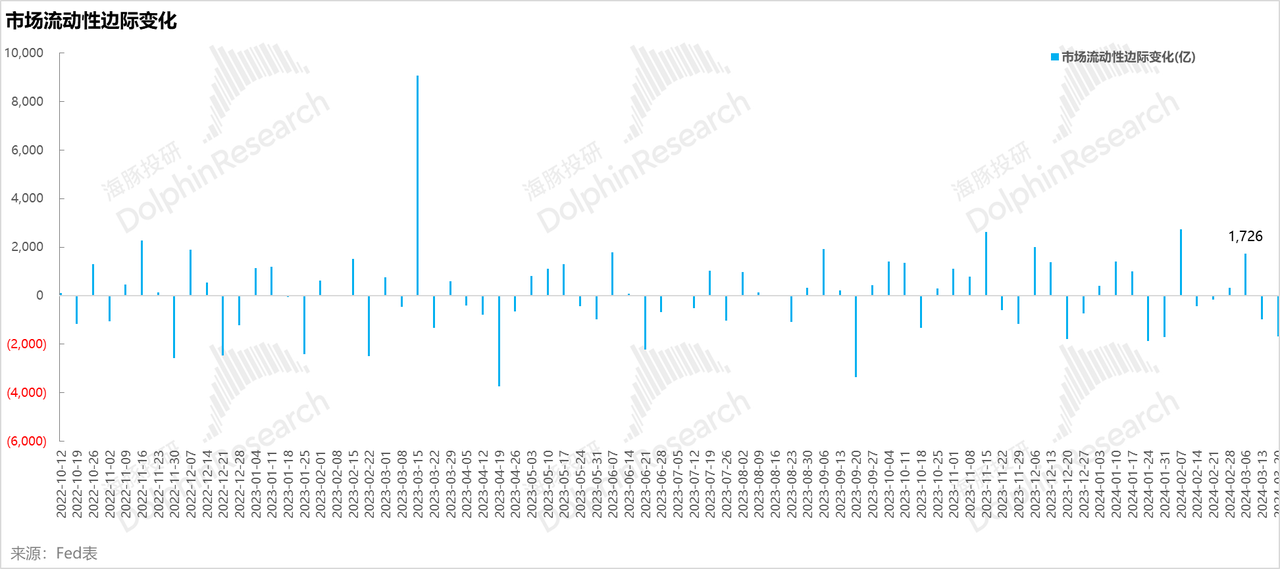

从上周开始,美股流动性虽然相比春节以来是更加充裕的,但是也有一些很有意思的变化:从上周开始 BTFP 到期,在美联储的资产端上跟着美债一起缩量,而负债端 TGA 现金余额反而在增加而逆回购降幅并不明显,导致银行准备金降幅较大。这导致两周前逆回购释放的流动性被快速对冲掉,而且还不够抵消准备金的短期下行。

流动性小幅波动的情况下,看这两天的行情波动——AI+ 科技回调,只有比特币涨幅维持,似乎很有意思。而接下来美国应该进入纳税季,流动性应还会持续波动,但由于目前还有不少的逆回购额(8500 亿美金)实际上还是有缓冲垫的。$纳斯达克综合指数(.IXIC.US)

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。