US Stock Options | Bulls Bet on NVIDIA to Rise to $400! TSMC Options Trading Surges Sixfold

On Thursday, semiconductor stocks rose sharply and options trading was also very active. The trading volume of bullish options for Nvidia surged, while the trading volume of options for AMD and Intel doubled, and the trading volume of options for TSMC increased sixfold. The trading volume of Snowflake options tripled.

On Thursday, May 25th, the US stock market diverged, with the Nasdaq rising 1.7% due to the surge in Nvidia.

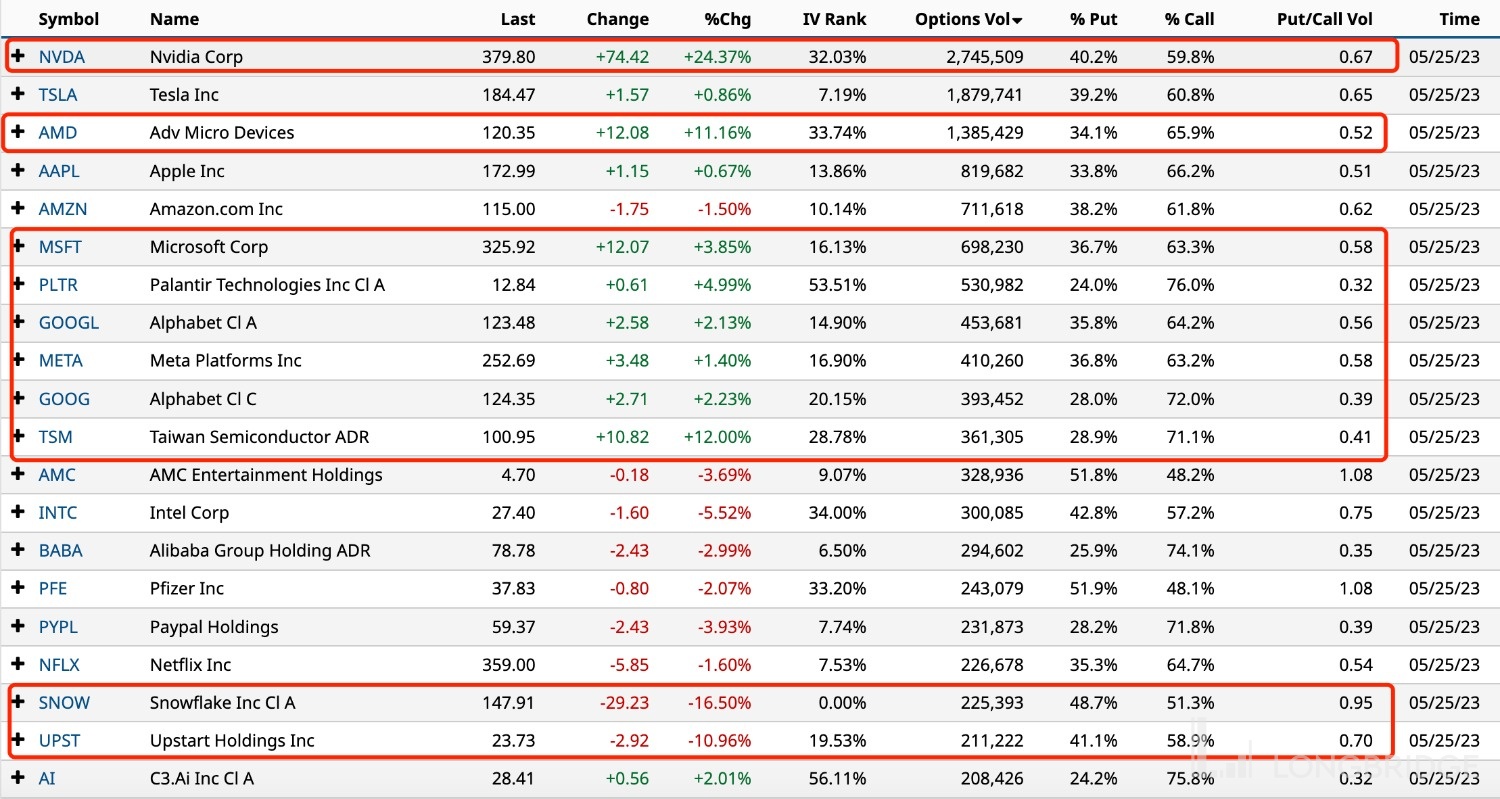

Top 10 US Stock Options

On Thursday, tech stocks rose, especially semiconductor stocks, which collectively surged, and options trading was also very active.

The top 10 US stock options traded were: Nvidia, Tesla, AMD, Apple, Amazon, Microsoft, Palantir, Google A, Meta, TSMC, Intel, and Alibaba.

Nvidia surged 24%, with options trading of 2.75 million contracts, three times the daily average, and call options accounting for 60% of the trading volume. Call options with a strike price of $400 were the most active.

Tesla rose nearly 1%, with options trading of 1.88 million contracts, and call options accounting for over 60% of the trading volume. Call options with strike prices of $185/$190 were the most active.

AMD surged over 11%, with options trading of 1.39 million contracts, doubling the daily average, and call options accounting for 66% of the trading volume; TSMC surged 12%, with options trading of 360,000 contracts, six times the daily average, and call options accounting for over 70% of the trading volume.

Apple rose slightly, with options trading of 820,000 contracts, and call options accounting for 66.2% of the trading volume. Call options with a strike price of $175 were the most active.

Amazon fell 1.5%, with options trading of 710,000 contracts, and call options accounting for over 60% of the trading volume.

Google A surged over 2%, with options trading of 450,000 contracts, and call options accounting for 64.2% of the trading volume.

Microsoft surged nearly 4%, with options trading of 700,000 contracts, and call options accounting for 63.3% of the trading volume.

Alibaba fell 3%, with options trading of 290,000 contracts, and call options accounting for 74.1% of the trading volume.

Intel fell over 5%, with options trading of 300,000 contracts, doubling the daily average, and call options accounting for 57.2% of the trading volume.

Snowflake fell 16.5%, with options trading of 230,000 contracts, tripling the daily average, and call options accounting for 51.3% of the trading volume.