Earnings Report is Out | TSMC's Q2 Profits Better Than Expected, Continued Growth in Automotive Business

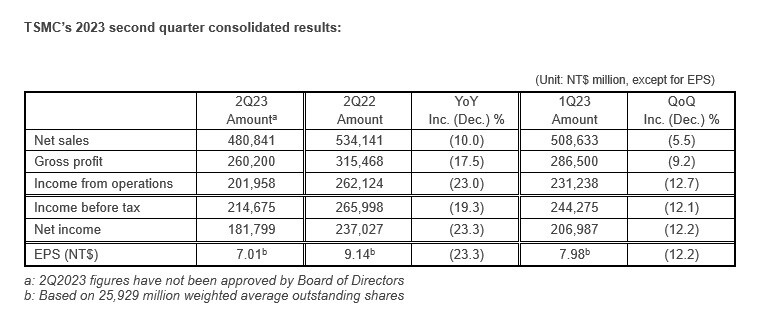

Second-quarter revenue for TSMC was NT$480.84 billion, with a net profit of NT$181.8 billion, surpassing market expectations of NT$172.5 billion. The YoY decline was 10.0% and 23.3% respectively.

TSMC released its second-quarter financial report, with profits and gross margin exceeding market expectations, while the North American market and automotive business maintained growth.

Analysis of Q2 Performance

TSMC's revenue in Q2 was NT$480.84 billion, compared to NT$534.1 billion in the same period last year.

Net profit in Q2 was NT$181.8 billion, surpassing the market expectation of NT$172.5 billion, but lower than NT$237.027 billion in the same period last year.

Diluted earnings per share were NT$7.01 (ADR equivalent of $1.14).

Compared to the same period last year, Q2 revenue decreased by 10.0%, and net profit and diluted earnings per share both decreased by 23.3%.

Compared to Q1 2023, Q2 revenue decreased by 5.5%, and net profit decreased by 12.2%. All data is compiled according to TIFRS.

In US dollars, Q2 revenue was $15.68 billion, a YoY decrease of 13.7% and a MoM decrease of 6.2%.

The gross margin for Q2 was 54.1%, higher than the market expectation of 53.3%; operating margin was 42.0%, and net profit margin was 37.8%.

Analysis of Segment Business

In Q2, our business was affected by the overall global economic conditions, which suppressed demand in the end-market and led to customer inventory adjustments.

Overall, the automotive business continued to grow, with growth in the North American market, while the Chinese market slowed down.

From a technological perspective, the 5nm process contributed 30% to the total wafer revenue in 2Q23, while the 7nm process accounted for 23%. Advanced technologies (7nm and below) accounted for 53% of total wafer revenue.

In terms of platforms, HPC and smartphones accounted for 44% and 33% of net revenue, respectively, while IoT, automotive, DCE, and others accounted for 8%, 8%, 3%, and 4% respectively.

Revenue from HPC, smartphones, IoT, and other businesses decreased by 5%, 9%, 11%, and 5% respectively, while revenue from automotive and DCE businesses increased by 3% and 25% respectively.

From a regional perspective, revenue from North American customers accounted for 66% of total net revenue, while revenue from China, Asia Pacific, Europe, Middle East and Africa (EMEA), and Japan accounted for 12%, 8%, 7%, and 7% respectively.