Options

Options Traded Value

Traded ValueBerkshire Hathaway 13F

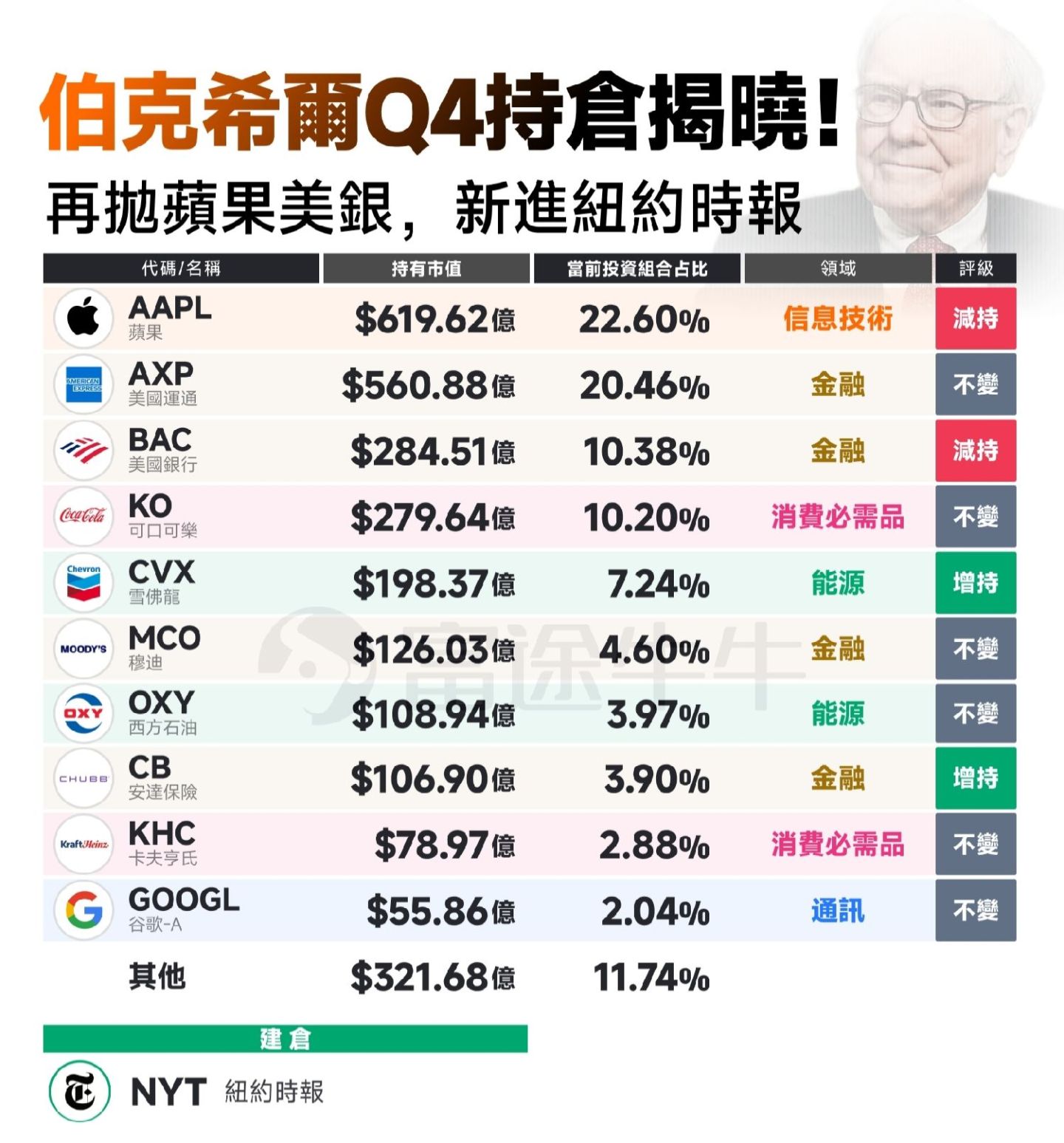

After U.S. markets closed on February 17th Eastern Time, the 13F filing submitted by Berkshire Hathaway to the U.S. Securities and Exchange Commission (SEC) showed that $Berkshire Hathaway Inc. (BRK.B.US)$ continued to adjust its holdings in tech giants in the fourth quarter of 2025, selling off Amazon significantly while continuing to reduce its stakes in Apple and Bank of America, and making its first investment in the traditional media company The New York Times. The filing revealed that by the end of the fourth quarter of last year, Berkshire's overall portfolio size was $274 billion, an increase of approximately $7 billion from the $267 billion in the third quarter.

This report also holds special historical significance. As the final portfolio disclosure before Warren Buffett officially stepped down as CEO at the end of 2025, it marks the official conclusion of the era personally steered by the "Oracle of Omaha." Furthermore, Berkshire recently announced that it will release its full-year results on February 28, at which time it will publish the first CEO letter to shareholders from "successor" Greg Abel.

Top Ten Holdings Remain "Familiar Faces"

Overall, as of the end of the fourth quarter of 2025, by market value of holdings, Berkshire's top ten holdings did not change, with only slight adjustments in their rankings. The top ten holdings accounted for a staggering 88.26% of the total portfolio value, continuing Buffett's classic investment style of "putting all your eggs in a few baskets."

$Apple(AAPL.US) $Coca Cola(KO.US) $Amazon(AMZN.US) $New York Times(NYT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.