Hong Kong stock risk premium is already high! What does it mean?

Despite the many macro uncertainties that still exist, the Hong Kong stock risk premium is not expected to return to the extreme levels seen at the end of last year. Therefore, if there is another significant adjustment, it will provide an opportunity to lay out positions! In short, there is no need to be overly pessimistic about downside risks!

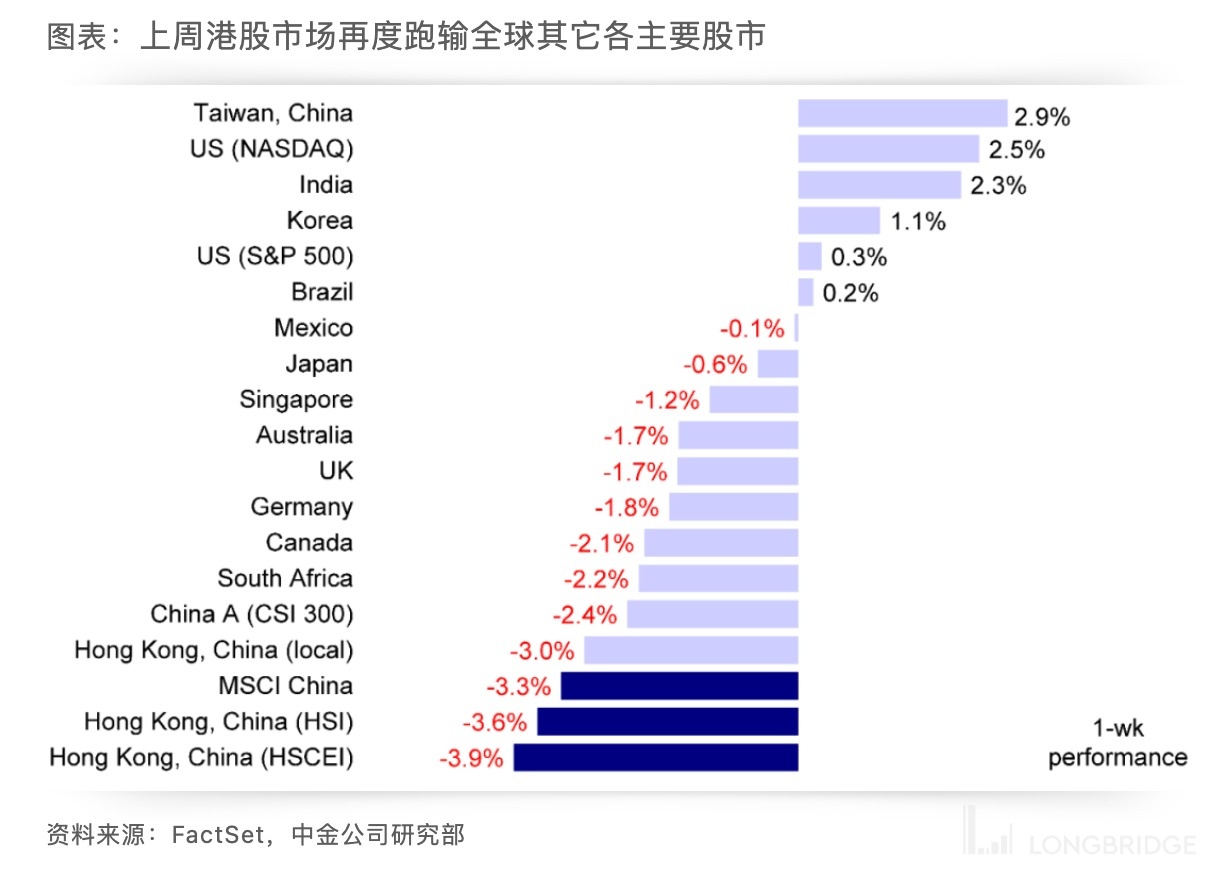

Affected by multiple factors such as the outflow of northbound funds, weak domestic growth prospects, and the expectation of the Fed's interest rate hike, the overseas Chinese-funded stock market continued its weakness and accelerated its decline last week, with the Hang Seng Index falling below 19,000 points. The large-scale outflow of overseas funds last week also increased the market's selling pressure.

Recently, CICC has continued to remind investors that the market may lack trends and maintain a volatile pattern in the weak economic recovery environment. This is similar to many aspects of 2019, such as moderate economic growth, continuous lack of direction in the market, more structural opportunities, and RMB depreciation.

CICC believes that the above situation may continue unless there is a clear switch in growth trends, especially in momentum (such as new wide credit grasping hands such as real estate). Before this happens, it is still recommended that investors focus more on structural opportunities rather than the overall market trend.

That being said, CICC is not overly pessimistic about the downside risk. Although the current weak economic growth prospects limit the upside space, the continuous recovery of the Chinese economy and the possibility that the Fed's policy may not tighten further will also provide downside protection for the market.

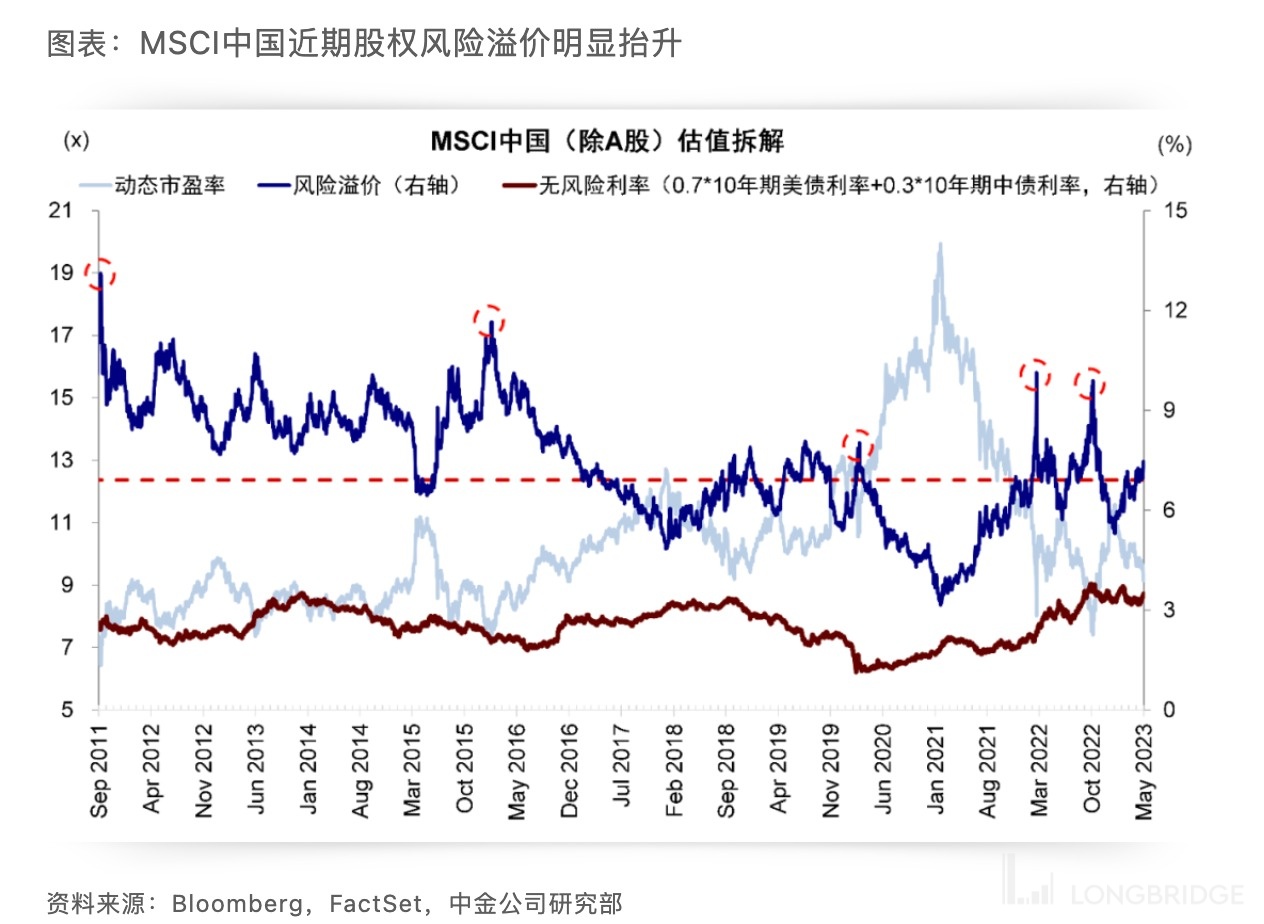

In addition, the current risk premium is already at a high level. The 12-month dynamic P/E ratio of the MSCI China Index (excluding A shares) is currently 9.2 times, and the risk premium is close to 7.5% after deducting the 3.5% risk-free rate (0.710-year US Treasury bond rate + 0.310-year China bond rate), which is a new high (10%) since the end of October last year.

Admittedly, there are still many uncertainties in the long-term economic growth prospects, but the risk premium is not expected to return to the extreme level at the end of last year. Therefore, it is expected that if there is a large-scale adjustment again, it will provide layout opportunities.

Against this background, CICC still recommends that investors focus on structural opportunities and adopt a "dumbbell" strategy: state-owned enterprises with the potential to increase their dividend ratios + growth sectors such as the Internet and technology; the healthcare sector may benefit from the greater flexibility after the Fed's easing.