初见盈利,快手在变现预期的道路上狂奔

大家好,我是海豚君!

北京时间 8 月 23 日港股盘后,快手发布了 2022 年二季度业绩。整体业绩再超预期,国内业务经营利润也首次转正。不过二季度优秀的成绩背后也有一些疫情相对优势带来的红利。由于下半年复杂的宏观环境(疫情趋稳,但消费恢复缓慢),以及暂时还未体现出来的直播监管影响后续,因此管理层的展望与指引仍然更值得关注。

稍后海豚君会第一时间将电话会纪要发布到用户投研群,感兴趣的朋友可添加微信号 “dolphinR123” 入群获取。

具体经营情况:

1、流量指标淡季不淡,用户粘性提升,平台整体流量(总日均用户时长)扩张速度 39%。

2、收入上三大业务均超市场预期,二季度宏观面承压下,直播业务反而加速增长,可能源于线下疫情封锁,部分营销预算迁移至直播打赏方式的品牌宣传。

展望下半年,广告收入有望看到明显修复,但与此同时直播业务可能也会开始体现监管新规的影响。

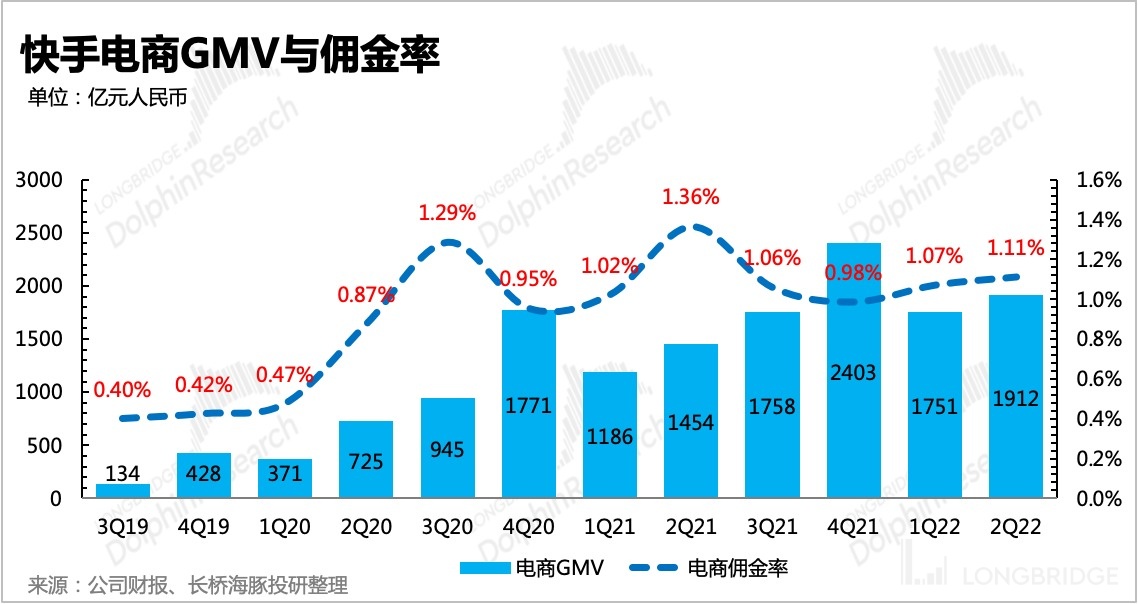

3、电商 GMV 达到 1912 亿元,高于公司前期指引,佣金率 1.11%,环比提升。二季度疫情封锁,但快手相比于传统电商平台有相对优势,预计公司全年 9000 亿目标有望达成。

4、直播分成比例优化,员工薪酬以及推广营销费用超预期下滑,使得最终减亏效果显著超预期。最终 Non-IFRS 净亏损 13 亿,亏损额度同比下滑 72%。值得一提的是,分市场来看,二季度国内实现了经营利润转正。

5、二季度经营活动现金净流出 23 亿,环比改善的同时,也还了一部分应付账款。加上本季度资本开支 14 亿元,自由现金流出 37 亿元。截至二季度末,快手账上现金 + 存款 230 亿元,一些短期可变现的理财产品近 200 亿,合计可利用资金 413 亿元。在不断改善的减亏趋势下,暂无现金流风险。

海豚君观点

与此前阐述的逻辑一样,在去年三季度出现业绩拐点之后,海豚君对快手的短期基本面没有过多担忧,无论是商业化释放、盈利预期改善都抱有较高的信心。这些都是身处短视频赛道,而带来的优势和增长红利。

但短期乐观的同时,随着监管的施压(算法监管、直播监管),以及视频号的加速商业化,我们也需要适当调低市场对快手的乐观预期。从实际执行情况来看,上述监管的影响还未完全体现到抖音快手上,比如打赏榜单、主播 PK 截至目前仍然存在。因此二季度的成绩代表过去,重点是要关注管理层对未来的展望,尤其是监管要求完全落实之后。

长期逻辑上,快手则可能会受到生态流量标签的影响。在行业性的增长红利放缓之后,如何获得更多自身竞争优势带来的增长,快手仍然需要做更多的努力。

目前估值不高,若后续管理层电话会对下半年展望良好,那么受到短期业绩利好催化,有望提振一下近期被腾讯抛售传闻吓趴的股价。

对于电话会上管理层对未来展望以及后续指引信息,我们会在用户投研群第一时间发布,感兴趣可添加微信号 “dolphinR123” 入群。

本季财报详细解读

一、生态流量:淡季不淡,优质短剧、直播凸显高粘性

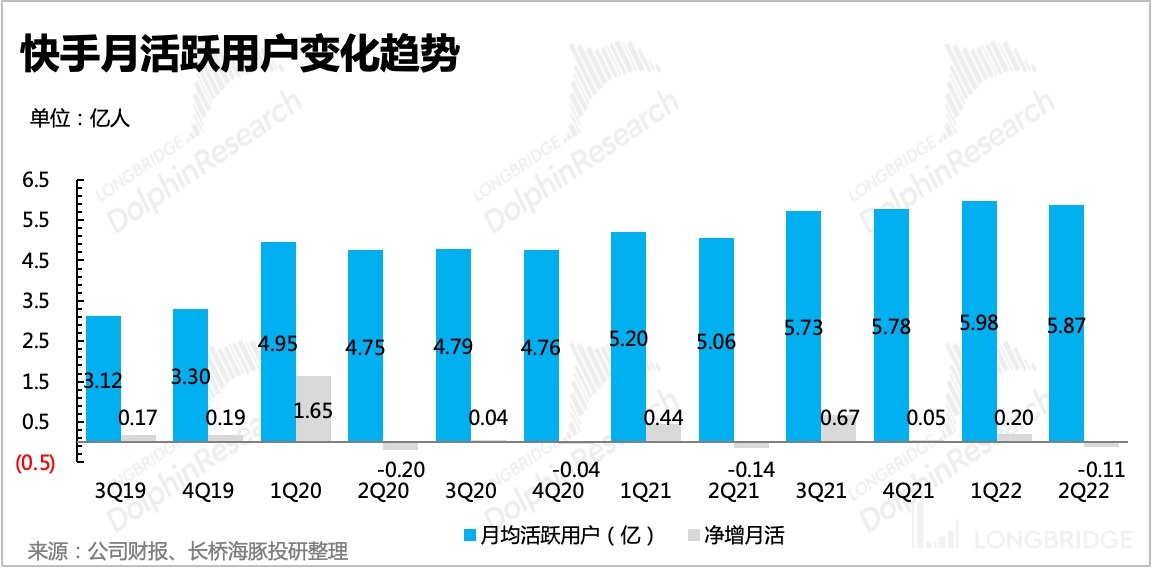

二季度快手生态流量继续高速扩张,虽然月活 MAU 由于季节效应预期内环比回落,但日活 DAU 却仍然保持增长态势,使得用户粘性指标 DAU/MAU 跃至 59.2%,加速看齐快手给自己定下的中长期目标 60%。

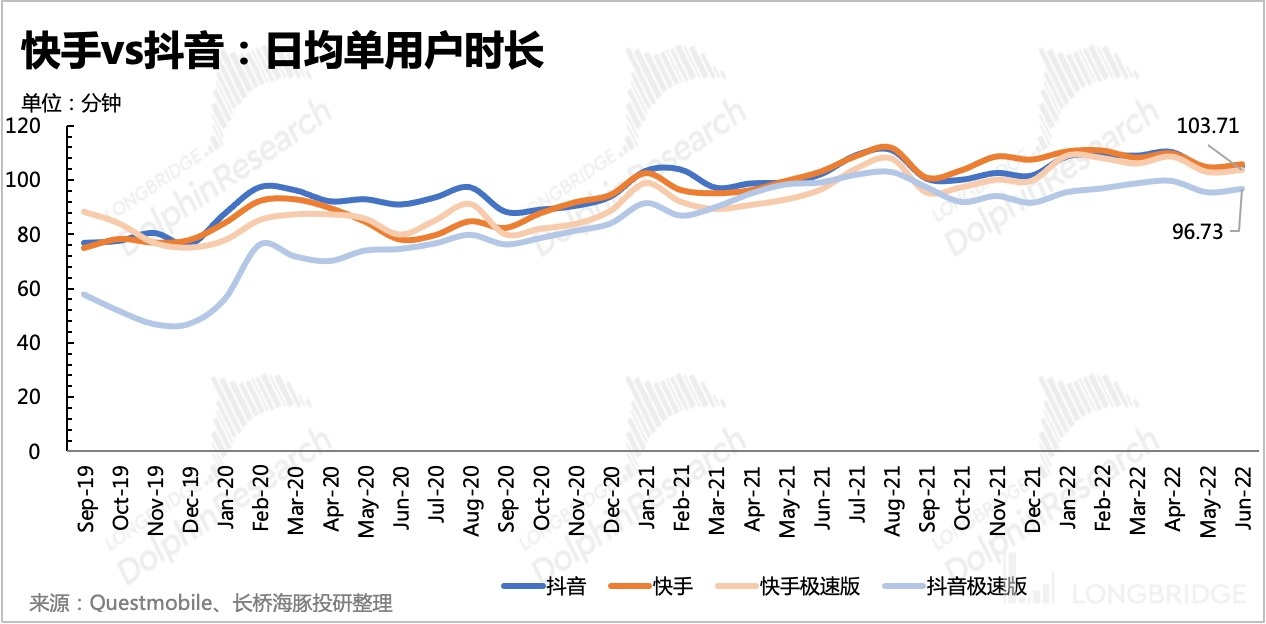

快手二季度单季月活达到 5.87 亿,同比增长 16%。日活达到 3.47 亿,同比增长 18.5%。除此之外,用户时长也仍然保持在 125 分钟/天,计算下来,整体流量扩张速度(日活增速 * 日均用户时长增速)为 39%,在互联网流量红利殆尽的当下,充分体现了短视频的平台优势。

海豚君认为,这让人眼前一亮的用户留存和粘性,背后恐怕少不了二季度更多优质短剧的上线,比如《再婚》、《古蛇传》,以及人气明星的直播首秀。短剧的作用不仅仅体现在提高整体用户的平台粘性,更多的想象力在于平衡当前快手的用户分布,吸引更多的一二线女性活跃用户。这部分用户群体往往代表着高购买力,无论是对于商家的品牌营销还是直播电商,都意味着会有一个不错的流量转化效果。

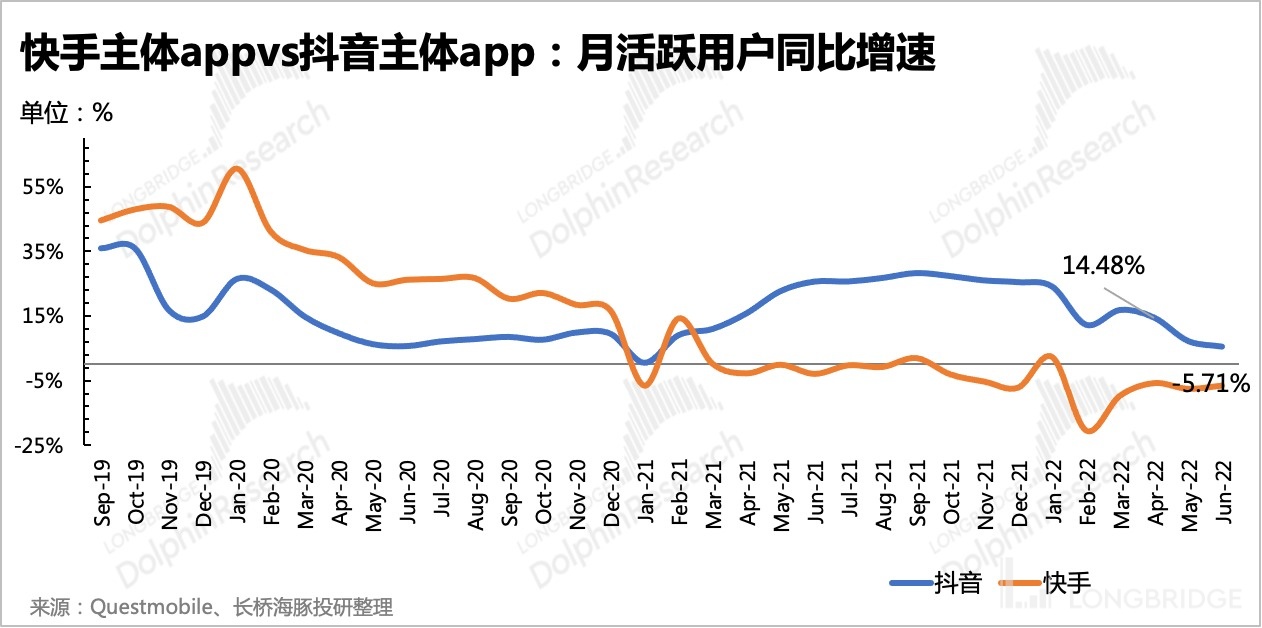

从 Questmobile 数据看流量扩张,快手目前的流量增长主要还是来源于极速版,即主要面向的是三四线下沉市场,但主站月活的下滑趋势已经稳住。除此之外主站和极速版的用户日均时长仍然在同比增长,并且整体优于抖音。

私域属性更强带来的用户粘性更高、用时更久,是快手的一贯优势。因此虽然在广告变现上不及公域属性更强的抖音,但在电商转化上,尤其是在用户整体购买力不及抖音的情况下,快手的电商交易并没有落后。

保持优势,补齐短板,这也是今年以来两个平台在版本变动方向上截然不同的原因:

(1)抖音今年战略重心是电商,其单纯的广告变现已经相对极致,加载率超过 12%,因此选择放大私域、朋友流量入口的同时,提高商城入口优先级,推荐页排序推后。

(2)快手今年的战略重心是广告,目前广告加载率 7% 左右,eCPM 也相比同行较低,均有提升空间。因此选择突出公域流量池的「精选页」到一级入口。在电商上,快手则相比去年多了一个 “大搞快品牌” 战略,也就是扶持小微商家的自有品牌,引导 “白牌” 向 “快品牌” 演进。

海豚君认为,“快品牌”是快手在抖音今年主打品牌电商,攻势猛烈的情况下,通过力推性价比电商来打差异化竞争。毕竟快手的用户群体分布更偏向二、三线以下城市,整体购买力不及抖音。中大型品牌或者是同一品牌的高端产品,从店播的角度,更乐意在淘宝、抖音上做推广和直播交易,而在快手平台上可能更愿意选择与直播达人合作。而随着直播电商以及本地生活电商在抖音的战略地位持续重要,这样的差异化趋势很可能会长期持续。

二、收入全面超预期,三大业务均未有拖累

二季度快手总营收 217 亿元人民币,同比增长 13.4%,超出市场一致预期 207 亿。二季度宏观基本面最差,市场对短期业绩放缓已有充分预期。上个月公司给的前瞻指引已经不错,实际出来成绩更佳,更加凸显了短视频在互联网各个细分赛道的成长优越性。

从细分业务来看:

1、这次表现比较突出的是直播业务,同比增长 19%,但海豚君认为,这背后并不代表秀场直播的活力重现。另外需要提醒的是,平台还未完全执行直播监管新规(取消榜单、取消主播 PK),这对于 MCN 机构打榜、商家品宣打榜带来的流水收入会有不小的影响。

快手的直播收入一般以主播打赏分成为主,快手一般抽总流水的 30%-40%。根据市场调研,主播的打赏收入中 60-70% 来自于榜一、榜二的大 R 氪金用户。这里的 “大 R 用户”,除了一些土豪个人外,主要是:

(1)MCN 机构为了提高主播的人气值而打榜;

(2)商家为了让主播宣传品牌,增加曝光而打赏;

(3)直播达人之间的互相引流打榜。

也就是说,快手的直播收入实际上有不少本质上属于营销性质的买量收入。这与快手 “私域属性大于公域属性” 特征息息相关,在部分商家眼中,主播达人的口播营销效果大于在公域流量池的曝光分发,因此部分潜在的广告收入通过直播打赏的方式来呈现。

这样来看,二季度直播的亮眼增长,恐怕与秀场直播本身日暮夕阳的行业大趋势无关,而是与二季度 618 电商季下重点城市疫情封控,但线下营销停摆,商家广告预算部分迁移线上而带来了可观的增量。

从驱动收入增长的因子拆分来看,付费用户规模的增长是主要动力。公司提到,年初以来力推的蓝领招聘 “快招工”,对这次直播活跃度的增加,贡献了不少作用。尤其是在快手极速版上,海豚君个人体验下来,“快招工” 直播间渗透率超乎意料的高,财报披露二季度 “快招工” 版面月活达到 2.5 亿人,基本上占了整体月活的 40%,较一季度增加 90%。

这个数据实际上已经非常高,此前市场调研数据披露,我国传统蓝领市场劳动力规模也就在 4 亿左右。也就是说,主打蓝领招聘的 “快招工” 2.5 亿月活,渗透率已经超过 60%。

作为一个去年底刚引入的新模块,“快招工” 神速增长,除了反映当下较大的经济压力,失业率走高,求职者活跃的宏观环境,同时也体现了短视频平台就是一个巨大的流量池,在业务拓展上的想象力很高。

快手蓝领招聘顺利开展,则暗示着传统招聘平台,尤其是以本地蓝领招聘为主的平台,比如 58 同城,以及未来以蓝领招聘为增长想象力的 BOSS 直聘、51Job,可能在未来会遇到快手的强有力竞争。

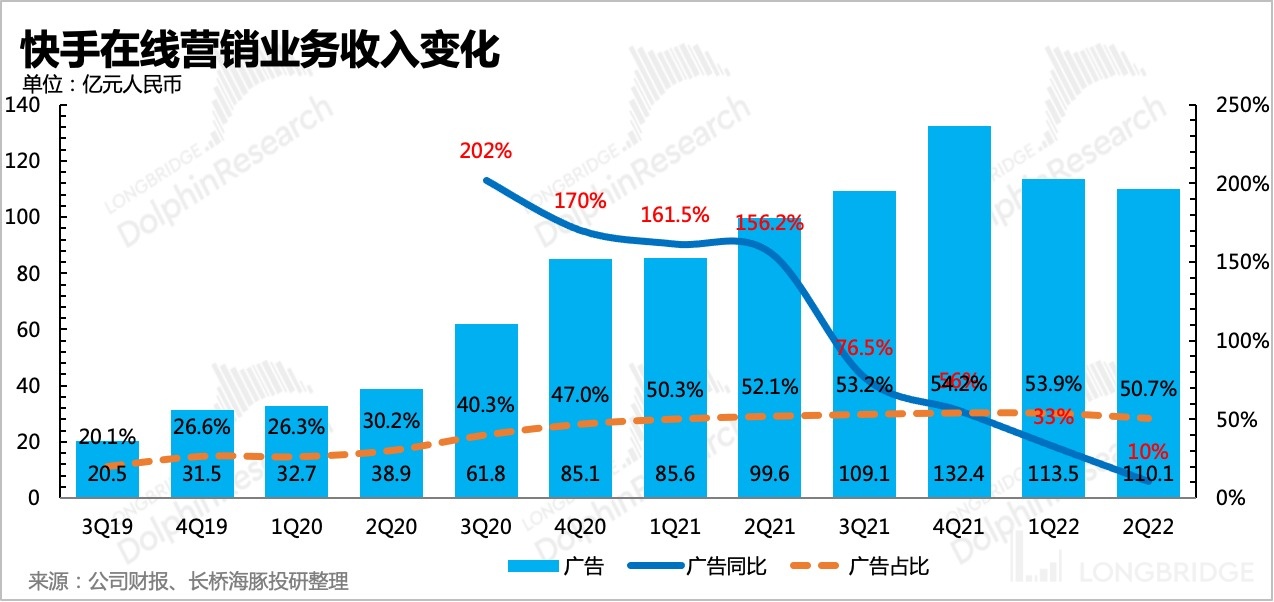

2、广告收入则主要体现公域流量分发的效果,一般广告主通过磁力金牛来投放。广告变现能力主要与快手的生态流量扩张、广告库存释放以及平台报价相关。

快手单季广告收入 110 亿,同比增长 10%,优于市场预期。由于二季度快手的生态流量、用户时长均在扩张,因此海豚君认为,增速放缓主要由平台报价环比下降带来。

平台报价下滑则主要源于二季度的宏观环境压力,以及物流受阻等影响,广告主在投放上更加谨慎。除此之外,今年相比去年,还少了教育、游戏、金融等监管趋严的广告主客户。

相比于分众的大比例下滑,腾讯广告超预期但仍然是近 20% 的同比萎缩,快手广告的两位数增长,充分体现了当下广告主对短视频渠道的青睐,这也是腾讯选择加快视频号变现脚步的关键原因。

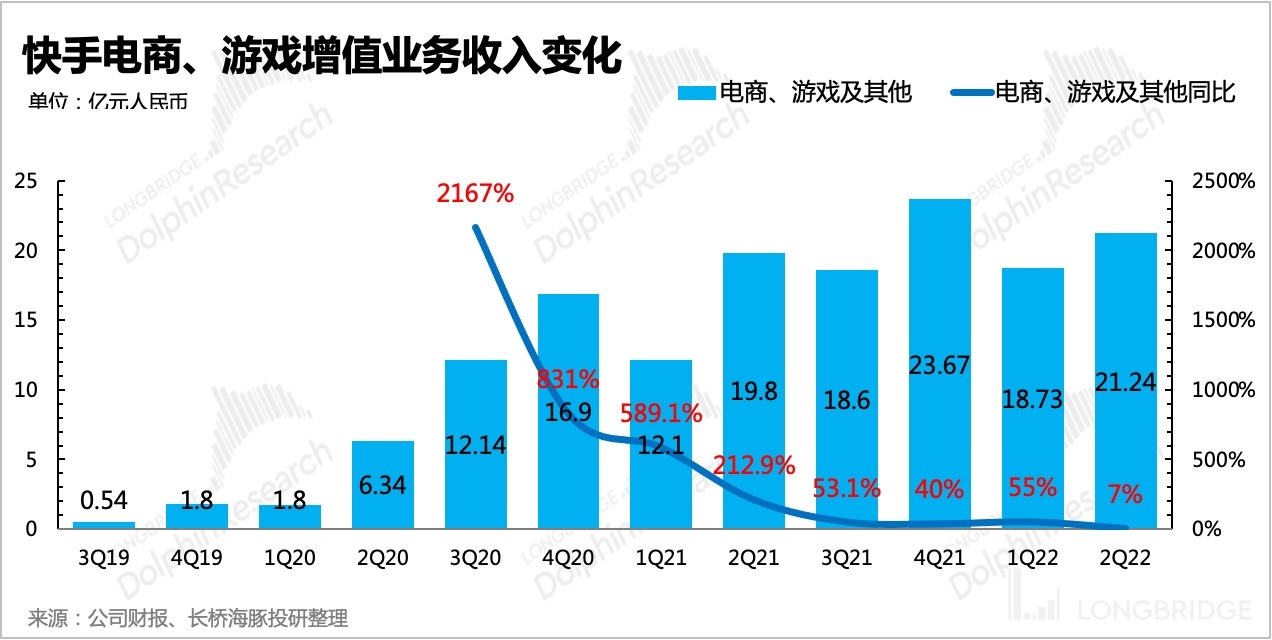

3、电商可能有疫情相对红利。二季度快手电商等其他服务收入 21.2 亿元,同比增长 7%,成交额 GMV 达到 1912 亿元,同比增长 31%,超出此前指引的 25%。计算出的综合佣金率为 1.11%,相比一季度的 1.07% 有所提升,从而也贡献了一些收入的增量转化,主要体现快手内部电商交易额占比的提升。

本季度的电商超预期,海豚君认为相比于其他传统电商平台,虽然都受到物流不畅通的影响,但快手在 6 月疫情趋稳上海解封后,反而拥有一定的相对优势。

疫情期间,线下门店停摆,线上电商物流受封控营销,商家存在大量货物积压,现金流也受到不小影响,因此在 6 月解封后急需甩货周转。同时为了快速提高动销,部分商家也不得不选择打折促销。

直播电商是整个电商行业为数不多的高增长赛道,而快手作为线上流量洼地,同时又兼具性价比电商标签,再加上这两年平台本身对于白牌、传统品牌商家的流量扶持,因此在解封后短期内能够获得更多商家的选择。公司财报中也提及,在二季度获得了更多传统品牌以及纳入 “快品牌” 商家,其中 “快品牌” 商家数量环比翻倍增长。

短期相对优势吸引来的商家,能否转化为长期留存的客户,还需要快手做更多的持续工作和服务。当然 “大搞品牌商家” 是快手今年的战略重点之一,无论是传统品牌,还是从白牌演变成的 “快品牌”。 在今年 7 月底的快手造风者大会上,也公布了一个数据:

去年知名品牌在快手上的成交量近 1000 亿,相当于总 GMV 的 1/7。今年截至 6 月底,店播(品牌商家的直播间)GMV 同比增长 500%,足以可见快手对品牌直播电商的扶持和重视度。

但从长期竞争的角度,快手也并不是没有短板。正如海豚君前文所说,快手用户的整体购买力天生不如抖音、淘宝以及京东,因此大型品牌商家在入驻快手做店播的意愿度很可能都不如抖音,或者是为了契合快手用户消费水平,将品牌中的高性价比产品放在快手上做直播,中高端还是走淘宝或者抖音。

因此,在行业整体高速增长,以及消费者对性价比更看重的当下,快手能够吃到不少红利,但在商家有品牌升级、产品高端化等需求的时候,快手也可能会流失这些商家客户。

那么问题也就回到最初的用户生态上来了,这也是快手一致寄希望于改变用户画像分布而持续投入做短剧内容、采买长视频版权内容的原因。

三、利润超预期:直播分成优化,费用继续紧缩

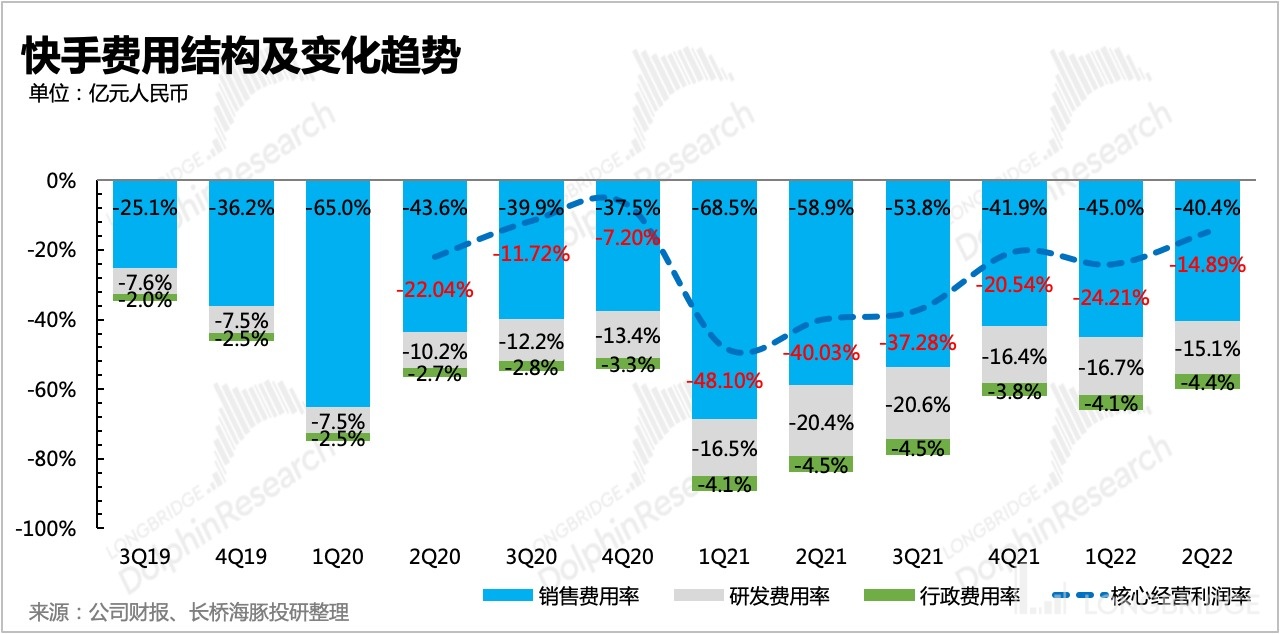

二季度快手减亏速度也超了市场预期,调整后净亏损 13 亿元,亏损额度同比下滑了 72%,利润率为-6%,相比一季度的-18% 大幅改善。

不过对互联网员工来说,股权激励是薪酬福利的主要构成,因此海豚君倾向于加回股权激励的支出影响,同时在剔除了投资收益、财务收入支出等项目之后,看主营业务的核心经营利润情况。由于本季度这些与主营业务经营无关的财务项目未有明显变动,因此快手的核心经营利润优化趋势和调整后净利润差不多,由一季度的-24% 大幅优化到本季度的 15%。

减亏超预期,主要源于:

1、直播分成优化带来的毛利率改善

快手在直播打赏分成上,相比抖音给了主播更多让利。尤其是引入了主播公会之后,公会也要伸手分一笔,最终留给快手的只有总流水的 30%,而抖音则可以拿到 40%,传统直播平台则可以拿到 50% 以上。

随着直播生态逐渐完善,以及监管趋严的影响,快手可能在扩张秀场直播业务的投入上也在放缓,开始要求更贴近行业的分成比例。从成本中的「收入分成成本」上,其占总营收的比重,从一季度的 34% 下降至 31%。

海豚君通过业务拆分估算,快手在主播打赏流水的分成占比可能从一季度的 70% 下降到了 63% 的水平。

2、减少营销推广、裁员带来的费用紧缩。

二季度快手的三项经营费用均同比下降,主要体现了年初裁员的效果。除此之外,海外营销投放收缩,减少用户的现金激励也是今年快手紧衣缩食的优化方向。

从单用户获取及维系成本(营销费用/总用户规模),以及海豚君在《都是 “血亏” 的巨婴病,快手与 B 站谁能痊愈?》中提出的用户成本指标(广告与直播业务相关的内容成本与营销费用)来看,二季度在变现收入环比扩张、生态流量稳定的情况下,流量成本继续降低,进一步印证了快手的平台壁垒。

<此处结束>

海豚君「快手」历史研究:

财报季

2022 年 5 月 24 日电话会《一季度业绩已经反映一些疫情影响(快手电话会纪要)》

2022 年 5 月 24 日财报点评《逆流而上,快手交卷一点 “不含糊”》

2022 年 3 月 30 日电话会《除了降本增效,快手还有 “承载很多行业” 的野心(电话会纪要)》

2022 年 3 月 29 日财报点评《快手:老铁经济开启 “赚钱倒计时”》

2021 年 11 月 23 日电话会《财报边际改善,管理层背后做了哪些变革?(快手电话会纪要)》

2021 年 11 月 23 日财报点评《人换了就是不一样,快手腰杆挺起来了?》

2021 年 8 月 26 日电话会《快手:未来重点是将更多的公域流量转化到私域中去(电话会纪要)》

2021 年 8 月 25 日财报点评《快手:行业老二的漫漫穷追路》

2021 年 5 月 25 日财报点评《快手:砸钱买量的玩法还能撑多久?| 海豚投研》

2021 年 5 月 24 日电话会《快手一季度业绩电话会 Q&A》

2021 年 3 月 23 日财报点评《快手的 “1166 亿” 竟成了我被问最多的问题》

2021 年 1 月 19 日财报点评《海豚投研 | 三季度业绩出炉,500 亿美金快手含金量如何?》

深度

2022 年 6 月 15 日《都是 “血亏” 的巨婴病,快手与 B 站谁能痊愈?》

2022 年 5 月 5 日《破局泛娱乐:再探腾讯、B 站们的星辰大海》

2021 年 2 月 24 日《快手槽点重重,价值从何而来?》

2021 年 1 月 26 日《海豚投研 | 被看低的老铁经济,快手千亿市值可期》

2021 年 1 月 15 日《海豚投研|快手有原罪?》

本文的风险披露与声明:海豚投研免责声明及一般披露

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。