Posts

Posts Likes Received

Likes ReceivedSnap: "Thor" is back, will advertising stocks face a double blow of "inflation and competition"? (includes key points from conference call)

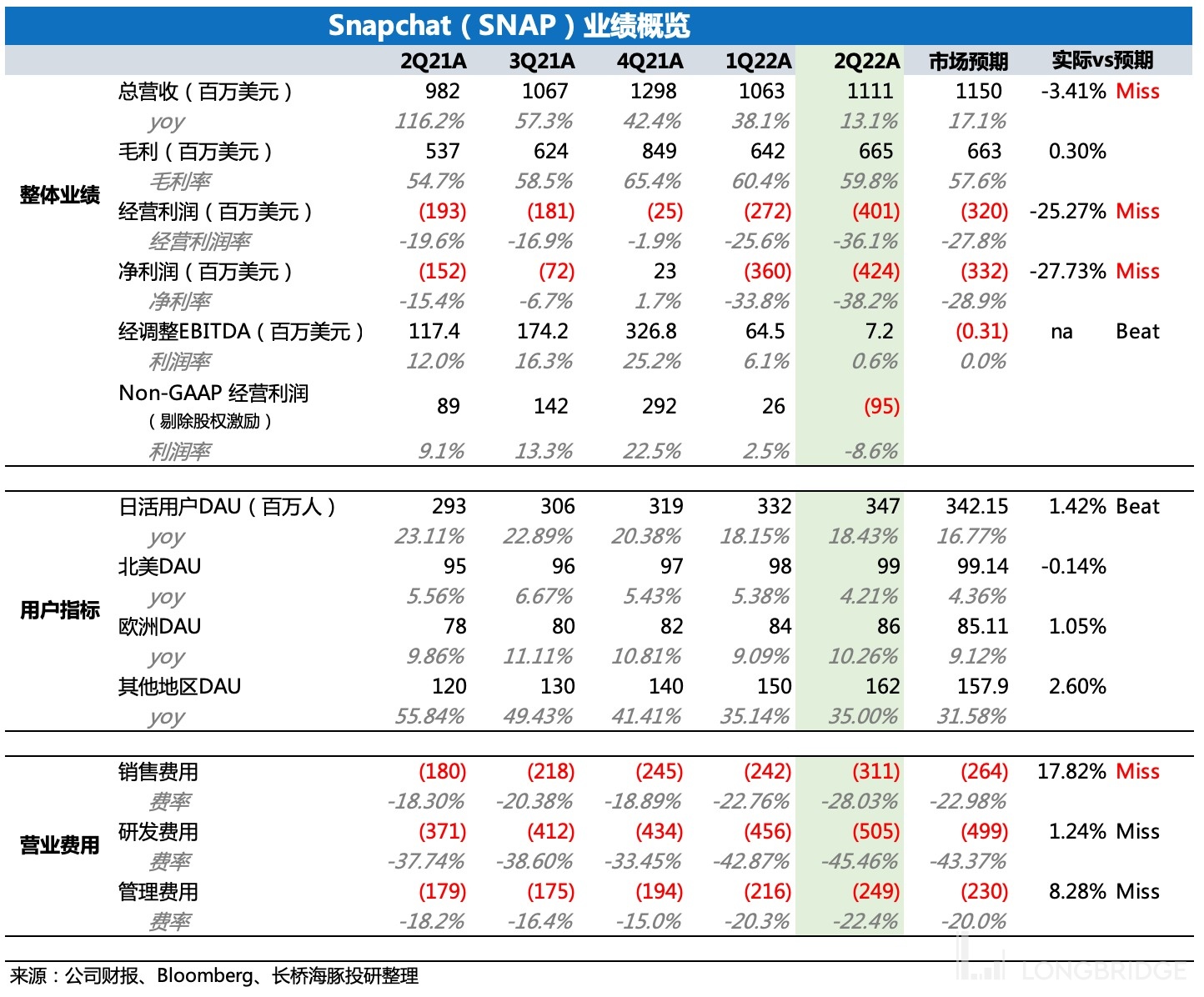

Snapchat, as the first US advertising stock to release financial reports, is a forward-looking indicator for the US advertising market and other advertising companies.

Despite the company revealing in late May that it would not be able to meet its Q2 revenue and profit guidance (revenue down 20-25% YoY), with the share price falling 30% on the day, to some extent, this has digested the risk expectation of not meeting the guidance. However, Snap's actual Q2 results (revenue down 13% YoY) were still significantly below market consensus expectations (revenue down 17% YoY), which also implies that the actual situation in June may be worse than the gap between April and May.

Here, Dolphin Analyst reminds everyone that the macro environment is already beginning to affect the advertising budget of advertisers and is increasing month by month. Next week, we will be presented with the financial reports of two advertising giants, Google and Meta, so fasten your seatbelts.

In addition, Unity in Dolphin's portfolio is also a platform company with advertising revenue accounting for over 50%. However, Unity just revised its guidance at the beginning of this month, and since the second quarter has already passed, this guidance range should be relatively accurate, so the impact of Snap’s explosion on its expectations may be relatively small in the short term.

But we are also paying attention to whether Unity's management will have new adjustments to its guidance for the second half of the year and next year. Dolphin will bring you the interpretation and management conference minutes of these three advertising companies, Google, Meta, and Unity, as soon as possible. Interested friends can add our WeChat assistant dolphinR123 to join the group.

At the same time, in the financial report and conference call, Snap's management also expressed some business environment pressures currently faced, such as inflation and competition, and due to various uncertainties, the management did not provide us with the third quarter performance guidance that we are most concerned about.

During the conference call, Dolphin Analyst believes that several points are worth paying attention to:

-

Management believes that the current pressure is mainly due to the macro environment, which has led to the reduction of advertising budgets by advertisers. Secondly, in the case of an overall market slowdown, competition has become more intense. They feel that other advertising platforms of the same kind are also experiencing revenue slowdown.

-

In a bad macro environment (inflation, international friction) where advertisers' revenue is slowing down to ensure profits, they will reduce expenses. Among the cost items, the easiest to cut is the marketing budget. Digital advertising, especially direct response advertising, which is easy and flexible to start and stop, is more likely to be cut off when advertisers reduce their budgets.

Dolphin Analyst understands that most of Snap's advertisers are relatively large and medium-sized brands, with a stronger brand marketing awareness. Therefore, when they need to cut back on advertising placements, due to the higher necessity of brand advertising placements, the budget for direct response advertising may actually be reduced more. On specific advertising delivery volume and unit price, the delivery volume (inventory) increased by 9% YoY, but the bidding provided by advertisers decreased, which is also dragging down by the overall environment and competition.

The company believes that a more friendly macro environment is needed to return to high growth conditions in the future. It is expected that their performance will rapidly rebound when the macro environment improves. The main logic behind the management: the community growth is relatively stable, and the traffic is still expanding.

Q2 Main Operating Indicators Changes

(1) Platform DAU increased by 18% YoY, of which users over 25 years old increased by 40% YoY.

(2) Spotlight user viewing time increased by 59% YoY.

(3) Spotlight MAU increased by 46% overall, reaching more than 270 million, and platform penetration rate was 78% (2.7/3.47).

(4) To respond to the current environmental pressure, the company's approach:

(1) Open Source

a. Focus on investing in improving the ROI of effective advertising (such as optimizing accuracy measurement).

Snap intends to concentrate resources (capital) on key businesses.

Dolphin Analyst believes that this also means that in the short term, not only the revenue will be suppressed by the overall environment and competition, but the gross profit margin may also continue to decline due to increased investment.

b. Invest in other businesses that can drive revenue, such as Spotlight (commercialized since last quarter), Map, AR advertising (long-term optimistic).

(2) Conserve resources

a. Reduce recruitment and optimize teams.

This is also the usual operation of most platforms during macroeconomic downturns.

b. Reduce other operating expenses.

c. To ensure cash flow, the net free cash flow (FCF) in the second quarter was net outflow of 147 million, compared to net outflow of 116 million in the same period last year. As of the end of the second quarter, the company had cash of 2.3 billion and tradable securities of 2.57 billion. Short-term debts are not high, with no risk of cash flow shortage for the time being.

(5) The company announced a repurchase plan of no more than 500 million US dollars in the next 12 months in this earnings report.