US Stock Options | Bullish bets on Tesla rising to $220, options for Nvidia and Palantir Tech double in volume.

On Tuesday, the trading of bullish options was relatively active among tech giants. Bullish options trading accounted for 66.3% and 68% of Tesla and Apple, respectively. The call options with a strike price of 410/420 US dollars for Nvidia were the most active. Options trading for Ford and Qualcomm increased three to four times.

On Tuesday, May 30th, US stocks rose, with the Nasdaq leading the gains, but then fell back.

Top 10 US Stock Options

On Tuesday, US tech stocks remained strong, and call options were relatively active.

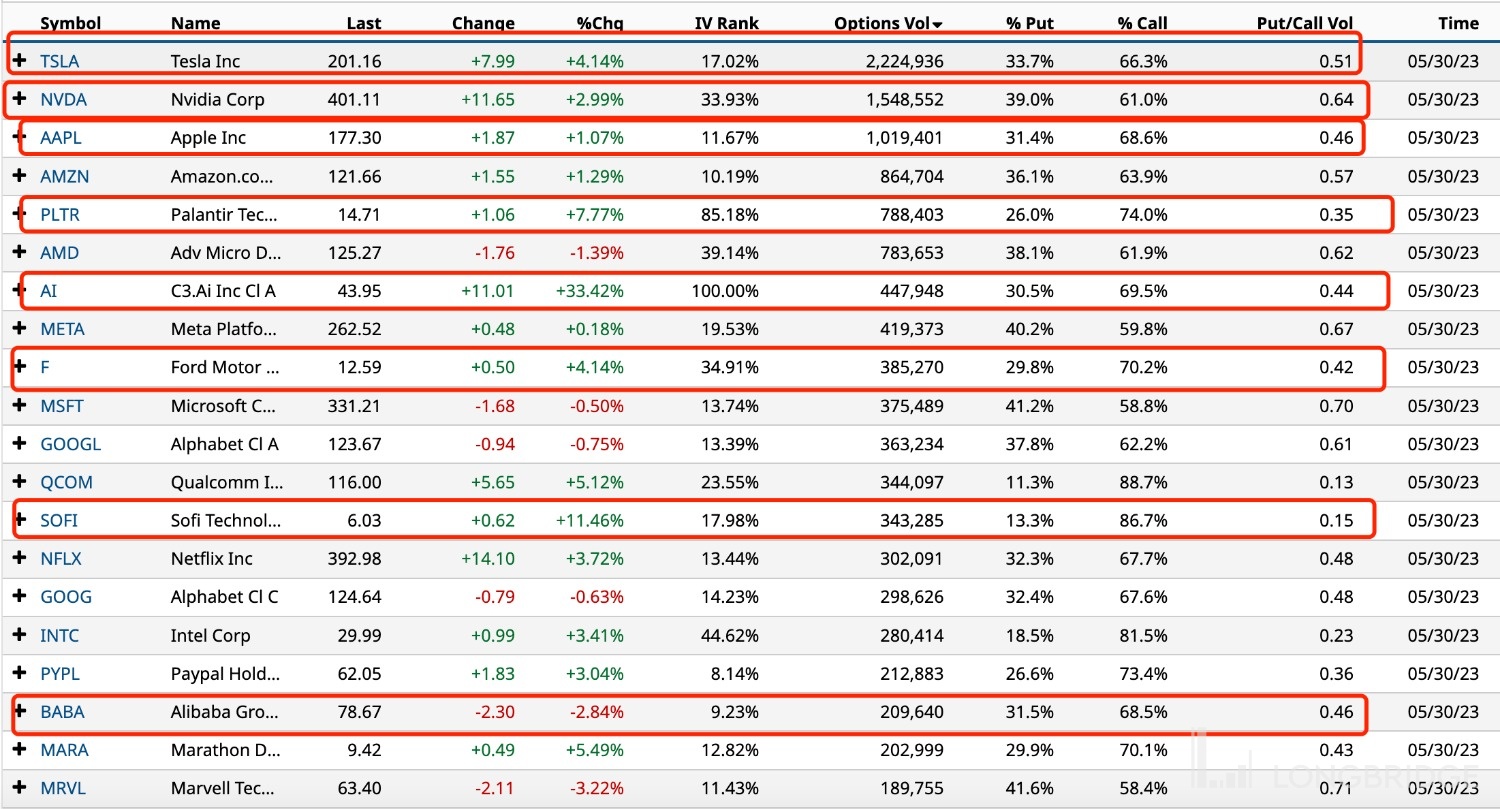

The top 10 US stock options traded were: Tesla, Nvidia, Apple, Amazon, Palantir Tech, AMD, C3.Ai, Meta Platforms, Ford Motor, Microsoft, and Google A.

Tesla rose more than 4%, with 2.22 million options traded, and call options accounted for 66.3% of the total. Call options with strike prices of $200/$210/$220 were the most active.

Nvidia rose 3%, with 1.55 million options traded, nearly double the daily average, and call options accounted for over 60% of the total. Call options with strike prices of $410/$420 were the most active.

Apple rose more than 1%, with 1.02 million options traded, and call options accounted for 68.6% of the total. Call options with a strike price of $180 were the most active.

Amazon rose more than 1%, with 860,000 options traded, and call options accounted for 63.9% of the total. Call options with a strike price of $123 were the most active.

Palantir Tech surged nearly 8%, with 790,000 options traded, nearly double the daily average, and call options accounted for 74% of the total. Call options with a strike price of $15 were the most active.

AMD fell more than 1%, with 780,000 options traded, and call options accounted for over 60% of the total.

C3.Ai surged more than 33%, with 450,000 options traded, nearly quadruple the daily average, and call options accounted for 70% of the total.

Meta Platforms rose slightly, with 420,000 options traded, and call options accounted for 60% of the total.

Ford Motor surged more than 4%, with nearly 390,000 options traded, nearly triple the daily average, and call options accounted for 70% of the total.

Qualcomm rose more than 5%, with 340,000 options traded, quadruple the daily average, and call options accounted for nearly 90% of the total.

Sofi surged more than 11%, with 340,000 options traded, and call options accounted for 87% of the total. Call options with a strike price of $6 were the most active.