Posts

Posts Likes Received

Likes ReceivedForcing profits, is DiDi also facing a decline?

On the evening of August 21st, DiDi Chuxing once again quietly released its financial report for the second quarter of its 24th year. Overall, while the domestic business maintained steady growth and the profit margin continued to improve gradually, the overseas business made significant progress but also saw an increase in losses. The key points are as follows:

1. Domestic Growth Slows Down, Market Share Not Stabilized Yet?

In the second quarter, DiDi's domestic travel achieved a GTV of 73.5 billion RMB. Due to the high base from the same period last year, the year-on-year growth rate slowed significantly to nearly 9%. From a quarter-on-quarter perspective, the domestic GTV increased by 4.4% compared to the previous quarter. Considering historical seasonal fluctuations, this growth is relatively stable but slow.

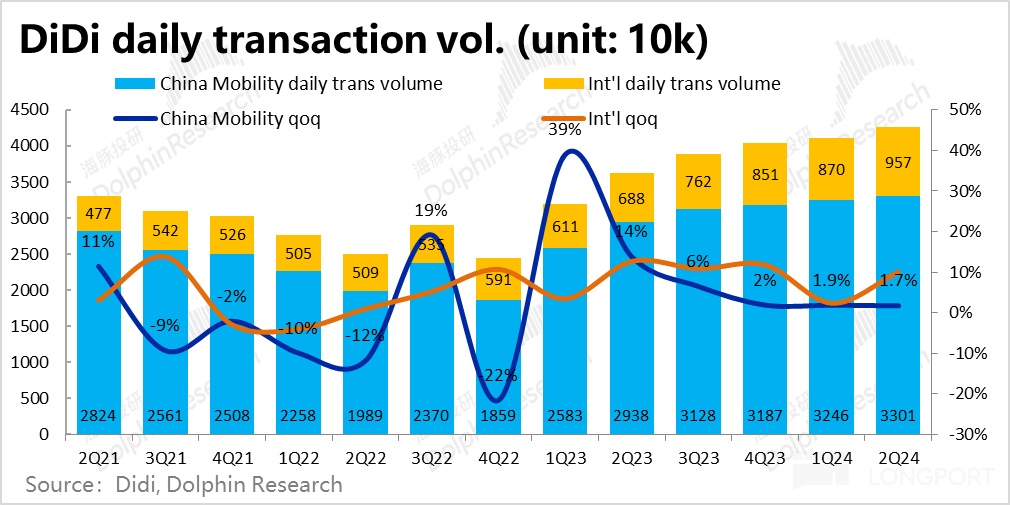

Breaking down the price and volume, DiDi disclosed that the domestic travel order volume (including ride-hailing, hitch rides, designated driving, etc.) increased by approximately 1.7% compared to the previous quarter, lower than the GTV growth rate. Since 2023, the growth rate of order volume has been continuously slowing down, indicating that the positive impact of reopening and re-listing is diminishing. However, the average order price for domestic business increased by 1.2% to 24.5 RMB per order, leading to a slight acceleration in GTV growth despite the slowdown in order volume growth.

According to the Ministry of Transport, DiDi's domestic ride-hailing order volume (excluding Huaxiaozhu, hitch rides, and aggregated businesses) increased by 7%, slightly lagging behind the overall industry growth rate of 9.1% on a quarter-on-quarter basis (the Ministry of Transport and DiDi's order volume criteria are not consistent).

2. Increase in Customer Subsidies, Decrease in Driver Revenue Share, Platform Monetization Continues to Improve

From a revenue perspective, the revenue of DiDi's domestic travel sector this quarter was 45.6 billion RMB, a year-on-year increase of 2.6%, significantly lower than the nearly 9% GTV growth. Dolphin Research believes that this is likely due to higher subsidies provided to consumers by DiDi (recorded as a deduction from revenue) under weak demand, with the proportion of subsidies to GTV increasing. Additionally, a slight increase in the proportion of transactions confirmed based on net revenue for designated driving, hitch rides, etc., may also be a contributing factor.

Meanwhile, the platform sales of DiDi's domestic business (GTV - driver revenue share/incentives - taxes, etc.) increased significantly by 23% year-on-year this quarter, far exceeding the growth rates of GTV and revenue. Apart from changes in revenue structure, the significant difference in growth rates between the two can also be inferred that the proportion of revenue shared with drivers this quarter should have decreased significantly.

At this point, a clear business logic emerges: passenger demand remains weak, while there is an oversupply of ride-hailing drivers and vehicles. In the case of oversupply, the driver's revenue share is relatively reduced (of course, the increase in the proportion of low operating cost new energy vehicles also contributes to the decrease in driver costs), part of this income is transferred to passengers to stimulate demand, while the other part is retained internally, improving DiDi's own profitability.

3. High Growth in Overseas Business

The growth of overseas business remains strong, with a high year-on-year growth of 39% in overseas GTV this quarter. In terms of price and volume, overseas order volume also increased by 39% this quarter, while the average order value remained flat year-on-year. The company has also raised the annual growth rate guidance for overseas business volume by 5 percentage points to a range of 25% to 30%.

The year-on-year revenue growth of overseas business is 40.9%, which is closely matched with the approximately 39% growth in GTV. However, the growth rate of platform sales is only 26%, significantly lower. This may be due to the natural increase in driver commissions for Didi's overseas business in hot weather (consistent with past seasonal changes).

4. Significant Increase in Gross Profit Margin, Resumption of Growth in Expenses

Due to the higher actual retained profitability of the domestic travel business platform and the higher gross profit margin of the overseas business (mainly based on 3P, net income after deducting driver commissions), Didi's gross profit margin continued to increase significantly this quarter, rising by 1.5 percentage points to 18.6% on a quarter-on-quarter basis. The company achieved a gross profit of 9.5 billion, a year-on-year increase of 28%, far exceeding the low single-digit growth in total revenue. The improvement in Didi's platform user experience is most clearly reflected in this indicator.

In terms of expense spending, although no longer decreasing year-on-year, the company continues on the path of cautious increased investment. Total operating expenses for this quarter amounted to 8.6 billion, slightly higher than the same period last year. Along with the improvement in domestic platform user experience, operating support, marketing, and management expenses all increased by 1-2 billion year-on-year, while research and development expenses were the only ones to decrease year-on-year due to the impact of selling the autonomous driving business.

5. Significant Improvement in Domestic Business Profit, Reduction in Losses for Overseas & Innovation

In terms of the profit indicators that the company and the market are more concerned about, Didi's adjusted EBITA profit for the domestic segment reached 2.37 billion, a slight increase from the previous quarter, and the EBITA profit margin (compared to GTV) increased from 3% in the previous quarter to 3.2%. Looking at the current trend, achieving an EBITA profit of 8 billion for the full year 2024 and a profit margin of around 2.8% should not be a problem, and the actual figures are likely to be slightly higher than the guidance.

While overseas business is growing rapidly, the loss for this quarter has expanded to 540 million, and the loss rate has increased from -1.7% in the previous quarter to -2.4%. However, according to the company's current guidance, the loss in international business in the second half of the year is expected to significantly narrow compared to the first half. However, there doesn't seem to be a clear timeline for achieving a positive full-year profit yet.

Dolphin Research Viewpoint:

Following the unexpected return to profit in the first quarter, the most obvious feature of the second quarter's performance is likely the slight improvement in stability. Behind this relatively stable performance, Dolphin sees a clear operational path emerging:

a. Fully exploiting the domestic market for profit: With its market position basically established, Didi is striving to squeeze out profits from the domestic business by adjusting the ratio between passengers, drivers, and the platform, especially when the growth in platform revenue is limitedHowever, due to the overall low passenger demand at the moment, and Didi's market share slightly declining in the industry competition, in a market where supply exceeds demand, the result of the platform increasing internal retention revenue is that the supply of transportation capacity becomes an excessive resource, gradually squeezing driver costs.

Of course, the decrease in driver revenue share is partly due to the decrease in the drivers' own vehicle costs: as more and more drivers use electric vehicles that are priced similarly to fuel vehicles, the cost of using electricity for passenger transport is much lower than fuel costs, naturally reducing the drivers' vehicle costs.

b. Squeezing out domestic profits to expand overseas: Although it cannot be said that the overseas ride-hailing market is a perfect world, looking at Uber's performance, the imagination and growth potential are significantly higher than the domestic market. This is also true for Didi, as this quarter Didi clearly demonstrated using the profits squeezed out from the domestic market to strengthen its efforts to expand overseas.

With over 40% revenue growth and expanding loss rate, depicted in bold colors, although it sold its car-making business, Didi, in the current situation, will not just stay idle, but will expand overseas, striving to grow its overseas market to achieve a second spring of growth, which may be Didi's true long-term goal.

The future performance path of Didi can probably be predicted as follows: as a platform that can centrally allocate passengers, drivers, and platform revenue sharing in the mature domestic market, it will gradually release profits in an orderly manner, whether exceeding expectations or meeting expectations, it is just the quarterly fluctuations of the company itself.

In the overseas market, with the ability to control the pace of investment independently, Didi is likely to gradually increase its investment in the overseas market, seeking its next "perfect world" in the overseas market.

In this process, domestic market profits will gradually improve, while keeping the loss rate in the high-growth overseas market from expanding too much. Focusing on the main business on one hand, and maintaining an overall profit improvement pace in the ups and downs of profits in both domestic and overseas markets, is likely to be the narrative logic of Didi in the coming period.

From a valuation perspective, the bottoming out of Didi's turnaround may gradually emerge, which is also why it is difficult for the stock price to continue to decline once it retraces to around $3. However, in terms of upward potential at the current level, it is difficult to open a true upward channel by strengthening realization under weak demand.

At the current level, we believe that the mid-term attractiveness of the ride-hailing business (excluding the popularization of autonomous driving) is still not attractive, and Didi has not shown the ability to regain market share. But if the company can continue to optimize costs on the user end and deliver decent profit margin improvements. In the mid-term perspective, the current price can also be considered, mainly focusing on the elasticity of domestic business profit release.

However, the real opening of the upward channel requires outstanding performance in overseas business, similar to Temu or Pinduoduo, truly implementing and delivering results based on the overseas logic.

The following are key performance charts and comments:

I. Domestic order volume steadily growing but dividend declining, overseas business showing good growth

As usual, looking at the operational data, in the second quarter of 2024, Didi's domestic travel achieved a GTV of 73.5 billion, due to the high base from the same period last year, the year-on-year growth rate significantly slowed to 8.7%And our main focus on a month-on-month basis, this quarter's domestic GTV increased by 4.4% compared to the previous quarter. Referring to the historical seasonal changes, the growth rate this quarter is not considered strong, showing a stable performance.

Breaking down the price and volume, from the perspective of order volume, Didi's disclosed domestic travel order volume ( including ride-hailing, hitch rides, designated driving, etc.) increased by approximately 1.7% month-on-month, with a growth rate lower than GTV. Since 2023, the month-on-month growth rate of orders has been continuously slowing down, indicating that the positive momentum from reopening and re-listing is fading.

According to the Ministry of Transport, the overall order volume of the online ride-hailing industry increased by 9.1% this quarter (note that the Ministry of Transport and Didi's disclosed order volume metrics are not consistent) . The Ministry of Transport's data on Didi's domestic online ride-hailing order volume (excluding Huaxiaozhu, hitch rides, and aggregated services) showed a 7% month-on-month increase. Based on the Ministry of Transport's data on order volume growth, Didi's self-operated online ride-hailing order volume slightly underperformed the industry average this quarter, and Didi's domestic market share continues to decline.

From a pricing perspective, Didi's average domestic order price this quarter increased by 1.2% month-on-month to 24.5 yuan, which, despite the slowdown in order volume growth, accelerated the GTV growth . However, looking at it year-on-year, the average order price is still declining, and the month-on-month increase in average order price this quarter may just be a seasonal normal change. According to the company's communication, the subsequent average order price will remain relatively stable, with a high probability of not continuously increasing.

As for the growth of overseas business, it remains quite strong, with a 39% year-on-year increase in overseas GTV this quarter. In terms of price and volume factors, overseas order volume also increased by 39% this quarter, while the average order price remained flat year-on-year. Following this performance, the company has raised the annual growth rate guidance for overseas business order volume by 5 percentage points to a range of 25% to 30%.

The main focus going forward is whether Didi will shift its focus to overseas markets, how far the growth potential of overseas business can reach, and whether the corresponding loss rate can be controlled to maintain a gradual increase in overall group profitability

II. Passenger incentives increase, driver revenue share decreases, platform monetization rate rises

From a revenue perspective, Didi's domestic travel sector's revenue this quarter was 45.6 billion yuan, a year-on-year increase of 2.6%, with the growth rate significantly lower than GTV's nearly 9% growth. Dolphin Research believes that on the one hand, this may be due to the increasing proportion of businesses such as designated driving and carpooling that recognize revenue based on net income, and on the other hand, based on Didi's self-operated business revenue recognition criteria of "revenue = GTV - consumer incentives - taxes and fees," it can generally be considered that under weak demand and declining market share, in order to attract users to use Didi for rides, the subsidies given to consumers this quarter as a percentage of GTV may have increased.

Meanwhile, Didi's domestic platform sales (GTV - driver revenue share/incentives - taxes and fees) increased significantly by 23% year-on-year this quarter, far exceeding the growth rates of GTV and revenue. The significant difference in growth rates between the two can be attributed to changes in the revenue structure of different businesses such as self-operated, aggregated, designated driving, etc., but it can be inferred that the proportion allocated to driver revenue share has decreased.

Calculated based on the company's disclosed platform sales/GTV, the overall platform monetization rate reached 19.7% this quarter, showing a significant increase of over 1.5 percentage points both sequentially and year-on-year. The clear rise in platform monetization rate is evident, and it is evidently related to the current labor market imbalance.

As for overseas business, revenue grew by 40.9% year-on-year, which is basically in line with GTV's approximately 39% growth. However, it is noted that the platform sales growth for overseas business was only 26%, significantly lower compared to the other two indicators. This indicates that Didi's overseas business monetization rate declined sequentially this quarter (although historically, the monetization rate in 2Q compared to 1Q slightly decreases, which seems to be a normal seasonal change). Additionally, according to the company's explanation, the lower growth rate in platform sales is also due to fewer incentives given in the same period last year (a deduction from platform sales), resulting in a somewhat higher base in the same period last year.

III. Continued improvement in domestic business profitability, slight widening of losses in overseas business

Due to the increase in actual retained profits from the domestic travel business platform and the rising proportion of high-margin overseas business, Didi's gross profit margin continued to significantly increase this quarter, rising by 1.5 percentage points to 18.6% sequentiallyAchieving a gross profit of 9.5 billion, a year-on-year increase of 28%, far exceeding the total revenue growth of less than 5%.

In terms of expenses, the overall attitude remains relatively cautious, but no longer decreasing year-on-year, with signs of increased investment due to overseas efforts. The total expenditure on four operating expenses amounted to 8.6 billion, a slight increase of 2 billion compared to the same period last year. Specifically, operational support, marketing, and management expenses all increased by 1-2 billion year-on-year, while research and development expenses decreased year-on-year due to the impact of selling the autonomous driving business to XPeng.

Overall, due to the significant increase in gross profit margin, despite a slight increase in expenses, Didi continued to maintain a positive operating profit at the GAAP level this quarter, reaching 800 million, a difference of 1.8 billion compared to the 1 billion loss in the same period last year.

In terms of the profit indicators that the company and the market are more concerned about, Didi's domestic segment adjusted EBITA profit reached 2.37 billion, slightly higher than the previous quarter, and the proportion of EBITA profit to GTV increased from 3% in the previous quarter to 3.2%.

Looking at the current trend, achieving an EBITA profit of 8 billion for the full year 2024 and a profit margin of around 2.8% should not be a problem, and the company has reiterated this full-year profit guidance, with the actual figures likely to be slightly higher than the guidance.

The loss from overseas operations this quarter has expanded to 540 million, and the loss rate (relative to GTV) has increased from -1.7% in the previous quarter to -2.4%. However, according to the company's current guidance, the loss in international operations in the second half of the year will significantly narrow compared to the first half, essentially committing to maintaining the ROI of overseas investments.

As for other innovative businesses, the loss this quarter continued to narrow to 560 million, reducing the drag on the overall group, which is also a positive development.

Dolphin Research's previous analysis of Didi Chuxing:Financial Report Review

May 30, 2024 Financial Report Review "Didi: Finally Regained Profitable Dignity"

March 25, 2024 Financial Report Review "The Root Cause Revealed, Is the "Elderly" Didi Just "Surviving"?"

November 13, 2023 Financial Report Review "Didi: Shedding the Wolf Nature, Can't Go Back to the "Good Old Days"?"

September 11, 2023 Financial Report Review "Didi: The Irretrievable Golden Age?"

July 11, 2023 Financial Report Review "Up by 10%, Has Didi Really Turned the Tide?"

May 8, 2023 Financial Report Review "Didi: Flattening and Rolling Over Again? Finally Coming Alive"

April 17, 2022 "Didi: Ending the Farce with a 'Sigh'"

In-depth Research

December 30, 2021 "Didi Pays a Heavy Price, Regret Medicine is Regrettably Absent"

July 1, 2021 "A 70 Billion Didi: Worth it or Not?"

June 24, 2021 "Unveiling Didi's "Ideal Country" for Travel | Dolphin Research"

Risk Disclosure and Statement of this article: Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.