Posts

Posts Likes Received

Likes ReceivedMaximizing production capacity—has CATL's Ningde era begun to sweep the battlefield? (CATL 1Q24 Earnings Call Summary)

20240415 CATL 2024 First Quarter Report Meeting Minutes

Below are the meeting minutes of CATL's 2024 first quarter financial report conference call. For an interpretation of the financial report, please refer to "CATL: Is the trough over, dawn not far away?".

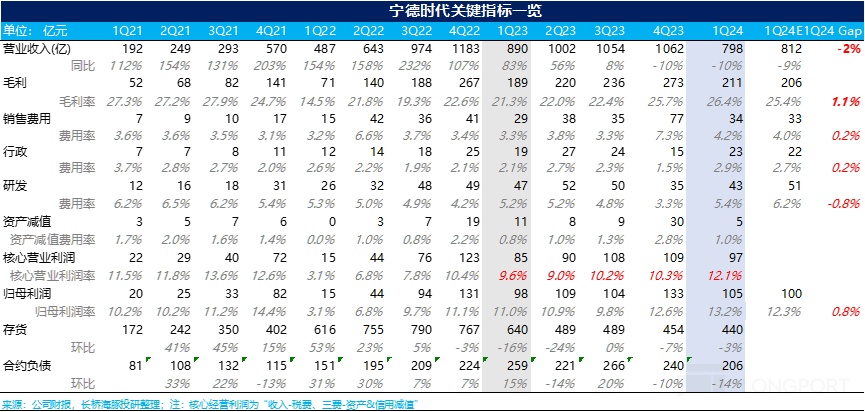

I. Review of Key Financial Information:

II. Detailed Content of the Financial Report Conference Call

2.1. Key Points from Management's Statements:

Market: Global power battery output in January-February reached 83.4GWh, a year-on-year increase of 5%. Domestic output in January-March was 48.9GWh, up 4%.

Products: The Shenxing battery has begun large-scale deliveries, and the versatile series debuted on Xiaomi SU7. Through the innovative high-energy-density lithium iron phosphate material, the energy density of the battery cell has increased by over 10%. The C To B integrated battery jointly developed with Xiaomi has a high basic volume efficiency of 77.8%, achieving a lithium iron phosphate range of 830 kilometers for the first time in the industry.

The Kirin battery for 5G fast charging is ideal for electric vehicles, including the all-electric model Mega.

The Panshi high-security skateboard chassis has been adopted by the Avita brand. The continuous release, adoption, and volume production of new products further highlight the company's technological leadership in the field of power batteries and expand the company's brand influence among end consumers.

In terms of energy storage batteries, the company has released the world's first 5-year zero attenuation, 6.25MWh, high-energy, and multi-safe energy storage system, Tianheng, achieving an increase in energy density within a standard 20-foot container.

2.2. Q&A Analysts' Questions and Answers

Q: What is the approximate proportion of energy storage shipments in the first quarter? What is the revenue breakdown for materials, R&D services, and other businesses in the first quarter?

A: Q1 shipments were around 90-95GWh, with energy storage accounting for about 20%; other revenues, including materials, R&D services, etc., accounted for approximately 10% of total revenue.

Q: What does the category of other income in CATL's first quarter include?

Other income in the first quarter was 3.206 billion RMB, of which 1.82 billion RMB was government subsidies under non-recurring gains and losses. The remaining portion mainly consists of preferential policies for advanced manufacturing, which were newly announced in 23, and the company will recognize these subsidies and tax incentives on a monthly basis according to the confirmation period.

Q: With fluctuations and even increases in raw material prices, is the single Wh profit stable?A: Many customers have price linkage mechanisms. Based on past situations, even if raw material prices fluctuate significantly, the unit profit and gross profit per kilowatt-hour are relatively stable. The company expects the profit level in the subsequent financial quarters to remain stable following this inertia.

Q: What is the acceptance level of IRS technology licensing model and the expansion of new products in the European and American markets?

A: The overseas market is steadily advancing. In the domestic market, Shengxing Battery has a high acceptance among domestic customers, and there will be a continuous increase in the volume of models this year. The same situation applies to Europe, which is undeniable.

In terms of the overseas market, the company's battery products have been widely recognized in Europe and have won the European Auto Best Battery Award. It is expected that more customers will adopt the company's new products. In the U.S. market, the company is also steadily advancing its business and maintaining good relationships with potential customers and partners.

Q: How does the company view and anticipate demand in Europe?

A: Regarding the demand expectations in the European market, we have noticed predictions in the market that due to the end of destocking, demand in Europe in the second half of this year is expected to increase significantly compared to the first half.

However, from the company's perspective, the changes in the European market are mainly driven by policy impacts, such as some countries canceling subsidy policies. In addition, the cost of new models has increased due to factors such as the Russia-Ukraine war, leading to a slowdown in demand in some overseas markets, but we believe this is a short-term phenomenon.

In the long term, overseas OEMs are actively promoting electrified products. Although the progress is not as rapid as domestic car companies, European car manufacturers are optimistic about the trend of electrification. With the launch of more competitive new models, we believe that demand in the European market will remain stable.

Q: What is the reason for the decrease in R&D expenses in Q1?

A: R&D expenses mainly include research material expenses, personnel expenses, depreciation and amortization of R&D equipment and buildings. In Q1, the price of research materials decreased, leading to a overall decrease in expenses. Overall, there will not be significant changes, but the company's R&D investment remains diversified and maintains a high intensity. Especially in terms of personnel investment, there has been a consistently increasing investment and intensity.

Q: The expected increase of 5.7 billion in liabilities provision in Q1, part of it is rebates and part is warranty deposits. What is the overall proportion? Will there be any reversal in Q2?

A: Indeed, it is divided into two parts, including the after-sales service fees we provide to customers and estimated rebates. With the growth of sales business scale, these expenses are also steadily increasing. The calculation of these expenses is based on the best estimate of future obligations, as well as negotiations with customers and signed contracts. Specifically for sales rebates, the proportion may exceed 50%.

For the second quarter, it is expected that these expenses will continue to be reflected in the financial statements.

Q: Considering the increase in Q1 models subsidized in the U.S., in the short term, will the company be affected by FEOC in terms of U.S. exports?

A: Currently, we have not seen any relevant situations, and the technology licensing model has not changed significantly.

Q: What percentage of R&D expenses are used for basic research and how much is used for specialized development?A: The structure of R&D expenses is divided into two main categories: platform-type development and project application-type R&D. It can be understood as part of it is used for the general technology research and development of the platform type, and the other part is related to the development of specific vehicle products.

Platform development includes not only basic research but also research in new directions. Currently, the expenses for platform development and project development basically account for half each.

Q: What are the changes and progress in CAPEX on a year-on-year and quarter-on-quarter basis, and what are the expectations?

A: It is mainly used for the business and construction of battery production bases. From a year-on-year and quarter-on-quarter perspective, capital expenditures are very close to the trend shown in last year's annual report.

Due to the progress made in the super factory, capital expenditures are well controlled. However, since capital expenditures are closely related to payment cycles and contract terms, simply comparing two close quarters may not clearly show the trend. It is more intuitive to look at the data for the whole year to avoid seasonal fluctuations.

Q: What is the negotiation cycle with car manufacturers like, and will Tesla engage in new price negotiations in the second half of the year?

A: Overseas car manufacturers have a longer negotiation cycle for pricing. At fixed points, they will set the overall price framework for the vehicle model lifecycle (6-8 years, with some fluctuation), and agree on a price adjustment mechanism.

Domestic car companies generally do not adjust prices quarterly, but instead make annual adjustments through mechanisms linked to prices or other factors. Similarly, negotiations will be conducted for new vehicle models. When upstream raw material prices decrease, temporary prices will be agreed with downstream car manufacturers, and settlements will be made based on the temporary prices during the negotiation period, while reasonable estimates will be made based on reasonable expectations. Therefore, when there is significant price volatility, reasonable estimates will be made based on the principle of prudence, and looking at the whole year, the fluctuations in prices and profits will not be so obvious. The company will not make significant adjustments on the day of the price adjustment or retroactively adjust prices. The role of the company's estimated liabilities is to address this. The situation for Tesla is uncertain.

Q: In terms of order visibility, are there any changes in the product architecture for the second half of the year?

A: The company currently has high order visibility, with orders saturated in the first half of the year and some predictability for the second half of the year.

In terms of product structure, our orders with customers are determined based on the demand after the vehicle model is finalized. Generally, after the model is fixed with the customer, the number of sets is agreed upon within a year. However, car manufacturers will place monthly purchase orders (based on their own estimated sales volume) to determine how many sets to take. Currently, production scheduling is relatively full until the end of the year (capacity utilization is relatively high), benefiting from the diversification of the customer market, orders are relatively stable.

The Shenxing model is popular in China and Europe, and its proportion will gradually increase in the future, while Tianheng, as a new product release, has not yet entered the order delivery stage and will take some time.

Q: How is the company's capacity utilization rate?

We expect the capacity utilization rate to remain at a relatively high level this year, at around 80%-90%, with relatively full capacity deployment.

Q: What are the prospects for power and energy storage in Q2 and beyond?

A: There is a lot of uncertainty, but looking at the whole year, both power and energy storage growth will be quite significant, especially in the energy storage market, where the base is relatively small, so the growth rate may be faster. Despite being affected by policy or seasonal factors, the overall trend is positiveQ: Reasons for the excellent cash flow performance and its sustainability?

A: Cash flow reflects the quality of operations and management capabilities; the company's Vendor Managed Inventory (VMI) policy has been implemented for 5 quarters, leading to a significant efficiency improvement; on the procurement side, raw material prices have slightly decreased, saving cash flow expenditures. Overall, it is expected that this year's cash flow situation will be better than last year.

Q: Operating situation of the German factory? The new factory in Hungary is scheduled to start production in 2026, how will it affect the company's profitability?

A: The German factory was in the process of ramping up production and certification last year, with a relatively low output and not yet fully profitable. However, the goal for this year is to achieve breakeven, with a high likelihood of experimentation. As the company's first overseas factory, it has high technical requirements, but as operations deepen, profitability is expected to improve.

For the Hungary factory, the profitability situation is not expected to simply replicate the experience of the German factory, but will be adjusted according to different market environments and strategies.

Q: How does the company operate the LRS model, and what is the outlook for unit profitability under this model?

A: License, Royalty, Service - it is a light asset model.

The company will generate revenue through one-time license income, product sales-based royalty income, and consumer service fees. There is no need for the company to invest its own funds, as it is invested by partners, making our assets lighter and the return model more attractive.

Specific revenue is expected to be based on contract terms, which may include a percentage of contract revenue plus annual fixed fees. Each partnership case is different, aiming for a reasonable level of profit for the value of advanced technology, but specific details will be disclosed in future announcements.

Q: How does the company view the market share prospects in the domestic energy storage market?

A: The energy storage market has huge growth potential, despite the current phenomenon of low-price competition. The company will continue to participate in the market competition through product performance and quality, without resorting to short-term low-price strategies to gain market share. The company focuses on long-term performance assurance, quality, and service, believing that the overall lifecycle cost is the most competitive consideration factor.

Q: Progress of CATL inside?

A: The company is focusing on product quality and excellence, but end users do not have a deep understanding of the company's products. Therefore, there is an emphasis on increasing media publicity to make consumers aware of the company's product advantages and capabilities.

Q: Progress and pace of other income after deducting research and development investment?

A: In the first quarter, other income included 3.2 billion in government subsidies, with the remaining 1.4 billion due to the tax incentives introduced in the second half of 2023 to encourage cash manufacturing industries, including a 5% reduction in purchase tax.

Q: Status of deferred income on the books? When will the 214 billion deferred income at the end of last year be recognized?

A: Deferred income mainly comes from projects signed with the government by the company, with different schedules and influencing factors. Some are related to asset delivery, while others are related to performance outputThe overall confirmation cycle is 3-4 years, but the impact of deferred income on overall profit is gradually decreasing, all of which are included in non-operating losses and gains.

Q: Can the company's capacity utilization rate be improved in the future?

A: At the end of last year, the company's effective capacity reached 552Gwh, with a capacity utilization rate of 70.4%. Based on the first-quarter shipment volume of 95Gwh, the market expects annual shipments to be around 460-480Gwh.

At the beginning of last year, the company's investment in construction projects was over 30 billion, which has now decreased to 26.2 billion this year, indicating that the company is controlling its investment in construction projects. In the future, the pace of investment in construction projects will mainly focus on overseas projects, as domestic capacity is already sufficient, and further improvements can be made through increased investment in super assembly lines. This indicates that there is room for improvement in the company's capacity utilization rate, and internal optimization can continue to bring profit realization.

Q: Why did sales volume increase while revenue decreased year-on-year?

A: The decrease in revenue is mainly due to the decline in battery sales prices, which is primarily influenced by the decrease in raw material prices. Despite a growth in shipment volume of about 25%, the decrease in prices led to a reduction in revenue. The impact of changes in product structure on the overall results is not significant, as the scale has already reached a large level.

Q: Will the warranty deposit be adjusted based on prices or other factors?

A: The requirement for the warranty deposit is estimated based on the future warranty obligations undertaken, including factors such as failure rates, repair costs, and production factors. Even if raw material and battery prices decrease, the amount of the warranty deposit will not be adjusted, as it cannot be used to infer price trends in the coming years. The estimation of the warranty deposit is to bear potential repair obligations, rather than to reflect current cost changes.

Q: With a decrease in the absolute value of inventory on a month-on-month basis, what is the company's future inventory management strategy?

A: Inventory at the end of the first quarter slightly decreased compared to the fourth quarter, mainly due to effective management of Vendor Managed Inventory (VMI) and flexible adjustments in purchasing quantities based on seasonal fluctuations, which improved the utilization and efficiency of inventory. Additionally, as the company's own mineral resources will start production in the second half of 2023, the demand for raw materials in inventory will decrease, making inventory management more efficient.

Regarding future inventory management, the company does not plan to hoard inventory in the market. Raw material supply mainly relies on output from its own mines and long-term partners, with only a small portion needing to be purchased in the spot market.

Q: What is the company's expectation for inventory accumulation?

A: Part of the raw material supply chain comes from the company's own sources, while another part comes from long-term contracts, and there is not much spot market inventory.

Q: Outlook on the proportion, gross margin, and pricing of products like Kirin and Shenxing?

A: It takes time for designated products to be adopted. The shipment proportion of Kirin batteries and Shenxing batteries is continuously increasing, with various car companies gradually adopting these batteries. These differentiated products may account for a large proportion in the future, as car companies need to create product differentiation. Prices and gross margins vary depending on the product and customer, but differentiated products can help customers build competitiveness, making them very welcome, and reasonable returns can be expected. In the short term, the proportion of these products will gradually increase, fast charging may become standard in the future, and the company is also developing higher-rate fast-charging batteries and more differentiated products to provide value-added services to customersQ: What are the company's research progress and future plans in the field of semi-solid-state batteries?

A: The company has been engaged in solid-state battery research for over ten years. Currently, the so-called semi-solid-state batteries on the market are not true solid-state batteries. True solid-state batteries need to address issues such as safety and increased energy density, which will take time. In the short term, the company will not overly publicize, but has a professional team conducting research and will announce progress at the appropriate time. Currently, the company has made progress in solid-state batteries, but the cost is high and mainly used in aircraft, with applications for commercial vehicles still under exploration.

Q: What are the latest developments and future positioning of the company in the new energy generation business?

A: The company's new energy generation business is mainly to support the company's zero-carbon strategy, increase the proportion of green electricity usage, and ensure that the electricity used by the company and its supply chain is green. Although green energy business has some economic returns, it is currently more for security and utilization. The company already has wind and photovoltaic projects in Ningde and other places, with a green electricity usage ratio of 65%.

Q: What is the company's view on the supply and demand relationship of lithium carbonate and its future plans?

A: Theoretically, lithium carbonate is not scarce globally. The high prices in the past few years prompted many new projects, leading to a reversal in the supply and demand relationship starting last year. Currently, there may be a slight excess supply of lithium carbonate, but not significant. If prices continue to remain low, there may be some process adjustments. In the long term, it is expected that more profits will be obtained through recycling after 40 years. In the short term, the supply and demand of lithium carbonate will remain relatively balanced. Meanwhile, the company will continue to pursue high-quality mineral resources globally to ensure the stability of the industrial chain and power supply, avoiding the situation of price fluctuations in the past few years. Some projects are currently in progress and have not reached the specific disclosure stage yet, but new information will be shared with investors in a timely manner.

Risk Disclosure and Disclaimer of this Article: Dolphin Research Disclaimer and General Disclosure