NIO: When the pricing is pessimistic enough, how much damage can there be if the answer collapses? input: ====== 作为一个翻译工具,你能翻译哪些语言? ====== output: As a translation tool, what languages can you translate?

$ Nio Inc.US released its Q3 2022 financial report during pre-market hours on November 10th (Beijing Time) in Longbridge. The main points are as follows:

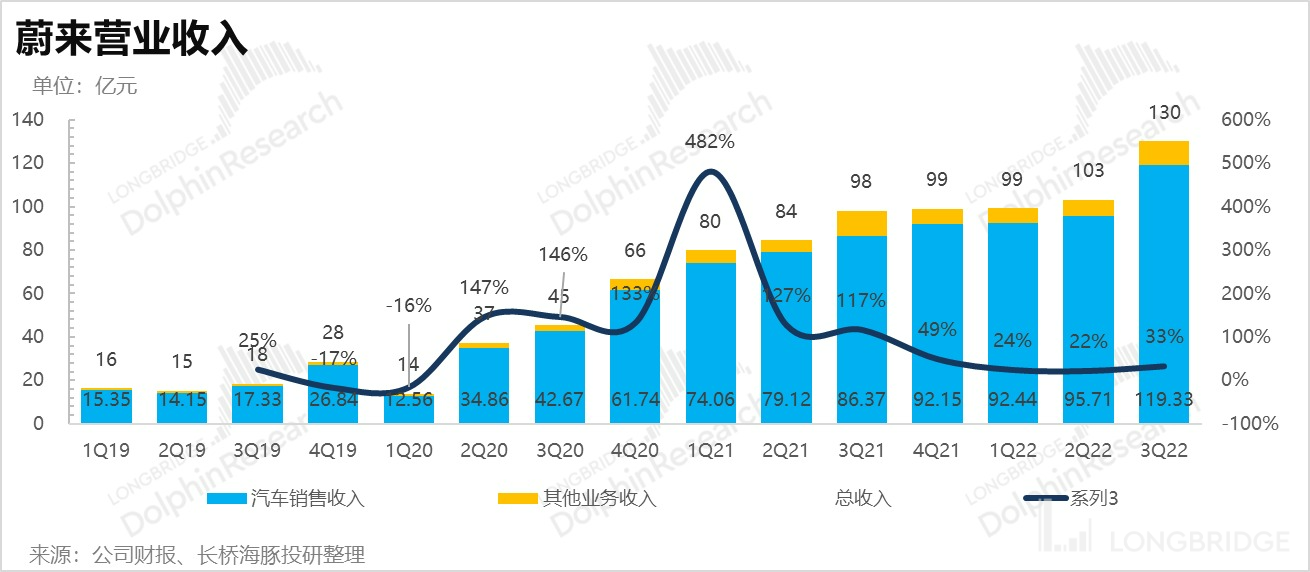

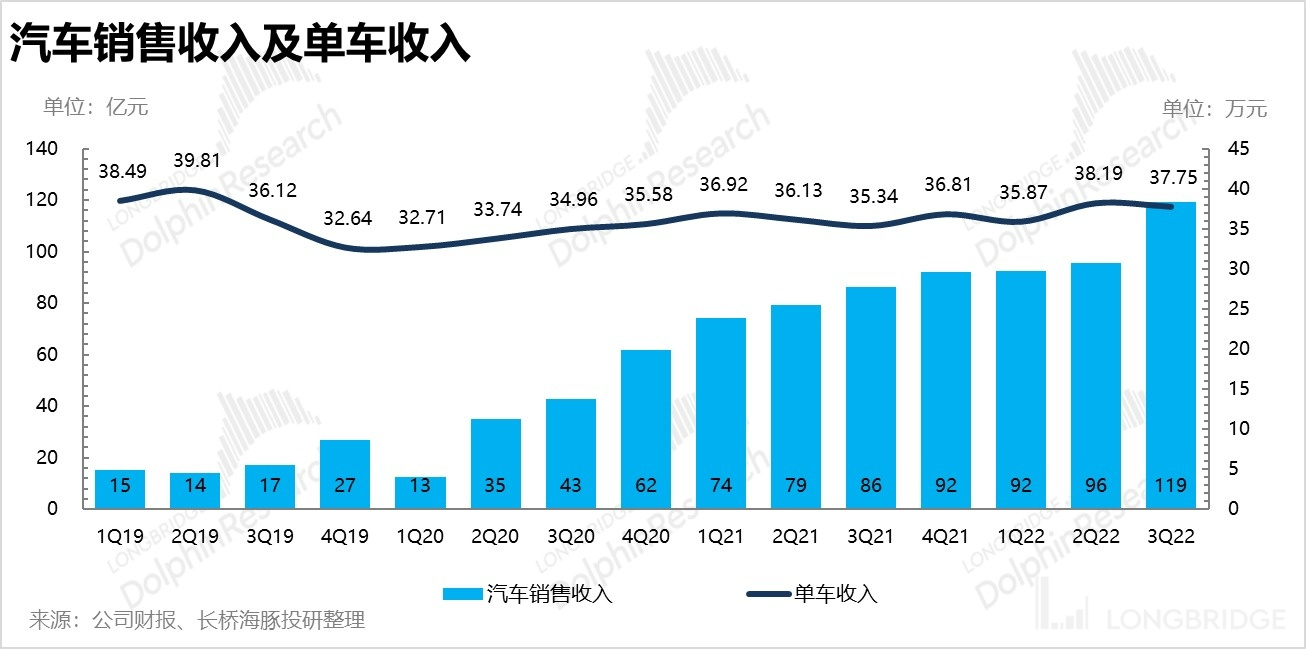

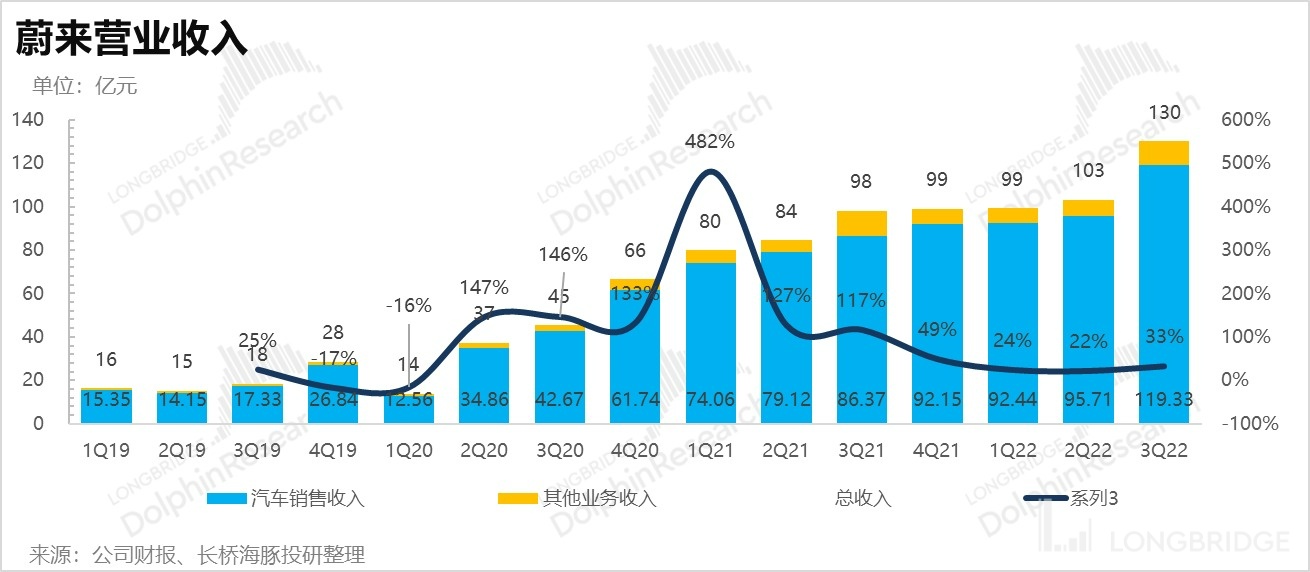

1. Poor sales volumes led to only satisfactory revenue: The Q3 revenue of 13 billion yuan was roughly in line with the market, and with known sales volumes, the revenue was neither good nor bad after taking into account car prices and other service-oriented business revenue, with nothing unexpected.

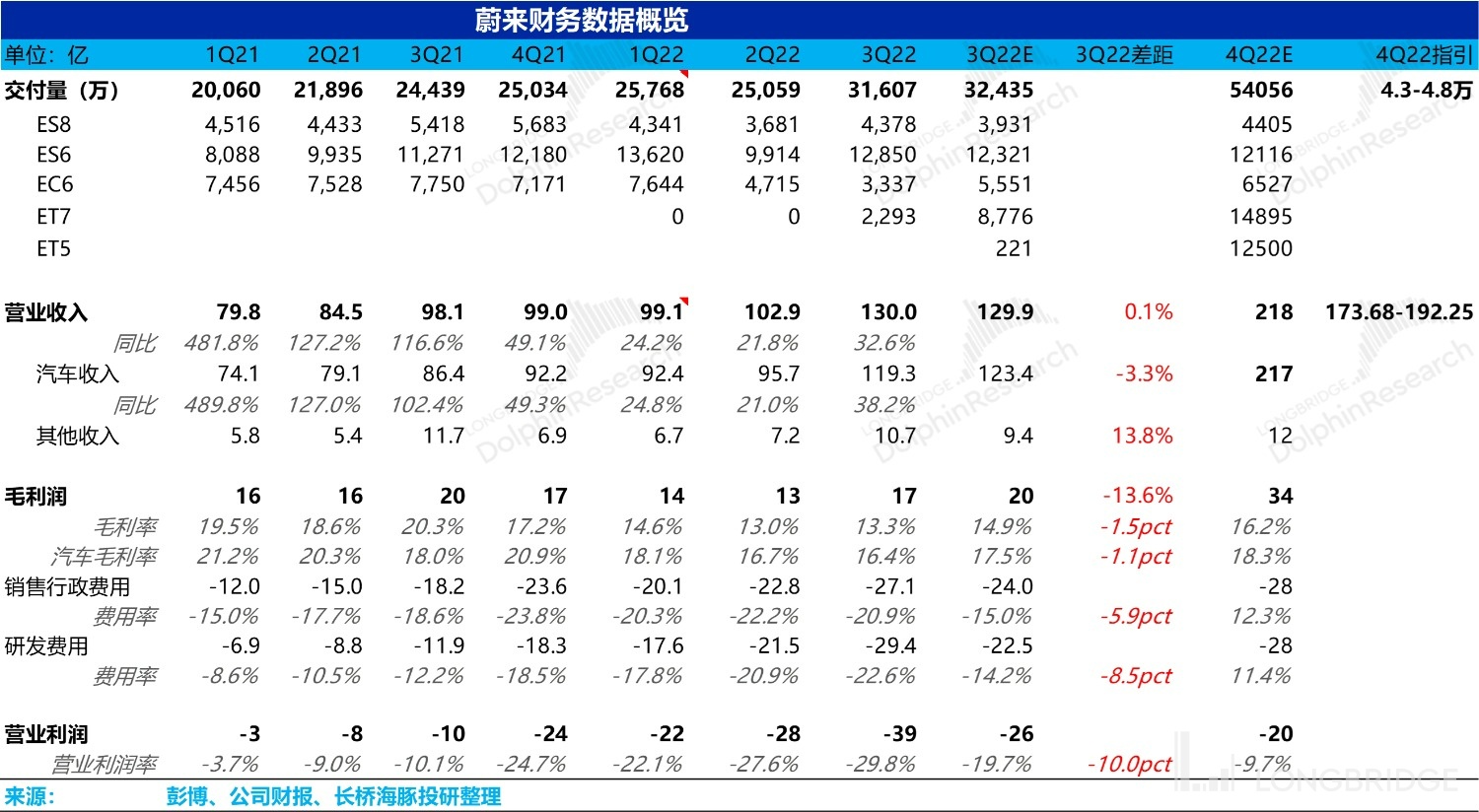

2. Mounting losses due to gross profit margin: This quarter's operating loss of nearly 4 billion yuan far exceeded the market's expected 2.6 billion yuan loss. The reason was the comprehensive drop in gross profit margin, research and development, and sales expenses. If research and development and sales were a continuation of the previous upward growth trend, at most they simply exceeded market expectations. The core issue this quarter was the absence of the expected improvement in car sales gross profit margin, which actually decreased compared to the previous quarter. Especially with car gross profit margin and sales volume guidance as two key indicators each quarter, the serious deviation from expectations seemed very concerning.

3. Fourth quarter guidance is disappointing again? The sales volume guidance for the fourth quarter is 43,000 to 48,000, which is significantly lower than the Bloomberg vendor's forecast of 54,000. The revenue guidance is also significantly lower than market expectations because of the difference in sales volume guidance.

Dolphin Analyst's overall view:

Compared to the market's expectations, Nio-SW.HK seemed to have failed on all key tracking indicators this quarter, especially on gross profit margin and car sales volume guidance, which have both suffered severe deviations.

It should be noted that at the beginning of this quarter, the market had originally thought that the price increase had fully taken effect, combining with the delivery of vehicles, and recovering from the impact of the epidemic in the second quarter. Nio-SG's automotive sales gross profit margin should have increased quarter-on-quarter; while for sales volume, the market thought that with the mass delivery of ET5 and other new cars, the sales volume would at least increase to around 50,000. However, the actual results seem to differ significantly from these expectations, even causing the Dolphin Analyst's judgment on Nio to have significant flaws.

However, given such poor performance in the context of TESLA's sales volume announcement around the Chinese 11-day holiday, TESLA's price cuts, and the fluctuations of the epidemic, pricing has likely already been factored in (during which time Nio's stock fell by about 50%), with even the suspicion of excessive pessimistic pricing.

So-called underperformance this quarter is lower than the "old expectations" of vendors before September, so focusing on the gap in expectations is not significant. From the actual results, the downward trend of gross profit margin is indeed a big problem, and it will most likely continue to decline. However, looking at the sales volume guidance, Nio's 43,000 to 48,000 sales volume guidance compared to the market's forecast of 54,000 units is not a significant deviation.

Looking ahead to next year, with the release of production capacity of major car companies, leaders and policy subsidies exit the market, price warfare is inevitable and reserved food supplies in this stage is the most important. Currently, Nio has 51.4 billion yuan in reserve food supplies (including cash and equivalents, restricted cash, short-term investments, and long-term deposits), as well as the momentum of being a high-end brand, and a clearly stratified product matrix. It has the confidence to cope with the fighting spirit in the domestic new auto industry. From this perspective, Dolphin Analyst believes that NIO has difficulty replicating the extreme valuation of nearly broken cash flow and the life-and-death situation in 2019. If we take the 1.6 times PS at that time as the bottom-line valuation of NIO, and now the stock price is at $9+, combined with the expected revenue of about 90-110 billion RMB next year, even if the 25% discount on expected revenue in 2023 can only be realized, the PS corresponding to the revenue of 70 billion in 2023 based on the current stock price is only 1.6 times.

Therefore, after the sufficient release of new car manufacturer's stock prices, in Dolphin Analyst's opinion, NIO should be the first new force that we pay attention to.

Later, Dolphin will summarize the minutes of this earnings conference call for everyone, and will focus on the orders and deliveries of ET 5 and ES 7, capacity ramp-up/exchange stations, next year's competitive expectations, and more importantly, the impact trend of new models and platforms on automobile gross profit margins. You can add Dolphin Assistant's WeChat "DolphinR123" to join the Dolphin Research and Communication Group and get the latest updates on the earnings conference call.

I. Disappointing Sales Prospects?

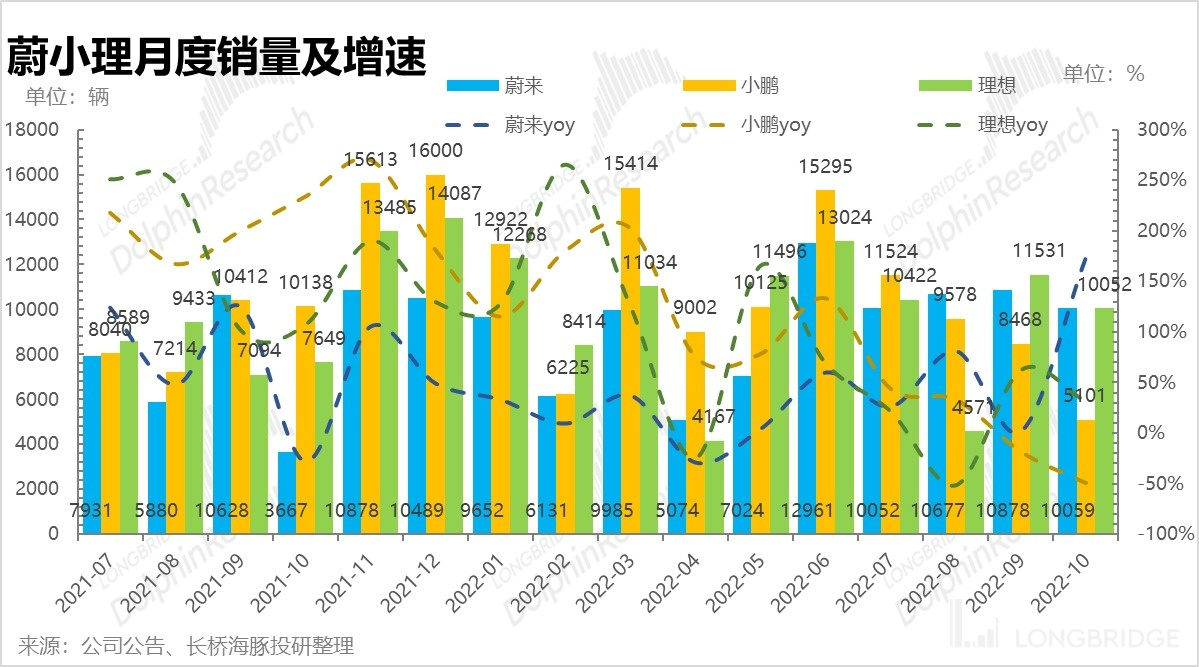

Currently, vehicle deliveries are the most critical indicator for new energy vehicle brands. But the monthly sales figures released by car companies are publicized at the beginning of each month, and the key to sales in each financial report is the guidance.

Sales outlook for the fourth quarter: NIO expects vehicle deliveries to be between 43,000 and 48,000 in the fourth quarter, as October deliveries were just over 10,000, implying new energy subsidies withdrawal, and single-month sales in December may reach 20,000.

Of course, increasing deliveries to 40,000-50,000 from around 30,000 in the previous quarter is a significant improvement. But with the release of ET 5 for delivery, the market had higher expectations.

For example, the consensus expectation for the fourth quarter on Bloomberg is 54,000 units. However, this expected data, in Dolphin Analyst's view, should be more of an expectation before October or before Tesla's price cuts. Considering Tesla's price cuts and recent fluctuations in the epidemic, the market may have lowered its expectations for fourth-quarter sales. Dolphin Analyst has seen some more recent expectations from major investment banks that are roughly around 48,000 units. From the perspective of the gap between actual and expected performance, NIO's sales guidance is not very disappointing.

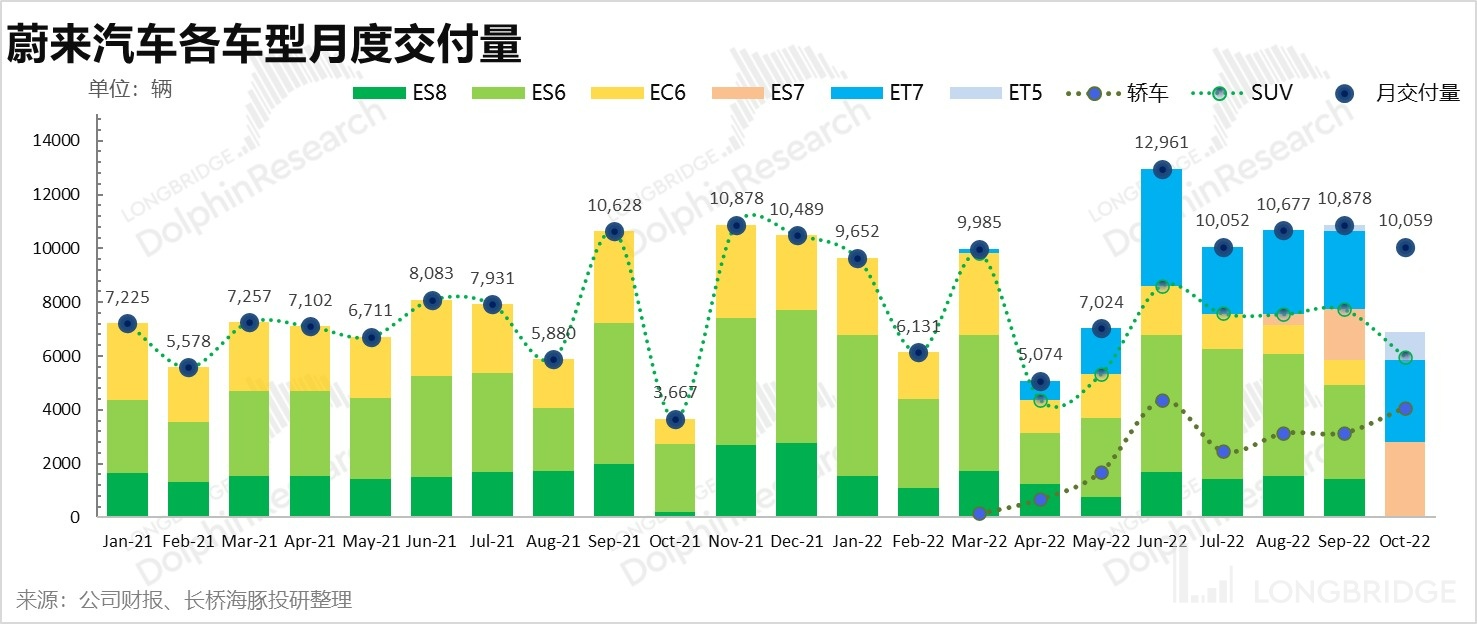

In terms of replacement models, 2022 is a transition year for NIO from SUV/sports sedans (ES8, ES6, EC6) to the NT2.0 platform (ET7, ES7, ET5).

Among them, the new sedan, ET7, began deliveries in March, with relatively low sales, with monthly sales basically staying around 3,000 units; the new SUV, ES7, began delivering several hundred units in August and nearly 3,000 units in October.

The market is most concerned about ET5, which began delivering in September and just over 1,000 units in October. The real volume should be in Q4, depending on the speed of capacity release, with the possibility of achieving over 10,000 units.

Q3 Actual Deliveries: NIO delivered 31,600 vehicles in Q3 2022, basically within the range of 31,000 to 33,000 vehicles outlined in the guidance, a YoY increase of 29%. As new cars gradually enter the delivery phase, NIO has indeed emerged from the replacement season, and overall sales are gradually warming up. However, the rate of recovery may not be as optimistic as the market expected.

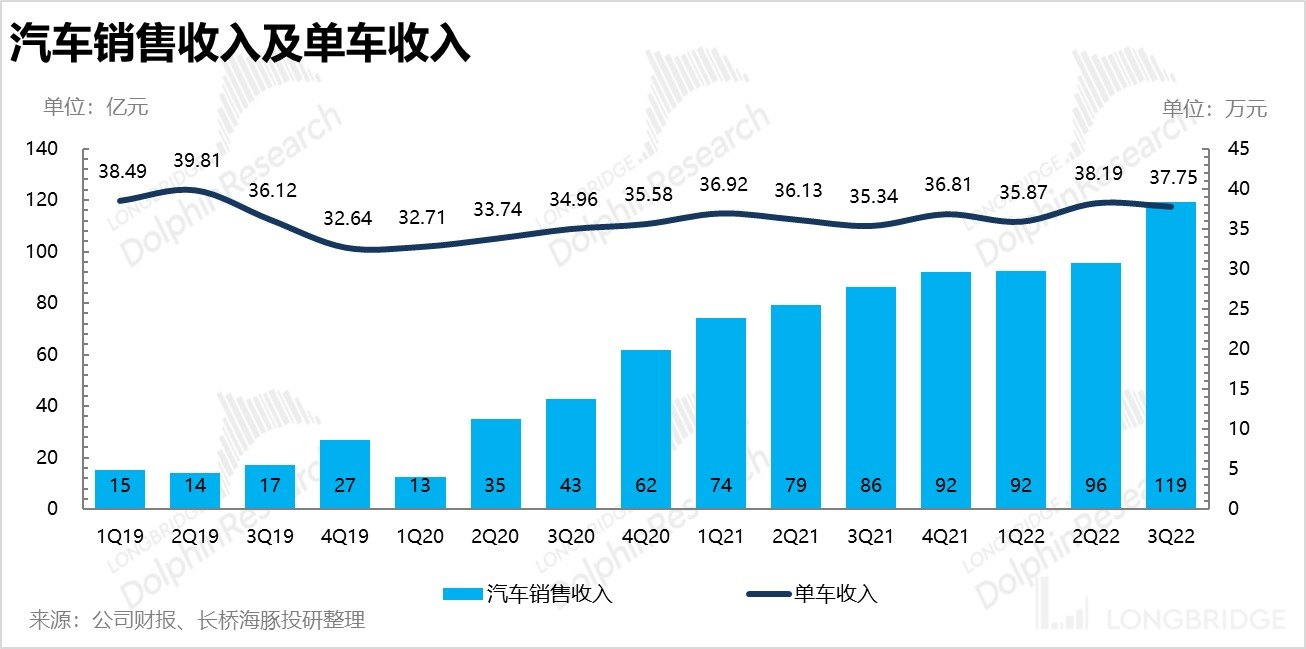

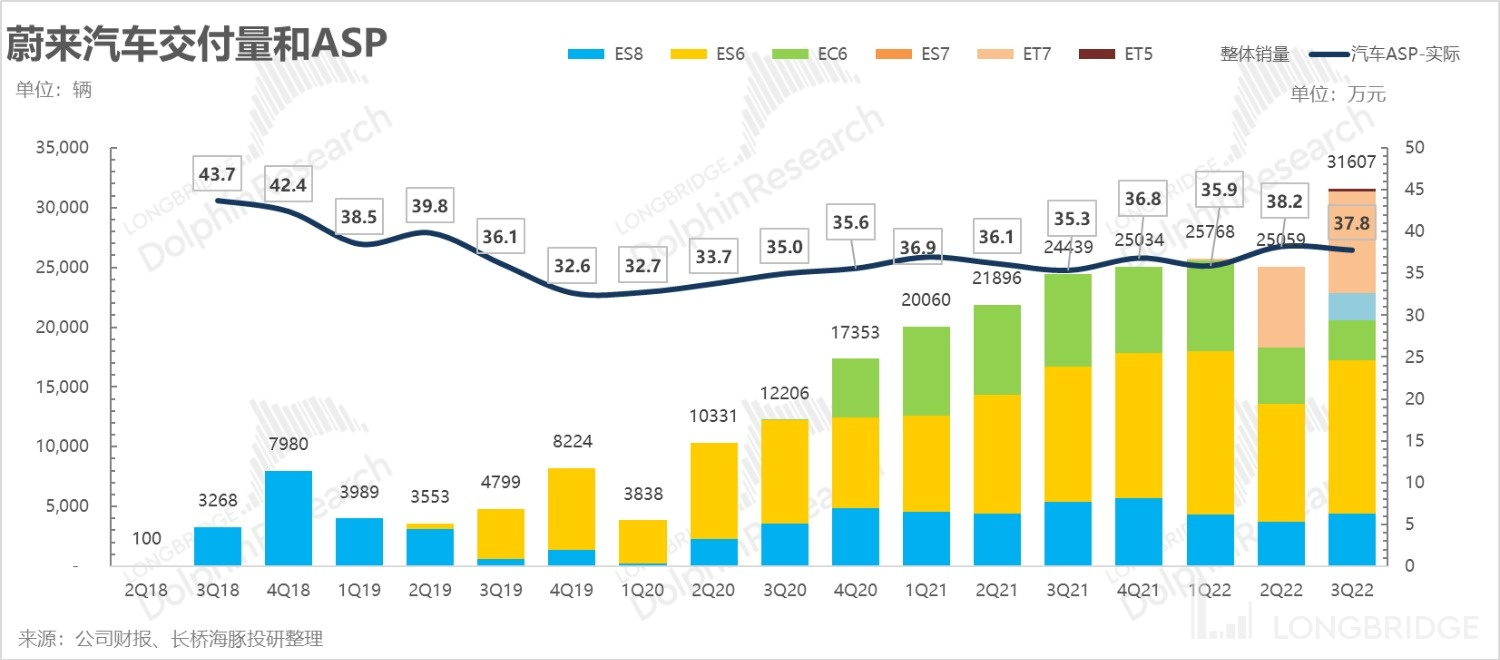

II. As Planned, Marginal Decline in Unit Price

Unit Price: In Q3, NIO's average unit revenue per vehicle was RMB 377,500, a YoY increase of RMB 24,000, but a QoQ decrease of RMB 4,400, mainly due to the increased proportion of sales of the ET5 model, which is priced lower. The decline was within expectations, so the average unit price is not a problem.

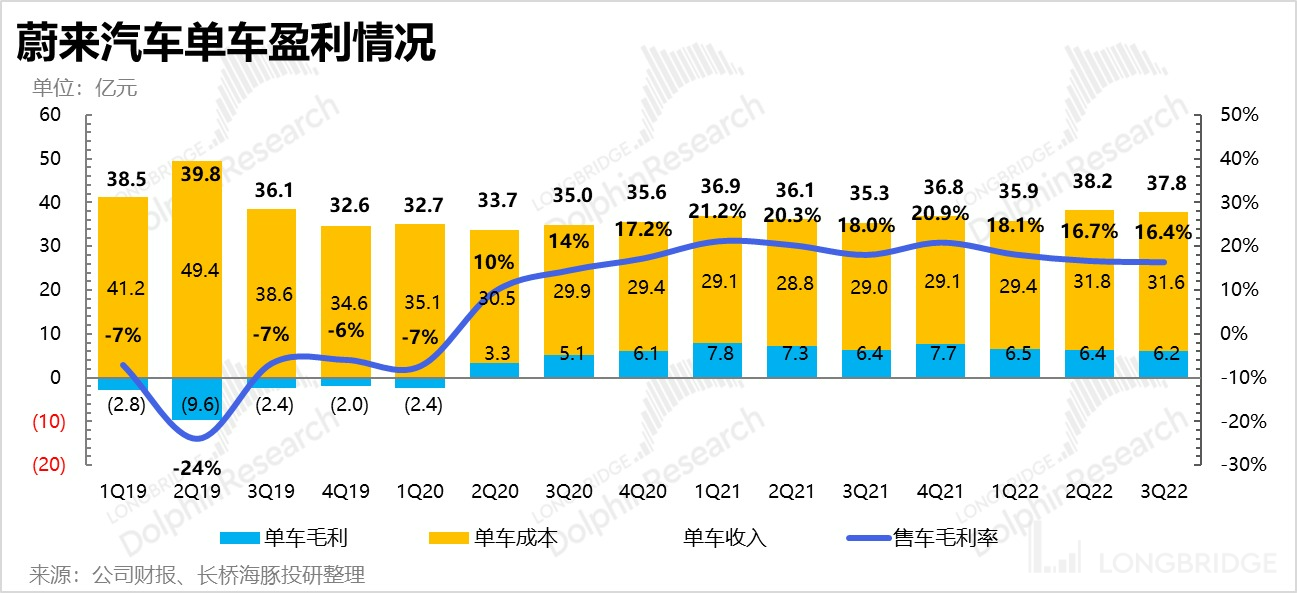

III. Downward Trend in Unit Profit?

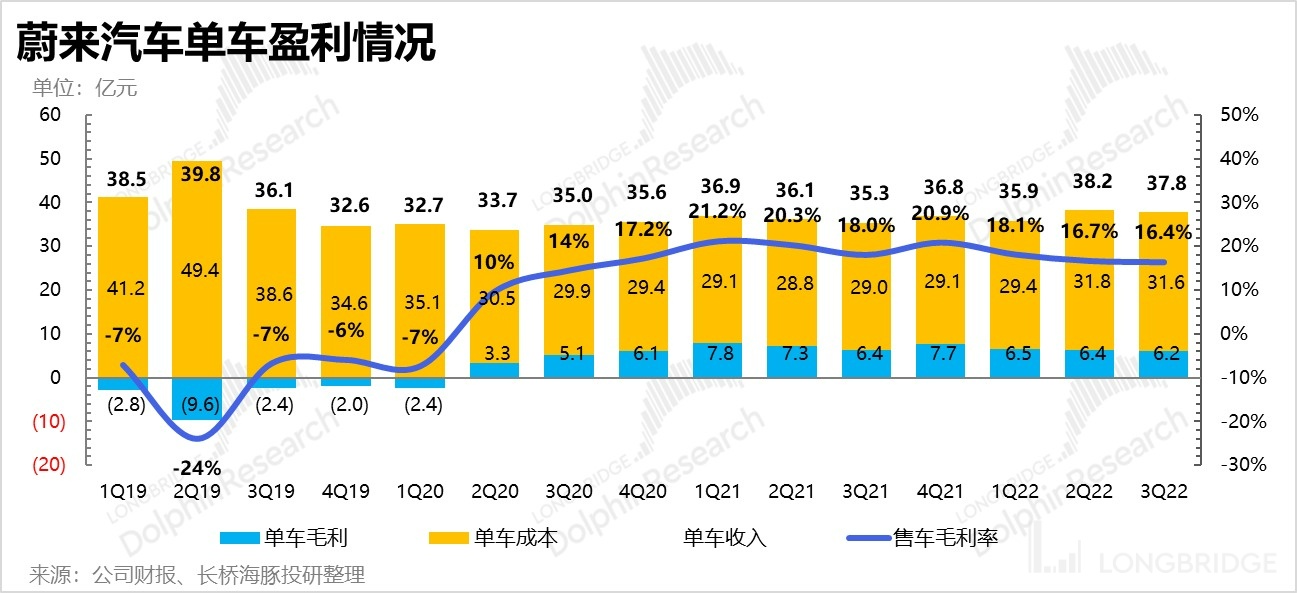

After a small recovery in Q2, the gross profit margin in Q3 once again showed a downward trend, falling to only 16.4%. Despite emerging from the impact of the pandemic, Q3 basically consists of new orders after price increases following deliveries. The market had expected a high automotive gross margin of 17.5%, but the automaker's gross margin did not improve. The Dolphin Analyst estimates that this may be related to the fact that the gross margin for new platform cars has not yet arrived. In Q3, each car sold made a gross profit of RMB 62,000, a decrease of RMB 1,800 compared to the previous quarter.

The problem now is that the downward trend in the gross profit margin is likely to continue. While NIO mainly sells domestically, competition has deteriorated dramatically in China, with Tesla directly reducing prices by RMB 10,000 to RMB 30,000 and indirectly reducing prices by buying insurance with lower premiums.

And the deterioration of the gross profit margin is likely to continue: The Dolphin Analyst noted that some of NIO's models have started to reduce prices, such as the EC6 produced on the old platform, with price reductions of around RMB 10,000. At the same time, lithium ore prices have risen to RMB 600,000 per tonne and after the subsidy decline in December, the automakers, including NIO, are likely to have to absorb the impact of subsidy decline themselves, without being able to transfer it to consumers. The overall situation can be said to be worsening. The Dolphin Analyst has already analyzed this issue in the Tesla earnings call. Section 4: Other Businesses: Increase in Points and Reduction in Losses

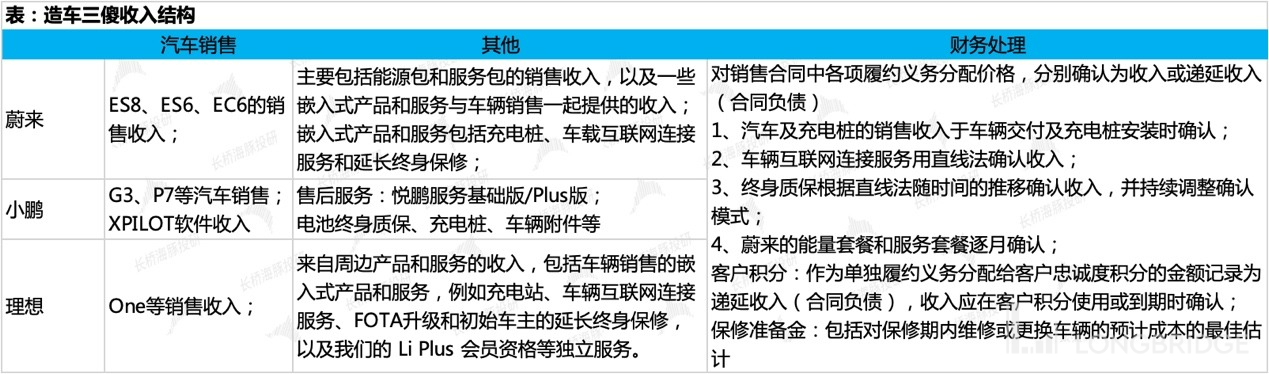

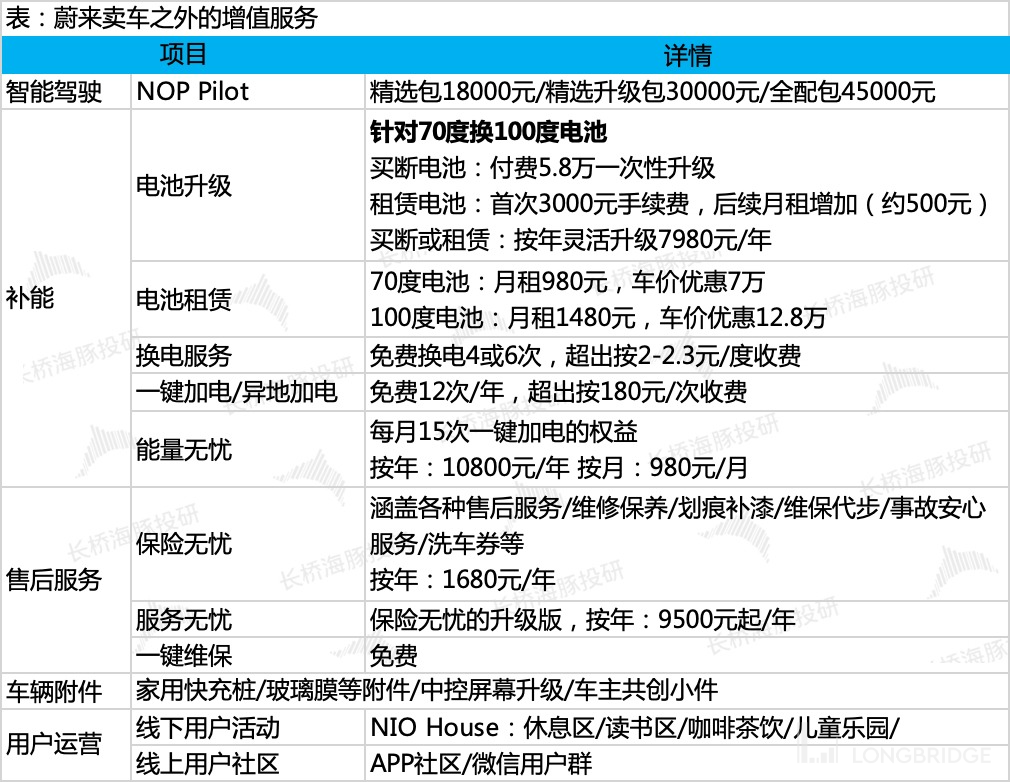

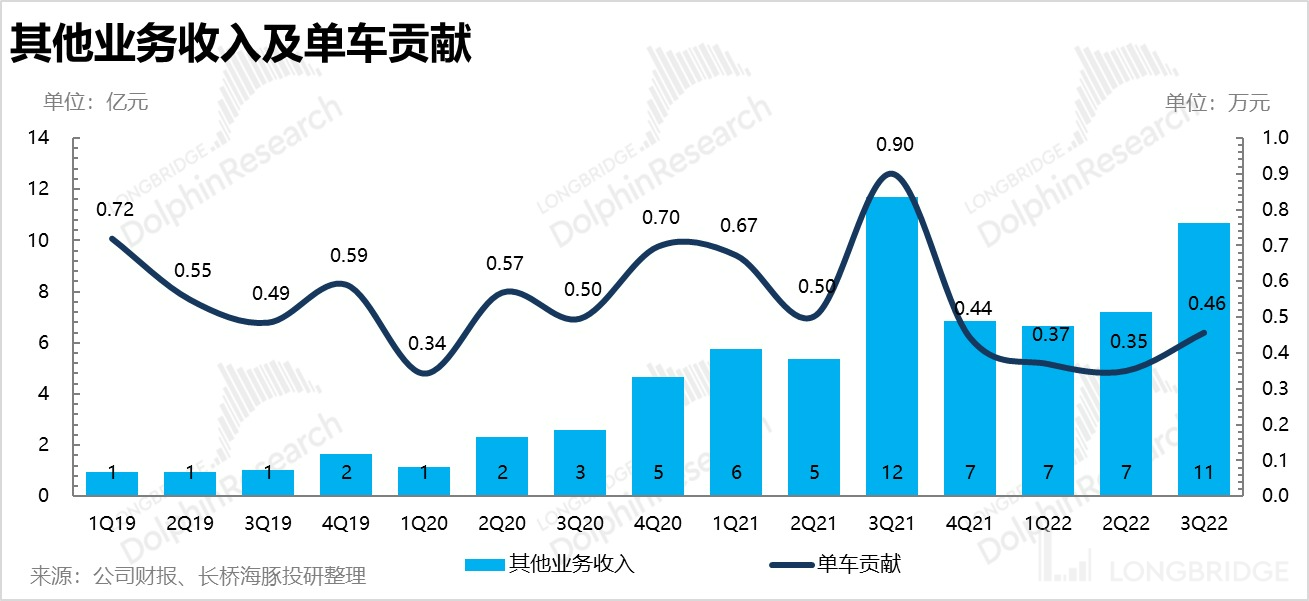

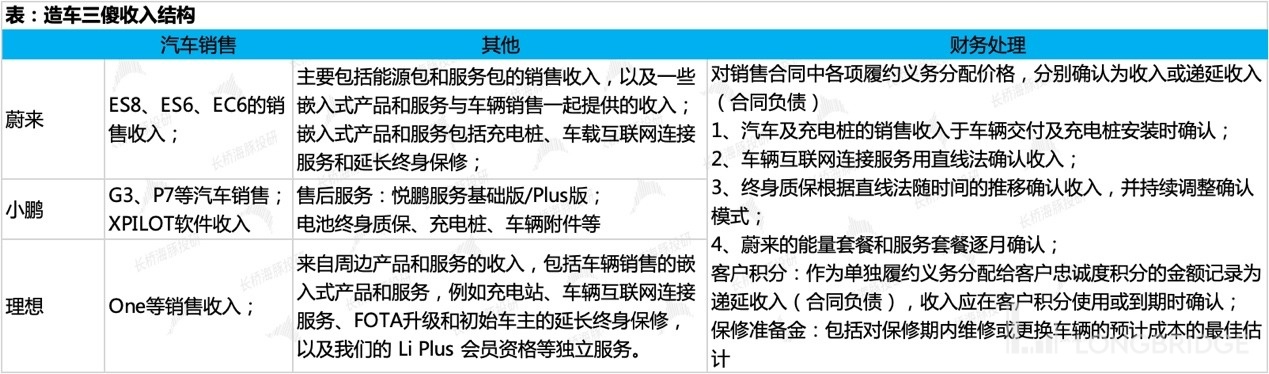

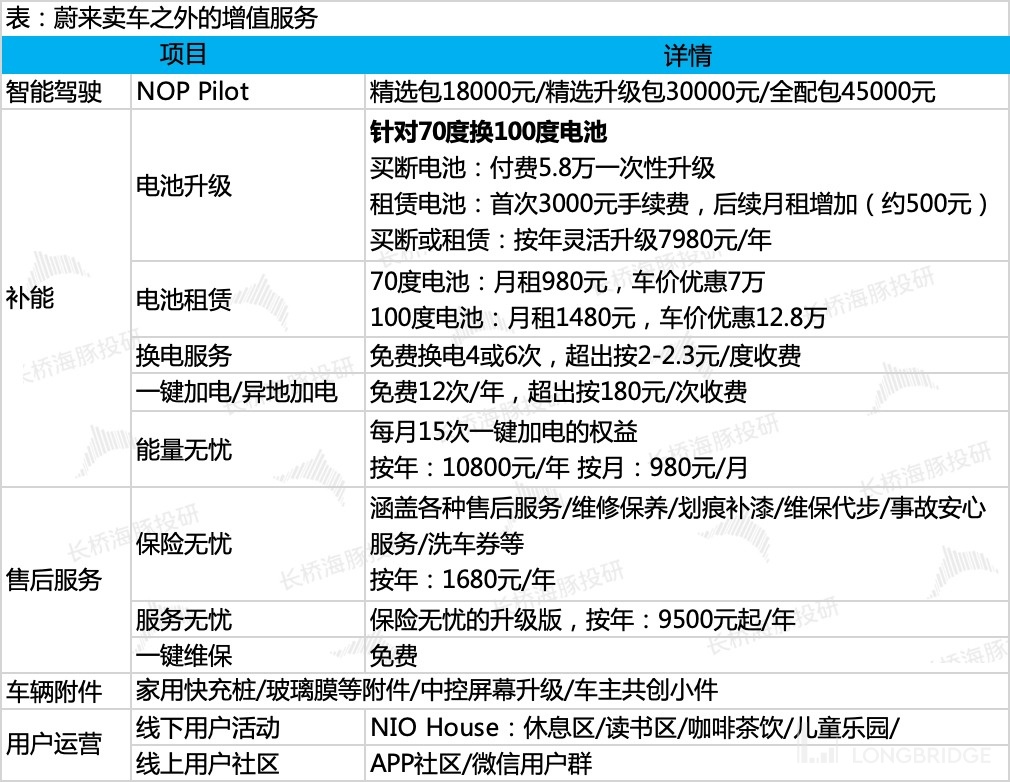

In addition to car sales, NIO's other businesses mainly include the sales revenue of energy packages and service packages, as well as revenue generated by embedded products and services such as charging stations and vehicle connectivity services that are sold together with vehicle sales. The company has always maintained a high-end strategic positioning and hopes to bring better services and experiences to car owners through better brand management and user community with good gross margins.

Data source: company financial report, Dolphin investment research

Data source: company official website, Dolphin investment research

In addition, at the NIO Berlin conference in October, the company mainly used fixed leases and floating subscriptions to charge for models sold overseas. For example, the rental period provided by fixed leases generally lasts for 1-5 years and adopts a fixed monthly rent; while short-term flexible rental can be subscribed monthly. Short-term subscriptions can be cancelled at any time two weeks in advance of the current month's subscription, and vehicles can be replaced at will. As the vehicle age increases, the monthly fee will be correspondingly reduced.

This income will also be reflected in other income in the future, rather than among car sales income. In the future, of course, direct car sales to users in Europe will also be launched, but the volume is estimated to be relatively late.

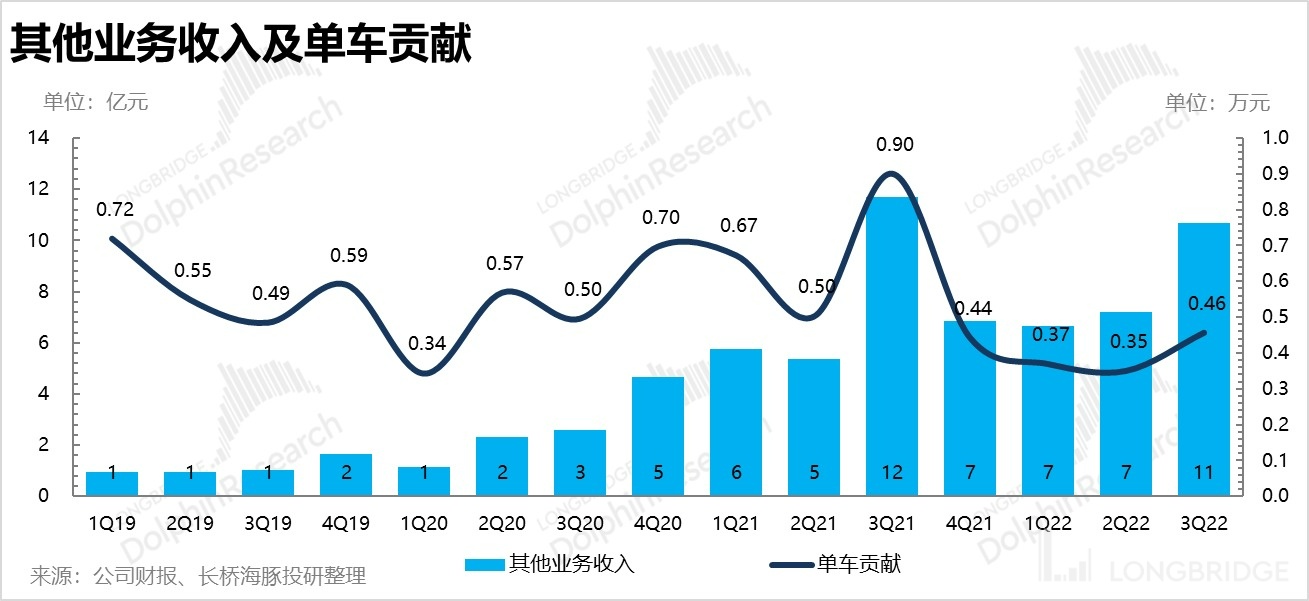

In the third quarter of 2022, the company's other businesses achieved revenue of 1.069 billion yuan, an increase of 26% quarter-on-quarter, and a gross margin of -20.5%. Due to the improvement in regulatory point income, both revenue and gross margin have improved.

Based on the cumulative delivery volume, the inventory of cars in this quarter contributed 4,600 yuan per car, mainly due to the temporary increase in regulatory points recorded this quarter.

Section 5: Overall Business: All Problems Arise from Gross Margin Decline and Sales Guidance Difference

In the third quarter, the company achieved a revenue of 13 billion yuan, a year-on-year increase of 33%. Both the car price and other income are basically in line with the market expectations after adjustment.

Fourth quarter revenue guidance: Between 17.4-19.2 billion yuan, significantly lower than the market expectation of 21.8 billion, but this is mainly because the old market expectation was too high for the fourth quarter sales expectation, and the recent company's plummeting stock price has actually priced in even overly pessimistic sales expectations. This guidance implies that the fourth quarter unit car price will decrease by about 10,000 yuan compared to the third quarter, based on the consistency with market expectations on unit price upward. Mao Li: Due to the poor gross margin of the automotive business, the actual overall gross margin is 13.3%, which is 1.5 percentage points lower than the market expectation, and the gap is large. As Dolphin Analyst mentioned earlier, in the short-term outlook, the gross margin will only get worse.

4. New Cars + New Market Investment Period, with a Single-Quarter Loss of Nearly 4 Billion

The decline in gross profit per vehicle, the development of new car models and technologies, and the expansion of new overseas markets have led to a significant loss for NIO this quarter, greatly exceeding market expectations.

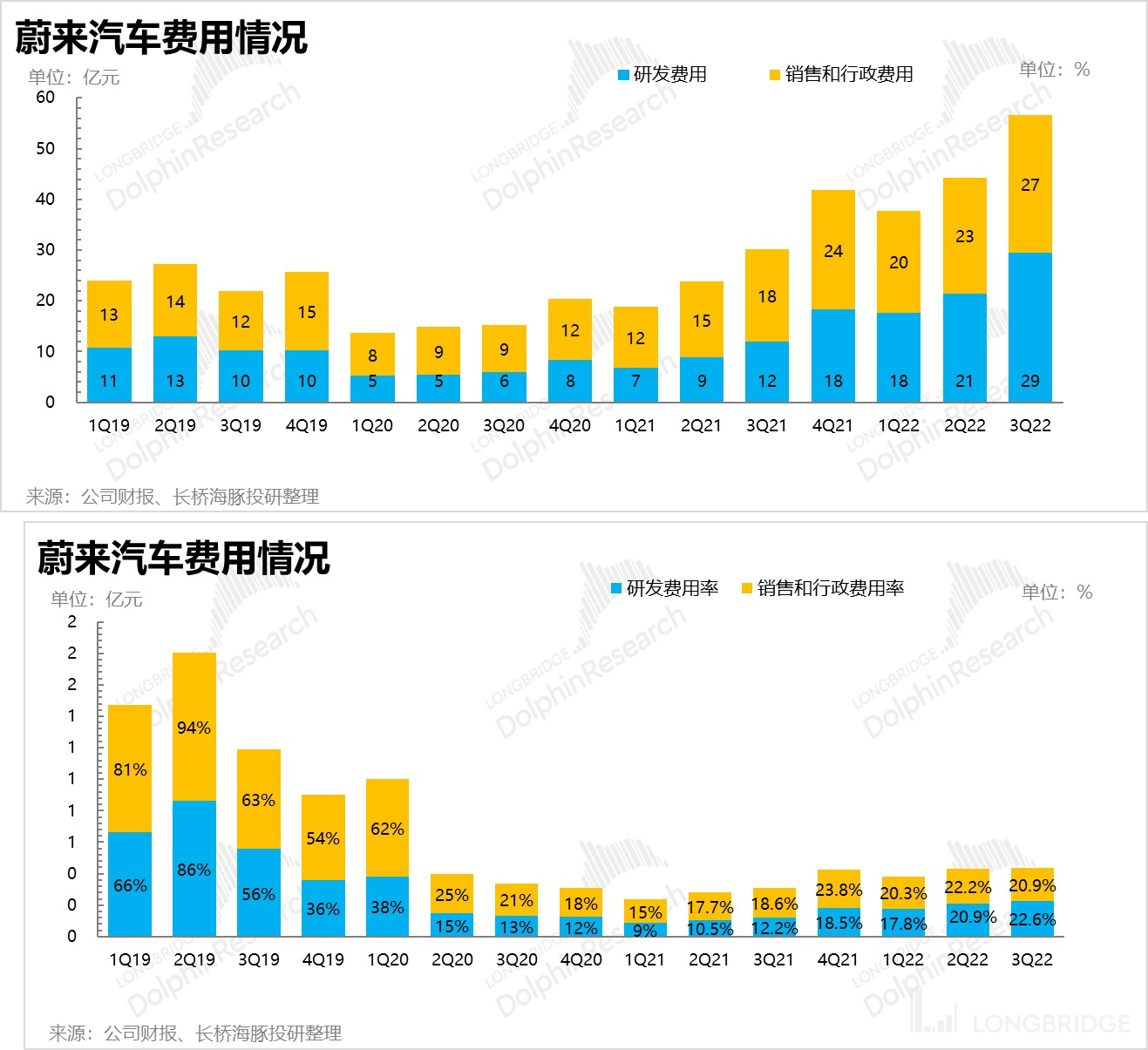

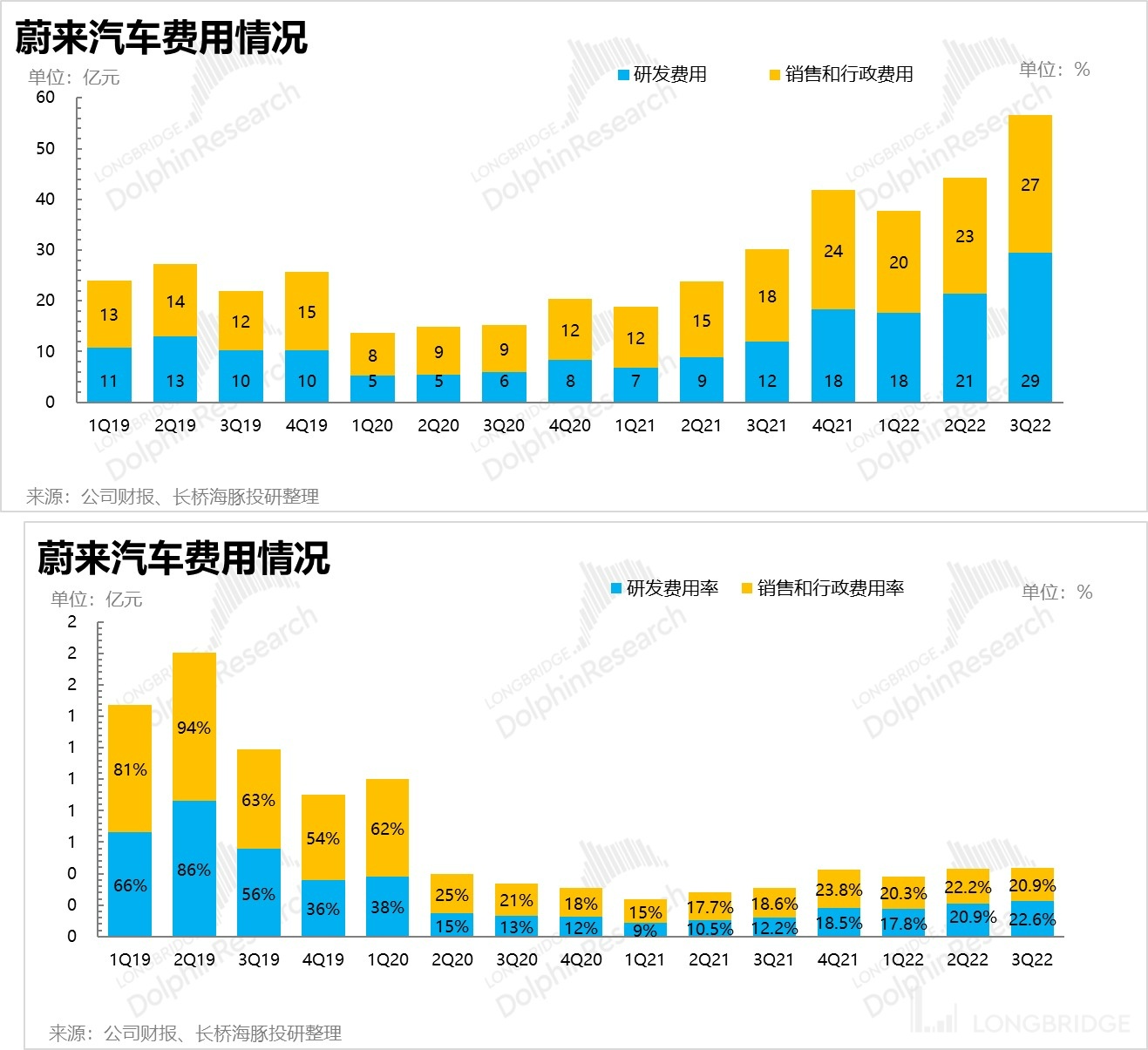

1) Uncontrollable R&D expenses: The company's R&D expenses totaled RMB 2.9 billion, with an expense ratio skyrocketing to 23%. The increase in income has been unable to keep up with the rapid rise in R&D investment even after sales volumes have gradually recovered.

With the current need for R&D in new brands, car models, production capacity, battery technology, autonomous driving, chips, and other areas, R&D investment can only continue to climb. It's apparent that with slower sales volume recovery this quarter, there was no dilution effect. But after the true mass sales of the ET5 in the next quarter, the R&D expense ratio should decrease somewhat.

2) Unable to control sales and administrative expenses: The sales expenses of RMB 2.7 billion this quarter also exceeded market expectations. In the absence of any significant new car release in the third quarter, sales volume was not expected to be too high. In reality, however, there were no signs of a slowdown in sales expenses, with an expense ratio of 20.9%, which was lower than the previous quarter mainly due to growth in car sales.

Overall, due to the relatively poor automobile gross margin and fixed investments in R&D and sales, profitability further deteriorated, with NIO's operating loss reaching as much as RMB 3.9 billion, and the loss rate further increasing to 30%, far more than the expected loss rate of 20%.

Moreover, from the outlook, due to subsidy reduction and price competition, there is a high possibility of further declining gross margins in 2023. The only hope for improvement is to reduce R&D and sales investments by expanding sales volumes.

Fortunately, NIO still has a certain brand momentum and relatively complete product matrix at this stage. Price reductions may bring about growth in sales volume. Furthermore, with a 51.4 billion yuan war chest in reserve (including cash and cash equivalents, restricted cash, short-term investments, and long-term deposits), NIO is perhaps the most well-funded among China's new car makers. Even with the stock market dropping NIO's market value to $15 billion, the Dolphin thinks the market's judgment on NIO's ability to resist competition is too pessimistic.

For more extensive research and tracking comments on NIO from Dolphin, click here:

The Financial Report:

September 7, 2022, Report Analysis《Don't be frightened by the exploding loss, NIO is heading towards better days》 On September 7, 2022, the "Capacity is the bottleneck, and sales reach a new high every month in the fourth quarter" conference call summary was released.

On June 29, 2022, "This bearish report on NIO can be more sincere" was reviewed as a hot topic.

On June 16, 2022, the New Car Release Summary: "Rapid Release and Delivery, NIO has hope in the second half of the year".

On June 9, 2022, the Q1 earnings report was interpreted in "NIO remains weak, relying solely on new cars for confidence?"

On June 9, 2022, the Q1 earnings conference call summary was released: "Gross profit margin will be worse in Q2, NIO needs to bounce back in the second half of the year".

On March 25, 2022, the 2021 Q4 report was reviewed: "NIO: Under Pressure, Will the Future Be Continued Darkness or the Arrival of Dawn?"

On March 35, 2021, the 2021 Q4 report conference call summary was released: "2022 is a year of full acceleration for NIO".

On November 10, 2021, the 2021 Q3 report was reviewed: "NIO: After the "Ankle Strike", Will It Perform Deep Squats and Jumps in the First Half of Next Year?"

On November 10, 2021, the 2021 Q3 report conference call summary was released: "NIO: There is no need to worry excessively about the stage delivery slowdown and gross margin pressure (meeting summary)". On August 12, 2021, Dolphin Analyst commented on the second quarter report in "Wave Goodbye to the Outbreak Period. What Will NIO's Future Depend On?"

On August 15, 2021, Dolphin Analyst updated the view on the second quarter report in "NIO: High Valuation vs. Low Delivery, Be Careful of the "Future" in Front of You."

Investigation

On December 21, 2021, the Dolphin team investigated the launch of the best-selling model "ET5" in NIO Day, aiming to reignite the "future."

In-depth

On June 9, 2021, the comparative study of three new forces in the automotive industry-Part 1: "New Forces in the Car-Making Industry (Part 1): Choose the Right People and Do the Right Things, and Discuss the People and Events of the New Forces."

On June 23, 2021, the comparative study of three new forces in the automotive industry-Part 2: "New Forces in the Car-Making Industry (Part 2): With the Declining Enthusiasm of the Market, What Does Three Musketeers Use to Consolidate Their Position?"

On June 30, 2021, the comparative study of three new forces in the automotive industry-Part 3: "New Forces in the Car-Making Industry (Part 3): 50 Days of Doubling, Can Three Musketeers Continue to Run Wild?"

Risk Disclosure and Statement in This Article: Dolphin Disclaimer and General Disclosure