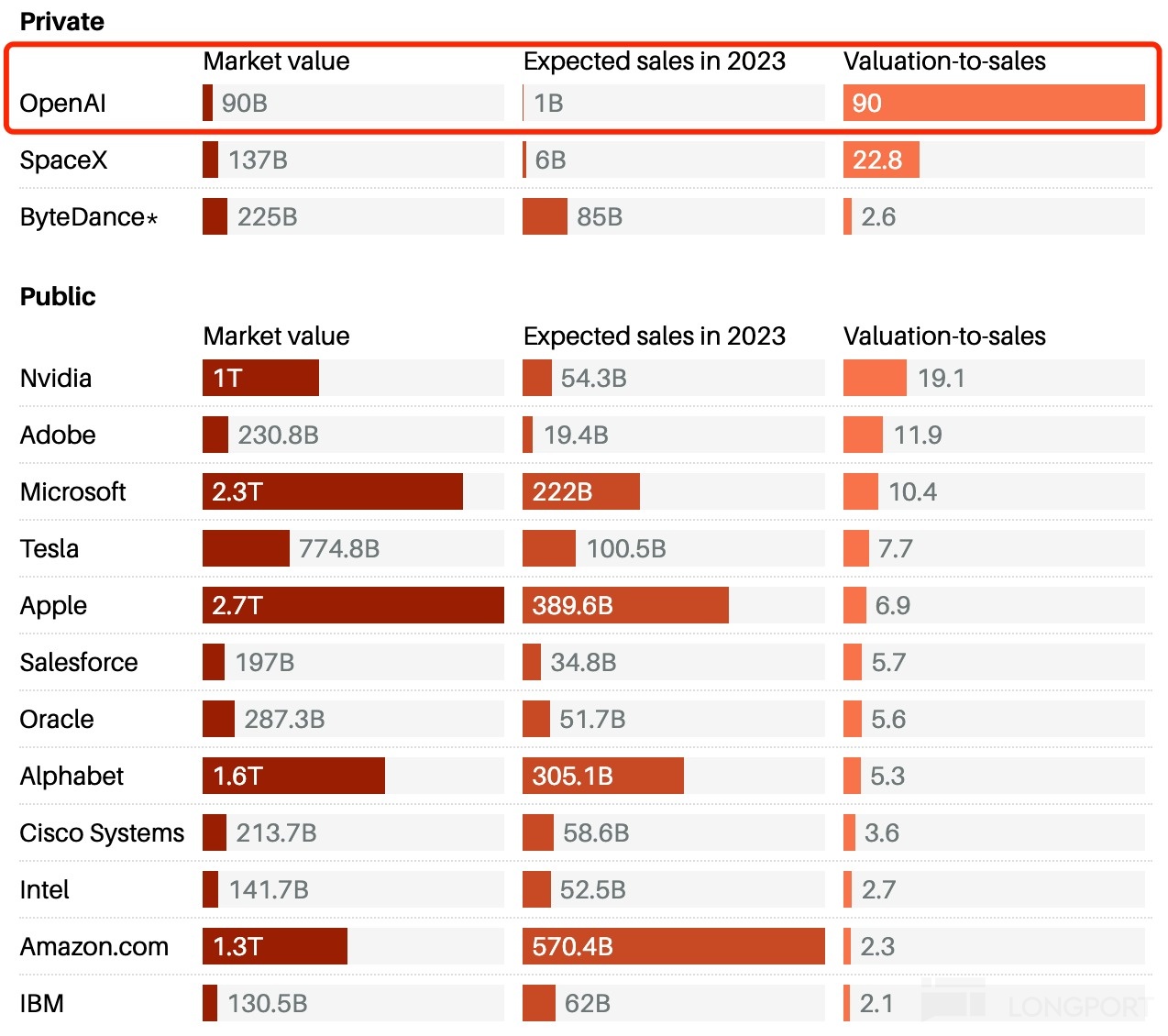

Is OpenAI, valued at $90 billion, only second to ByteDance and SpaceX, too expensive?

ByteDance and SpaceX have valuations of $225 billion and $137 billion respectively, which means their price-to-sales ratios are approximately 2.6 times and 22.80 times.

According to a report from The Wall Street Journal on Tuesday, OpenAI is in negotiations with investors regarding the possibility of selling stocks at this valuation, which would allow employees to cash out by selling stocks to external investors. In the past, venture capital firms have purchased OpenAI stocks through tender offers.

According to sources cited by The Wall Street Journal, the company has informed investors that it expects to generate $1 billion in revenue this year, with an additional several billion dollars by 2024.

While the basic version of OpenAI's ChatGPT is free, the company charges for its more advanced and powerful features. Companies that want to use OpenAI's large language models in their own products also need to pay a fee.

OpenAI's valuation could triple to reach between $80 billion and $90 billion. A valuation of $90 billion would mean that investors would be paying $90 for every $1 of revenue generated this year.

More Expensive than SpaceX and Nvidia

Investor interest in OpenAI is justified as it appears to be at the forefront of a major technological revolution.

Microsoft has invested billions of dollars in OpenAI and currently owns 49% of the company. Alphabet is preparing its own artificial intelligence program, Gemini, to compete with OpenAI's state-of-the-art large language model, GPT-4.

If OpenAI's employees are indeed able to sell their stocks at the expected price, this AI company will become one of the highest-valued startups. It would be second only to ByteDance and SpaceX, with valuations of $225 billion and $137 billion, respectively.

ByteDance had revenue of $85 billion last year, with profits soaring 79% to $25 billion, resulting in a market-to-sales ratio of approximately 2.6.

Meanwhile, SpaceX generated $1.5 billion in revenue in the first quarter of 2023, with an estimated market-to-sales ratio of 22.80.

OpenAI only started generating significant revenue after the release of ChatGPT in November last year and is likely not yet profitable. Given the company's current limited revenue, the valuation of $80 billion to $90 billion demonstrates investors' optimism towards artificial intelligence.