美国经济 “金融化”,耶伦、鲍威尔成美股门神?

美国经济 “金融化”,耶伦、鲍威尔成美股门神?

近期,美股财政部发布了 3 月联邦财政、更新了最新的财政预算,美联储也再 5 月的议息会议也公布了。这次海豚君就结合这些最新的信息来更新一下对美国经济的理解,直入正题:

一、一个现实:留意美国经济金融化风险

为什么说实体经济金融化?主要体现在以下几点:

第一:美国居民财富中,金融财富占比较高,其中最终穿透为股权和债权的金融资产占比为 43%,超过了房产。因此股债波动对居民财富效应影响较大。

第二、联邦税收当中,与金融资产挂钩的税收影响大

联邦财政收入当中,对居民正受到个人所得税占到了财政总收入的 42%。但个税中,企业代缴大约 40%,剩下的 60% 是利息、分红和资本利得等类收入的居民自主申报。

而这 60% 中,主要与股债等金融资产收益关联较大。像 2024 年,重建法案下财政支出收缩不下去,居民就业稳定增长,那么关键的税收增量,则变成了浮动性金融资产。

第三、储蓄率下降与金融资产升值的梦幻联动

当前美国 GDP 能够高速增长的一个关键是高就业、高收入下,居民消费能够以比收入增长更高的速度往前跑而带动 GDP 中居民内需(商品消费和服务消费均)旺盛释放的主要边际增量是不断走低的储蓄率。

所以当前情况下,储蓄率能否继续走低,甚至维持在当前低位,而不是回补到疫情前 6-8% 的状态,对后续经济增长动力的判断直观重要。

当期收入分配给储蓄的不高,原因一般是 a) 家里现金余粮高,对负债的还款能力强(现金还款能力);b)资产升值。这两个同时能做到,基本上就是资产负债表上,有资产、有现金,再搭配当期赚钱能力能力文件(收入表强劲),那么储蓄率还能有希望边际走低。

从当前的美国居民的资产负债表情况来看,确实是总资产因金融资产膨胀而持续升值,其中资产端流动性资产存款则因为疫情中的超额储蓄和疫情后就业较好,储蓄相对于负债的支付能力非常强,不需要存额外现金来准备还款。

换句话说,支撑当前储蓄率走低的三大要素——就业好(跟居民需求好,一定程度上互为因果)、现金余粮多、资产升值效应(主要是风险资产的升值效应)。

这三点叠加起来,意味着美国经济金融化风险再加大,金融的波动可能会对经济增长产生比较大的次生灾害影响,强化经济本身的顺周期属性。

二、美联储 + 财政的双重呵护

而分解完上面的内容,就能理解当前美联储和财政部的一些动作:

第一,美联储重拾 “Fed Put” 功能

5 月议息会议,真正的增量信息主要是两个:

a. 基本清除了加息的可能性,明确表态,当前的政策利率对于实现 2% 的通胀目标,具有 “足够的限制性 “(restrictive enough)。政策利率是降息开始开始,以及降息速度的问题。

这个在居民就业单月 20 万而且居民储蓄率越走越低的情况下,这样的决策驱动方式本身就是偏鸽派的决策思路。

b. 放缓量宽紧缩进度的计划正式公布:国债从原来的每月被动抛售 600 亿美金收缩为 250 亿美金,6 月正式启动。MBS 抛售速度保持不变,仍然是 350 亿美金。

这个决策背景是,去年量化紧缩的抽调的流动性,本身就是之前过量宽松的剩余流动性,因为从 2022 年 5 月开始抽水到现在,被抽走的都是逆回购这种惰性资金,而银行的存款准备金,整个抽水抽到一点未减。

而且在逆回购一定余额空间(目前 8500 亿美金,对应疫情前平均 2000-3000 亿美金)的情况下,6 月开始放缓,而且直接就砍掉了 350 亿的削减额度,这个力度是超出了海豚君的预判的。

无论是在货币价格政策上基准利率的决策思路,还是货币总量政策上放缓量化紧缩的速度,海豚君认为当前的美联储背后的底子越来越呈现出 “Fed Put” 的宽松性货币政策思维方式。

第二、高支出的财政,对经济仍然很呵护

首先从财政预算上来看,1.5 万亿的财政赤字虽然绝对值没有去年天量刺激的 1.7 万亿高、今年的财政顺风没有去年那么高,但对比疫情前的赤字绝对值和赤字率,仍然是在相对偏高的状态。

在去年金融市场整体收益较高的情况下,今年前三个月整体美国财政的收入状况在个人收入超额的带动下,财政收入表现也还不错。

而 4 月由于是税收季,最新的 4 月财政数据表现就更好了:由于从居民部门征收到的个税收入较高,美国联邦 4 月是 2100 亿美金的财政顺差,剔除利息支出,顺差接近 3000 亿美金。

但即使这样,美国财政部在发布 7-9 月季的融资规划的时候,还是超出了市场原本预期的体量。下一个季度里,在假设美联储还是每个月抛售 600 亿国债的情况下,财政部计划向市场借债接近 8500 亿美金,同时把 TGA 账户的目标余额从之前的 7500 提高到 8500 亿美金。

看解析一下这个目标:

1. 当前 TGA 账户余额接近 8200 亿美金,相对于提高后的 8500 亿目标,几乎不用填充,不需要稀收市场资金;

2. 由于实际美联储从 6 月开始,国债抛售量每月实际是 250 亿美金,而不是 600 亿,其他条件不变,财政部的借债规模应该是 7500 亿美金。

虽然没有之前宣布的高,但本身仍然不低(2023 年刚放开了财政当时的举债上限的 9 月季,也就是发了 8500 亿),也就是说财政在支出上的 “克制” 几乎可以忽略不计。

主要是从宣布的发债期限安排上来看,接下来融资仍然会以短债为主,而不会在长债上为难市场。这样,再配合美联储缩量的 QT,财政其实融资额就没有那么大。

而这样操作之后,与股市走势密切正相关的银行准备金余额就不会太消耗,货币、财政一套组合拳下来,市场交易的资金仍然会相对充沛的状态,市场杀流动性是比较难的,主要还是看企业的增长和盈利预期。

三、流动性快速回归

之前,海豚君在组合策略中说过,之前美股回调的原因,除了无风险利率走高之外,4 月中旬纳税高峰期,TGA 账户余额快速扩充,抢食了市场资金。但这个事情持续了两周之后,市场流动性已开始边际转增,不再拖累。

而财政上,4 月纳税季让财政小金库充值了之后,民主党这个高开高支风政府,不等钱在存款账户上捂热,已经开始了撒币模式:

最近两周美联储资产端的缩表,全部是通过 TGA 的账户余额减少来实现的,而 TGA 转化为市场资金,是增加实体产业的资金周转,助长经济增长的。

四、组合调仓与收益

美股财报季已过,海豚君对已发业绩的部分公司基于业绩中的信息,先做了一些调出的动作。接下来,在理清估值的基础上,还会再录入调入一些公司,敬请期待。

上周主要是调出了 Uber 和瑞幸,具体原因如下:

上周结束,组合收益上涨 0.4%,跑输了沪深 300(+1.7%)和 MSCI 中国(+1.9%)和标普 500(+1.9%),稍强于恒生科技(-0.2%)。

这主要是因为,海豚君仓位中涨幅较大的中概资产之前两周涨幅较大,而对于逻辑较弱的低估反弹票,海豚君不做波段,也不配置,所以后半段涨幅较小,而上周则是因为国企分红股上涨为主,海豚君没有覆盖也没有配置。

自组合开始测试到上周末,组合绝对收益是 36%,与 MSCI 中国相比的超额收益是 52%。从资产净值角度来看,海豚君初始虚拟资产 1 亿美金,目前回升到 1.39 亿美金。

五、个股盈亏贡献

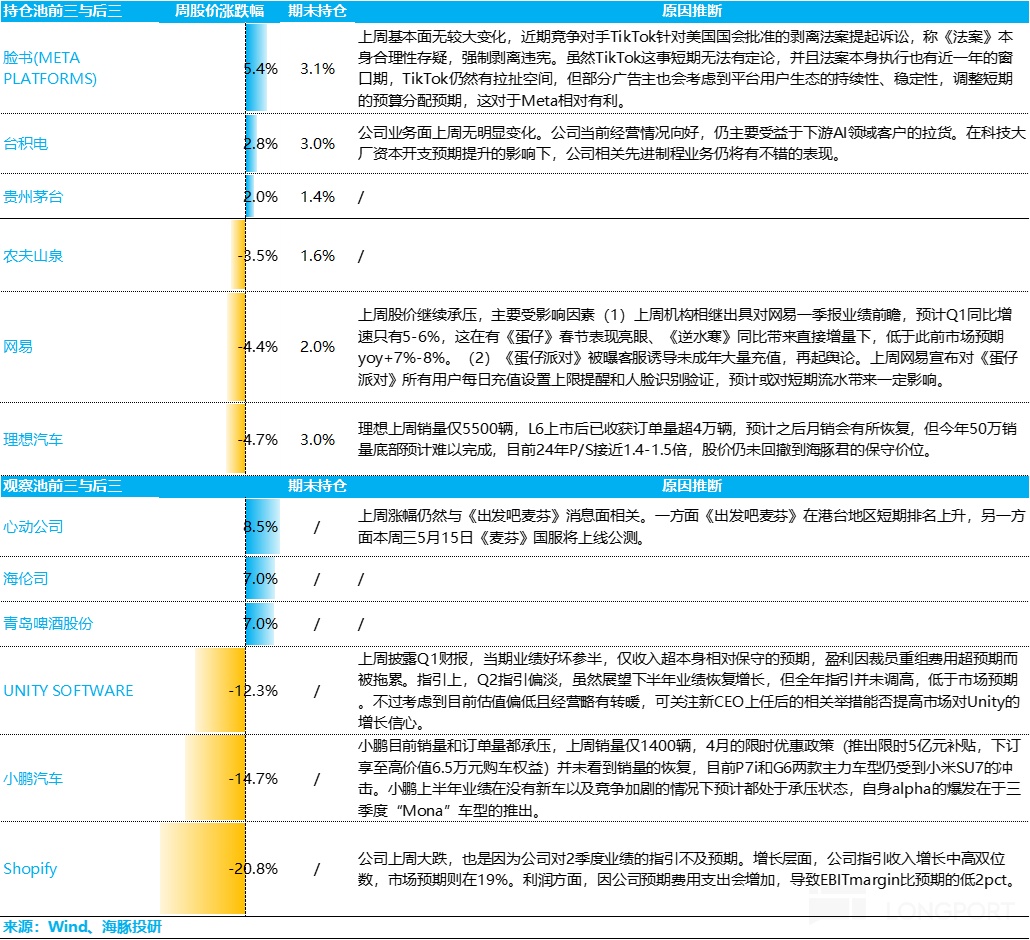

上周的涨跌,主要是以个股财报季的基本面驱动为主。

对于海豚君持仓池和关注池中,上周主要涨、跌幅比较大的公司以及可能原因,海豚君分析如下:

六、组合资产分布

Alpha Dolphin 虚拟组合清空 Uber 和瑞幸后,共计持仓 19 只个股与权益型 ETF,其中标配 5 只,其余权益资产为低配,剩余为黄金和美债和美元现金。目前现金与类现金资产剩余较多,接下来几周仍会加仓权益资产。

截至上周末,Alpha Dolphin 资产配置分配和权益资产持仓权重如下:

七、本周重点事件

美股财报季进入尾声,中概财报季集中来袭,海豚君本周会覆盖以下公司,相关公司的重点关注点总结如下:

<正文完>

本文的风险披露与声明:海豚投研免责声明及一般披露

近期海豚投研组合周报的文章请参考:

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。