Hong Kong stocks may rebound! Will TENCENT, MEITUAN-W, and KUAISHOU-W lead the way?

Previously, the overall market risk appetite was suppressed, and the stock prices did not fully reflect the solid fundamental performance of large technology stocks. After the quarterly report, TENCENT's full-year revenue growth rate and profit margin rebounded in resonance, with considerable potential profit elasticity and expected medium- to long-term growth; MEITUAN-W's stock price is at a historically relative low level, and it is recommended to pay close attention.

Hong Kong stock internet financial report week landed smoothly, the performance of major giants exceeded expectations, and the opportunity for stock price rebound has come?

The team of Kong Rong from TF Securities sees that due to the previous overall market risk preference being suppressed, the stock price has not fully reflected the solid fundamental performance of large technology stocks, and the current valuation level implies relatively high risk return.

Looking ahead, it is expected that corporate profits will still be in an upward cycle, and there is also a significant space for valuation repair. The focus is on beta marginal potential improvement factors.

Specifically, for several leading companies, TF Securities believes:

- TENCENT

External factors/fundamental short-term fluctuations do not affect the company's high-quality fundamentals, and the valuation is at a historically relative low level. As of May 19th, Bloomberg's consensus forecast for TENCENT's 2023 forecast PE is about 20 times, and the 2022-2024 forecast PE is about 17 times.

The company's core business pattern is stable, commercialization is accelerating, and games/advertising/finance have both recovery beta and new product alpha, with resonant growth in annual revenue growth and profit margins, and considerable potential profit elasticity, with long-term growth prospects.

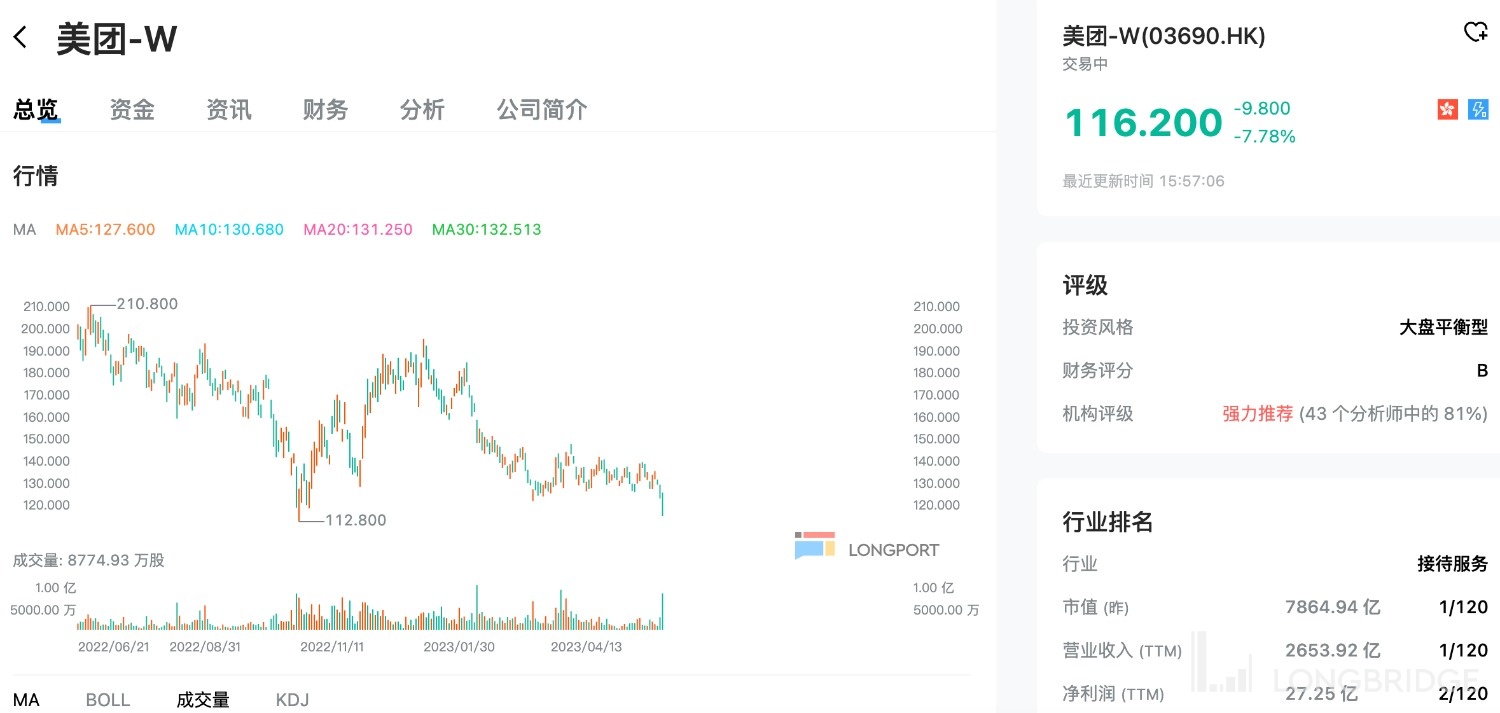

- MEITUAN-W

The valuation is at a historically relative low level, the takeaway business barriers are stable, the in-store business significantly benefits from offline recovery, the external competition pattern is gradually clear, and the core competitiveness is still stable.

The recent subsidy activities help to narrow the price gap, consolidate user awareness, and stabilize market share. As of May 19th, MEITUAN-W's market value corresponds to a core business operating profit of 21x in 2023, and the stock price is at a historically relative low level, and it is recommended to pay close attention.

- KUAISHOU-W

The company's various businesses have shown resilience this year, with steady traffic growth, stable market share, and recovery speed may exceed previous expectations.

With the recovery of the macroeconomic situation, the company's core business advertising revenue recovery may be better than expected; as of May 19th, Bloomberg's consensus forecast for 2023 is 1.8X PS.

- POP MART

Domestic offline store repair, ByteDance's new channels are expanding, and overseas store expansion is accelerating. The mid-term core IP operation capability and IP monetization methods are expanding (games, parks). As of May 19th, Bloomberg's consensus forecast for 2023 forecast PE is about 23 times.