Rate Of Return

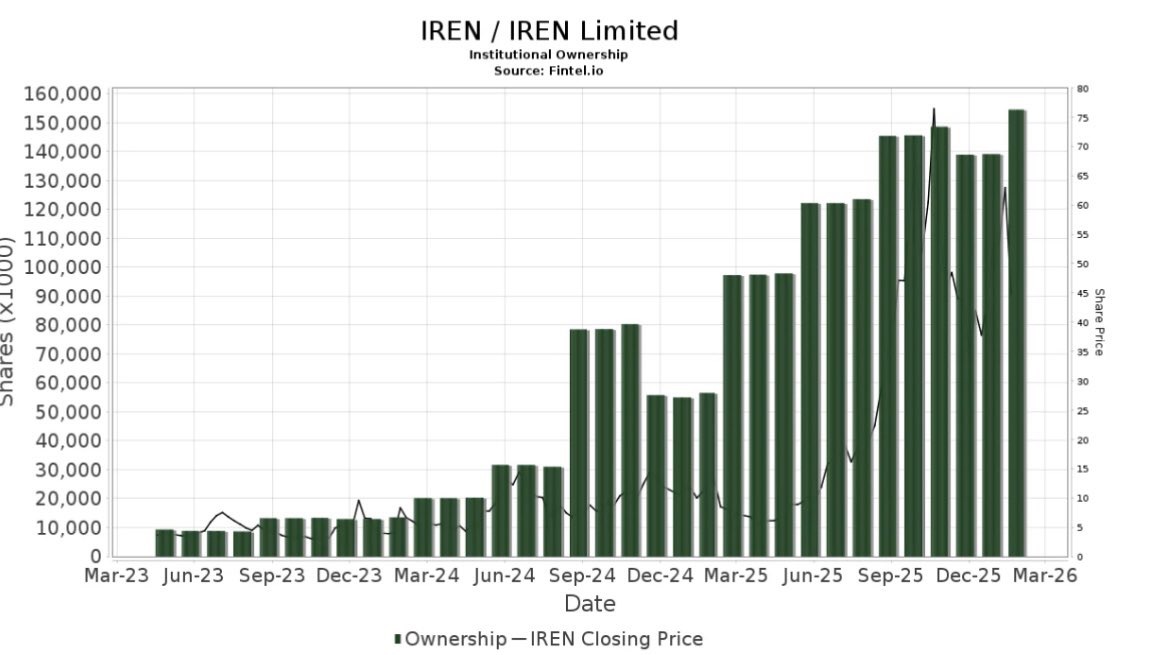

Rate Of Return🚨📊 $IREN(IREN.US)(IREN.US)(IREN.US) Institutional Holdings Hit Record High — Is This Really a Signal of "Smart Money Entering"?

When multiple institutions simultaneously disclose new positions, the market's first reaction is often:

"Institutions are bottom-fishing."

Let's first lay out the list clearly:

$IREN(IREN.US)(IREN.US)(IREN.US)

Institutions adding new holdings include:

BNP Paribas

Clear Street Group

Wolverine Asset Management

Qube Research & Technologies

Capital Research Global Investors

Total institutional holdings have exceeded 150 million shares, setting a new historical high.

But what really needs to be unpacked are three things.

First, what type of capital is this?

BNP, Capital Research → More traditional asset management

Wolverine, Qube → More quantitative and multi-strategy

Clear Street → More trading and market structure

This is not "all long-term value investors," but a resonance of multiple capital types.

Second, what does rising institutional ownership mean?

An increase in institutional ownership ratio typically brings:

More stable liquidity

Higher research coverage

Lower retail-driven volatility

But it does not automatically equal "fundamentals are confirmed."

Many quantitative and multi-strategy fund positions may be based on:

Factor models

Volatility structure

Sector rotation

Event-driven strategies

Not long-term conviction.

Third, why now?

$IREN(IREN.US)(IREN.US)(IREN.US)'s core narrative revolves around:

Power resources

Data center capabilities

Bitcoin mining + HPC transformation narrative

When the market starts to reprice "mining companies" as "computing power infrastructure," institutional participation naturally rises.

The real question worth asking is not:

"How much did institutions buy?"

But rather:

Are they betting on Bitcoin price?

Or are they betting on AI computing power expansion?

Or are they engaging in high-beta sector rotation?

Record institutional holdings essentially indicate:

This stock has entered the radar of mainstream capital and is no longer a peripheral asset.

But this also means—

Consensus is forming.

After consensus forms, the risks lie in:

Trading congestion

Amplified volatility during sentiment reversals

The key variables remain:

Computing power utilization rate

Power costs

Expansion pace

Cryptocurrency market liquidity

The question here is:

Do you see this as the "beginning of a long-term infrastructure revaluation,"

Or a "high-beta sector amplified by institutional rotation" as a temporary market move?

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.