美團、DoorDash、Uber:同是外賣,中美有何大不同

2023 年年底,海豚投研曾在《滴滴 & Uber:相似的出生,不同的命運》一文中以滴滴和 Uber 為抓手,探討了這兩家出身接近(同一時期成立、商業模式相同),但至今的結局卻大為不同(Uber 的市值是滴滴的 7~8x 倍)背後的原因:

1)更早拓展國際化,且成果斐然:Uber 成立一年後即開始拓展海外市場,至今非北美市場營收貢獻過半; 2)成功的橫向業務的拓展:Uber 在 16 年就開始拓展外賣業務,且至今外賣業務 GTV 貢獻同樣佔比過半; 3)平台變現率中樞的差距:據我們的測算 Uber 的變現率(20%~30%)遠超滴滴(同口徑下僅 10% 左右)。

本文作為該系列的第二篇,就以同屬本地生活板塊的外賣業務為目標行業,國內以美團,海外則以 Uber、DoorDash 為例,對比和探討外賣行業在中國和美國異同之處,結論如下:

① 美國單一市場的外賣行業成交額體量和國內外賣體量很巧合的近乎一致(統一匯率後),但佔整體餐飲的滲透率上,美國外賣的滲透率稍低於國內,大約是 18%~19% vs. 21%~22% 的情況。但單量上,美國可能近有國內的 1/7~1/8。

② 外賣業態在美國成形的時間更早於國內,但早期主要是連鎖門店自配的形式。即便到 2022 年時,商家自配的比重仍近 50%,“下單 + 配送” 的一體式外賣平台實際滲透率仍不足 10%。

③ 美國的外賣行業,配送成本佔比高於國內(配送效率更低),平台抽成也更高,且消費者需為外賣服務支付相當可觀的額外成本(相比堂食價格貴 30%~40%);而國內消費者平均僅需支付約 10% 的加價,配送/佣金等額外成本多數是商家承擔。換言之,美國的外賣服務和外賣平台給消費者帶來的價值並不多。

④ 美國外賣平台儘管有着明顯更高的淨變現率14% vs. 國內平台的約 7%~8%(剔除配送成本,基於實付價格),但國內平台的利潤率卻高於海外同行,adj.EBITDA margin 國內的 4% vs. 美國的 3%。海外平台在經營槓桿和內部控費,或者説 “卷” 的能力上不如國內。

⑤ 另有展望請見文末

以下為正文詳細內容:

一、過往表現誰勝誰輸

仍然先從投資最終的目 -- 按股價回報的角度,Meituan,DoorDash,Uber,Grab 這四家全球主要的上市外賣平台公司,看起來可分為兩組:① 以歐美等發達(或者説高消費力)國家為主要市場的 Uber 和 DoorDash 股價表現相對跑贏,其中外賣 + 網約車雙輪驅動的 Uber 表現最佳;② 而分別以東南亞和中國等發展中(低消費力)國家為主要市場的 Grab 和 Meituan 股價較 2021 年初都是不止於腰斬,但這組中兼備外賣 + 網約車業務的 Grab 卻是表現最差的。

不過,單純以是根植於發達國家市場還是發展中市場,來區別和解釋上述幾家公司之間表現的差異,顯然是個過於簡化的猜測。

進一步從基本面的角度,四家公司過往外賣業務體量的增長上:在 2020 疫情元年,除美團因受管控影響反而增長較慢,其他三家海外公司在疫情爆發期也經歷了外賣業務增長的爆發階段(當年增速高達 90%~200%)。但隨後幾年各公司的外賣業務成交額的增速就迅速滑坡並趨於一致,2022 年後各公司外賣業務的增速都已回落到 30% 以下,且略顯意外的是 2023 年和今年一季度美團外賣成交額的增速反而是四家同行中最高的。

海外外賣公司都受到了疫情的明顯推動,經歷了短暫爆發式增長,但隨後增速迅速逐年滑落,波動更為明顯。相對的,國內的美團並未在疫情期間出現爆發式的增長,因此也沒在疫情後出現猛烈的增速滑坡,目前反而有着同行中最高的外賣業務增速。

外賣業務成交額的絕對體量上,儘管各公司披露的數據口徑略有不同,但大數上美團僅憑中國一國市場外賣業務體量仍高於 Uber、DoorDash 等坐擁歐美多國市場的海外同行。而DoorDash 雖然在美國外賣市場的份額大幅高於 Uber eats,但兩者的外賣成交額卻大體是相近的,這意味着Uber 在美國本土以外市場的拓展更為成功。

二、中國、美國外賣市場有何異同

1、行業體量和滲透率

首先,從行業規模、外賣業態的滲透率、發展歷程、市場份額格局這些繞不過的關鍵指標來看:

① 中國和美國的外賣市場體量巧合的近乎一致,17 年時都是略超$400 億的規模,到 23 年時也都在$2000 億上下。不過雖然頭尾兩個時間節點上的規模相近,增長的軌跡來看,中國的外賣行業呈現出更平穩、持續的增長勢頭; 美國市場則更多歸功於 2020 一年翻倍的爆發,可以説如若沒有疫情的刺激,美國的外賣市場規模或者説發展應該是會明顯遜於國內的。

② 外賣(到家)成交額佔整體餐飲的滲透率上,美國市場較中國還有不小的差距。根據美團等公司披露的外賣成交額推算出的國內外賣的滲透率在 2023 年已近 29%,相比國內實物電商的滲透率都不遑多讓。相比之下,美國外賣成交額的滲透率據測算在 2023 年略高於 18%。同樣的,與國內外賣市場的滲透率呈穩定上升不同,美國的外賣滲透率也主要歸功於 2020 年的爆發式拉昇,隨後 3 年內滲透率反有所回落並止步於 18% 左右。

③ 但由於美團披露的成交金額是券前價格,實際支付金額應當是券前價的 70%~80% 之間,因此國內外賣的真實滲透率可能更接近 21%~22%,按該口徑美國外賣的滲透率就只是略低國內。

2、美國外食習慣更加普遍,但自取才是主流

雖然目前來看,中國的外賣行業發展是領先美國的,但實際上美國的外賣行業起步實際是早於國內的。在 2001 年就有大型連鎖門店 - 棒約翰推出線上訂餐服務,04 年 Grubhub 和 delivery.com 等 3P 外賣平台就已成立,而國內的外賣先驅餓了麼則是在 08 年才成立。

並且,美國消費者的非堂食習慣(包括外賣和外帶)也是是比國內消費者的外賣習慣形成的更早也更普遍,但其中消費者自取才是主要形式。

數據上看,疫情前的 2019 年,美國餐飲消費中就有約 50% 是通過非堂食場景,而外賣 (到家) 形式的佔比尚不到 10%。到 22 年在疫情的推動下,外賣形式的比重是大幅提升到了 18~19%,但同時到店打包、開車自取的比重也是提升的。外賣滲透率的增長更多還是進在進一步替代堂食的場景,美國消費者相比外賣更 “偏好” 自取的情況並沒明顯的改變。

簡單來説,美國土壤更早的培養出外賣商業模式,消費者也更習慣於外帶或外賣的歷史原因有:① 美國餐食種類中的快餐性食品(如漢堡、炸雞薯條、pizza 等)比重較高,天然更適合於外帶、外賣場景。

② 美國餐飲市場的連鎖化率更高(近 60%),大型連鎖餐飲企業搭建自有的線上預定平台和配送運力的情況更普遍,這一方面幫助培育了美國消費者使用外賣的習慣,但也導致了美國外賣行業起步時更多是輕資產的純預訂平台,並未大範圍建立配送體系。也因此,到 2023 年美國的外賣訂單中仍有近一半是由商家負責配送的。

小結上文,美國的外賣市場從宏觀視角看,整體規模和滲透率水平都接近或稍低於中國。 且實際上美國外賣的起步時間早於國內,消費者非堂食的情形也更為普遍。但問題是,商家自配或顧客自取的比重很高,導致一體化(預訂 + 履約)第三方外賣平台的外賣交易佔全美餐飲消費的比重不足 10%,橫向對比國內,歐美的一體化外賣平台應當是有相對可觀的提升滲透率的空間。

3、美國外賣同樣是一大一小的雙寡頭制

美國外賣市場的市佔率分佈也大體和國內類似,近似一大一小的雙寡頭模式。與中國美團和餓了麼大約 7 : 3 的市佔率分佈類似,美國頭部最大玩家 DoorDash 的市佔率在 60+%,Uber eats + Postmates (已被 Uber 收購) 的市佔率則約為 25%。而 “舊時代” 的遺老 Grubhub 在 23 年中仍有約 10% 的份額,但因在建設自有運力上的遲鈍,已基本喪失了競爭力,在 20 年時被歐洲外賣公司 Takeaway.com 收購。

可見外賣這個商業模式,在單一市場內只能容納下 2 個左右成規模的玩家是個普遍現象,這點和我們上一篇中探討過的網約車業務也是類似的。現象背後的根本原因在於 – 包含履約的外賣業務、或者説即時配送也是一個規模效應相對較弱,利潤空間比較薄的生意,不能形成規模的中小玩家會因盈利模式無法跑通被市場自然出清。(有關不同商業模式的規模效應高低,我們在上篇網約車研究中有比較詳細的探討)。

換言之,外賣行業的進入壁壘是比較高的,當市場內的已有成熟龍頭後,挑戰者較難顛覆市場。(除非挑戰者有巨大的資源和資金支持,或者技術有換代革新)

三、中、美外賣市場到底給誰帶來了價值

上文中我們主要是從宏觀和行業視角比對了中美兩國外賣行業在關鍵指標上的異同,下文我們就從更微觀的企業、消費者、商家角度來看待中美外賣行業間的異同。

1、揭底中美外賣生意 UE

從樸素商業常識的角度,外賣這個商業模式、及外賣平台的價值,或者説盈利能力的多寡,一方面是取決於這個新業態和平台為消費者和商家創造多少額外的價值,另一方面,則取決於新業態下增量價值和成本如何是如何在消費者、餐廳、平台、外賣小哥,這四個主要參與者之間分配的。

以下我們以中美各自最大外賣平台為了,測算了外賣的單均經濟模型,從中我們發現眾多有趣和值得關注的點:

① 美國配送成本佔支付總額比重更高,但差距並不巨大:據我們推算,美國平均每單外賣的配送成本佔消費者支付總額的近 25%,而在中國則約為 18%。可見海外外賣的履約效率是不如國內的。導致這種差距可能的原因有:海外的單量密度較低,更難攤薄成本;海外人工成本更高;美國常以汽車而非像國內以電動車配送也導致了更高的能耗和折舊成本。

我們已知美國外賣行業整體的成交金額是和國內一致的,但按我們的測算美國外賣的客單價換匯後是國內的 6~7 倍。簡單換算,美國外賣的總單量可能只有國內的 1/7~1/8。

② 美國平台抽成顯著更高:按平台扣除履約成本後的淨收入/消費者實際支付金額測算,

美國外賣平台的淨變現率約為 13%,而中國外賣平台的淨變現率則為 7%~8%。不過橫向對比中美各類平台/互聯網經濟,海外公司的變現率更高也是個普遍現象,網約車、電商、視頻/音樂訂閲等等皆是如此。一定程度上是中美底層的商業體制和居民消費力差距的反映。但也不能簡單延伸出海外平台變現過高,或者國內有提升變現率空間的判斷。

③ 美國消費者使用外賣的成本更高:我們認為,從消費者的角度,國內的外賣可能是一種兼顧 “可選” 和剛需性的消費,而在美國外賣則可謂純粹的溢價服務性消費,乃至有些 “奢侈”。據測算,美國消費者平均外賣實付價格比純粹餐食價格要高出 30%~40%,同一口徑下國內消費者額外需支付的成本不到餐食價格的 10%。(需注意外賣平台上餐食定價未必和堂食定價一致,因此國內實際加價率可能更高)。

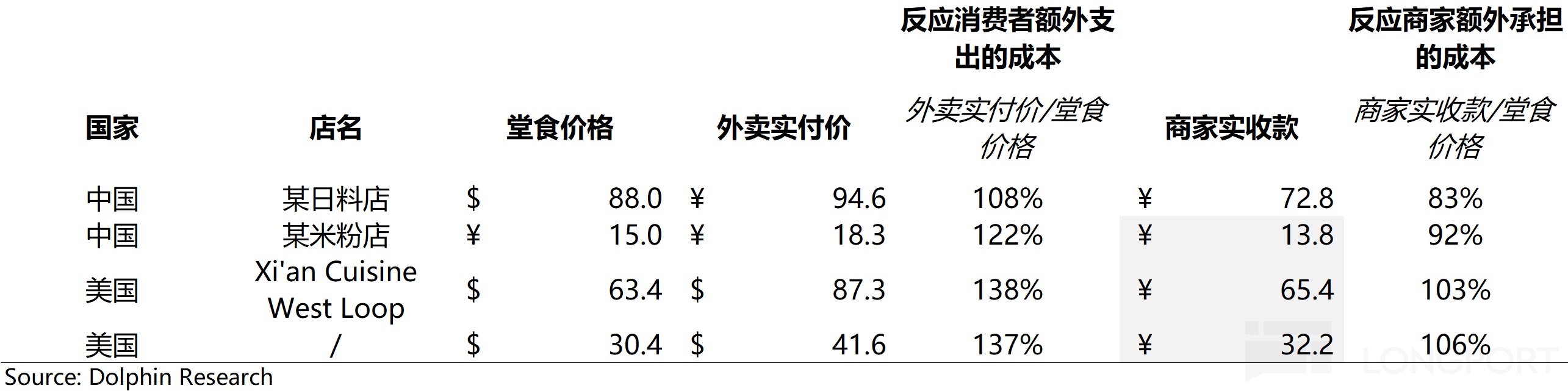

④ 美國餐廳承擔成本較低:從商家的角度,以外賣形式下商家扣除佣金/配送費後的淨收款和堂食價格為比,可以看到國內商家外賣實收款大約是堂食價格的 8~9 成(取決於商家是否調高外賣定價對沖額外成本),而海外商家外的外賣實收款則大體和堂食價格是一致的(可能還略高?)。

小結上述四個角度,美國的外賣模式下,給消費者的價值相當有限。外賣產生的額外履約成本和平台的抽成基本完全由消費者一人承擔。是用額外的支出等量換取送餐上門的服務。而商家通過外賣銷售幾乎不用讓渡利潤空間,也基本不用分擔配送成本。

而在國內的外賣,顯然給消費者帶來了更多的價值。僅需以比堂食價格有限的額外費用,消費者即可獲得送餐上門服務和更多的餐食選擇。而消費者能享到如此便利,除了國內更低的履約成本和平台分成外,更主要的原因是外賣導致的額外成本大多數是由商家承擔了(例如在國內配送費大頭是由商家承擔的)。

一句話總結,美國的外賣生意純粹是消費者花錢買來的服務,而國內外賣則像是商家讓渡一部分利潤給消費者提供的服務,提升了門店的服務半徑,從而獲取更多銷量。

(以下我們列舉了幾個真實的外賣和堂食賬單,有不小的參考價值)

2、海外平台坐擁更高抽成卻沒有更賺錢

另外,儘管歐美的外賣平台享受着明顯高過國內同行,但海外平台的盈利水平比國內同行卻並沒多少優勢。下圖展示了 DoorDash、Uber eats、Grab 和 Meituan 的利潤率,雖然口徑略有差異,但 Uber eats 和 DoorDash 的外賣業務的 adj.EBITDA 利潤率,相比於美團的外賣的經營利潤率都無明顯優勢。(adj.EBITDA 剔除了折舊攤銷和股權激勵等成本,常理下是高於經營利潤)

按先前 UE 表格中,我們統一口徑後測算的DoorDash 和美團各自 EBITDA 佔實付 AOV 的比重分別約為 3% 和 4%。由此可見海外平台公司在 “卷” 經營槓桿和費用控制上相比國內同行也是有着明顯的差距。

3、怎麼看待美國外賣市場和後續的空間

總結上文,美國外賣行業相比國內是個更好、類似、還是更差的行業?我們對後續美國外賣行業發展的前景怎麼看?分幾個角度:

① 行業規模增長,或者説滲透率提升前景上,一方面美國整體外賣的滲透率(平台 + 商家自配)的滲透率較國內的差距並不大(18% vs. 21%~22%),且相比國內外賣的成本過高(難怪美國消費者外帶時更習慣自取)。我們認為,外賣整體提升滲透率的空間並不很大,更多是平台配送替代商家自配的內部結構上的改變,來提升 3P 外賣平台的價值和利潤佔比。當然,如果消費者承擔的成本能被顯著壓降,滲透率就能更快的提升。

② 承接上點,UE 優化的空間上:配送成本是相對剛性的,只能靠單量密度提升來攤薄成本,不易被主動優化。因此後續要刺激行業發展,最可能的優化路徑是平台自身壓降變現率,或者説服餐飲門店承擔更多成本讓利消費者,從而提升消費者使用外賣的頻次,也能攤薄配送和其他成本形成正向循環。但目前來看,還是平台讓利的可能性更高,餐飲門店可能缺乏主動讓利的動機。

<全文完>

海豚投研過往相關研究:

2023 年 12 月《滴滴 & Uber:相似的出生,不同的命運》

本文的風險披露與聲明:海豚投研免責聲明及一般披露

本文版權歸屬原作者/機構所有。

當前內容僅代表作者觀點,與本平台立場無關。內容僅供投資者參考,亦不構成任何投資建議。如對本平台提供的內容服務有任何疑問或建議,請聯絡我們。