悲观预期已经兑现,消除了不确定性,人心反倒是踏实了。新的廉价车加速上线,人们焦躁盼望上涨的心总算得到一丝慰藉了

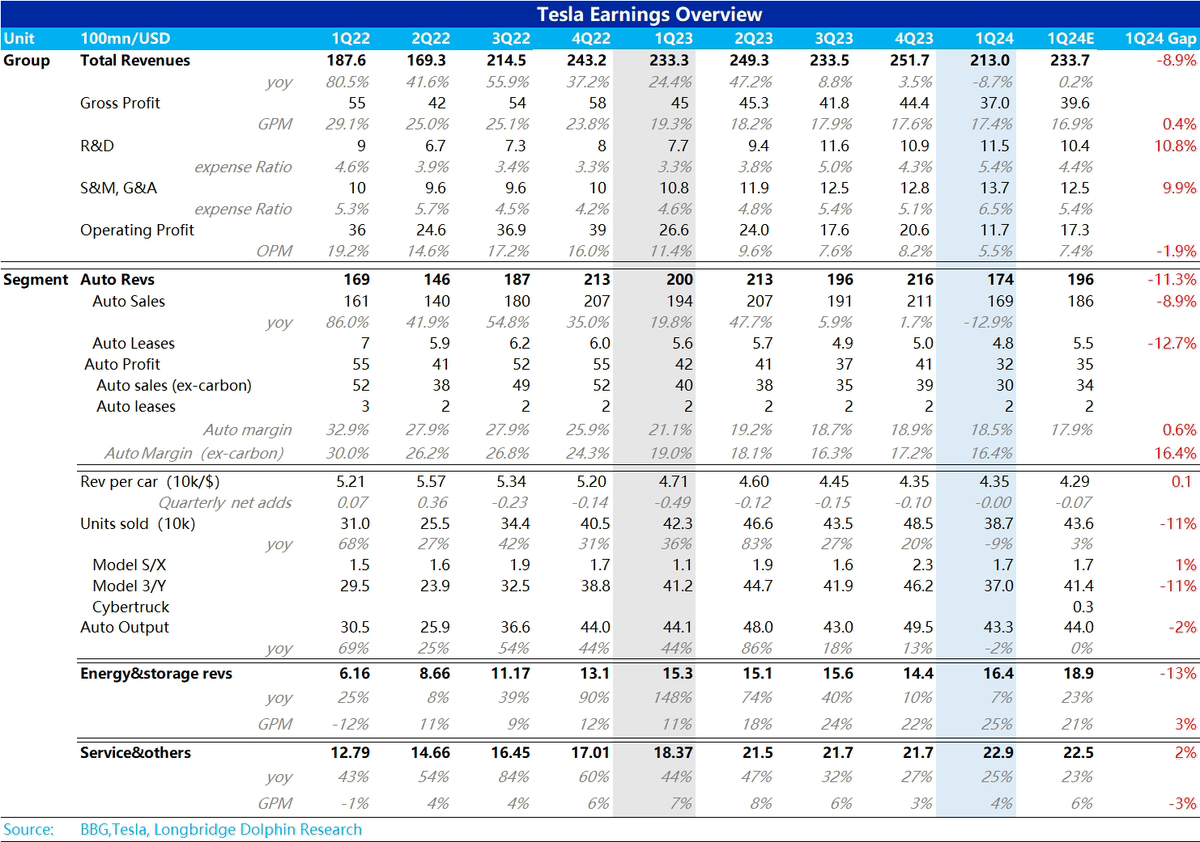

$特斯拉(TSLA.US)海豚君 First take:全球电动车风向标——特斯拉 2024 年一季度开局初看似乎就是一个大写的悲剧——支柱汽车业务已经是 13% 的负增长、能源业务也熄火了,利润率也勉强、开支还在逆势走高,相比市场预期一片惨淡。

但要注意的是,这个市场预期早已过时,从海豚君看到近期更新特斯拉业绩展望的大行预期来看,特斯拉在收入端基本大差不差。

而作为每次财报最为关注的重点——汽车业务毛利率,反而对当前已经几乎跌透的股价形成了实质性利好,汽车业务整体 18.5% 的毛利率,还是剔碳积分的汽车业务毛利率 16.4%,都远远超出了市场预期。尤其是在关键的剔碳积分汽车毛利率上,市场一直在下调的毛利率预期(多数在 15% 以内,部分已经下调到了 13-14% 之间)。

显然,价格操作上,通过新款提价再降价、期间又小涨价的价格运营 “小心思”,汽车的毛利率其实没有想象的那么差。

换句话说,对于特斯拉这种大量估值需要靠未来兑现,而现在能兑现的业务本身不确定性也较高,导致预期高度摇摆的公司,一致性的过度悲观和一致性的过度乐观,都一样危险。

这次财报背后的体现的底色是:新能车市场确实竞争在加剧,特斯拉确实在遭遇销量瓶颈,它在车和围绕车的衍生业务上重心可能也存在摇摆,但宏观不确定下,马斯克之前的融资创伤融资症,让他在弱经营周期内异常强调 “保命” 思路——不会不要毛利只管卖车,而当汽车真正难卖的时候,公司还是会尽量在毛利率和市占率之间做一个平衡,以免行业较差的时候失血过度。

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。