Hong Kong Stock Strategy: Use Mid-Term Estimation to Defend Against Big Drops, Wait for Tech and Internet Stocks to Rebound

After the rebound of Hong Kong stocks in the future, they may encounter resistance or new risks and fall again. The bottom of the Hong Kong stock market this year may appear in the second half of the year.

Recently, Hong Kong stocks have continued to decline, with the Hang Seng Index and Hang Seng TECH Index hitting a six-month low.

If Hong Kong stocks rebound in the future, they may encounter resistance or new risks, or fall again. The bottom of the Hong Kong stock market this year may appear in the second half of the year, unless all risks are released in the second quarter. However, some risks are gradual changes rather than isolated events and cannot be discounted, so potential risks cannot be fully priced in the previous market decline.

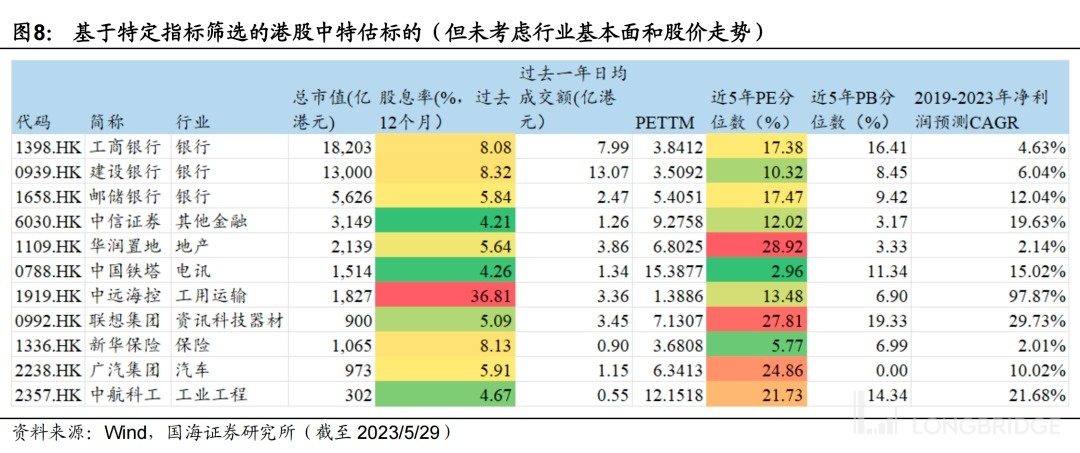

Configure 中特估 when Hong Kong stocks plummet, 中特估 sector relatively resistant to decline

The essence of 中特估 is a defensive strategy based on high dividends and low valuations rather than pure thematic investment.

There are three characteristics of 中特估 that need to be clarified:

First, high dividends and low valuations may lead to a decline in dividend yield and an increase in valuation as stock prices rise;

Second, some 中特估 stocks are pro-cyclical stocks, and investors value their dividend attributes rather than their pro-cyclical nature, because the current economic recovery is weaker than the previous period, and pro-cyclical stocks are theoretically less likely to rise;

Third, many 中特估 are large-cap blue-chip stocks. Currently, the stock market is not good and liquidity is insufficient. 中特估 is more likely to rise slowly rather than continue to rise rapidly.

Wait for the rebound of the technology and internet stocks when Hong Kong stocks rise

Starting from November 2022, when Hong Kong stocks rebounded and rose sharply, technology and internet stocks also rebounded strongly. When Hong Kong stocks plummet, technology and internet leading stocks with good liquidity are often sold off, because these stocks are held in large numbers by investors, but the decline in the index may obscure the fundamental advantages of individual stocks.

When Hong Kong stocks rise sharply, these stocks often have a high degree of elasticity, not only because these stocks have a large weight in the index, but also because these stocks are characteristic targets of Hong Kong stocks (A shares lack large-scale platform economy companies, but not 中特估), and they are important core assets.

From the perspective of liquidity, if the Federal Reserve stops raising interest rates in the future, it will also be beneficial to the valuation of technology and internet stocks.

In addition, if the Federal Reserve stops raising interest rates in the future, it will also be good news for sectors such as medicine and gold.