US Stock Options | Trading volume of Tesla and Apple options nearly doubled, trading of bullish options on tech stocks remains active.

Last Friday, Tesla options traded 3.87 million contracts, with bullish Apple options accounting for 74% of the volume. MongoDB and Broadcom options trading increased fivefold and threefold respectively, while bullish Alibaba and NIO-SW options trading accounted for over 70% of the volume.

Last Friday, US stocks rose sharply, with the Nasdaq and S&P 500 hitting new highs, and the Dow rising more than 2%.

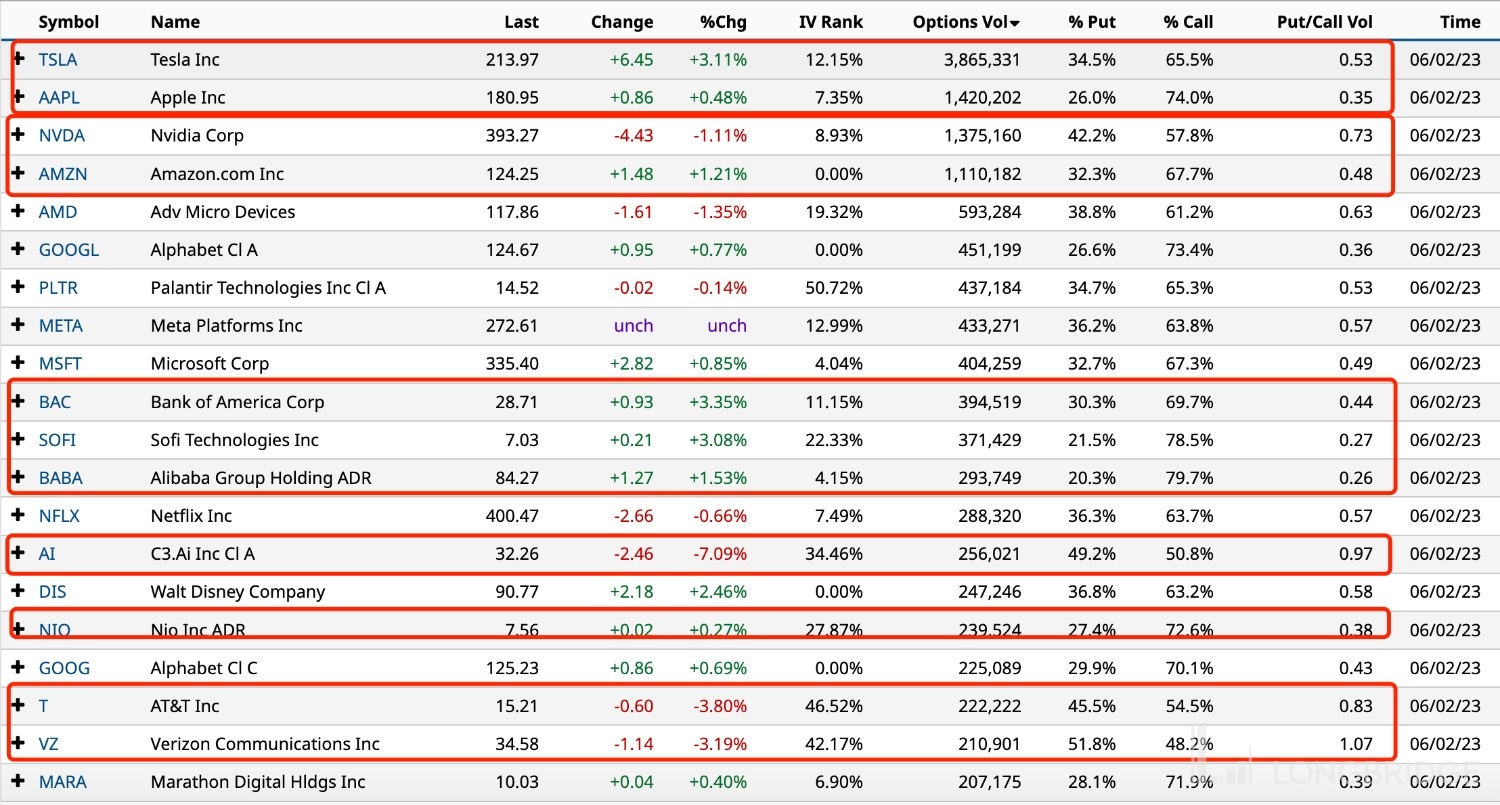

Top 10 US Stock Options

Last Friday, US stocks remained strong, with technology stocks remaining active, and bullish options trading also active.

The top 10 US stock options traded: Tesla, Apple, Nvidia, Amazon, AMD, Google A, Palantir Tech, Meta, Microsoft, Bank of America, Sofi, Alibaba.

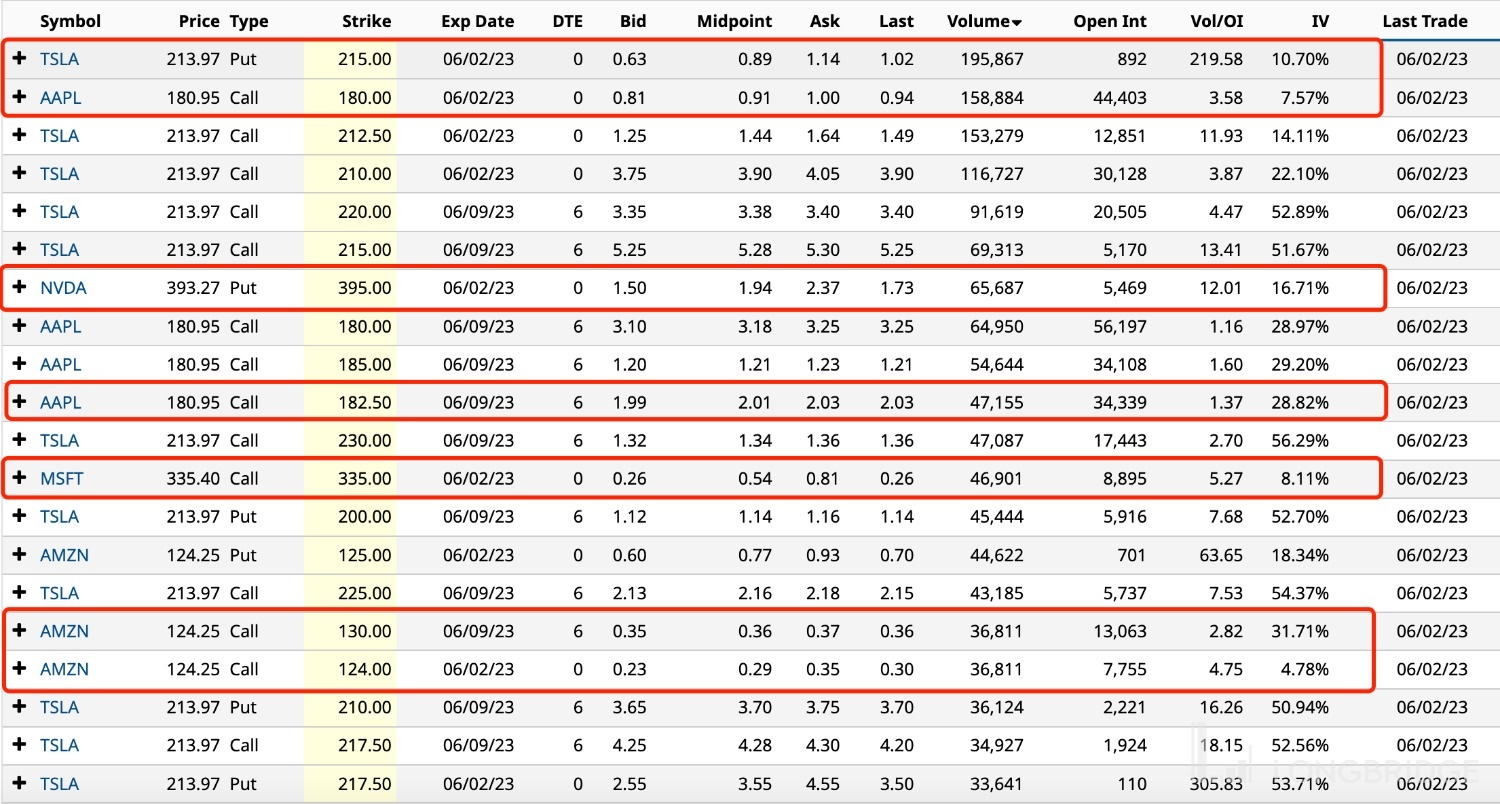

Tesla rose more than 3%, with options trading of 3.87 million contracts, nearly double the previous week, and bullish options accounting for 65.5% of the trading volume. The most active put options were those with a strike price of $215, followed by call options with a strike price of $210-220.

Apple rose slightly, with options trading of 1.42 million contracts, nearly double the previous week, and bullish options accounting for 74% of the trading volume. The most active call options were those with a strike price of $180.

Nvidia fell more than 1%, with options trading of 1.38 million contracts, and bullish options accounting for 57.8% of the trading volume. The most active call options were those with a strike price of $395.

Amazon rose more than 1%, with options trading of 1.11 million contracts, and bullish options accounting for 67.7% of the trading volume. The most active put options were those with a strike price of $125.

AMD fell more than 1%, with options trading of 590,000 contracts, and bullish options accounting for more than 60% of the trading volume.

Google A rose slightly, with options trading of 450,000 contracts, and bullish options accounting for more than 70% of the trading volume.

Microsoft rose nearly 1%, with options trading of 400,000 contracts, and bullish options accounting for 67.3% of the trading volume.

Bank of America rose more than 3%, with options trading of 390,000 contracts, and bullish options accounting for 70% of the trading volume.

Alibaba rose 1.5%, with options trading of 290,000 contracts, and bullish options accounting for nearly 80% of the trading volume; NIO rose slightly, with options trading of 240,000 contracts, and bullish options accounting for more than 70% of the trading volume.

MongoDB rose 28%, with options trading of 100,000 contracts, five times the daily average.

Broadcom rose nearly 3%, with options trading of 130,000 contracts, three times the daily average.