Pan-entertainment "Opening Red", who will have a more lasting rebound, Tencent or Bilibili?

Hello everyone, I am Dolphin Analyst!

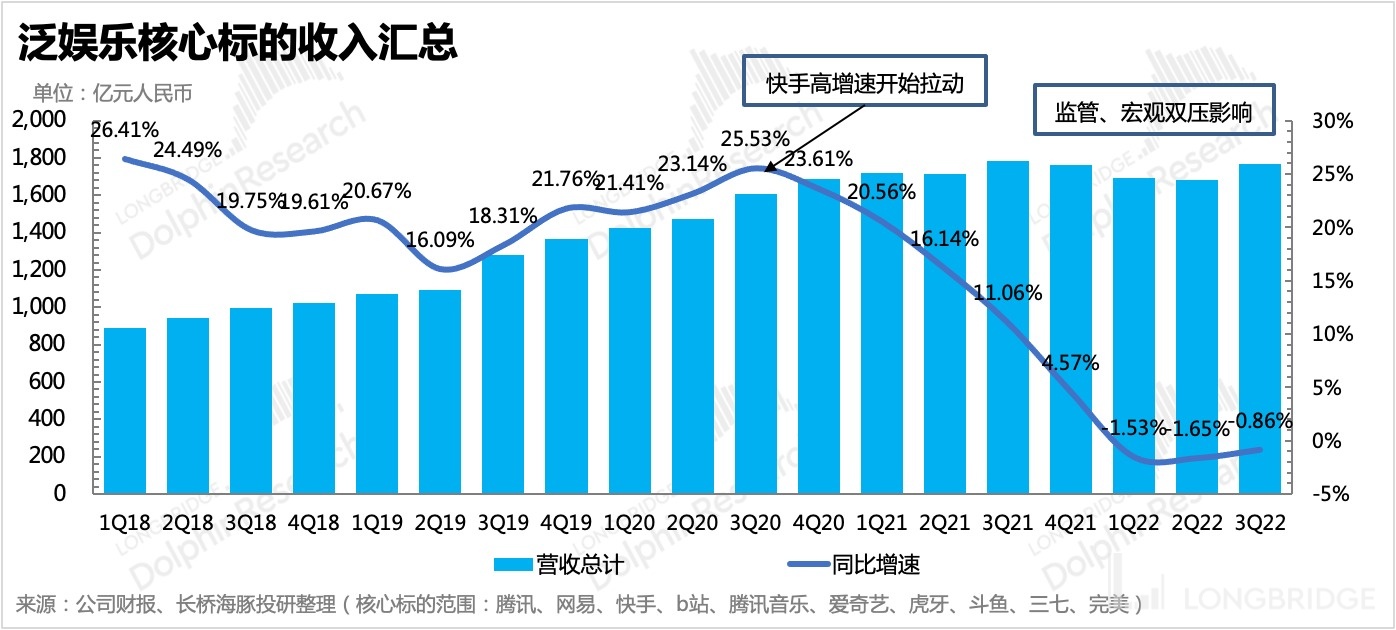

After the third quarter report baptism, reducing costs and increasing efficiency is still the main theme of the financial reports of pan-entertainment platforms. However, under the market expectations of continuous decline, the performance of the pan-entertainment platforms looks less bad. Because most platforms exceeded market expectations in terms of reducing costs and increasing efficiency, despite the mediocre revenue performance, the profit or loss showed many surprises.

Some opinions believe that although 2023 is regarded as the starting point for economic recovery, for online entertainment platforms, if the situation after the relaxation in the United States is referenced, the elastic recovery of its performance may be affected by the fading of the "home economy" after the epidemic. But Dolphin Analyst does not think so. Unlike the European and American markets, the potential demand for entertainment in China has not been fully stimulated, and the overall market size is more affected by the supply of content.

In the 2022 blockade of the epidemic, due to supervision and macro double pressure, the supply of content was severely limited, and the epidemic dividend in 2020 did not continue. Therefore, when offline activities are released in 2023, online entertainment is not affected by the high base number of the European and American markets.

For pan-entertainment in 2023, it is more suitable to be regarded as a period of returning to a normal operating environment. At this time, the focus of attention should not be on the space for reducing costs and increasing efficiency after tightening belts. A platform whose income has no long-term imagination and can only rely on continuous contraction to obtain profits has a low possibility of continuing to bounce after the valuation rebounds, and performance will immediately return to its original state.

On the contrary, we pay more attention to platforms with their own track and competitive barriers and sustainable business models. In other words, after returning to normal period, the competition is not just about who can create profitable value, but also the emphasis on sustainability.

First of all, we believe that the pan-entertainment in 2023 will continue to enjoy the industry beta dividend, especially in the gaming and movie industries with significantly improved industry supply. However, the individual stocks we should focus on mainly perform as high operational efficiency, which will not only drive profit growth but also lead peer companies in organizational efficiency.

Combining two criteria of certainty and rebound space, Dolphin Analyst believes that;

1) Tencent Holdings Ltd. is still our top choice;

2) Secondly, Kuaishou Technology, with relatively considerable rebound space, but the risk-reward ratio is slightly worse. Kuaishou also needs to be closely monitored in the face of intensified competition this year, especially whether the high marketing expenses can be effectively optimized according to the expected slowing trend in the face of intensified competition.

3) Although Bilibili Inc. has imagination, whether it can land in the end still depends on the management's organizational efficiency. Its uncertainty is relatively high. We tend to find a more suitable position;

4) Love Bargain US and Tencent Music Entertainment Group, Dolphin Analyst believes that the main business does not have enough growth potential, and the current rebound is basically in place. If there is an opportunity for a pullback, the certainty of Tencent Music Entertainment Group is higher than that of Love Bargain.

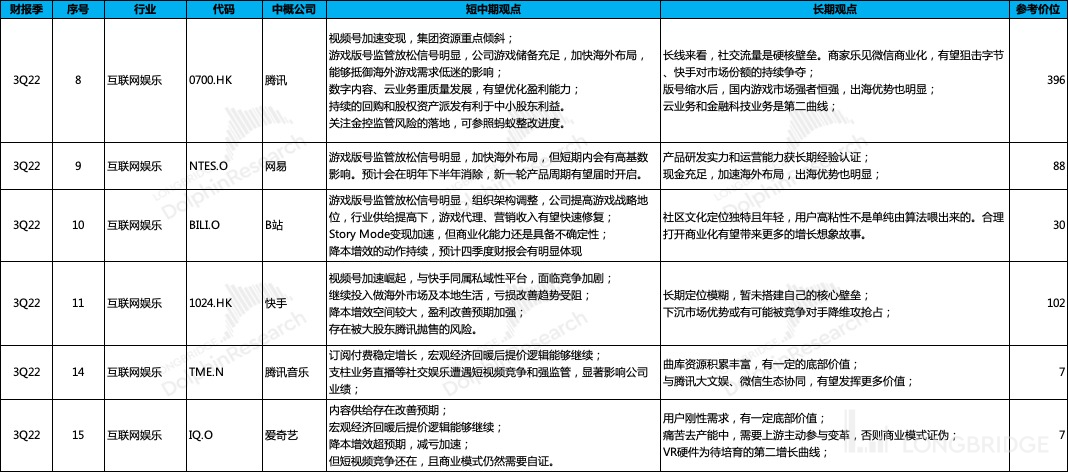

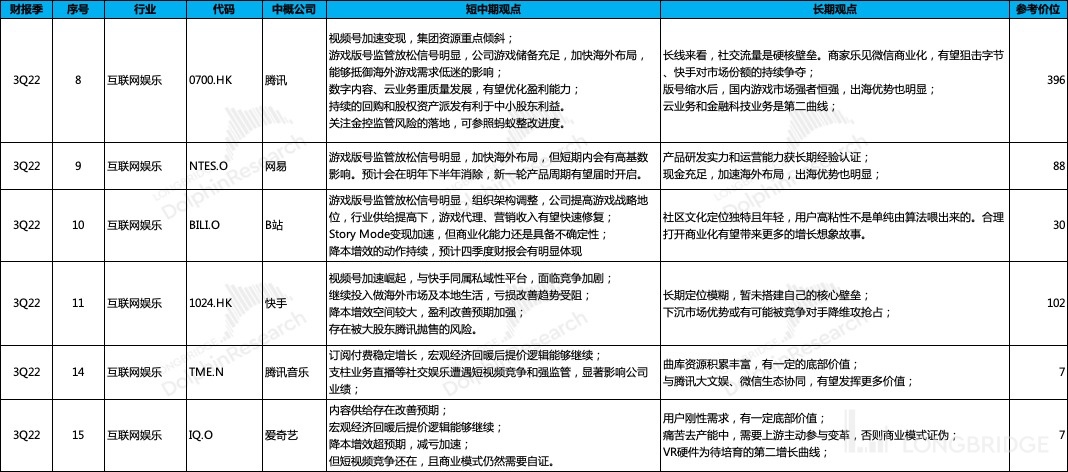

A summary of the investment logic of specific individual stocks is as follows:

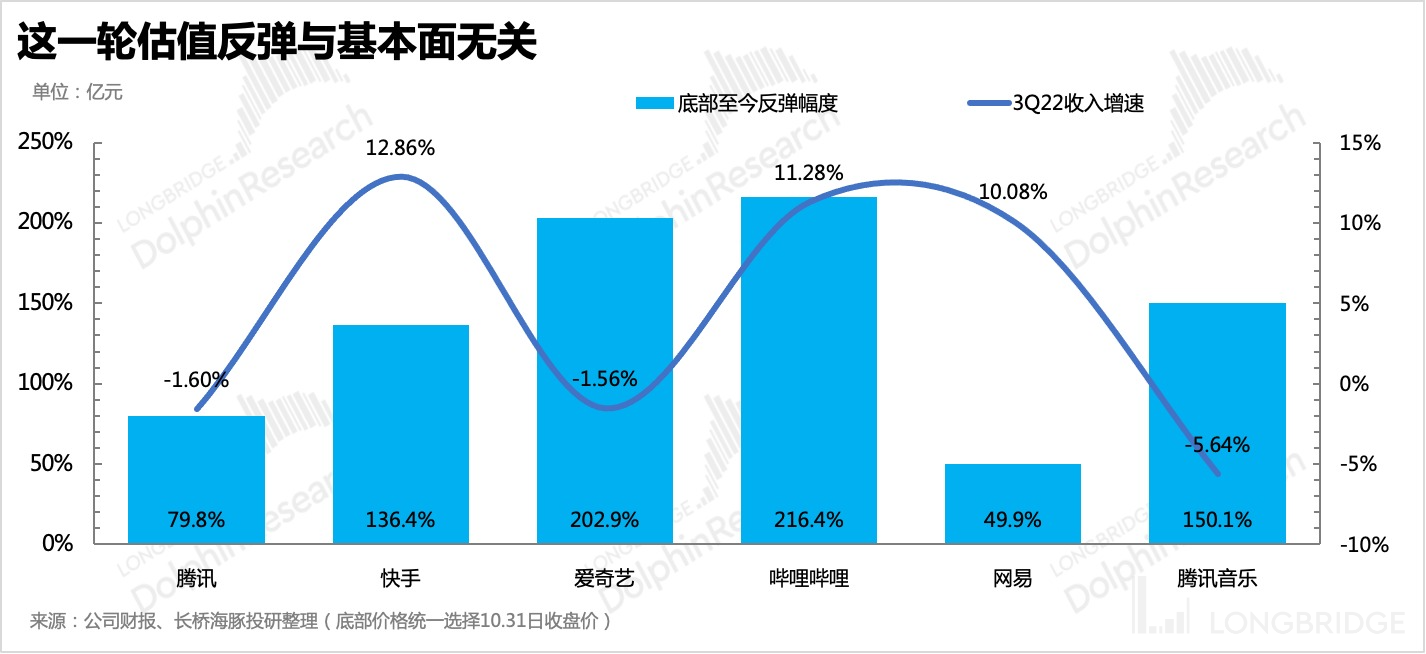

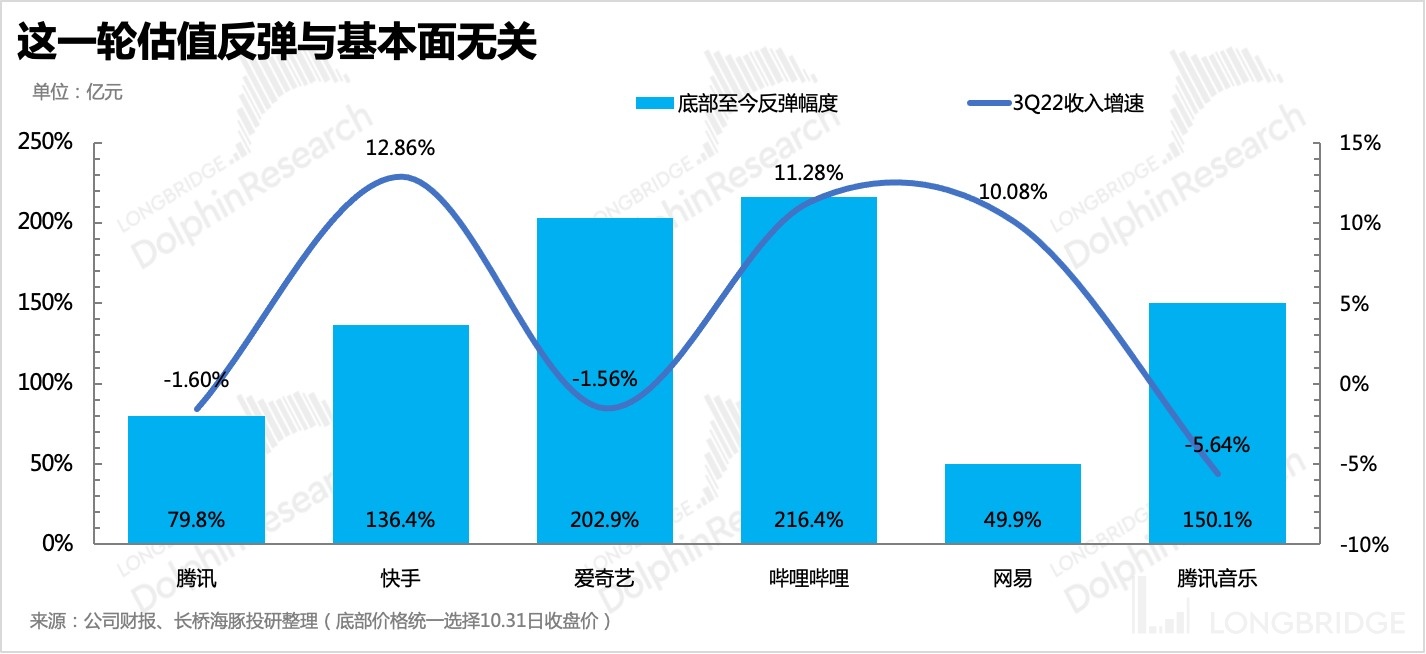

1. One round of valuation repair unrelated to fundamentals

As the US dollar interest rate peaks, China's epidemic prevention policy is adjusted, and the continuous release of regulatory relaxation signals, the Chinese companies that have had a tragic year sent themselves to the throne of annual explosive chicken in a wave of strong rebound.

Among the several stocks with the most violent rebounds, they appeared in the entertainment sector that is usually not well-regarded. As the cultural content consumption with the strictest regulation and the earliest reduction in expenses under the economic downturn, this year’s days are particularly difficult. Until the third quarter, the main tone of each financial report was still to reduce costs and increase efficiency, and to survive with a broken arm. However, it is precisely these types of growth stories in the past that need to tell the story of turning adversity into a reversal of fortune. The "magic tickets" that are supposed to be bad, such as iQiyi and B station, are in a leading position in this round of rebound.

In the early stage of the influx of funds and the phase of boosting industry valuation, it often mainly manifests as the "group dance" of uncertain tickets. But more solid reversal still needs to return to the fundamentals of the company. Especially for online entertainment platforms, in 2023, they may still face the uncertain impact of offline entertainment diversion and multiple expectations of whether consumption will have a strong recovery. (See Dolphin Analyst's consumption "[Two Years of Escape End, and Big Consumption "Return with a Vengeance"] (https://longportapp.com/topics/3825653?invite-code=032064)" and the overview of pan-retail "[Attack and Defense Reversal, "Alibaba, Ctrip, Didi" Will Counterattack] (https://longportapp.com/topics/3829490?invite-code=032064)").

In an uncertain environment, Dolphin Analyst will still focus more on companies with more deterministic performance.

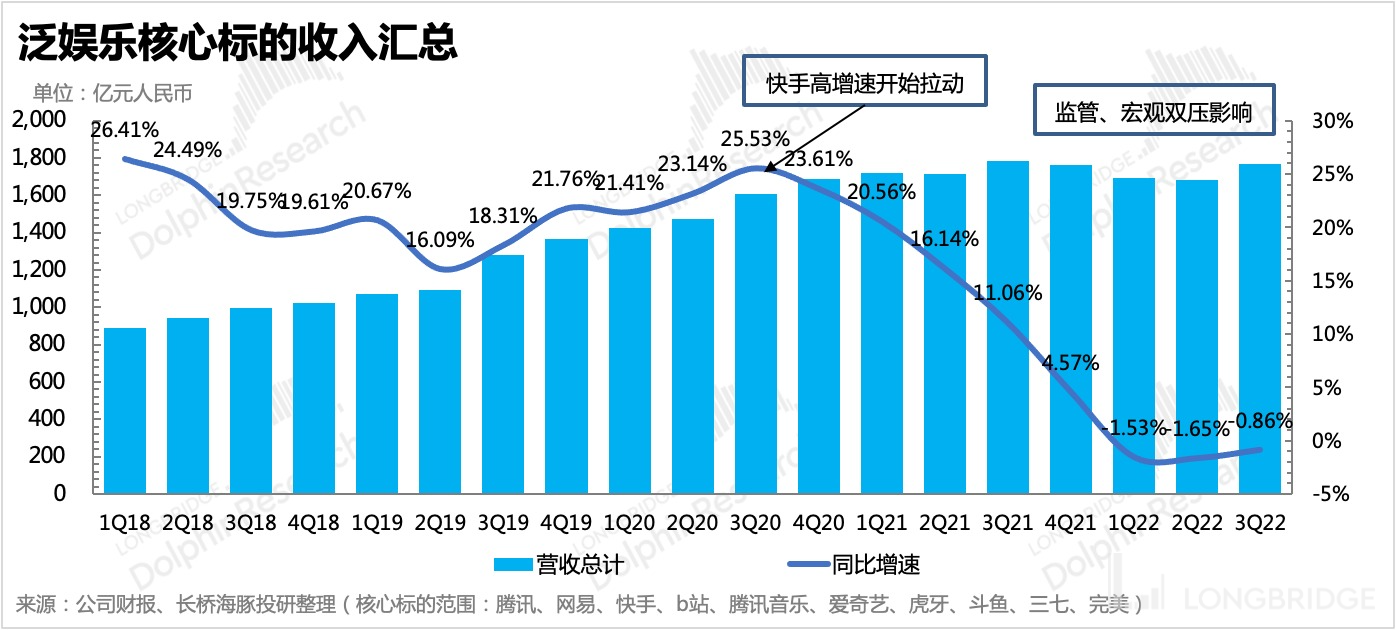

2. Review of Q3 reports: "Reducing Costs and Increasing Efficiency" beyond expectations

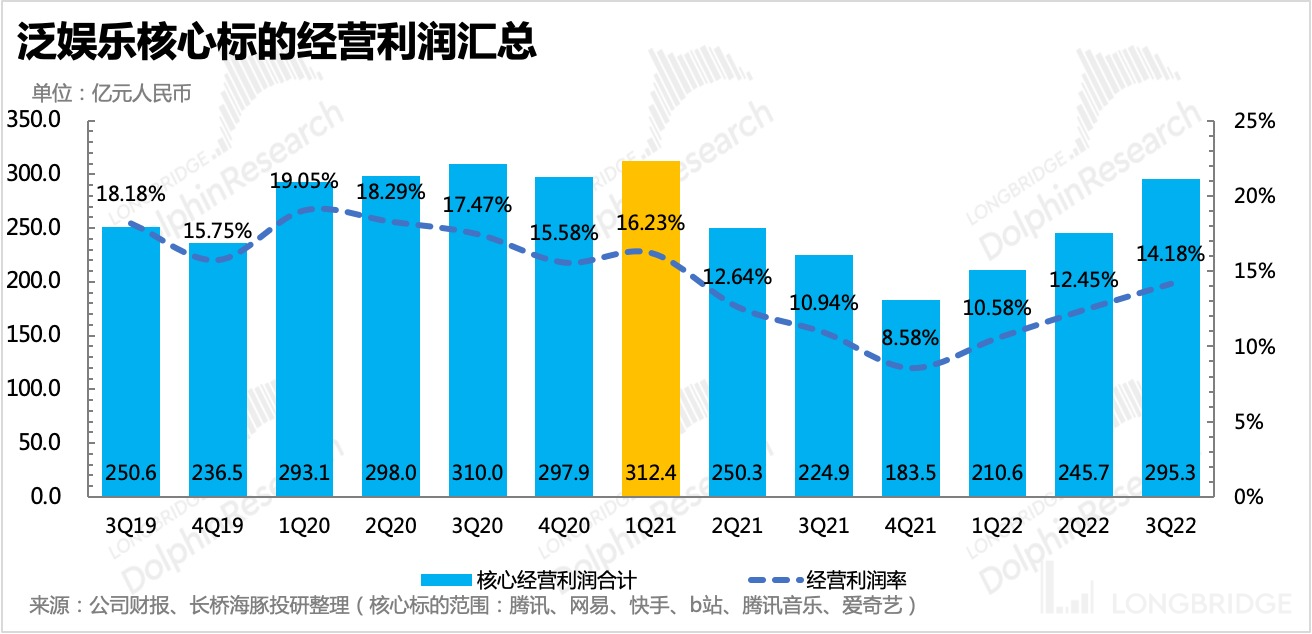

Let's first review the Q3 report. Although the answers of the entertainment companies are not so bad, they cannot be called good either. The consistent performance is that the predictability of revenue is under pressure, but the companies' "reducing costs and increasing efficiency" has been done well. Even platforms like iQiyi with difficult-to-prove business models have entered the profitable camp after cutting off one arm.

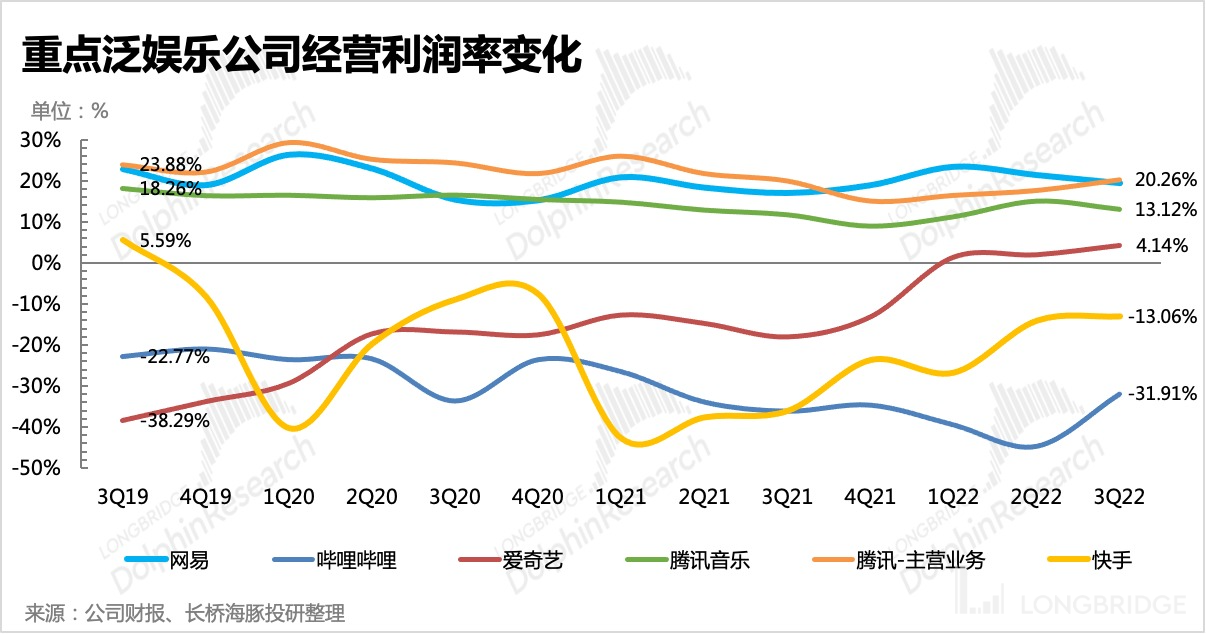

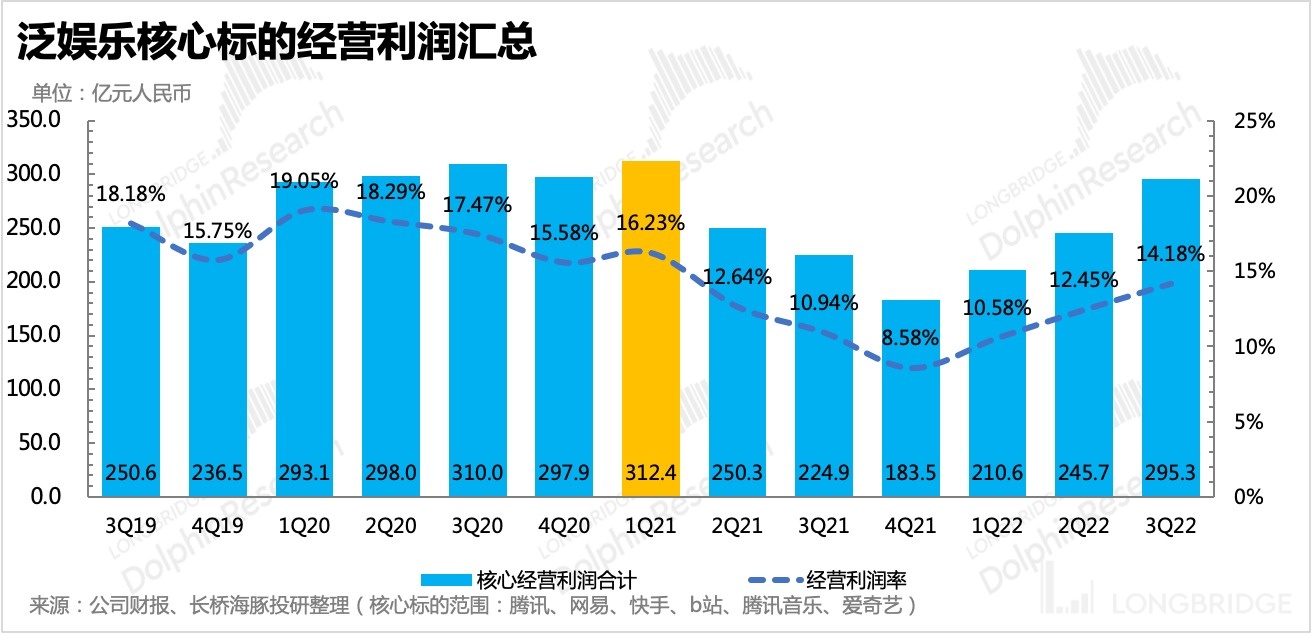

Looking at the overall trend, although the "reducing costs and increasing efficiency" in the third quarter was a continuation of the operating route in the first and second quarters. But compared with the absolute value, the total operating profit of the pan-entertainment platform in Q3 has almost approached Q1 2021, when it was at a peak. The market underestimated the determination of the Internet platform to "slim down".

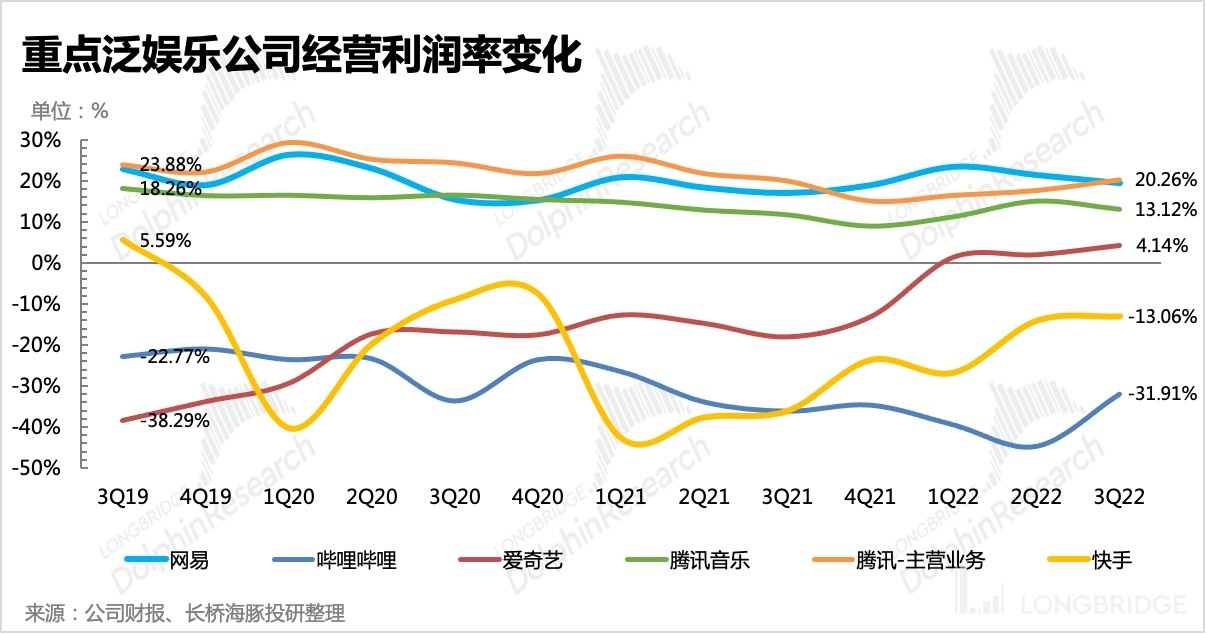

However, from the perspective of operating profit margin, the operating efficiency of the pan-entertainment companies in the third quarter has theoretically not been optimized to the same degree as the comprehensive operating profit margin of around 18% under normal circumstances, leaving room for improvement. However, not all pan-entertainment platforms have room to further shrink for profit optimization.

-

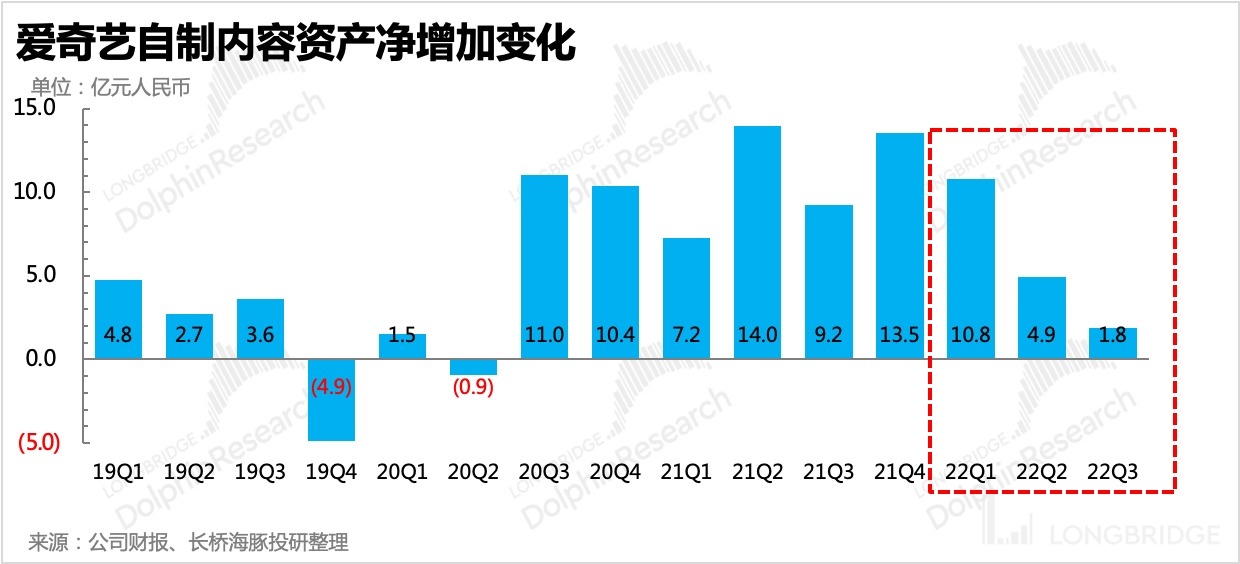

iQiyi, Tencent Music, which are leading the pack, have almost reached the extreme in reducing costs and increasing efficiency, especially iQiyi, which has reduced its operating expenses to almost the level of 2018 due to its self-sacrifice. If budgets are cut further, it may affect normal business operations.

-

Tencent and Bilibili, which had major layoffs only after the second quarter, have just reflected the results of cost reduction and efficiency improvement in their financial reports.

-

And there is also NetEase, which has already jumped out of this round of industry cycle and is following its own product cycle. In the most difficult year of 2022 in the Internet industry, it still maintains continuous growth in operating investment.

III. Industry Outlook: Squeezing Online with Offline? The positive impact of supply-side improvement may be greater

Looking ahead to next year, the market's greatest concern for the pan-entertainment industry is the suppression of demand for online entertainment due to the opening of offline. But Dolphin Analyst believes that compared to the past two years, the biggest change in the pan-entertainment industry in 2023 lies in the significant improvement in the supply side under relaxed regulation. China's pan-entertainment industry belongs to a market that is basically determined by the supply side. As long as there is good content, users are willing to pay for it.

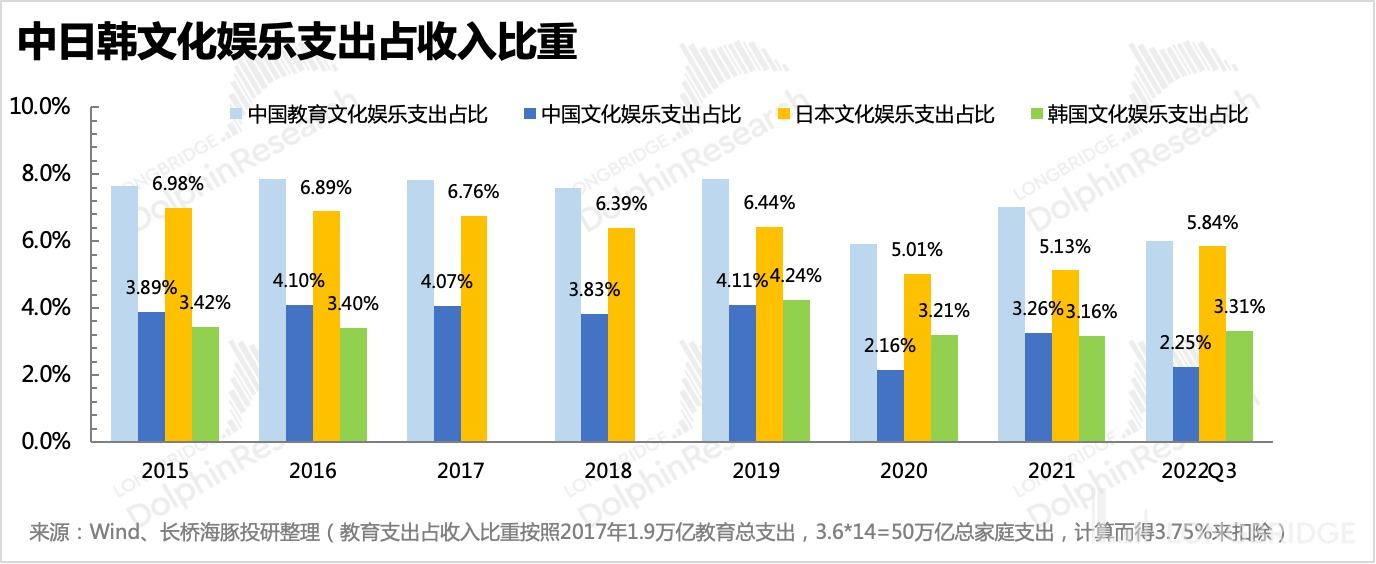

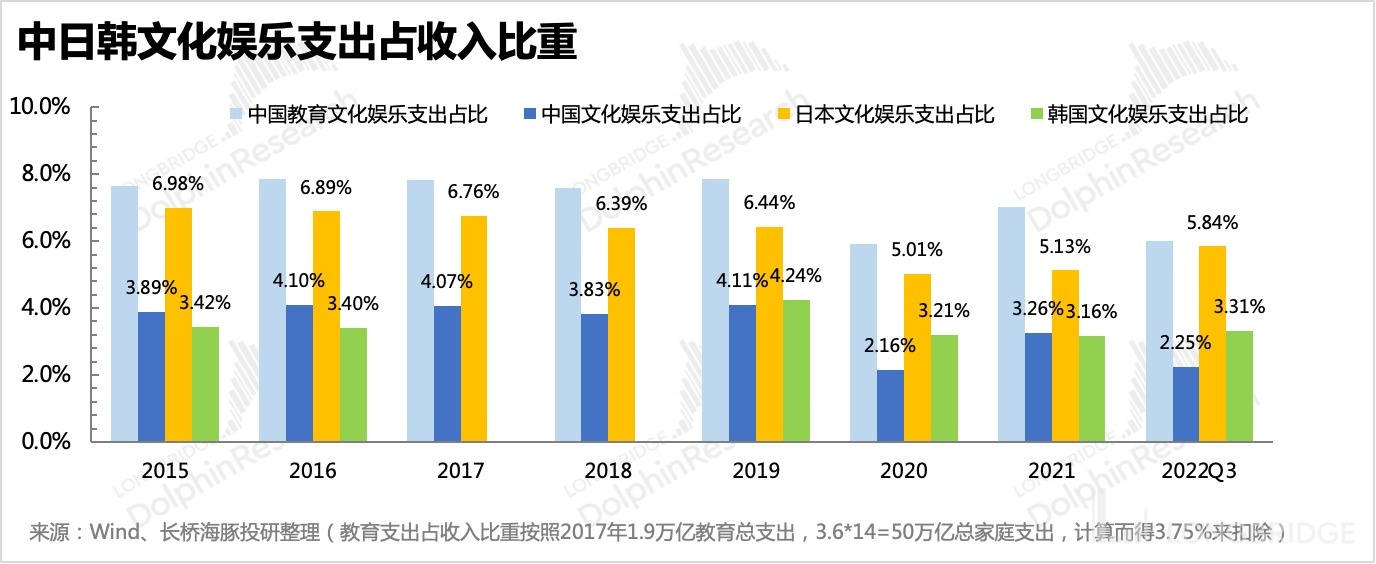

Looking back on the development of the entertainment industry over the years, Chinese users' demand for culture and entertainment still has considerable potential for exploration compared to Japan and South Korea, and in an industry where (potential) demand is far greater than supply, the overall market size will be more vulnerable to the impact of the supply side.

As the overall entertainment industry supply improves by 2023, overall market demand is expected to receive a favorable stimulus. Online entertainment will not be as heavily impacted as overseas markets, as it will not experience a significant squeeze due to the release of offline entertainment demand.

As the overall entertainment industry supply improves by 2023, overall market demand is expected to receive a favorable stimulus. Online entertainment will not be as heavily impacted as overseas markets, as it will not experience a significant squeeze due to the release of offline entertainment demand.

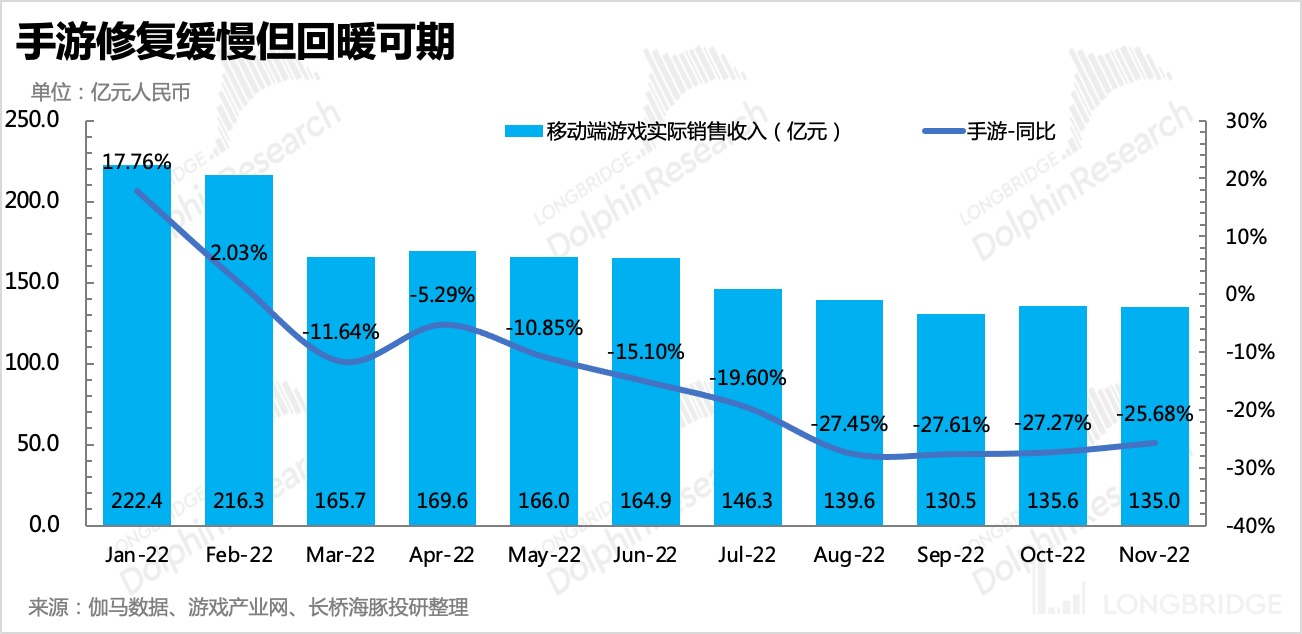

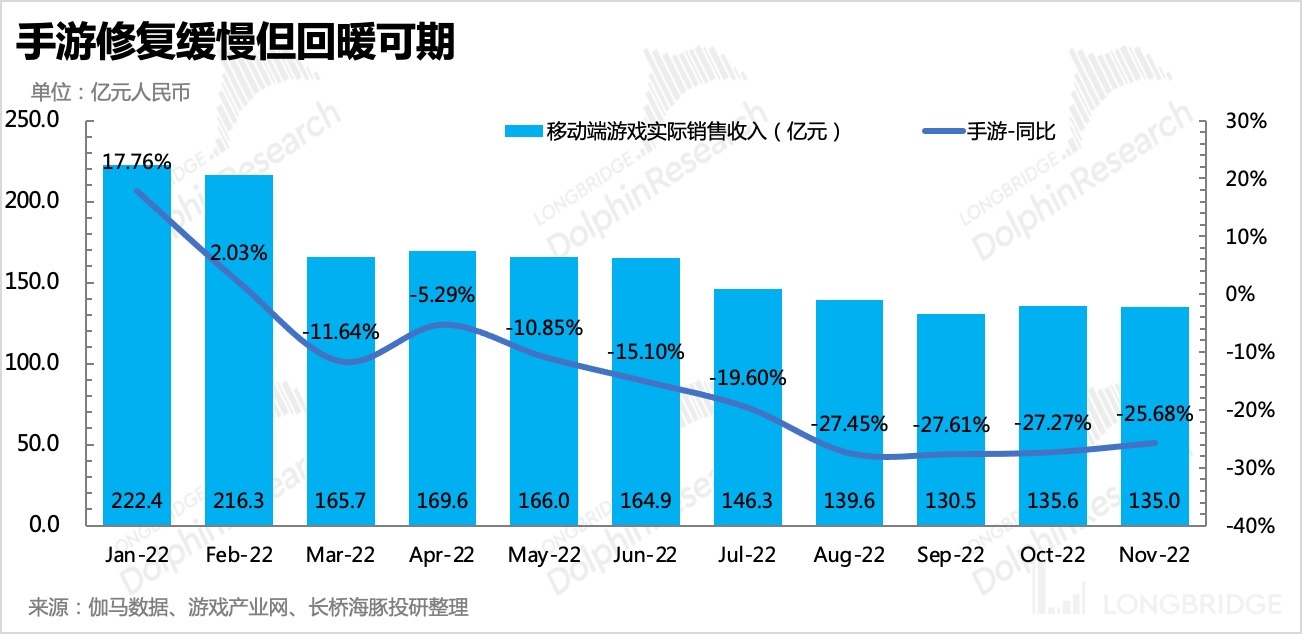

Taking the gaming industry as an example:

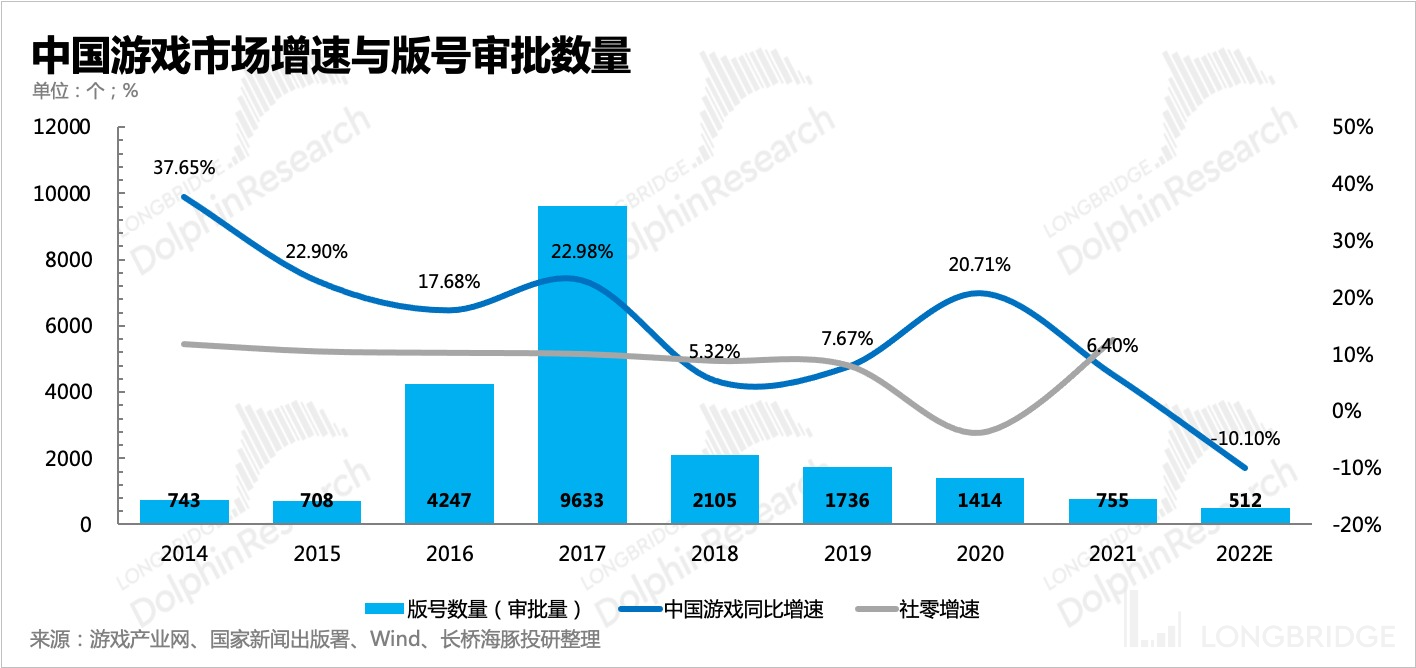

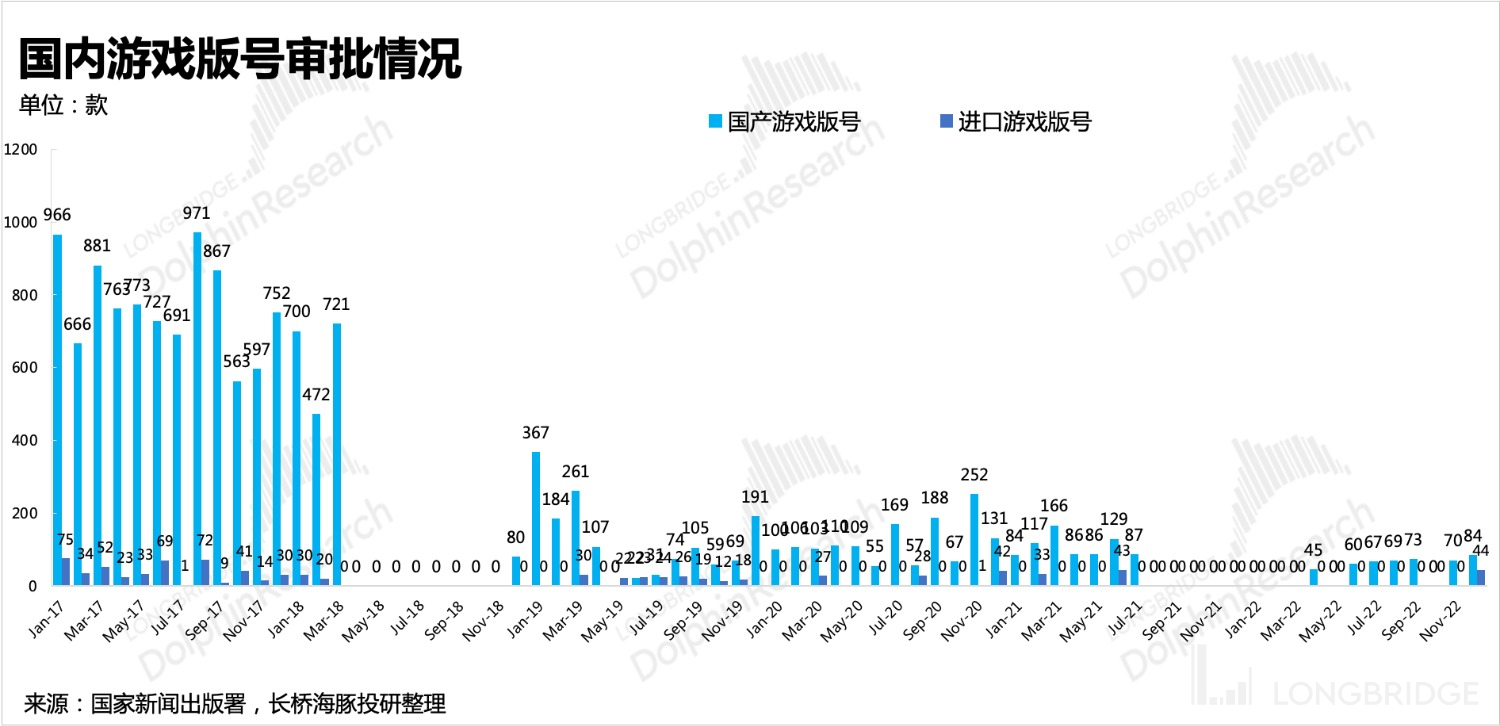

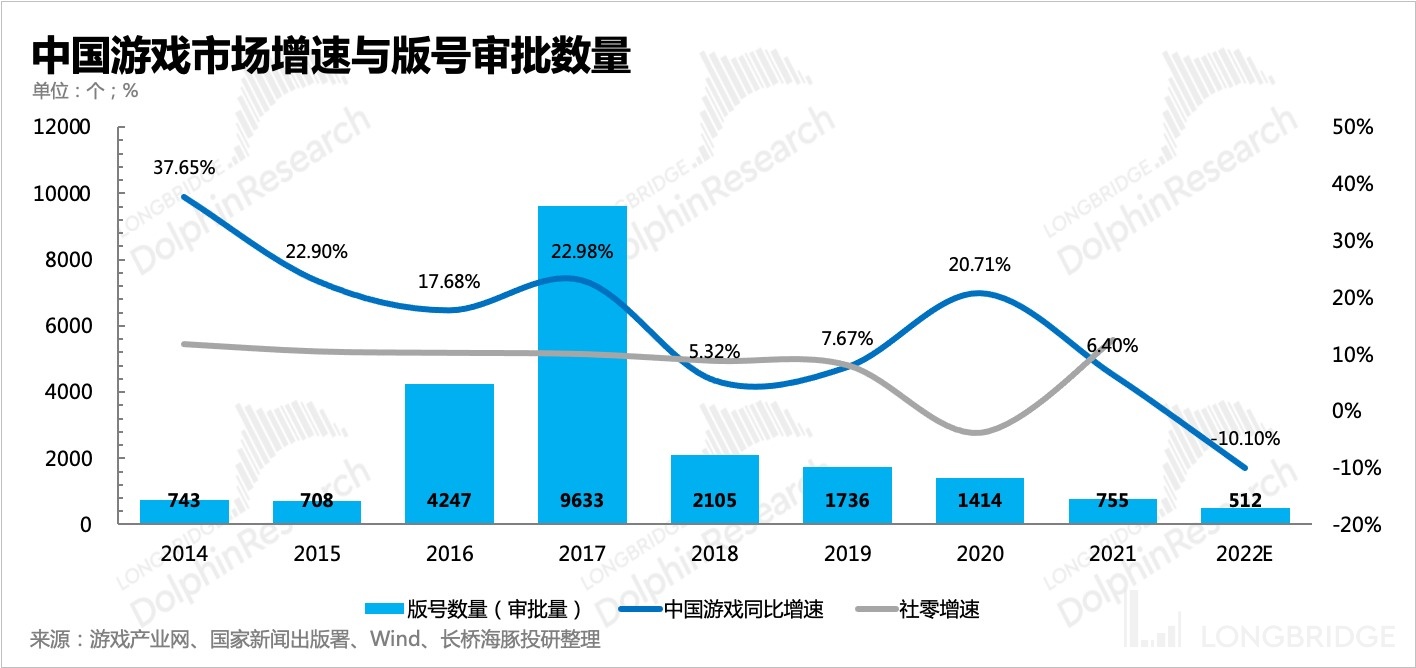

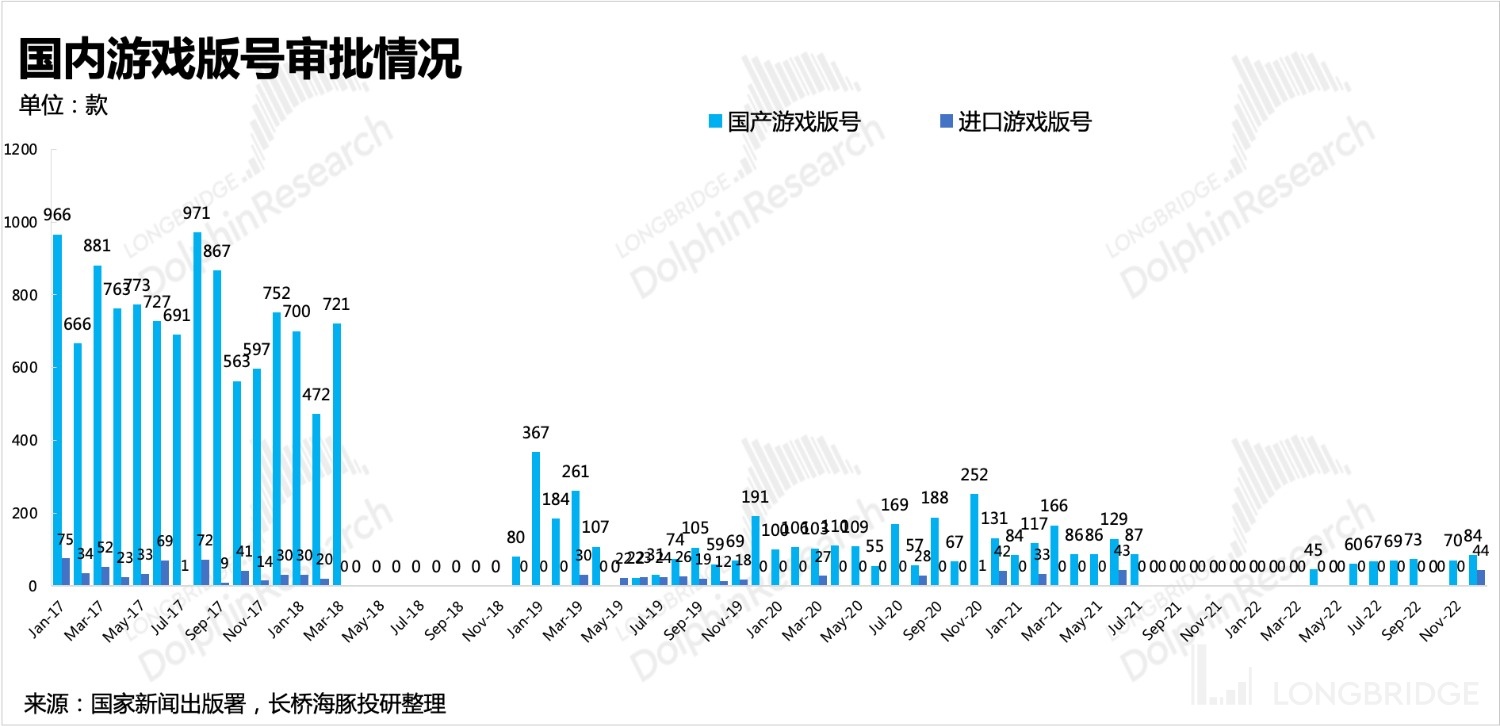

In the past ten years, gaming market prosperity has been affected by macroeconomic factors, with a higher correlation to the number of game license approvals. Although licenses approved in a given year may not necessarily be launched within that same year, the ease of license approvals will affect gaming companies' plans for releasing games to the market. Thus, the number of licenses issued can be used to represent the supply situation for that year and can also display the industry market scale changes that are crucially affected by supply-side phenomenon.

-

Before 2015, game license approvals were relatively low, but the frequency of approvals remained stable. The gaming market remained in a high-speed stable growth state due to the low base number.

-

In 2016-2017, there was a surge in game licenses issued, and the approval rhythm was stable, breaking the linear growth trend of the industry. The gaming market achieved accelerated growth.

-

From 2018 to 2020, the number of game licenses issued was significantly lower than before, causing industry growth to decline. However, the 2020 pandemic bonus catalyzed a wave of demand.

-

From 2021 to now, game licenses have once again experienced stops and restarts, with the frequency and quantity of licenses issued not yet fully stabilized, and still differ from the previous stage.

Therefore, if the number of game licenses issued in 2023 can rebound to 70% of the level seen from 2018 to 2020, with a total of 1,200 domestic and imported game licenses issued per year, we predict that the market scale will not continue to stagnate like overseas markets, but rather will see a robust recovery.

The same logic applies to the film and television industry:

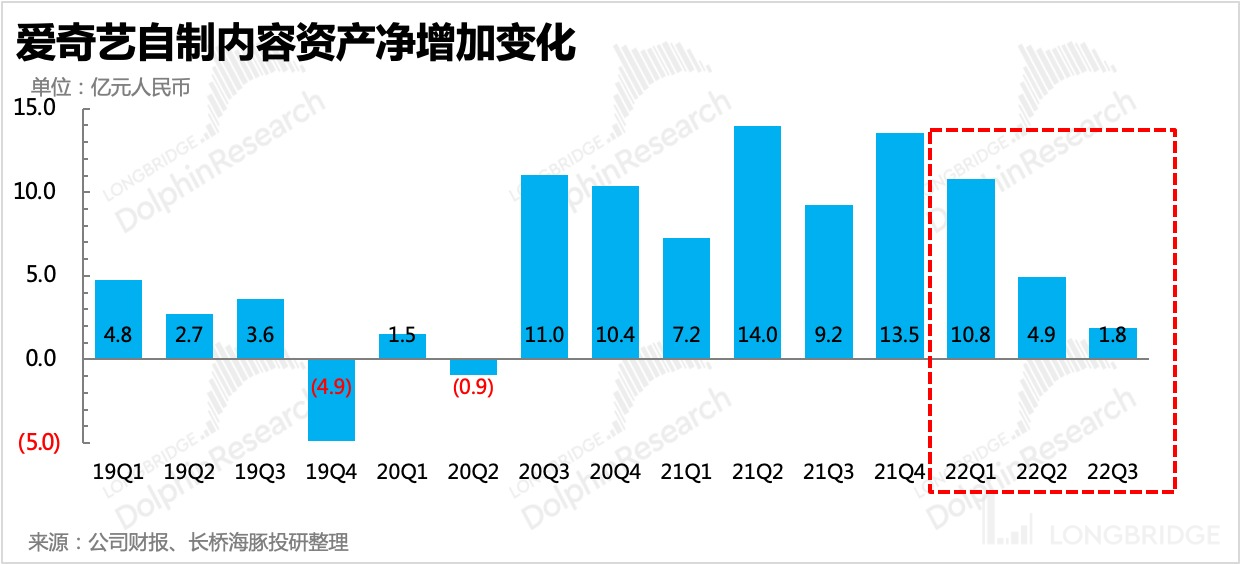

This year, high-quality film and television content is clearly lacking due to regulatory issues and COVID-19 lockdowns affecting shooting schedules. In addition, major platforms have streamlined their operating strategies by reducing film and television investments, resulting in a decrease not only in high-quality content but also in overall industry content supply.

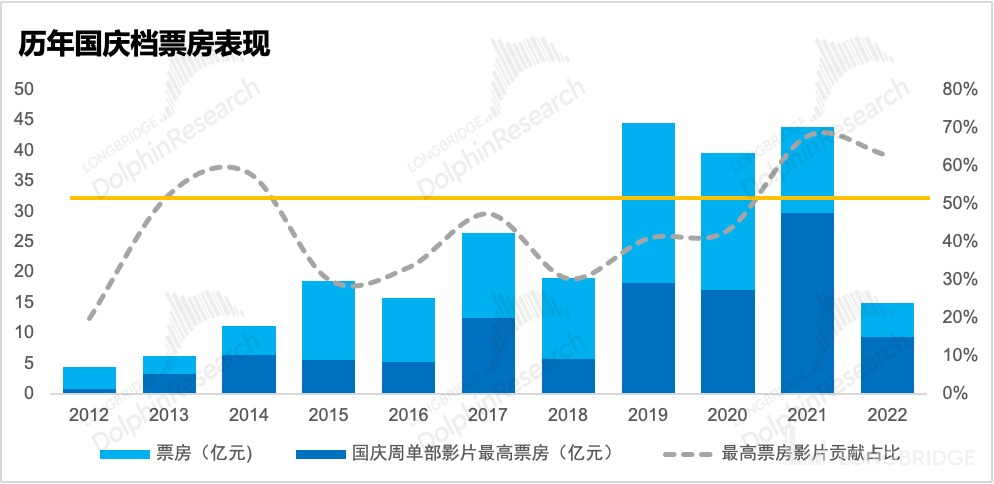

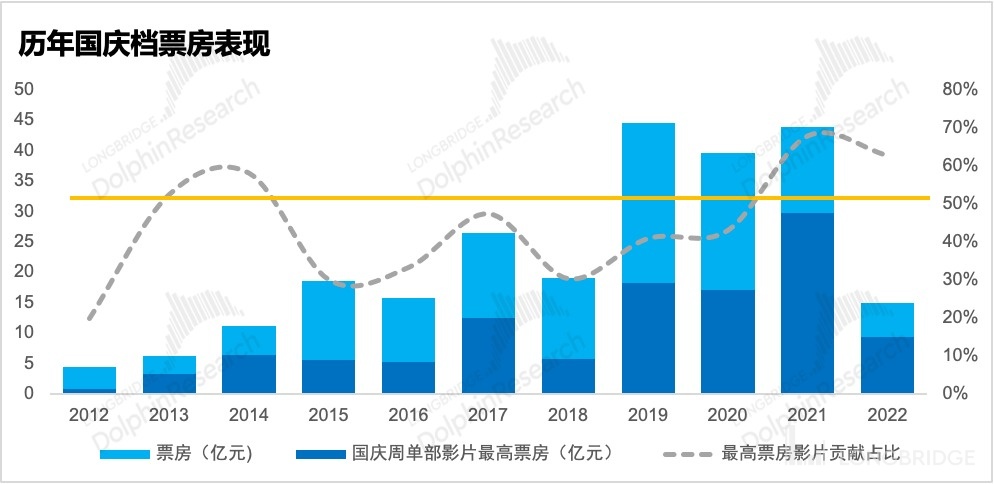

Comparing the box office performance of National Day movies in previous years, although the lockdown was not severe during the National Day holiday in 2022, box office revenue was particularly poor, and the proportion of TOP1 box office films was excessively high. This indicates an unhealthy state on the supply side, and the impact of content supply on the overall market revenue-generating ability is evident.

4. Tencent internal speech, pointing out the way out for pan-entertainment?

At the Tencent internal meeting in mid-December, Ma Huateng conducted a comprehensive diagnosis of Tencent's various businesses, pointing out the future development direction and the existing problems -- there is still structural waste of resources and cost-effectiveness needs to be improved continuously.

(1) The key development direction of consumer internet: with Video Number as the core, the main monetization methods are advertising and e-commerce, which are almost recognized as Tencent's strategic direction for the next three to five years.

(2) Maintain the pace of improving cost-effectiveness: with the peak of traffic and the difficult-to-prove commercial model of paid content, especially long videos that directly compete for time with short videos, continue to be the main target of improving cost-effectiveness.

1. Let's first look at the development direction

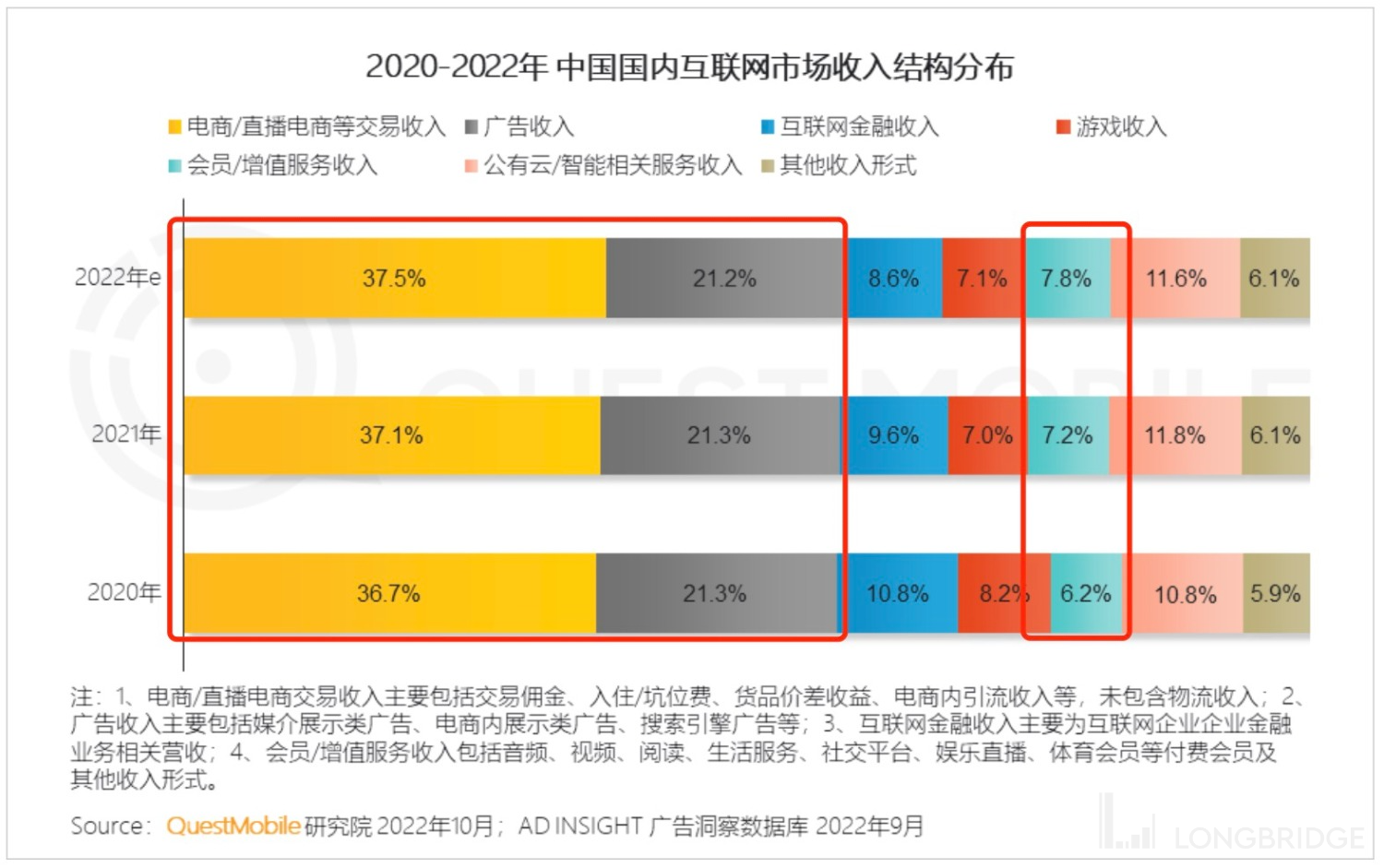

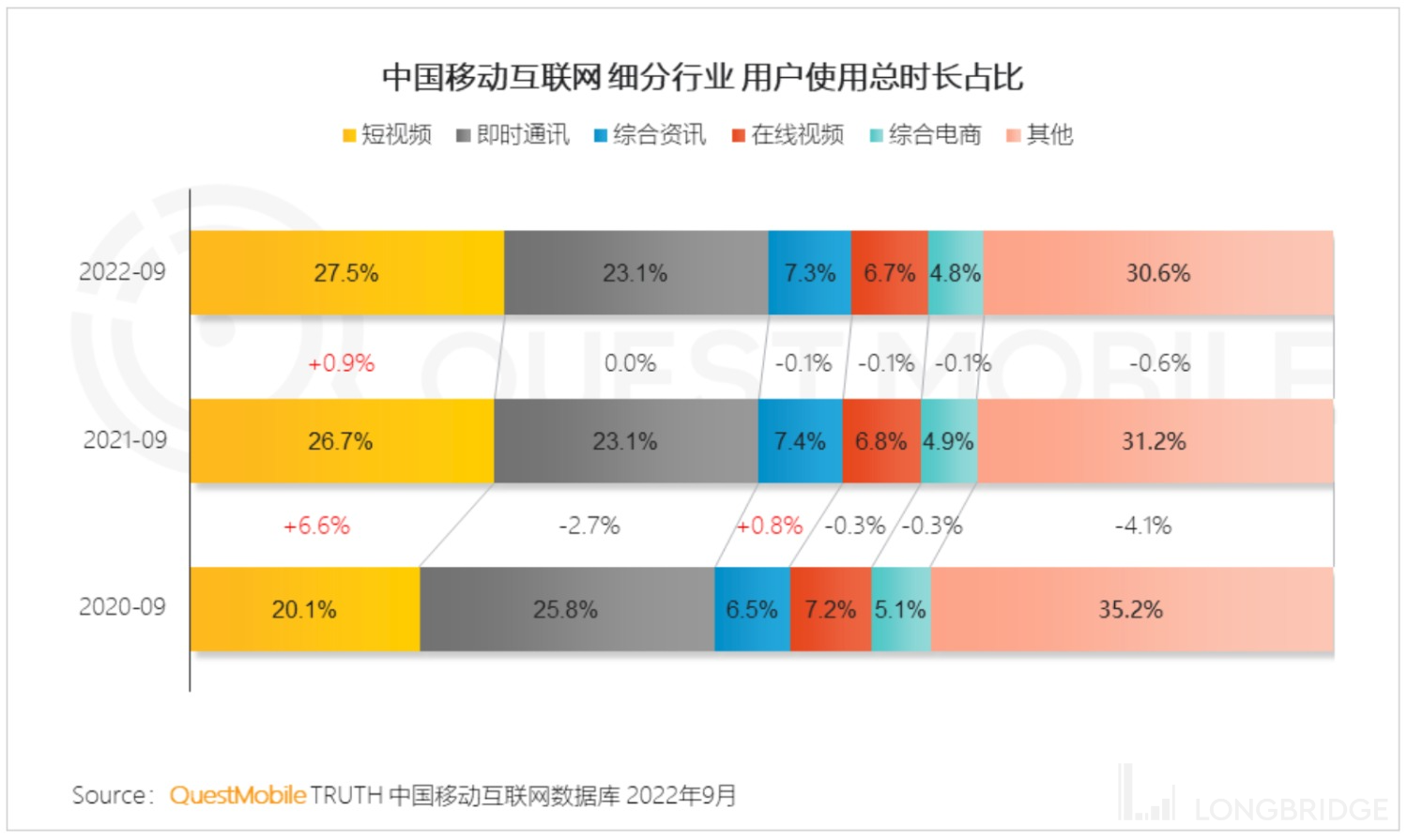

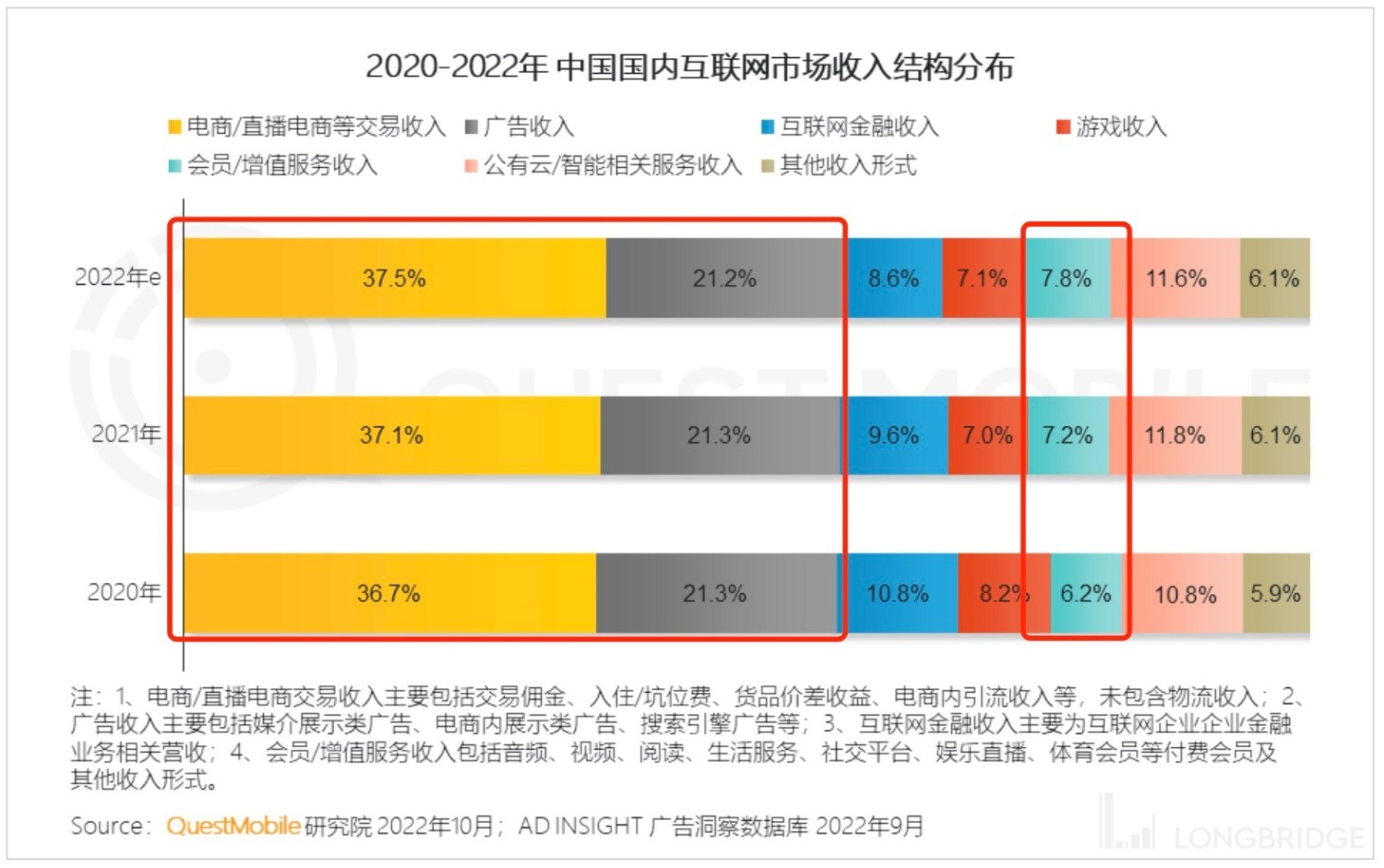

If Tencent's strategy is applied to the entire pan-entertainment segment, it means that overall, monetization of traffic facing merchants (advertising, e-commerce) is still easier to promote than content payment facing consumers. As for who can win more favor from businesses, it still depends on who has more traffic growth. The short-video traffic black hole currently has no solution and can only be defeated by magic.

However, the prospect of content payment is not completely hopeless. Vertical platforms with high-quality content barriers can still harvest their "core users" and achieve their "consumption upgrade".

This presents a relatively torn market competition pattern:

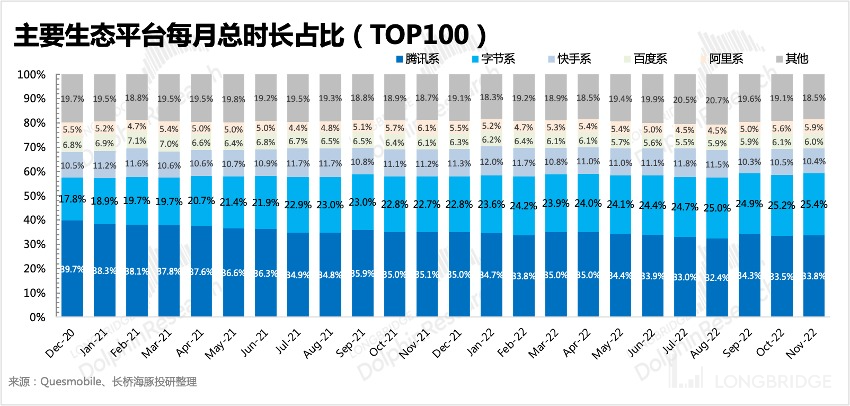

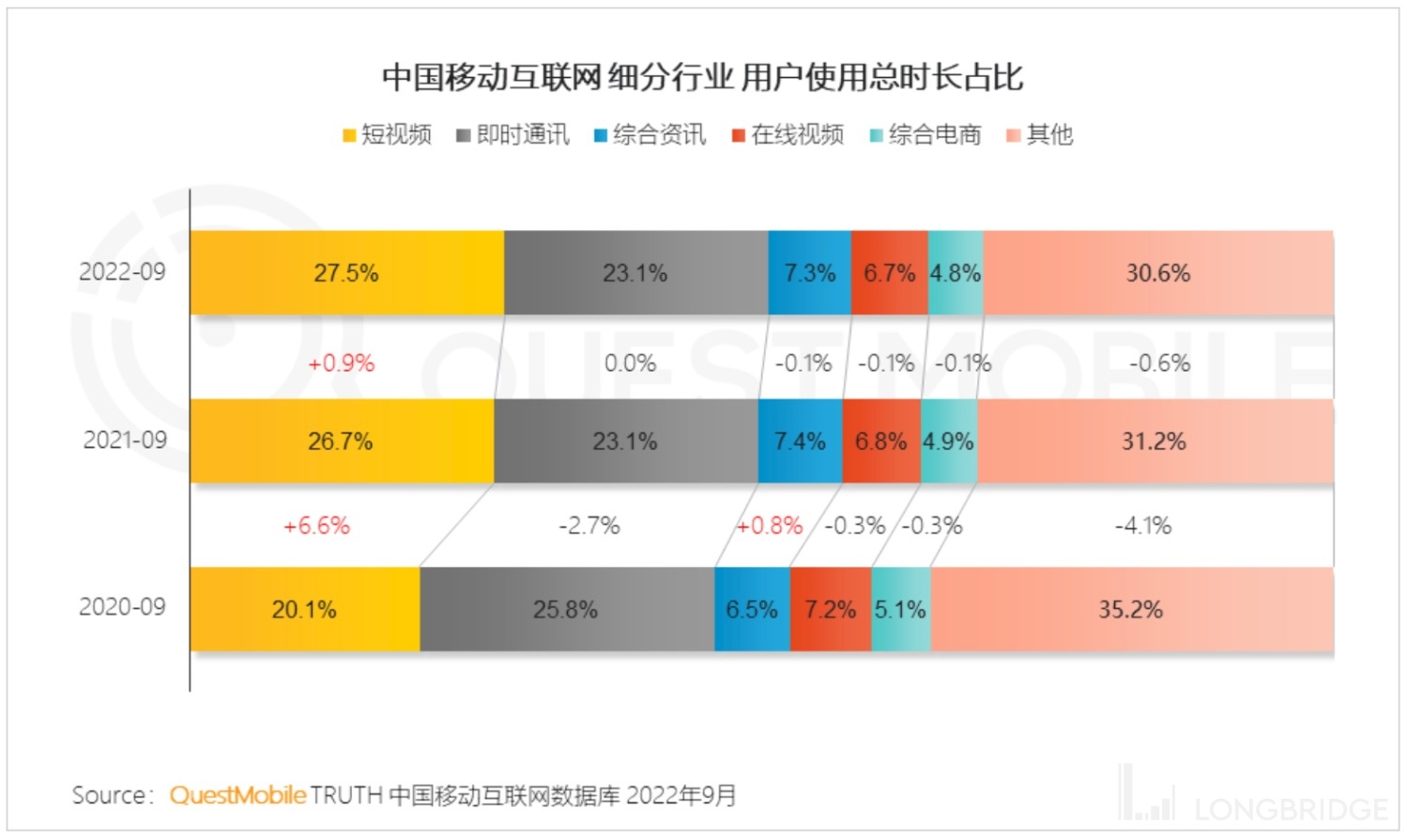

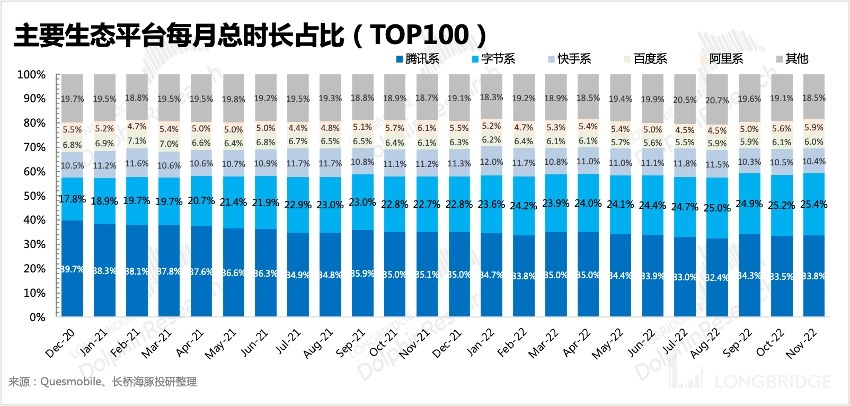

- Short videos are no longer exclusive to Douyin and Kwai and have become essential for all platforms, especially comprehensive platforms, which will accelerate the improvement of their short video functions and the series of functions derived from live streaming and e-commerce. Although pure short video platforms led by Kwai are still dividing more time shares, their growth rate has shown a significant decline, while traditional comprehensive social platforms have achieved a significant increase in duration after adding short video functions.

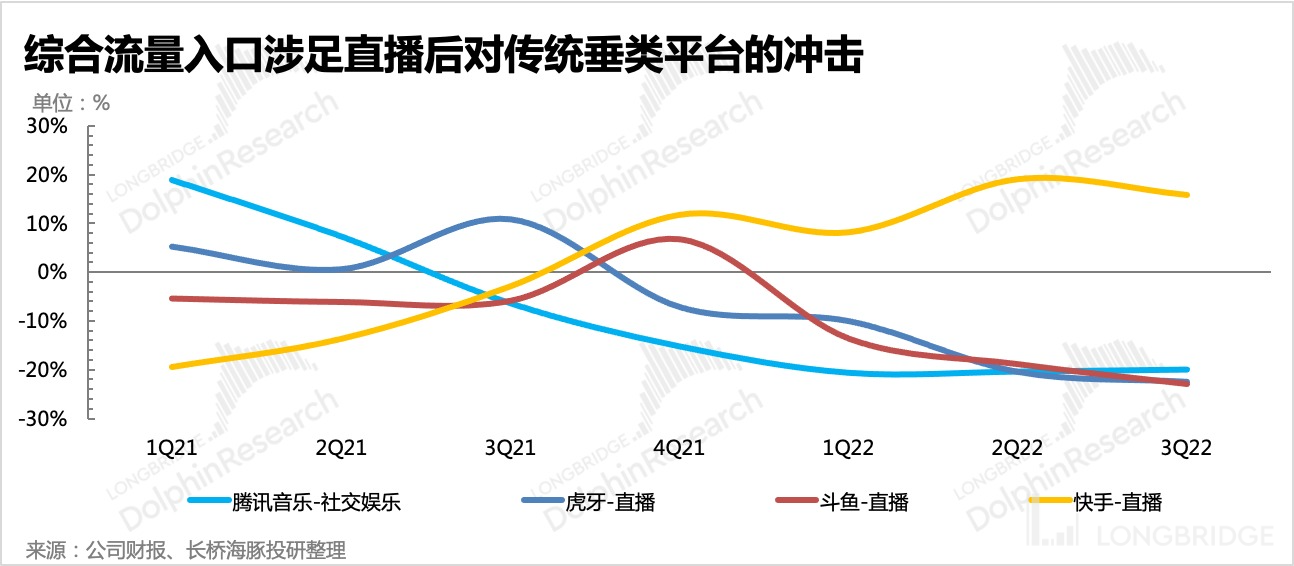

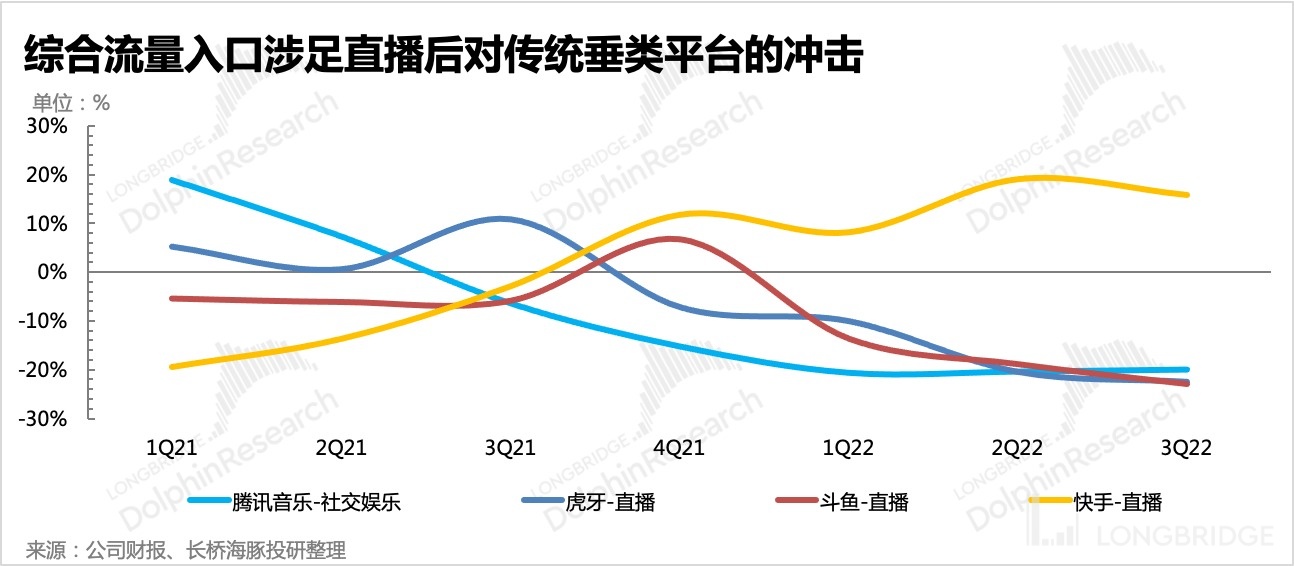

2) Big platforms, driven by income growth anxiety, will leverage their overwhelming advantage in traffic integrated entry points, to enter some low entry barrier fields (such as live streaming), squeezing the living space of the existing platforms in the field. For example, after Kuaishou and Bilibili entered live streaming, they impacted more traditional live streaming platforms like Huya and Douyu.

2) Big platforms, driven by income growth anxiety, will leverage their overwhelming advantage in traffic integrated entry points, to enter some low entry barrier fields (such as live streaming), squeezing the living space of the existing platforms in the field. For example, after Kuaishou and Bilibili entered live streaming, they impacted more traditional live streaming platforms like Huya and Douyu.

- Among comprehensive platforms, "on the surface" it becomes a game of comparing traffic duration. However, when the problem of dwindling traffic is unavoidable, aside from a few platforms that still have a traffic increment, the remaining platforms compete in terms of who can use smaller investments to stimulate larger traffic monetization. In actuality, the true competition is a PK of organizational efficiency for companies, which goes beyond the intrinsic value of traffic itself.

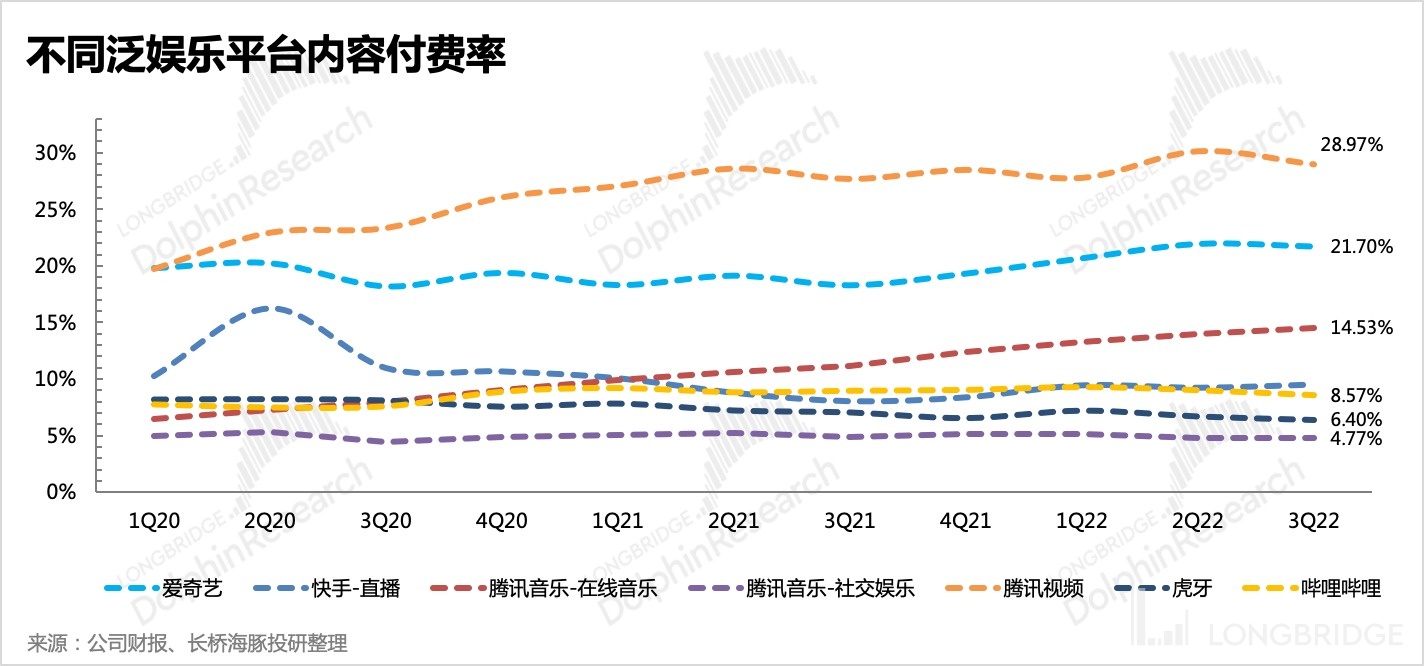

- For paying for segmented vertical content, ignoring games, which require the highest payment effort, other vertical content (long videos, digital music, online literature) can only focus on the core user groups in the short term. However, platforms with high content barriers and exclusive copyrights can still improve their profitability model by raising prices, becoming a "small and beautiful" presence based on content strength. Therefore, the criteria for selecting superior from inferior among such platforms lies in the platform's higher ability to raise prices and improve its payment rate.

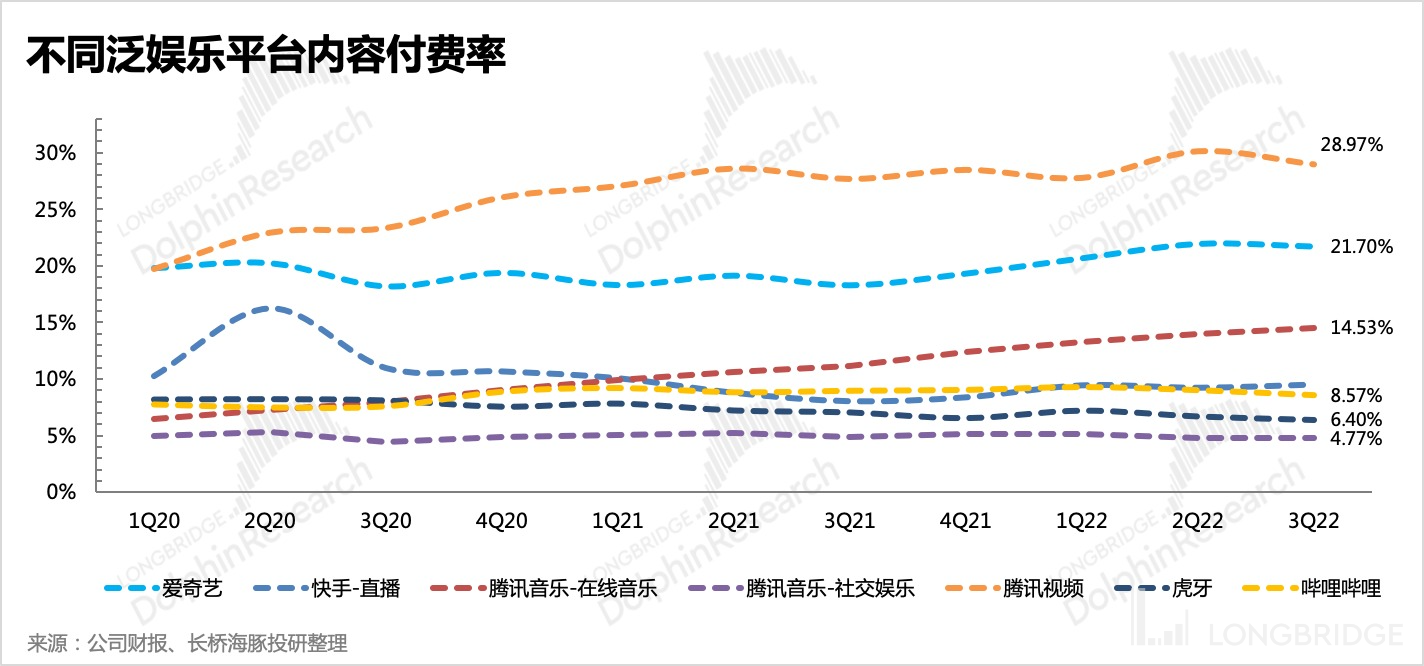

If a 20% payment rate for long videos is taken as the level of mature content payment platforms, then there may be room for further improvement in digital music, while the payment rate for live streaming is generally low. Under regulation and economic downturn, payment rate continued to decline. Therefore, under the relaxed and recovering environment of 2023, the payment rate for live streaming may return to the normal 10% level, but since it is not exclusive content with copyright attributes, the payment rate for live streaming is difficult to compare with that of digital music and long videos.

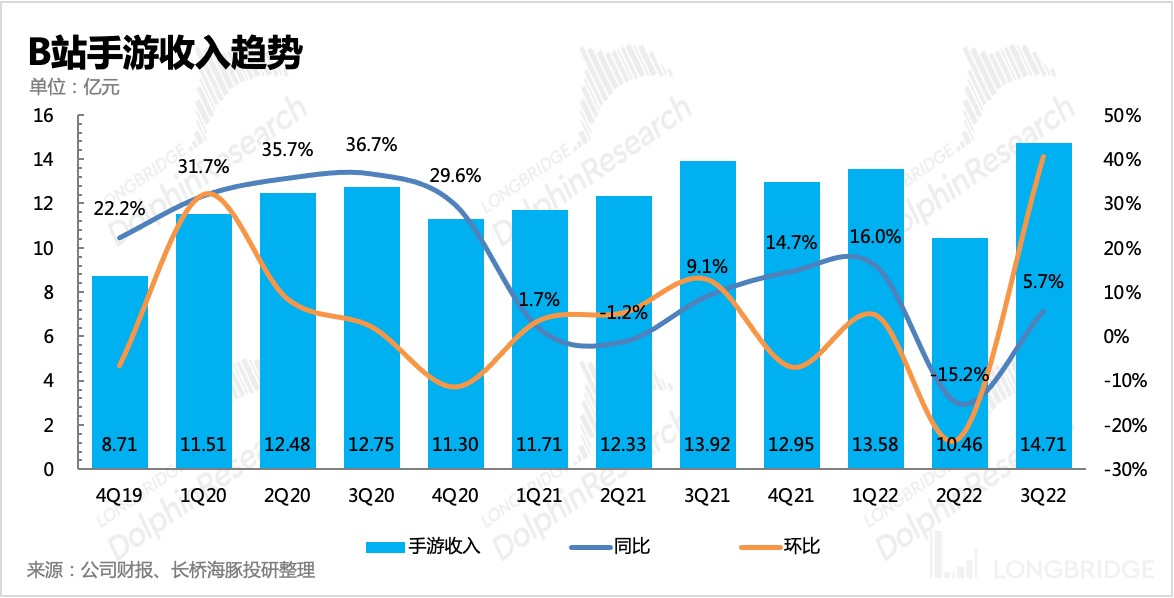

In the gaming industry, apart from companies with clear content cycles (such as Tencent Games, Xindong), the overall increase in content supply in the industry can also bring higher revenue expectations for channel partners (such as Bilibili and Xindong who do game agency and distribution).

2. Looking at cost reduction and efficiency

Despite Tencent's continuous emphasis on cost reduction and efficiency, Dolphin Analyst believes that the focus here is not on continued contraction, but rather on the return on investment.

In the past two years, the entire consumer internet, including the pan-entertainment industry, has been in a difficult operating environment. Due to the need to adopt a mindset of "stinginess for the winter" and tighten our belts to make ends meet, we have competed to see who has the largest space for cost reduction and efficiency.

However, when the unfavorable factors of the 2023 environment disappear one by one and return to a normal operating environment, continued contraction will only accelerate our lagging behind our peers. But that does not mean that we will return to the period of reckless spending to drive growth from 2020 to the first half of 2021. Only those who have higher investment efficiency, where the same investment can bring higher output, can obtain the maximum benefit of economic recovery and break free from the downward trend of the mobile internet industry cycle.

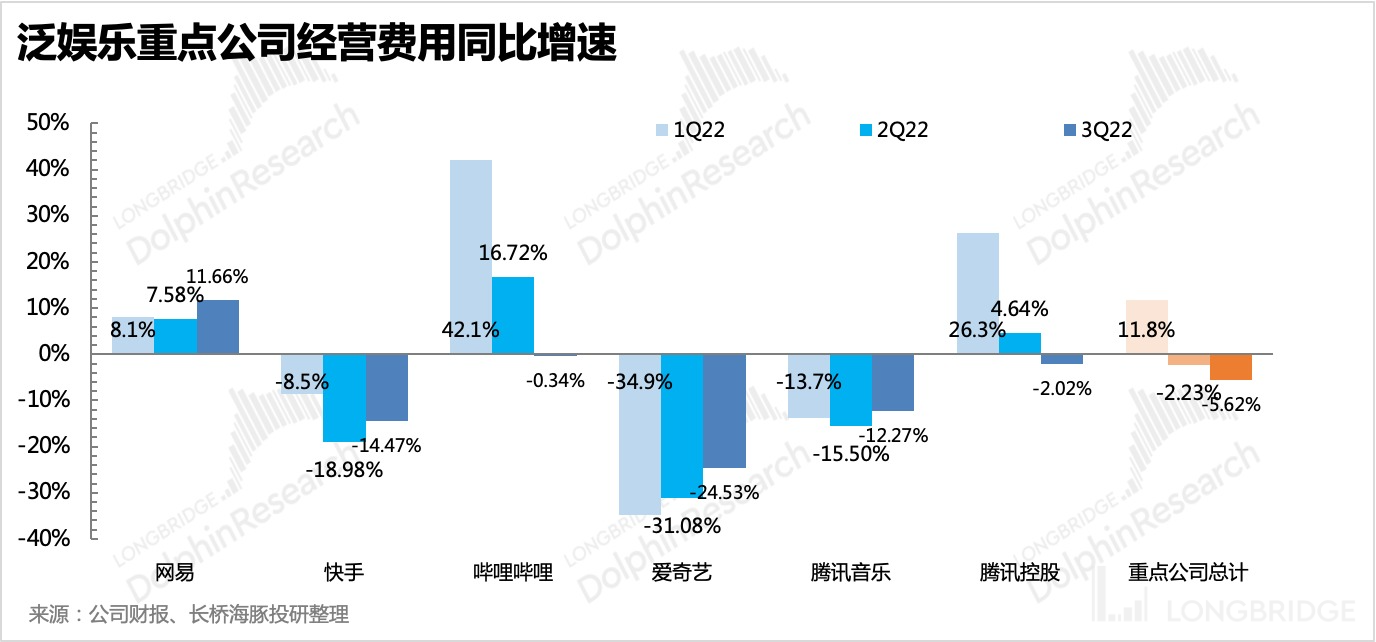

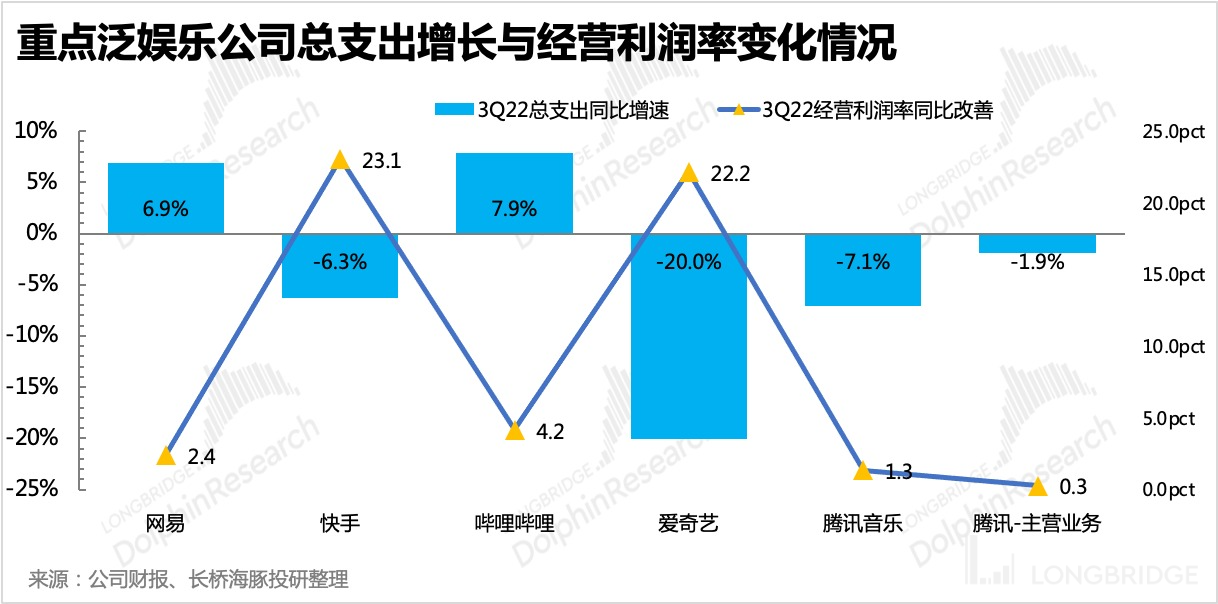

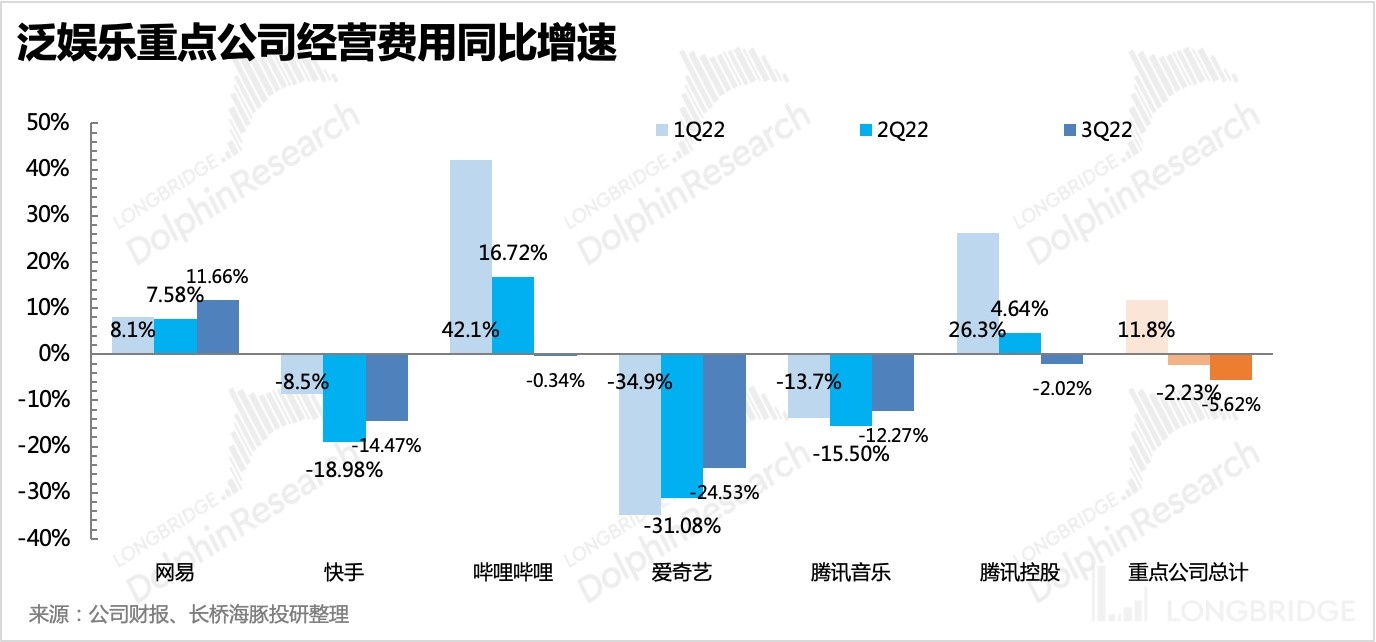

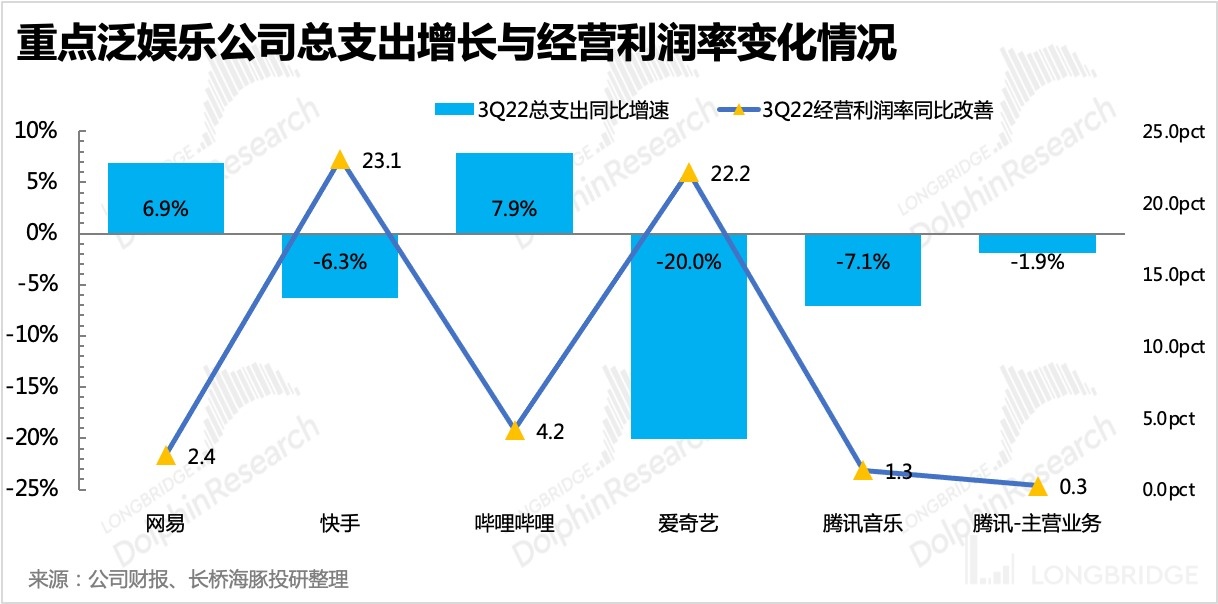

In the third quarter, among the pan-entertainment companies covered by Dolphin Analyst, although the overall investment direction was contracting and costs and operating expenses both accelerated year-on-year declines, there were significant differences in the pace of cost reduction and efficiency improvement among different companies. Some companies are already in the final stage of contraction and have even begun to increase investment again, while others are still in the process of contraction.

As shown below, iQIYI and Tencent Music are typical vertical platforms that exchange profits for cost savings. Faced with the siege of short video competition, their main businesses have no effective response.

For NetEase, Bilibili and Tencent, their total expenditures have not yet shown a significant contraction, but because each investment brings higher revenue growth, they can also ease the pressure on cost and slightly improve profitability. On the other hand, without looking at revenue, NetEase, Bilibili and Tencent theoretically have more room for efficiency improvement than iQIYI and Tencent Music.

Compared to simply cutting costs, what Dolphin Analyst pays more attention to is the improvement in profitability brought by improving investment efficiency, in other words, there are still growth stories to tell. For example, Tencent's Video Number, Bilibili's StoryMode commercialization and game agency,

On the other hand, iQIYI and Douyin, whose visible growth has peaked, can only focus on whether there is still room for valuation repair at most.

Therefore, what we can expect is that in the 2023 upcycle, Tencent and Bilibili can not only digest cost pressures through revenue growth higher than their peers but also strengthen their profitability/reduce losses through more effective organizational management. Of course, in terms of organizational efficiency, Dolphin Analyst has more confidence in Tencent's management. 5. The biggest change next year: official launch of Video Account

Since the third quarter, pan-entertainment companies have basically adhered to the strategic thinking of "more thrifty, more focused" to consolidate their own capabilities and streamline resource investment outside their own capabilities. However, there are also obvious differences in the specific practices between comprehensive platforms and segmented categories.

(1) More thrifty: Tencent, Bilibili continue to have large-scale layoffs;

(2) More focused: more obvious performance in segmented categories

1) iQIYI successively cut off derivatives such as games and online literature, focusing on film and television. After launching its self-produced hit variety shows and dramas, it raised prices again during a hot market;

2) Yuewen launched a heavy attack on piracy literature, improving the payment rate while also increasing the price of QQ Reading membership.

3) Tencent Music reduced member promotion activities and raised prices in disguised form. After its live karaoke business was seriously impacted by Douyin and Kuaishou, it tightened the payment power of core users.

(3) Comprehensive platforms wield the traffic power of vassals

For comprehensive platforms with obvious social scale, after perfecting short video functions and accelerating information flow advertising, they have successively entered the e-commerce field. Live shopping and local life have become a revenue-generating elixir that platforms with large-scale traffic want to try.

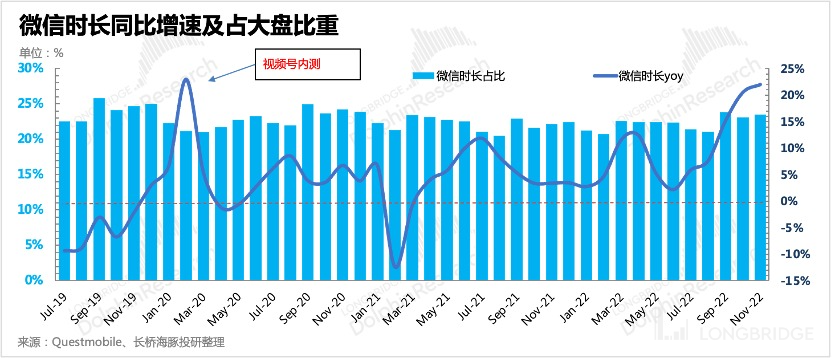

Among them, the impact on industry competition brought by Tencent's Video Account is the greatest. The company's management team's resource tilt towards Video Account and its performance goals have far exceeded the original expectations of Dolphin Analyst. Therefore, combining with some latest research data, Dolphin Analyst mainly updates the view of Video Account here.

1. Commercialization of Advertising

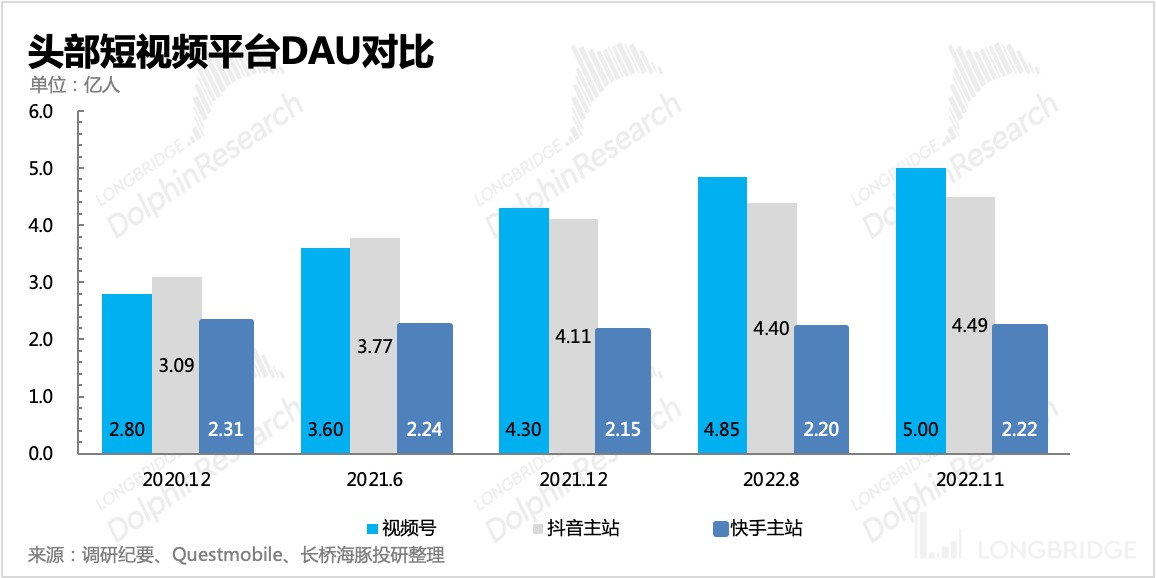

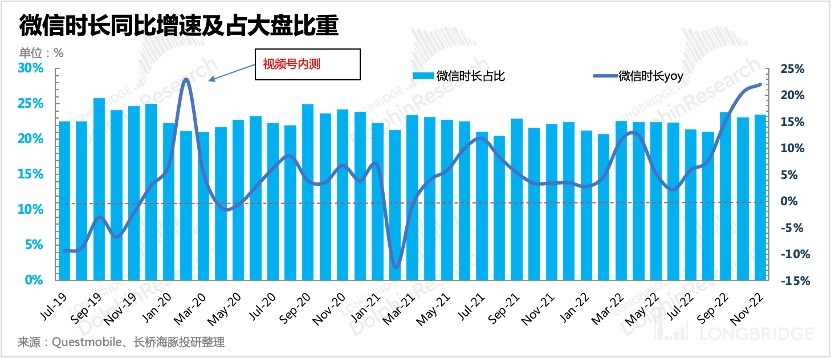

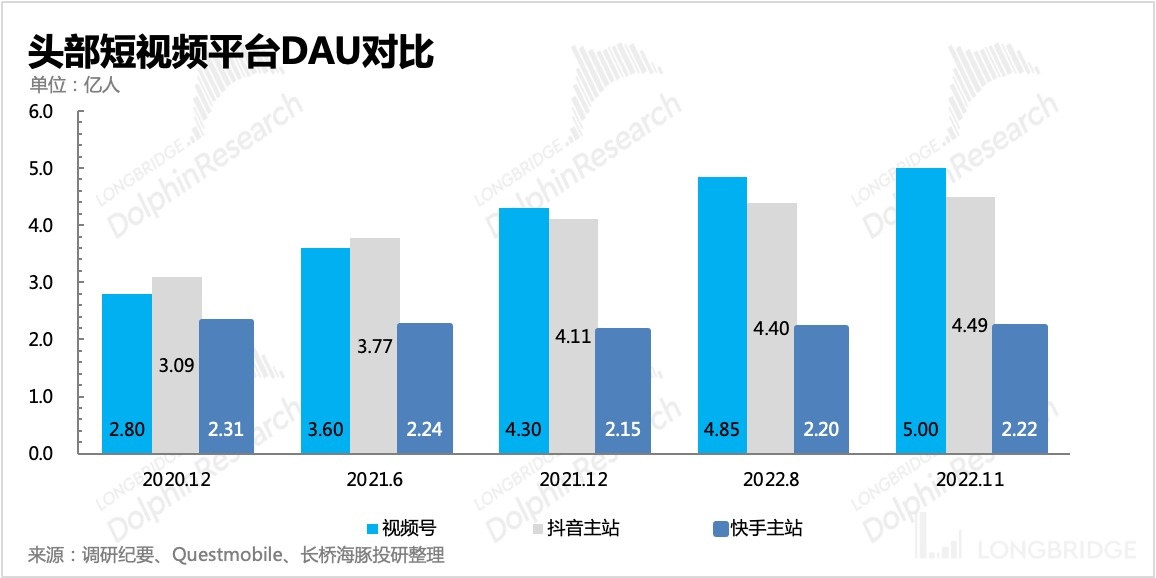

Firstly, it is the expanded space for commercialization of advertising due to the accelerated penetration of Video Account users. The maximum caliber of DAU has increased from 430 million at the beginning of the year to 500 million at the end of the year. If based on a 15-second stay time, the number of narrow-caliber DAU is also approaching 400 million.

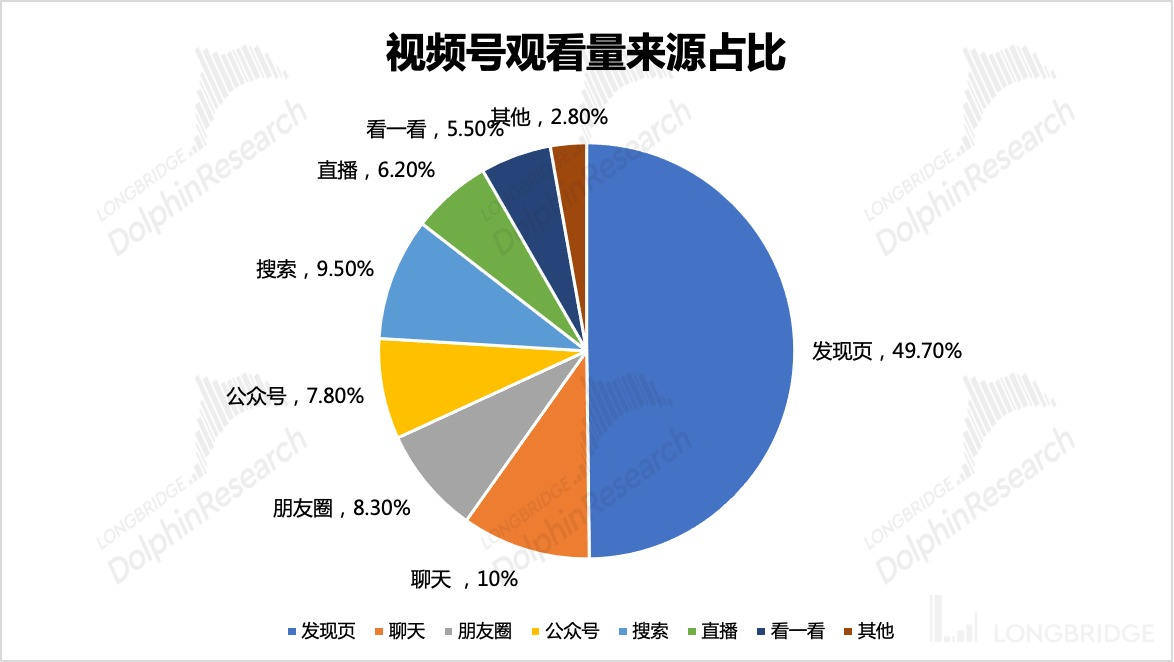

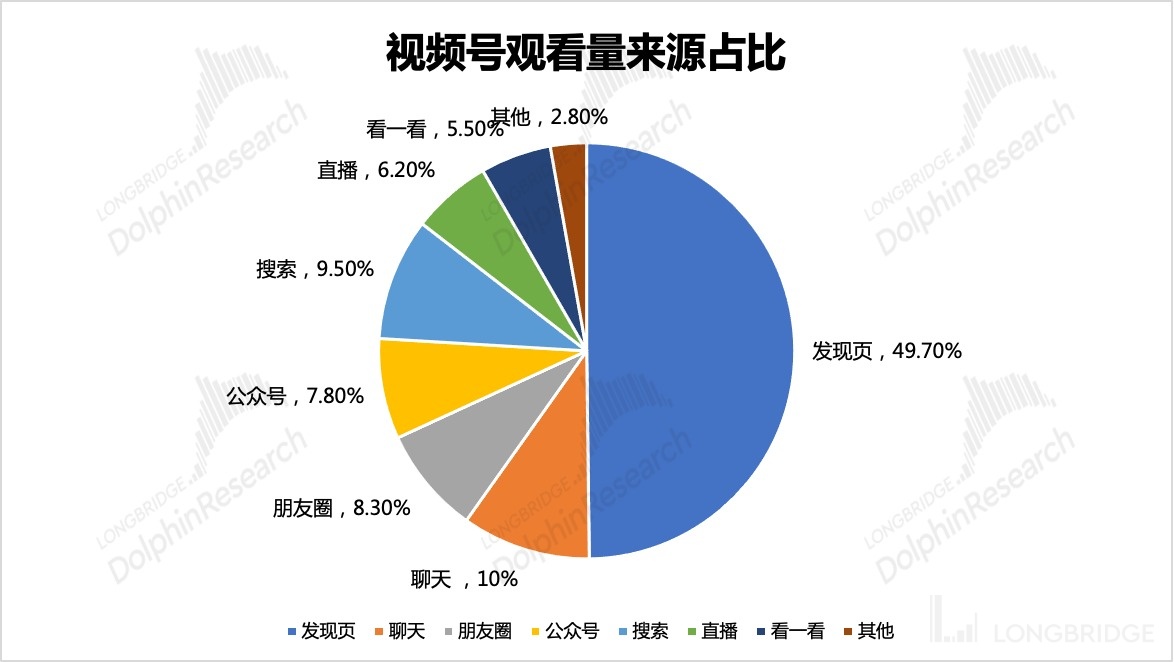

However, since Video Account is parasitic on the WeChat ecosystem, the public domain traffic that can be used for commercialization needs to be discounted based on the overall number of DAUs. According to research data, the proportion of actively entering traffic from the discovery page is about 40%, but the average viewing quantity of users who enter actively is higher. Therefore, according to the caliber of Video Views, the viewing quantity of discovery page entrance accounts for 50%, significantly exceeding the original estimate of Dolphin Analyst (~30%), but there is still a gap compared with Douyin's 60% recommendation page proportion.

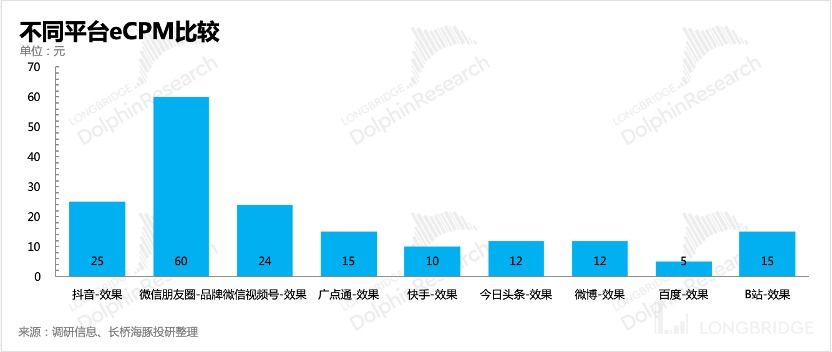

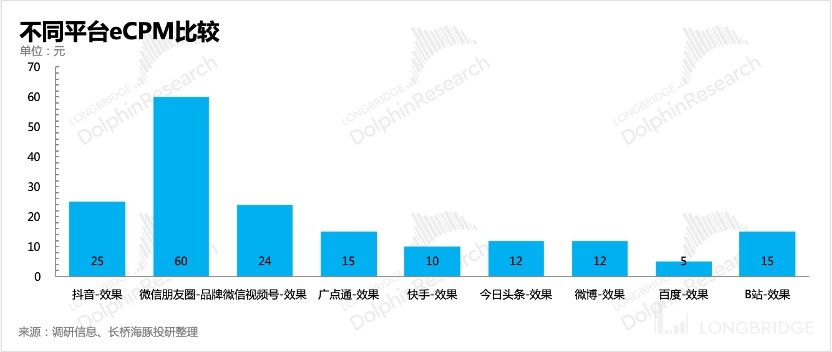

In terms of CPM quotation, Video Account benefits from the strong backing of WeChat and its traffic itself is relatively high-quality. Therefore, although its scale is not yet as good as Douyin, its quotation level is basically in line with it, which means it will be much higher than Kuaishou.

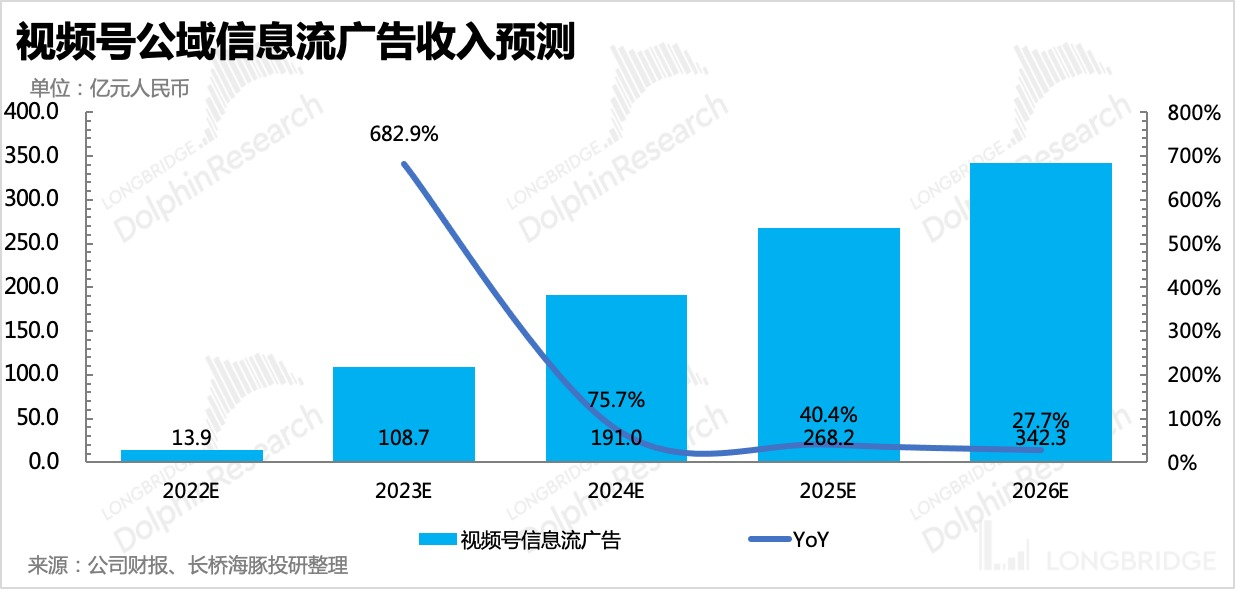

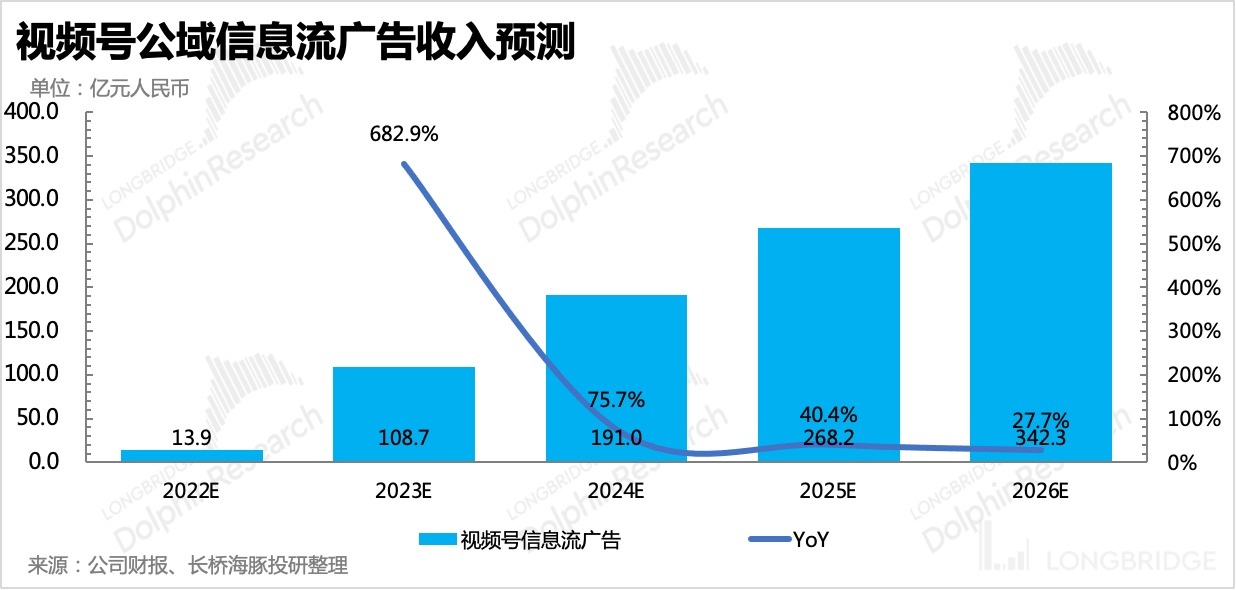

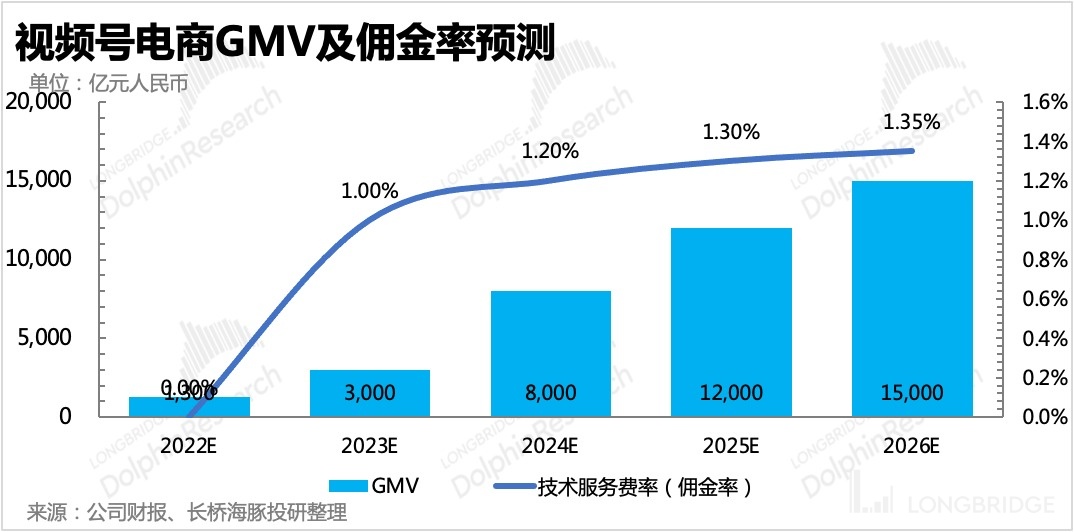

Based on the formula Ad revenue = VV (video views) x proportion of recommended pages x ad loading rate x eCPM (with ad loading rate following the current commercial rhythm of other WeChat ecosystems, about 5-6%), we are more optimistic about the commercial scale of Video Accounts than before, and we expect to approach 20 billion by the end of 2024.

However, relying solely on an advertising increase of 20-30 billion, the increase that can be directly driven for Tencent's current annual advertising revenue of over 80 billion and total revenue of 550 billion is not particularly high. The greater commercial value of Video Accounts should still be realized through e-commerce, in order to stimulate more internal-circulation e-commerce advertising revenue.

2. E-commerce Transaction Loop

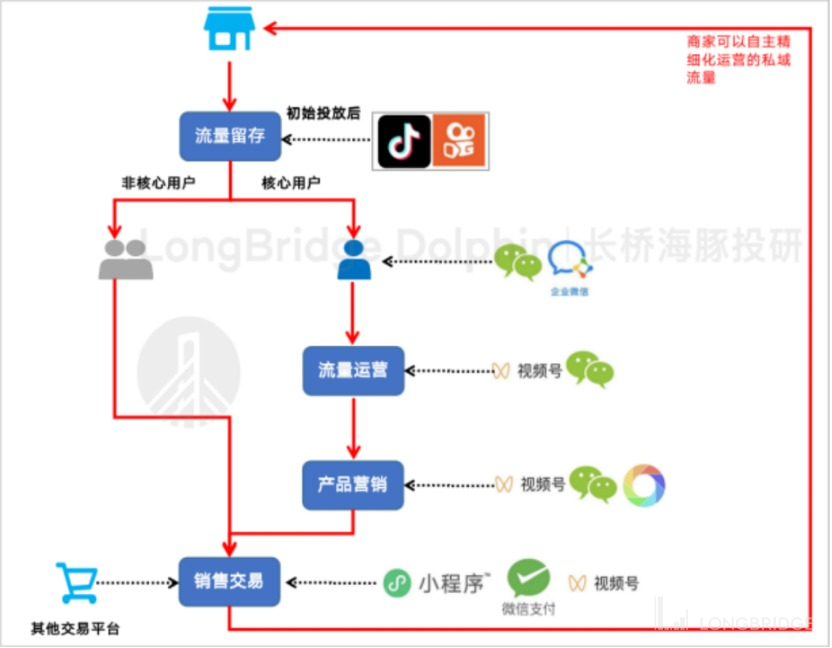

Ma Huateng said in an internal meeting that Video Accounts is Tencent's "hope for the community", and he wants Video Accounts and tools such as Mini Programs and Enterprise WeChat to work together to build Tencent's own closed-loop transaction without personally participating in e-commerce.

In fact, this is similar to what the Dolphin Analyst predicted in mid-2021, "Battle for Traffic Rights: Merchants Join In, Tencent is Confident". However, with the daily active users of Video Accounts approaching 400 million and gaining an important traffic entry point, merchants no longer need to spend as much on external traffic purchasing from Douyin and Kuaishou.

For some businesses, they can even play the entire process within the WeChat ecosystem, including "buying, retaining, private domains", as well as the underlying "supply chain services, payment services, and marketing services". Once traffic is incorporated into the merchant's private domain, it means that for future repurchases, the merchant no longer needs to repeat external traffic purchase in the same way. From a merchant's perspective, as long as Video Accounts have a steady flow of active traffic, they are more willing to realize a closed loop of transactions within the WeChat ecosystem and only pay the same technical services fee (transaction commission) to Tencent and other platforms.

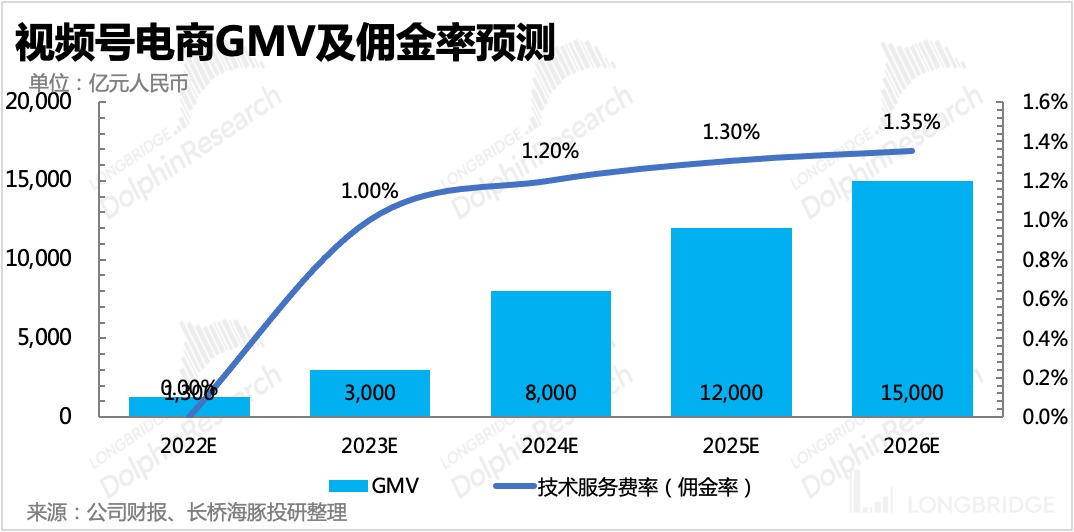

At the end of December 2022, Tencent Video Accounts announced that it will start charging technical service fees to merchants from January 1, 2023, with a rate ranging from 1% to 5%, similar to the charging methods of different product categories on Douyin and Kuaishou.

Combined with research data, the wide-defined daily active users of Video Accounts have reached 200 million, with a daily penetration rate as high as 40%. The average daily active users of live broadcasts are expected to be around 150 million in 2022, with 70.46 million annual active buyers among them. Comparing with Kuaishou's current data, the DAU penetration rate of live streaming in 3Q22 exceeded 80%, reaching 290 million, and the annual active buyer number exceeded 200 million. Obviously, Kuaishou has a higher payment rate. The reason behind the gap is probably due to the active live streaming users of Video Account. The e-commerce penetration rate is still not high, and many users are watching live concerts, knowledge lectures and other content.

However, when the future Video Account size expands further, although the live streaming active penetration rate is not as high as Kuaishou's, it does not mean that the absolute size of live streaming users is not high. Assuming that the annual active buyer number reaches the current level of Kuaishou (~200 million), with an average customer unit price of 3000-5000 yuan, corresponding to GMV of 6,000-10,000 billion.

Based on Kuaishou's current commission rate of 1% and Kuaishou's target monetization rate of 4% (commission of 1.5% + 2.5% for internal e-commerce advertising), it means that the e-commerce line of Video Account is expected to tap another 60-40 billion in revenue growth.

3. The mismatch period of investment and monetization has ended, releasing more room for profit improvement.

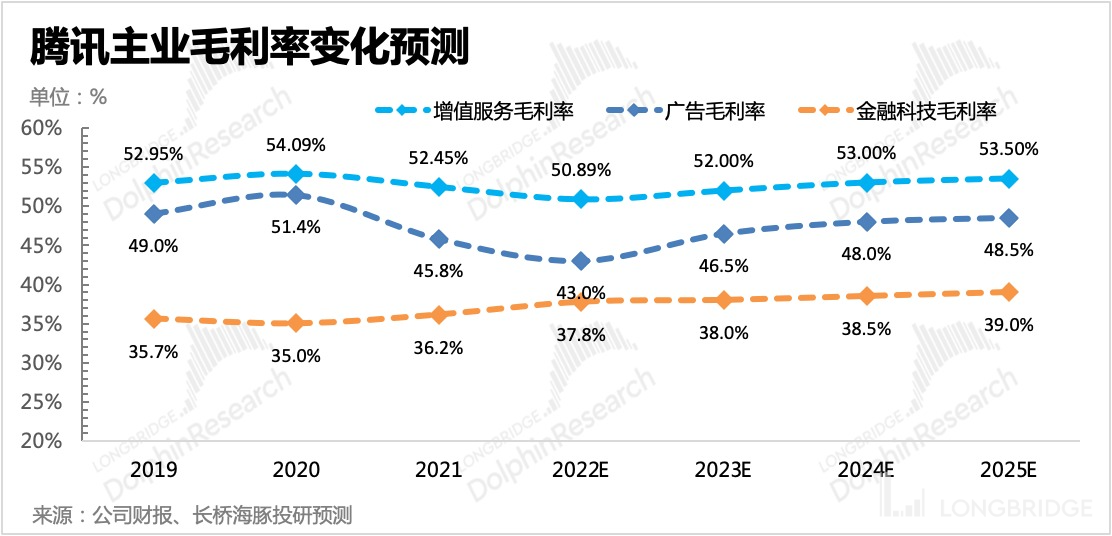

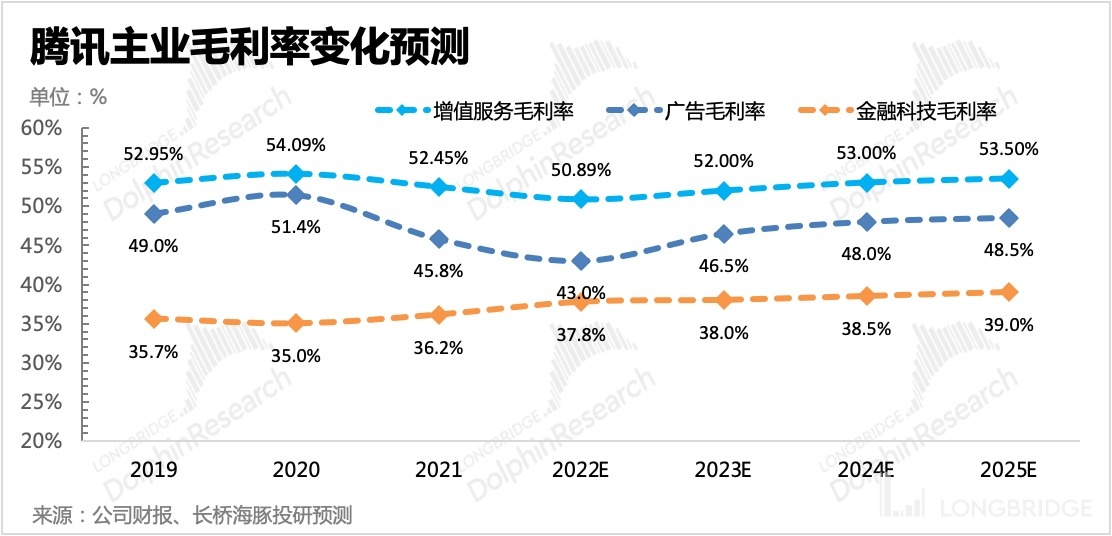

The accelerated monetization of Video Account means that the investment costs of the past two years can be prematurely allocated, weakening the expectation of the gross profit rate of advertising for the past two years will significantly recover and improve. We expect the gross profit rate of advertising in 2023 to slightly exceed the level in 2021, and further improve as the scale of e-commerce advertising expands.

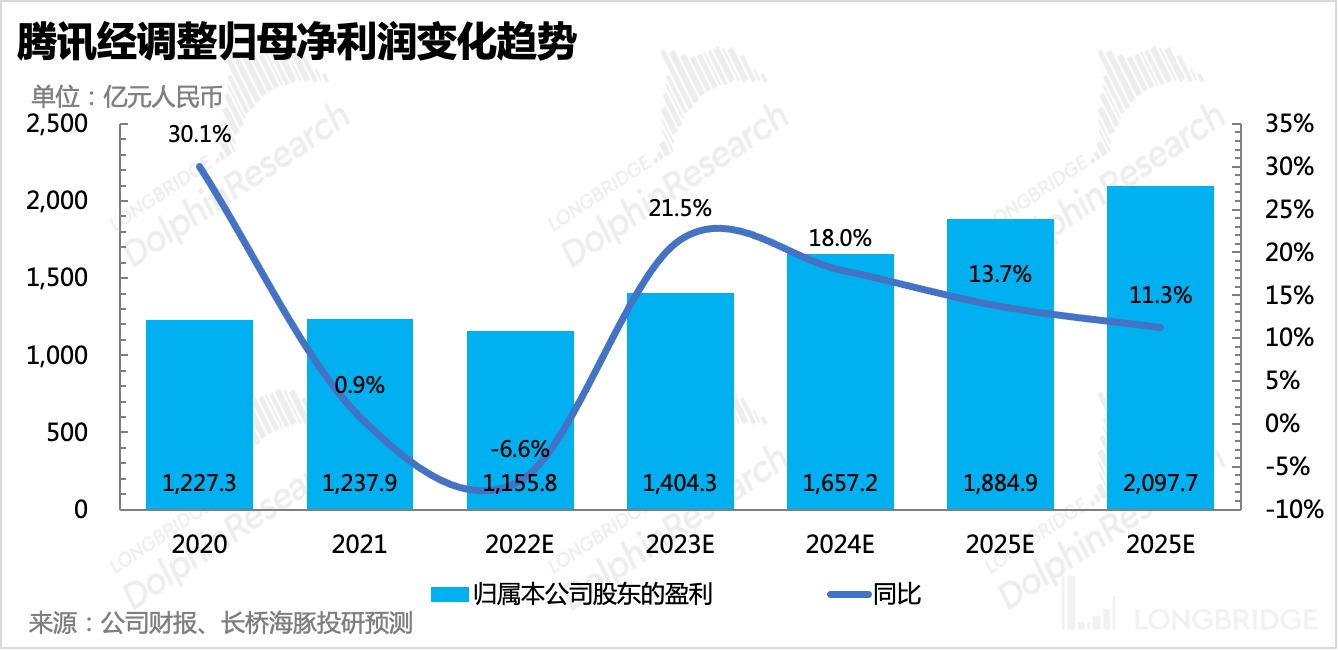

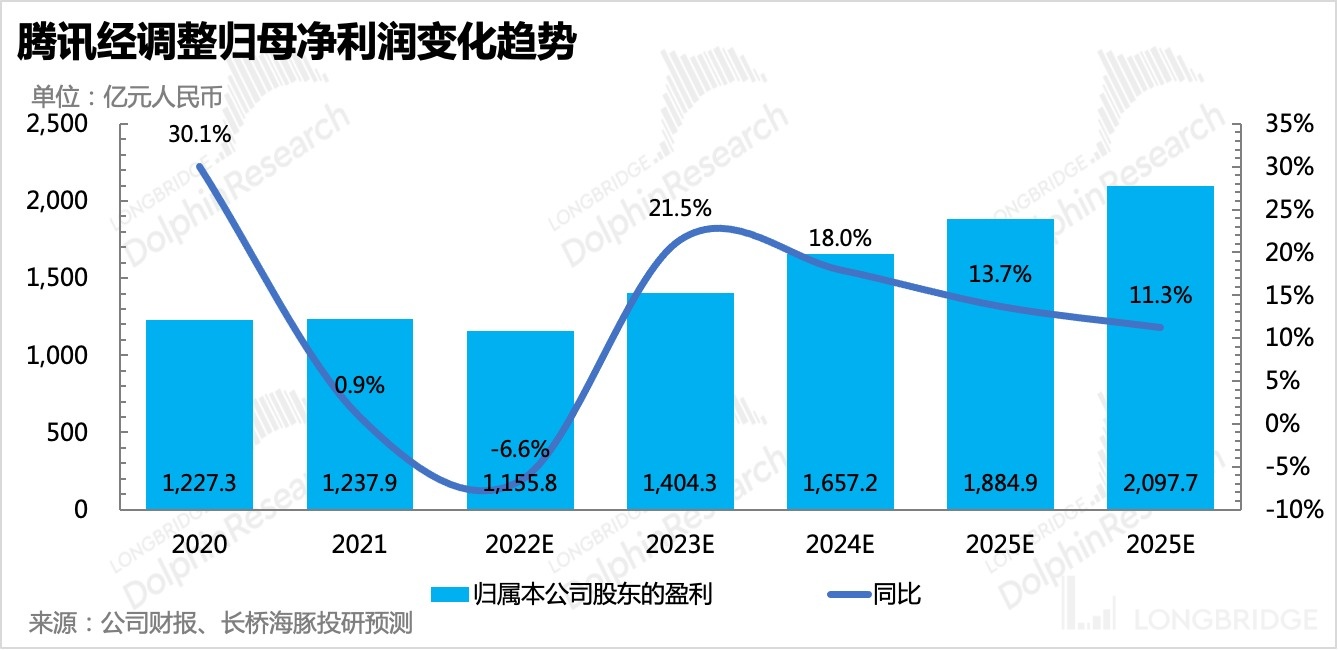

At the same time, the continuous reduction of digital content costs and the "quality over quantity" of Tencent Cloud, as well as the improvement of overall organizational efficiency, will help Tencent's growth performance on the profit side (~20%) to significantly outperform the revenue side (~10%) this year. In addition to continued share buybacks and investment asset stock dividends, small and medium-sized shareholders will also receive higher investment returns.

VI. What stage has the rebound of key companies reached?

After analyzing so much, in the investment strategy of the pan-entertainment sector, the Dolphin Analyst can summarize it into two points: (1) look at the barriers of vertical industries (2) consider organizational efficiency comprehensively. In addition, it is also necessary to combine potential valuation space.

Although the rebound of performance next year is a certainty, what the market is more concerned about is whether the current valuation has fully reflected the expectation of performance rebound.

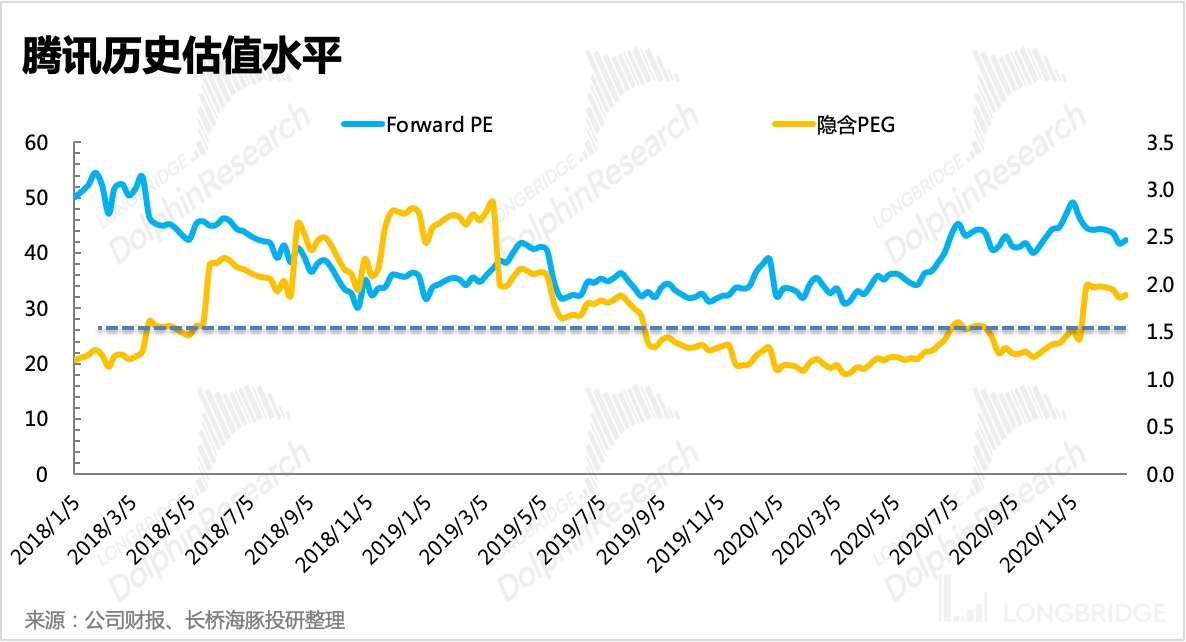

1. Tencent: Thin safety net but wins in certainty.

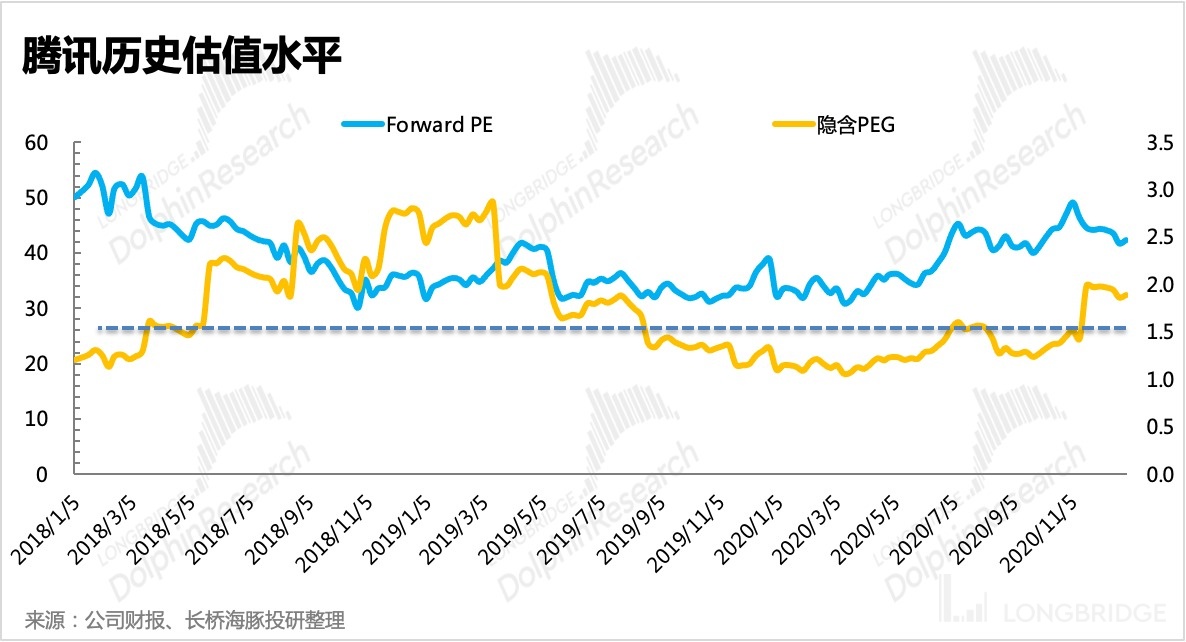

In addition to the long-term historical valuation center in the range of 30-40x, if it is viewed in stages, before the general market was flooded in 2020-2021, Tencent's valuation level has always maintained balance with the growth expectation of net profit attributable to shareholders, bearing PEG=1.5. The fluctuation range of the interval is large, about 1-2. For example, in 2017, the adjusted net profit growth rate was around 40-45%, and the forward PE remained above 50x, with an implied PEG of 1.25.

It is worth mentioning that, as is now the case, there is a turning point with performance recovery expectations - the time window in the middle of 2019. Due to market sentiment, the implied PEG soared to 2. For example, if we expect earnings growth of around 20% next year and the short-term sentiment is very good, perhaps the highest PE will reach 40x.

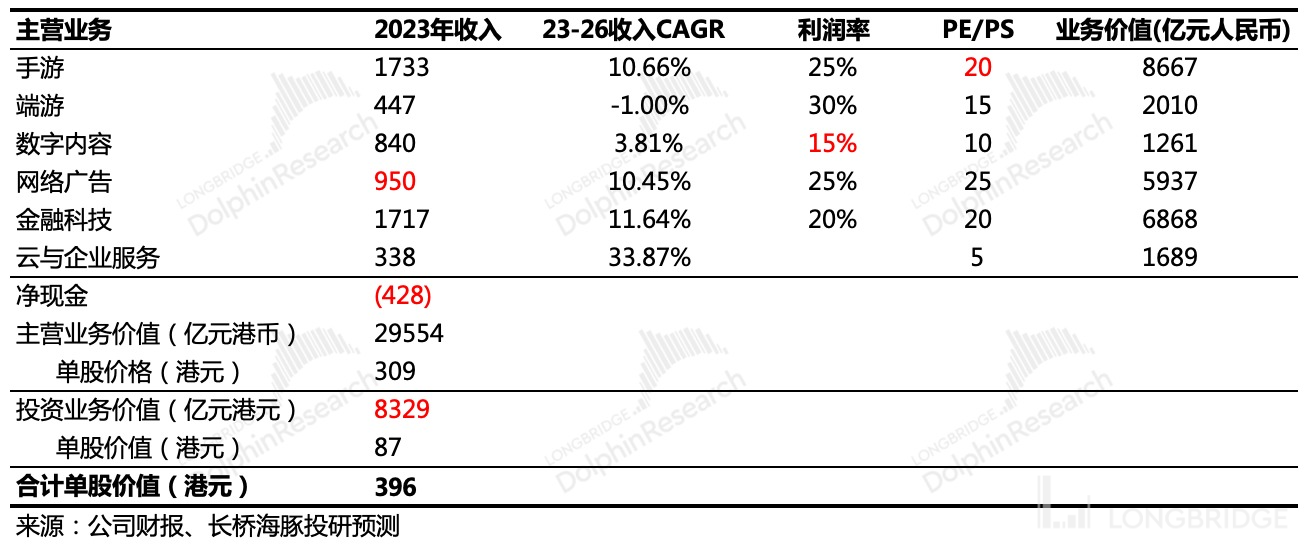

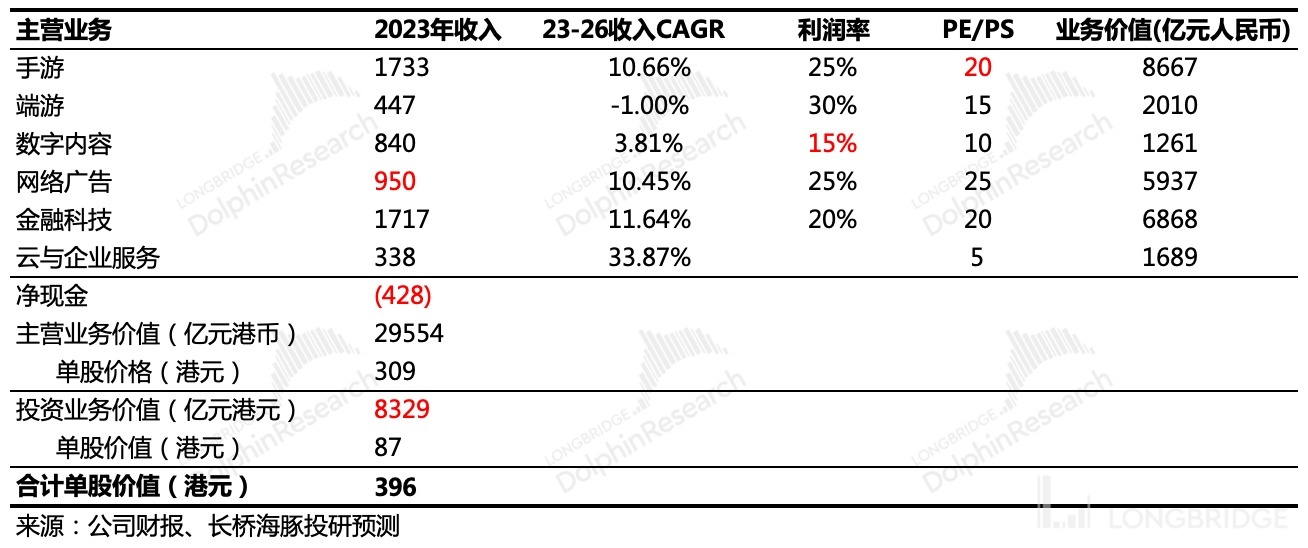

However, due to the systematic pressure of the global economy, Dolphin Analyst recommends a neutral expectation and, based on the balance relationship with an implied PEG of 1.5, gives a rough estimate of a 30x PE on the basis of next year's earnings expectations, which corresponds to HK $3.75 trillion.

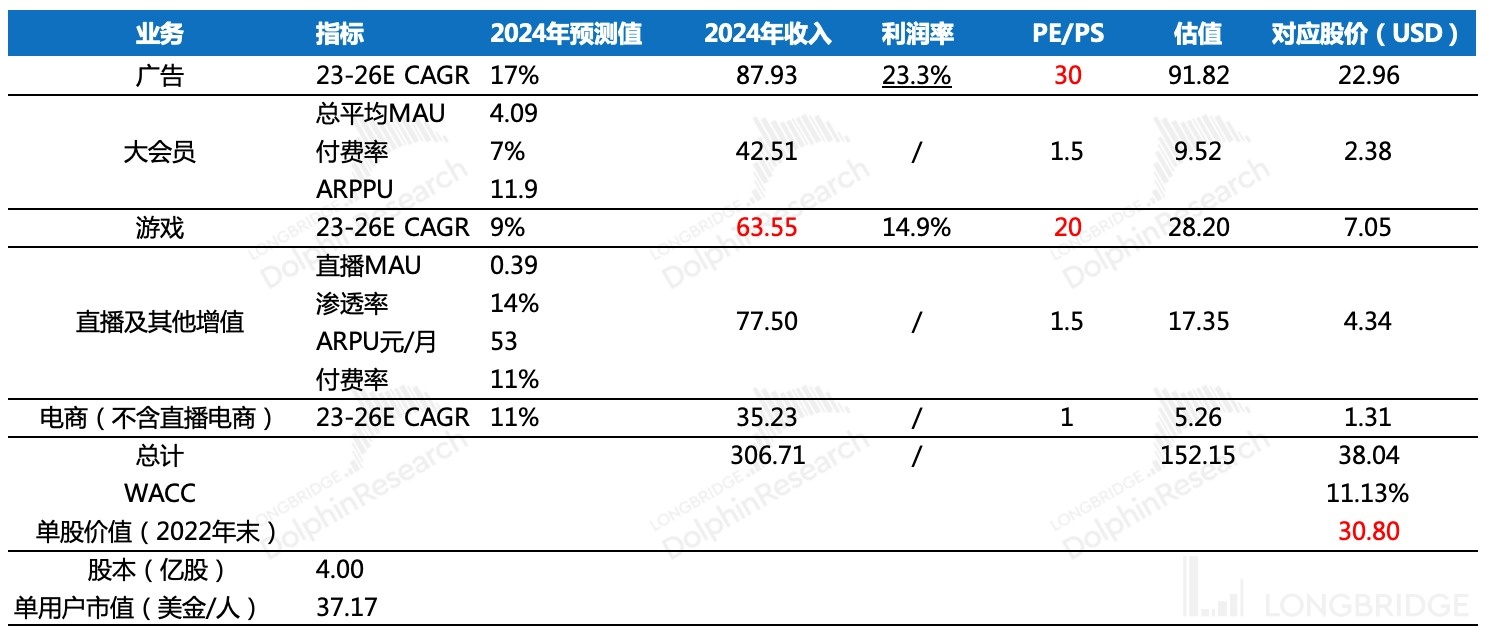

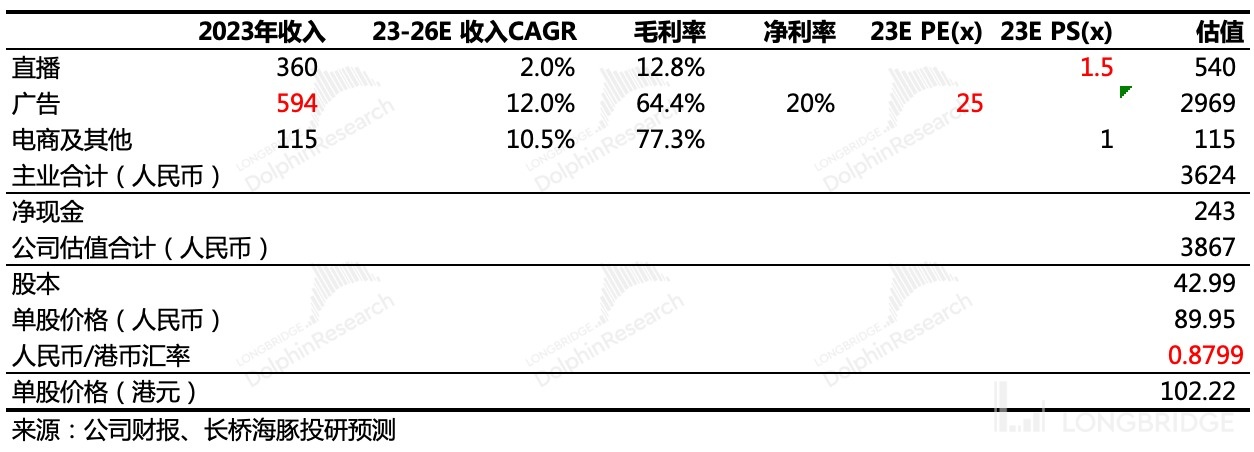

If the valuation is further divided according to SOTP, given positive factors such as the recovery of consumer expectations, video resource tilt exceeding expectations, and relaxed regulatory signals for gaming approvals, compared to Tencent's updated valuation after the second quarter report in "Rediscovering Tencent, Exploring the Bottom of the Stock King", we have mainly raised our expectations for advertising revenue growth, the profitability of digital content, and the valuation level of the gaming business. In addition, due to the rebound of Chinese concept assets, Tencent's equity assets are no longer discounted separately. The final valuation is HK$3.8 trillion, a 4% increase from the previous HK$3.65 trillion.

Compared to the current market capitalization of HK$3.4 trillion, the valuation of HK$3.8 trillion still has 12% room for growth, although the safety cushion has been significantly reduced. If video or gaming repairs are excellent and IFRS net profit attributable to equity holders significantly exceeds our expectations, then the optimistic valuation of the stock king may continue to rise.

2. Bilibili: Room for imagination, but high uncertainty in actual efficiency

Based on the above analysis, Bilibili theoretically also has room for efficiency improvement through revenue growth and cost reduction, but the problem with Bilibili lies in the need for users' free consumption habits to change. Otherwise, in 2023, when video is the main focus, there will still be resistance to surpassing expectations in terms of Bilibili's advertising monetization. In addition, from the perspective of organizational efficiency, the final competition on the comprehensive platform is uncertain in terms of improving the company's organizational efficiency, as previous management experience has shown.

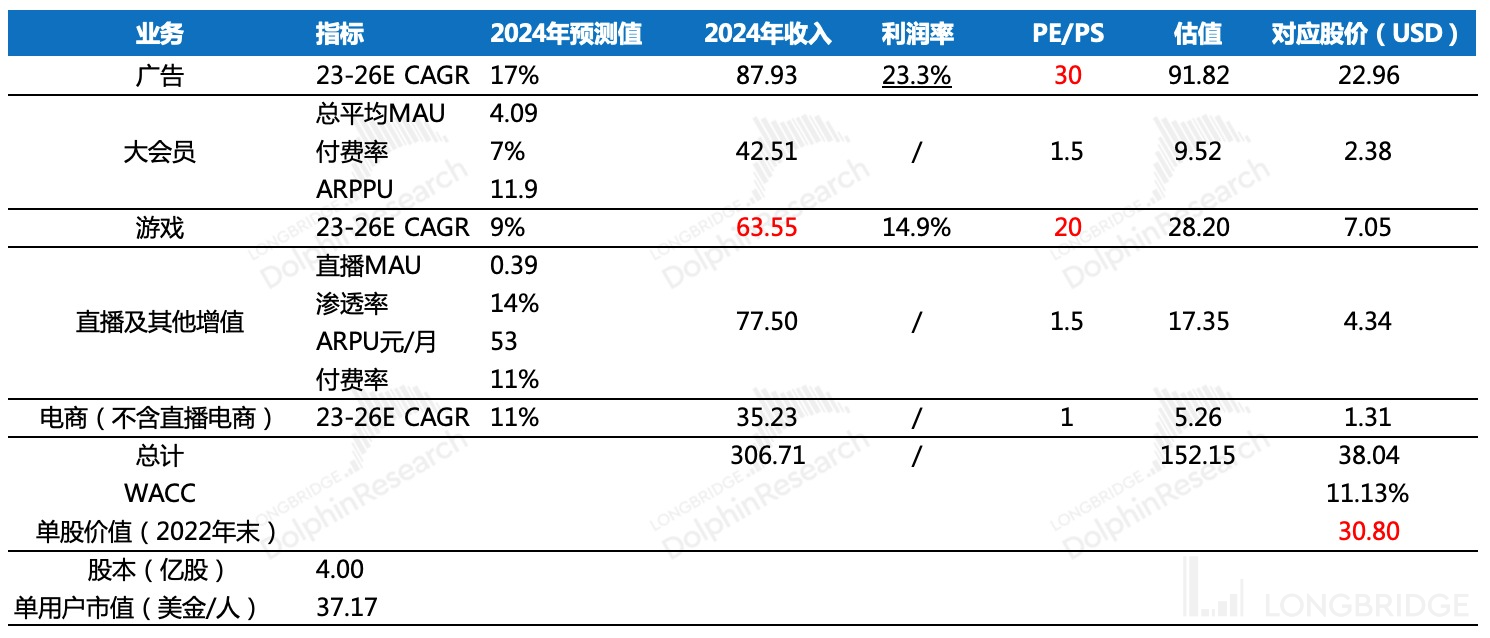

Relative to the valuation in the Q2 report summary, we have raised our expectations for game revenue and also increased the valuation multiples of games and premium member businesses. The updated divisional valuation is as follows: Dolphin Analyst suggests that given the recent rebound, we do not adjust our observation of B station from the perspective of finding fundamental certainty. If there is a certain thickness of safety cushion in the future, we will update it based on business operations.

"3. Kuaishou: With the decline of short video excess dividend, can high organizational efficiency alleviate competitive pressure?"

First, let's look at the space for reducing costs and increasing efficiency. Kuaishou's high marketing expenses are still the main target for expectation. Looking at last year's Q1-Q3 financial report, Kuaishou was not "stingy" enough, and the speed of profit improvement can be faster.

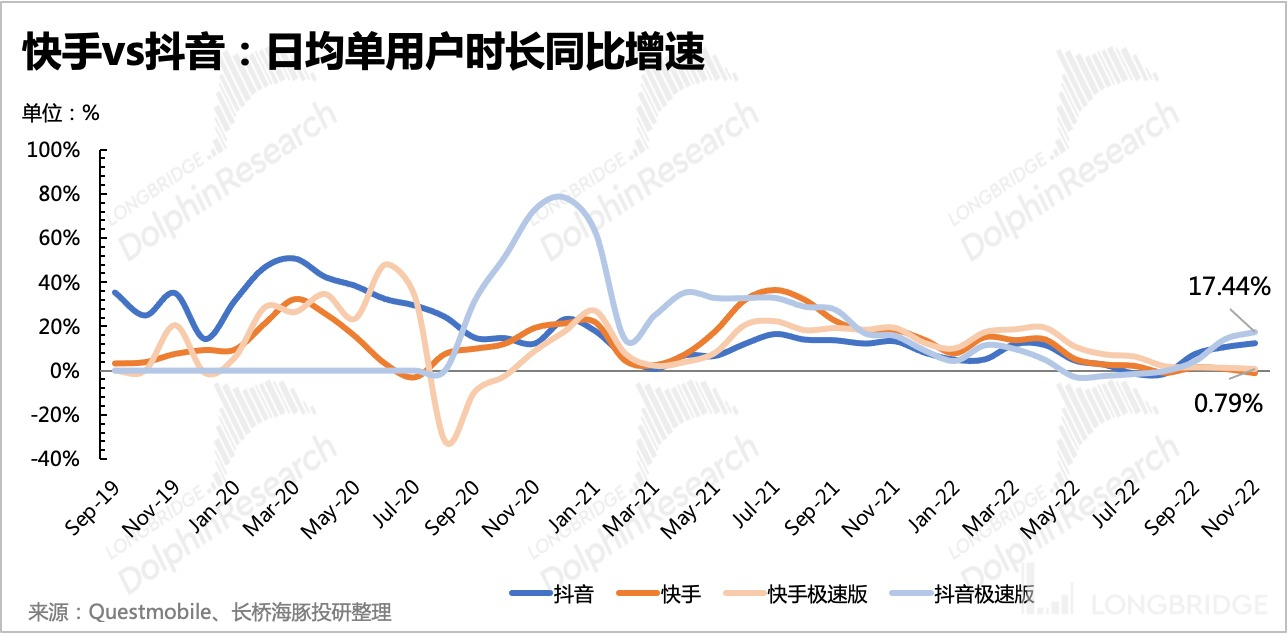

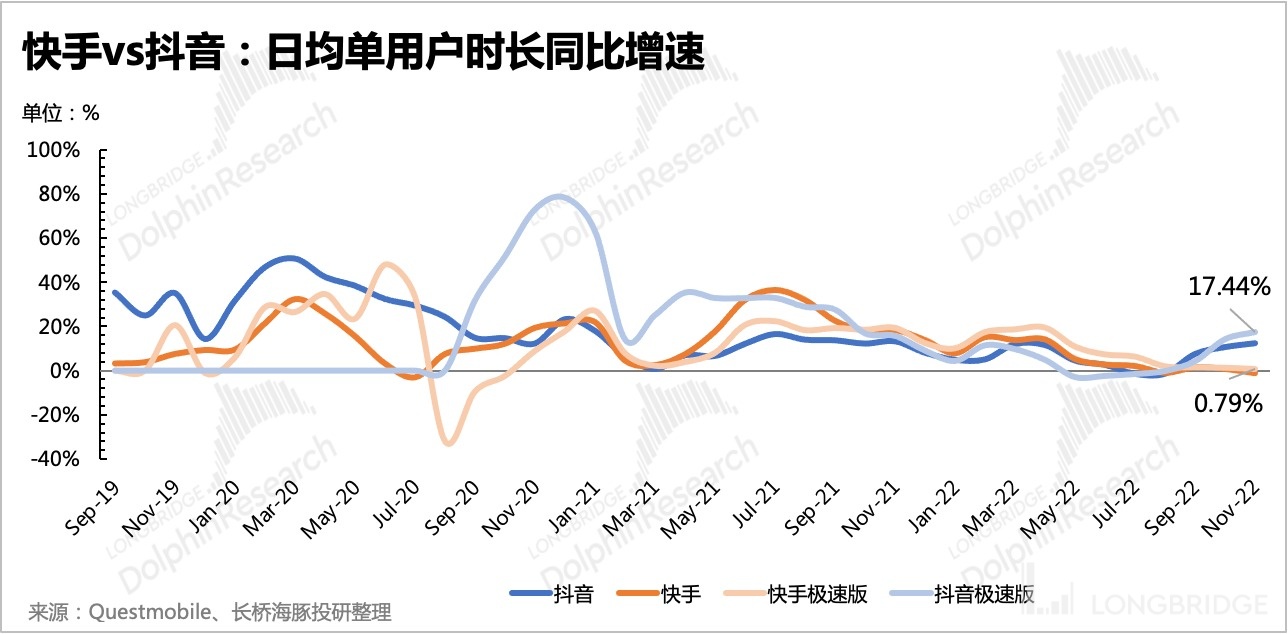

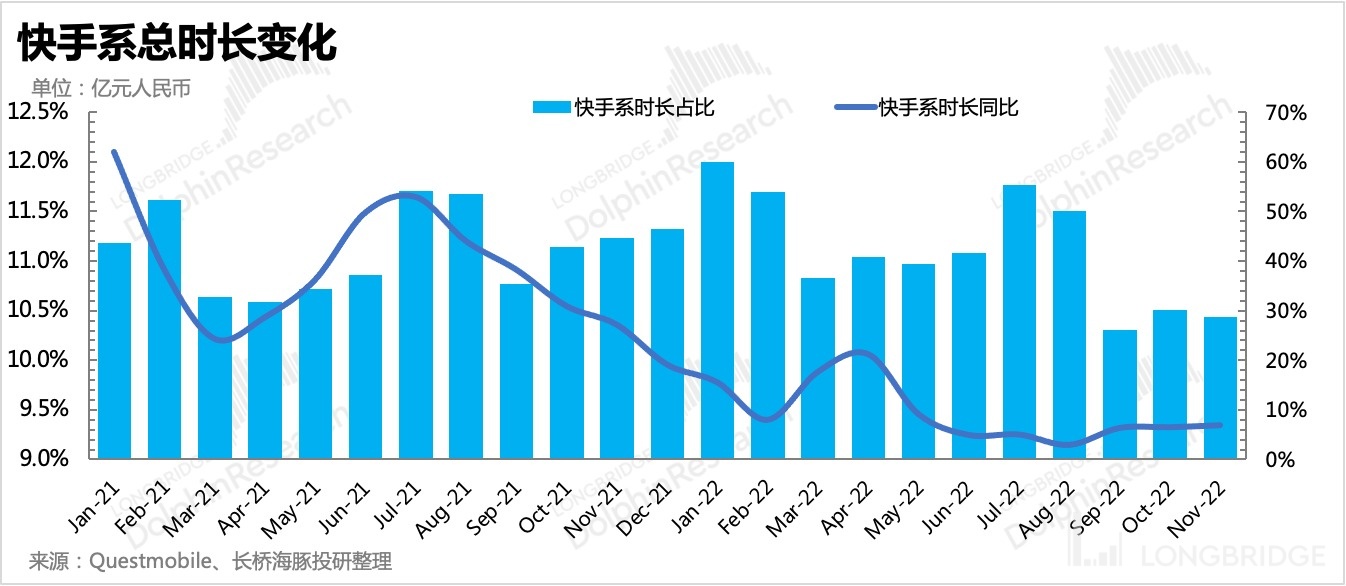

But the drawback of Kuaishou is that the value of its own traffic makes its potential monetization ability not directly comparable to that of Douyin. At the same time, as various platforms have added short video features, Kuaishou's excess dividend in short videos has also become less and less.

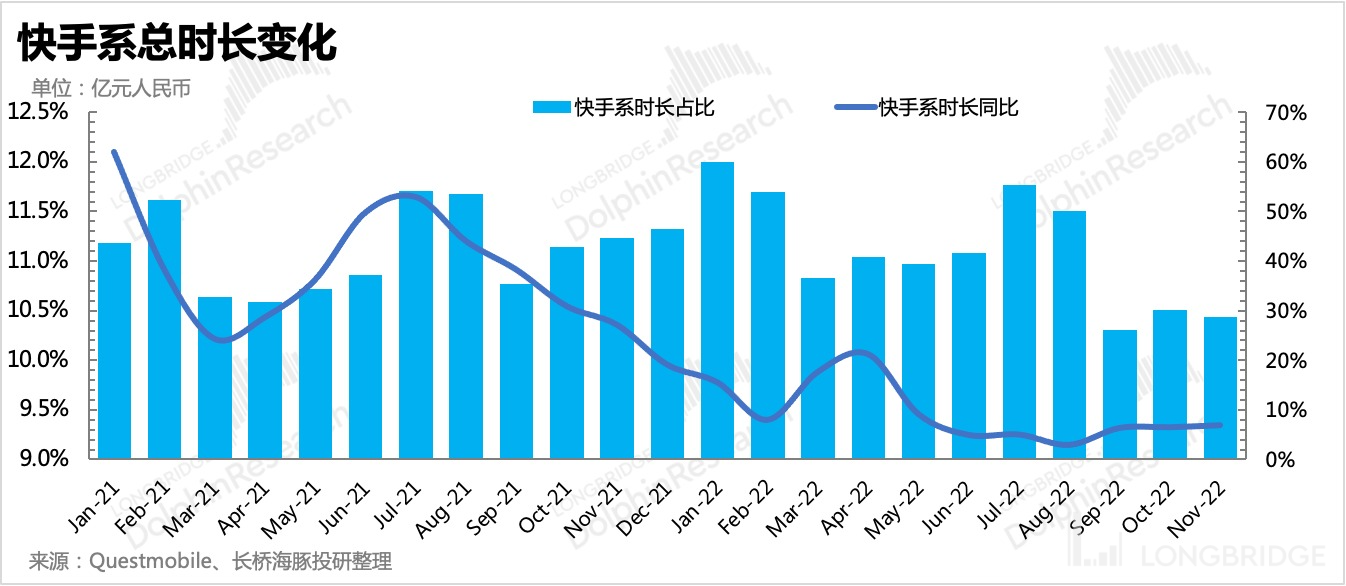

According to data from Questmobile, as a pure short video platform in the dividend period, Kuaishou's duration growth rate fell behind last year, and the overall duration share did not consistently increase like ByteDance, but stagnated.

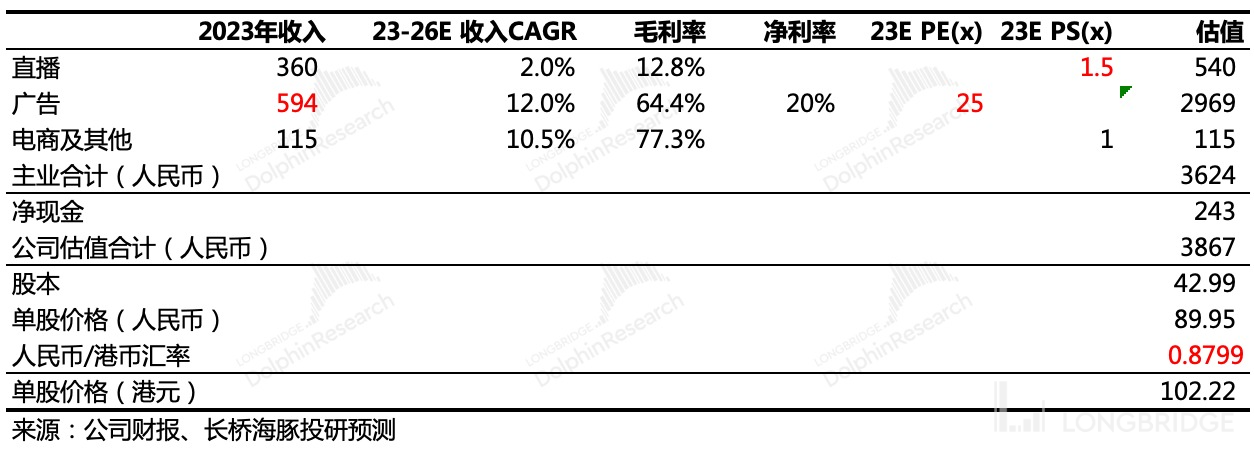

Therefore, when the video number, which is also a private domain attribute, focuses on this year, exerting the entire group's efforts to support, it is difficult to avoid the impact of the video number when expecting Kuaishou's market share. Therefore, we slightly lower our expectations for advertising revenue, and at the same time, like other peers, increase the valuation multiples of live broadcasting and advertising businesses to reflect the market sentiment under normal operating conditions.

"4. Paid vertical content: Do not consider growth, only valuation repair"

Finally, let's discuss the vertical platforms, Tencent Music and iqiyi, which have already seen the ceiling in the short term but still have a certain competitive barrier/monopoly position in the segmented track. In the eyes of the Dolphin Analyst, their current focus is on repairing their valuation and they do not currently have optimistic expectations for further growth. Therefore, they are not on the Dolphin Analyst's preferred list. Instead, we choose to evaluate whether there is still room for growth based on current revenue and the ideal profit model.

(1) iQIYI currently has 100 million paying users, and with an average payment of 15 yuan per month, we expect annual subscription revenue of 18 billion yuan, assuming there is no significant user loss after a price increase. Based on previous revenue structures, advertising sponsor income: content distribution income: subscription income = 25%:10%:65%, which means the total revenue is expected to be 27.5 billion yuan.

Based on the gross profit margin level of streaming media leader Netflix (~40%), iQIYI has a profit potential of up to 15% (the gross profit margin in 3Q22 is 24%), which means that the ideal after-tax operating profit margin for long-form video in China is roughly 15%.

According to this level of profitability, giving a 10x PE valuation to the digital content industry corresponds to a market value of approximately US $6 billion for iQIYI. There is not much room left for a valuation recovery. Therefore, from a risk-reward perspective, the Dolphin Analyst chooses to continue to observe.

(2) Tencent Music is relatively more complex because, on the one hand, there is still untapped potential for paid subscriptions, and on the other hand, the original mainstay business, social entertainment, is facing competition and pressure from comprehensive platforms such as Kuaishou and Bilibili. Due to the loss of copyright exclusive advantages, it is currently difficult to see some of the corresponding barriers to be put in place, which means that this part of the revenue also faces the risk of continuous outflow.

In an ideal state, paid subscriptions can reach 120 million, corresponding to a potential of 1.2 billion based on the current 600 million monthly active users and the ceiling of the domestic digital content payment rate (benchmarking the 20% payment rate for long-form video). Based on the current average payment of 8.5 yuan per month, subscription revenue is expected to reach 12 billion yuan per year.

Content distribution and advertising revenue account for about half of the subscription revenue based on the current income structure, resulting in approximately 6 billion yuan.

As for social entertainment revenue, because it is still in a downward trend, we assume that it will stabilize at a scale of 13 billion yuan per year after dropping another 15% from this year. This allows the total revenue to reach 31 billion yuan.

The profit structure is also based on Netflix, the global streaming media leader, and the gross profit margin of Tencent Music in 3Q22 has 7 percentage points of room for improvement compared to Netflix's 40%. This means that the after-tax operating profit margin is expected to increase from 13.6% in 3Q22 to 19.2% (effective tax rate of 20%) in an ideal state.

Based on this level of profitability, we give a 15x PE ratio. Because it belongs to the Tencent ecosystem, a certain premium can be given on the basis of the 10x valuation of the digital content industry. This corresponds to a market value of approximately US $12 billion for Tencent Music. However, the current market value has reached 15 billion yuan, which indicates that Tencent Music has rebounded too strongly according to the Dolphin Analyst's expectations. Overall, entertainment stocks in 2023 will continue to enjoy the industry beta dividend, especially the gaming and film industries with significant improvements in industry supply. However, stocks that have sustainable opportunities and are worth the attention of Dolphin Analyst will manifest as high-operational efficiency companies, not only reflecting profit improvement driven by growth but also the improvement in organizational efficiency.

Combining certainty and rebound space, Dolphin Analyst believes that:

-

Tencent is still our first choice;

-

The second choice is Kuaishou, which has a relatively considerable rebound space, but the risk-return ratio is slightly lower. Kuaishou also needs to be closely followed, especially whether high marketing costs can be effectively optimized as expected during intensified competition;

-

Though Bilibili has imaginative potential, whether it can fall in place ultimately depends on the management's organizational efficiency, with higher uncertainty, so we prefer to look for a better position;

-

On the other hand, niche platforms, iQiyi and Tencent Music, do not have sufficient growth force on their main business, and the current rebounds are essentially in place. If there is a pullback opportunity, the certainty of Tencent music is higher than that of iQiyi.

Dolphin Investment Research "Entertainment Overview" Historical Articles:

September 27, 2022, "Can the vanished Kuaishou, Xindong, iQiyi, and Tencent Music reverse their plight?"

September 16, 2022, "After their respective paths, Tencent, Kuaishou, and B Station face different outcomes."

May 5, 2022, "Exploring the Boundless Sea of Tencent and B Station in the Entertainment Industry."

April 15, 2022, "Why can't the revival of game stocks from the license restart kick off the craze?"

September 15, 2021, "Retrospecting the Entertainment Industry (Part II): How Far Away is the Spring Day of Tencent and Kuaishou amidst Another Winter?"

September 13, 2021, "Retrospecting the Entertainment Industry (Part I): How Far Away is the Spring Day of Tencent and Kuaishou amidst Another Winter?" This article's risk disclosure and statement: Dolphin Research's Disclaimer and General Disclosure

!

!