Posts

Posts Likes Received

Likes ReceivedIn the battery chain, the alternative "fresh and delicate" style can exist as Enjie's faith allows.

On the evening of August 30, 2022, ENN Energy Holdings Limited (SZ: 00006) announced its performance for the first half of 2022. As the first quarter results had already been released, the Dolphin Analyst focused on the incremental information conveyed in the second quarter of the first half of the year.

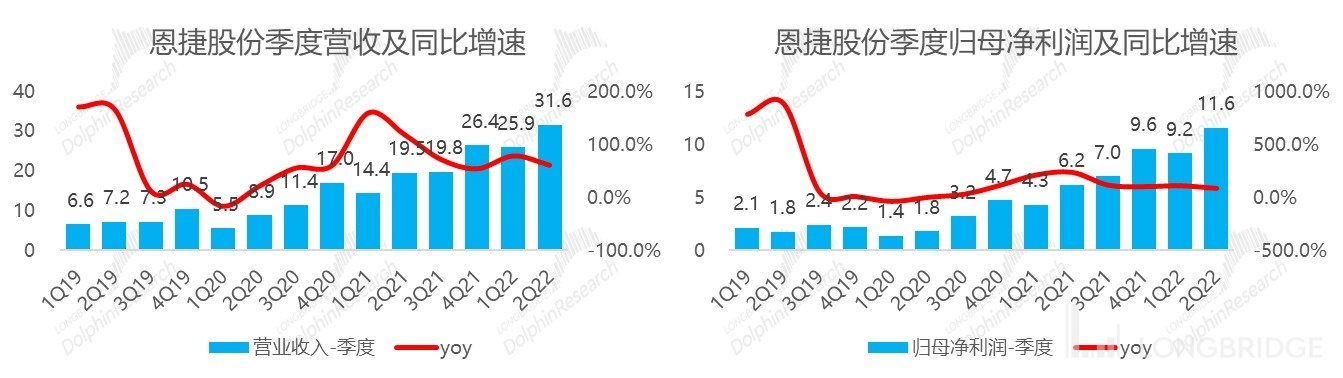

(1) The company achieved a net profit attributable to its parent of CNY1.1 billion for the second quarter of 2022, a year-on-year increase of 88%. The revenue in the second quarter was CNY3.2 billion, a year-on-year increase of 62%. Both revenue and profit were about 23% higher than the market's expectations for the full year (a profit of CNY5 billion and revenue of CNY13.9 billion), falling within a normal range.

(2) Membrane revenue and profit are as steady as ever: Membrane products' revenue exceeded 90% for the first time in the first half of the year, and its year-on-year growth is still accelerating. However, due to the rise in raw material costs, the gross profit margin has slowed down slightly, as the company is not willing to transmit the price increase. Instead, it is more inclined towards stable partner and supply relationships.

(3) The realization of overseas investments has been temporarily impeded: due to the global expansion of China's domestic power battery factory, the overseas power battery manufacturer's share of the automobile market has significantly declined, which dragged down ENN's overseas revenue contribution.

(4) Energy storage and dry process? This year's hot energy storage market has not been fully enjoyed by ENN due to the lack of a mature dry membrane production line, and the short-term stagnation of overseas power battery revenue also prevents it from expanding its incremental market.

In general, from the revenue, profit, and overall operating conditions in the second quarter and the first half of the year, compared to the crazy price game between the entire battery materials, battery factory, and EV industry, even the photovoltaic industry's game, ENN's wet membrane track can be described as "breath of fresh air." Its revenue and profit are as steady as a rock, and its global market share and market position in wet membranes have always been stable. Its solid market share and gross profit margin significantly surpassing the peers in the battery industry chain also make it a leader in the industry. Not having to gamble and transmit the pressure to raise the prices, and with the significant increase in the domestic power battery factory's market share, its structural increase of overseas revenue also affected its short-term momentum to increase the gross profit margin.

Furthermore, from the perspective of the market trends, the energy storage market is hot, but its dry production lines have not yet been released, leading to a lack of incremental revenue opportunities. These short-term negative factors have also caused it to have a relatively large retracement in this wave.

However, its position as the leader in the wet membrane field remains stable, with no logical problems. Investing in it only requires a reasonable price.

This article is an original article by Dolphin promoted by Dolphin Research. Unauthorized reproduction is prohibited. Users who are interested are recommended to add "dolphinR123" WeChat account to join the Dolphin Research Circle to study global asset investment views together!

The following are detailed points:

- One word: steady! As the first-quarter earnings have already been released, Dolphin Analyst focuses on observing the second-quarter performance implied by the first-half results to see its performance trend.

Let's first look at the big numbers: The company's attributable net profit for the first half of the year was RMB 2.02 billion, and the company's original guidance was between RMB 1.996 billion and RMB 2.076 billion, basically in line with guidance. Revenue was RMB 5.8 billion, a year-on-year increase of 70%, which is also basically in line with market expectations.

Of the total revenue, the second quarter revenue was RMB 2.6 billion, an 80% increase over the same period last year, accounting for 19% of the full-year revenue target (RMB 13.9 billion). Considering seasonal factors, the company's contribution to full-year revenue in the first quarter was within a reasonable range of 15% to 20%.

The company achieved a net profit attributable to its parent company of RMB 1.1 billion in the second quarter of 2022, an 88% increase year-on-year. Revenue for the second quarter was RMB 3.2 billion, a year-on-year increase of 62%. Both revenue and profit were roughly 23% of the full-year market expectation (profit of RMB 5 billion and revenue of RMB 13.9 billion), which is basically within the normal range.

Data source: Company announcements, Dolphin Investment Research

2. Overseas Story Fulfillment is Too Slow

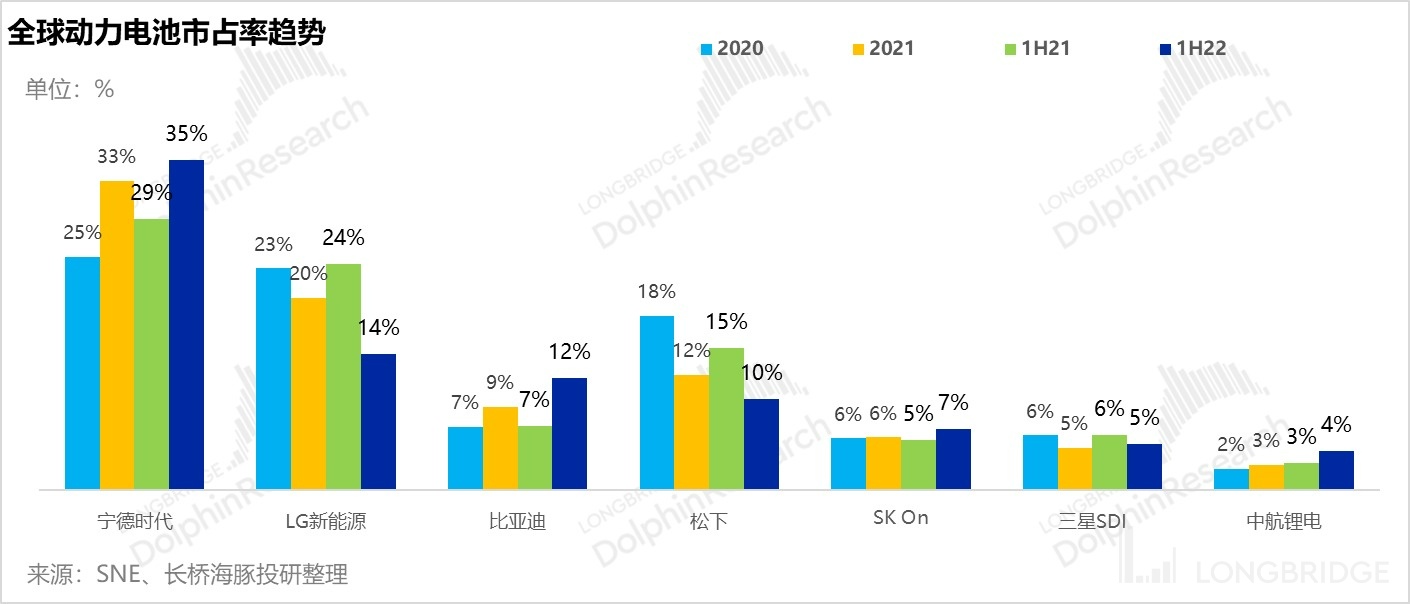

The battery separator accounts for more than 90% of the company's revenue, and the industry has an ultra-high market share. Enjie's downstream customers basically cover all the mainstream battery manufacturers, including Panasonic, Samsung, LGES, and French ACC, among others.

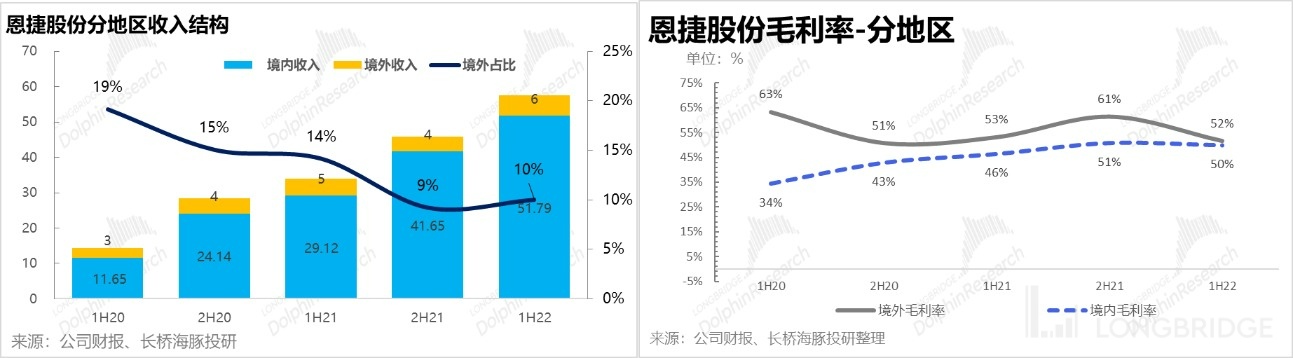

However, in the first half of this year, Chinese power battery manufacturers continued to erode global power battery market share, and Enjie's contribution to overseas market temporarily stagnated since the second half of last year. It seems that there is no logic for overseas market demand in wet separator.

However, due to its strong market position in wet separator and strong production capacity binding, as long as power battery assembly is growing rapidly, whether domestic or overseas clients are growing, its wet separator is basically as steady as a rock.

The market's main concern now is increment, especially in the energy storage market, both domestic and overseas, and energy storage batteries are mainly dry separator. Currently, Enjie's dry process capacity has not yet been released.

The reason why the market is looking forward to the overseas market is that the quality requirements for the separator are high, and the gross margin is also higher. However, from the overall situation in the first half of the year, the gross margin has fallen slightly after reaching its peak in the second half of last year.

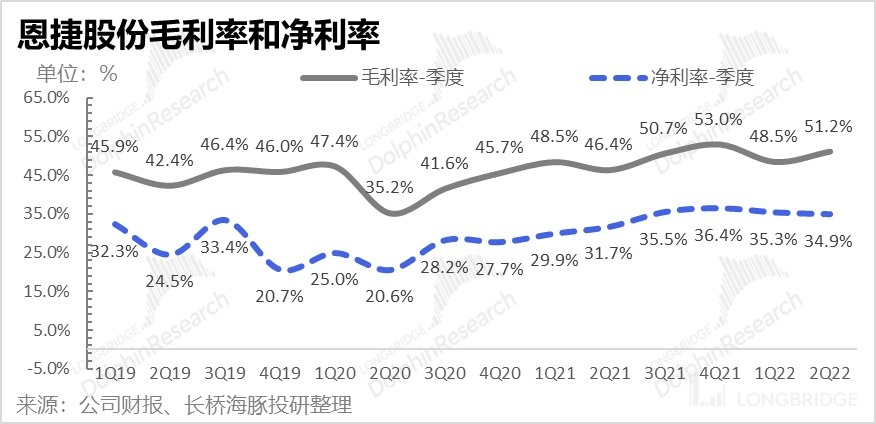

The separator is an industry with a gross profit margin of more than 50%, and the gross profit is comparable to that of packaged water. The main reason is that the cost of raw materials such as PET accounts for about 30% of the separator's revenue. As both domestic and overseas gross margins fell slightly from their high points in the second half of last year, Dolphin Analyst estimates that the rise in crude oil prices may have affected its gross margin due to the price hike of byproducts.

3. Membrane: revenue growth remains strong, but gross margin trend slightly stagnant

In the first half of this year, membrane products contributed more than 90% of Enjie's revenue for the first time, accounting for 91% of the company's total revenue. As a result, looking at Enjie's membrane product revenue is sufficient for understanding the company's performance.

With stable BOPP membrane market, the annual revenue of membrane products is basically between 500-600 million yuan, and all revenue growth comes from battery separators.

Enjie's membrane products have grown by 79% year-on-year in the first half of this year, amounting to 5.2 billion yuan, while the gross margin of the products has decreased from its peak in the second half of last year, mainly due to the rising cost of raw materials mentioned by Dolphin Analyst earlier.

Currently, the company's overall production capacity has been limited in the first half of the year, and some of the production lines can only climb up in the third or fourth quarter. The expected production capacity in the first half of the year is between 4.5-5 billion yuan. This time, we did not see any specific disclosure of the shipment volume of separators in the company's financial report, but the overall production capacity for this year is expected to be around 7-8 billion square meters.

3. Profitability: Incentives Slightly Lower Profit, Net Margin Remains Stable

With regard to the current profit release story of the company, due to their high gross margin, their raw material price increases are withstood. The company is not passing on the increased cost, but rather is locking in long-term cooperation relationships through long-term agreements and securing supply, to ensure the durability and stability of the business.

The improvement in gross margin is mainly driven by three structural improvements:

(1) An increase in the proportion of high gross margin products: coated film is a higher value-added product than basic film, and an increase in the proportion of coated film helps the company improve its overall gross margin. The company's current major customers purchase basic membrane, with the proportion of coated film being approximately 20-30%, representing a larger potential for growth.

(2) An increase in the proportion of overseas business: the quality requirements of overseas markets for separator products are higher, and prices and profits are higher. An increase in the proportion of overseas revenue helps the company improve its overall gross margin. In 2021, the proportion of overseas revenue was only 11%, and the target market share for overseas wet-process separators in 2025 is 35-40%.

(3) Technological improvements and self-developed equipment: currently, the core equipment for separator production is mainly done through binding with overseas suppliers. The company estimates that after self-developed equipment is introduced, procurement costs may be reduced by 40%-50%.

However, from the situation in the second quarter, due to the exploitation of overseas players by Chinese power battery manufacturers mentioned by Dolphin Analyst, overseas revenue has decreased, and short-term cost of raw materials have risen, which may have suppressed the continuous upward trend of the company's gross margin. Nevertheless, as a leading company in the tight supply and demand balance period of the overall market, the company's gross margin remains very stable, relying on production capacity and technological barriers to earn profits.

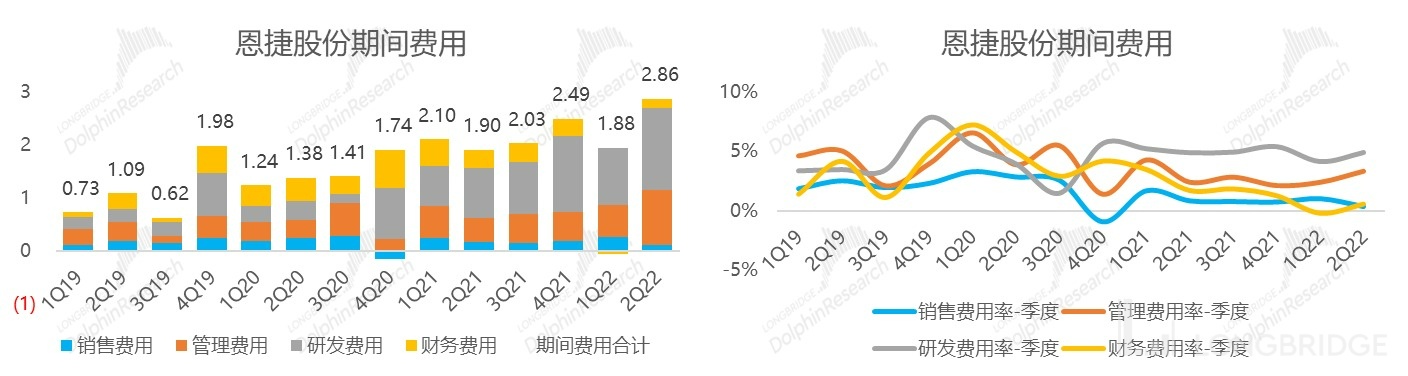

Expenses management incentive is slightly higher: The company has a stable position due to having a lot of long orders, and the industry as a whole is in a tight supply-demand balance. Therefore, the company does not require much sales cost. In terms of research and development, continuous investment is required to maintain its leading position in the industry. However, the amount is not very important for the time being, and the overall performance this quarter is relatively stable.

The main relatively high expenses this quarter are in management fees. Dolphin Analyst took a detailed look at the data and found that this is mainly due to the high growth in salary or equity payment expenses.

Overall, unlike other companies, the company does not have much room for reducing its costs and increasing its efficiency. Its overall expenses have always been relatively low, and research and development are also indispensable. The core is still to improve the gross profit margin and expand market share through product upgrades, customer structure, and technological upgrades.

Data source: Company announcement, Dolphin Research And Investment

Dolphin Analyst's historical articles on Enjie Co., Ltd. (002812.SZ):

September 23, 2021 - Industry Insight - "Battery Materials (Part 1): The Pattern is Opening Up, How to Choose a Long-Distance Runner?"

October 18, 2021 - Industry Insight - "Battery Materials (Part 2): Supply and Demand Inversion, How to Choose the Sprint Champion?"

December 29, 2021 - Company Insight - "Enjie Co., Ltd.: Has the New Energy Bubble Burst and Come with Cost-effectiveness?"

April 12, 2022 - Financial Report Review - "Enjie Co., Ltd.: The 'Double King' with Growth and Profit, More Fragrant After the Heavy Blow?"

April 12, 2022 - Meeting Minutes - "With Equipment and Process Barriers, Enjie Co., Ltd. Holds a Stable Position (Performance Explanation Conference Minutes)"

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.