US Stock Options | Tesla, Nvidia, and Amazon options trading volume doubled, tech stock call options unusually active.

Last Friday, technology stocks rose sharply. Tesla, Nvidia, and Amazon options traded 4.51 million, 1.78 million, and 1.73 million contracts respectively. Ford options trading volume quadrupled, while MiMedx Group's trading volume increased nearly eightfold and C3.Ai options trading volume more than tripled.

Last Friday (May 26), the US stock market rose sharply, with the Nasdaq up more than 2%.

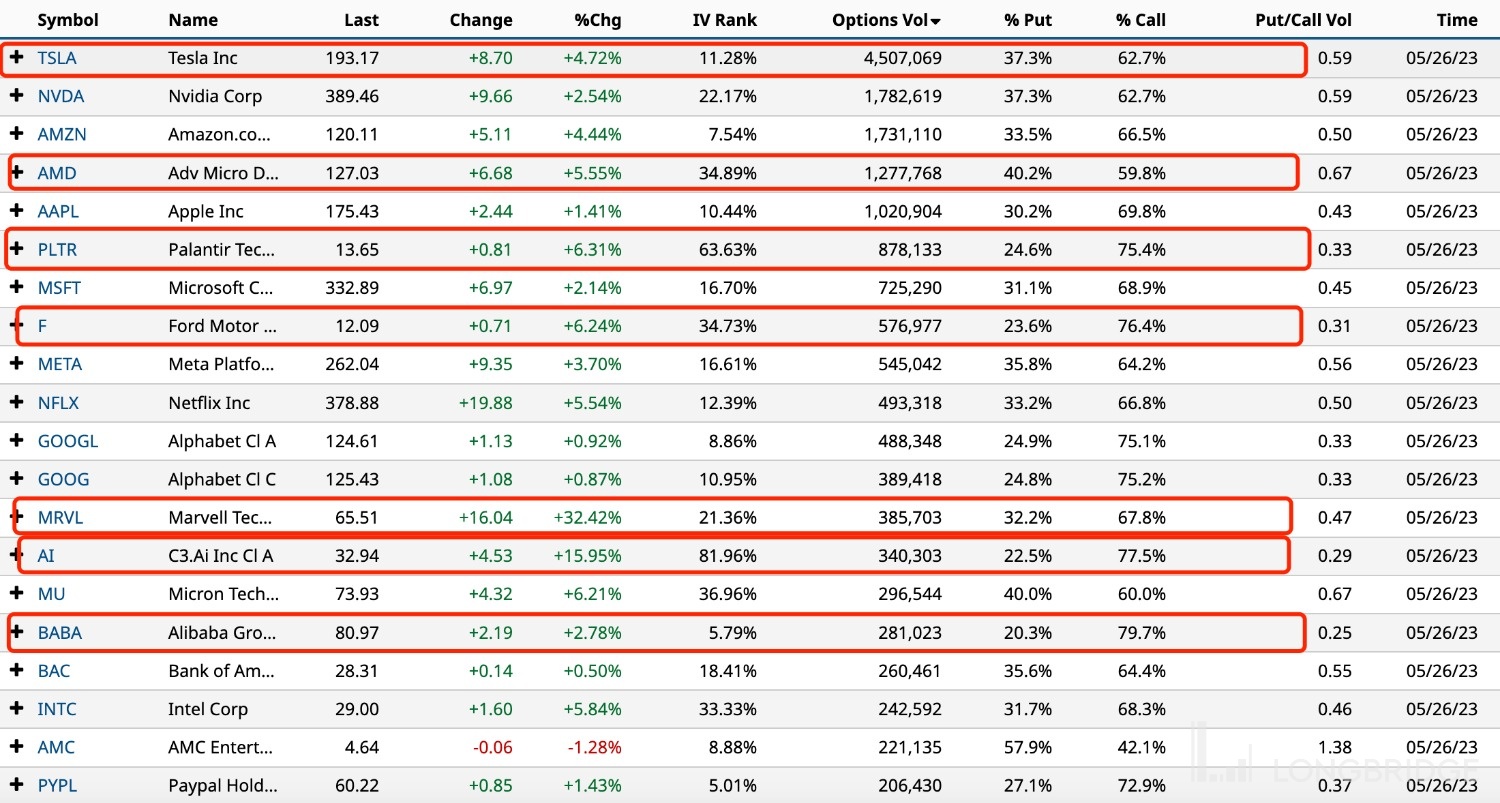

Top 10 US Stock Options

Last Friday, technology stocks collectively rose, leading the market index.

The top 10 US stock options traded: Tesla, Nvidia, Amazon, AMD, Apple, Palantir Tech, Microsoft, Ford Motor, Meta Platforms, Netflix, and Google A.

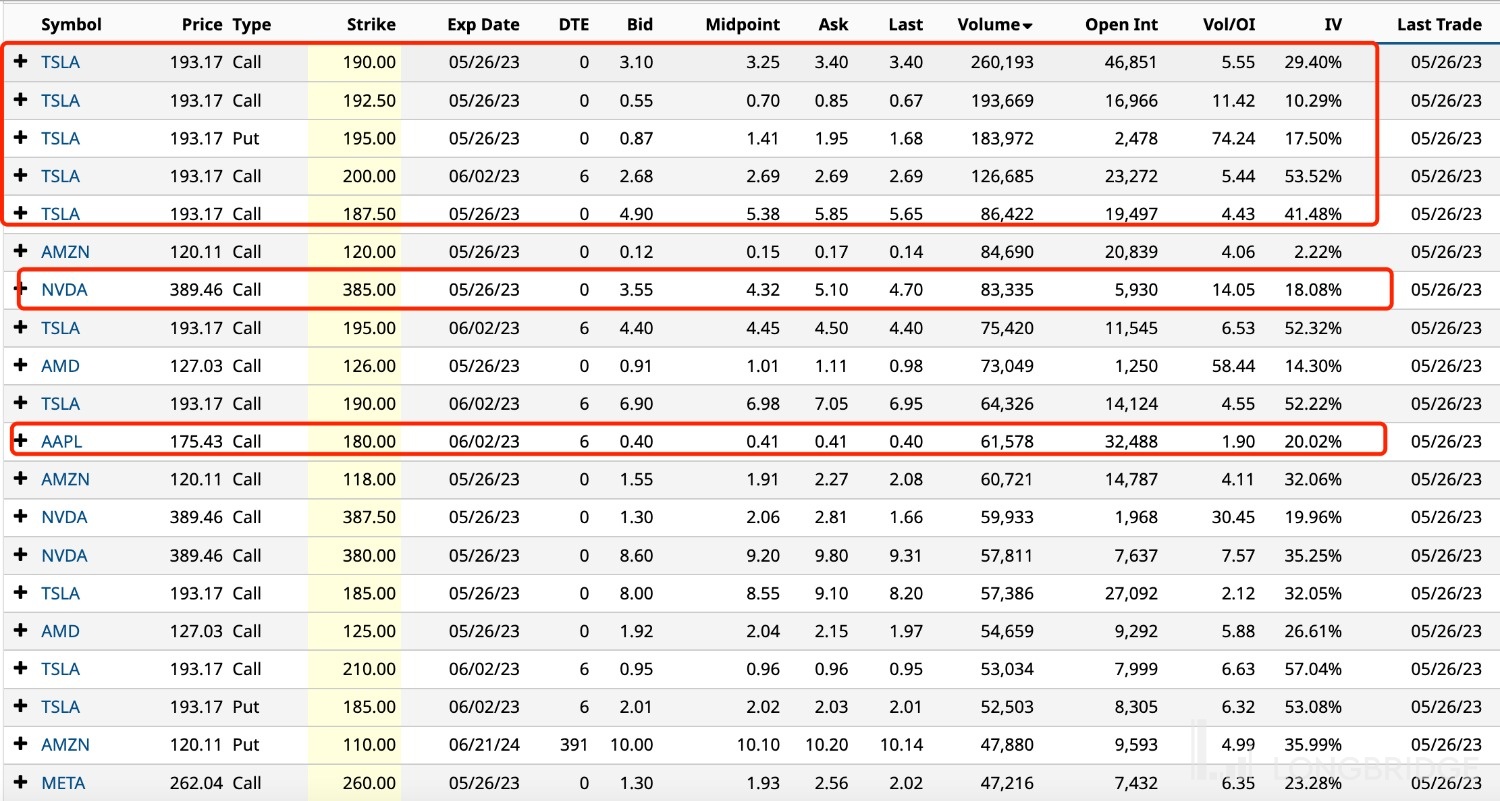

Tesla rose nearly 5%, with options trading 4.51 million contracts, more than twice the daily average, and the proportion of call options trading was 62.7%.

Nvidia rose 2.54%, with options trading 1.78 million contracts, twice the daily average, and the proportion of call options trading was 62.7%. The call option with a strike price of $385 was the most active.

Amazon rose more than 4%, with options trading 1.73 million contracts, and the proportion of call options trading was 66.5%. The call option with a strike price of $120 was the most active.

AMD rose more than 5%, with options trading 1.28 million contracts, and the proportion of call options trading was nearly 60%. The call option with a strike price of $126 was the most active.

Apple rose 1.4%, with options trading 1.02 million contracts, and the proportion of call options trading was nearly 70%. The call option with a strike price of $180 was the most active.

Microsoft rose more than 2%, with options trading 730,000 contracts, and the proportion of call options trading was nearly 70%.

Ford Motor rose more than 6%, with options trading 580,000 contracts, four times the daily average, and the proportion of call options trading was 76.4%.

Meta Platforms rose nearly 4%, with options trading 550,000 contracts, and the proportion of call options trading was 64.2%.

Milestone Technologies surged more than 32%, with options trading 390,000 contracts, nearly eight times the daily average, and the proportion of call options trading was 67.8%.

C3.Ai rose nearly 16%, with options trading 340,000 contracts, more than three times the daily average, and the proportion of call options trading was nearly 80%.

Alibaba rose nearly 3%, with options trading 280,000 contracts, and the proportion of call options trading was nearly 80%.