Posts

Posts Likes Received

Likes ReceivedIs JD going to become a value stock without growth? input: ====== 海豚君,分享下上海的天气怎么样了? ====== output: Dolphin Analyst, could you share how the weather is in Shanghai?

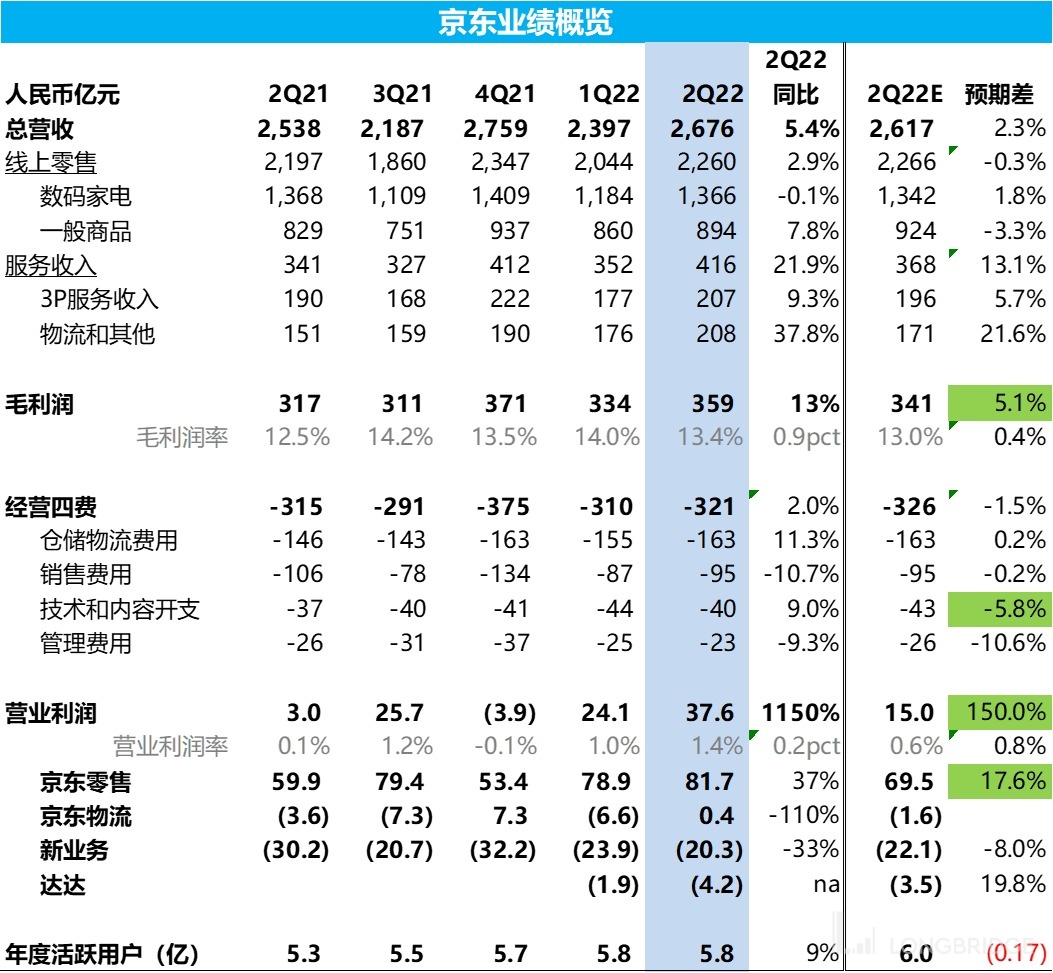

On the evening of August 23, before the U.S. stock market opened, JD.com (JD.US) released its Q2 2022 financial report. Overall, profitability exceeded expectations, but revenue growth was as poor as expected, leaving both positive and negative impressions. The highlights are as follows:

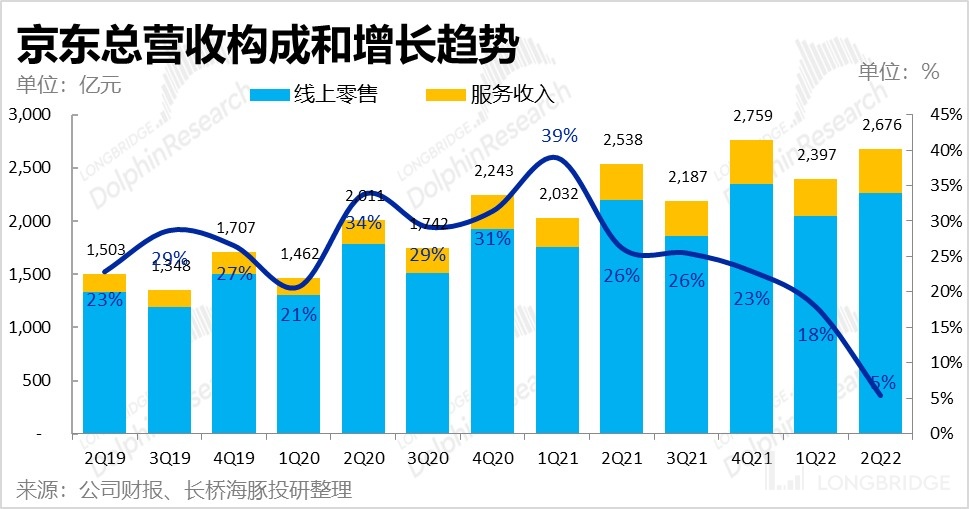

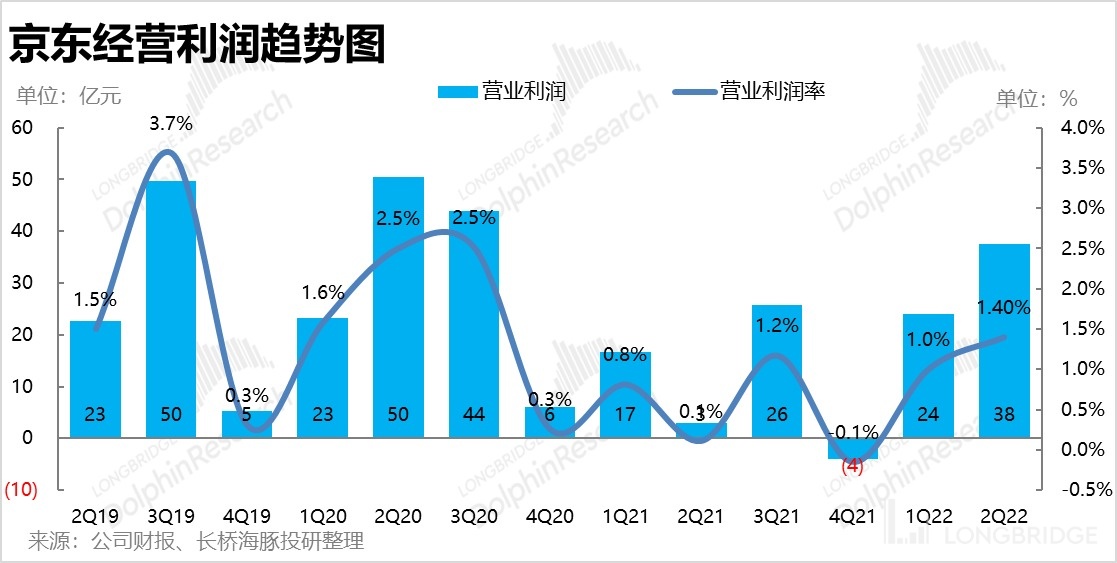

1. Poor Revenue but Much Higher Profit Than Expected: Because JD's business has a higher proportion in major cities, it was hit harder during the pandemic. In the quarter, JD achieved revenue of CNY 267.6 billion, a year-over-year growth rate of only 5.4%. If the revenue of CNY 2.28 billion from mergers and acquisitions was excluded, the comparable growth rate would be 4.5%, which can only be described as very poor as expected. But the encouraging part is that JD achieved an operating profit of CNY 3.76 billion this quarter, far exceeding the market's expectation of CNY 1.5 billion. Although Q2 is a lean season for profits and affected by the pandemic, JD's profit release continues to improve compared to the previous quarter, once again verifying JD's ability to release profits.

2. The power, daily necessities and 3P platforms all performed poorly, only logistics performed strongly: Among JD's four revenue categories, the revenue growth (excluding the impact of revenue from Dada) for self-operated power, self-operated daily necessities and 3P platform revenue in this quarter were 0%, 7.8% and 9.3%, respectively, showing substantial slowdowns compared to the previous quarter. Moreover, the quarter's online physical retail growth in China was 7.5%, and JD no longer led the industry as before. Although JD was "blamed" by the pandemic, the continuous slowdown of its business growth has reduced its visibility for future growth.

Only the logistics business achieved high growth this quarter, against the trend, with a growth rate of 38%, benefiting from the shortage of capacity during the pandemic.

4. Gross profit is the core point that exceeds expectations, while cost control measures are steadily advancing: This quarter, JD achieved a gross profit of CNY 35.9 billion, far exceeding the market's expectation by about CNY 1.8 billion. The reason may be that this quarter's gross margin of 13.4% was higher than the expected 13% and the same period last year's 12.5%. Due to the 6.18 promotion, Q2 has always been a seasonal low point for gross profit and profit, but gross profit was exceptionally strong this quarter. Dolphin Analyst believes that the possible reason is that suppliers had difficulty selling goods during the pandemic, thus giving JD more favorable prices, or JD proactively reduced its discount effort during the 6.18 promotion.

In terms of operating expenses, JD spent CNY 32.1 billion this quarter, which is basically consistent with the market's expectation of CNY 32.6 billion. Among them, under the difficulty of fulfilling orders during the pandemic, expenses increased by 11%. But marketing expenses and administrative expenses both decreased by 9%-11% year-on-year, and the general direction of reducing costs and increasing efficiency remains unchanged. Only the research and development expenses are relatively rigid, and they also increased by 9% year-on-year. However, ensuring technological investment as a driving force for long-term growth is reasonable. Therefore, driven by gross profit exceeding expectations by CNY 1.8 billion and operating expenses slightly less than expected by CNY 500 million, the company's operating profit exceeded expectations by CNY 2.3 billion.

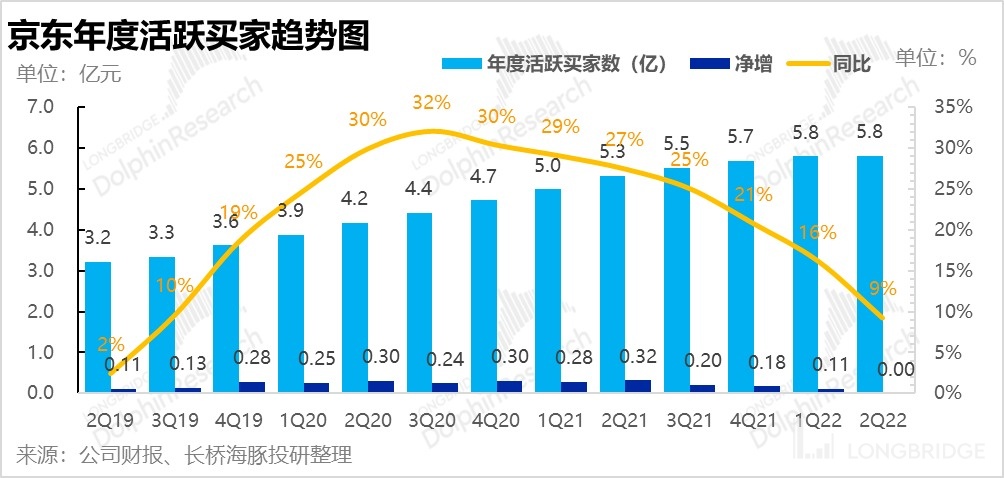

5. After the investment was reduced, JD's user growth also stopped: This quarter, JD's annual active users reached 580.8 million people, an increase of only 300,000MoM. User growth has slowed down for two consecutive quarters. It can be seen that after JD drastically reduced its Jingxi business department, which was responsible for going deeper into the sinking market and reducing channels to reach rural consumers, JD's main site has little room for further penetration among urban consumers.

Dolphin Analyst Opinion:

Overall, the unexpected profit release of JD.com is gratifying. It can still maintain its gross profit margin and reflect JD’s impressive bargaining power under the impact of the epidemic. The decisive control of expenditure and the steady improvement of profit release ability also convinced the market. However, the back side of proactive contraction and reduced investment is the greatly slowed revenue growth. The dividend that JD previously led in industry growth in electrical and daily products, and 3P business was gradually released. At the user level, after reducing the JD Daojia business group, JD closed the channels that reached out to sinking users, and user growth stagnated.

Therefore, the profit-making ability of JD was once again proved in this financial report, but the visibility of future growth is further dimmed. From the perspective of the picture shown in this financial report, JD even has a tendency to transform into a value stock with low growth but profit-making. Therefore, the management's guidance on the annual growth rate in the conference call is quite important. However, although there are both pros and cons in this financial report, Dolphin Analyst believes that from the valuation perspective, the current stock price of JD is still significantly lower than its fair price, and the upside potential of JD under the current valuation is far greater than the downside risk.

If you are interested in interpreting Chinese companies' research reports, please add the WeChat ID "dolphinR123" to join the investment research group, and get the Dolphin's in-depth research report for the first time, and discuss investment opportunities with investment veterans.

Detailed interpretation of this quarter's financial report:

I. User growth is stagnant temporarily

After winning the excellent publicity channel of the Spring Festival Gala in the first quarter, JD added only 11 million net active buyers in that quarter. The number of annual active users of JD in this quarter has basically stopped growing. At the end of the second quarter, the company had 580.8 million active users, an increase of only 300,000 from the previous quarter. Although it was affected by the epidemic, the significant slowdown in user growth for two consecutive quarters still reflects that JD stands to gain less by greatly reducing its sinking JD Daojia business group and cutting the channels that reached rural consumers. The space for further penetration among urban consumers has also become smaller.

II. Significant slowdown in revenue growth under the impact of the epidemic, but expected

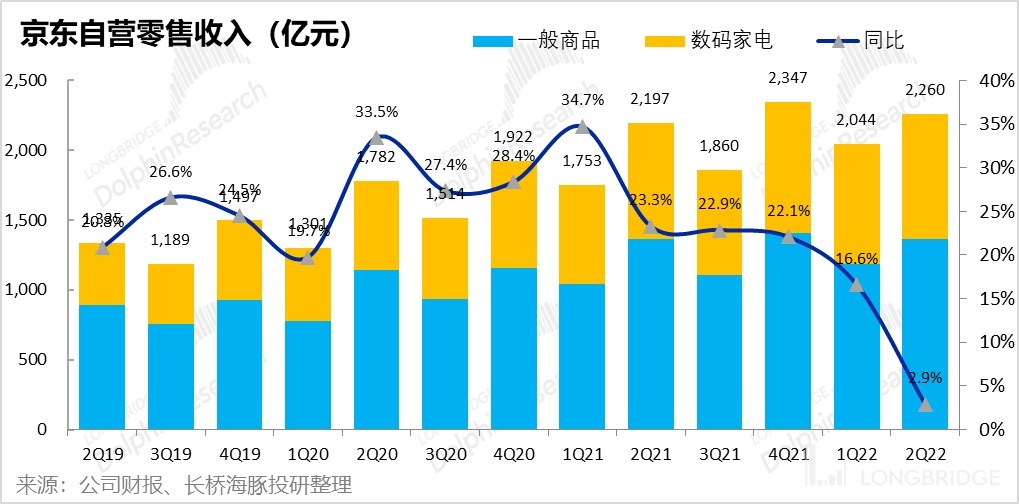

1. Self-operated retail: First of all, let's look at JD's cornerstone self-operated retail business, which achieved revenue of 226 billion yuan this quarter, a significant slowdown in growth at 2.9% under the impact of the epidemic. Although the performance looks bad, it is basically consistent with the market expectation of 226.6 billion yuan after communicating with the company.

However, compared with the zero growth of China's online retailing industry on a year-on-year basis, and the 7.5% year-on-year growth of physical online retailing, JD's performance of continuously leading its business growth and the industry growth in the past fell short. Of course, this is also related to the higher proportion of JD's business in large cities, so it is more affected by the epidemic.

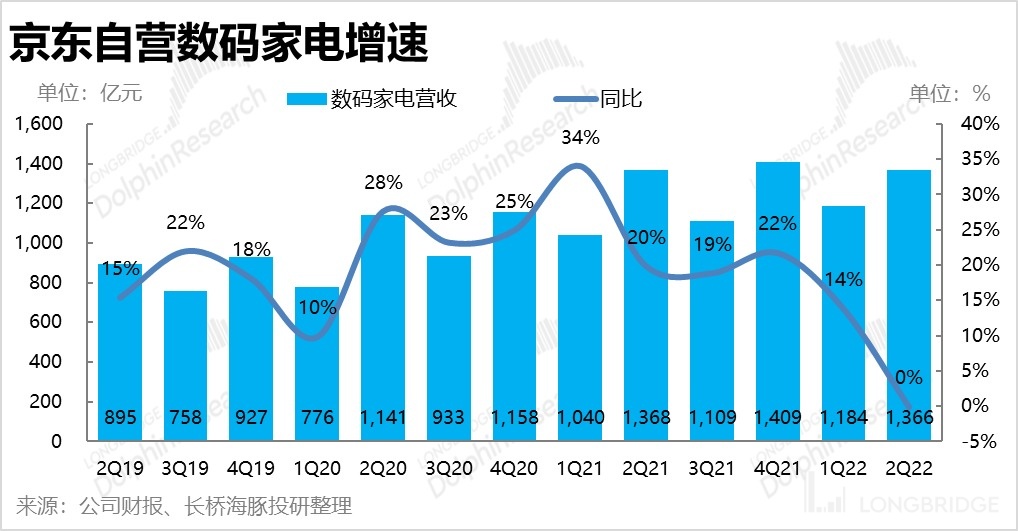

In this quarter, the revenue of electric products was RMB 136.6 billion, unchanged from the same period of last year. Due to weak demand for 3C products such as mobile phones before the new product release wave in the second quarter and difficulties in delivering large household appliances during the epidemic, the overall retail sales of electric products shrank by 4% year-on-year this quarter, compared to which Jingdong was still more resilient. However, the lead of Jingdong in the industry is also significantly narrowing. Against the backdrop of the low post-cycle of real estate, the dividend of independent high growth gained by seizing the market share of Suning may be disappearing.

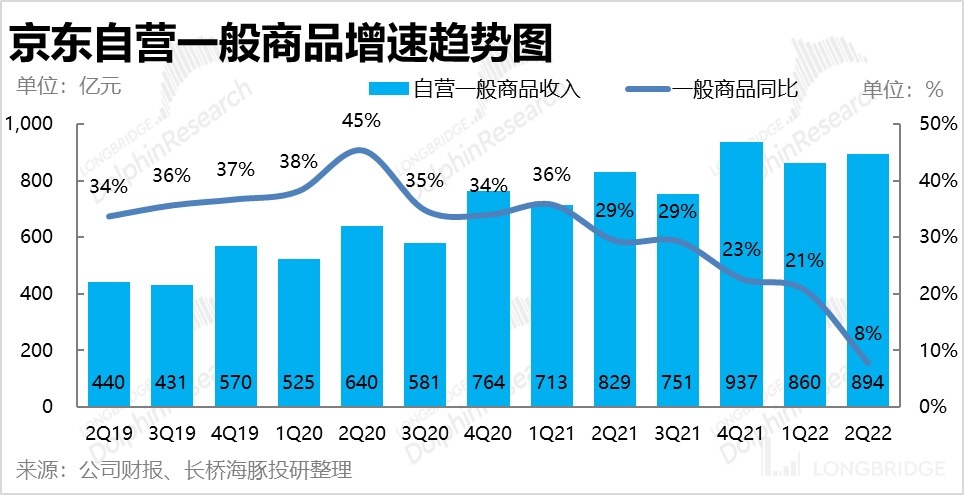

The revenue of general merchandise, mainly daily necessities and clothing and beauty, was RMB 89.4 billion this quarter, with a year-on-year growth rate of 8%, which fell significantly below the market expectation of RMB 92.4 billion. During the epidemic period, the online shopping demand for food and daily necessities should have been relatively favorable, but Jingdong's performance was quite ordinary. In addition, under the logic of increasing penetration rate of fast-moving consumer goods online, general merchandise with higher growth rate is one of the second growth curves of Jingdong, so the continued rapid slowdown of growth rate is worrying, and we need to pay attention to how the management gives guidance on the normal growth after the epidemic in the conference call.

2. Platform services: The platform service revenue of Jingdong, mainly reflecting the commissions and advertisements of Jingdong platform, was RMB 20.7 billion this quarter, with a year-on-year growth rate of 9%, which also slowed down significantly. Under the situation of poor performance of self-operated business and incomplete delivery even for the third-party business, the 3P business is also difficult to show the leading performance. At the same time, if we exclude the contribution of about RMB 800 million in platform revenue from Dada consolidation, the comparable revenue growth is only 5%. Dolphin Analyst believes that most 3P merchants of Jingdong are mainly in clothing and beauty categories where 1P lacks, so weak consumption of optional product categories should be the reason for the poor performance of 3P business.

3. Logistics and other services The revenue of logistics and other services in this quarter was RMB 20.8 billion, with a year-on-year growth rate as high as 38%, even after excluding the impact of Dada consolidation, the comparable growth rate still reached 29%, slightly accelerating from the previous quarter. Dolphin Analyst believes that this is because during the epidemic period, logistics capacity was tight, which instead pushed up unit prices and revenue. The 18.2% increase in revenue of ZTO Express this quarter also reflects this logic.

4. Combining the various businesses mentioned above, JD's overall revenue this season was RMB 267.6 billion, a year-on-year increase of 5.4%, slightly higher than the market's expected revenue of RMB 267.6 billion, and the difference is mainly due to the strong growth of the logistics business. Overall, JD's performance on the revenue side can only be said to be as expected. Due to the high proportion of urban areas and the greater impact of the epidemic, the slowdown in revenue growth is "disturbing", and the excellent performance that has previously led industry growth has disappeared. Therefore, whether JD's growth rate can rebound to the previous high level after the epidemic, or continue to slowly decelerate, will be the core factor that dominates the trend of the stock price.

4. Combining the various businesses mentioned above, JD's overall revenue this season was RMB 267.6 billion, a year-on-year increase of 5.4%, slightly higher than the market's expected revenue of RMB 267.6 billion, and the difference is mainly due to the strong growth of the logistics business. Overall, JD's performance on the revenue side can only be said to be as expected. Due to the high proportion of urban areas and the greater impact of the epidemic, the slowdown in revenue growth is "disturbing", and the excellent performance that has previously led industry growth has disappeared. Therefore, whether JD's growth rate can rebound to the previous high level after the epidemic, or continue to slowly decelerate, will be the core factor that dominates the trend of the stock price.

-

Profit performance is strong, mainly exceeding the expected point.

-

Gross profit: This quarter, JD achieved a gross profit of RMB 35.9 billion, which was significantly higher than the market's expected level of about RMB 1.8 billion and is the most important point of JD's performance that exceeded expectations. Since revenue is in line with expectations, in essence, gross margin exceeds expectations. Specifically, the gross profit margin for this quarter was 13.4%, higher than the market's expected 13% and last year's same period of 12.5%. Since JD's 6.18 anniversary promotion was held in the second quarter, historically, the second quarter has always been the seasonal low point for JD's gross profit and profit. However, this quarter it did not decline significantly. The possible reasons for this are that under the epidemic, suppliers had difficulty selling goods, so they gave JD more favorable prices, or JD reduced its discount during the 6.18 period to decrease costs and increase efficiency.

- The four expenses are in line with expectations: Under the epidemic, the difficulty of fulfillment and the increase in expenses rose as expected, with spending growing 11% YoY, significantly higher than 3% YoY growth of the self-operated business's revenue.

However, in the direction of reducing costs and increasing efficiency, the company's marketing expenses and management expenses (including equity incentives) have declined YoY in this season. Marketing expenses decreased by 11% YoY, while management expenses also decreased by 9% YoY. The sharply lower marketing expenses correspond to the higher gross profit and the lower GMV growth during the 6.18 period.

At the same time, under the company's budget tightening, the equity incentive costs distributed to management and employees this season also decreased significantly by 24%, indicating that management still has a conscience.

In addition to the above three expenses, the company's investment in research and development remained relatively stable. This season, R&D expenses increased by 9% YoY but as one of the main drivers of long-term growth, it is essential to ensure investment in technology.

Overall, the company's four expenses amounted to RMB 32.1 billion this season, which is basically the same as the market's expected RMB 32.6 billion.

3. Operating profit: As a result of the gross profit exceeding expectations by 1.8 billion yuan this season, and the operating expenses being slightly less than expected by about 500 million yuan, JD.com achieved an operating profit of 3.76 billion yuan this season, exceeding market expectations by nearly 2.3 billion yuan. Although the second quarter was the most affected by the epidemic and historically the low-profit season, JD.com's excellent cost and expense control enabled the profit to further improve from the first quarter, demonstrating the company's ability to release profits to the market.

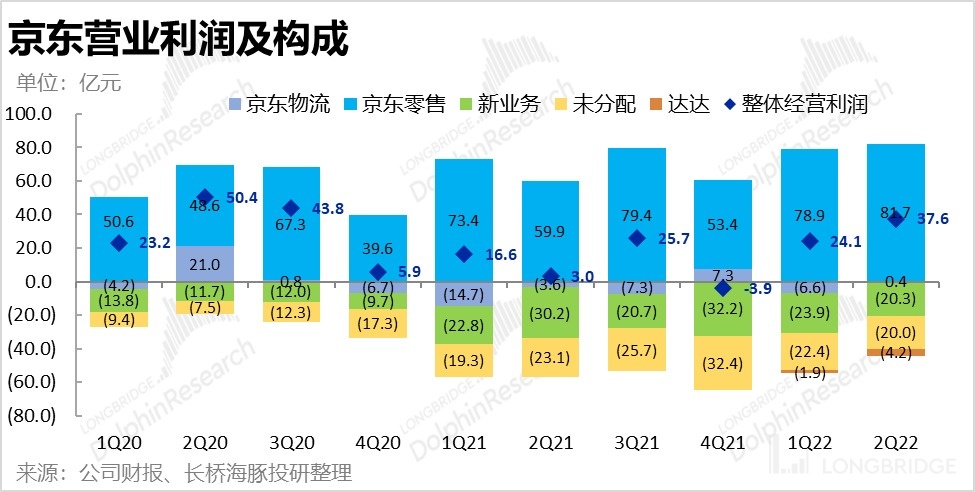

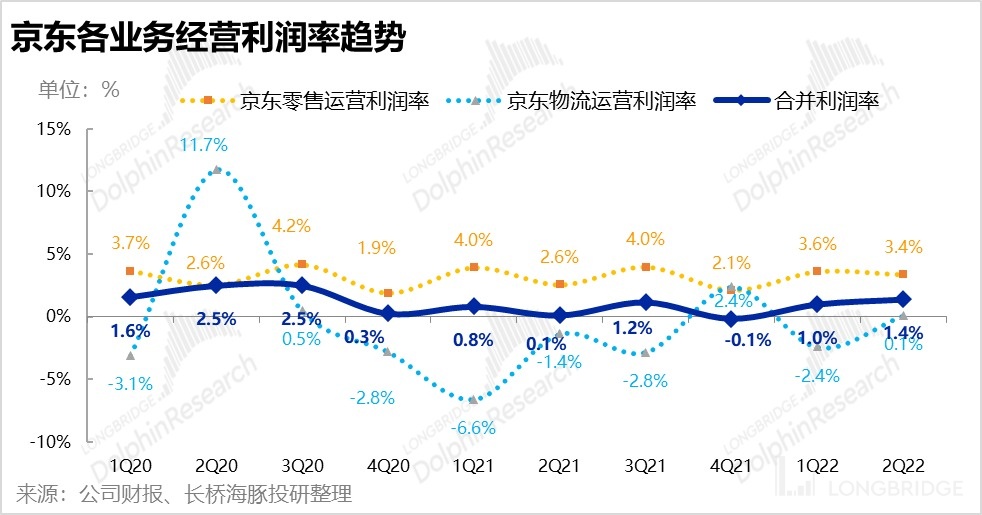

IV. Profits of all departments have improved across the board

Looking at the individual departments, the profit release situation of the company's various sectors was better than expected:

-

Firstly, JD.com's mall business has further increased its profits, with an operating profit of as high as 8.17 billion yuan this season, greatly exceeding the market's expectations of 6.95 billion yuan. The profit margin of 3.38% is significantly improved from the 2.57% of the same period last year, and only slightly lower than the 3.63% of the previous quarter.

-

Due to the favorable impact of the epidemic, logistics services (including both domestic and international services) have once again turned losses into gains, achieving an operating profit of 36 million yuan this season. Dolphin Analyst believes that JD Logistics is close to reaching a balance between profits and losses, and it has already shown promising prospects for stable profits in the future.

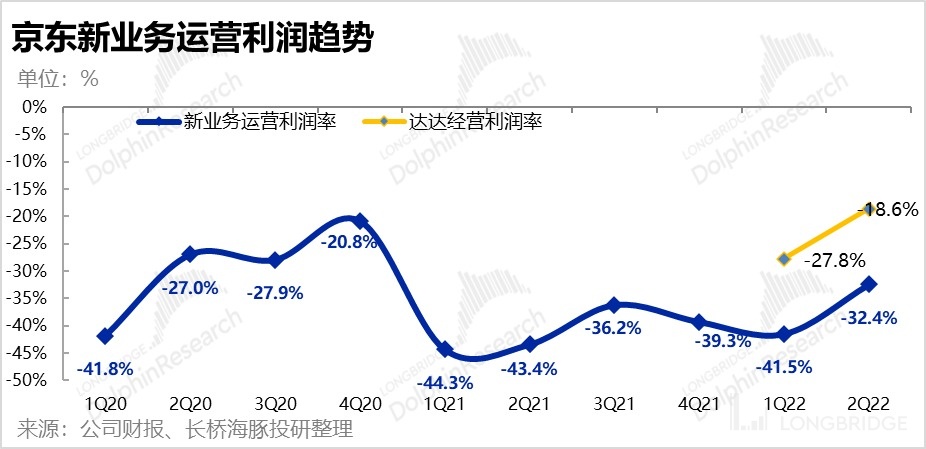

-

Losses from new businesses such as JINGXI have further narrowed from 2.39 billion yuan in the previous quarter to 2.03 billion yuan, indicating that the company is steadily advancing the reduction of marginal and loss-making businesses.

-

According to Dada's own financial report, Dada Group, which focuses on instant delivery and all-channel logistics, reduced its operating losses from 630 million yuan in the previous quarter to 610 million yuan this quarter, despite a 13% increase in revenue. This shows that Dada has also crossed the stage of becoming more and more loss-making and is continuously improving its profitability.

Past Research:

Deep Dive

April 22, 2022 "Meituan, JD.com, why are they excelling in the existing market competition?" On September 27, 2021, "Getting to Know JD Again, Ridiculed by the Whole Network" was published.

Earnings Season

On May 17, 2022, the conference call for the second quarter was held, "Taking a Break," but there is still room for cost reduction and efficiency improvement (Minutes of JD.com Conference Call).

On May 17, 2022, the earnings review was released, "Fighting Against the Epidemic, Restraining Profits, JD.com is Still Sincere."

On March 10, 2022, the conference call was held, "With Uncertainty Increasing, Can JD.com's Self-Operated and Self-Logistics Models Help Maintain Its Leading Position? (Conference Call Minutes)."

On March 10, 2022, the earnings review was published, "JD.com Arrives at a Crossroads, Revenue Shines, Future Uncertain?."

On November 18, 2021, the conference call was held, "Putting Me First, Summary of JD.com's Performance Conference Call."

On November 18, 2021, the earnings review was released, "JD.com: E-commerce Growth is "Cooling Down"? JD.com is the First to Disagree."

Risk Disclosures and Statements for this Article: Dolphin Investment Research Disclaimer and General Disclosures

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.