Technical Analysis | Why is Nvidia, which costs $400, already profitable to liquidate?

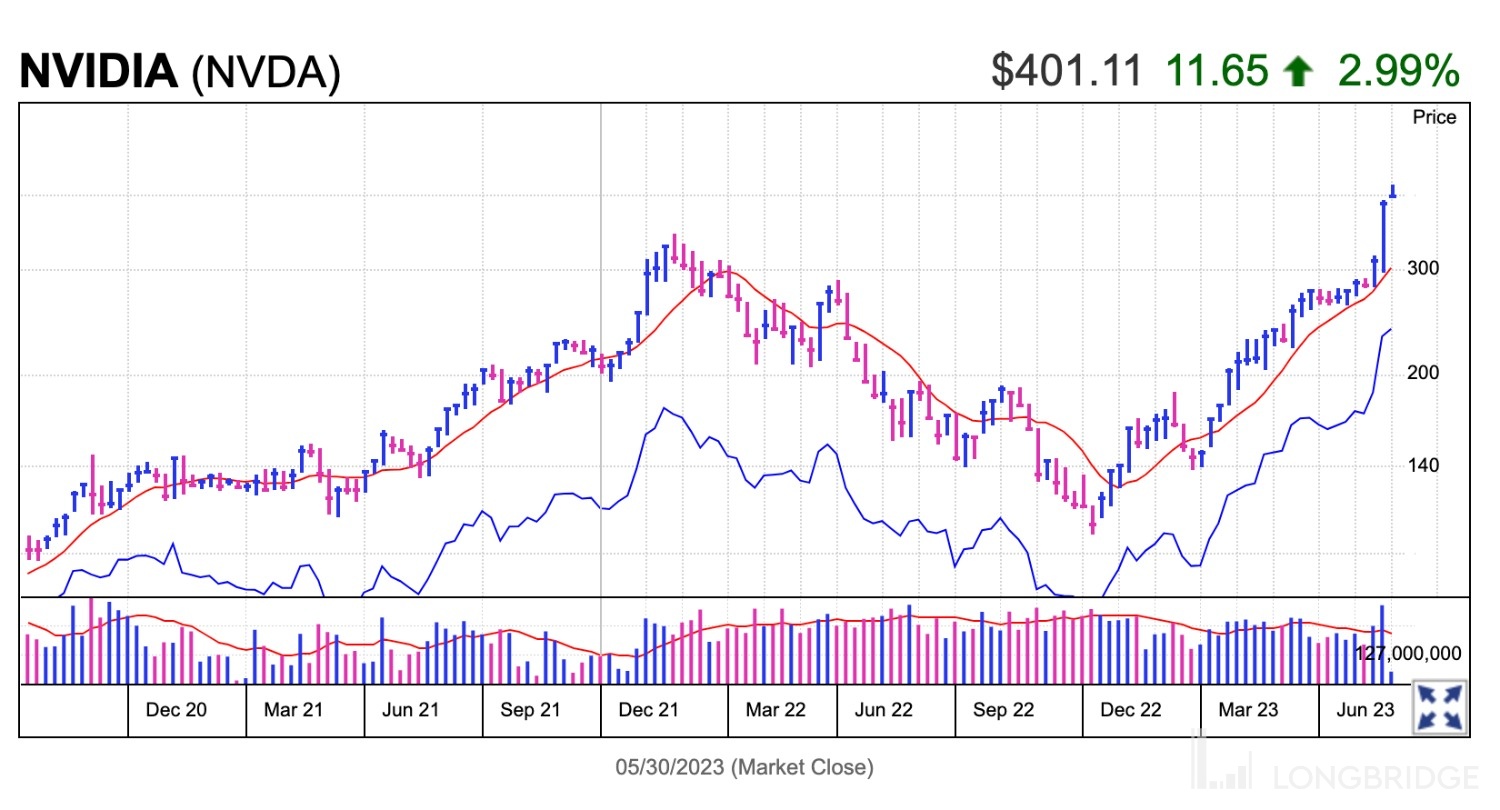

NVIDIA has performed far better than the market this year, with its current stock price more than 100% above its 200-day moving average! Typically, the stocks of many industry leaders will peak when their stock prices exceed the 200-day moving average by 70%-100%.

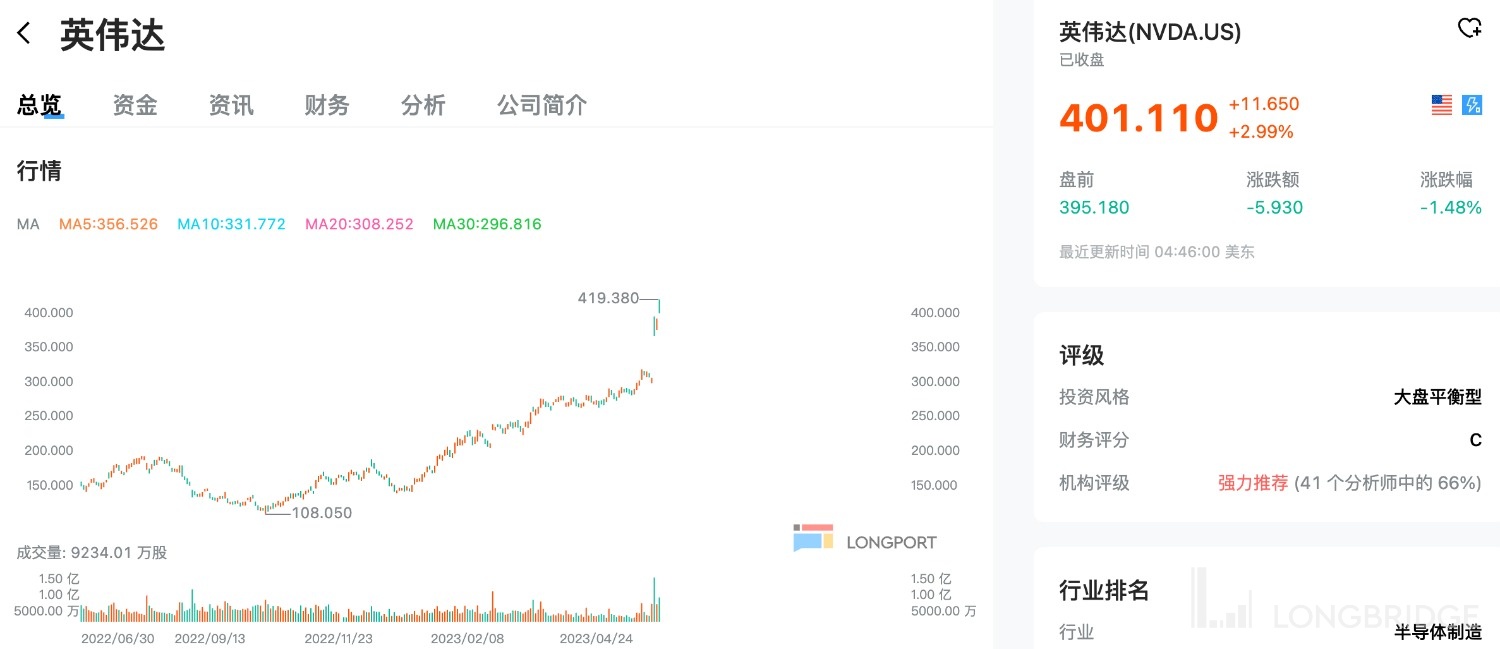

After the performance report, Nvidia's stock price soared more than 30% in the following three trading days, breaking through the $400 mark and even briefly entering the trillion-dollar club.

Since May, Nvidia has been on the rise since breaking through the buy point of $281.2 at the beginning of the month, with a cumulative increase of 45%.

With Nvidia's stock price skyrocketing, what should investors do?

First of all, it should be noted that, as shown in this chart from IBD MarketSmith, Nvidia's relative strength line (RS line) hit a new high on May 30th (blue line in the chart), and a rising RS line means that the stock is outperforming the S&P 500 index.

More importantly, Nvidia's current stock price is already more than 100% above its 200-day moving average - typically, many industry leaders' stocks will peak when their stock prices exceed the 200-day moving average by 70%-100%.

Therefore, Investor's Business Daily pointed out that investors can now consider taking profits, but they can also hold on and not sell until other danger signals appear.