Apple, Microsoft, Google, Amazon! The "Four Trillion" in the US stock market, who is expensive? Who is undervalued?

Morningstar, a rating agency, believes that Amazon and Google are undervalued, Microsoft's stock price is relatively reasonable, while Apple and Nvidia, which once reached a trillion-dollar market value, are completely overvalued! Especially Nvidia, even after Morningstar raised its fair price by 50% to $300, it is still very expensive!

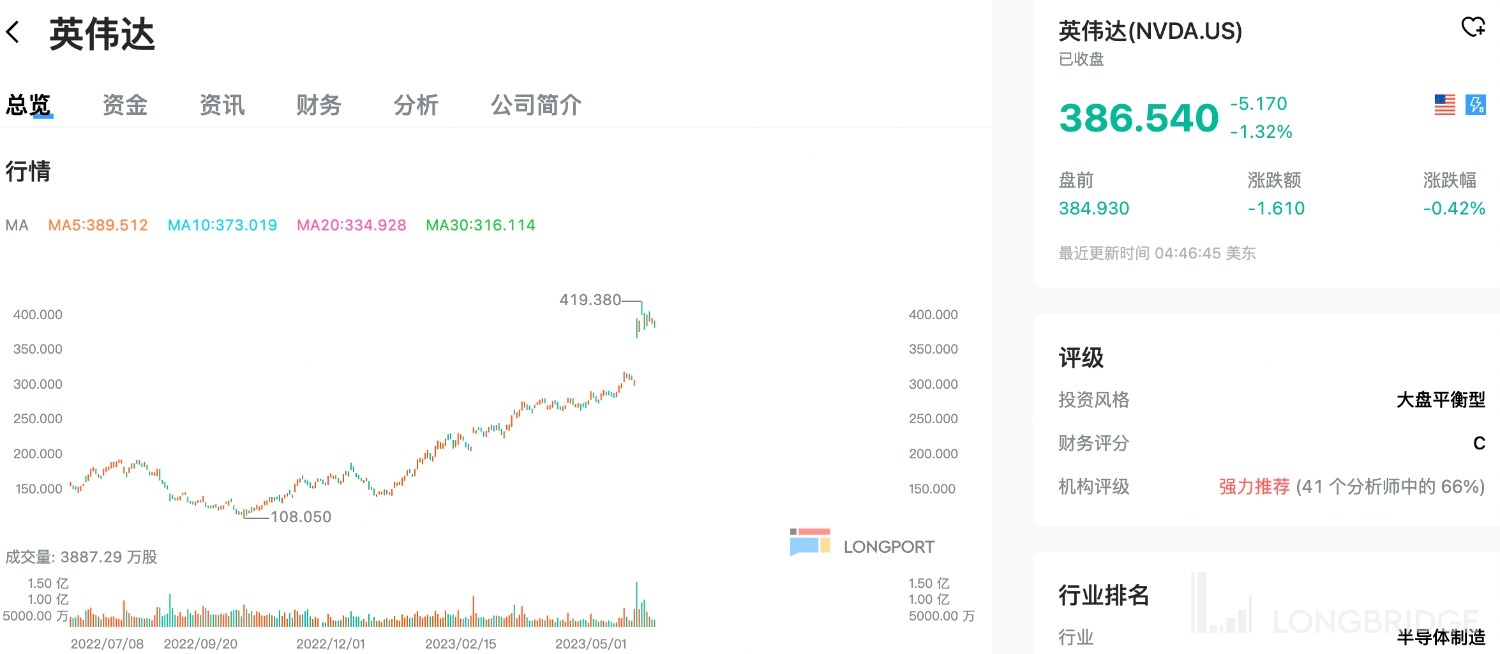

Since NVIDIA's market value exceeded $1 trillion last week, the members of the "elite club" with the highest market value in the US stock market have once again returned to the spotlight.

Currently, there are four stocks in the US stock market with a market value still above $1 trillion, all of which are leading technology stocks: Apple, with a market value of $2.82 trillion, followed closely by Microsoft with a market value of $2.48 trillion. Google and Amazon are ranked third and fourth, with market values of $1.62 trillion and $1.3 trillion, respectively.

Is the "four trillion" market value of the US stock market really justified? Who is overvalued? Who is undervalued?

According to rating agency Morningstar, Amazon and Google are both undervalued, Microsoft's stock price is relatively reasonable, while Apple and NVIDIA, which once reached a market value of $1 trillion, are completely overvalued!

In terms of individual stocks, Morningstar believes that Amazon's first-quarter performance looks good due to the boost from e-commerce and advertising, but AWS cloud services have slowed down, so a fair price of $137 is given. Based on the latest closing price, this price implies an 8% upside!

Google, on the other hand, despite search and cloud businesses still being growth engines, is facing pressure on YouTube and online advertising revenue, so a fair price of $154 is maintained. Based on the latest closing price, this price implies a 21% upside!

Microsoft has demonstrated comprehensive strength in the first quarter, with significant increases in revenue and profit, and the outlook for the next quarter is better than expected. Therefore, Morningstar raised its fair price from $310 to $325, a 5% increase. Based on the latest closing price, this price implies a 3% downside.

As for Apple, Morningstar believes it is overvalued mainly because Apple's performance has exceeded expectations due to strong iPhone and service revenue, while the macroeconomic headwinds continue. Therefore, it adopts a cautious attitude towards the next few quarters.

Morningstar gives a fair price of $150 for Apple. Based on the latest closing price, this price implies a 16% downside.

As for NVIDIA, despite raising its fair price from $200 to $300, a significant 50% increase, after impressive performance and astonishing forecasts, Morningstar still considers NVIDIA to be very expensive as this price is still 22% lower than its latest closing price.