US Stock Options | Amazon's forward put deals are active, Intel and Sofi options trading surges fourfold.

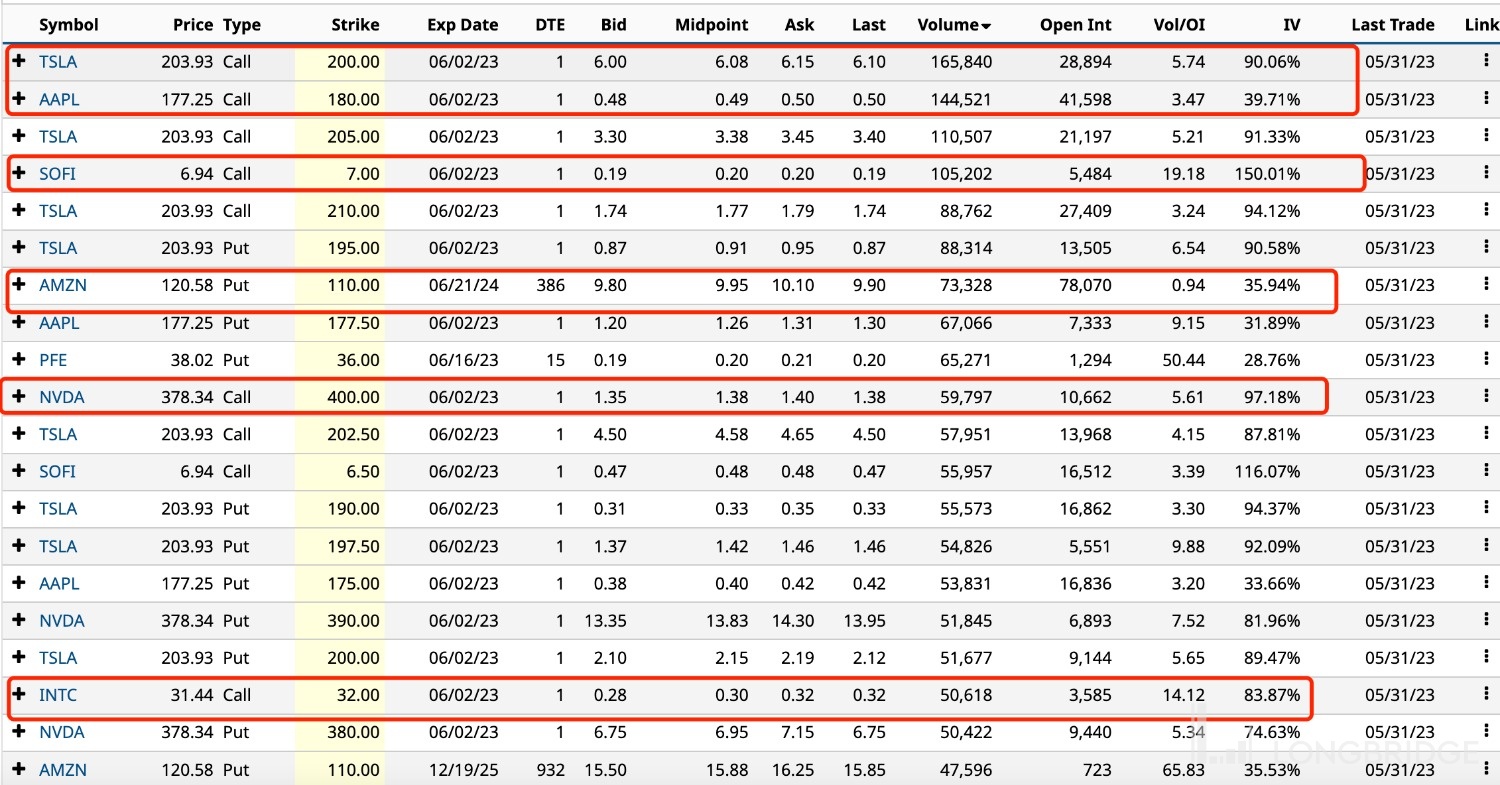

On Wednesday, tech stocks fell, with Tesla and Apple call options accounting for over 60% of the trading volume. Nvidia fell nearly 6%, while call options for Intel accounted for 80% of the trading volume. Call options for Sofi accounted for 79% of the trading volume. The most active call option traded was for Amazon, with a strike price of $110 and expiration one year from now.

On Wednesday (May 31), the US stock market was under pressure, with all three major indexes falling slightly.

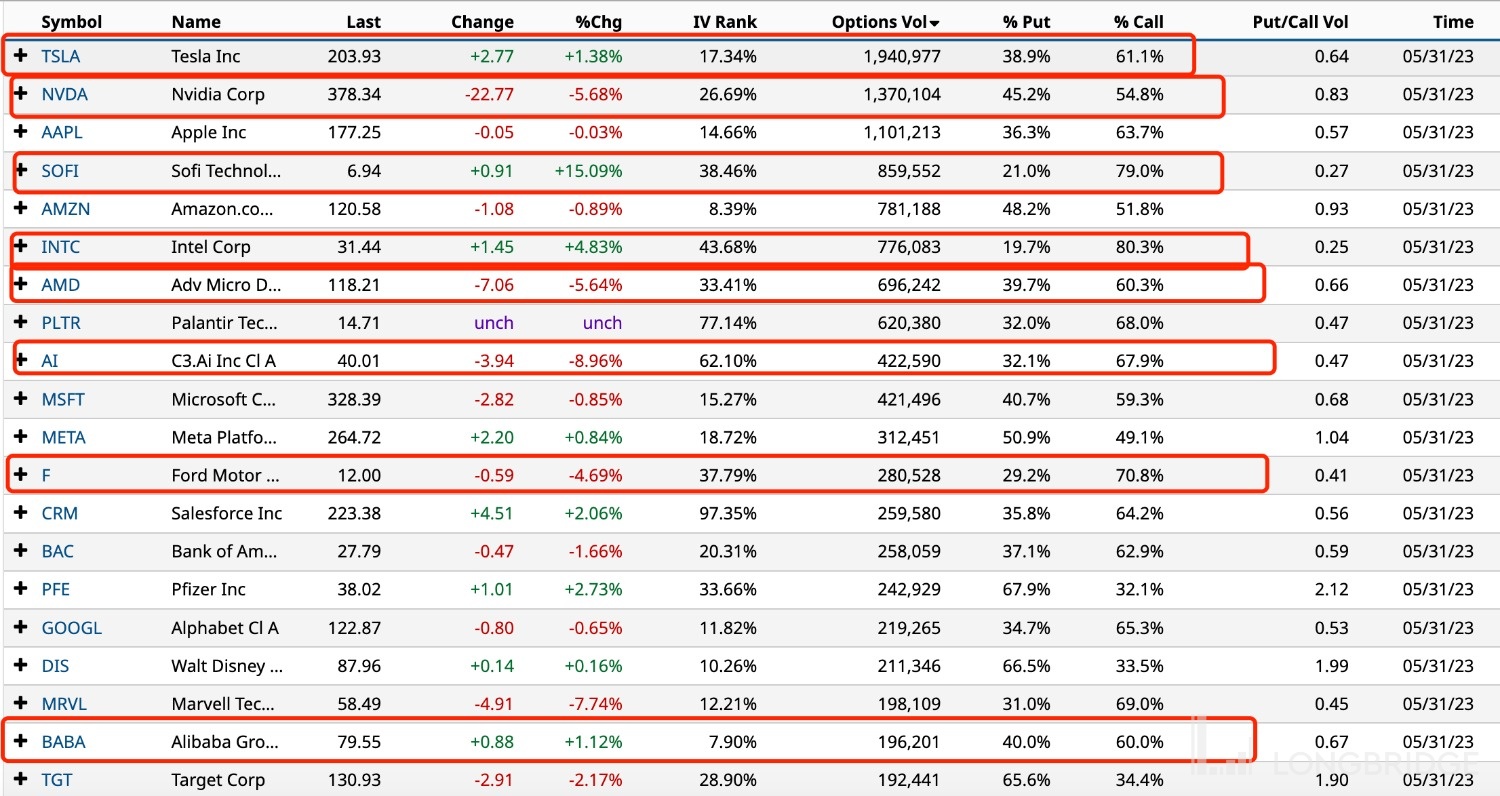

Top 10 US Stock Options

On Wednesday, technology stocks fell, and the top 10 US stock options were traded: Tesla, Nvidia, Apple, Sofi, Amazon, Intel, AMD, C3.Ai, Microsoft, and Meta.

Tesla rose 1.4%, with 1.94 million options traded, and the proportion of call options traded was 61.1%. The call option with a strike price of $200 was the most active.

Nvidia fell nearly 6%, with 1.37 million options traded, and the proportion of call options traded was 54.8%. The call option with a strike price of $400 was the most active.

Apple fell slightly, with 1.1 million options traded, and the proportion of call options traded was nearly 64%. The call option with a strike price of $180 was the most active.

Sofi surged 15%, with 860,000 options traded, four times the daily average, and the proportion of call options traded was 79%.

Amazon fell nearly 1%, with 780,000 options traded, and the proportion of call options traded was 51.8%. Among them, the call option with a strike price of $110 and expiring in one year was the most active.

Intel rose nearly 5%, with 780,000 options traded, four times the daily average, and the proportion of call options traded was 80%.

AMD fell nearly 6%, with 700,000 options traded, and the proportion of call options traded was 60%.

C3.Ai fell nearly 9%, with 420,000 options traded, and the proportion of call options traded was 68%.

Ford Motor fell nearly 5%, with 280,000 options traded, about twice the daily average, and the proportion of call options traded was over 70%.

Alibaba rose more than 1%, with nearly 200,000 options traded, and the proportion of call options traded was 60%.