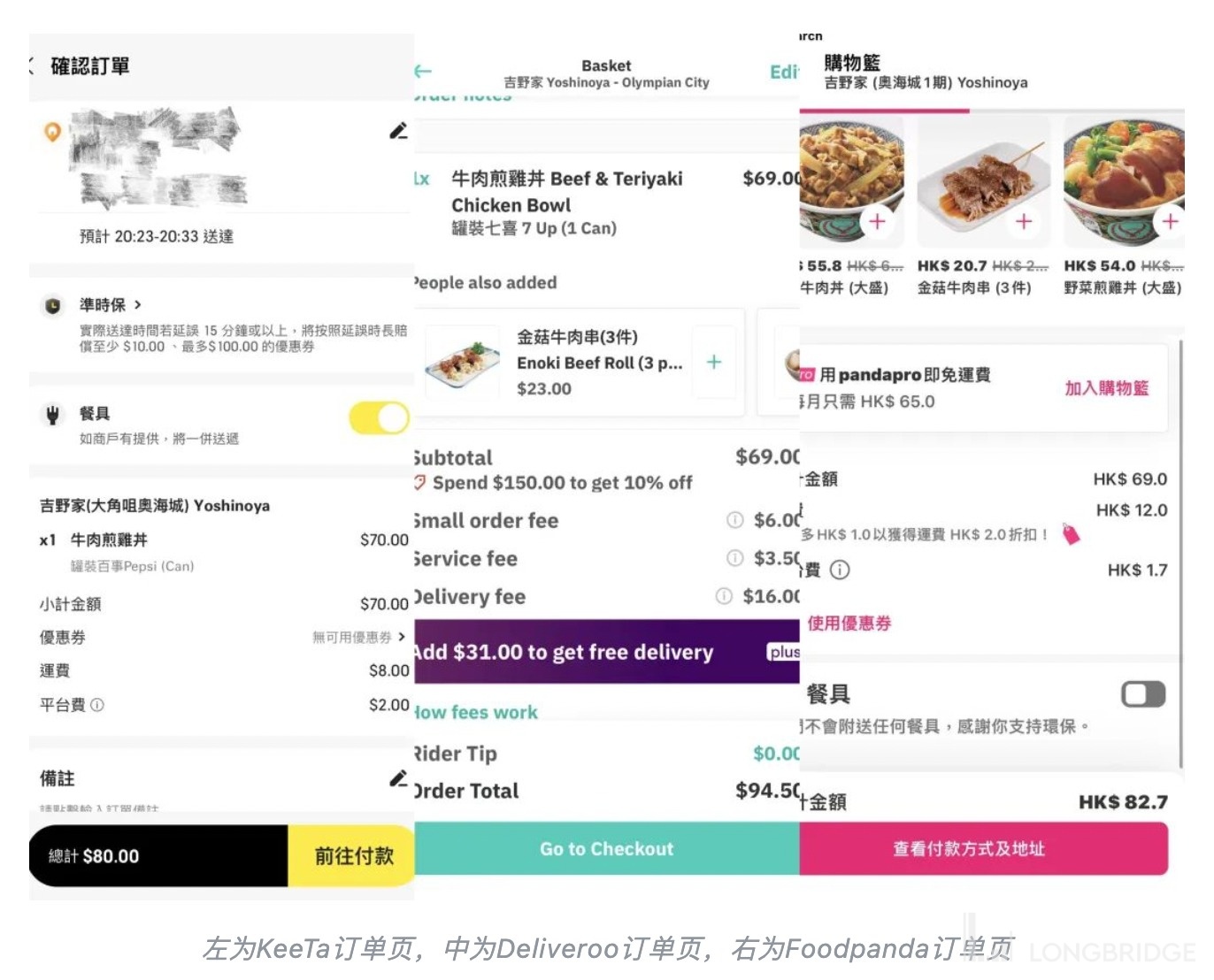

A user named Linda (pseudonym) who lives in Tai Kok Tsui demonstrated the price difference of ordering a "beef and chicken bowl" from Yoshinoya Hong Kong Tai Kok Tsui O Plaza store on three food delivery platforms. Among them, KeeTa needs to spend 80 yuan, including 8 yuan for shipping and 2 yuan for platform fees; the most expensive is Deliveroo, which still needs 94.5 yuan even with a membership discount, including 6 yuan for small order fees, 3.5 yuan for service fees, and 16 yuan for delivery fees; while Foodpanda needs 82.7 yuan, including 12 yuan for shipping and 1.7 yuan for platform fees.

Taking the "free shipping coupon" as an example, it requires a minimum purchase of 100 yuan, and can reduce up to 45 yuan. However, for most users, it is difficult to place an order that is far away within a range of more than ten square kilometers. Moreover, if you purchase Deliveroo membership, you can enjoy free shipping for orders over 100 yuan, which will allow KeeTa to offer more favorable prices in the high-end market through subsidies.

It is worth mentioning that without subsidies, KeeTa's platform fees have not opened up a gap with its competitors, and its real advantage lies in shipping fees. Therefore, we can roughly assume that MEITUAN-W's entry into the Hong Kong food delivery market is mainly focused on "price", and its focus is on the shipping fees that local users have been suffering from for a long time.

Combined with the news of high-paying recruitment of full-time delivery staff, MEITUAN-W is outputting high-performance-to-price ratio to the market through various strategies. On the other hand, in terms of the richness of the supply side, MEITUAN-W seems to have also put in a lot of effort.

When browsing the KeeTa page on Photon Planet, it was found that the platform has now gathered a very considerable group of merchants, including well-known chain brands such as KFC, McDonald's, Yoshinoya, and Maxim's MX, as well as popular local restaurants such as HUNGFOOKTONG, Bridge Bottom Dai Pai Dong, and Like Rice Noodles.

"In Hong Kong, MEITUAN-W cannot rely solely on price." A local user said that Deliveroo, Foodpanda, and HSBC credit cards have cooperation, and users can redeem discount privileges with points. This means that before KeeTa finds a local partner bank, it needs to use real money to make up for the low price in order to impress users. KeeTa not only competes with local platforms in the takeaway field, but also with self-pickup and dine-in services. According to Light Planet, if KeeTa uses subsidy coupons, it can lower prices to be lower than self-pickup and consistent with dine-in prices.

In addition to subsidies, KeeTa has also brought mainland China's "on-time guarantee" service policy to Hong Kong to solve the problem of delivery delays. Short-term users do not need to pay for insurance services, which will be borne by the platform.

Hong Kong version of the "takeaway war"

Wang Xing once said that "people all over the world need to eat", which laid the foundation for MEITUAN-W's globalization. This entry into the Hong Kong market also marks the first confrontation with overseas takeaway players.

Currently, the Hong Kong takeaway market is mainly dominated by Foodpanda and Deliveroo, which entered the Hong Kong market in 2014 and 2015, respectively. Foodpanda's market share is around 51%, with about 1.2733 million active users, while Deliveroo's market share in Hong Kong is about 46%. Former platforms such as Uber Eats and HKTV Express have already withdrawn from the Hong Kong market.

Foodpanda and Deliveroo each dominate half of the Hong Kong takeaway market, but there are differences in their positioning. Deliveroo focuses on high-end and boutique restaurants, so its target users are more high-spending. Foodpanda has a larger user base and initially focused on delivering fast food and other popular and affordable meals.

As the market expands, there is already a clear trend of "mutual invasion" in the access of restaurants by the two platforms, and KeeTa's entry will intensify this restaurant battle.

Foodpanda and Deliveroo occupy more than 95% of the Hong Kong takeaway market, but this does not mean that the market is saturated. Public data shows that the current proportion of Hong Kong's takeaway transactions to the catering industry is only 8.3%, far lower than the 21.9% in the mainland market. This is both an opportunity and a challenge for MEITUAN-W.

Ami frankly stated that after the epidemic, local Hong Kong users tend to order on takeaway platforms and then pick up the food themselves. On the one hand, this is due to the deepening of the habit of contactless delivery during the epidemic, and on a deeper level, it is due to the high cost of takeaway consumption in Hong Kong.

Looking at the two platforms of Foodpanda and Deliveroo, the initial minimum order amount for both was basically HKD 80-90, equivalent to about RMB 70-80. Influenced by KeeTa's entry into the market, Foodpanda was forced to follow the low-price strategy and has now lowered its minimum order amount to around HKD 60. Deliveroo still maintains a minimum order amount of HKD 75. Light Planet found that KeeTa's minimum order amount is significantly lower than the other two platforms, at around HKD 50-60. Compared with the minimum order amount of RMB 20 in mainland China, the overall average order value of takeaway food in Hong Kong is significantly higher. At the same time, if the selected product does not meet the minimum order requirement, Hong Kong's food delivery platforms usually ask users to make up the difference. For example, if the selected food and beverage product is priced at HKD 70, the user needs to make up the remaining HKD 10 at checkout to reach the HKD 80 minimum order requirement in order to complete the purchase. This is the so-called "small order fee."

In addition, expensive delivery fees also increase the cost of food delivery for Hong Kong users. The delivery fees for each order on the two major food delivery platforms in Hong Kong range from HKD 20 to HKD 40, and the restaurants are mostly concentrated within 1km. Overall, the cost of food delivery orders is mostly around HKD 100, which is not cost-effective for users.

As the distance increases, the delivery fee on food delivery platforms also increases accordingly. According to Photon Planet's research, the delivery fees for KeeTa platform restaurants when the distance from the consumer is 200m, 400m, 700m, and 1100m are HKD 8, HKD 11, HKD 17, and HKD 24, respectively. Currently, KeeTa's delivery fees are lower than those of the Foodpanda and Deliveroo platforms.

In the mainland market, one of the core advantages of MEITUAN-W's food delivery service is its well-established delivery network and sufficient rider resources, which are important guarantees for reducing food delivery costs and improving user experience. Now that MEITUAN-W has entered the Hong Kong market, if it can improve the high delivery costs in the local area, it will become an important support for KeeTa to establish a foothold in the market.

Faced with such high delivery costs, it is not surprising that MEITUAN-W is recruiting riders in Hong Kong with a maximum salary of HKD 35,000. The high labor costs in Hong Kong and the limited delivery methods due to transportation have overall increased MEITUAN-W's delivery costs in the Hong Kong region.

MEITUAN-W's rider recruitment in Hong Kong mainly includes infantry, bicycle riders, and electric bicycle riders. Among them, infantry refers to walking food delivery personnel, which is the difference in food delivery in Hong Kong. Walking delivery has increased the demand for delivery teams on the platform in the case of affecting delivery efficiency, thus increasing the overall delivery cost.

Currently, KeeTa has just launched and has a comparable advantage in overall delivery costs, but it is not yet certain whether this is a new user acquisition strategy during the initial launch of the platform.

In the mainland market, MEITUAN-W reduces overall delivery costs by improving rider acceptance and delivery efficiency. If MEITUAN-W can fundamentally improve the delivery costs in the Hong Kong region, it will hit one of the most important pain points in the development of food delivery in Hong Kong, and provide certainty for KeeTa's expansion.

Two Hidden Lines

In the current context of Douyin, Alibaba, and JD.com frequently increasing their investment in local life, MEITUAN-W's entry into the Hong Kong food delivery market is obviously aimed at opening up new markets and hedging against competition in the old market.

At present, KeeTa's "1 billion reward" for shipping fees and new user acquisition is actually triggering the "food delivery war" in Hong Kong. As long as there is a platform to follow suit, other competitors will not sit still. Once everyone starts a subsidy war, the larger scale will stand invincible. Because subsidies turn the competition between platforms from an all-round game into pure capital consumption, and this happens to be what MEITUAN-W lacks the least. Moreover, MEITUAN-W's patience is well-known.

Entering the Hong Kong market may have another deeper meaning - a practical exercise in going global.

Deliveroo and Foodpanda are two global takeaway platforms. Deliveroo was founded by Chinese Xu Zixiang in the UK in 2013 and has now launched takeaway services in many regions such as the UK, France, Spain, Italy, Singapore, and Australia. Foodpanda is a mutual aid internet takeaway platform under the German takeaway company Delivery Hero. Since its operation in 2012, its business has covered many regions in Asia and Europe, especially in Southeast Asia.

If MEITUAN-W has plans to continue going global in the future, then Hong Kong is indeed an excellent practical training ground: here, there are opponents that will definitely be encountered when going global, completely different business models from the mainland, and high delivery costs - which also provide more room for development.