美股大撤退,到底谁是元凶?

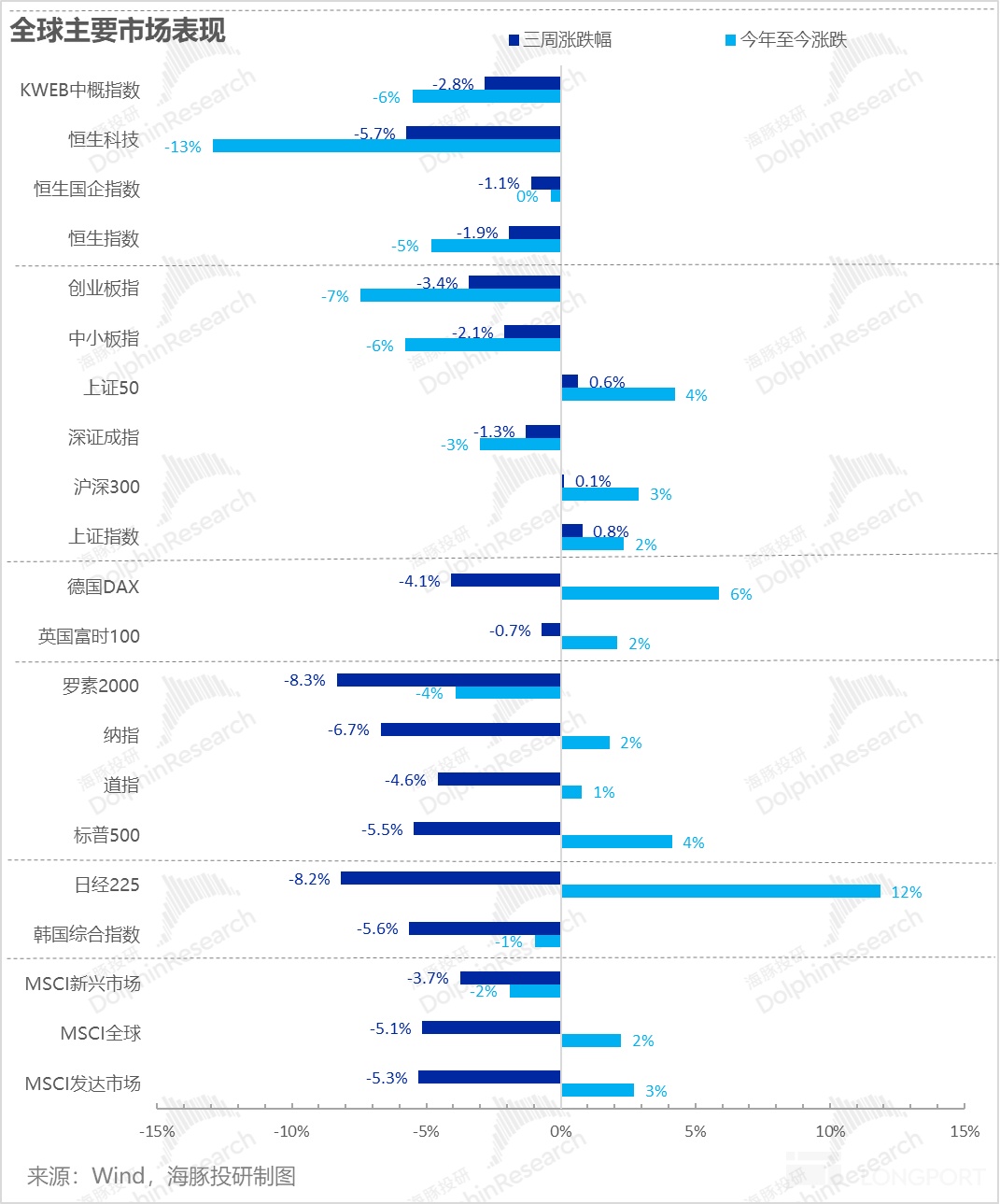

去年四季度以来一直牛气冲突的美股最近突然蔫了:美股中表现最为强势的标普 500,在连跌三周,合计下跌 5.5% 后,已经把年初至今的涨幅缩到了 4%。

道指和纳指也基本把年初至今的涨幅跌得只剩下 1-2%。全球市场,除了春节前股灾的 A 股,其他平均跌幅基本是在 4.5%-5% 之间。

整个上周我们看到了美国社零数据的超预期带来的美债收益率上行、覆盖财报的过程中注意到 AI 龙头们业绩的好坏参半,以及每天频繁的巴以冲突弹窗。

那么最近三周,尤其是最近一周,到底发生了什么,市场回调地如此龙卷风?是什么导致了美股的大撤退,以下海豚君提供一下自己观察到的信息。

一、美国爆棚的 3 月社零,是问题所在吗?

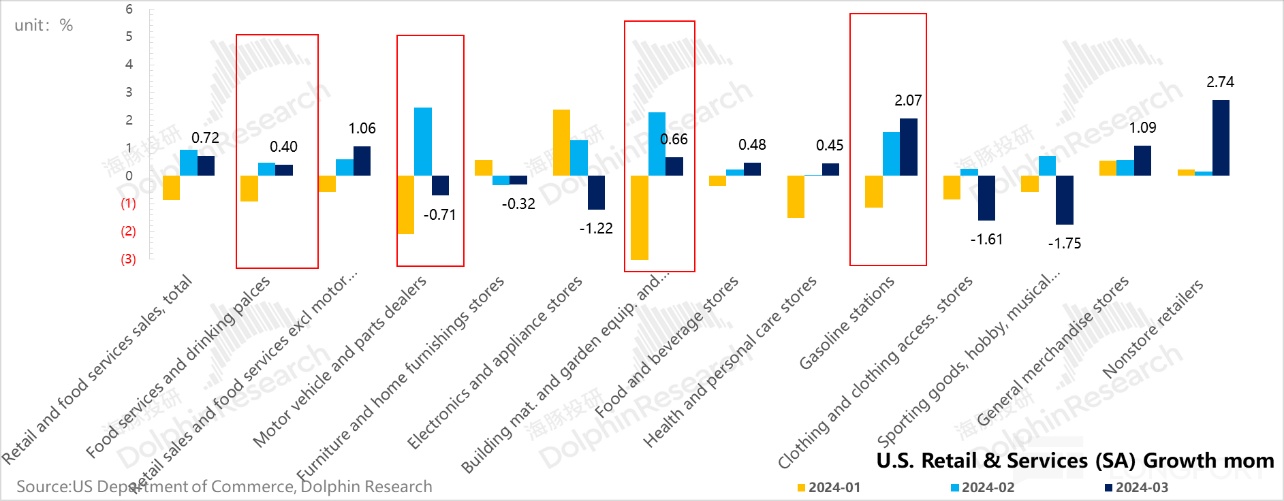

3 月美国的社会零售额又爆棚了,这是继 3 月火热的就业、CPI 数据,又一个硬核经济数据。3 月季调后的社零环比增速在 2 月增长了 0.94% 之后又拉了 0.72%。

结构上,是非常明显的可选弱——汽车零部件、3C 家电、服饰、运动爱好等比较弱,但在社零中占比较高的必选类目,比如说一般日用品与无店铺零售都非常强劲。

这样剔餐饮、汽车零部件、加油站和建材之后的核心零售环比增速达到了 1.1%,反而在加速增长当中。

换句话说,3 月的社零表明, 虽然高息环境下,消费者在支出结构上,减少了需要搭配贷款来购买的可选商品,而把更多的支出放到了线上和必选当中。

但在高就业的支撑下,消费者的商品消费支出总额还在快速增长,并没有减少;而且之前认为的超额储蓄耗尽会反向拖累消费的事情并未发生。

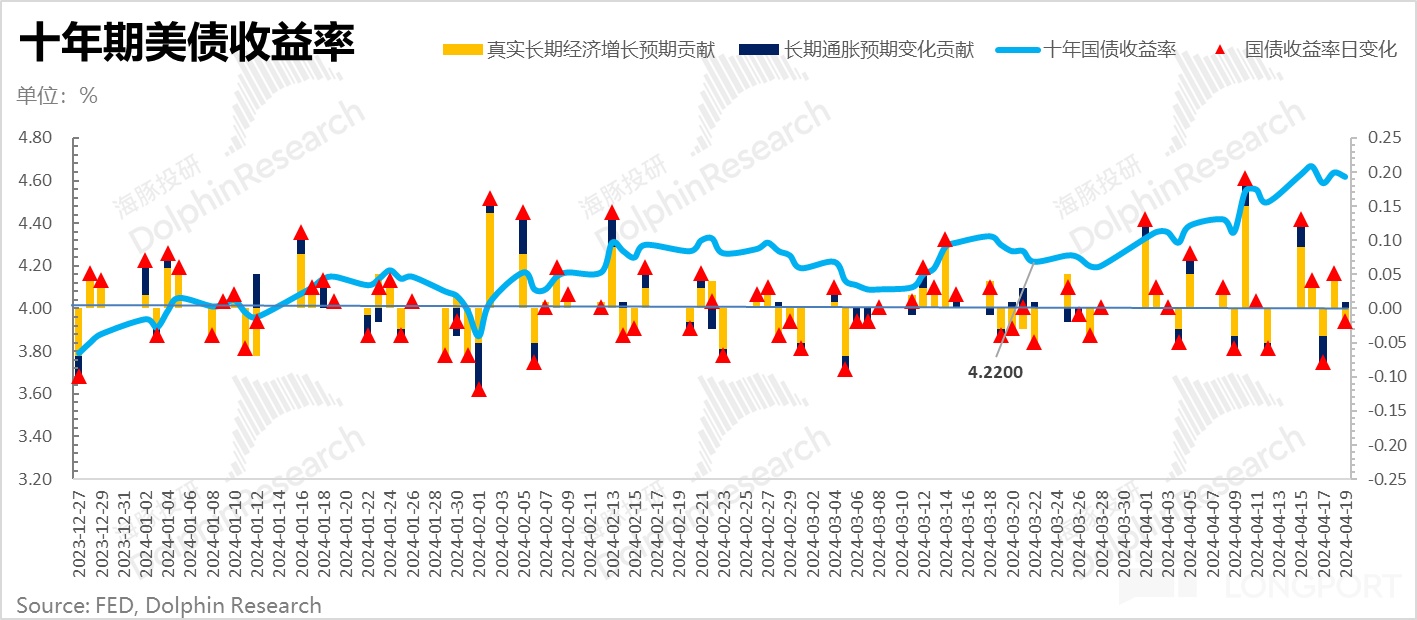

结果,这个社零数据出来,又把市场对于降息的预期往后推迟了,再加上目前巴以地区不安分的地缘冲突,似乎油价在全球经济修复带来的自然增长之外,又添了一层向上动力,通胀的时间可能会拉得更长了。

各种预期交错之下,这一轮十年期美债的收益率从 4 月 10 日以来就一直稳在 4.5% 以上;而与利率预期比较敏感的两年期国债收益率已经拉到了接近 5%,对比当前美联储实际 5.33% 的实际基准利率,当下的市场对于 2024 年降息已不报太大希望,今年年内有一次降息就够了。

但宏观基本面的数据,其实从今年以来,其实一直就在不断挑战市场的乐观预期,3 月社零数据只能说是雪上加霜了而已。而且由于宏观角度,基本面的数据短期在不同的市场情绪下可以做双向解读——一方面它是打击了市场对于降息的预期,但数据本身表明的是经济的韧性,说明经济走势较好,对应财报季个股,尤其是顺周期公司,暴雷概率也会较小。

二、高估值下,报税季的流动性抽水才美股急跌的真正导火索?

海豚君在上周的策略周报观察美国 3 月财政收支的时候提到过,美国税收的大头是与个人相关的税收,占到了联邦税收的 40% 以上。而这部分税收大约有 40% 是企业代扣代缴的,剩下的 60% 是个人自主申报的。

企业代扣代缴总数最终与当年的就业情况和薪资水平高度相关,而 60% 个人自主申报一般包括了利息分红等收益,以及股票、地产等资产变卖的资金利得税。

其中自主申报部分的税额受美股回报收益驱动非常明显。而美股居民的报税季从每年 1 月持续到 4 月,每年 4 月 15 日是最后期限(节假日顺延)。

我们从 2024 年 1-3 月的财政收入中已经开始感受到联邦政府在个税收入上的增加,财政的解释是财政给居民的税收返还相比之前一年减少了。而海豚君的理解是,返还减少还是去年美股以牛为主,资本利得对应的税收增加,税收抵免减少。

而上周是居民自主申报的最后一周,大量税收上缴后,资金从居民账户流入到财政账户,对应资产负债表上,资金从强流动性的银行准备金余额账户转入到基本不流动的 TGA 账户(财政部在美联储开的存款账户)。

上周,因为居民集中纳税,代表市场流动性的银行准备金余额单周缩水了接近 2900 亿美金,而 TGA 账户则一周之内余额猛拉接近 40%,从稍显勉强的 6700 亿扩张到了 9300 亿美金。

再加上美联储当周也在雪上加霜,大幅抛售中长期名义/通胀指数债,美联储资产端净缩水了接近 330 亿美金。

最终美联储资产负债表上,负债端 TGA 账户的扩张、资产端国债的抛售,在上周都是让市场的流动性指标——银行准备金余额来背锅,上周的流动性快速边际收紧。

对比之下,2023 年的纳税季因为 2022 年的熊市,单周缩水不过 1800 亿,唯一比这次更猛烈的一次流动性收紧还要回溯到了 2022 年的 4 月报税季,当时因为 2021 年美股大牛市,在 2022 年报税的最后一周,银行准备金单周大缩水 4500 亿美金,对应美股也有数周的回调。

而且从过往的报税周期来看,报税周除了当周的流动性大收缩之外,中间还通常伴随额外 1-3 周所有的流动性中性偏下的情况。

当下流动性在报税情况下抖动收紧 + 美股持续回吐之前的降息预期交易,财报季上个股稍有风吹草动,就会成为股价调整的导火索,这次财报当中,无论是阿斯麦、台积电,还是奈飞,面对喜忧参半的业绩,资金更多是借负面信息下杀,对于正面信息则是充耳不闻。

继上周 AI 股们的出师不利,这周 AI 下游的应用迎来财报大周——特斯拉、Meta 和谷歌相继揭榜,在流动性没有明显缓解的情况下,如果业绩没有实质性的超预期,本周的资金仍然有可能更关注财报中偏空的信息而非正面信息。

但要注意的是,后续走出因报税季带来的流动性扰动,当下的美国政府仍然偏大财政做派(除非财政政策发生本质变化,目前看不到),TGA 账户上超额的资金盈余恐怕很快会被投入到实体经济当中,高效率创造货币乘数效应,来助长经济基本面增长,对应的这次美股回调大概率也是个技术性回调,过调反而为优质个股带来比较好的买入机会。

三、组合调仓与收益

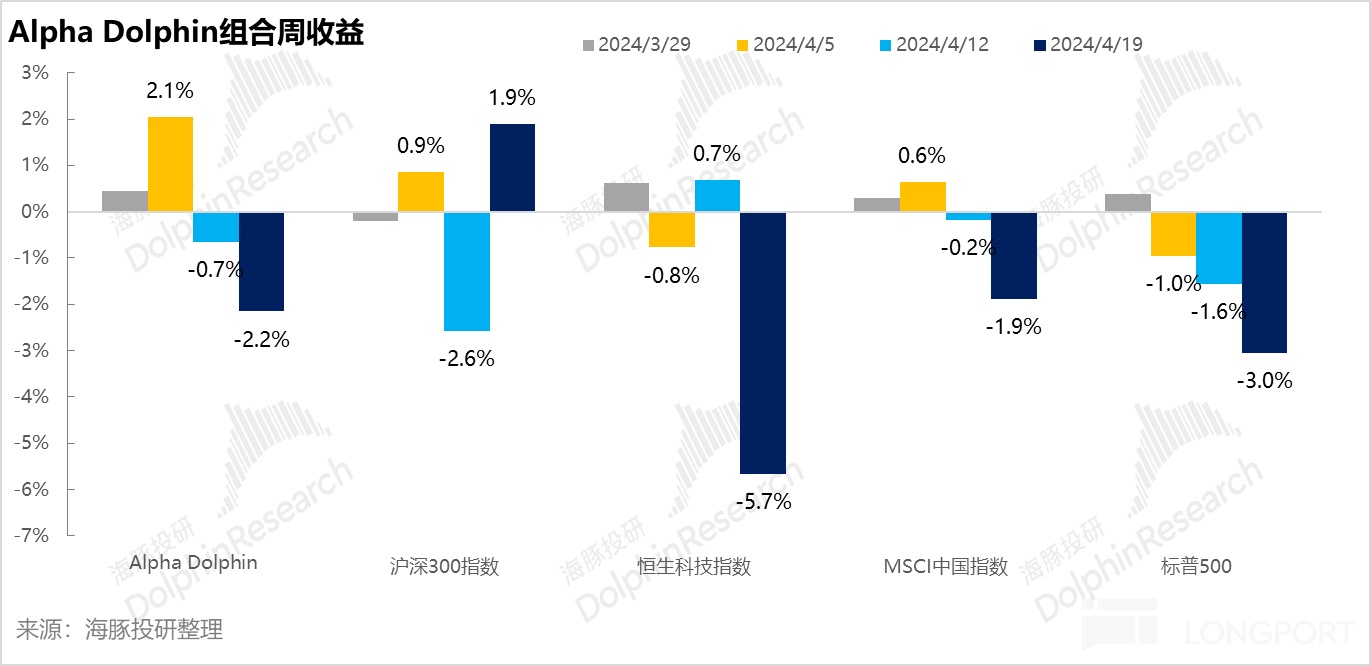

因国内宏观基本面再次转弱,同时外围流动性和估值压力都在变高,因此 4 月 19 日周,Alpha Dolphin 虚拟组合调出 Beta 收益型指数 KWEB,但认为当前超过 4.6% 的美债收益率已经充分定价了不降息的风险,海豚君加仓了美债。

当周结束,组合收益收跌 2.2%,虽然跌幅较大,但仍然跑赢了除沪深 300(+1.9%)和 MSCI 中国(-1.9%)之外的多数指数,包括恒生科技(-5.7%)、标普 500(-3%)。

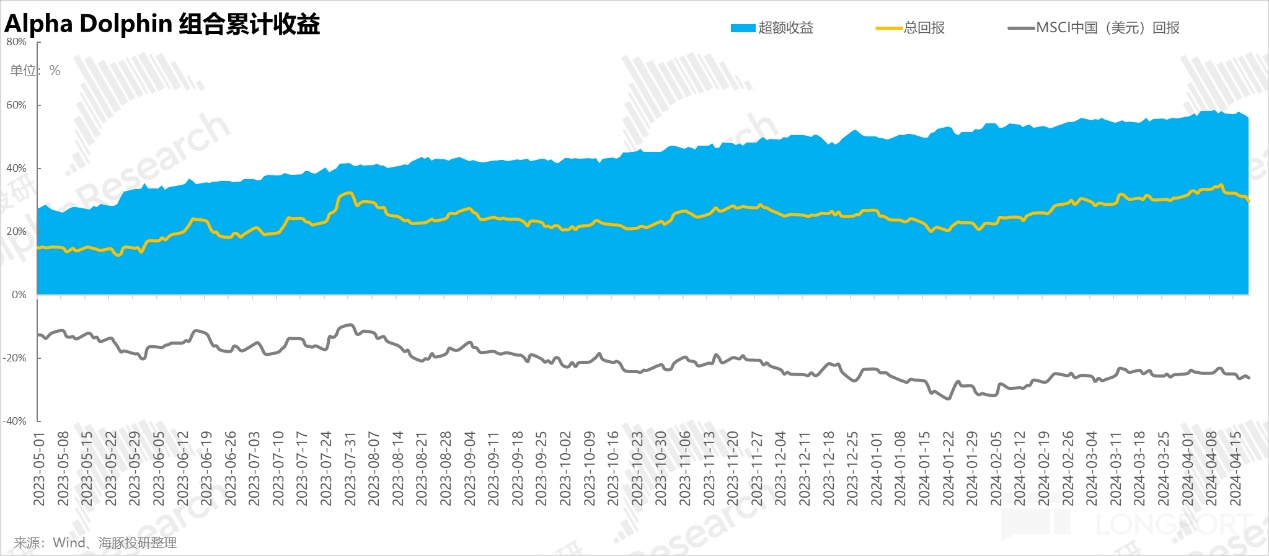

自组合开始测试到上周末,组合绝对收益是 30%,与 MSCI 中国相比的超额收益是 56%。从资产净值角度来看,海豚君初始虚拟资产 1 亿美金,目前回升到 1.32 亿美金。

四、个股盈亏贡献

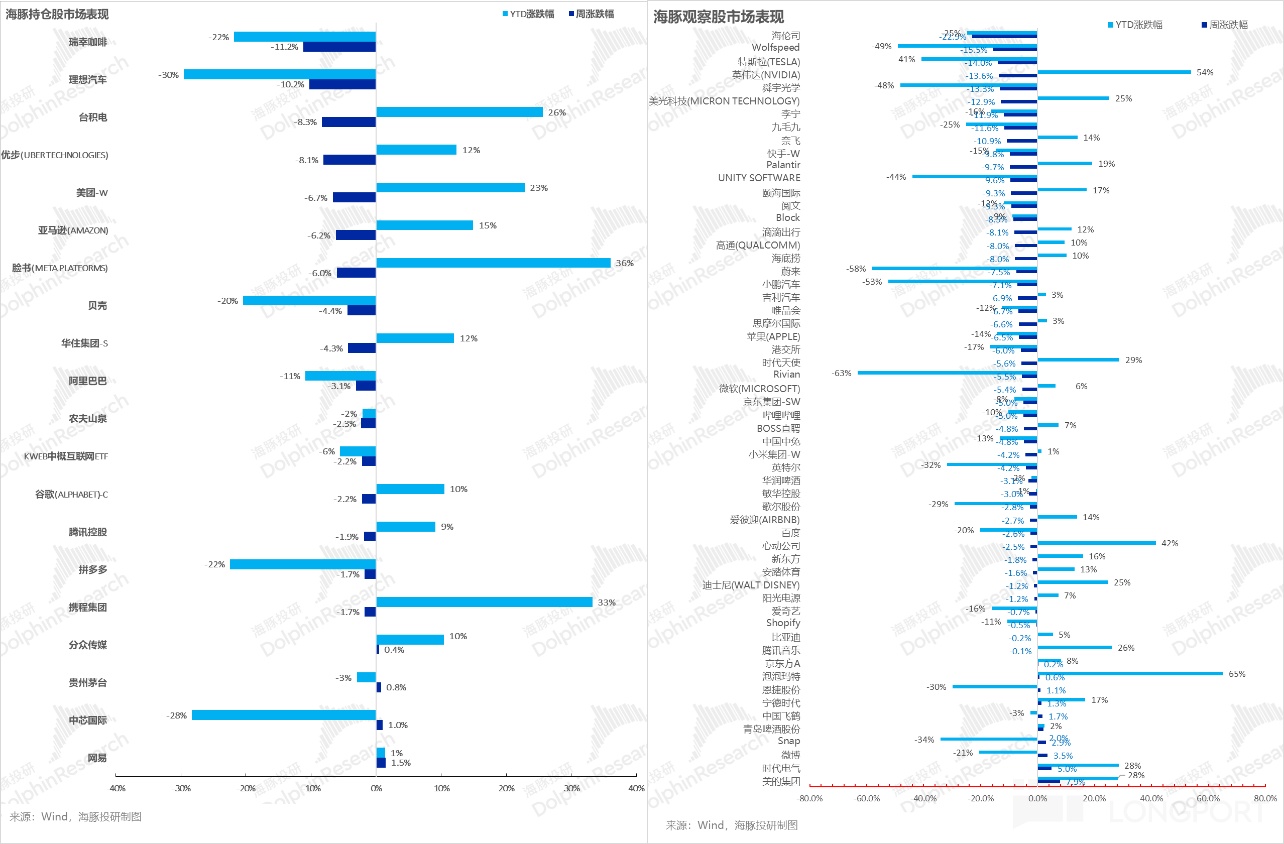

这一轮的下跌当中,跌幅较高的公司,特征非常明显:要么基本面差,要么估值太高,要么二者兼而有之。

之前涨幅较高的弹性股,这轮跌幅也比较高。流动性收紧下杀估值的意味明显。

无论是海豚君观察仓中的海伦司、Wolfspeed、Tesla,持仓股中的瑞幸和理想基本都是基本面相对较弱的情况。

而英伟达、台积电、美光等,在海豚君看来更多是在 AI 挤水分下的杀估值,本身的业绩并不弱,只是估值太高了。而类似中芯国际这种,其实台积电业绩中释放的传统制程需求疲软,应该对中芯国际是不利的,但由于本身估值较低,股价反而没有影响。

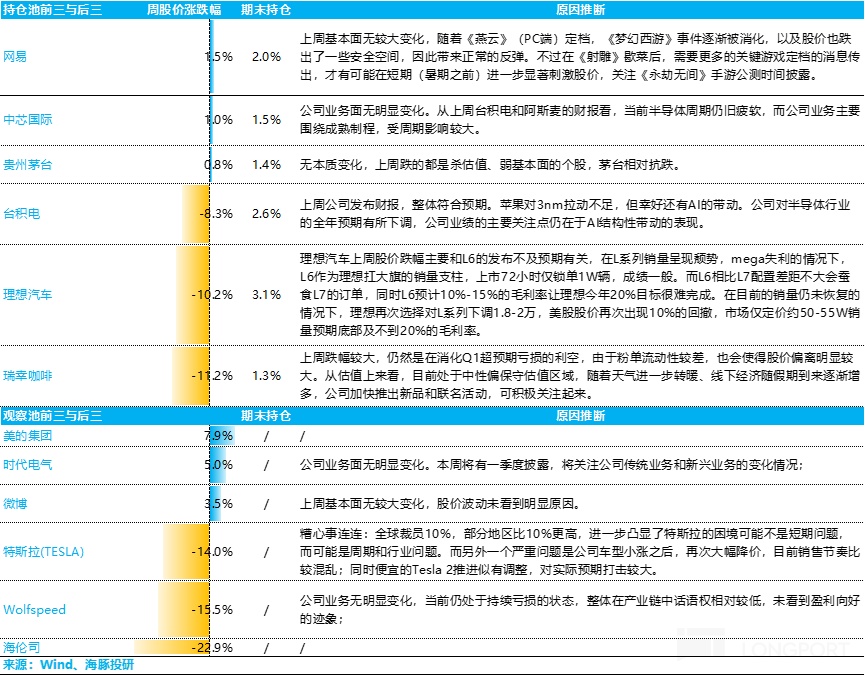

对于海豚君持仓池和关注池中,上周主要涨、跌幅比较大的公司以及可能原因,海豚君分析如下:

五、组合资产分布

Alpha Dolphin 虚拟组合清空 KWEB 后、加仓美债后,共计持仓 21 只个股与权益型 ETF,其中标配 5 只,其余权益资产为低配,剩余为黄金和美债和美元现金。

截至上周末,Alpha Dolphin 资产配置分配和权益资产持仓权重如下:

<正文完>

本文的风险披露与声明:海豚投研免责声明及一般披露

近期海豚投研组合周报的文章请参考:

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。