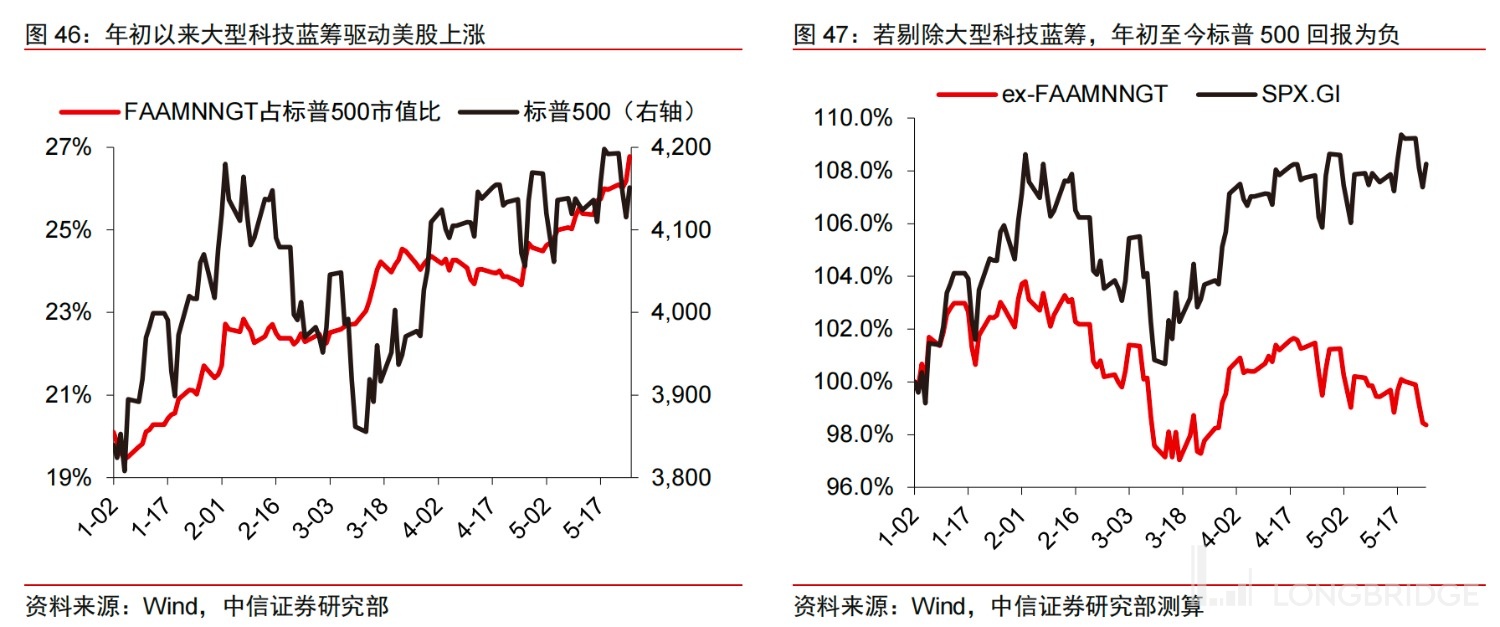

The rise depends entirely on FAAMNNGT! US stocks face sector rotation in the second half of the year.

If we exclude FAAMNNGT (Meta, Apple, Amazon, Microsoft, Nvidia, Netflix, Alphabet, Tesla), the return rate of the S&P 500 is negative.

Source: Wang Yihan, CITIC Securities

However, under the risk of recession and the extremely tight monetary policy of the Federal Reserve, the United States may fall into a recession in the fourth quarter, and the liquidity environment may not be able to support the current high valuation level. Since the beginning of the year, the rise driven by technology blue chips may face "rebalancing".

As the recession expectations further reflect, the defensive consumer, healthcare, and utilities sectors in the third quarter may relatively outperform.

In the medium and long term, focus on the semiconductor industry entering a new upward cycle and the internet giants empowered by AI, cost reduction, high overseas income and benefiting from the depreciation of the US dollar.

The US economy may fall into recession in the fourth quarter

After the liquidity crisis in the US banking system broke out, US commercial banks have significantly tightened credit, leading to an increased risk of recession.

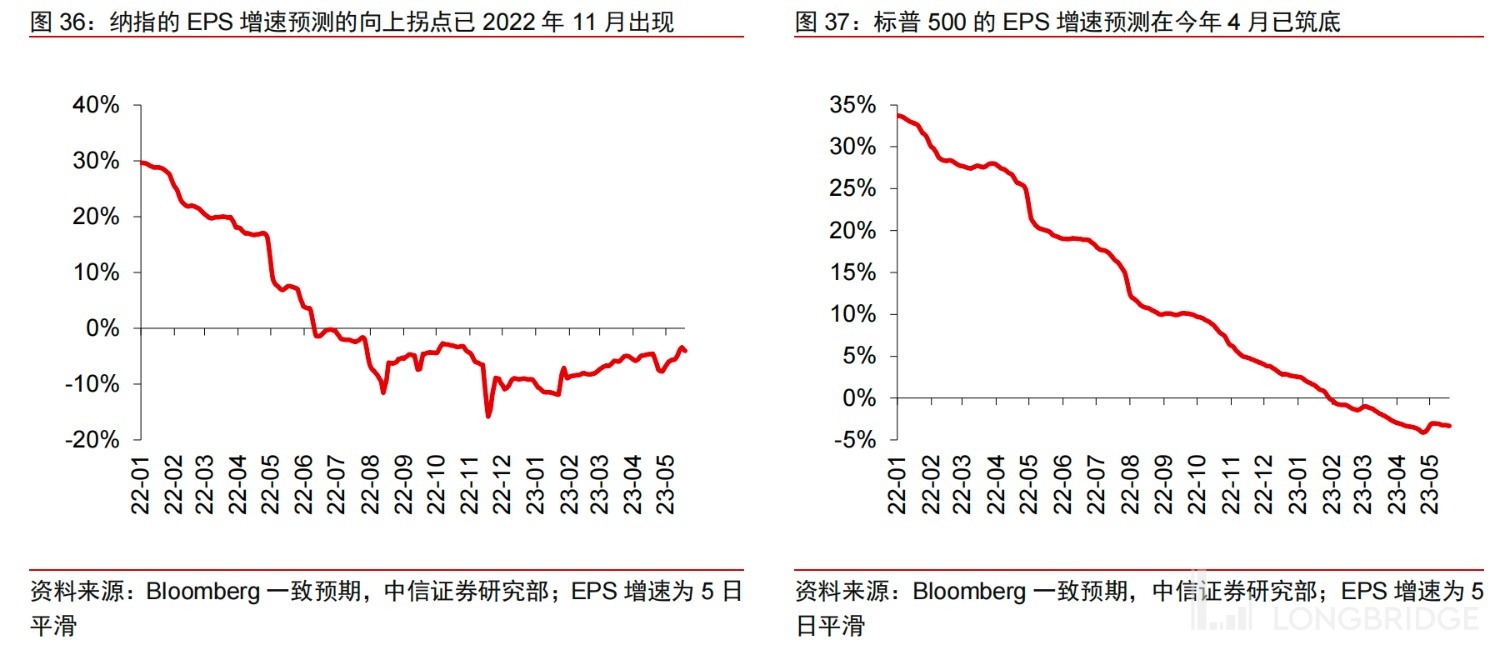

According to the New York Fed's economic recession model, the United States may fall into a substantial recession from the fourth quarter of this year. Although the rolling EPS expectations of the Nasdaq have rebounded from the bottom in November last year, they are still in the negative growth range compared with the same period last year.

Although the future 12-month rolling EPS growth rate expectation of the S&P 500 stabilized after the first quarter report, it has shown a downward trend since mid-May.

Historically, US stocks usually reflect recession expectations about a quarter in advance, so it is judged that the performance expectations of US stocks may face further downward revisions from the third quarter.

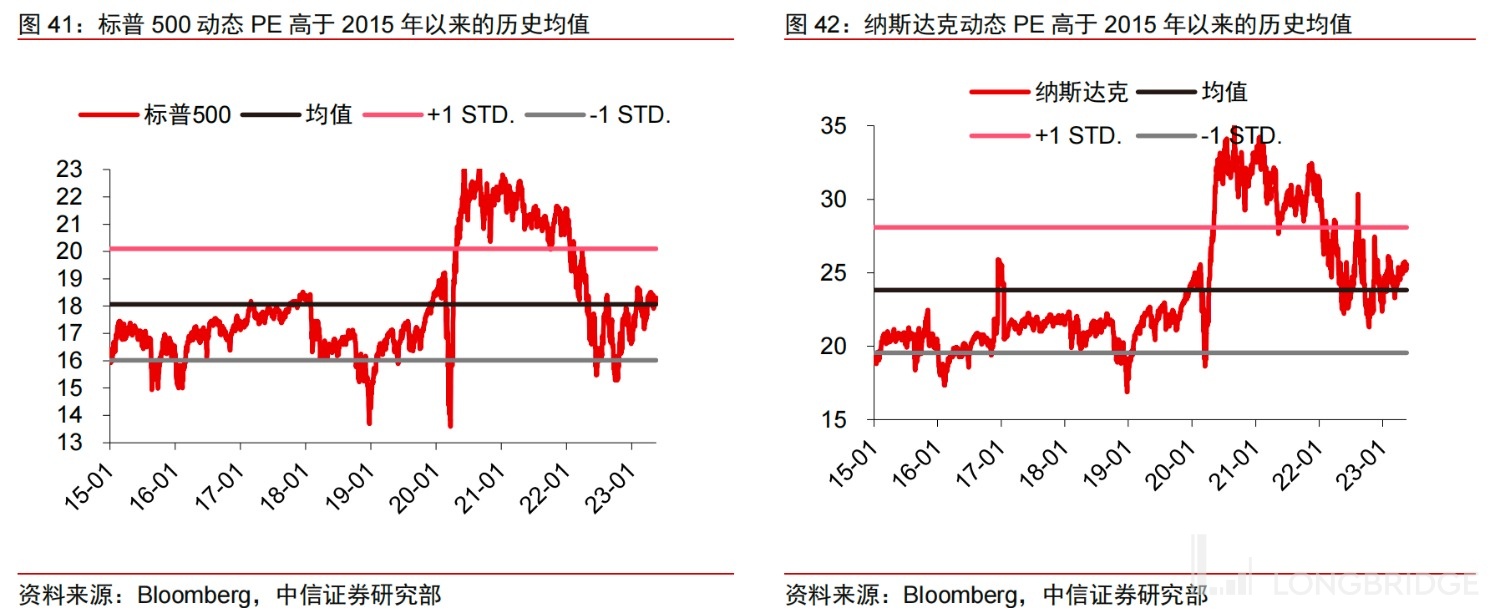

US stock valuations are too high, and the current liquidity environment is difficult to support

The current dynamic PEs of the S&P 500 and Nasdaq are 18.3 times and 25.6 times, respectively, far exceeding the historical average, especially considering that the Federal Reserve is still in the process of monetary tightening, reflecting investors' expectations of "shallow recession and interest rate cuts in the United States this year".

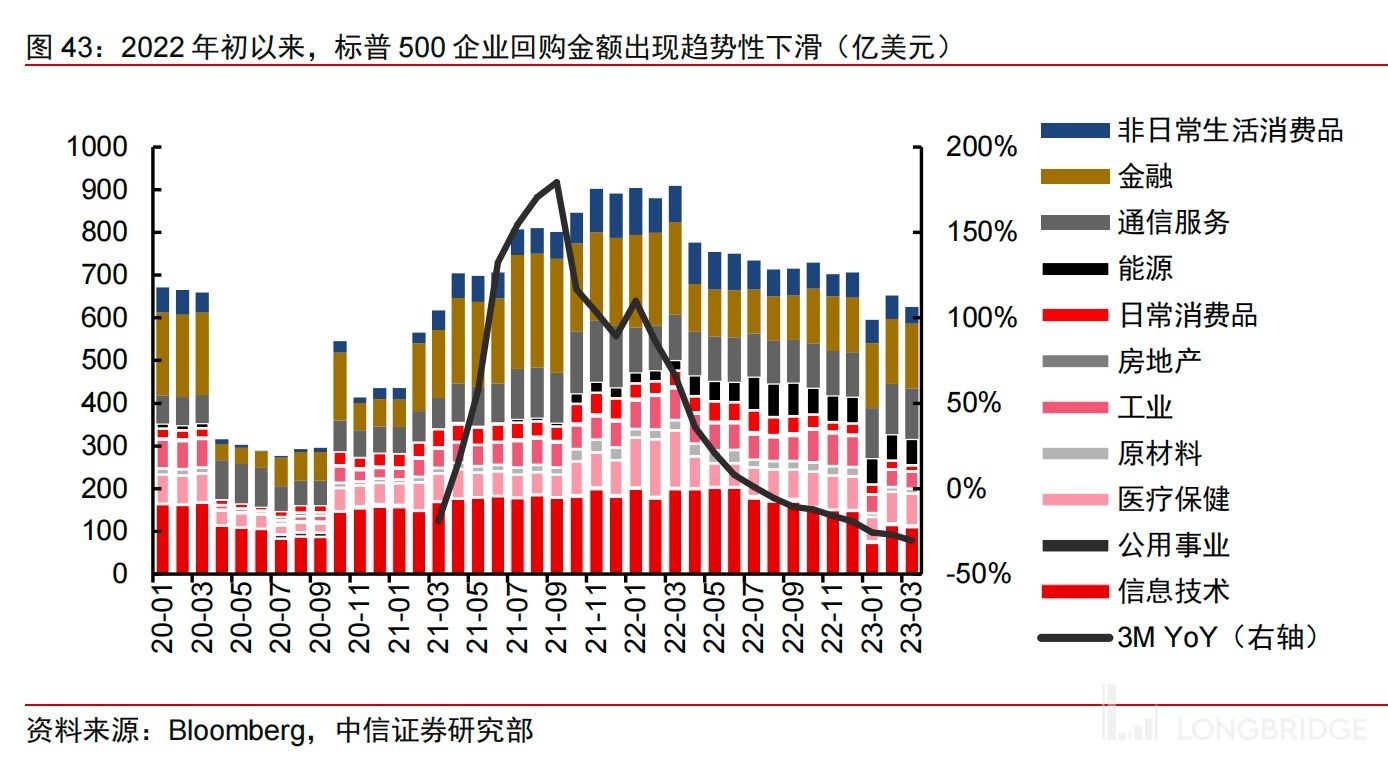

However, in terms of liquidity, the amount of S&P 500 buybacks has continued to decline since the first quarter of last year, with only US$187.4 billion in the first quarter of this year, a sharp drop of 30.4% year-on-year.

Institutional funds are also showing an overall outflow trend, with a cumulative outflow of more than US$90 billion in the rolling 12 months as of March this year.

In addition, the financing balance and available margin balance in the United States have fluctuated around US$800 billion since the fourth quarter of last year, showing that the willingness of retail investors to leverage is not strong.

Overall, if the Federal Reserve continues to maintain aggressive monetary tightening in the second half of the year, coupled with the risk of recession, the current valuation level is difficult to support.

Investment Allocation Suggestions

"Recession Trading" with Rebalancing and AI-Enabled Tech Blue Chips.

Since the beginning of the year, the rise of tech blue chips has driven the US stock market. If we exclude FAAMNNGT (Meta, Apple, Amazon, Microsoft, Nvidia, Netflix, Alphabet, Tesla), the return rate of the S&P 500 is negative. Considering the potential impact of the debt ceiling deadlock and commercial real estate defaults in the future, the US stock market may face sector rotation.

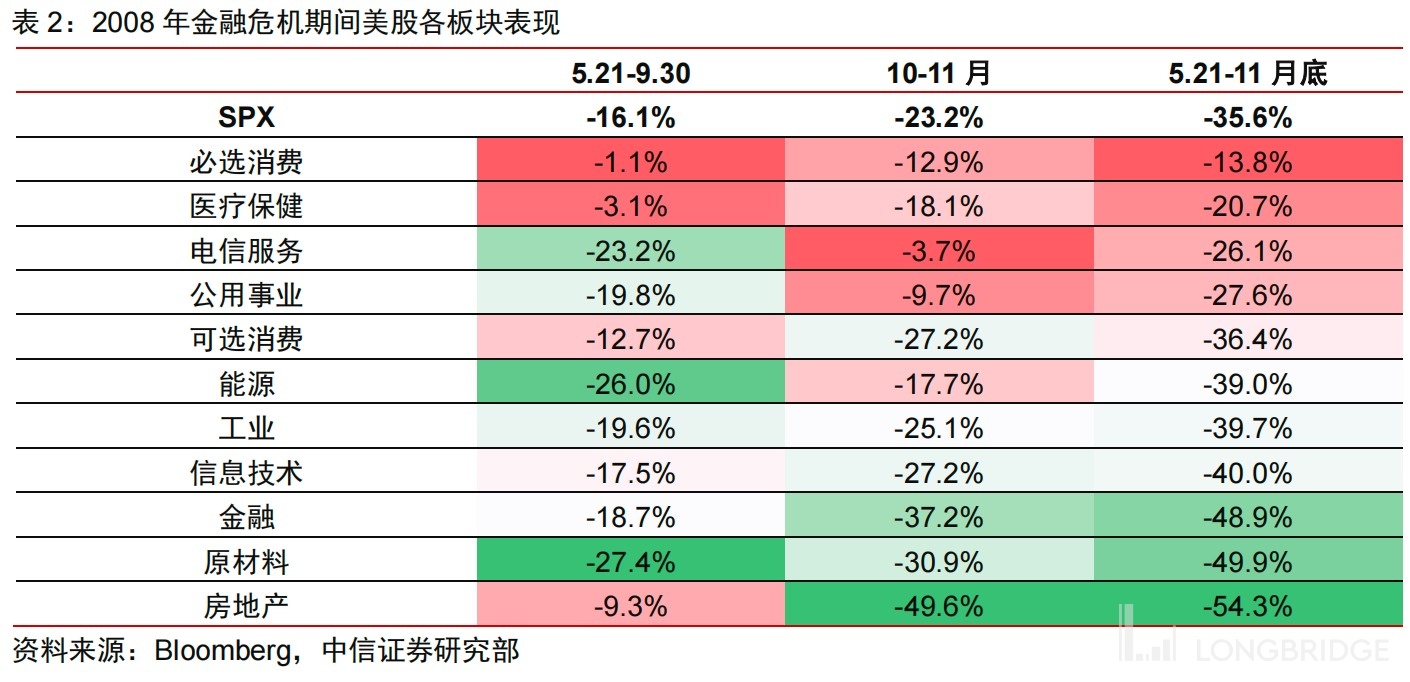

Looking at the third quarter, in the case of further reflection of recession expectations, defensive sectors such as essential consumer goods, healthcare, and utilities may relatively outperform.

After entering a substantive recession, as investors gradually form expectations for the Fed's monetary policy shift, the growth sectors with "long duration" attributes will benefit from the warming liquidity environment.

At that time, tech blue chips may once again usher in allocation opportunities. It is recommended to focus on the semiconductor industry and AI-enabled companies that have entered a new cycle of growth, with cost reductions, high overseas revenue ratios, and benefits from the depreciation of the US dollar.