Posts

Posts Likes Received

Likes ReceivedHow can Sun Power support a market value of 200 billion yuan without increasing revenue but profits?

On the evening of August 25th, 2022, Sunshine Power (300274.SZ) released its 2022 interim report. The analysis of this financial report will be divided into two parts: first, observing the latest second quarter performance of Sunshine; then, based on the incremental data only available in the semi-annual report, analyzing the development of the company's various businesses in detail. Let's take a closer look:

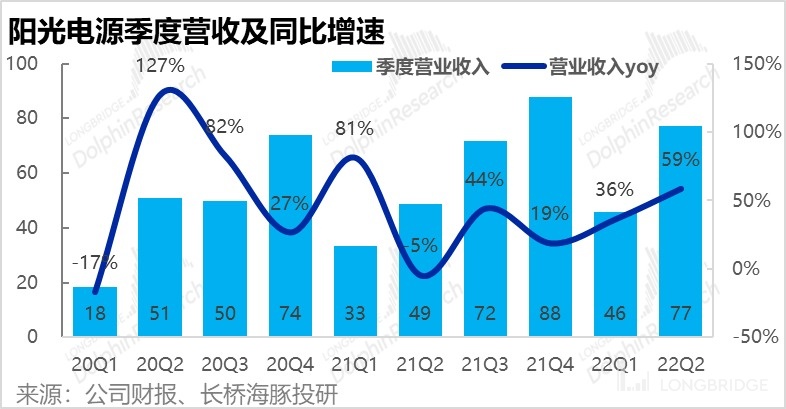

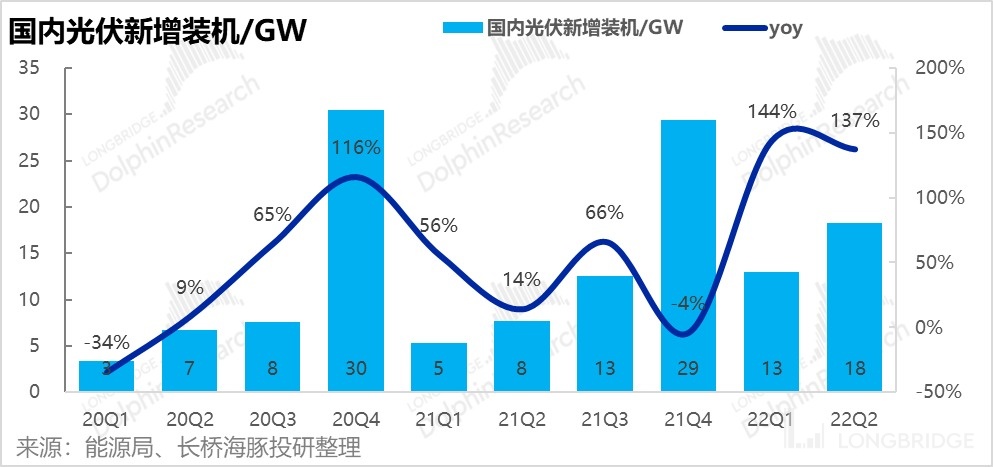

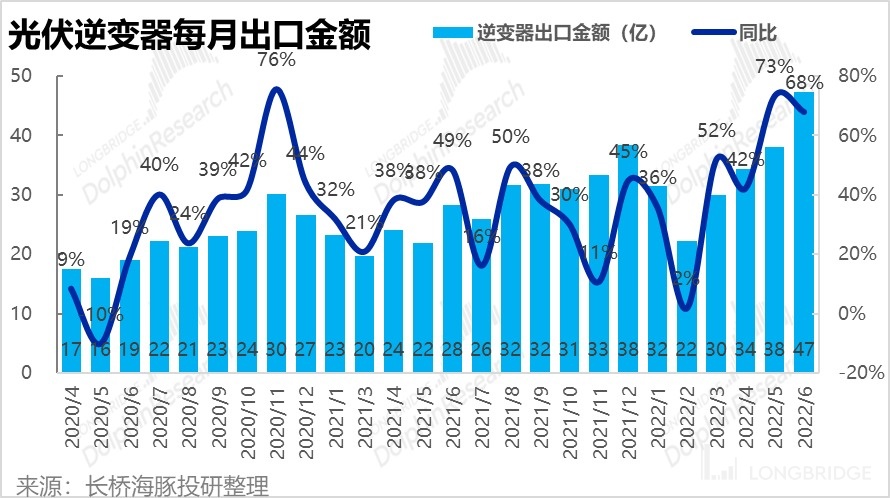

1. Resonating domestic and overseas demand leads to strong revenue growth in Q2: The momentum of domestic photovoltaic installations in the first half of 2022 was obvious, with both production and sales increasing by around 140% YoY. In the first half of this year, the installation volume was 19% higher than that of the same period last year, which was 1-9 months in 2021. In addition, there has been a surge in overseas demand for inverters in Q2, with the export amount of Chinese inverters in May and June increasing from the previous 50% to more than 70%. Therefore, driven by strong demand, the company achieved revenue of RMB 7.7 billion in the second quarter, with a YoY growth rate of 59% despite the impact of the pandemic, setting a new record for growth rate.

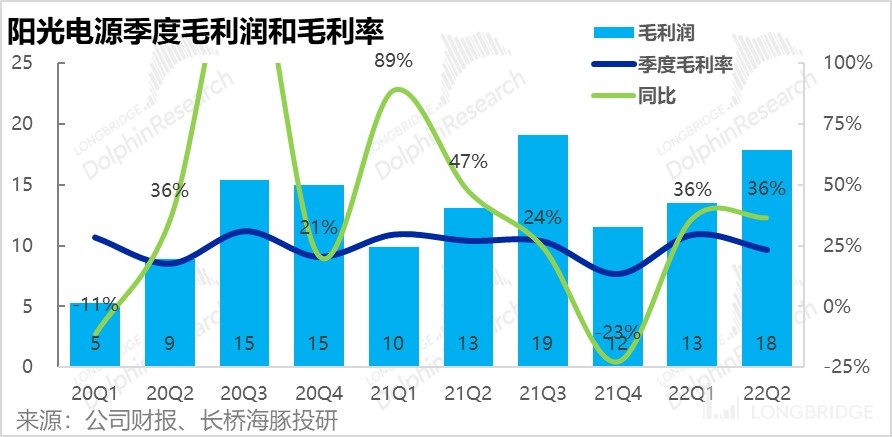

2. Continued fierce competition leads to margins decline: The gross profit margin of the company in the second quarter was 23.2%, a decrease of 6pct and 4pct MoM and YoY respectively. Gross profit only increased by 36% YoY to RMB 1.8 billion, which is much lower compared to revenue growth rate. Dolphin Analyst speculates that the rise in costs such as IGBT and other semiconductor materials, as well as continuing competition that led to lower unit prices and therefore margins is the reason for the decline. We need to pay attention to the management's explanation and information on the shipment price and quantity of inverters in the conference call.

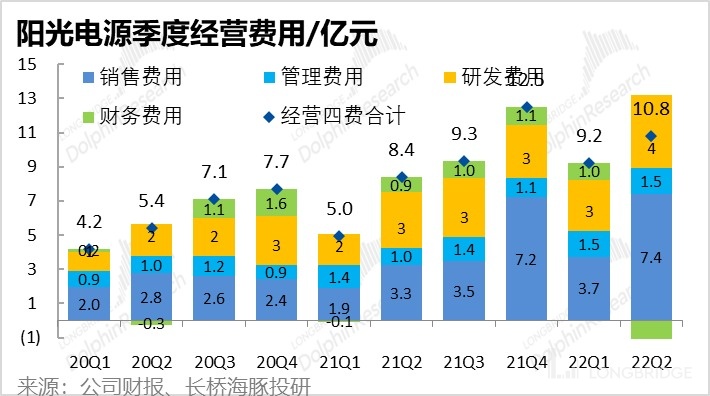

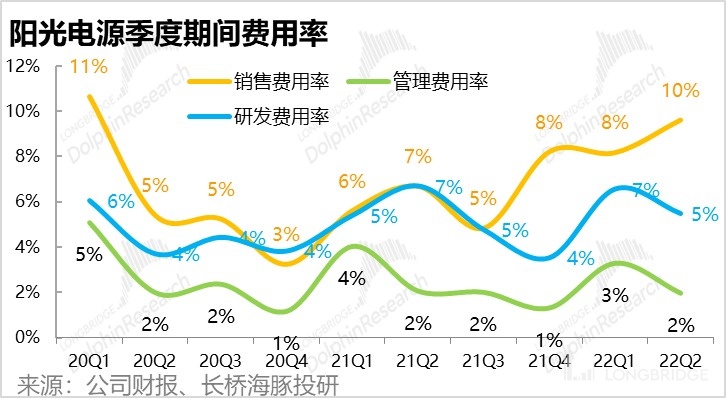

3. Intensified competition leads to sharp increase in sales expenses while other expenses increase smoothly: Corresponding to the decline in gross profit, sales expenses increased greatly by 128% in the second quarter, with a YoY increase from 7% to 10% of revenue. However, the R&D expense ratio decreased from 7% to 5%. The logic behind it is that the brand effect of the inverter is strong, and users have a strong perception of after-sales service, repair, brand, channels, etc., but the iteration of inverter technology is slow, making it difficult to form a significant technology gap. Therefore, investing in sales expenses (rather than R&D expenses) is the company's most effective means of competition.

4. Revenue growth but profit decline, and removing forex gains revealed miserable profit: Despite the decline in gross profit margin and the growth in sales expenses, due to the rise of the US dollar against RMB in the second quarter, a large amount of forex gains helped the company achieve financial income of RMB 240 million, while past periods generally had more than RMB 100 million financial expenses. With its help, the company still achieved a net profit attributable to the parent of RMB 490 million in this quarter, which increased by 32% YoY. However, if we remove the contribution of forex gains, the company's profit in the second quarter is quite dismal.

5. Photovoltaic inverters and energy storage businesses work together

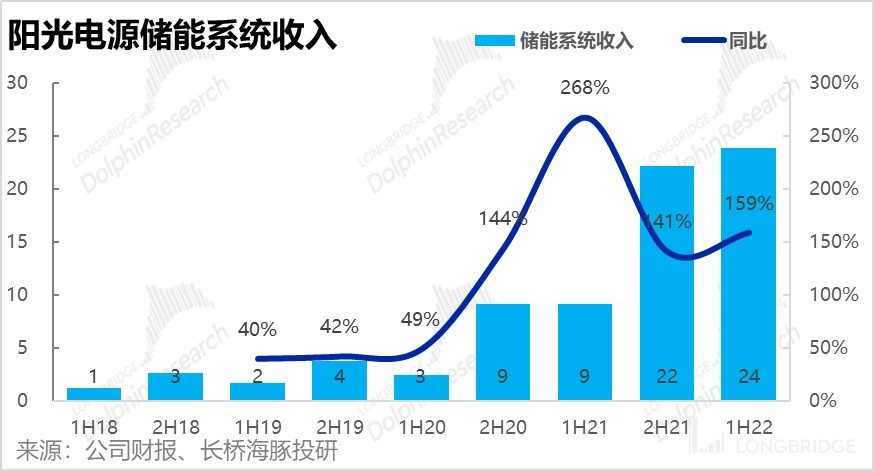

- In the first half of 2022, the revenue of photovoltaic inverter business reached RMB 5.9 billion, a YoY growth rate of 65%, which was the core driving force of the company's growth. In addition, the proportion of overseas revenue reached a new historical high of 53%, indicating that overseas business is also one of the driving forces of the company's growth. 2) In the first half of the year, the revenue of energy storage business reached RMB 2.4 billion, with a YoY surge of 1.6 times, making a contribution of 19% to the company's total revenue, and soon will become the second largest source of revenue for the company. 6. The gross profit margin of various businesses generally declined

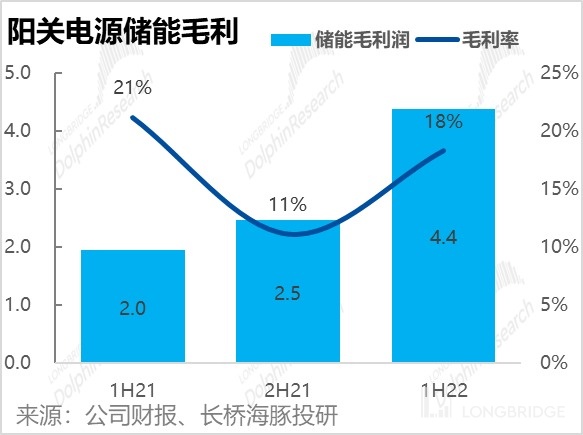

Although the core business can bring growth, the common problem is that increasing revenue does not increase profit. In the first half of the year, the gross profit margin of the photovoltaic inverter business compared to the same period of last year shrunk significantly by 5 percentage points from 38% to 33%, and the gross profit margin of the energy storage business in the first half of the year decreased by 3 percentage points to 18% compared to the same period last year. Compared with the gross profit margin of the energy storage business in the first quarter of 20, it has further deteriorated.

Therefore, although the company's inverter and energy storage businesses are growing rapidly, the company only achieved a net profit of RMB 900 million attributable to the parent company in the first half of the year, a year-on-year increase of only 19% (excluding the impact of exchange rate gains and losses).

Dolphin Analyst's view:

Overall, despite the impact of the epidemic, the company's revenue growth (especially in photovoltaic inverters and energy storage) is quite impressive, and the industry's demand is also strong, and the prospects for future growth are promising. However, in the short-to-medium-term, the problem of raw material prices and long-term competition problems are serious, the problem of increasing revenue without increasing profit is serious, and marketing investment has also increased. If the fundamental problem of profit release cannot be solved, the Dolphin Analyst believes that how to support a market value of nearly RMB 200 billion without a profit of RMB 1 billion in half a year is a big problem.

Dolphin Analyst will share the telephone conference summary with Longbridge's user group through the Longbridge App. Interested users are welcome to add WeChat "dolphinR123" to join the Dolphin Investment Research Group and be the first to obtain the telephone conference summary.

Quarter 1 and 2 saw revenue increase without profit increase again.

1. Revenue: In the second quarter of 2022, the company achieved revenue of RMB 7.7 billion, a significant year-on-year increase of 59%, and the growth rate hit a new high. Combined with industry data, the newly added photovoltaic installed capacity in China has a significant momentum after experiencing a small underestimation in 2021. The growth rate of installed capacity in the first and second quarters of this year is around 140% year-on-year. This year, the domestic installed capacity has reached nearly 31 GW, significantly exceeding last year's installed capacity of about 26 GW from January to September.

Moreover, not only is domestic photovoltaic installation strong, but also the overseas demand for inverters has exploded since the second quarter. According to statistics, the year-on-year growth rate of exported inverters in China in May and June has also increased significantly from around 50% to 70%.

Therefore, although affected by the epidemic, under the push of strong domestic and foreign demand for photovoltaic installation and inverters, the company's revenue growth accelerated in the second quarter, which is still a cause for celebration.

2. Gross profit: Despite the strong revenue growth, the marginal decline in gross profit margin in the second quarter of the company may be due to the upstream raw material price increase such as IGBT, and the excessive inside competition of domestic photovoltaic enterprises, resulting in a drop of 6% and 4% respectively compared with the previous quarter and the same period last year, to 23.2%. Since the gross profit breakdown is not included in quarterly data, pay attention to the delivery price-volume data disclosed by management during the conference call, and which business is dragging down the overall gross profit decline of the company, the Dolphin Analyst will also share the conference call summary of the company later.

2. Gross profit: Despite the strong revenue growth, the marginal decline in gross profit margin in the second quarter of the company may be due to the upstream raw material price increase such as IGBT, and the excessive inside competition of domestic photovoltaic enterprises, resulting in a drop of 6% and 4% respectively compared with the previous quarter and the same period last year, to 23.2%. Since the gross profit breakdown is not included in quarterly data, pay attention to the delivery price-volume data disclosed by management during the conference call, and which business is dragging down the overall gross profit decline of the company, the Dolphin Analyst will also share the conference call summary of the company later.

However, it can be clear that due to the drag of gross profit margin decline, the gross profit of the company in the second quarter increased by only 36% to 1.8 billion yuan compared with the same period last year, which is obviously much inferior compared with the revenue growth.

3. Cost and profit: Corresponding to the decline in gross profit margin, the marketing expenses this quarter also increased significantly. The competition in the photovoltaic inverter industry should be more intense in the second quarter. The marketing expenses increased by 128% to 740 million yuan compared with the same period last year, accounting for 10% of the revenue, up from 7% last year. In terms of business logic, the brand effect of photovoltaic inverters is strong, so the investment in after-sales maintenance, brand channels, and other aspects is high, so it is normal for sales expense ratio to be high.

As the technical iteration speed of photovoltaic inverters is not fast, it is difficult for various companies to form a significant technological advantage, so technology research and development is not an effective means of competition, and the company’s research and development investment is relatively stable, with a year-on-year increase of 30% this quarter, and the cost ratio also decreased from 7% to 5% year-on-year.

The management expenses are stable. They increased by 51% year-on-year this quarter and are basically consistent with the revenue growth rate, with a stable proportion of about 2% of revenue, which has little impact on the overall profitability of the company.

However, under the background of more than half of the company's overseas revenue, the appreciation of the US dollar against the renminbi in the second quarter has greatly increased the company's foreign exchange gains, and the company has achieved a financial income of 240 million yuan this quarter, while the past was generally over 100 million yuan of financial expenses.

Due to the contribution of financial expenses, although the gross profit margin in this quarter decreased by nearly 4% year-on-year, and the marketing expenses increased significantly, the company still achieved a net profit attributable to the parent of 490 million yuan, a year-on-year increase of 32%, which is basically consistent with the gross profit margin. However, if the contribution of foreign exchange gains is excluded, the company's profit in the second quarter should be quite ugly.

Second, Performance of the Main Business Segments

Overall, in the first half of 2022, the company achieved a total revenue of CNY 12.28 billion, with a year-on-year growth of 50% driven by the second quarter. In terms of volume, the installed capacity of all photovoltaic equipment in the first half of the year was 45 GW, an increase of 61% year-on-year. It can be seen that the contribution of revenue per GW of installed capacity decreased by about 10% year-on-year. As for the specific price and volume data of each business segment, it still needs to be discussed during the conference call.

Looking into detail, the performance of the core photovoltaic inverter board is impressive, and the emerging energy storage business is still soaring at a three-digit growth rate, while the revenue-rich but low-profitable power plant development business has a very low growth rate.

1. Photovoltaic Inverter:

The main photovoltaic inverter business achieved a revenue of CNY 5.9 billion in the first half of 2022, a year-on-year growth of 65%, which played a key driving role in the overall revenue growth of the company.

In addition, according to the company's disclosed revenue breakdown, overseas revenue accounted for a record high of 53% in the first half of this year, an increase of 2% from the previous quarter. Combined with the aforementioned surge of more than 70% in inverter exports in the second quarter, overseas business should be one of the main driving forces behind the company's revenue growth.

However, the inverter business also faces the problem of increasing revenue but not profit. In the first half of this year, the gross margin of the photovoltaic inverter business decreased by 5% year-on-year, from 38% to 33%. The gross profit was CNY 3.14 billion, a year-on-year increase of only 36%.

2. Energy Storage System Is Still Soaring

The revenue of energy storage system in the first half of 2022 reached CNY 2.4 billion, an increase of 160% year-on-year. It has contributed 19% to the total revenue of the company and is expected to become the second largest revenue source of the company soon, surpassing the power plant development business, which accounts for 23% of the total revenue. This helps reduce the dependence on power plant development, which is a heavy asset in the company and difficult to earn money.

However, although the energy storage business has grown rapidly, the company stated in its annual report conference call that its sales target for the full year of 2022 is around 10 billion yuan, which means that the energy storage business in the second half of the year needs to increase by nearly 250% compared to the same period last year to achieve its target, putting enormous pressure on the company.

The energy storage business is also not immune to declining gross margins. The gross margin for the first half of 2022 was 18%, a decrease of 3 percentage points year-on-year. In the conference call last quarter, management stated that the gross margin for the energy storage business in the first quarter was 20%. If it is true, it means that the gross margin for the energy storage business further declined in the second quarter.

It seems that if the gross margin of the energy storage business cannot be significantly improved in the long run (currently it is still declining), then after deducting the operating expenses of more than ten points, the profit margin that can be retained is very limited. In this case, even if revenue growth is high, it is difficult to make a significant contribution to profits, and the problem of not increasing profits with growth remains serious.

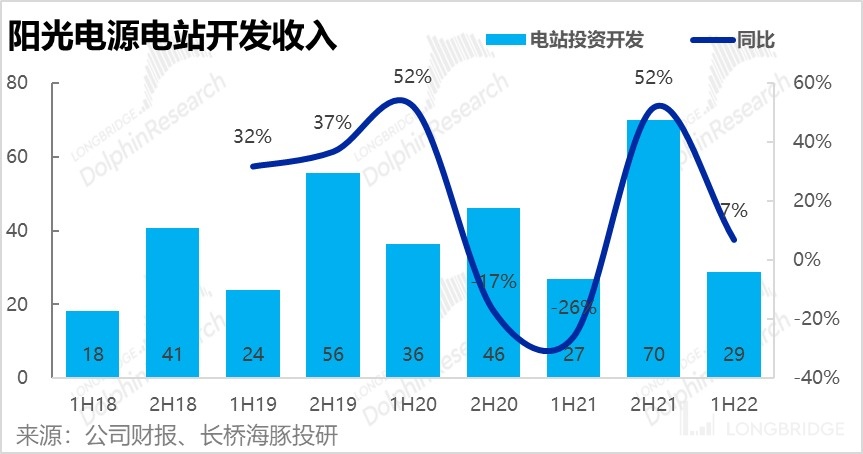

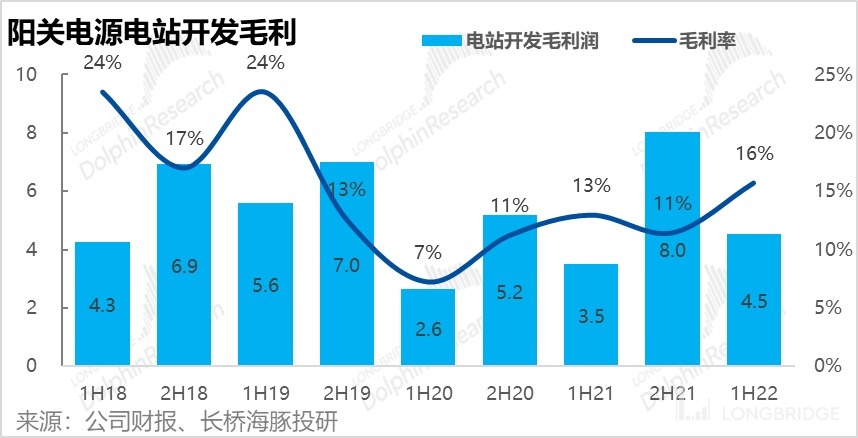

3. Power Station Development Business: The power station development business is a tough job. This quarter achieved revenue of 2.9 billion yuan, but compared with the low base period of the same period last year, it only increased by 7% year-on-year.

However, while revenue growth has stalled, the gross margin of the power station development business has increased significantly from 13% last year to 16%. Dolphin Analyst speculates that this may be because the gross margin of this business was only a little over 10%, and growth has significantly slowed. Therefore, the interest of various development companies in this tough job has decreased, reducing competition and causing a rebound in gross margins.

Since the gross margins of other businesses other than power station development are declining, the overall gross margin has also decreased from 28% to 25.5% year-on-year. Specifically,

- In terms of business organizations, although the gross margins of various businesses have generally declined, the proportion of photovoltaic inverters with the highest gross margins (contributing about two thirds of gross profits) has increased. Therefore, the decline in the company's overall gross margin is relatively small.

The economics of photovoltaics require a year-by-year improvement, requiring a year-by-year decrease in the cost of photovoltaic systems, as shown in the previous figure, the price of photovoltaic inverters also shows a year-by-year decrease trend;

- As carbon neutrality is a long-term global trend, the potential of the photovoltaic and energy storage markets is huge. There will definitely be more players attracted to the market, intensifying competition, causing internal price declines in every sector of the photovoltaic industry chain. From a medium to short-term perspective, the bottleneck in the supply of semiconductor chips such as IGBT and raw materials such as silicon wafers has also led downstream companies in the photovoltaic industry to face generally rising costs (until upstream supply increases).

Due to the issue of stagnant revenue growth in the photovoltaic inverter and energy storage business, the company achieved a net profit attributable to the mother of RMB 900 million in the first half of this year, an increase of only 19% year-on-year. If the issue of profit release cannot be resolved, how can a profit of less than 1 billion yuan in half a year support a market value of nearly 200 billion yuan will be a major issue.

Dolphin Analyst's historical articles about SUNGROW POWER (300274.SZ):

April 20, 2022, Phone call meeting: "SUNGROW POWER: Inverter + Energy Storage, Stable Quantitative Benefit (Meeting Summary)"

April 19, 2022, Financial report review: "SUNGROW POWER: Full of Apologies, High Expectations Reduced in Shock?"

November 16, 2021 - Industry depth: "Left-hand parity, right-hand carbon neutrality, photovoltaic is the hope of new energy?"

February 7, 2022 - Company depth: "Unfavorable start for photovoltaics, Is SUNGROW POWER's head stronger than its tail?"

February 8, 2022 - Company depth: "After emotional catharsis, SUNGROW POWER still "chases the light""

Risk disclosure and statement of this article: Dolphin Research Center Disclaimer and General Disclosure.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.