Posts

Posts Likes Received

Likes ReceivedLi Ning's "Cycle Robbery" needs to endure for how long?

In the consumer review of the early 2021 "After two years of Battle Royale, Consumer Goods have Returned Strongly" by Dolphin Analyst, some thoughts about sportswear brands were shared, and the chosen company in the sportswear category was Li Ning ($Loews(L.US)i Ning.HK).

At the time, Dolphin Analyst believed that the recovery of the fashion category, especially the sportswear category, which has historically performed well in the segmented market, had a good recovery space, including the travel scenario that followed fashion category repair. Li Ning, which had better inventory digestion ability in the fashion category in recent years, may be a better choice in the sportswear category.

Therefore, this study focuses on the research of Li Ning, the leading brand in sportswear. This article discusses two industry-related issues in the first half:

-

Is there any further space for domestic sportswear brands after 30 years of rapid development?

-

How deep is the inventory of this wave of sportswear, and where is the inflection point of the inventory?

Dolphin Analyst's core conclusions are:

-

The industry has been in a downward trend for the past year and a half and is currently waiting for the timing of the bottom rebound. In the long run, although sportswear has penetrated rapidly in the overall clothing sector over the past few years, the per capita sports expenditure in China is still relatively low, and there is still room for doubling in the next five years. The industry can maintain a relatively considerable growth rate and support the performance of leading companies' stock prices.

-

In the short term, due to the current unfavorable terminal data, the top companies' inventory pressure is highlighted, and the industry is still in a period of dilemma. In a retrospective analysis, the previous round of inventory crisis had a profound impact on the industry, resulting in most companies not daring to take risks at this time. Even if they have confidence in the future reversal, investors will be extra cautious in participation, and the stock price still reserves room for marginal improvement.

-

According to historical experience, the inventory cycle of sportswear is generally 1-2 years. From a time perspective, it is nearing its end. The idea that there may be significant changes in the second and third quarters of this year is more prevalent in the market. Dolphin Analyst also agrees with this thinking. From the mid-2021 perspective, it is basically in the next two quarters, so it is essential to pay attention to the signal of marginal improvement.

Dolphin Research and Investment is devoted to cross-market interpretation of global core assets for users, grasping the deep value of enterprises and investment opportunities. Interested users can add the WeChat account "dolphinR123" to join the Dolphin Research and Investment community to discuss global asset investment ideas together!

I. The bleak textile and clothing, and the inevitable downturn of sportswear.

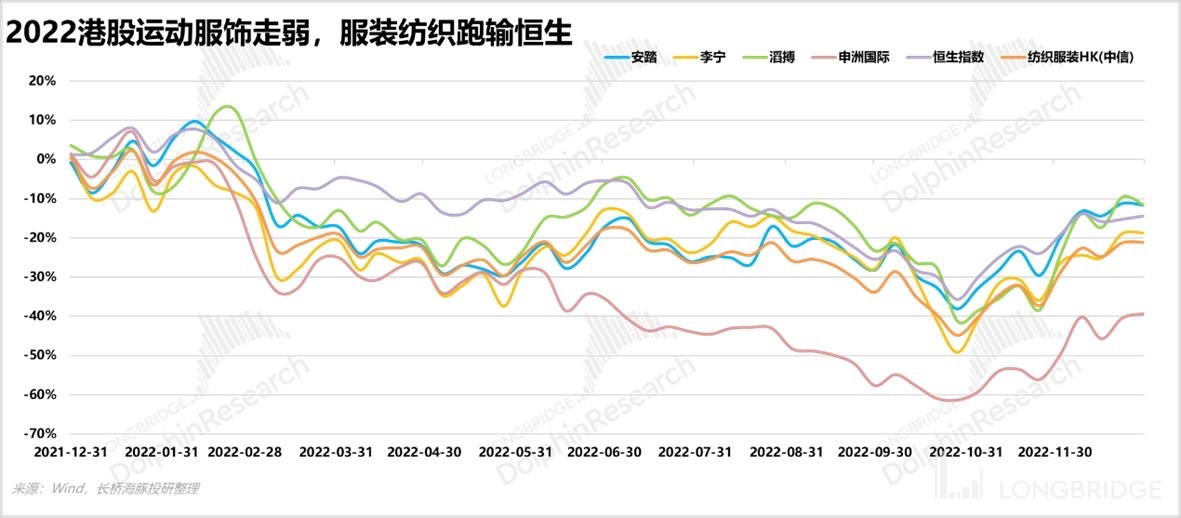

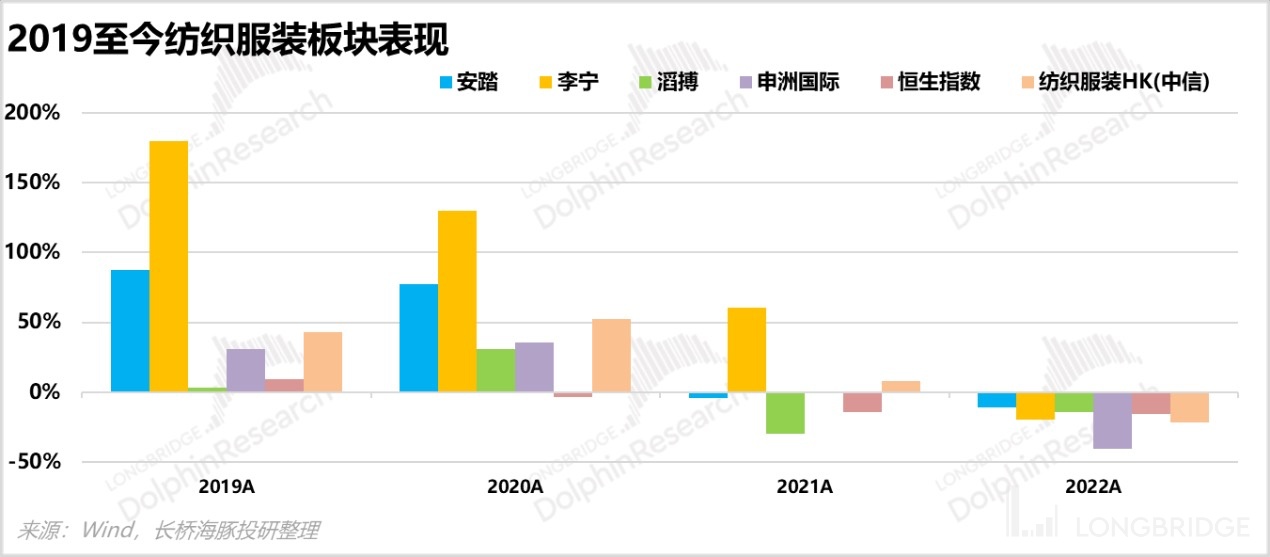

The textile and clothing sector in 2022 did not perform well, and the textile and clothing HK (CITIC) index underperformed the Hang Seng Index, both showing negative returns. Even in the sportswear category, which has always been strong in the industry chain, the performance is not satisfactory, regardless of the position in the industrial chain. Moreover, a large part of this performance comes from the rebound after the adjustment of epidemic prevention policies from November to December last year; otherwise, it will be more unattractive. ANTA, which performed the best, suffered the deepest decline, with a maximum decline of 40%, and only returned to -10% by the end of last year. Upon closer inspection, we can see that leading companies in China's open-end industry, such as Anta and Li Ning, have a gross profit margin of around 50% because they are in the most profitable position in the industry chain. Downstream channels such as Tops have a gross profit margin of around 40%, which is slightly ahead of the industry.

However, the upstream production end has a lower gross profit margin and significant exposure overseas. Starting from mid-2021, due to overseas inflation leading to the displacement of some optional consumption, as well as the domestic epidemic causing some orders to flow out to Southeast Asia, the textile manufacturing industry has been particularly difficult in the last year.

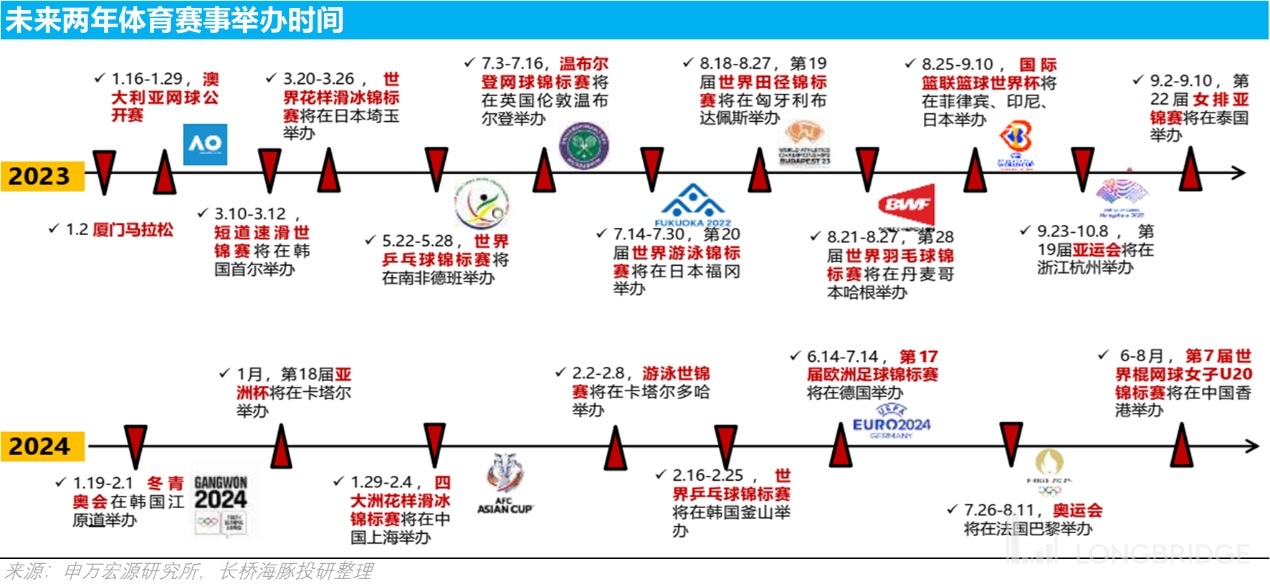

Focusing on the domestic market, we can review the entire textile and apparel industry last year. From January to February, due to the Winter Olympics, apparel retail, especially sportswear brands, saw significant improvement month on month. However, in March and April, the domestic epidemic resurged, and the impact on the East China region was particularly long-lasting. As a result, the market had particularly pessimistic expectations for the future performance of the retail industry.

Although there was an industry recovery in early June, there was a high rate of closures for domestic retail due to the outbreak of the epidemic nationwide in the third quarter, and the closure rate of some leading stores in first- and second-tier cities reached 20%. It was not until the change in epidemic prevention and control policies at the end of the year and some improvement in consumer confidence that there was a rebound, which had a bumpy ride.

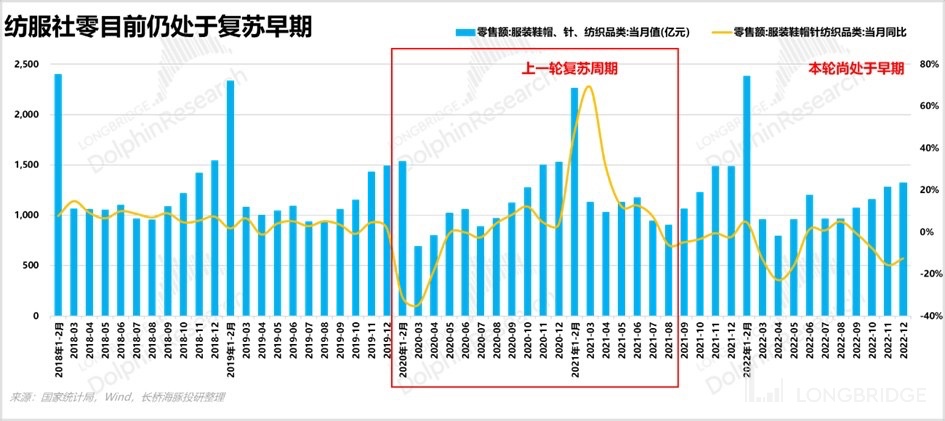

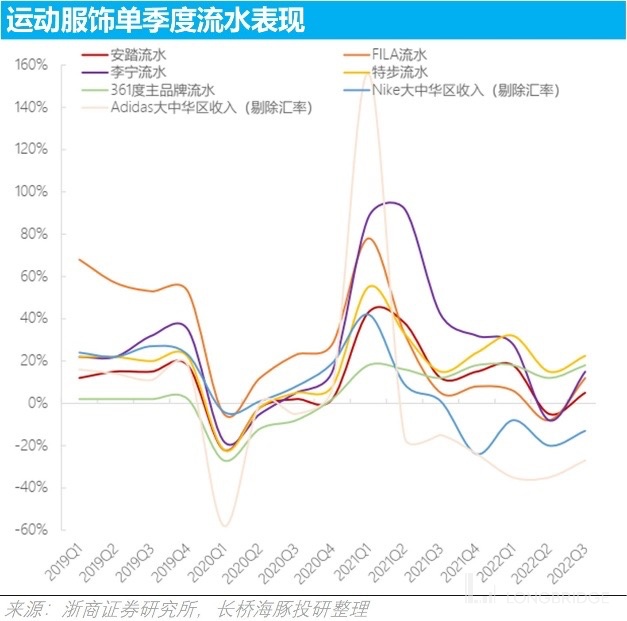

However, the sportswear sector experienced a relatively good recovery period before this, accompanied by the catalysis of native products after the sudden outbreak of the epidemic in 2020-2021H. The industry grew concerned about the impact on logistics and began to build inventory. After the second quarter, it basically saw a good period of recovery.

But after this round of cycles, the industry was left with a large backlog that has yet to be resolved. Until now, it is still in the preliminary exploration stage of this round of cycles, and because each company carries a relatively heavy inventory burden, the hesitation period in the early stage of this wave of cycles is clearly longer.

So why is Dolphin Analyst considering the sportswear sector at this time?

There are two main reasons: **On the one hand, from the perspective of the long-term basic scale, there is still considerable room for improvement in the sportswear and domestic sports brand sectors. There is even the possibility of leading domestic companies catching up with global leaders over the next decade. On the other hand, in the short-term, end retail data has yet to improve, enterprise inventory pressures are not light, and there is still disagreement in the market as to whether the industry has entered a new cycle. Therefore, the rebound has not exhausted the reasonable value of the top companies when they shake off their baggage and return to the right track, and investors may be able to find an opportunity from it. II. Long-term: Continuous Improvement in Penetration Rate and the Benefits of Domestic Trends

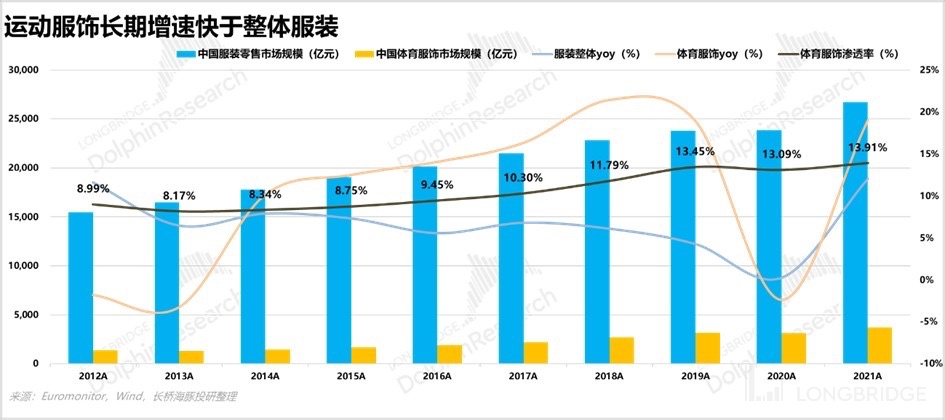

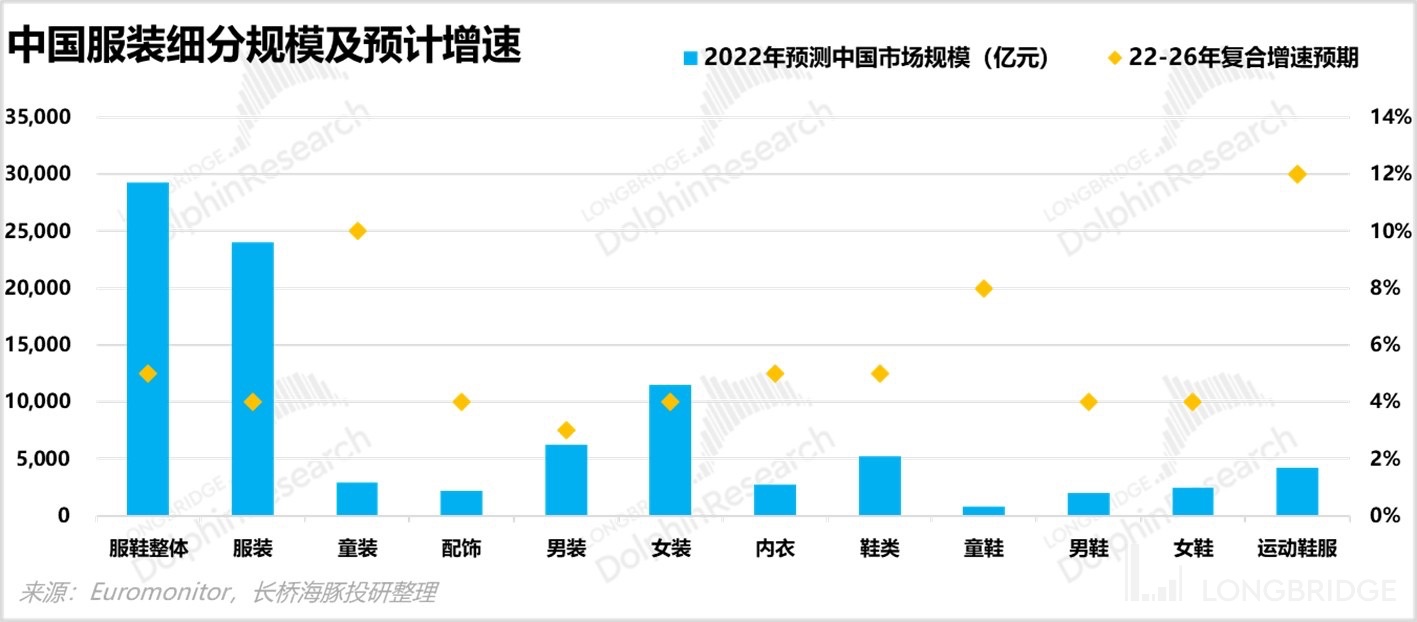

The sportswear industry in China has always been the most promising sub-industry in the clothing industry, and this confidence is not unfounded. According to industry statistics, in the past ten years, the compound growth rate of the domestic sportswear industry has exceeded 10%, which is much higher than the overall compound growth rate of the clothing retail industry, which is only 5%. The Dolphin Analyst believes that there are at least several reasons for this phenomenon:

2.1 Scene extension opens up incremental space

The success of Beijing's bid for the 2001 Olympics awakened domestic consumers' awareness of sports, and the number of fitness enthusiasts (defined as those who participate in fitness activities more than twice a week) continues to grow.

However, as of now, the domestic fitness penetration rate still has a large gap compared to overseas, only half that of Europe and America. It is expected that in the next five years, under the background of advocating national fitness, the annual compound growth rate of the fitness population in China can reach 6.5%, and the penetration rate of the domestic fitness population will just reach 30%, with a total of 400 million people.

As the domestic sportswear industry accompanies the rise of fitness penetration and enters a rapid development stage, and as the industry continues to evolve, sports apparel has gradually transitioned from emphasizing function to universality, further opening up market incremental space.

When choosing sportswear, consumers not only consider the product, but also pay more attention to the fusion of leisure and fashion styles as well as comfort, which has led to the outflow of sportswear usage scenarios into daily life.

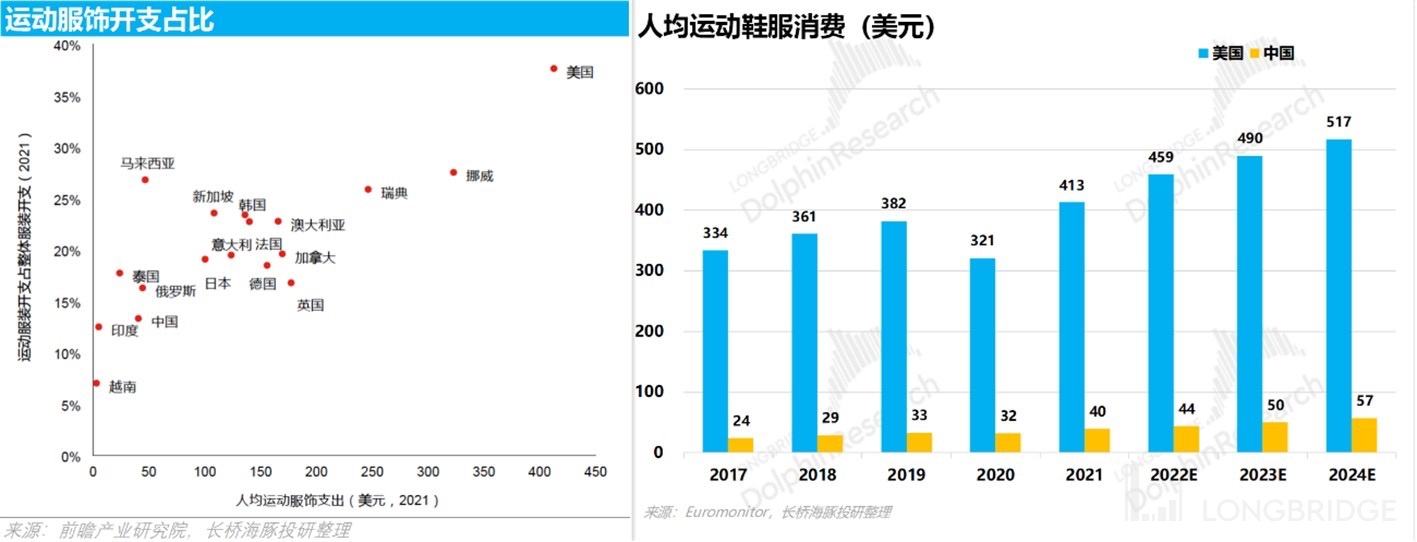

On this basis, combined with sports events and celebrity marketing, consumers’ attachment to sportswear has deepened even more. Therefore, in the past decade, the penetration rate of domestic sportswear relative to the overall apparel market has increased from 8% to 14%, which is already a very rapid increase. However, compared to the penetration rate of overseas sportswear of 30% to 40%, there is still plenty of room for growth. The Dolphin Analyst believes that the main reason for this gap is that the per capita consumption level of sportswear in China is still relatively low.

Currently, the per capita consumption of sports shoes and clothing in China is only higher than Vietnam, India, and Thailand (although the per capita consumption in Thailand is lower, the penetration rate is higher than China's), and it is still less than 300 RMB. In other words, on average, each person in China buys only half a pair of domestic sports shoes and a sport T-shirt each year (considering the wear resistance of domestic shoes, a pair of shoes can be worn for 1-2 years, and a T-shirt can be worn for one year). Over the past five years, Chinese per capita expenditure on sports shoes and clothing has increased nearly twofold from $24 to an expected $44. Assuming this trend continues, per capita expenditure is projected to continue to rise by nearly twofold to $80 over the next five years, or the average annual spending for one pair of sports shoes and two T-shirts (a relatively easy to achieve scenario), which would only reach the current per capita spending level in Japan and still one-third less than that in South Korea. Nonetheless, this also provides a greater opportunity and space for the domestic industry to continue sinking. A twofold increase in five years means an annual compound growth rate of as much as 15%.

a. Inspiration from Lululemon: Refining products for niche markets

Dolphin Analyst believes that for products with further refinement, consumers are willing to accept higher unit prices. This was also the reason for Lululemon's long-term success (with a current market value of nearly $40 billion, peaking at nearly $50 billion).

Lululemon's flagship product, yoga pants, are priced close to $100, twice that of similar products from Nike and Adidas.

In the past, there was a lack of professional clothing in the yoga industry, and Lululemon filled this gap by perfectly combining the concept of yoga with fashion and sports and leisure design. It continued to promote the transition from female awareness to self-binding and self-releasing spiritual beliefs, which is a very clever marketing technique that encourages consumers to show an active, healthy, and high-quality lifestyle attitude by wearing fashionable fitness and leisure clothes.

Moreover, Lululemon has more detailed considerations in product technology. The exclusive fabric provides different levels of covering and sweat dissipation for different sports. The cutting process is also more complex than other similar brands. For example, a pair of pants would usually be made by cutting and stitching two pieces of fabric, but Lululemon cuts it into eight pieces of fabric for a better fit. High costs and high satisfaction levels lead to consumers paying higher prices for the product. Therefore, a niche fashion ultimately becomes a huge trend.

There are still many similar niche scenes like yoga, such as outdoor activities, hiking, skiing, etc. The rising popularity of niche sports in recent years, such as skiing brought on by the Winter Olympics and "refined camping" following the epidemic, creates more opportunities for specialized clothing in corresponding scenarios to continue cutting market shares.

b. Product development capability on the basis of staple products

Even without the ability to develop niche demands, just focusing on the staple-level development of sports shoes can also improve product prices through technological iterations. The key lies in whether or not it has a strong product development capability.

For example, the sole of sports shoes has undergone several generations of material and technological iteration to meet the changing functional demands of consumers, from the initial EVA foam to the current lightweight and fatigue-resistant PPEBA foam sole, and price tags have increased from $300-400 to $800-1500. The improvement of the sense of experience can not only help consumers who are used to buying sportswear to increase their unit price, but also make some consumers who used to only pursue fashion transfer to sportswear because of its functional advantages.

According to Euromonitor's forecast, in the next five years, sportswear will still be the most prosperous track in the field of clothing. The growth rate of sportswear in the next five years is expected to reach 12%, which is close to the estimated growth rate of about 15% for per capita spending on sportswear in five years, while the industry growth rate is still only 5%. Therefore, it is only a matter of time before sports brands regain their past glory.

2.2 "National Treasure" accelerates market share increase

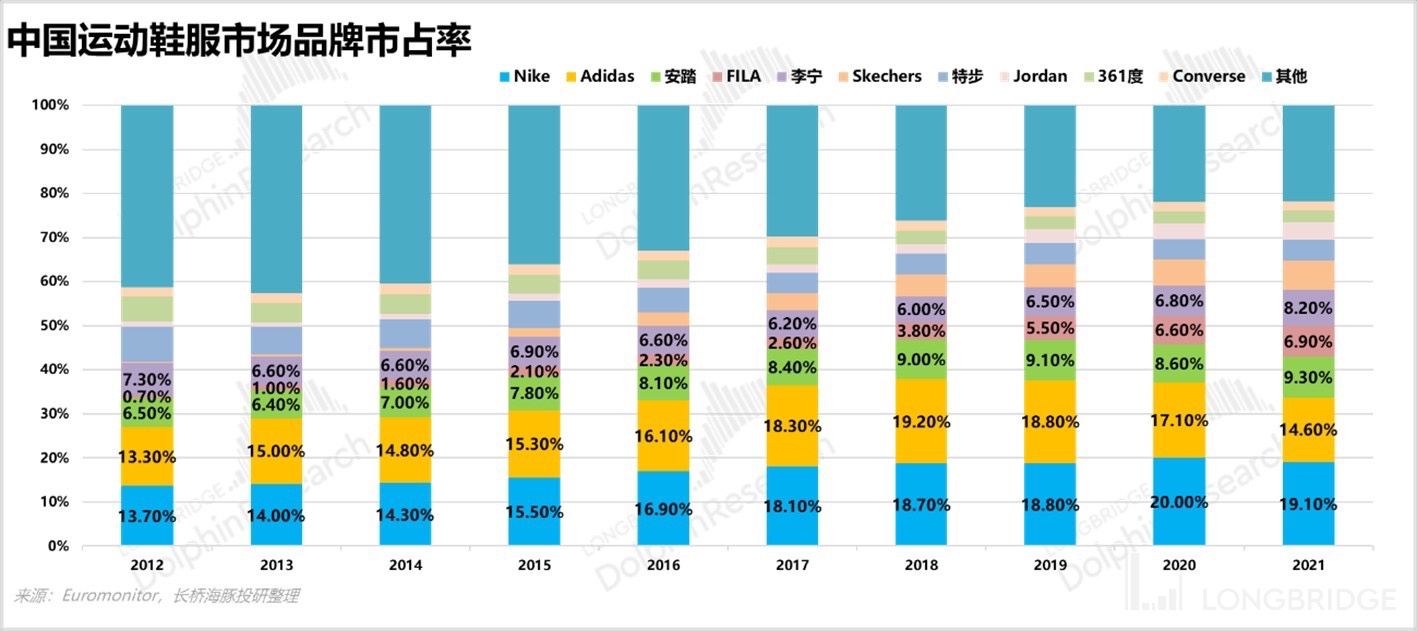

In the past five years, if we talk about what big events in the sportswear industry have had a profound impact, there are two that cannot be avoided. One is Li Ning Fashion Week, and the other is "Xinjiang cotton", and both events have accelerated the market share of domestic brands.

Since Li Ning began its internationalization route in 2010, its market share in China has been growing steadily, until it bottomed out and turned around in 2019. Li Ning's stagnation in the early stage was mainly caused by changes in the company's strategy, which we will discuss in the next section. Its turnaround mainly relied on the "sports trend" concept stunning the international fashion sports industry. As a national treasure in the past, Li Ning has found a new positioning for itself, and also led a group of Chinese sports brands to accelerate their development, thus ushering in the era of "national trend".

Regarding the national trend, Dolphin Analyst believes that the key point lies in the word "trend", which is design. If there are no products that cater to consumers' aesthetic tastes, it is difficult to sustain the trend by relying solely on a sense of patriotism. From 2019 to now, Li Ning's market share increase has also been relatively smooth.

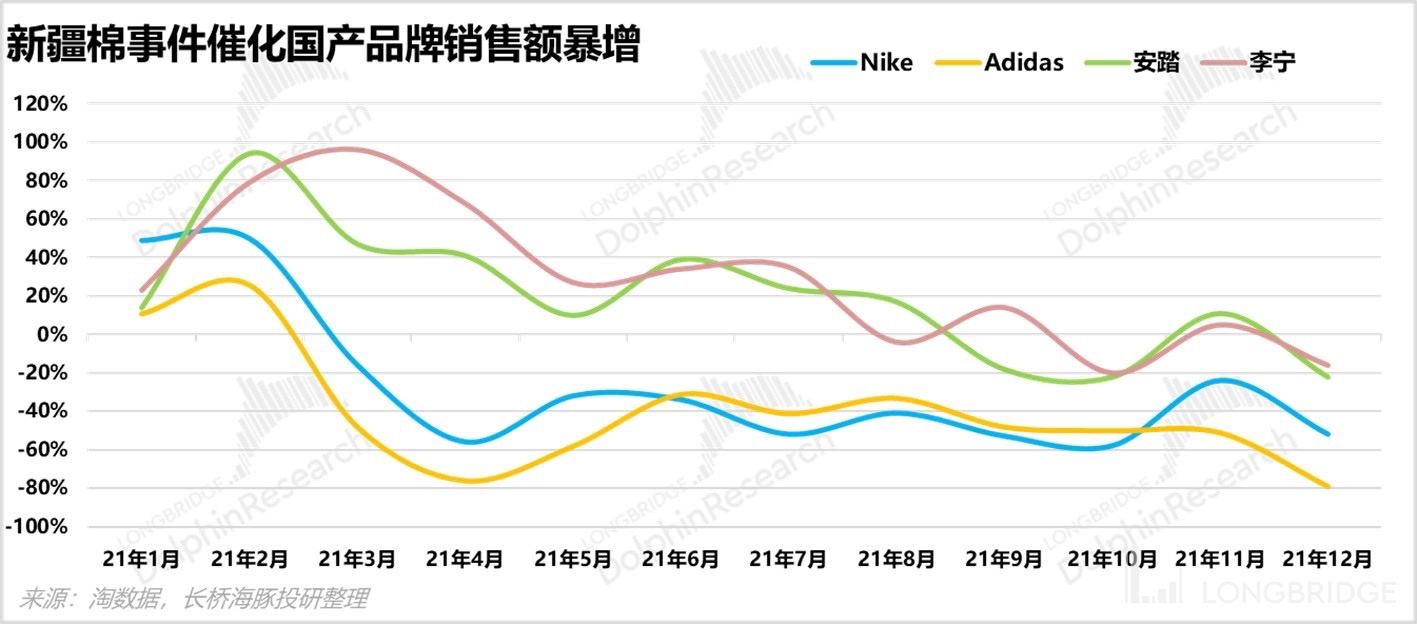

In addition to the national trend, the Xinjiang cotton incident at the beginning of 2021 also significantly benefited domestic brands, bringing profound changes to the domestic sports market landscape. After the incident broke out, many top-notch celebrities were immediately stimulated to switch, and top domestic athletes also accelerated their use of domestic products.

Under the catalysis of this incident, consumers' enthusiasm for domestic products surged, and Nike and Adidas in China have both shown negative growth in sales (also affected by the offline store closures due to the epidemic), and the market share of the two companies in China has continuously decreased in the past two years.

3. Short-term: "Inventory Crisis" is not resolved, focus on marginal improvement inflection point

In the long term, the trend of continuous increase in the market share of domestic brands will not be reversed, and domestic sports brand leading companies can still enjoy industry benefits. But at the current point in time, the rebound has lasted more than two months, has the expectation for the future been overdrawn? Dolphin Analyst believes that it has not, mainly for the following reasons:

3.1 Inevitable inventory cycle

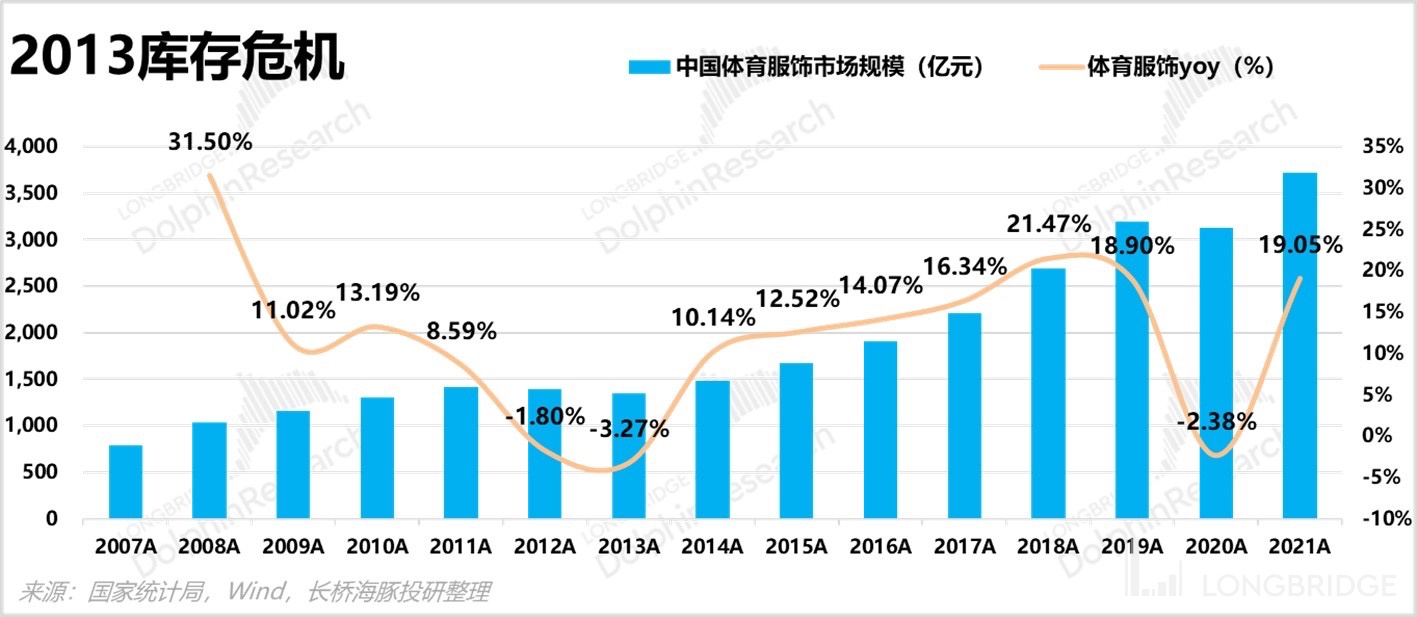

When it comes to inventory, this is the most concerned issue in the apparel and textile industry. In 2012, China's sports apparel industry experienced an "inventory crisis", and the market size of China's sports apparel market showed negative growth for two consecutive years.

The cause of the time was that under the catalysis of the Beijing Olympics in 2008, China's sports market went through a long period of irrational growth. The industry's judgment of the market potential was too optimistic, so there was a crisis of inventory throughout the industry. At that time, there were more than 20 domestic brands, and their number of stores exceeded 3,000.

After this battle, most well-known brands disappeared or returned to their old path of giving up their brands to do OEMs, and a wave of "store closing tide" occurred in China.

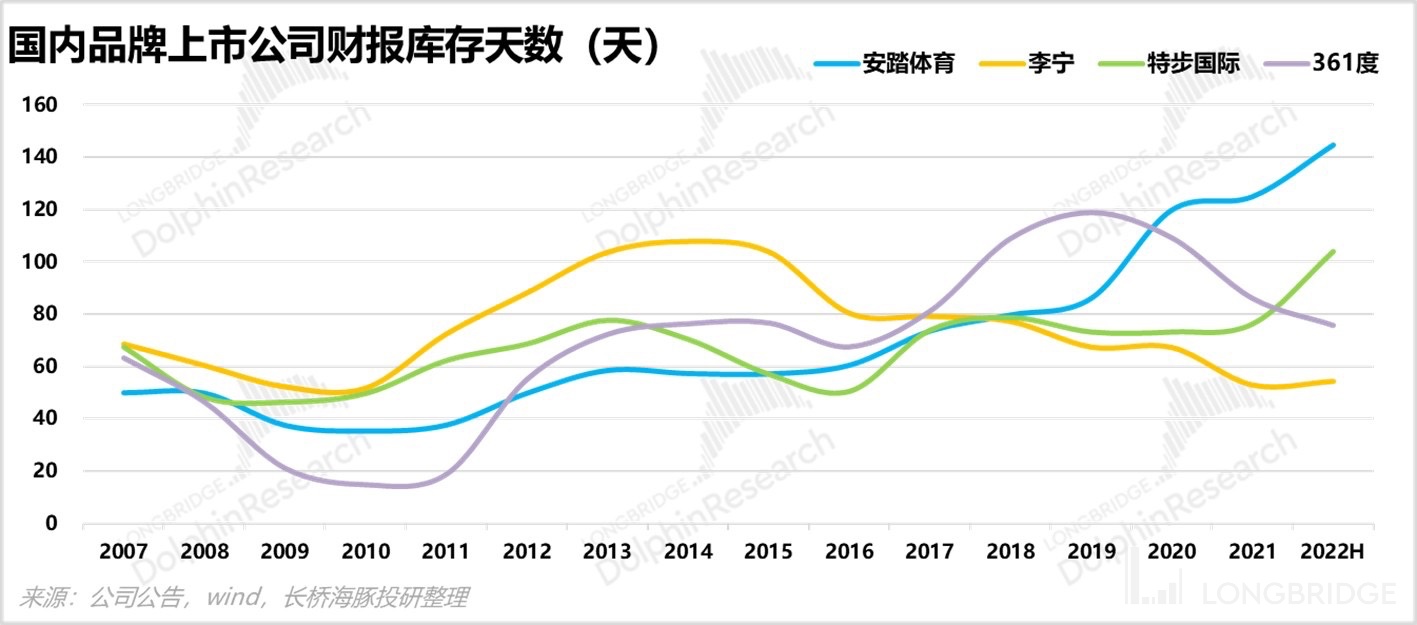

Therefore, the textile and apparel industry and sports brand companies are particularly concerned about inventory issues, and the expected inventory cycle basically dominates the company's stock price trend. Currently, both domestic and foreign leading sports brands are under considerable pressure: except for Li Ning, most brands have a lead time of more than 5 months.

As for overseas brands, the shipping prices have increased significantly in the past two years. At the same time, as the basic production capacity of most leading companies is in China and Southeast Asia, and there is a consideration of a halt in production due to the impact of the epidemic, brand owners have generally increased their order volumes and taken the initiative to replenish inventory. However, the inflationary pressure overseas gradually became evident, downstream demand weakened, and inventory accumulated to a high level. Deinventorying became the top priority for brand companies, but the effect of deinventorying was not satisfactory. Currently, most of them are still in the range of 4-5 months (it was basically healthy around 3 months in previous years).

So last year, most sports brand companies adjusted their performance expectations almost every quarter from the beginning of the year to the end of the year, resulting in significant damage to their stock prices. However, according to the financial reports of sports companies listed on the Hong Kong Stock Exchange over the years, the Dolphin Analyst has discovered an interesting phenomenon:

a) During the last inventory crisis in 2013, ANTA used very strict control measures to solve the inventory problem, and its stock price started to rise first, which made its stock price increase higher than that of Li-Ning from 2013 to 2017. Later, ANTA continued its DTC transformation, recovered a large amount of inventory from the dealers, and has always occupied a high position in the industry in terms of average inventory turnover days.

b) In contrast, Li-Ning suffered a major setback in 2013 and did not enter a benign state until 2018, four years later than ANTA's turnaround. With a solid foundation, Li-Ning's stock price began to outperform ANTA's after 2018.

Referencing the change trend of inventory cycles for international brands in history, the inventory cycle of sports apparel generally lasts 1-2 years (referring to Nike's inventory turnover days in history).

From a timing perspective, it is nearing the end of the inventory increase, and it can be roughly estimated that it will begin to decline in 2023, but which quarter specifically is still unknown. Currently, the market has many views that it will happen in the second or third quarter of this year, but it still needs to be observed further.

3.2 A new cycle is still in its early stages

Although there is a general direction of judgment for future recovery in the face of pressure from inventory, it is still difficult to confirm the specific node.

As mentioned earlier, in the past few months, social and retail sales data for clothing and shoes have not improved and are still uncertain due to the need for channels to prepare inventory three quarters in advance.

However, observing the traffic data of head brands after New Year's Day, there have been subtle changes and some slight rebounds, so some companies are very confident about 2023.

Therefore, there is still a significant difference in the market at this time, which means that stock prices are unlikely to be exhausted. If there is further marginal improvement in the future, stock prices will receive further support.

In addition, when reviewing 2022, we also mentioned that at the beginning of last year, the domestic epidemic was not very serious, and the people were still immersed in the atmosphere of the Winter Olympics, so the sales in the first quarter generally had a higher base. Even if the first quarter of this year is doing well, it will still create some pressure on listed companies based on last year's baseline, and the financial data that shows an improvement will only be visible after the second quarter.

Although the enthusiasm for placing orders is not high, if there is a clear recovery after the third quarter, listed companies will need to be more optimistic at this time, prepare inventory in advance, and cooperate with the channels. But if the rhythm is wrong, such as preparing too much inventory, and if the recovery is not valid in the third quarter due to various reasons, it will bring greater difficulties to the company.

So last year, most sports brand companies adjusted their performance expectations almost every quarter from the beginning of the year to the end of the year, resulting in significant damage to their stock prices. However, according to the financial reports of sports companies listed on the Hong Kong Stock Exchange over the years, the Dolphin Analyst has discovered an interesting phenomenon:

a) During the last inventory crisis in 2013, ANTA used very strict control measures to solve the inventory problem, and its stock price started to rise first, which made its stock price increase higher than that of Li-Ning from 2013 to 2017. Later, ANTA continued its DTC transformation, recovered a large amount of inventory from the dealers, and has always occupied a high position in the industry in terms of average inventory turnover days.

b) In contrast, Li-Ning suffered a major setback in 2013 and did not enter a benign state until 2018, four years later than ANTA's turnaround. With a solid foundation, Li-Ning's stock price began to outperform ANTA's after 2018.

Referencing the change trend of inventory cycles for international brands in history, the inventory cycle of sports apparel generally lasts 1-2 years (referring to Nike's inventory turnover days in history).

From a timing perspective, it is nearing the end of the inventory increase, and it can be roughly estimated that it will begin to decline in 2023, but which quarter specifically is still unknown. Currently, the market has many views that it will happen in the second or third quarter of this year, but it still needs to be observed further.

3.2 A new cycle is still in its early stages

Although there is a general direction of judgment for future recovery in the face of pressure from inventory, it is still difficult to confirm the specific node.

As mentioned earlier, in the past few months, social and retail sales data for clothing and shoes have not improved and are still uncertain due to the need for channels to prepare inventory three quarters in advance.

However, observing the traffic data of head brands after New Year's Day, there have been subtle changes and some slight rebounds, so some companies are very confident about 2023.

Therefore, there is still a significant difference in the market at this time, which means that stock prices are unlikely to be exhausted. If there is further marginal improvement in the future, stock prices will receive further support.

In addition, when reviewing 2022, we also mentioned that at the beginning of last year, the domestic epidemic was not very serious, and the people were still immersed in the atmosphere of the Winter Olympics, so the sales in the first quarter generally had a higher base. Even if the first quarter of this year is doing well, it will still create some pressure on listed companies based on last year's baseline, and the financial data that shows an improvement will only be visible after the second quarter.

Although the enthusiasm for placing orders is not high, if there is a clear recovery after the third quarter, listed companies will need to be more optimistic at this time, prepare inventory in advance, and cooperate with the channels. But if the rhythm is wrong, such as preparing too much inventory, and if the recovery is not valid in the third quarter due to various reasons, it will bring greater difficulties to the company.

Summary: Don't be afraid of the Cycle Plunder, there's still "Snow" on the Track

Considering these factors, investors who closely follow sports brands will most likely not go all in at this time, but rather wait for more certain signals before seizing opportunities. At the beginning of the year, when the consumer review "Two Years of Battle Royale Ends, Consumer Consumption Returns" was released, the textile and clothing index had just crossed the opportunity area and was not yet expensive. Currently, it is at the 40%-50% percentile level over the past five years.

Based on the data analysis in the previous section, the sports apparel track is expected to have a compound annual growth rate of 12-15% in the next five years, providing a certain guarantee for valuations of leading companies. The stock price will most likely have some room for growth, which is why Dolphin Analyst chose this segment industry.

Related Reading:

January 4, 2023 Consumer Review "Two Years of Battle Royale Ends, Consumer Consumption Returns"

Risk Disclosure and Declaration of this article: Dolphin Investment Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.