US stock market loses its biggest momentum! Under the pressure of interest rates, technology stocks have already pulled back by 10%.

人們擔心,隨着大型科技股的崩潰,市場可能會出現逆轉。

隔夜,美股三大股指均跌超 1%,大型科技股全線下跌,美債收益率上升和美元走強繼續令市場承壓,最新的房屋銷售和消費者信心數據引發了投資者對美國經濟狀況的擔憂。

大型科技股是今年上半年推動美股上漲的主要力量,然而進入 9 月,這一支撐一直在動搖。

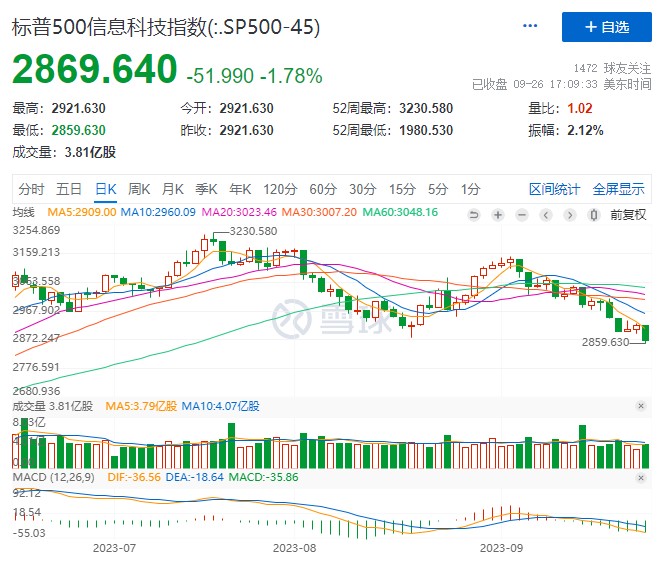

更集中於大型科技股的標普 500 信息科技指數,已從 7 月份的高點下跌了超 10%。該指數也在過去 5 個交易日中,第三次下跌 1%。

今年大部分時間裏,美聯儲的鷹派立場並未對股市構成問題,但隨着官員們繼續暗示利率可能需要在比投資者預期更長的時間內保持在較高水平,市場情緒正在惡化。

人們擔心,美聯儲抑制通脹的熱情可能會破壞經濟,再加上消費者趨於謹慎,隨着大型科技股的崩潰,市場可能會出現逆轉。

美國最大獨立經紀交易商 LPL Financial 的首席全球策略師 Quincy Krosby 表示:

“對收益率上升的擔憂尚未消散,甚至變得更加嚴重了,儘管科技股可能能夠堅持下去,但你開始看到裂縫。”

“市場的一個非常重要的因素——美國消費者,正變得越來越擔心,這不是市場希望看到的。”

利率將長時間高企的預期帶崩了消費者信心

週二,標普 500 信息科技指數週二下跌 1.8%,跌幅從 7 月高點擴大至 11%,10 年期美債收益率徘徊在 2007 年以來的最高水平附近。標普 500 指數下跌 1.5%。

明尼阿波利斯聯儲主席卡什卡里 (Neel Kashkari) 表示,如果經濟強於預期,他支持今年再加息一次,打擊了市場人氣。

此前摩根大通首席執行官傑米•戴蒙 (Jamie Dimon) 警告稱,最壞的情況仍然有可能發生,即美聯儲基準利率觸及 7% 並出現滯脹。

一度熱情高漲的消費者已經明白了這一點,美國諮商會消費者信心指數的大幅下滑就是明證。與此同時,該指數中反映消費者對未來六個月展望的預期指標跌至 73.7,低於 80 的水平,從歷史上看,80 是未來一年經濟衰退的標誌。

投資者懷疑科技股能否恢復上漲勢頭

雖然科技公司的全球化性質在一定程度上使它們免受國內增長困境的影響,但它們也無法完全置身事外。

知名投資機構 Miller Tabak 的首席市場策略師 Matt Maley 説,隨着人們對利率長期高企的擔憂加劇,拋售今年大部分時間表現最好的大型成長型股票,正日益成為投資者的一個資金來源。

Maley 還表示:

“現在終於意識到利率確實會在更長時間內保持在高位,(投資者) 很快開始擔心這些大型科技股的估值水平。”

即便自 7 月以來下跌了 10%,標普 500 信息科技指數年內仍上漲了 32%,而同期標普 500 指數的漲幅為 11%。

但投資者懷疑大型科技股能否很快恢復上半年的上漲勢頭。

花旗集團策略師表示,以科技股為主的納斯達克 100 指數目前單邊淨空頭頭寸為 81 億美元,所有多頭頭寸均已平倉。

對此有分析稱,部分原因是獲利了結,部分原因是股市的焦慮情緒,因長期利率走高的基調確實確實已然開始紮根。