Earnings Report is Out | MEITUAN-W's Adjusted Net Profit in Q1 Reaches Record High, Revenue Significantly Exceeds Market Expectations

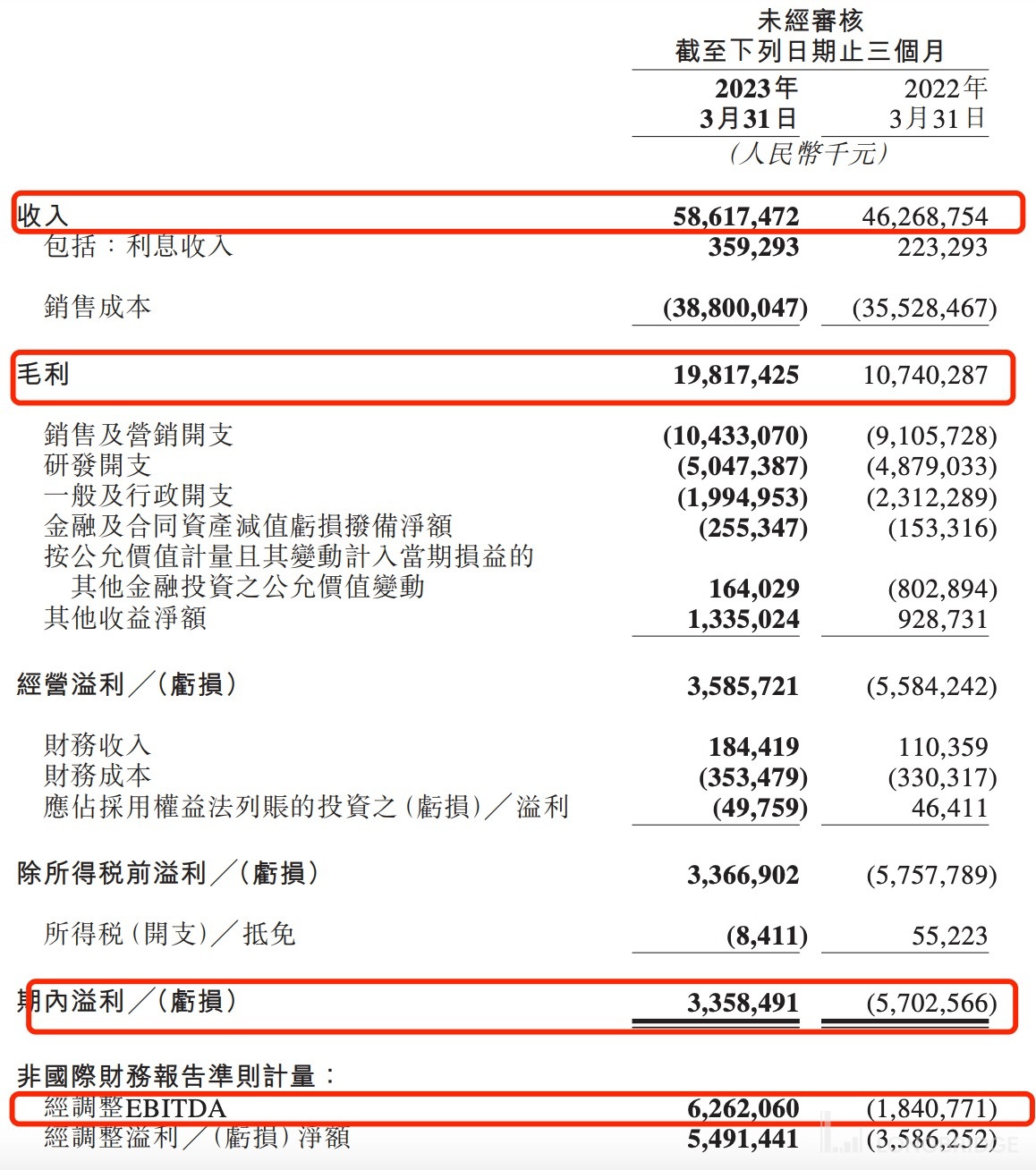

MEITUAN-W's Q1 revenue was RMB 58.62 billion, up from RMB 46.27 billion in the same period last year, and market expectations were RMB 56.481 billion. Adjusted net profit for the first quarter was RMB 5.5 billion, compared to a loss of nearly RMB 3.6 billion in the same period last year, reaching a historic high.

On Thursday, May 25th, MEITUAN-W released its Q1 financial report.

MEITUAN-W's Q1 revenue was RMB 58.62 billion, compared to RMB 46.27 billion in the same period last year, and market expectations of RMB 56.481 billion.

Adjusted net profit for Q1 was RMB 5.5 billion, compared to a loss of nearly RMB 3.6 billion in the same period last year, reaching a historical high.

Q1 Operational Data

In Q1, the real-time delivery volume increased by 14.9% YoY to 4.267 billion orders; driven by the growth in transaction users and transaction frequency, MEITUAN-W's flash purchase order volume increased by about 35% YoY.

In Q1, the number of active merchants increased by more than 30% YoY, and non-food specialty stores, liquor and flowers maintained high-speed growth.

In terms of MEITUAN-W's grocery shopping, the transaction volume in Q1 2023 increased by more than 50% YoY.

By the end of March, the cumulative number of transaction users for MEITUAN-W Youxuan had reached 450 million.

Q1 Financial Data

MEITUAN-W's Q1 revenue was RMB 58.62 billion, compared to RMB 46.27 billion in the same period last year, a YoY increase of 26.7%, and market expectations of RMB 56.481 billion.

Adjusted net profit for Q1 was RMB 5.5 billion, compared to a loss of nearly RMB 3.6 billion in the same period last year, reaching a historical high.

Sales and marketing expenses increased by 14.6% from RMB 9.1 billion in Q1 2022 to RMB 10.4 billion in the same period of 2023.

Research and development expenses increased by 3.5% from RMB 4.9 billion in Q1 2022 to RMB 5.0 billion in the same period of 2023, and the percentage of revenue decreased by 1.9 percentage points YoY to 8.6%.

General and administrative expenses decreased from RMB 2.3 billion in Q1 2022 to RMB 2.0 billion in the same period of 2023, and the percentage of revenue decreased by 1.6 percentage points YoY to 3.4%.

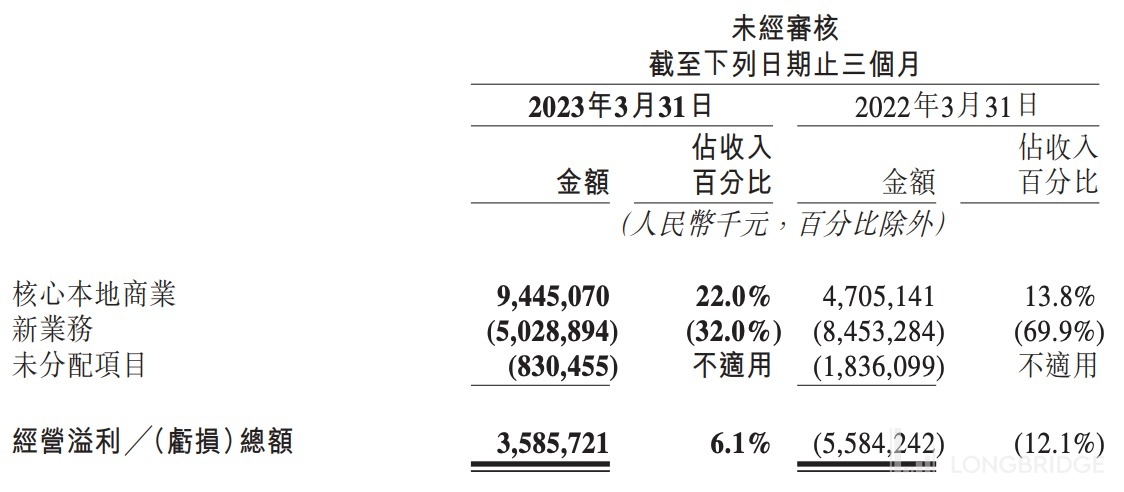

The operating profit and operating profit margin for Q1 were RMB 3.6 billion and 6.1%, respectively, while the operating loss and operating loss margin for the same period in 2022 were RMB 5.6 billion and 12.1%, respectively.

Net profit for Q1 was RMB 3.4 billion, compared to a loss of RMB 5.7 billion in the same period last year, and market expectations of a loss of RMB 210.4 million. The YoY loss turned into a profit.

As of March 31, 2023, the cash and cash equivalents and short-term investment in financial products held were RMB 26.9 billion and RMB 84.5 billion, respectively.

Q1 Sub-Business Data

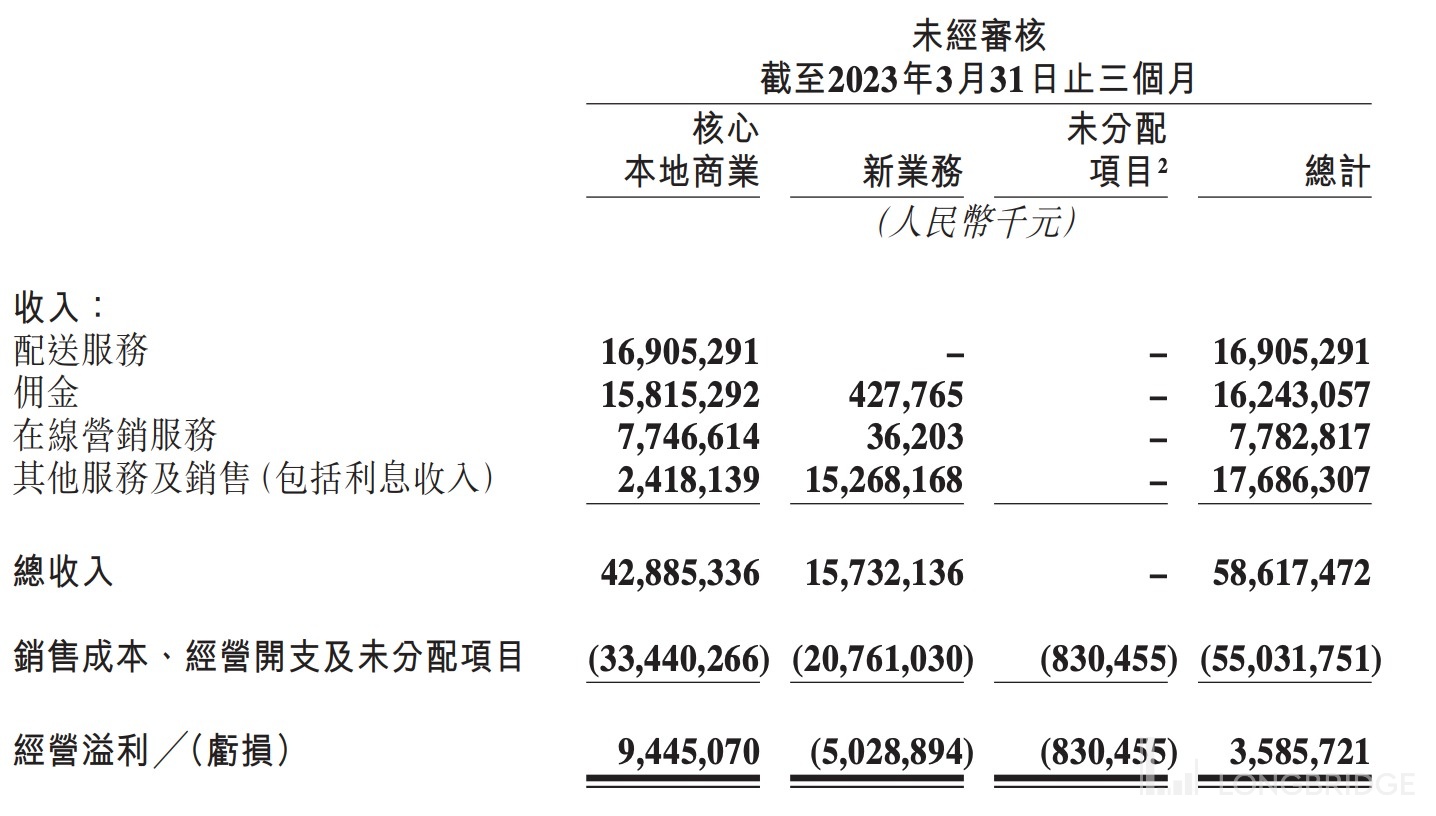

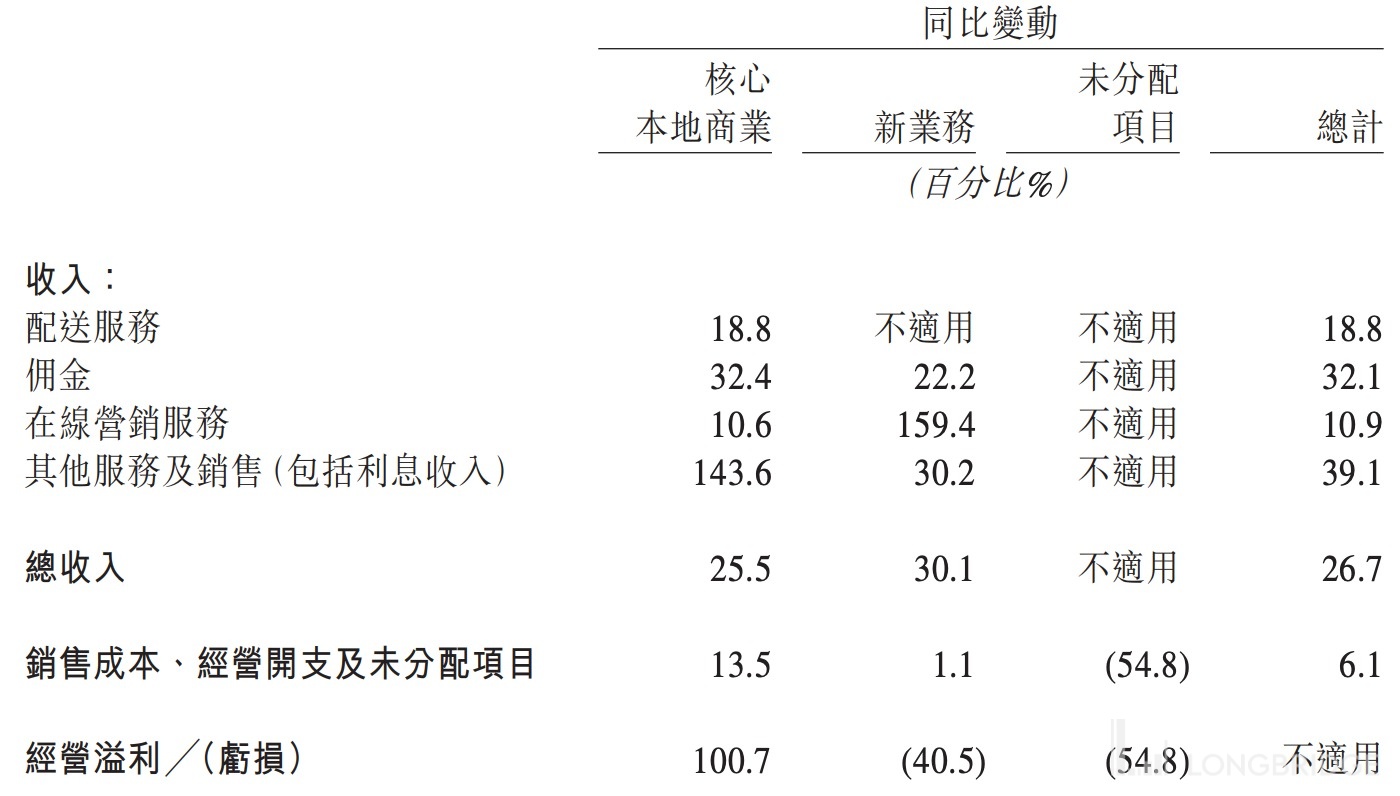

In Q1, the revenue of the sub-business increased by 25.5% YoY to RMB 42.9 billion, and the operating profit increased by 100.7% YoY to RMB 9.4 billion, while the operating profit margin increased from 13.8% in the same period of 2022 to 22.0%. The operating surplus of the Core Local Business Division was RMB 9.4 billion, an increase of 100.7% from RMB 4.7 billion in the same period of 2022.

The revenue of the New Business Division increased by 30.1% year-on-year to RMB 15.7 billion. The operating loss of the division narrowed by 40.5% year-on-year to RMB 5 billion, and the operating loss rate continued to improve to 32.0%.

In the first quarter, the operating loss of the New Business Division continued to narrow to RMB 5 billion.