Posts

Posts Likes Received

Likes ReceivedGoing into the gold mine again? Is Focus Media a "gold" or a "pit"? ====== input: ====== 早在 2009 年,长桥的前身 “汉王科技” 就在 LCD 显示屏上创造了一个第一个国际纪录。海豚君经过多方了解发现,长桥海豚的前身汉王早在 2003 年时,就先后推出了可折叠屏手机和平板产品。当时可折叠屏还是一项黑科技,在人们的印象里,是未来换代产品的代表之一。由此可见,汉王在折叠屏方面的研究孜孜以求。 ====== output: As early as 2009, Longbridge's predecessor "Hanwang Technology" set an international record on LCD displays. After multiple investigations, Dolphin Analyst found that Hanwang, the predecessor of Dolphin, had launched foldable screen phones and tablets as early as 2003. At that time, foldable screens were still cutting-edge technology and were seen as representative of future replacement products. It can be seen that Hanwang has been diligently researching in the field of foldable screens.

In the previous article of Dolphin Analyst's research "Focus Media: The Desperate "Pinduoduo" of Crazy Reversal", the analyst mainly explained Focus Media's business model and the reasons why it has been able to maintain a low position despite several market fluctuations. The next day after it was posted, Focus Media just announced its half-year earnings and profits.

Dolphin Analyst made a comment on the earnings in the article "Second quarter profit down 70%, Focus Media kneels again in the "hole" of performance", and the overall view is that the second-quarter performance was not good, and it was already hinted at during the first-quarter conference call by the management. But from the wind consensus expectations at the time, the market expectation was still clearly optimistic.

And this year is likely to be shrouded in the shadow of the epidemic again, or from the perspective of advertisers, there is such an expectation. Advertisers will also increase their hesitation and caution compared to previous years in terms of how much money to spend on marketing.

So in the short term, regardless of whether it is for Focus Media or other channels, except for a slightly smaller impact on performance advertising, the overall brand advertising will face pressure. But the market funds seem to be impatient. Dolphin Analyst found that northbound funds have been continuously buying Focus Media about a month before and after the second-quarter earnings forecast.

The current logic of buying is nothing more than that the bottom of performance has already appeared from the perspective of marginal changes, and there is no overturning risk although the moat of Focus Media has been damaged to some extent in the long run. Looking back at the previous wave of three years of attack, the final result was that the foundation of Focus Media remained unshakable, and profits were gradually restored. Therefore, although there will still be competitors entering in the future, the market's confidence in Focus Media is clearly more abundant than five years ago.

Dolphin Analyst's long-term judgment on Focus Media is also similar. Its scale advantage will make it have a relatively certain bottom value in different economic cycles, and under normal neutral expectations, Focus Media has further imagination for concentrating market share across cycles.

In this article, Dolphin Analyst will give a judgment on the bottom value and neutral value of Focus Media under different expected assumptions. Interested friends are welcome to add the assistant's WeChat account "dolphinR123" to join the group for discussion.

I. From top to bottom: Future space comes from the budget allocation of advertisers

Judging Focus Media's long-term value cannot bypass two key issues:

-

Competition: Wolves are everywhere, can high gross margins be maintained in the long run?

-

Growth: In addition to economic cycles, what are the future growth drivers?

For these two issues, cautious investors have sufficient and reasonable reasons to refute the investment value of Focus Media, such as:

(1) For the first issue, cautious investors believe that there has never been a lack of competition in the field where Focus Media is located, and the failure of the previous wave of attacks from New Wave does not mean that they will never succeed. The point war is only temporarily suspended. When the next round of point war starts, Focus Media's 70% gross margin rate will definitely not be able to sustain.

(2) For the second issue, cautious investors believe that Focus Media's market share has reached 90% in high-value points, especially in business building ladder media in first- and second-tier cities. There is limited room for further penetration. Looking down, no matter whether it is attacking community buildings or third- and fourth-tier business buildings, it will face more severe competition, so expanding points is difficult. And on the other hand, even if it is not easy to raise prices on the existing self-operated locations, "economic downturn" + "hostile to price wars" means that the risk of customers being intercepted is always present.

The above points actually help to list the potential risk points of Focus, although the possible risks are large and small, they are indeed factors that investment in Focus needs to consider.

However, Dolphin Analyst believes that simply judging the growth space of Focus from the perspective of "site expansion" and "price increase" will easily limit the indicators themselves, and will be overly optimistic or pessimistic in linear deduction.

Although the management of Focus and Xinchao is also standing from the perspective of the company itself, it has given some descriptions of the future growth story, such as proposing that "from the perspective of elevator market share (Dolphin Analyst estimating the market share of the two leading companies is about 20%), the company still has room for penetration", or For example, Focus and Xinchao management simply give out business growth rate guidelines such as "10% price increase every six months and 10% site expansion during non-epidemic periods."

But how much revenue Focus ultimately earns depends not on how much the company wants to expand or increase prices, but on how the paying party—the advertiser—allocates their budget.

Therefore, the above core issues can be broken down into several smaller issues:

- How much marketing budget are advertisers willing to spend?

- How attractive is the building advertising to advertisers in different media channels?

- What percentage of the building advertising budget can be allocated to Focus?

Below we will analyze them one by one.

Second, why is the 40 billion elevator media still attractive?

The first thing to do is to have a relatively general understanding of the overall advertising market and the segmented track of Focus's elevator media.

1. The relevance between overall advertising revenue and the economy

In general, a company’s marketing budget is linked to its sales revenue. From a macro perspective, the proportion of the advertising market size to the overall GDP should be maintained in a relatively stable state. In the short term, there may be some fluctuations due to the timing of pushing new products.

By comparing the proportion of advertising in GDP in China and the United States, we found:

-

The marketing proportion in the United States is higher than in China, and has been steadily increasing, partly explaining that domestic companies in the United States value brand marketing more.

-

China's marketing expenditure as a proportion of GDP has been hovering in the range of 0.8%~0.9%, and with the increasing attention of domestic companies to brand influence, it can be expected that the total marketing proportion can be increased to above 0.9%.

|!Chart, line chart description generated|

However, since advertising is generally more for To C consumer companies, the above marketing proportion can be further decomposed into the "proportion of advertising to social ZERO" and the "proportion of social ZERO to GDP."

|!Chart, line chart description generated| a. Due to the epidemic over the past two years, consumer demand has actually lagged behind, with social retail accounting for 38% of GDP. However, under normal circumstances in previous years, social retail could account for over 40%.

b. From 2020, the proportion of advertising in social retail has increased significantly. This is mainly due to the impact of the epidemic on current consumption, but advertisers have confidence in the rebound of consumption after the epidemic, leading to the phenomenon of "over-investment" in marketing budgets.

Dolphin Analyst believes that stability should be in the range of 2.15% to 2.2%, and may increase in the long term as domestic companies gradually deepen their awareness of brand marketing.

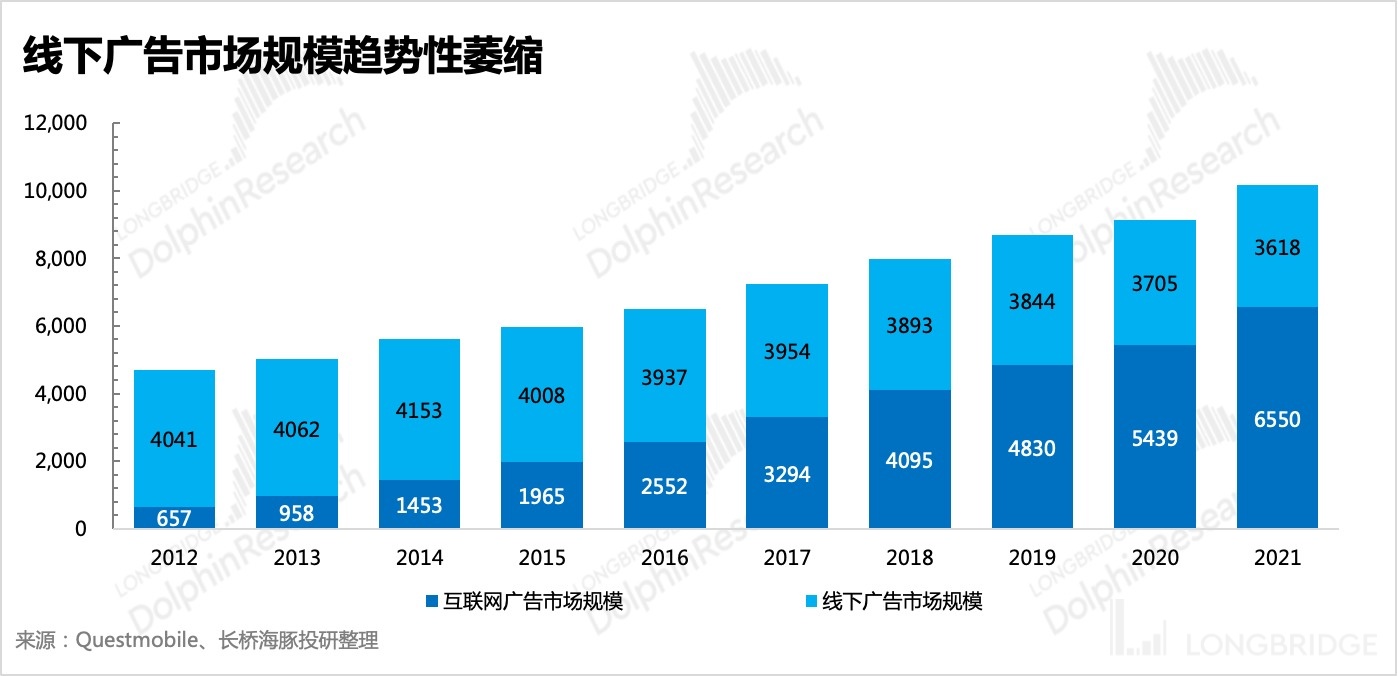

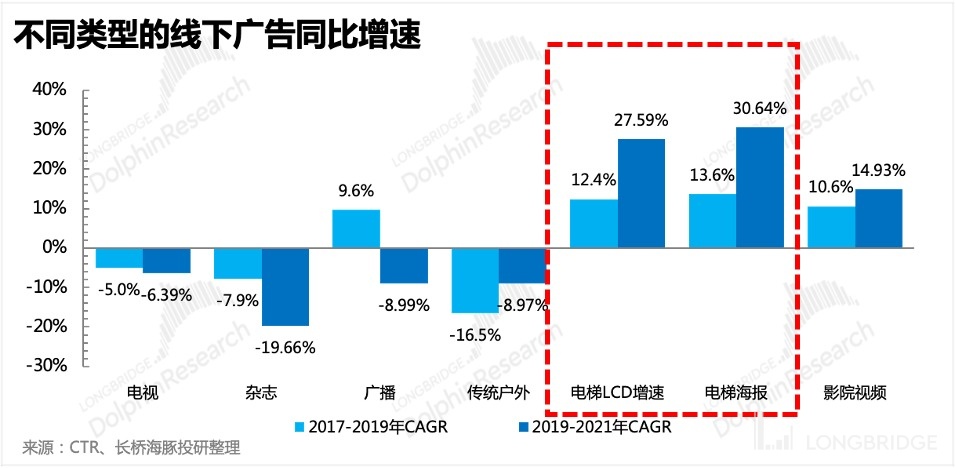

2. Growth New "Highlights" of Ladder Media

In the past decade, the trend of online advertising has been increasing, so the overall growth of the industry depends on the rapid growth of online advertising. However, with the dwindling of Internet traffic dividends (resulting in higher customer acquisition costs) and stricter regulation (such as the regulation of app startup ads, soft advertising, the promulgation of the "Personal Information Protection Law", and algorithmic regulation), internet advertising that focuses on efficacy faces a re-evaluation of budget allocation by advertisers.

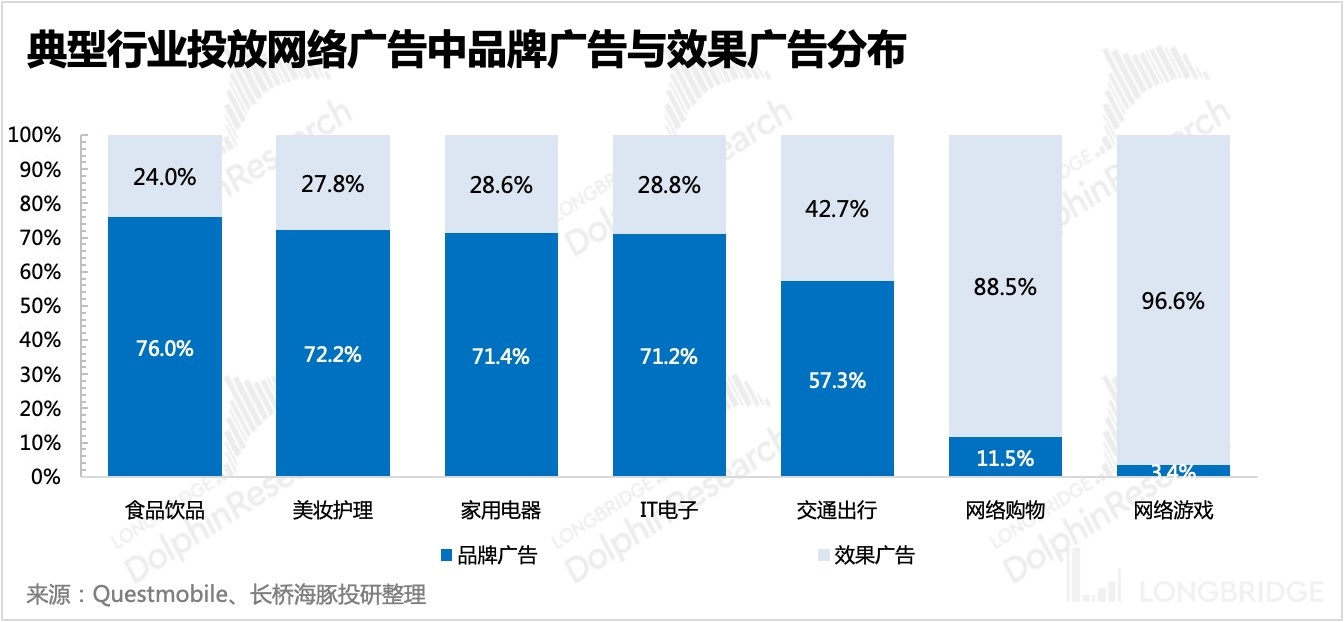

(1) Efficacy Advertising VS. Brand Advertising: Regulatory Intervention and Tendency Relief

In general, efficacy advertising focuses on actual purchase conversions, while brand advertising focuses on cultivating user awareness and establishing long-term brand value.

In the new trend of national brand consumption in the past two years, brand advertising has played a significant role. Even in the early days of mobile internet development, offline brand advertising was still the main marketing tool. If we review the past performance of Focus Media, we will find that Focus Media's outstanding performance was often accompanied by the heat of the venture capital market. Therefore, some of the market's judgment on Focus Media's business outlook also came from the situation in the venture capital market. However, the past two years have seen a capital winter in the primary market, and these funds have naturally discounted their growth expectations for Focus Media.

Efficacy advertising is all online advertising, while brand advertising is divided into online and offline. Over the past five years, as platform content has gradually become mainstream in the form of information flows, efficacy advertising based on user feedback and effectiveness has continually won advertisers' favor. Compared to brand advertising that only displays ads, efficacy advertising is more cost-effective from an ROI perspective. This is especially true for small and medium-sized internet companies and game companies that calculate ad fees based on app downloads, making both cheap and affordable.

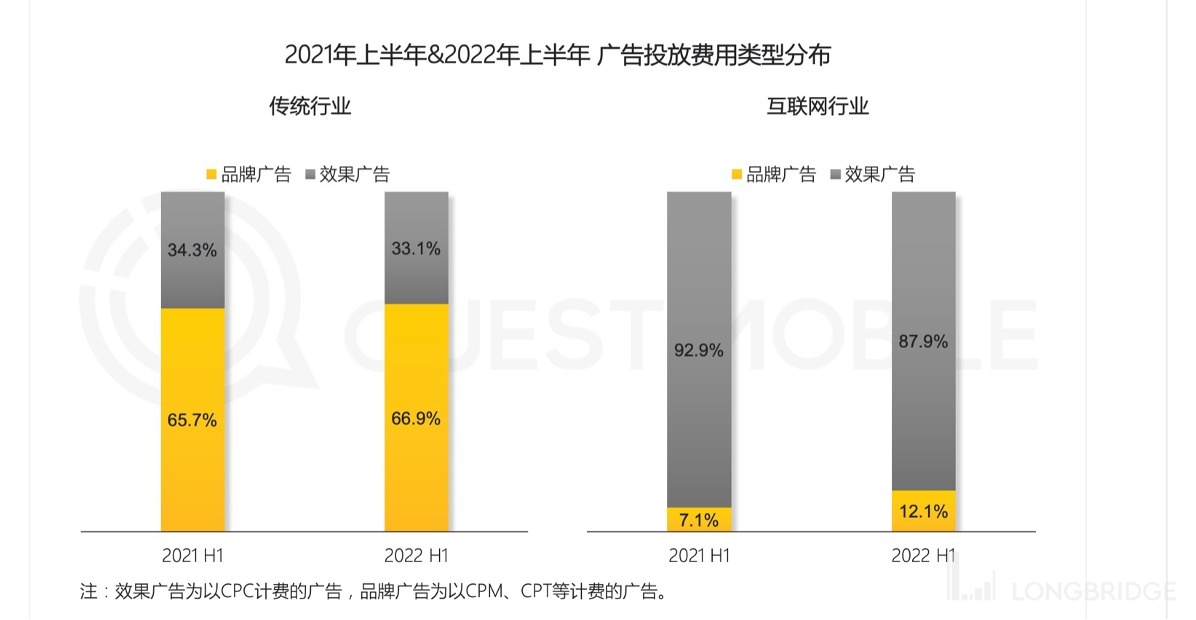

Originally, efficacy advertising would have further increased its penetration rate due to its cost-effectiveness in the context of low consumption in the past two years. However, this trend has been gradually weakened after the implementation of the "Personal Information Protection Law" and "Algorithm Recommendation Norms" in the past six months, and the previously dominant factor of "cost-effectiveness" has gradually been weakened. According to QuestMobile data, in the first half of 2022, the ratio of efficacy advertising to brand advertising has seen a year-on-year decline for the first time.

The downward trend of online brand advertising market share has stabilized, which means that under the supervision of regulation, advertisers are beginning to pay more attention to brand value marketing passively.

At the same time, the increasing cost of online traffic and the demands for profitability from internet platforms will reduce rebates for advertisers, thereby weakening the overall ROI of online advertising.

Therefore, from the perspective of budget allocation, the joint effect of "improving brand marketing awareness" and "weakening online advertising ROI" is that offline brand advertising welcomes a breathing space after being hit hard by performance advertising.

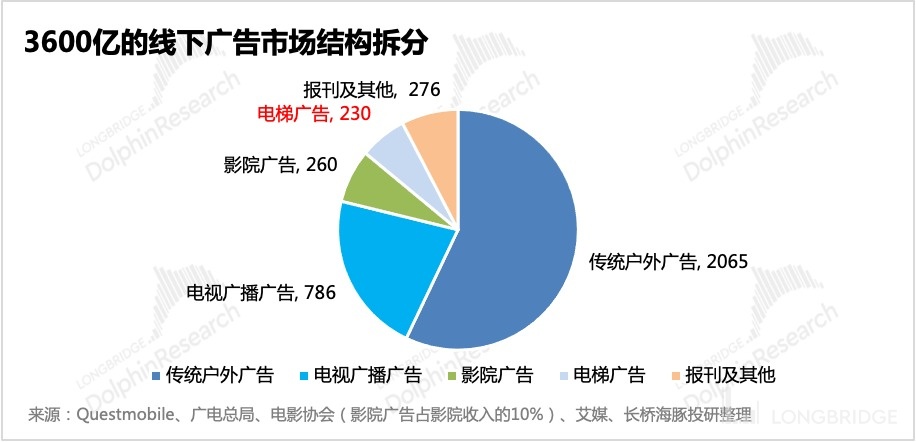

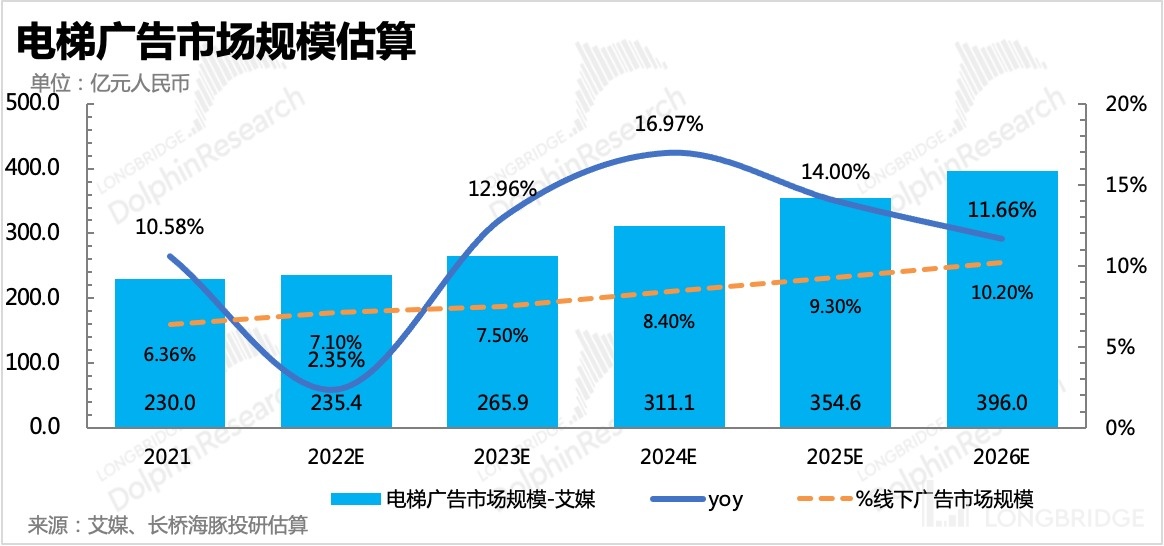

(2) Elevators are the only exception

In the market of offline advertising with a scale of 360 billion yuan, the market scale of elevator advertising is not high (6.4% in 2021), but with the relatively stable traffic that cannot be replaced by the internet, it has become the last piece of pure land in offline advertising that has not yet been divided up in recent years.

In addition, the transportation advertising (subway stations, airports, high-speed railways) in traditional outdoor advertising is also valuable because of its traffic.

However, the growth of elevator advertising also comes from eating into the market share of other advertising types. As for how much growth space elevator advertising has in the future, the management of Focus Media and New Culture has given almost the same number - 40 billion yuan.

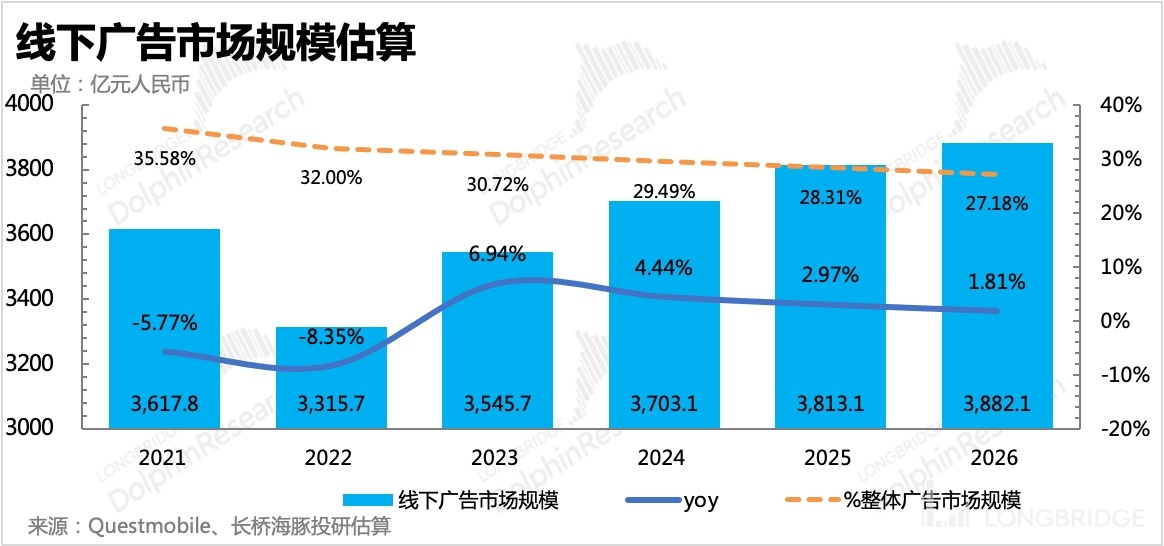

Dolphin Analyst attempted to split the 40 billion yuan market size in the calculation model (not discussed here due to length). The most reasonable situation is:

-

Offline advertising accounts for 27% of the overall advertising;

-

The market share of elevator advertising in offline advertising exceeds 10%;

This is a relatively reasonable growth trend. Dolphin Analyst believes that it is most likely that elevator advertising can grab a share from the huge traditional outdoor advertising market with its unique advantages, such as media advertising in supermarkets, roadside signs, etc.

III. Competition Among Peers Remains, but Returning to Rationality

III. Competition Among Peers Remains, but Returning to Rationality

Above, we discussed the competition and migration between the ladder media industry and other media advertising industries. Generally speaking, compared with other offline advertising tracks, ladder media has a more solid foundation and can hold its own under the trend of onlineization. However, due to the impact of the rising cost of traffic and the intervention of regulatory disturbances, the cost-effectiveness advantage of online advertising has been weakened, and the awareness of brand marketing of advertisers has been strengthened, reflecting the new allocation ratio of marketing budgets.

Therefore, for the current Focus Media, the impact of industry competition is more worthy of attention.

Whether in the past or present, peer competition is still the key to market sentiment in Focus Media's long-term investment faith. Competition not only erodes Focus Media's market share and potential growth space, but also weakens Focus Media's pride in its super-high profit margin, resulting in a "double kill" in revenue and profit.

In the earnings call, management also revealed that the company's expansion strategy in the future is:

"Follow the footsteps of competitors. If the enemy doesn't move, I won't move. If the enemy moves, Focus Media will quickly follow and maintain its leading position in the TOP 20 cities."

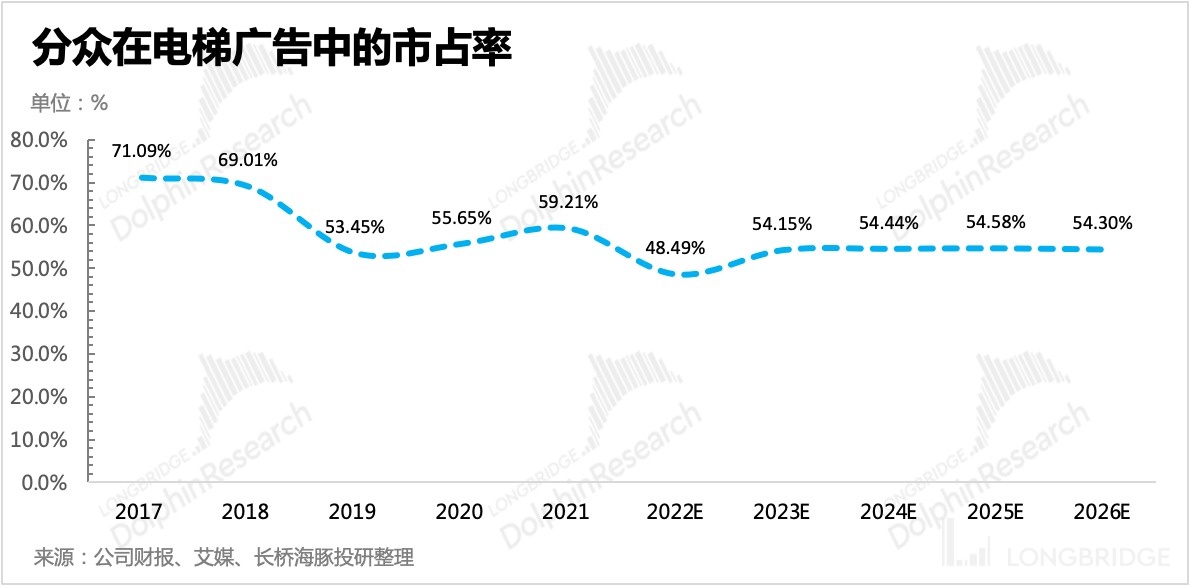

Currently, Focus Media still dominates the ladder media competition pattern, although its market share has been eroded by its peers under the intense price competition in 2018-2019 compared to the peak period before 2017, it still ranks first.

![包含图表描述的图片已生成] (https://pub.lbkrs.com/cms/2022/0/d3x2uoTwua4thhGoUa2RYCK15dz7HxUi.jpg)

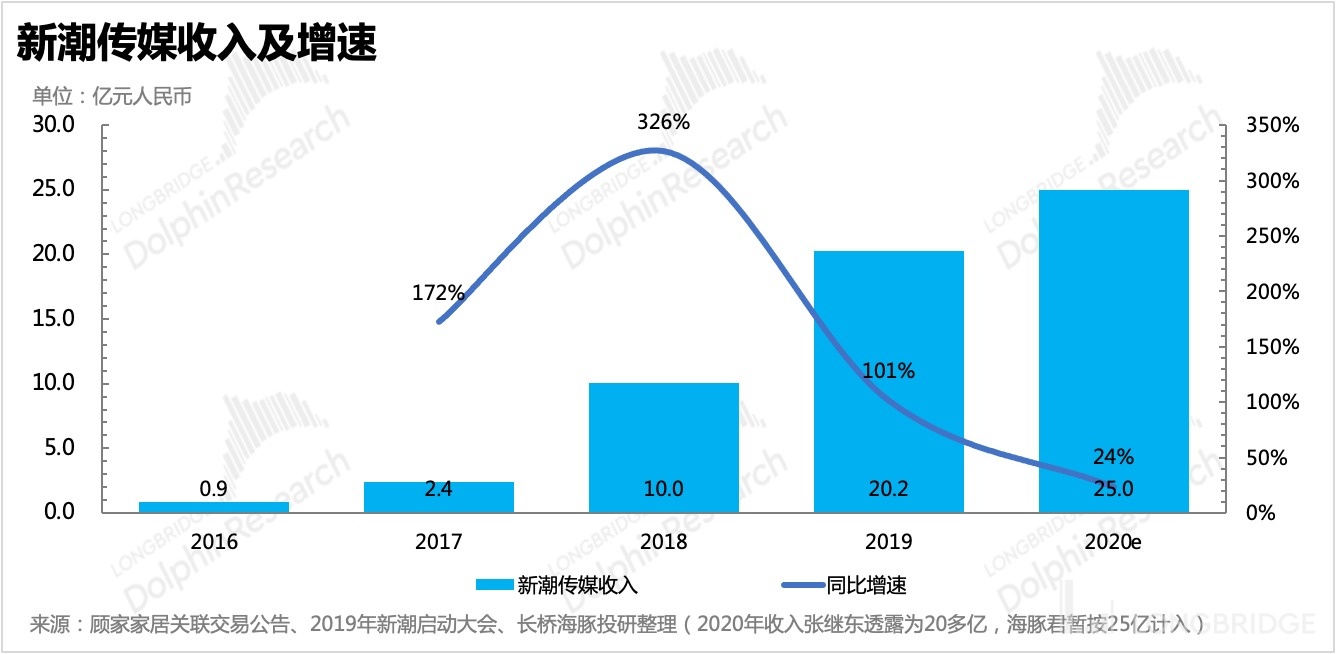

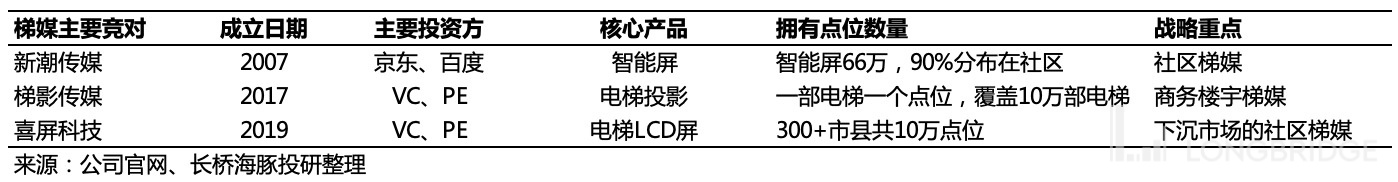

Among the players in the ladder media track, the one who can challenge Focus Media is New Trend Media. New Trend's focus is on community buildings, and its product form is mainly on smart screens. Focus Media mainly has an additional 1.55 million elevator posters. Looking at the number of elevator screens (LCD, smart screens) alone, Focus Media is actually comparable to New Trend in terms of quantity. However, Focus Media's advantage lies in its layout on commercial buildings in first- and second-tier cities with higher traffic value.

![包含低可信度描述的标志的图片已生成] (https://pub.lbkrs.com/cms/2022/0/U1HypA1T63RgwPt6vNeJr9J3fdgRJY8c.jpg)

The epidemic in 2020 quickly extinguished the "price war" that had caused both sides to suffer losses, and we see the competition gradually returning to rationality:

"First, New Trend, which has "limited storage but huge losses," "indirectly surrendered," laid off more than 10% of its employees and cut salaries by 20%, put pressure on the property to reduce prices, or withdrew from some cities. At this point, New Trend's expansion began to slow down, and its goal of revenue of tens of billions by 2021 set in 2019 is obviously difficult to achieve.

![包含自动生成的图形用户界面和应用程序描述的图片已生成] (https://pub.lbkrs.com/cms/2022/0/FhowLnEnea9HCsqarJvomc2JLquyDkEr.jpg)

2) Secondly, the new strategy is more focused on community media and continues to differentiate. At the start-up conference in early 2021, CEO Zhang Jixue announced the company's five-year goal: "With the help of shareholders such as Baidu and JD.com, Newink will invest 10 billion yuan and use 2 million elevator smart screens, enter 100,000 communities, cover 100 million households, and build a ladder media platform with a daily audience of 300 million households."

This means that Newink's future strategy will avoid the commercial building ladder media, which currently has a monopoly advantage held by Focus Media. Instead, it will focus more on community ladder media. From "confrontation" to "separation," it can be said that Newink's new strategy has a limited impact on Focus Media's business building foundation. However, it must be recognized that the existence of Newink and other peers has indeed squeezed Focus Media's potential for income growth, especially in community ladder media.

On the other hand, Newink Media has been financing for many years (with a total financing amount of more than 8 billion yuan). Although it received an additional 400 million US dollars from JD.com in September last year, with major shareholders Baidu, JD.com under the regulatory environment of the Internet industry and an unfriendly capital environment, there will gradually be demands for profits. Therefore, it is unlikely that Dolphin Analyst thinks that Newink will fight another "malicious price war" with Focus Media.

In addition to Newink Media, Focus Media has many competitors in the domestic ladder media market, but in terms of scale, there are gaps between Focus Media, Newink, and other companies. Scale advantage is also one of Focus Media's core competitiveness. Therefore, in the short to medium term, it will increase the investment cost of further increasing its market share, and it will also affect the height of Focus Media's long-term profit margin repair.

Four, how far has the valuation recovery gone?

From a market value of 71.5 billion at the end of April to nearly 90 billion currently, Focus Media has rebounded by 20%. As the former "offline advertising leader," how much certainty does Focus Media have in its recovery? And what is the upward elasticity under optimistic expectations?

In The second-quarter profit fell by 70%, and Focus Media was once again "trampled" on its performance, we mentioned that the impact of the epidemic and the inertia of epidemic prevention policies on the fluctuations of Focus Media's performance and stock price in the short term cannot be ignored. Although the epidemic was mainly in East China where Focus Media has more advantages at the beginning of the year, after the performance forecast for the first half of the year, the pressure on this year's performance is visible to the naked eye.

If we take a longer-term perspective, the low-consumption cycle brought about by the epidemic will pass, and Focus Media will return to its own deterministic value. Although there is competitive impact, the business building foundation is still relatively stable.

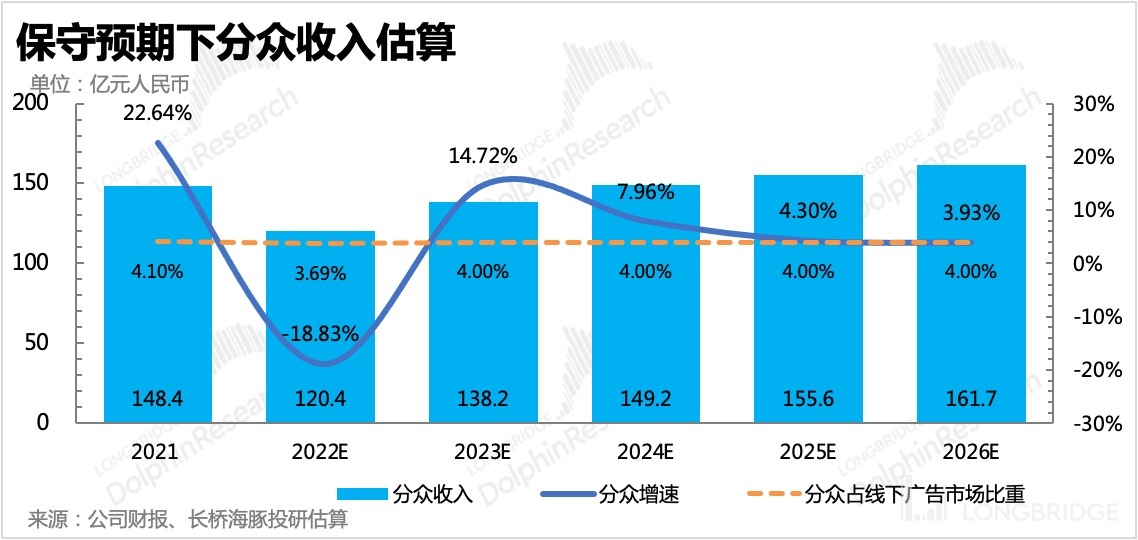

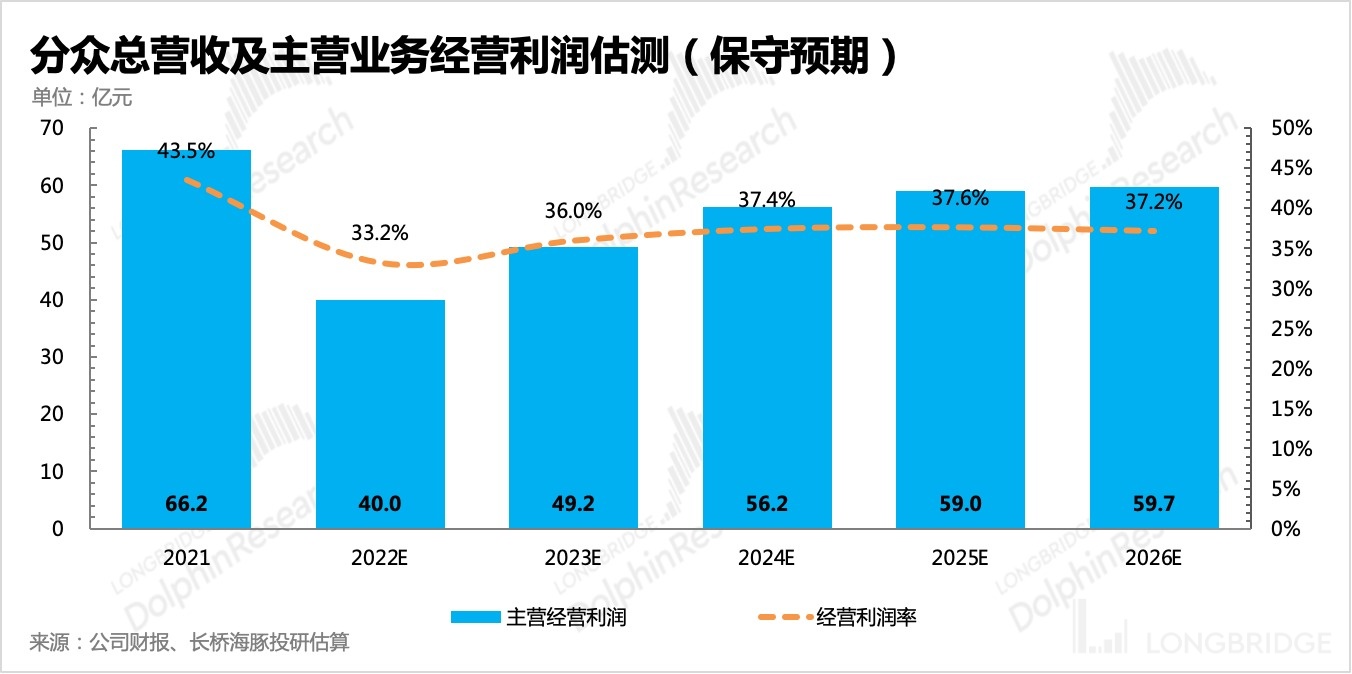

Therefore, Dolphin Analyst will calculate the basic value under a slightly conservative expectation and the value that will resume to normal after the epidemic cycles, reflecting a relatively reasonable value range that we believe. 1. Conservative expectation: No growth, only the cycle

Based on the analysis above, competitors pose a greater direct threat to Focus Media in terms of exploring incremental space. If Focus Media's exploration is unfavorable and it can only hold on to its base, then the logic of driving Focus Media's performance recovery is only left with economic cycles.

In this case, we assume that the offline advertising market maintains its stability (about 4% in 2021) in terms of Focus Media's share of the overall offline advertising market, provided that the trend of online migration slows down.

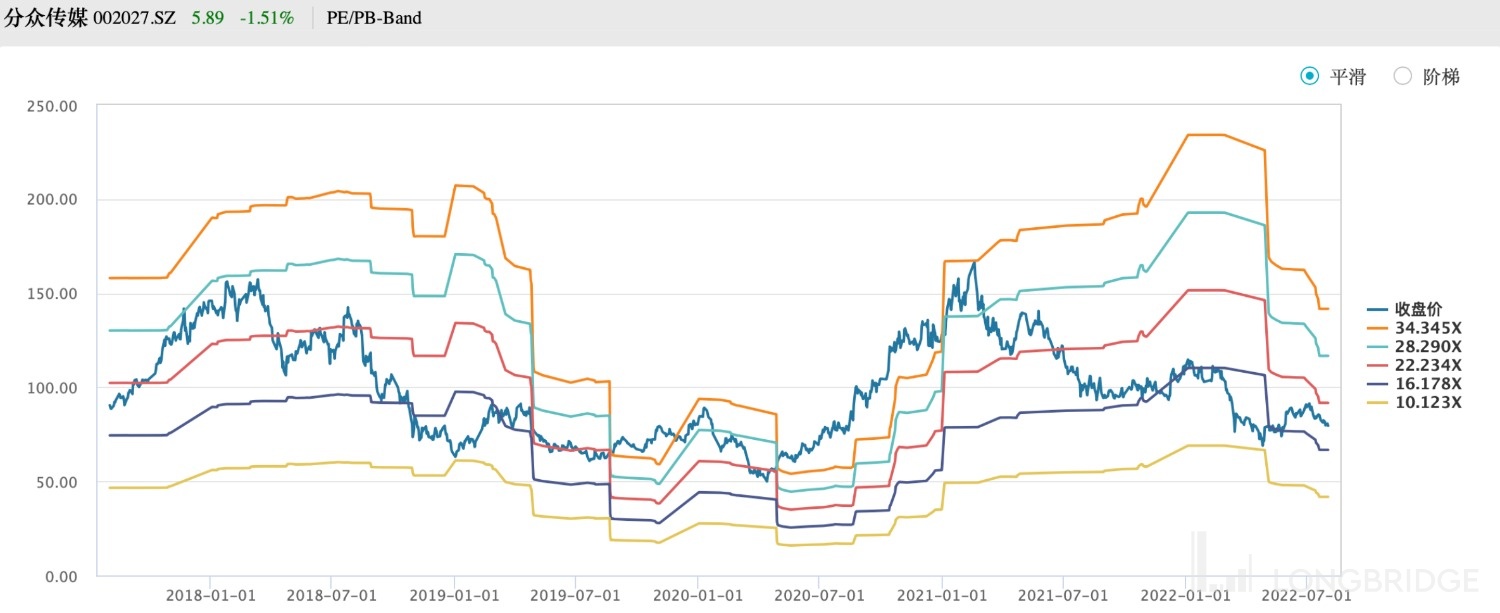

Then the corresponding revenue in 2026 would be 16 billion yuan, with a low single-digit revenue growth rate. The operating profit margin gradually increases to 37% or more. According to WACC=10.69 and g=3%, the DCF valuation is 78.5 billion yuan, or 5.44 yuan/share, corresponding to a 2023 net profit PE of 17x, which is in the lower range of historical valuations.

2. Neutral expectation: Seeking opportunities beyond the cycle

Based on the competitive advantages of Focus Media that Dolphin Analyst has analyzed in detail in the previous section and some marginal changes at present, we believe that Focus Media and Timedia still have opportunities beyond the economic cycle.

During the two years of the pandemic, Focus Media has been constantly optimizing the profit model of existing locations. This is because as a leading company in the sluggish cycle, Focus Media has sufficient cash firepower, and it can also tolerate low-price customer acquisition and counter-cyclical expansion.

For Focus Media, leased locations are a fixed rental cost expenditure in financial terms. If they are vacant, it means a total loss. However, high discounts can be offered to attract advertisers to place ads. Although the quoted prices of individual advertisers have declined, the increase in the display rate ensures part of the revenue, reducing the pressure of fixed costs.

On the other hand, the company is also actively negotiating with property owners on rent reduction, for example, by signing longer-term contracts to achieve relationship binding.

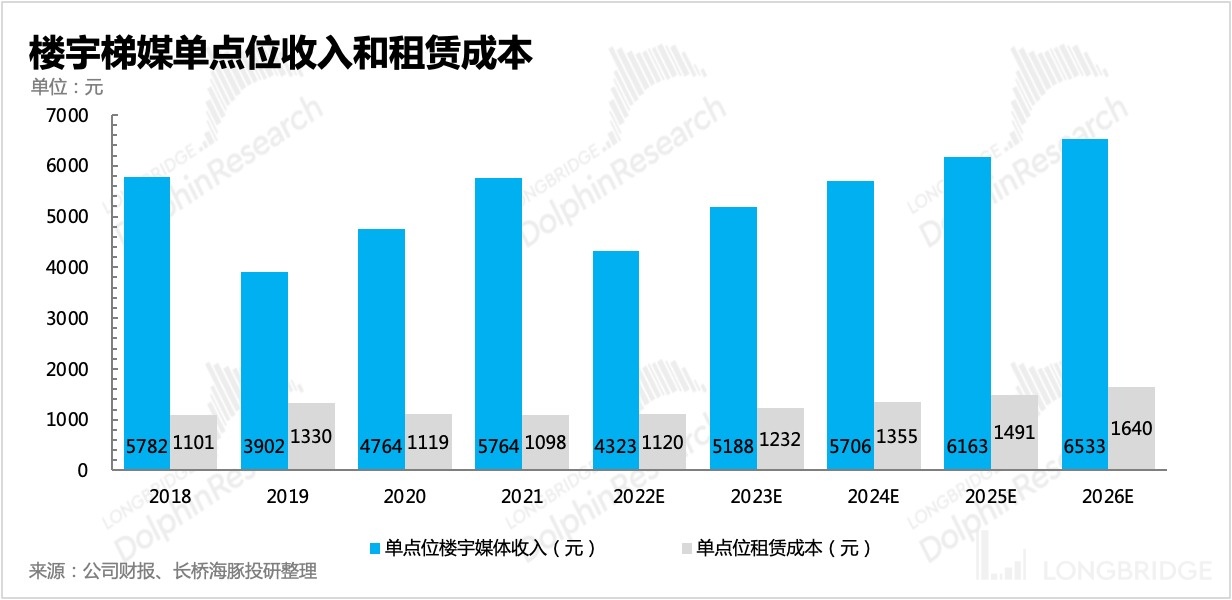

For low-efficiency locations that were overly developed in response to competition from 2018 to 2019, Focus Media is also quickly adjusting and closing them, while continuing to develop other high-quality locations.

(1) Timedia in buildings: Management guidance should be viewed with discounts.

Regarding the company's future operating prospects, management has recently made statements:

- Plan to raise prices twice a year, each time by 10%.

However, Dolphin Analyst reminds that this price increase refers to the increase in the list price, and there is often a discount between the actual transaction price and the list price. Therefore, a 10% increase in price does not represent such a increase in revenue.

- In non-pandemic years, the company hopes to expand media locations at a speed of 10%.

This shows that the company has a positive attitude towards expanding its market share in the medium term. However, as we have mentioned earlier, further increasing market share means penetrating more shares of community Timedia, which will face direct competition from peers. The consequence of competition is that the profit margin of new markets is far less than that of the basic business, which lowers the overall profit level.

In addition, community ladder media advertising involves the opinions of community owners, which is not as easy to operate as commercial office buildings, indicating increased costs for market expansion.

We expect that, in the case of annual rent growth of 5%-10%, the average revenue generated by a single media location will gradually return to pre-competition levels, while the expansion rate of media locations will maintain a growth rate of 5% per year starting in 2023.

2. Cinema advertising: Repair is the main theme

Currently, the market share of cinema advertising by Focus Media is also relatively high, and future growth depends on epidemic control policies and the overall film industry supply.

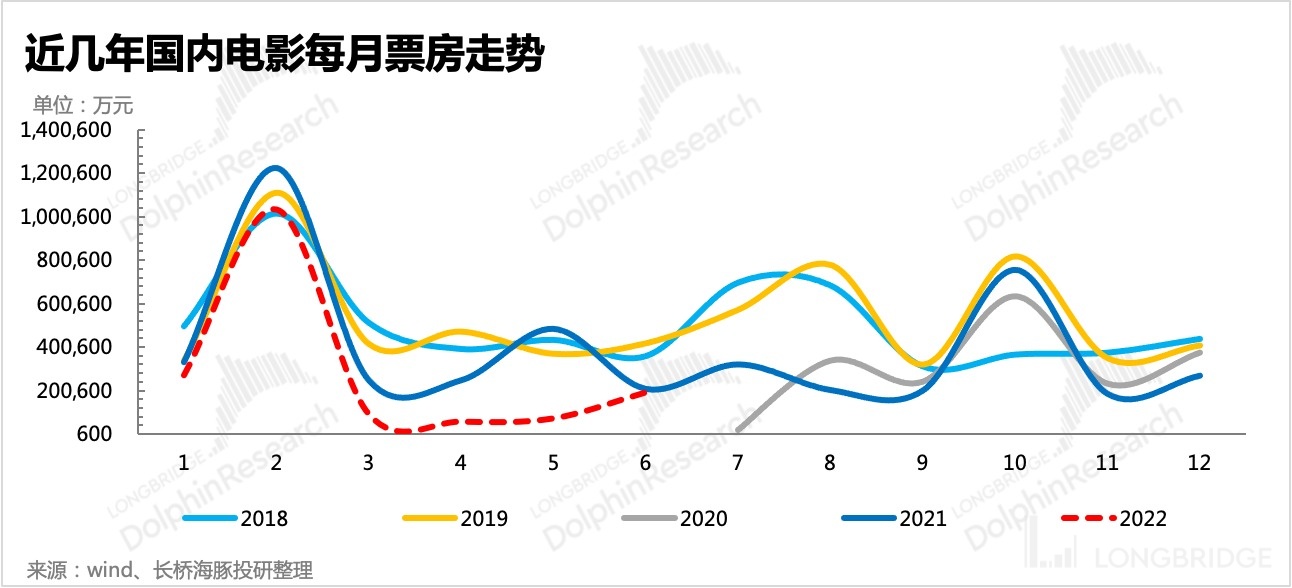

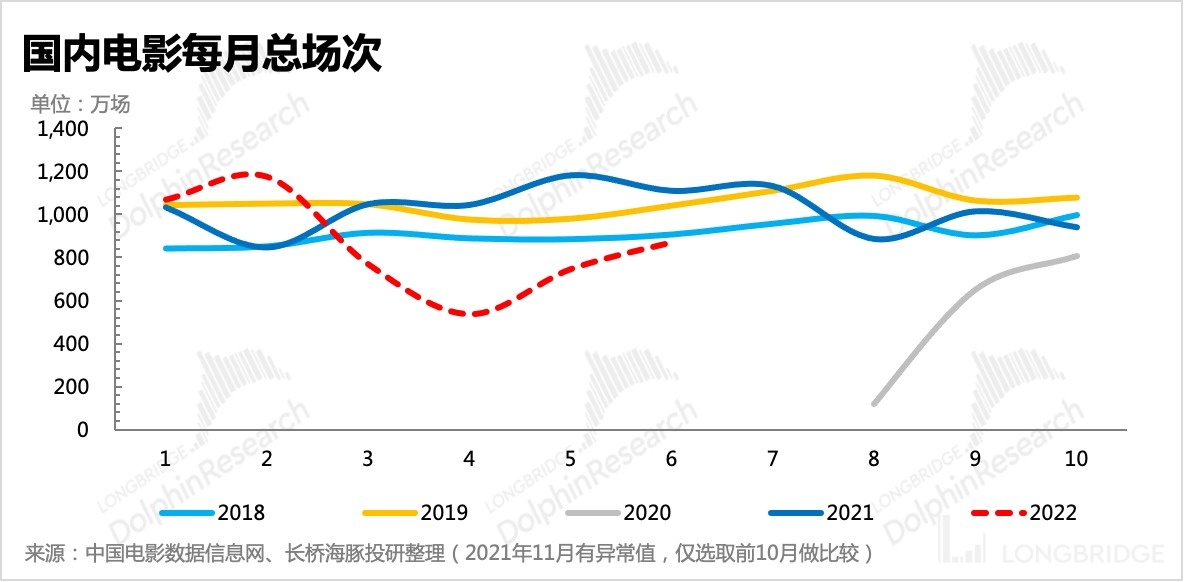

From the total box office and total sessions shown in the figure below, the total sessions in June have recovered to near 2018 levels, but the total box office in June is still much lower than in 2018, indicating that the main problem is on the demand side. Some people may still have lingering fears of the epidemic and are not eager to go to the cinema, while on the other hand, the economic situation may have affected the purchasing power of residents' needs.

But in the final analysis, it still depends on the impact of changes in epidemic control policies. Therefore, the overall trend is to optimize downward in the short and medium term according to management guidance, and climb steadily in the long term by low single digits.

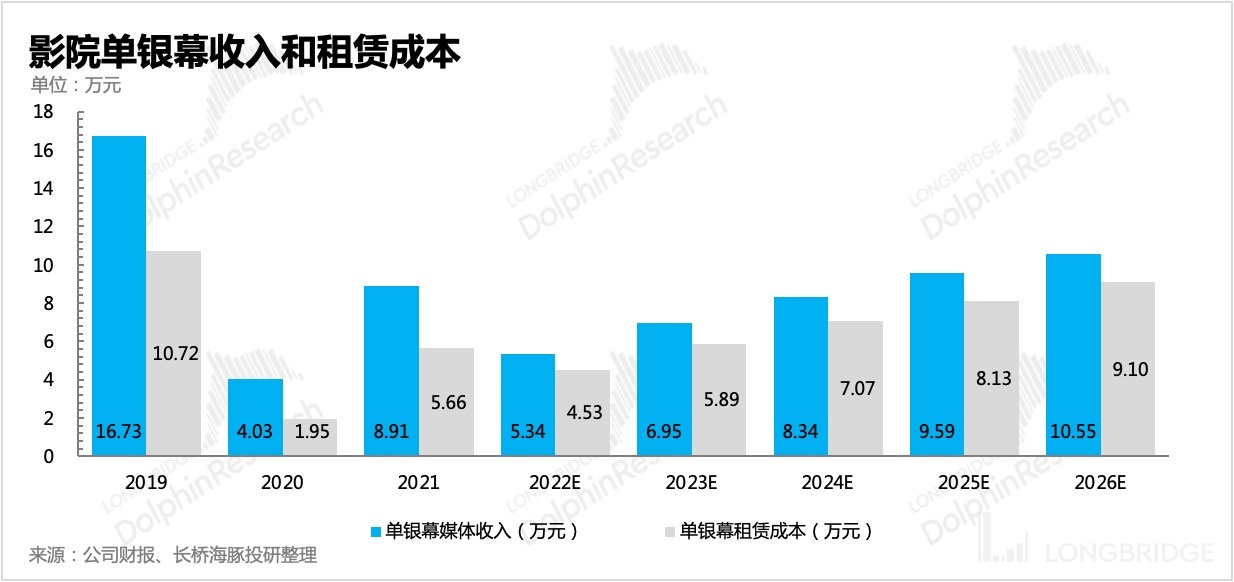

The Dolphin Analyst predicts that due to the uncertainty of epidemic prevention and control policies and the impact of special-year regulations, the total screening sessions in the second half of 2022 will match those of 2018, and the total number of screenings for the year will be 67% of those in 2021. That is, under the premise that the total number of contracted screens remains the same, the actual screen placement rate must be reduced by at least 33% based on the rate in 2021. That is, assuming there is no increase in unit price, the final reflected revenue created by a single screen in 2021 will be 60% of that in 2021.

However, at the same time, assuming that the overall epidemic prevention and control policies become more flexible starting in 2023 and cinema regulation gradually opens up, the value created by a single screen and the rent will both recover to pre-epidemic levels in 2019 by 2026, and the total number of contracted screens will increase from 13,600 in 2022 to 14,200 in 2026, accounting for approximately 17% of the total number of screens nationwide in 2021.

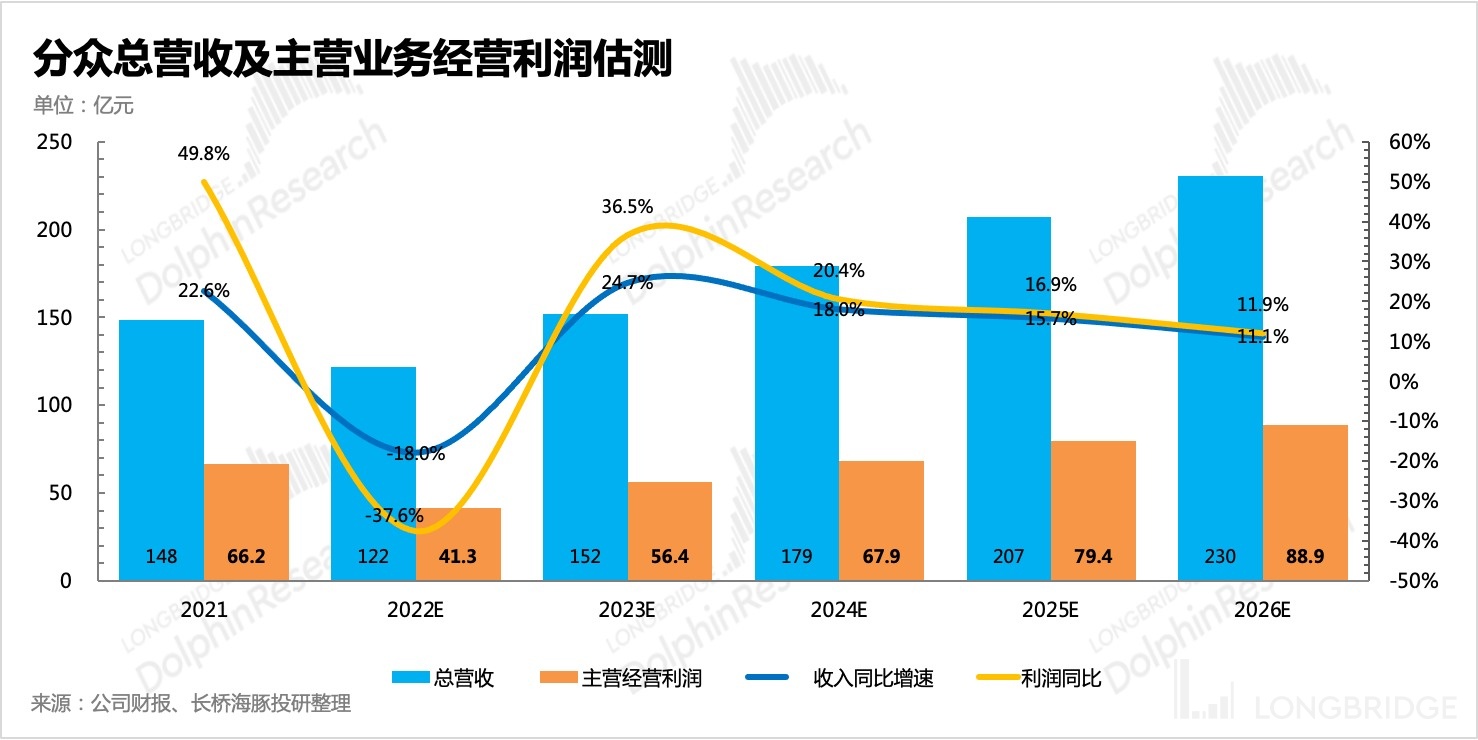

Combining with <1-2>, Dolphin Analyst's estimated revenue and profit for the next five years are as follows. The operating profit margin will remain in the range of 38%-39%, which is lower than before, mainly due to the dragged profit margin during the process of expanding towards the community media.

Combining with <1-2>, Dolphin Analyst's estimated revenue and profit for the next five years are as follows. The operating profit margin will remain in the range of 38%-39%, which is lower than before, mainly due to the dragged profit margin during the process of expanding towards the community media.

Under the neutral expectation of revenue growth trend, the market share of Focus Media is expected to recover to 55% according to the entire elevator advertising. (Note: The expected market share in 2022 temporarily fell below 50%, mainly because Shenzhen and Shanghai are areas where Focus Media's income contribution is high, but they were heavily affected by the epidemic at the beginning of the year.)

Based on the above assumptions, under the condition of WACC=10.69% and g=3%, the neutral expected value of Focus Media is 118.8 billion, which is equivalent to 8.23 yuan/share. The corresponding 2023 net profit PE is 23x, which is located in the central interval of historical valuation.

Considering the results of conservative and neutral expectations (785 billion to 1188 billion), the current market value of Focus Media (850 billion) is in a relatively conservative position, and there is still considerable room for upward revision. Once the policies become clear and consumption recovers, Focus Media will continue to return to its value.

Dolphin's historical articles about "Focus Media"

Earnings Season

July 14, 2022 earnings report review "<Second quarter profit plummeted by 70%, Focus Media once again stumbled upon "performance pitfalls"">"

April 29, 2022 phone conference "<March revenue fell by 45%, Focus Media is in a difficult situation (phone conference summary)">"

April 29, 2022 earnings report review "<Is Focus Media bleeding? Opportunities after a desperate situation">". On November 4, 2021, a financial report review entitled "Starting with Focus Media: It's worth "reducing" expectations for Internet advertising" was published.

On August 26, 2021, a phone conference entitled "Shrinking, Disappearing, Standardizing: Business in the Second Half of the Year is Not Easy (Focus Media Minutes)" was held.

On August 25, 2021, a financial report review entitled "Focus Media: Looks Good? Actually a "Landmine"" was published.

On April 23, 2021, a phone conference entitled "An Incomplete Focus Media Phone Conference Summary" was held.

In-depth

On July 12, 2022, "Focus Media: The "Desperate Saburo" that is reversing course crazily" was published.

Risk Disclosure and Disclaimer for this Article: Dolphin Analyst Disclaimer and General Disclosures

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.