Love making money and spending money MEITUAN-W, appears "rider tide" effect

MEITUAN-W is not keen on showing the outside world its stronger earning ability. The money earned through efficiency improvements in the season will be spent in the form of expenses in the same season. However, the money spent has not significantly developed new core capabilities for MEITUAN-W's business, apart from efficiency and sales capabilities, and has lost its safety margin.

It's midsummer in the north. Delivery riders are sweating profusely as they rush through the concrete jungle, fulfilling orders that ultimately translate into numbers that drive the fluctuation of MEITUAN-W's market value.

As a target that cannot be ignored in the TMT sector, what do investors think of MEITUAN-W's latest quarterly report? Speaking for myself, I find it increasingly difficult to understand MEITUAN-W's financial reports. Over the past three years, MEITUAN-W has omitted active users and transaction volume from its financial reports, and in the latest quarter, it has left out delivery costs.

Less numbers mean less attention. But as Taleb said, "The more you generalize and make things orderly, the lower the randomness. Our simplification behavior makes us think that the randomness of the world is smaller than it actually is."

Out of curiosity about MEITUAN-W's deliberate avoidance of randomness, we took a financial perspective and delved into the latest financial report, discovering three key phenomena that go against the current mainstream view of the market:

"The boy who cried wolf" has been shouting for a long time, but MEITUAN-W still has no real competitors in the local life sector.

MEITUAN-W has an invisible hand that controls the "rider tide."

"The infinite game" never stops.

There is only one "Chen Haonan" in the local life sector

Let's first take a look at the background information revealed in MEITUAN-W's first-quarter report:

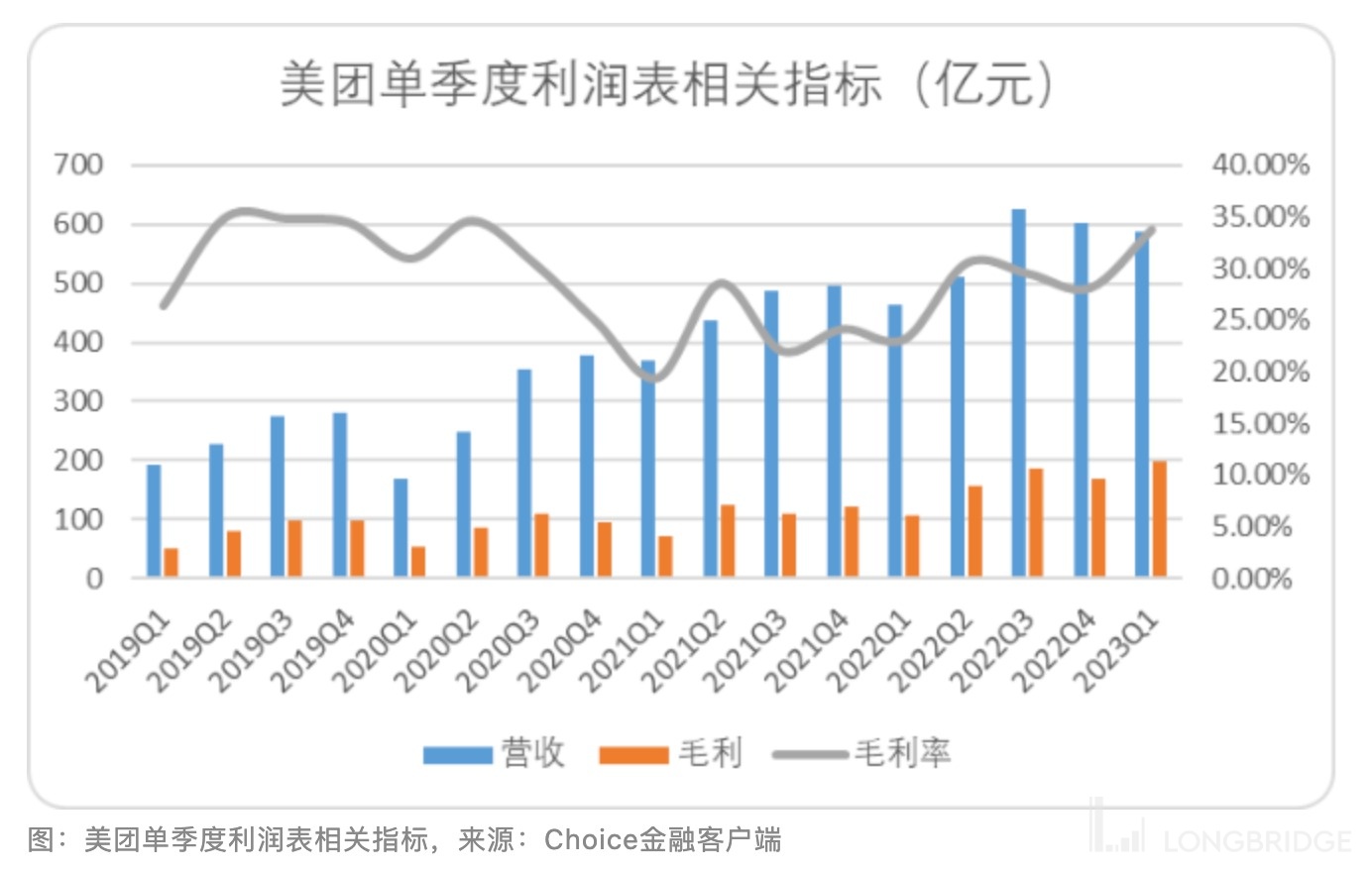

Revenue was RMB 58.6 billion, higher than Bloomberg's consensus estimate of RMB 57.5 billion; adjusted profit was RMB 5.5 billion, significantly higher than the consensus estimate of RMB 1.7 billion.

Looking at specific businesses, local services grew by 25% compared to the same period last year, and new businesses grew by 30%. The unadjusted profit narrowed by RMB 9 billion, and excluding undistributed projects, the local business profit increased by RMB 4.7 billion, while the new business contributed RMB 3.4 billion in profit.

For MEITUAN-W, this financial report can be described as "both style and substance." Especially as the core local business achieved over 20% growth in a high base, MEITUAN-W exceeded the cautious expectations of external investors.

With Ele.me teaming up with Alibaba to wage a price war and short video platforms such as ByteDance attacking, MEITUAN-W always mentions several main "competitors" in each performance communication meeting. It seems that MEITUAN-W's territory—the local life sector—has become a lamb waiting to be slaughtered.

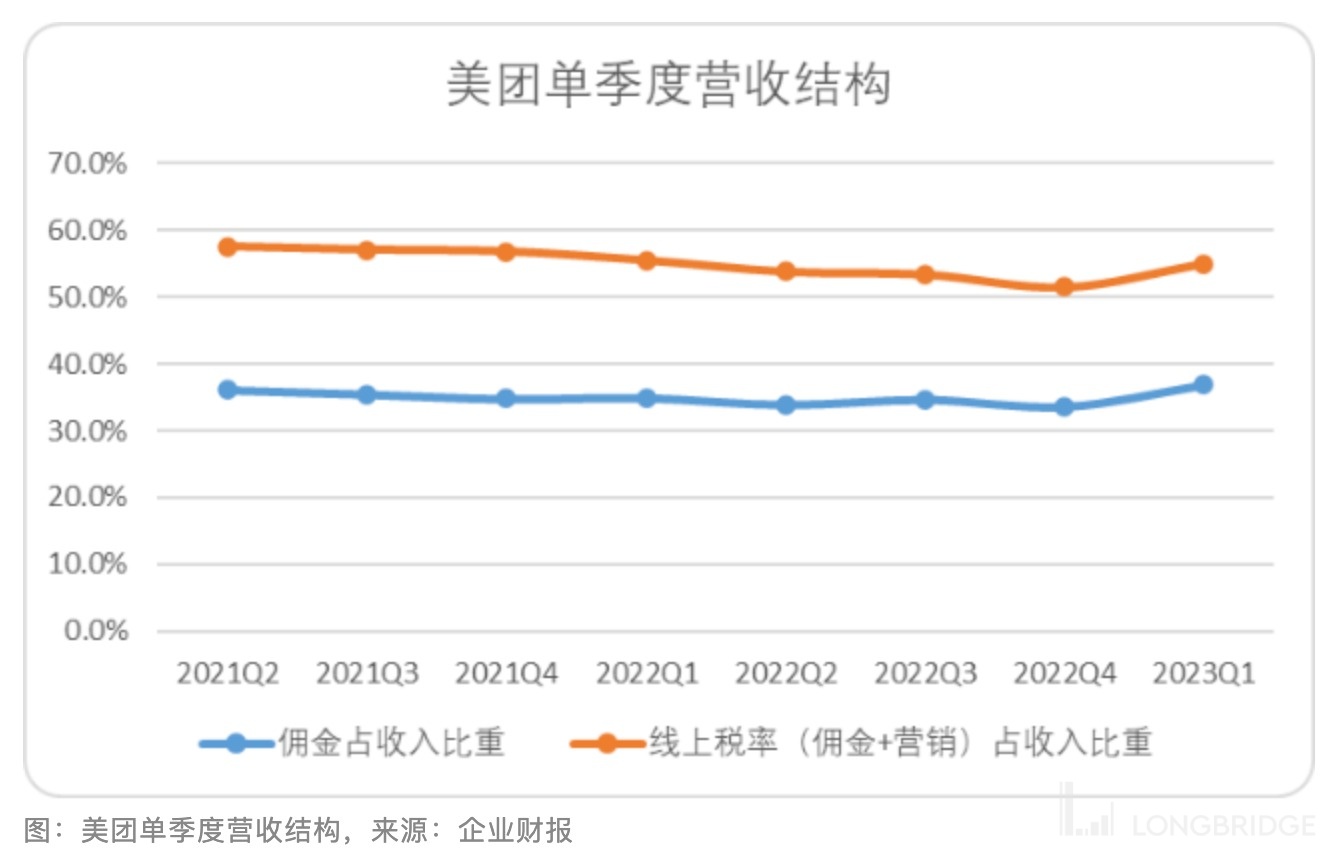

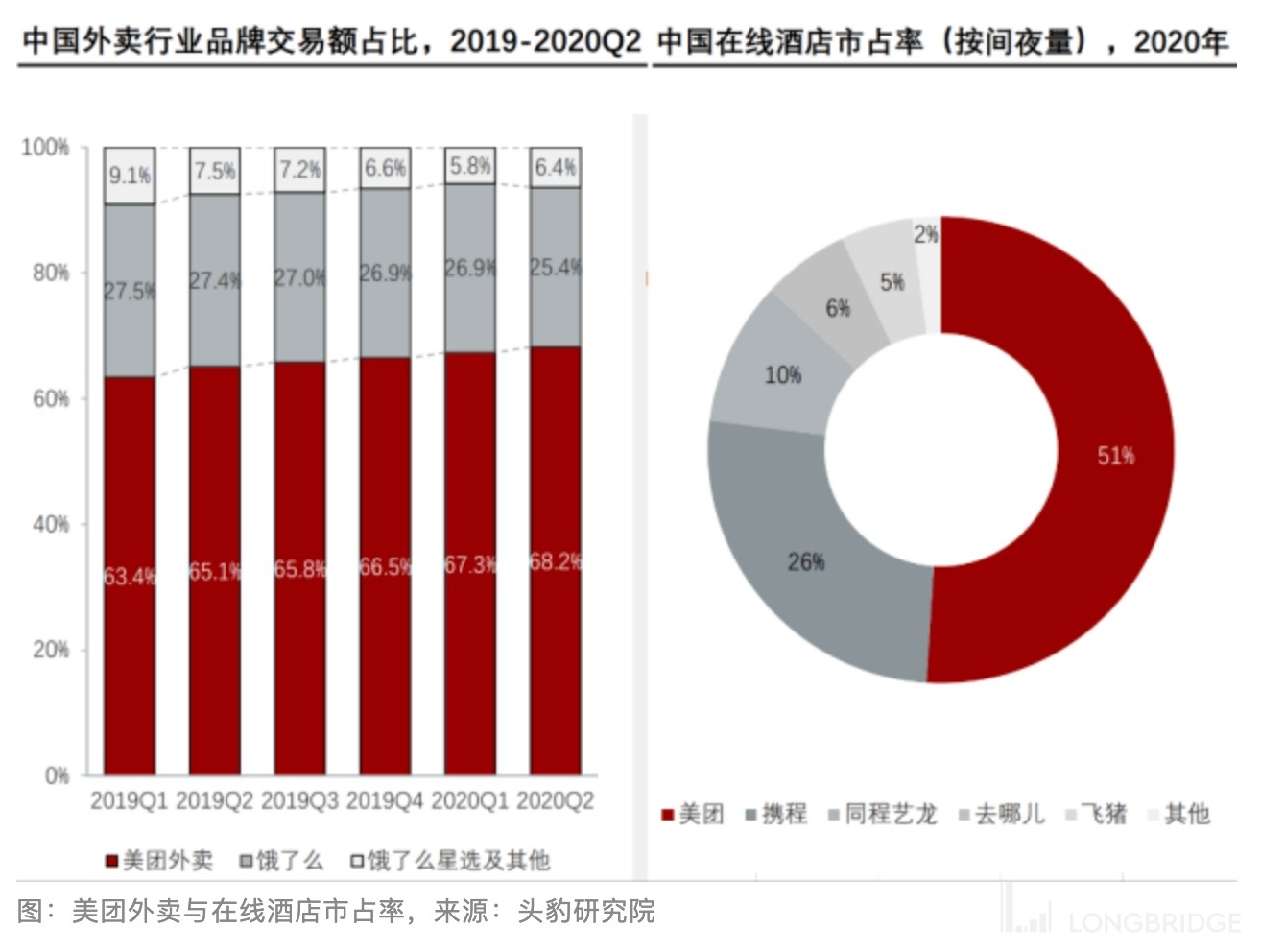

Looking back, commission income from local businesses increased by 32%, and online marketing increased by 10%. Moreover, commission and online marketing revenue—two revenues that are inversely correlated with market competition—are also stabilizing and rebounding in proportion.

So it seems that the local life cake is big enough, or maybe MEITUAN-W's demand logic is different from ByteDance's, or maybe MEITUAN-W's ground promotion ability is too strong. Whatever the reason, from the results, neither the old rival Ele.me nor the new player ByteDance, currently pose a substantial threat to MEITUAN-W.

In other words, MEITUAN-W's days are much better than expected by investors. But this may also indicate that a new and fierce battle is brewing.

"Rider Tide" Effect

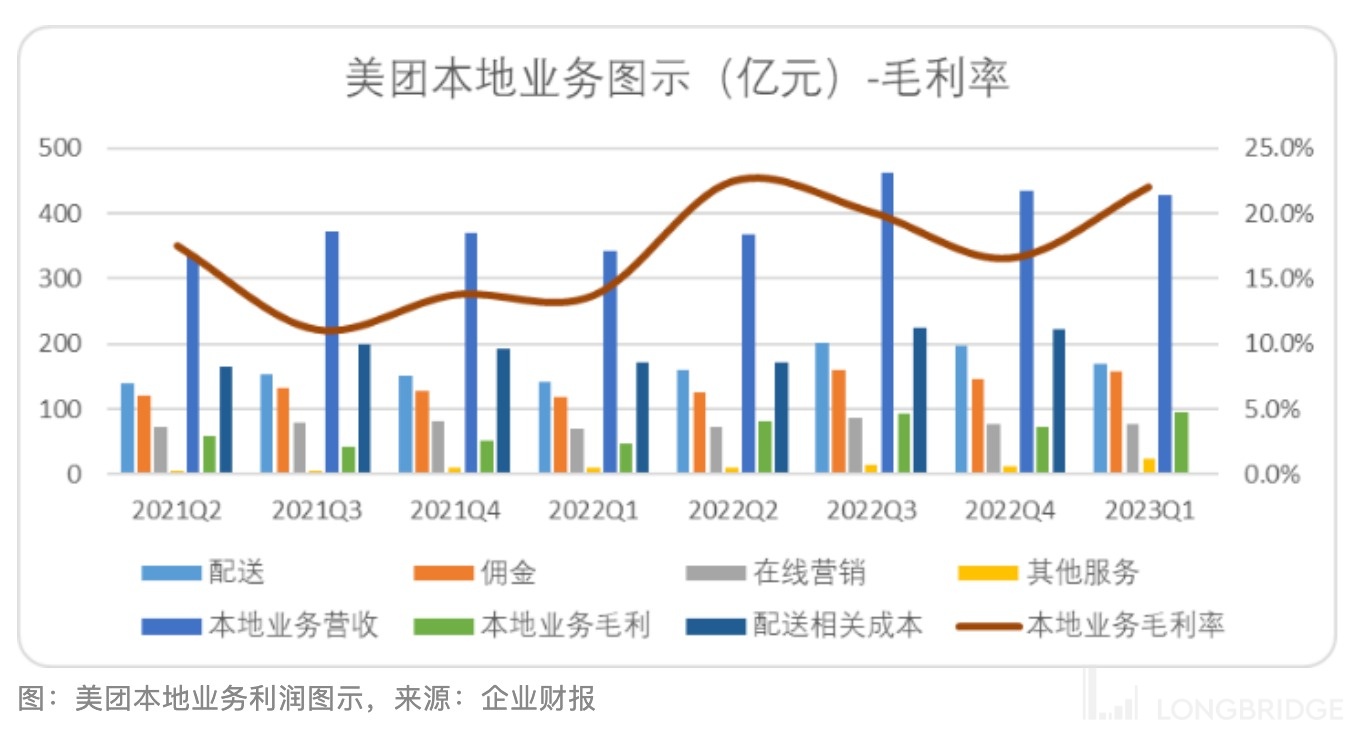

Breaking down MEITUAN-W's answer sheet that exceeded investors' expectations, we can see a clear marginal improvement: a significant increase in gross margin compared to the previous period.

We usually explain this phenomenon from a general perspective: that is, revenue growth dilutes costs. But for MEITUAN-W, this logic is not rigorous. For example, MEITUAN-W's revenue in 2022Q4 is much higher than that in 2022Q2, but the gross margin has shown a significant decline.

So in the process of exploring the reasons for the marginal improvement, we unexpectedly discovered a core code about MEITUAN-W: the "Rider Tide" effect.

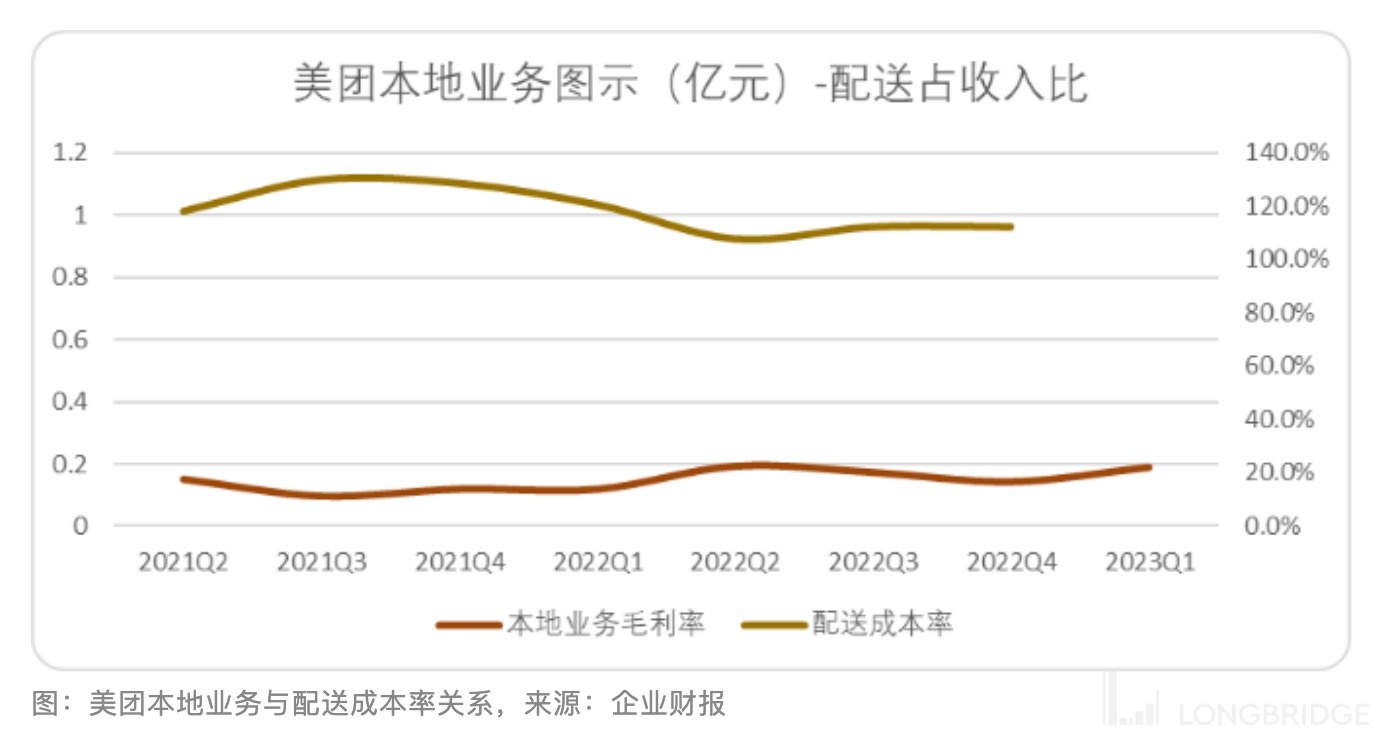

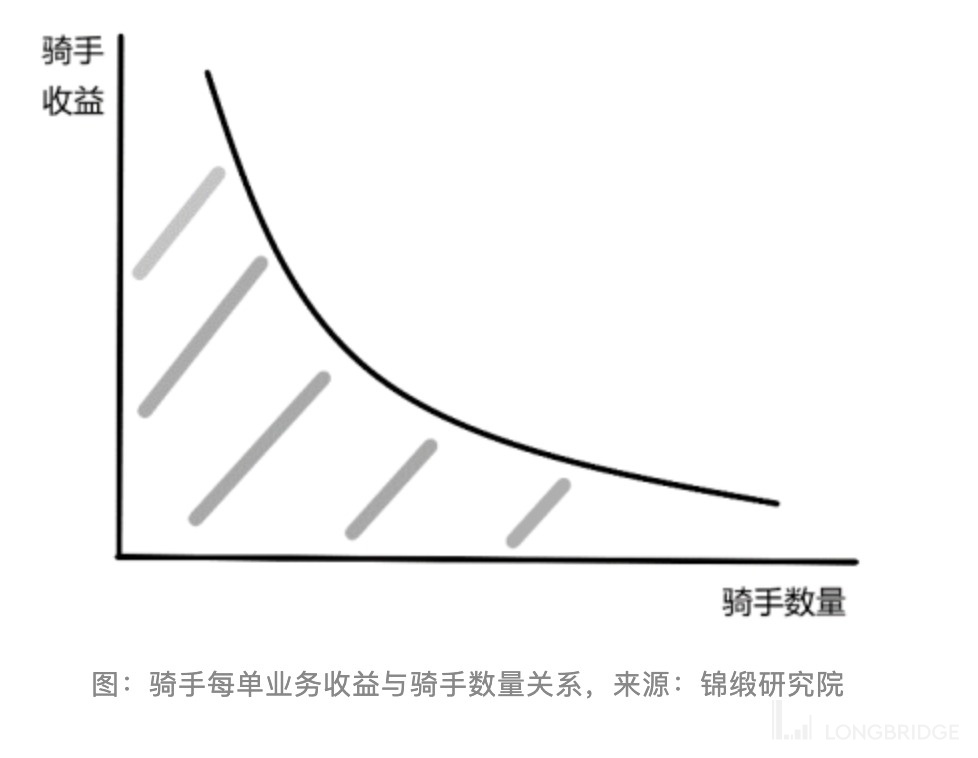

We can assume that if the rider's salary structure is a base salary plus business volume commission, then for MEITUAN-W, with a given business volume, the more riders there are, the lower the marginal benefit (ineffective base salary expenditure) - just like most companies, personnel cost-effectiveness will decrease marginally as personnel increase.

But MEITUAN-W is obviously not like this. It is more like a market economy model of pure business commission (step-by-step growth). That is: the more a single person delivers, the income increases in a step-by-step manner. This creates a result: given the business volume, the more riders there are, the lower the income per rider; the fewer riders there are, the higher the delivery cost expenditure of step-by-step increase, and the higher the income per rider.

On this basis, theoretically, two situations will occur:

-

The more riders there are, the higher the efficiency (MEITUAN-W's income), and the stable cost will push the gross margin to grow.

-

The fewer riders there are, the more advantageous prices need to be used to purchase the labor of riders, whether it is delivery subsidies or step-by-step growth in delivery unit price, theoretically, it will reduce MEITUAN-W's gross margin.

But in reality, this is not the case. For MEITUAN-W, "1" is established, and "2" can be effectively improved: when the number of riders with high income increases, and the number of riders with low income leaving increases, the two alternate to form a tide. When the tide tends to the latter, the advantage of no fixed cost (social security of a single rider) or low fixed cost (minimum wage) is reflected - MEITUAN-W uses the invisible hand of the market to combine supply and demand with cost curves perfectly, which allows it to control costs reasonably with over 6 million Longbridge Dolphins: it avoids the pressure of performance caused by a surge in business volume and the high cost caused by oversupply.

The principle is understood by everyone, but the supply and demand relationship in the market must have a lag, which is why agricultural and resource-based enterprises will experience cycles. The cleverness of MEITUAN-W's mechanism lies in the pricing mechanism of actuarial level, which controls cost expenditures and makes the delivery cost rate and local business gross profit rate show a clear negative correlation (see the figure below).

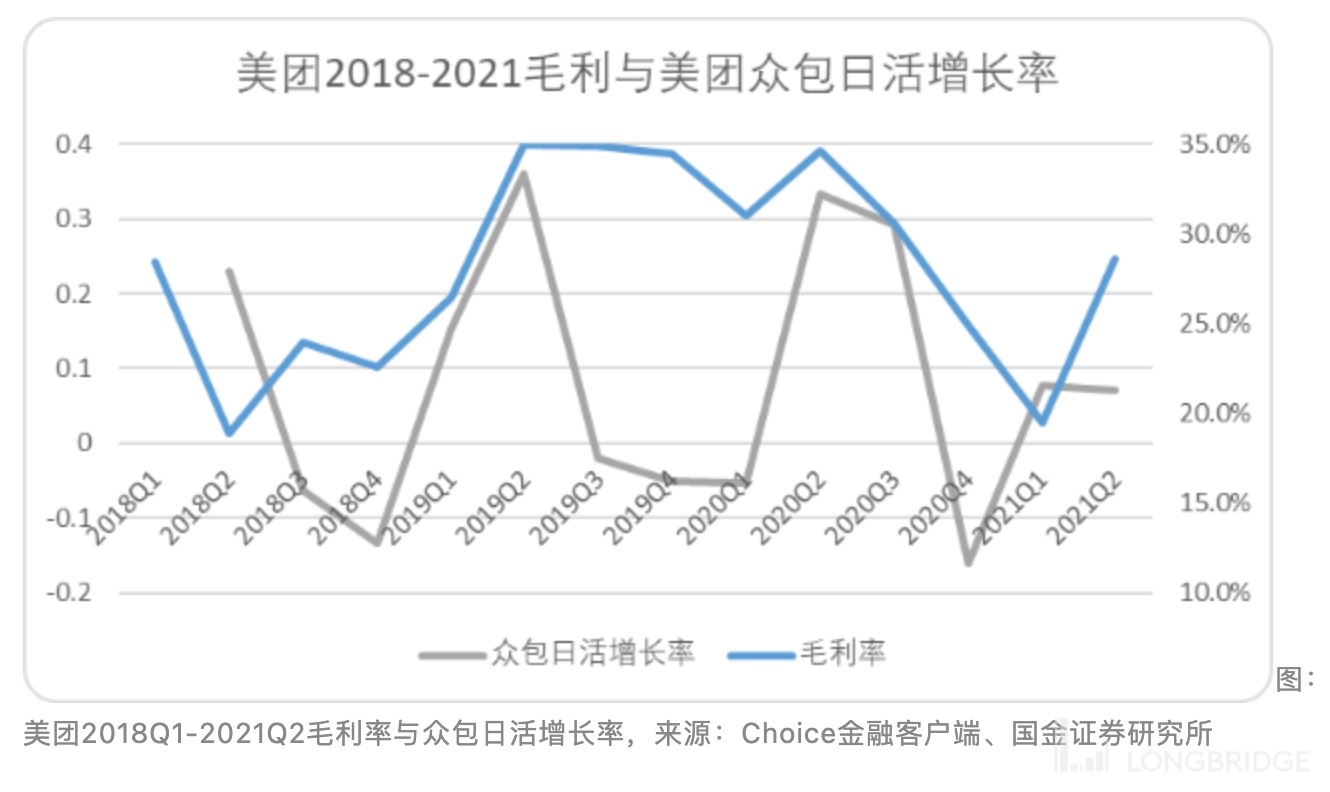

Of course, some people may question whether the delivery cost rate (delivery cost/delivery income) is "just" related to the gross profit rate, or whether the delivery cost rate is actually unrelated to the number of Longbridge Dolphins. Facts speak louder than words: although MEITUAN-W did not disclose its costs this year, we can use the daily activity growth rate of MEITUAN-W crowdsourcing and the quarterly gross profit rate of MEITUAN-W from 2018Q1 to 2021Q2 as a comparison. The trends of the two are also generally similar.

For MEITUAN-W, this is a clever balance. No matter how many Longbridge Dolphins are supplied, the absolute value of MEITUAN-W's cost is stable within a certain range (the shaded area on the left).

Through this mechanism, MEITUAN-W effectively smooths the risk of cyclical fluctuations: the more severe the internal competition among Longbridge Dolphins, the higher the gross profit rate. Therefore, based on this unique tidal effect, we judge that MEITUAN-W's gross profit rate level will fluctuate back and forth in the range of 15%-25% in the long term.

The infinite game never stops

If we really want to divide the biggest challenge that MEITUAN-W has encountered since its establishment, it is definitely not the current Ele.me and ByteDance. After all, from the data point of view, MEITUAN-W's performance has not been affected by these so-called competitors since its listing.

The real challenge in MEITUAN-W's history may still be the so-called "Hundred Regiments Battle" of group buying websites in the early 21st century. It was this battle that ultimately cultivated MEITUAN-W's core ability to dominate the market: super-strong ground promotion and sales capabilities.

If we analyze the rapidly developing new businesses of MEITUAN-W now, we can find that the significant narrowing of losses year-on-year in the first quarter of these new businesses is due to the growth of active merchants in flash purchases by 30%, the year-on-year growth of GTV in store travel by 52%, and the growth of GMV in MEITUAN-W buy vegetables by 50%. These seemingly diverse businesses and growth are still relying on MEITUAN-W's strong ground promotion ability to improve supply at the bottom logic.

On the other hand, as mentioned earlier, thanks to the improvement of the tide effect of riders and the efficiency of MEITUAN-W, MEITUAN-W has the ability to digest the supply brought by the ground promotion team. In order to improve the overflow of labor, MEITUAN-W has also gained considerable benefits even in the retail flash delivery market.

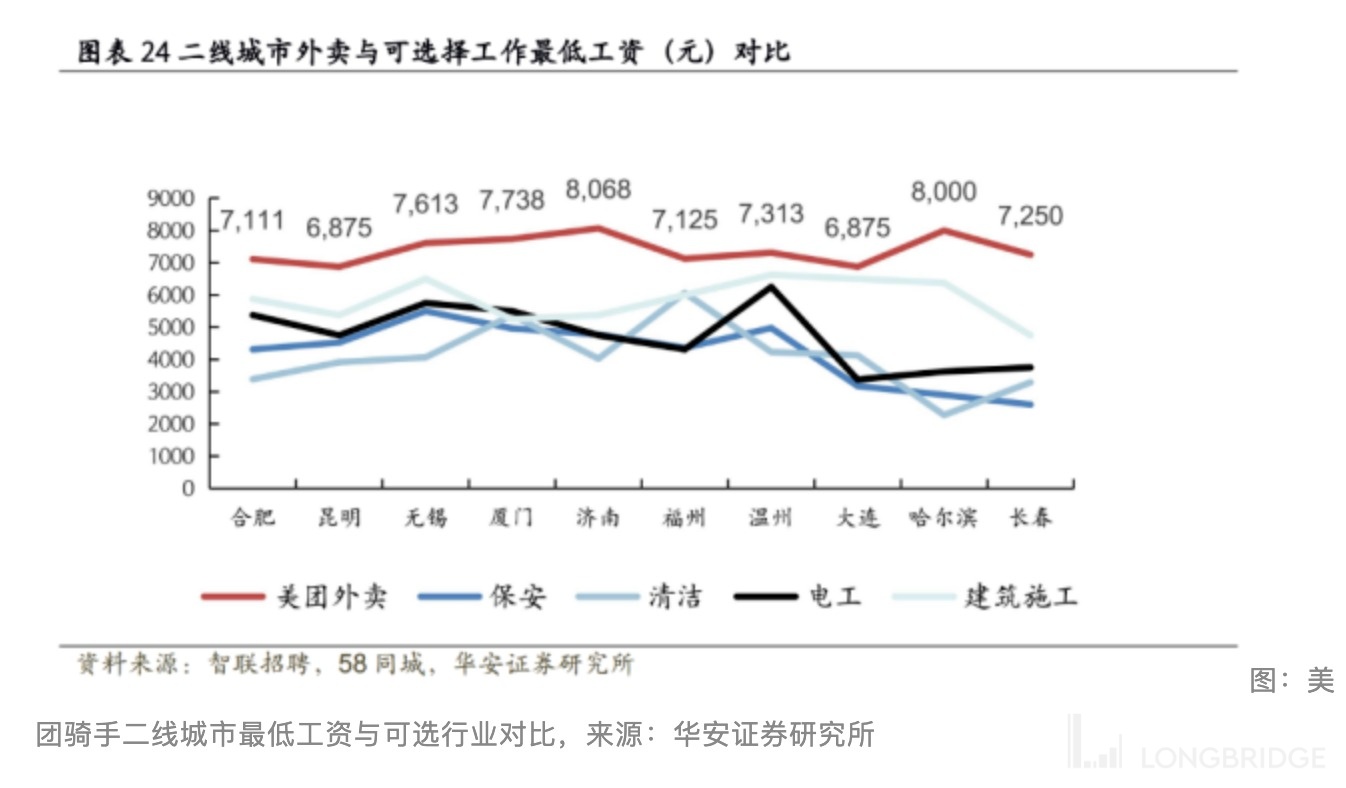

Even though we say that MEITUAN-W's profit margin is clearly dependent on the tide of rider supply, but in terms of the current economic structure, the income of MEITUAN-W riders is still significantly higher than that of ordinary positions in non-technical industries. Therefore, for individual riders, this is still a better career choice.

In summary, with one hand sales and one hand efficiency, the platform economy is played by MEITUAN-W, and in the past 5 years, it has almost not found a real opponent. Almost all the fields it has entered have firmly occupied the industry's leading position.

Relying on the ability cultivated by the "Hundred Regiments Battle", it has occupied the leading position of the platform enterprise for 10 years, and during the ten years, we seem to have seen MEITUAN-W's losses gradually narrow and profits gradually increase.

However, investors still need to pay attention to the hidden worries under the competitive advantage: looking back, in fact, the safety margin shown by MEITUAN-W in the financial statements is not thick.

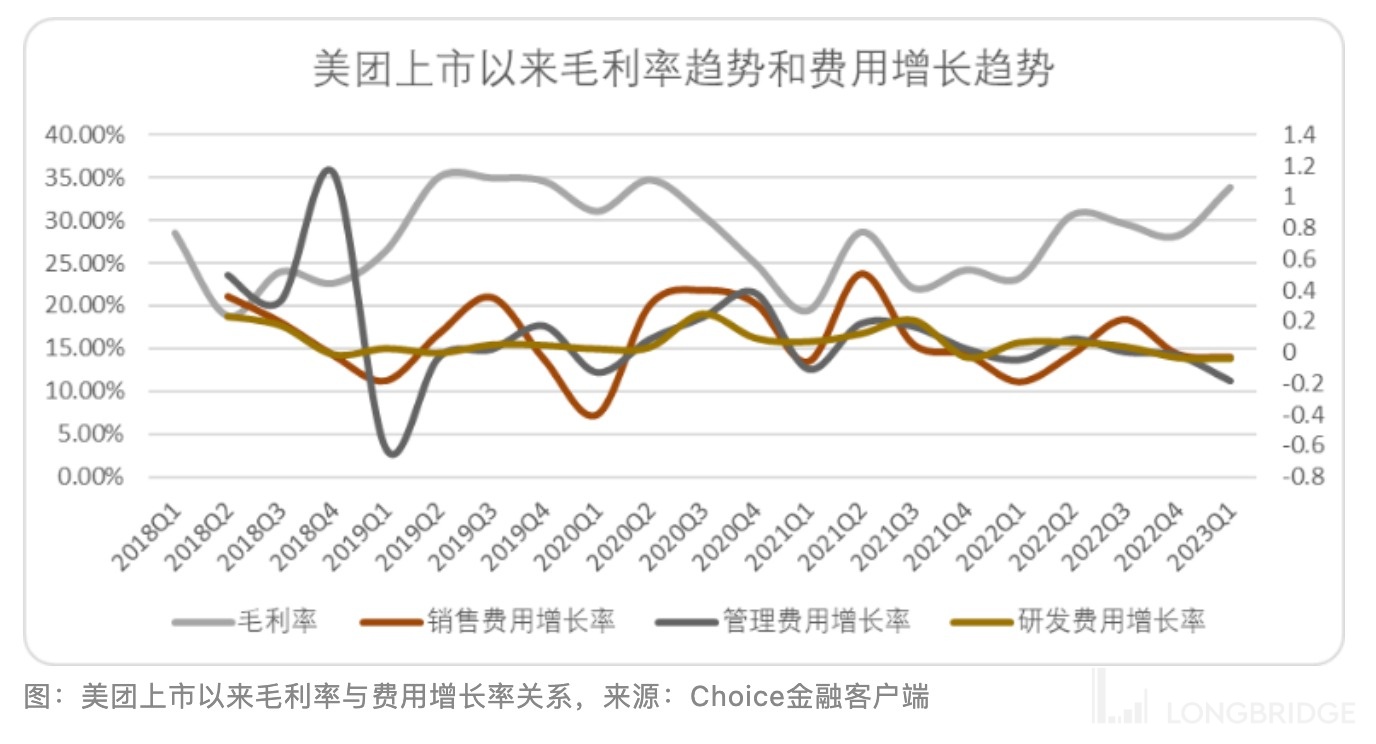

We can see that since its listing, MEITUAN-W's gross profit margin volatility has remained consistent with the three expense ratios. If there is a deviation in a single quarter, the growth rate of expenses in the second quarter will also maintain the same trend as the previous quarter.

In other words, MEITUAN-W is not happy to let the outside world see its stronger earning ability-the money earned through efficiency improvement in the quarter will be spent in the form of expenses in the quarter: either spent on marketing, research and development, or management. However, the money spent has not clearly cultivated new core capabilities for MEITUAN-W's business except for efficiency and sales capabilities, but has lost its safety margin.

Of course, it is also possible that the financial performance actually follows Wang Xing's "Infinite Game" thinking, but may "disappoint" investors, and MEITUAN-W's net profit margin may really be difficult to break through 10%.

Sacrificing marginal profits to earn more and spend more may also have a problem beyond will: if it is really necessary to increase the fixed cost of riders, or if the income of riders drops to a price range that is not competitive in optional industries, or once we are not aware of the "black swan" event, MEITUAN-W may be more fragile than imagined. This is not meant to pour cold water on MEITUAN-W, but just a friendly reminder. Taleb once mentioned the fire station effect in "The Black Swan": when firefighters talk too much, they tend to form the same opinions about things. And this phenomenon is exactly the breeding ground for black swans.