Growth stocks are killing value stocks! Is the frequent new high in the US stock market blind optimism or serious underestimation?

Technology stocks are fighting the entire market! In extreme cases, systematic risk or suppressed risk appetite may lead to a general decline in US stocks, which in turn will cause greater recessionary pressures. However, in the medium term, after the growth pressure forces loose expectations, the growth style will still be the first to usher in a rebound opportunity.

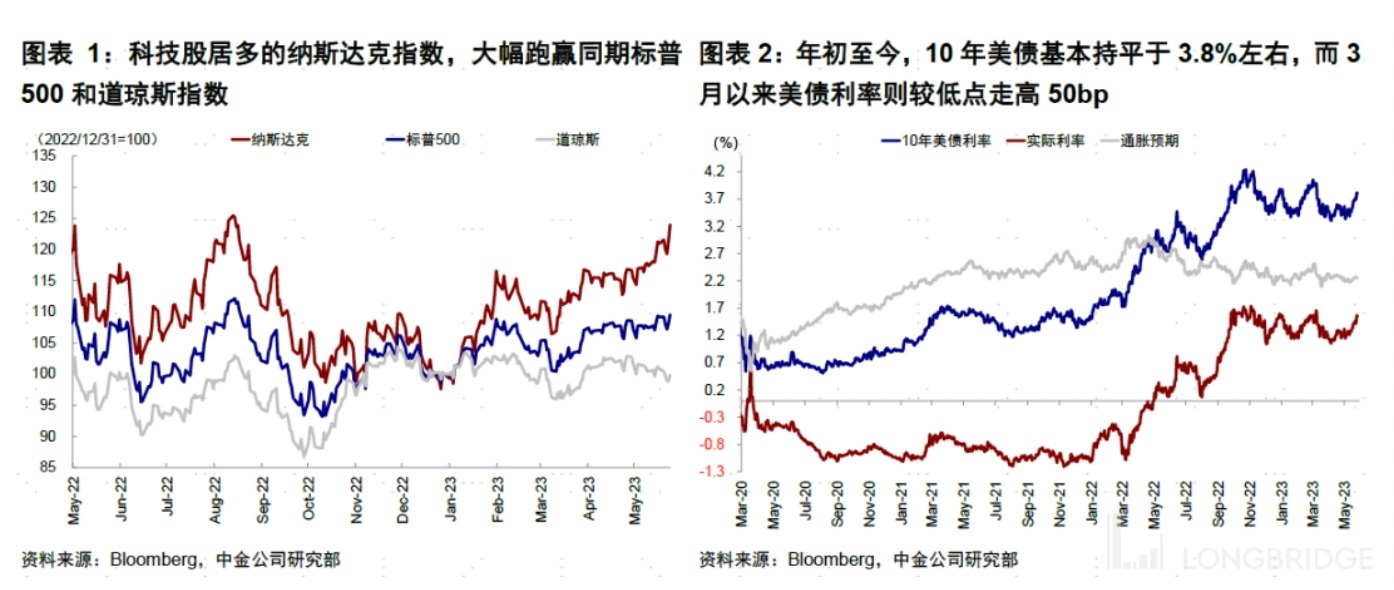

Recently, the US stock market has performed strongly and repeatedly hit new highs, especially the NASDAQ Composite Index, which has risen nearly 24% since the beginning of the year.

It should be noted that the recent rise in US bond yields, with the 10-year US bond exceeding 3.8%, concerns about high inflation, interest rate hikes, recession, debt ceilings, and banking issues have occasionally arisen. The strong performance of the US stock market seems to be "puzzling", and it is quite different from the cautious view at the end of last year.

Is the new high blind optimism and implies huge risks? Or is it underestimating and ignoring structural opportunities?

1. The driving force behind the new high: technology leaders dominate, and risk premiums shrink

This round of US stock performance presents the following characteristics:

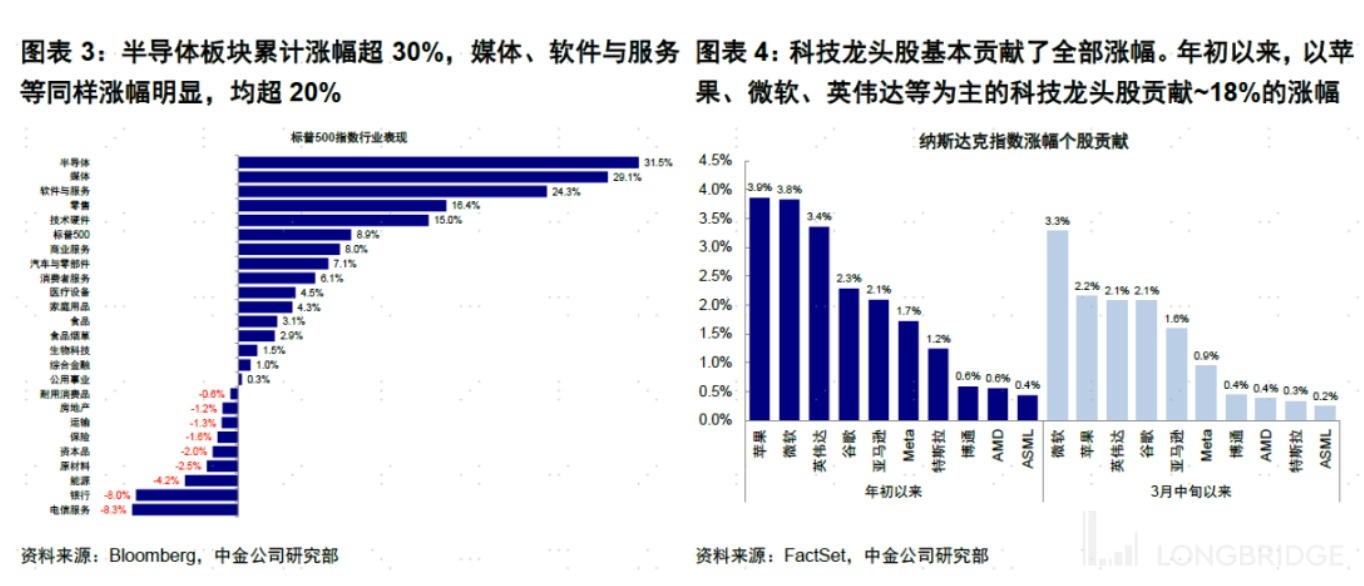

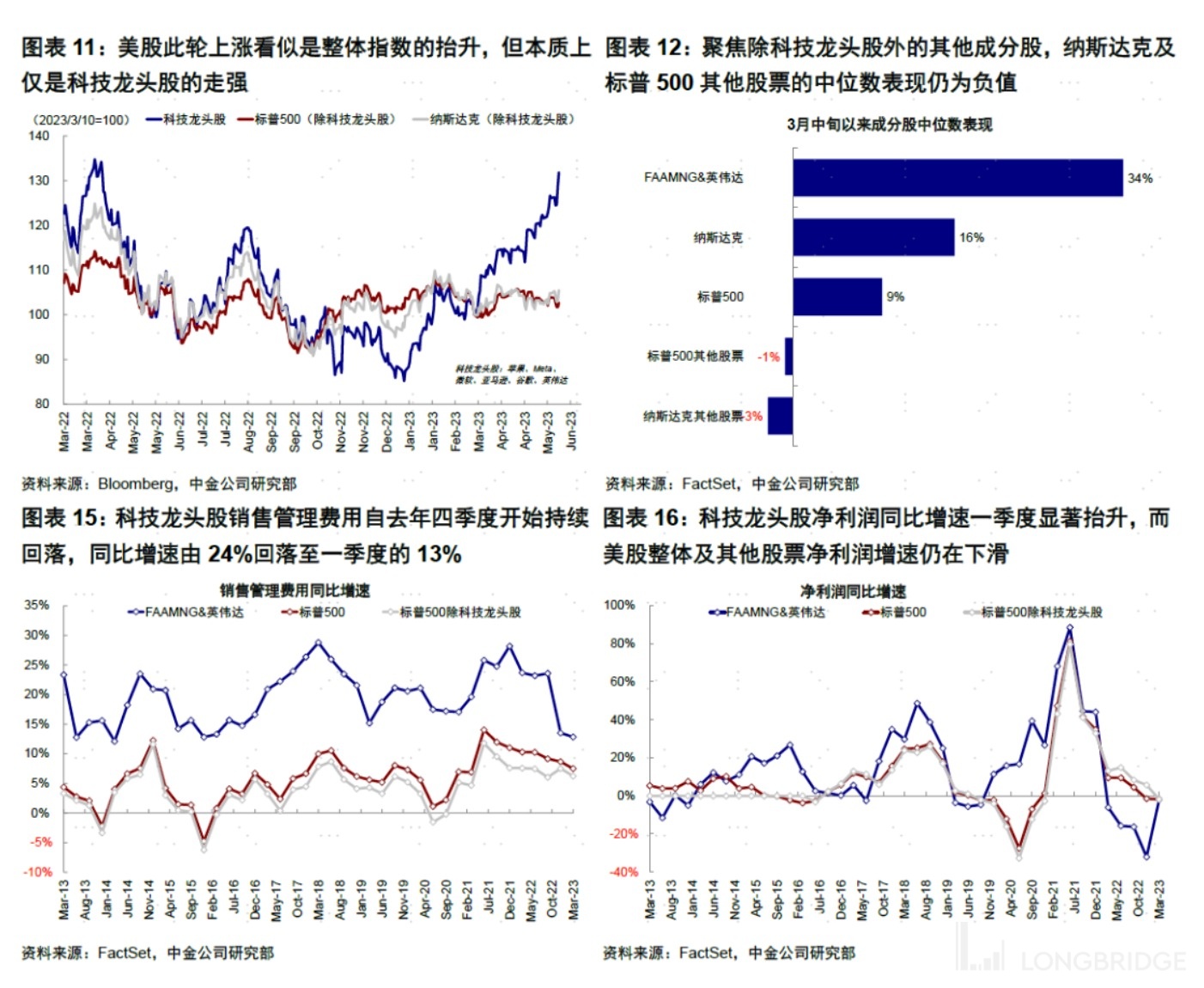

1) Growth leads: The NASDAQ Composite Index has significantly outperformed the Dow Jones Industrial Average, with the semiconductor, media, and software and hardware technology sectors far ahead of banks, energy, and raw materials;

2) Technology leaders dominate: The seemingly strong overall performance is actually the rise of individual leading technology stocks, which basically contribute to all the gains in the index;

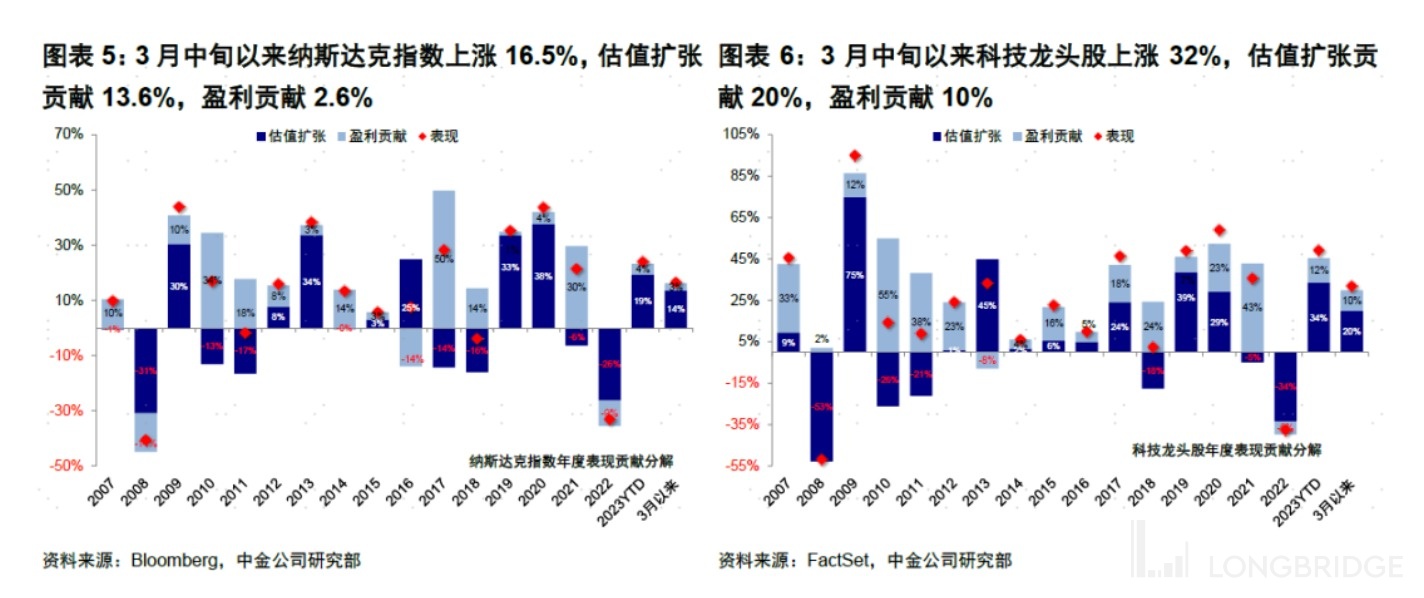

3) The shrinkage of risk premiums offsets the rise of risk-free interest rates: Valuation is the main contribution, but risk premiums that have shrunk significantly are the main reason, as risk-free interest rates have not fallen significantly.

2. The reason for the new high: the continued suppression of risk premiums, the structural mismatch of the US economy, and the trend of technology leaders

Macro credit cycle: The expansion of US credit offsets the effect of monetary tightening, and the government "backs up" the private sector, which significantly suppresses risk premiums and offsets the rise in interest rates.

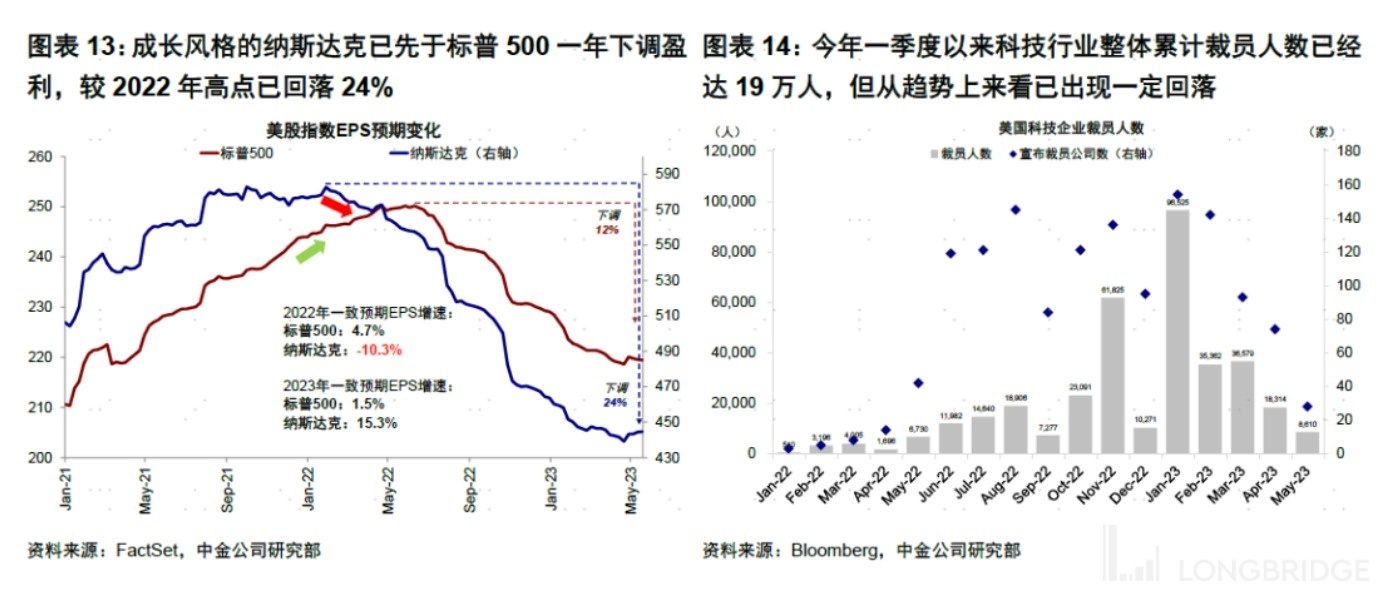

Structural mismatch of the US economy: Compared with the resilient but future-pressured service demand, the profit downgrades of technology companies were mostly completed last year.

Micro level: Large-scale layoffs to reduce costs and increase efficiency, as well as new trends in industries such as artificial intelligence, have also made leading technology companies more capable of resisting risks and thus boost the overall index as weight stocks.

3. After the New High: Blind Optimism or Strong Resilience?

Next, the implications of recession, easing, and market risks differ for the overall market and the technology sector.

-

Under the benchmark scenario, mild recession pressure has a greater impact on the profitability of cyclical and value sectors, while the technology sector is less affected.

-

If inflation exceeds expectations and the Fed raises interest rates more than expected, technology stocks will face pressure from the denominator.

-

If there is severe turbulence due to unexpected risks, it will inevitably bring some pressure on technology stocks that have made more profits. However, after the shift to easing, growth stocks will still benefit first.

In short, it depends mainly on the resilience of technology stocks and the size of the beta risk of the cycle.

In extreme cases, systemic risk or suppressed risk preferences may lead to a general decline in US stocks, which in turn will lead to greater recession pressure. However, in the medium term, after the pressure of growth forces the expectation of easing, it will still be an opportunity for growth stocks to rebound first.