指望美股大调再上车?可能性不高

大家好,以下是海豚君总结的本周策略周报核心内容:

1)高息压制之下,2 美国地产销售、开发反而双双升温; 而如果 2024 年连续降息三次,贷款利率下行过程中,房屋销量规模进一步恢复到 2019 年以上,房屋单价不再下行应该只是时间问题。到这里基本可以合理推测,美国地产市场的底部调整基本到底结束了。

2)基于美联储最新的经济预测,Fed 对下阶段美国经济的判断很可能是高增长、相对高利率、低失业率,在形态上可能非常接近 90 年代克林顿执政的经济状态,而目前的经济走势也确实符合这个趋势。

3)在基本面靠谱的情况下,海豚君认为应该关注市场流动性,但不应过分强调,尤其是经济和股市都较强的情况下,叠加逆回购余额上所体现的超额流动性,财政部和美联储有配合的空间,来避免流动性冲击。

4)整体上,在 2024 年一季度行将结束之际,美股所处的宏观环境是——强就业、强经济、高赤字,且流动性持续宽松。这种情况下,虽然权益资产或许估值相对较高,但很难有大幅度回调,最多是估值高了之后,等业绩发布来稀释估值。

以下是详细内容:

上周美股宏观信息量整体较少,主要是最新房屋销售数据以及 3 月美联储的议息会议。新房销售与房屋新开工数据都较高,而议息会议的结果很可能说明今年强经济之下还有降息助力,美股短期看难以有较大回调。

一、高息压不住美国地产的萌动

在房贷利率还在 6-7% 之间徘徊之际,2 月美国二手房 + 新房的销量季调折年上无论是环比还是同比,已经进入了正增长的状态。目前美国房屋销量基本恢复到了疫情前 2019 年同期的 90%。

分存量房和新房来看,新房是量增价跌,尤其新房价格同比环比都在下跌中,而二手房量价齐升,其中二月二手房交易量拉升幅度尤其大。

也由于地产市场表现较好,现在私人住宅新开工量持续增长,地产开发已经超前于降息周期体现进入了上行状态。

这种情况下,如果 2024 年连续降息三次,贷款利率下行过程中,房屋销量规模进一步恢复到 2019 年以上,房屋单价不再下行应该只是时间问题。

到这里基本可以合理推测,美国地产市场的底部调整基本到底结束了。

二、美联储 3 月会议:圆滑的周期老手

3 月的议息会议结束,毫无意外,美联储维持基准利率不变、维持年内降息三次的预期不变,但提高了 2024 年的经济增长预期,调降了 2024 年失业率预期,调高了 2024 年的核心 PCE 预期。

很明显,经过三个月美联储的委员们对美国经济更加自信了,当前的政策利率限制性过高,即使年后通胀反弹,也仍然不改年内降息三次的预期。

主要的变化来在于 2025、2026 年之后的预期:提提高了 GDP 的增长预期和政策利率的位置,这里似乎隐含着一种判断:

疫后美国经济是高增长、相对高利率、低失业率,在形态上可能非常接近 90 年代克林顿执政的经济状态。

而从目前经济的走势来看,在房地产和汽车两大核心产业上,地产有过去十年去库存下的低供给和居民强劲购买力托底,高端制造业(新能源汽车、芯片半导体)+ 基建重建等,有财政刺激下的拜登三大法案支撑 +AI 新技术推动,美国当前经济走势确实趋于软着陆或不着陆的路径。

三、美股流动性:关注但不过分强调

基本面无忧的情况下,海豚君认为市场的流动性应该是关注,但不应该过分强调。因事情演绎到现在,在资产通胀的背景下,美联储和财政部有足够的施政空间,防止出现流动性风险。

美联储在这次议息会议上,对于缩表节奏的表述:

a. 正式开打预防针:“美联储的委员们会议上讨论了放慢债券抛售节奏的问题,但此次并未做出任何决定。相对一致的想法是很快 (fairly soon) 放缓节奏是合适的,这与我们之前的计划一致。但放缓并不是减少最终的缩表量,更多是时长拉得更久一些。“

b. 资产结构优化:MBS 不会缩量,主要是放缓国债的抛售节奏。长期目标是把美联储的资产端集中到国债上,但目前决策的优先顺序上,抛债节奏判断第一,结构优化第二。

对于逆回购填补流动性缺口问题,鲍威尔的表述是:

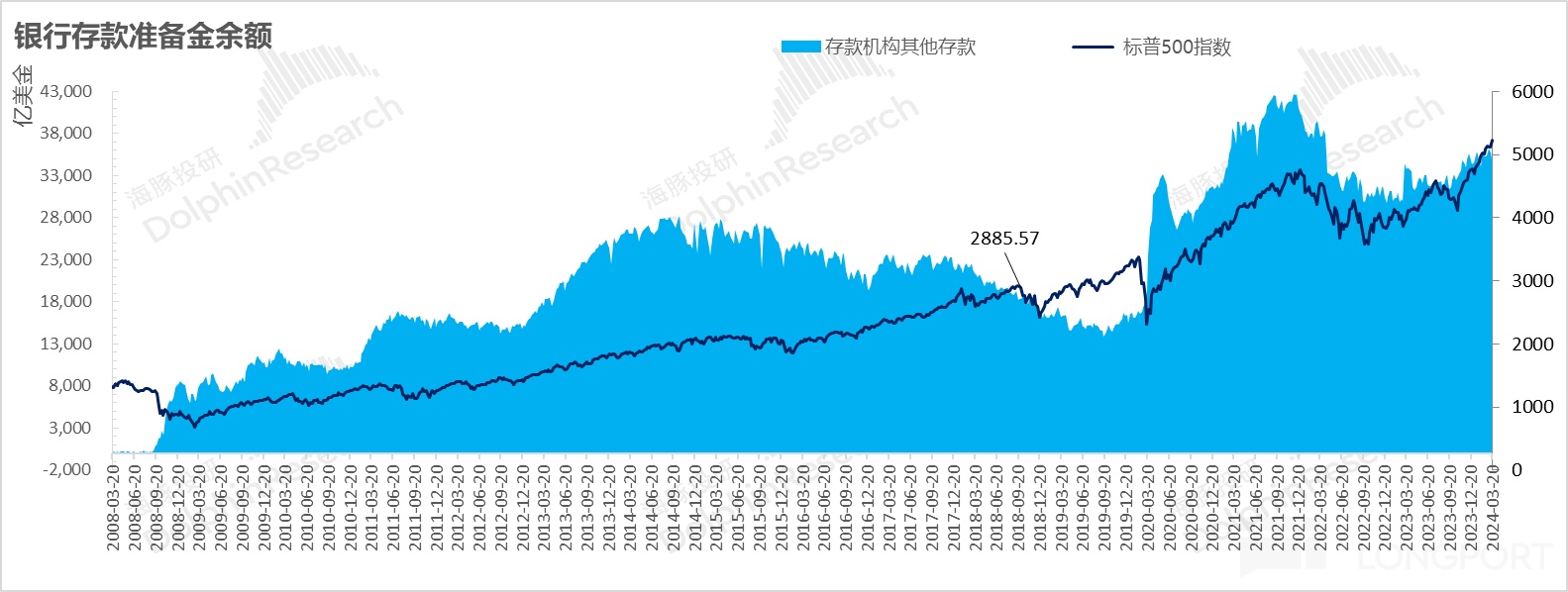

a. 一旦隔夜逆回购余额稳定下来,可能是零,也可能是接近零,那么资产负债表的进一步收缩,应该就对应着银行准备金余额等额的收缩。

b. 目前准备金是充裕甚至过剩(abundant),而目标是要缩量到充足(ample),观察指标如货币市场的各类利率指标,防止出现类似 2019 年和 2020 年的流动性冲击。

从以上描述可以看到:

第一,接下来两次议席会议的时间是 5 月和 6 月,假设 5 月发布放缓规划,给市场一些缓冲时间,那么年中放缓缩表节奏的计划应该就会执行;

第二,经过之前流动性冲击问题之后,明显现在的美联储长了很多教训,在政策意图上是谨慎防止出现流动性冲击事件。相比加息时候,主观上有意压降股市表现,美联储在缩表节奏上无疑制造流动性冲击,来压低债市和股市表现。

当然市场上有一种声音说,3 月中旬 BTFP 会到期,4 月会进入纳税季,到时市场流动性可能会受到冲击,同时逆回购快速消耗,市场流动性会受到冲击。

但从财政上来看,财政目前主打高收高支,个税缴纳之后,钱跑到 TGA 账户上,不等捂热就已经花出去了,很快转成积极财政政策带来的实物工作量,支撑经济扩张;且收入增多之后,财政融资压力减少。最终所谓纳税吸食流动性很可能通过财政部净融资额的减少而对冲掉了。

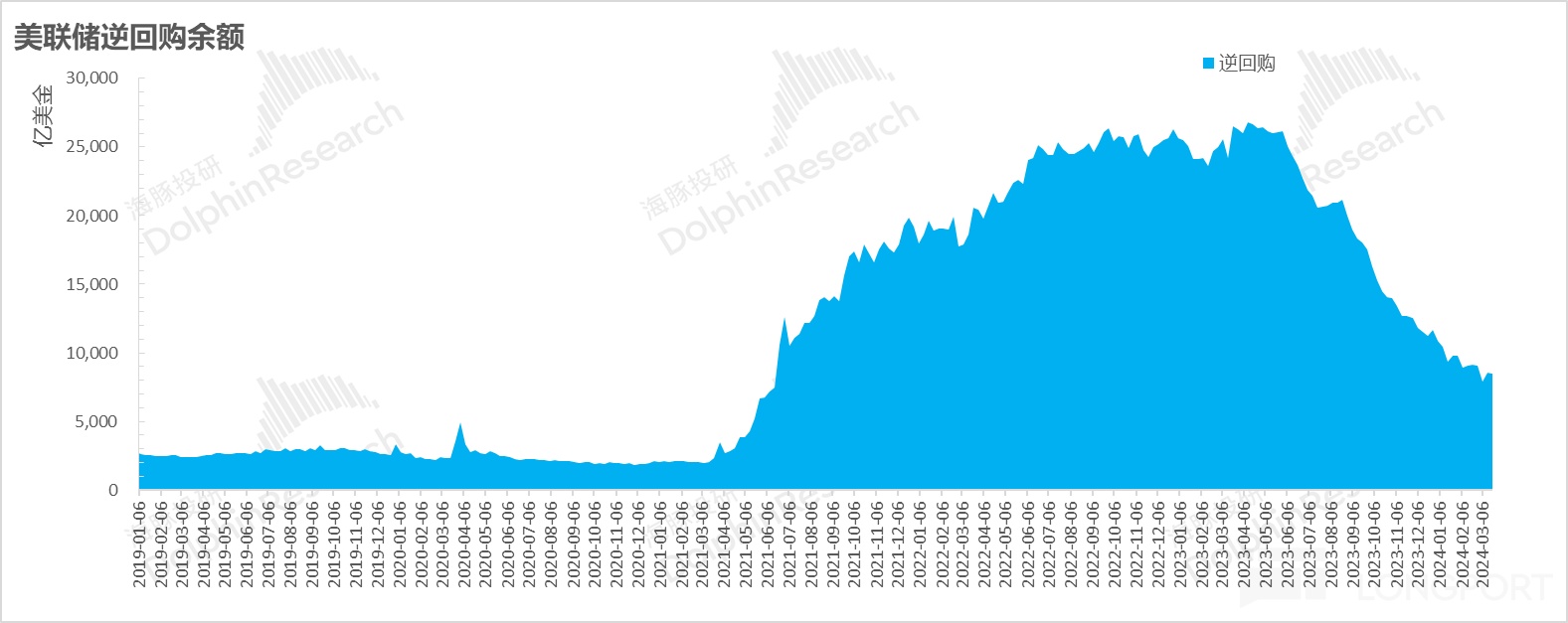

而逆回购上,随着 TGA 账户的增加,反而消耗速度有所放缓,到目前的余额是 8500 亿美金,即使后续 BTFP 到期导致月消耗从 1000-1500 亿美金,拉到月消耗 2000 亿美金,距离疫情前 2000 亿美金余额,仍有 3 个月的消耗时间。而三个月后,美联储又可以用缩表来对接上。

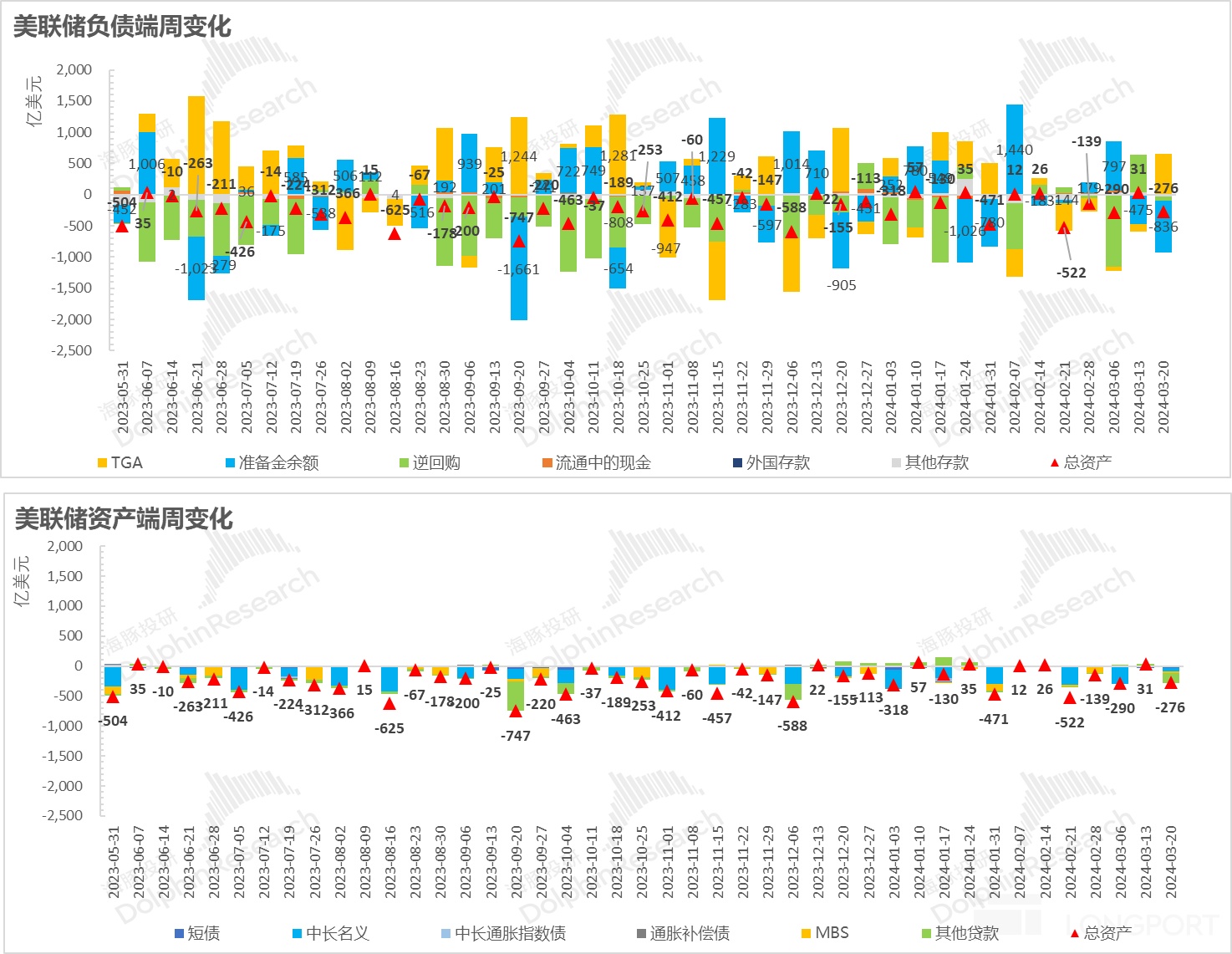

从最近一周的情况来看,由于 BTFP 到期后首周贷款余额缩量 166 亿美金,基本上通过之前释放的逆回购余额对冲掉了,而从春节到现在的整体流动性仍然在边际向上的状态。

整体上,在 2024 年一季度行将结束之际,美股所处的宏观环境是——强就业、强经济、高赤字,且流动性持续宽松。这种情况下,权益资产或许估值相对较高,但很难有大幅度回调,最多是估值高了之后,等业绩发布来稀释估值。

四、组合调仓与收益

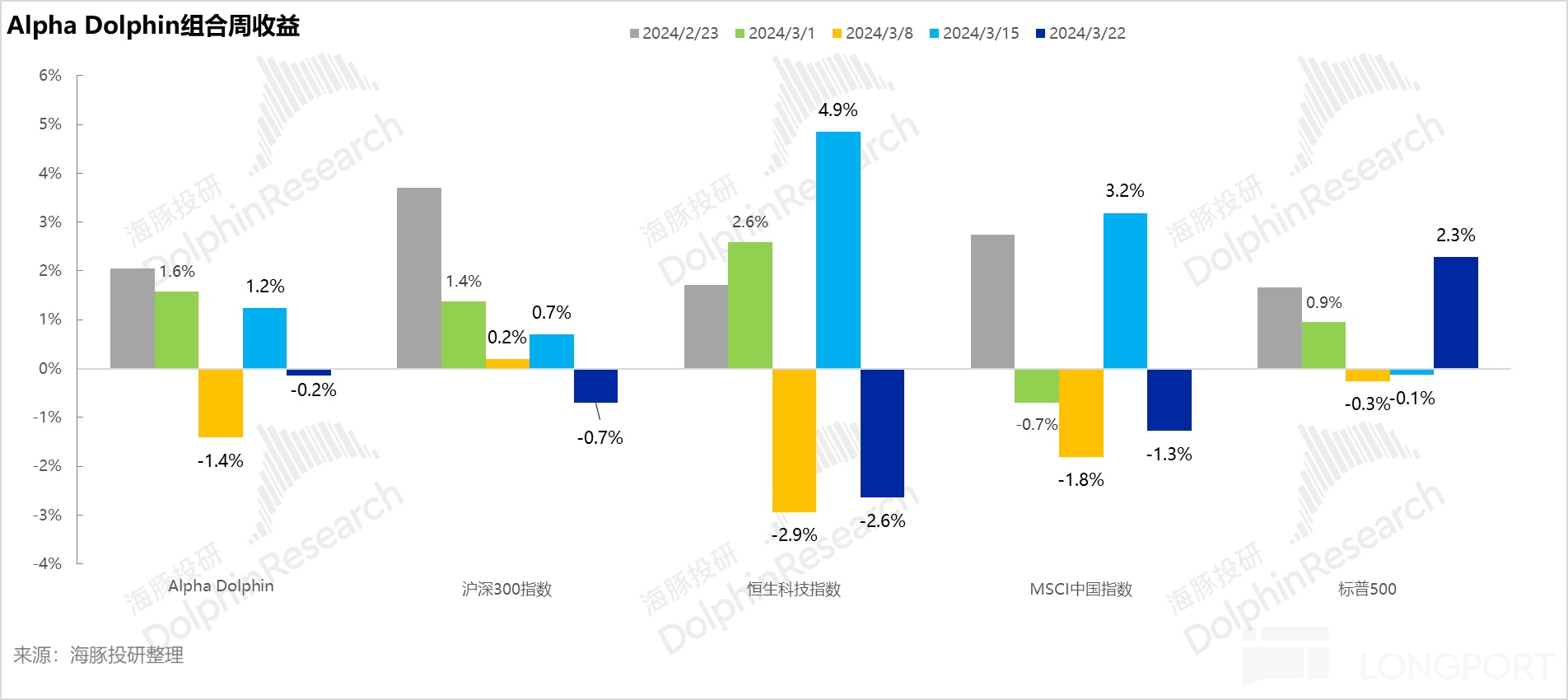

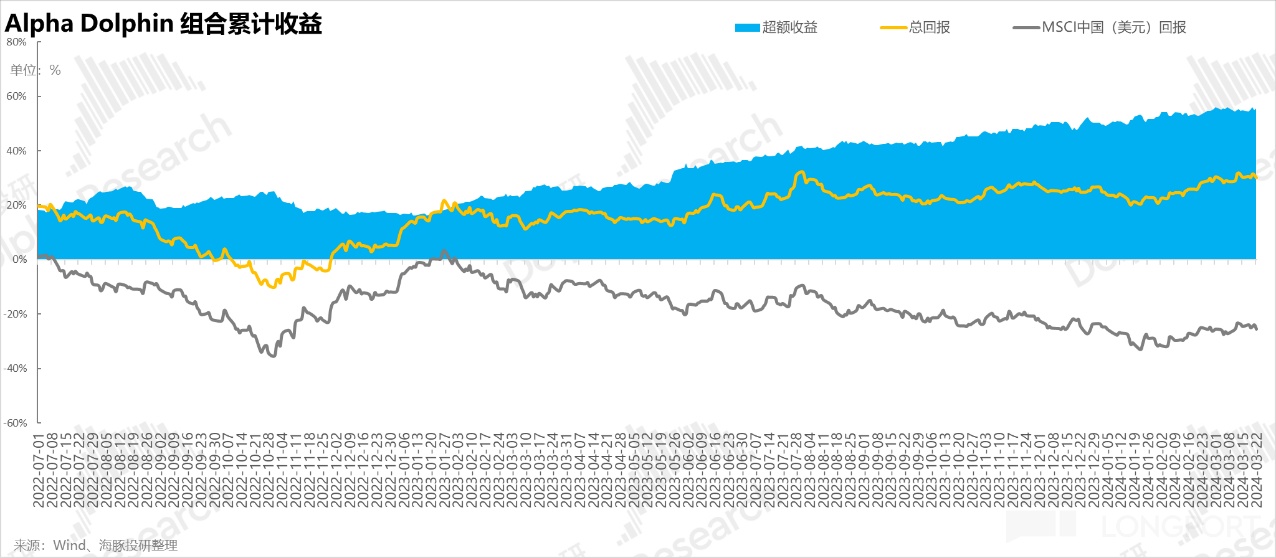

3 月 22 日周,Alpha Dolphin 虚拟组合无调仓。当周结束,组合收益微跌 0.2%,弱于标普 500(+2.3%),但强于 MSCI 中国(-0.7%)、恒生科技(-2.6%)与 MSCI 中国(-1.3%)。

自组合开始测试到上周末,组合绝对收益是 30%,与 MSCI 中国相比的超额收益是 56%。从资产净值角度来看,海豚君初始虚拟资产 1 亿美金,目前回升到 1.33 亿美金。

五、个股盈亏贡献

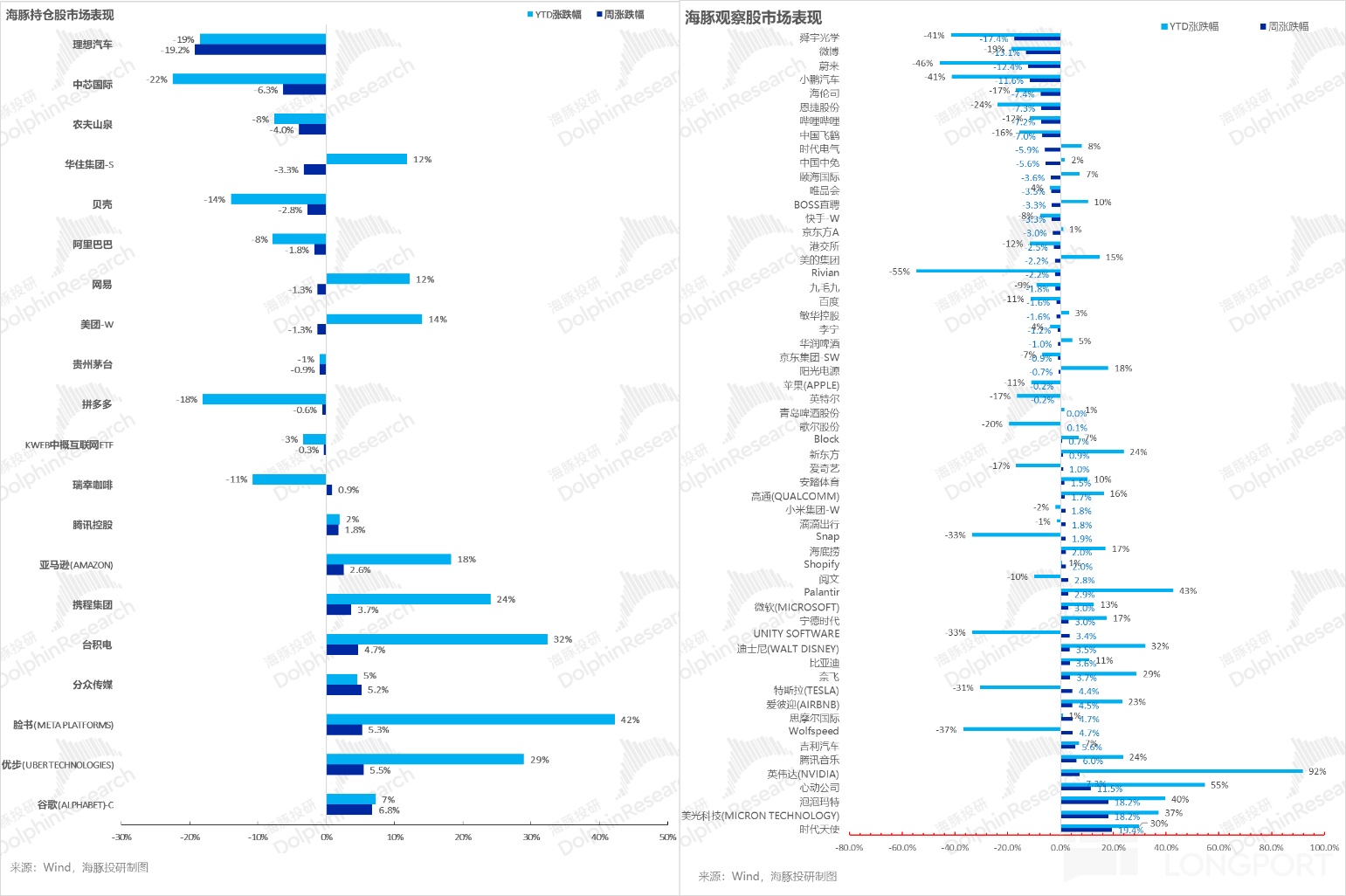

上周涨幅较大的仍然为美股半导体 + 中概消费资产的的修复性上涨。但流动性回流美股之后,对流动性较为敏感的新能源个股,人民币大跌下的流动性回流美股大盘股导致中概小票跌幅较大。其他跌幅较大的基本都是业绩比较烂。

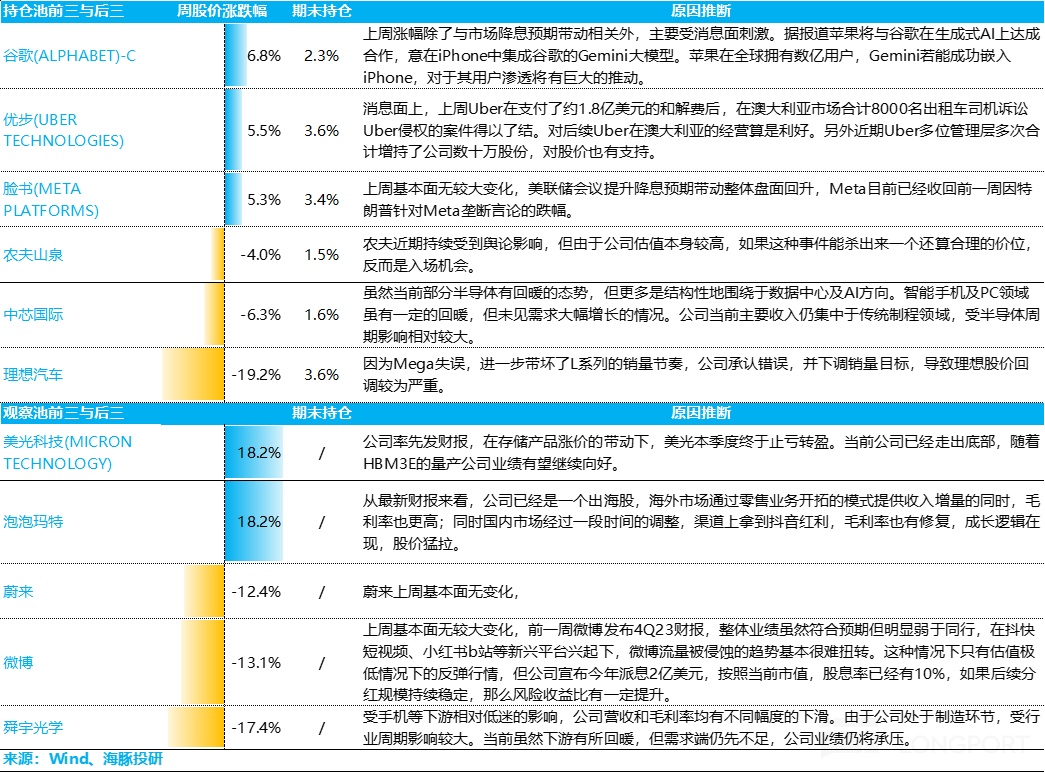

对于海豚君持仓池和关注池中,上周主要涨、跌幅比较大的公司以及可能原因,海豚君分析如下:

六、组合资产分布

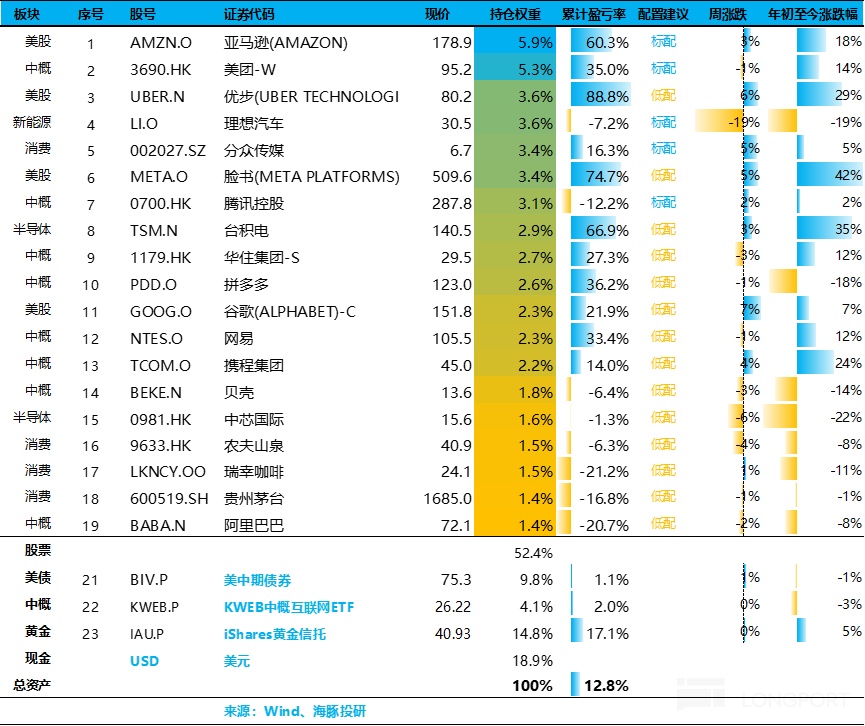

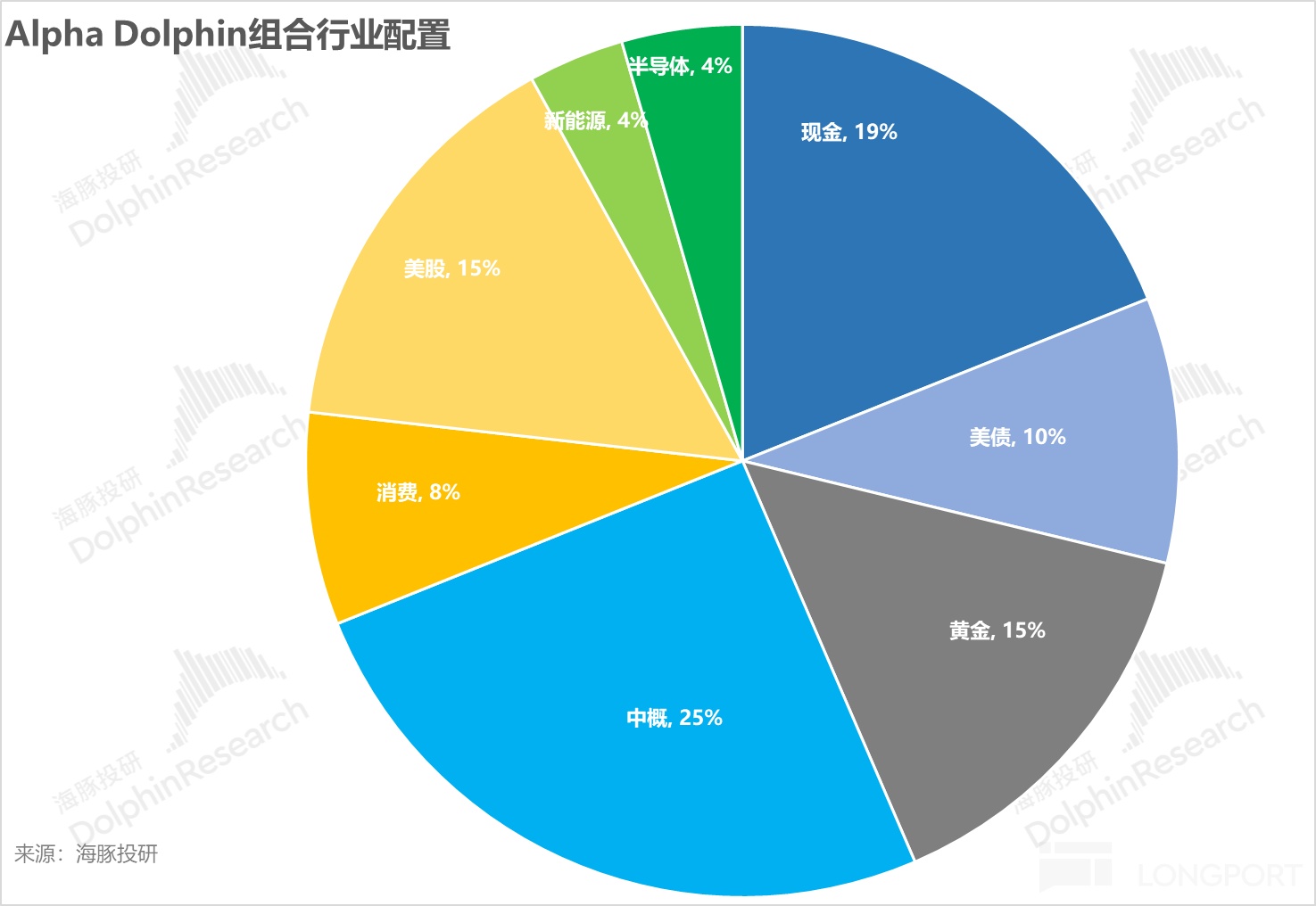

Alpha Dolphin 虚拟组合共计持仓 20 只个股与权益型 ETF,其中标配 6 只,其余权益资产为低配,剩余为黄金和美债和美元现金。

截至上周末,Alpha Dolphin 资产配置分配和权益资产持仓权重如下:

七、本周重点事件

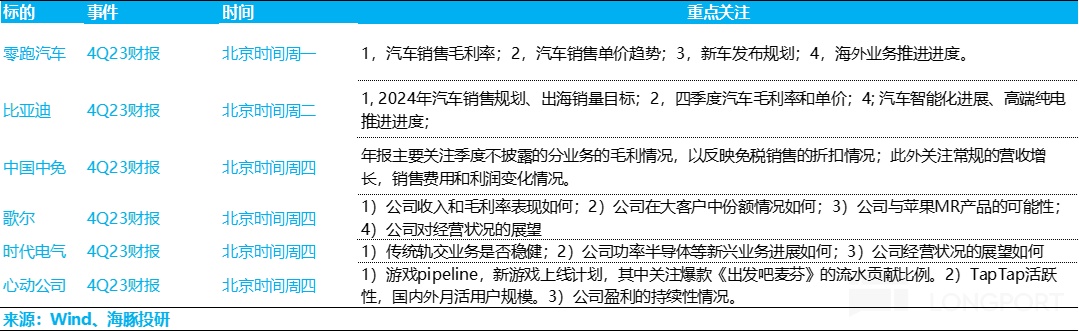

本周中概互联网财报结束,中国资产进入消费和石油等传统行业的财报发布周期,海豚君重点关注个股如下:

<正文完>

本文的风险披露与声明:海豚投研免责声明及一般披露

近期海豚投研组合周报的文章请参考:

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。