NetEase: Will the approval of "Egg Party" speed up the new cycle as approval licenses increase? input: ====== 近日,国家新闻出版广电总局官网发布的消息显示,发行许可证审批进入新周期。这是继 2019 年 9 月新版《游戏出版管理办法》开始施行,网游版号重启审批后的首个发行许可证审批周期。 对于受到版号影响的游戏从业者们来说,这无疑是一个利好消息。在此期间,国家新闻出版广电总局从 2021 年 2 月 8 日至 2 月 24 日,陆续向多家游戏公司发出了新一轮的游戏版号批复文件。而对于《蛋仔派对》开发公司 Cat Lab 来说,他们并没有通过这一轮审批。 Cat Lab 的 CEO 葛良表示:“未通过审核主要因为一些模块的版权问题,我们正积极与版权方沟通以解决问题,预计能在最近的一个周期内通过审核。” 据悉,《蛋仔派对》是一款以 Dolphin 为主题的模拟养成类手游,于 2020 年 12 月 25 日正式上线,备受期待。但随着版号短缺,这款游戏被迫断供。未来,随着国内版号发放政策的逐步放宽,《蛋仔派对》等游戏的上线将会迎来更广阔的发展空间。 ====== output: Recently, news released on the official website of the National News Publishing Radio and Television Administration showed that the approval of publishing licenses has entered a new cycle. This is the first approval cycle for publishing licenses since the implementation of the new "Regulations for the Administration of Game Publication" in September 2019 and the restart of game version approvals. For those in the gaming industry affected by license approvals, this is undoubtedly good news. During this period, from February 8th to February 24th, 2021, the National News Publishing Radio and Television Administration successively issued a new round of game version approval documents to multiple gaming companies. However, Cat Lab, the development company of "Egg Party," did not pass this round of approval. Ge Liang, CEO of Cat Lab, said: "The main reason for not passing the approval is due to copyright issues with some modules. We are actively communicating with copyright holders to resolve the issue and expect to pass the review in the recent cycle." It is reported that "Egg Party" is a simulating and cultivating mobile game based on Dolphin, which was officially launched on December 25, 2020, to great anticipation. However, due to the shortage of licenses, this game was forced to be discontinued. In the future, as the policy of domestic licensing gradually relaxes, the launch of games such as "Egg Party" will meet broader development opportunities.

Hello everyone, I am Dolphin Analyst!

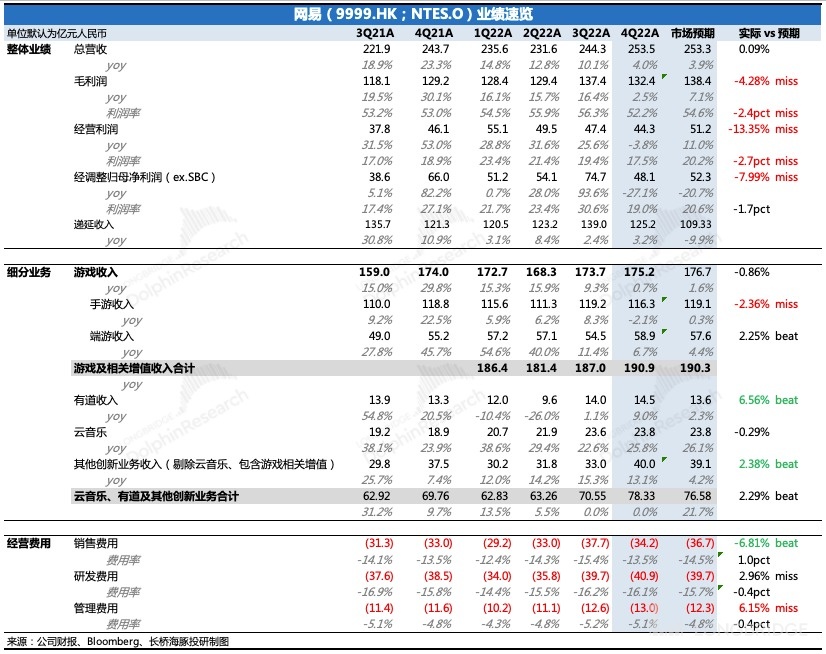

After the Hong Kong stock market closed on February 23, Beijing time, Netease-S.HK released its fourth quarter 2022 financial report. The performance of innovative businesses was good, and the game was average. However, I believe that the popular game "Egg Party" at the beginning of the year is expected to sweep away the poor performance of the fourth quarter, and coupled with the approval of heavyweight product permits, it is expected to accelerate Netease's new product cycle.

Specifically:

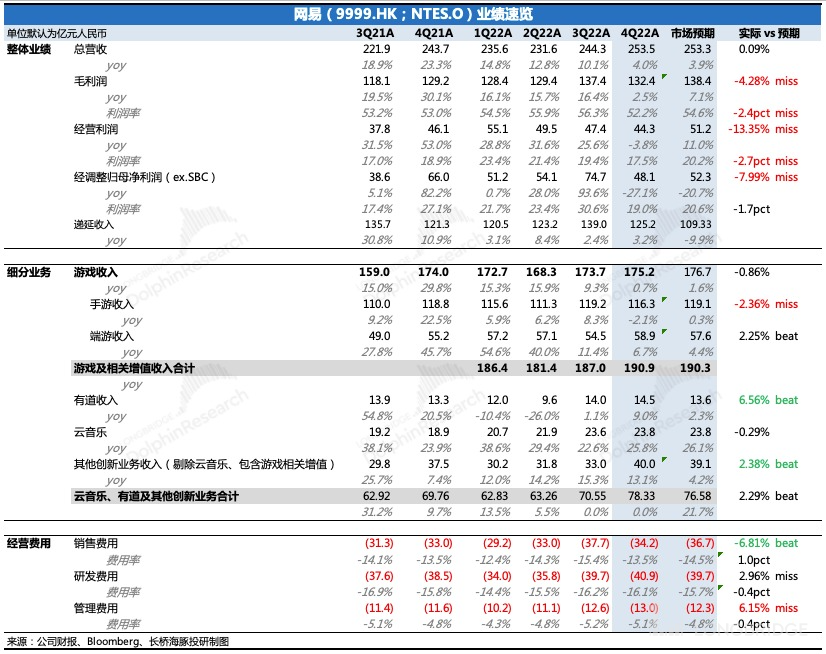

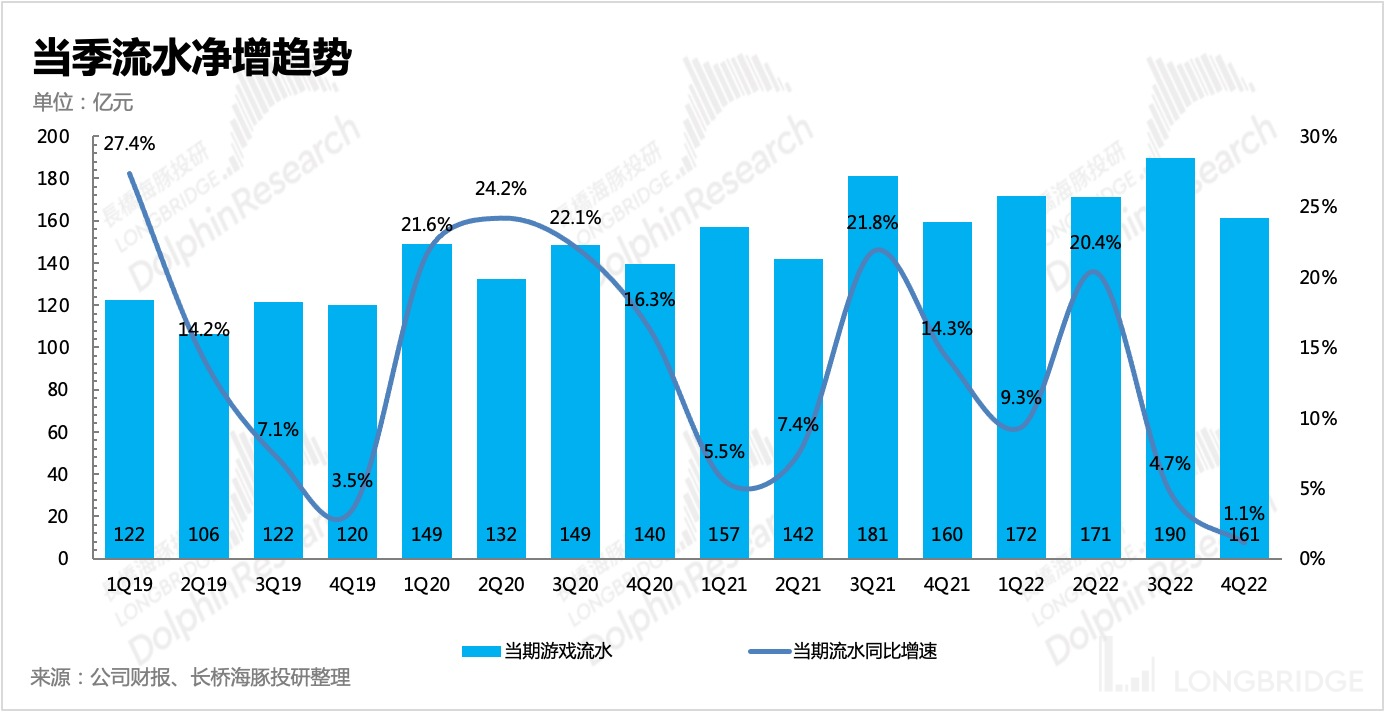

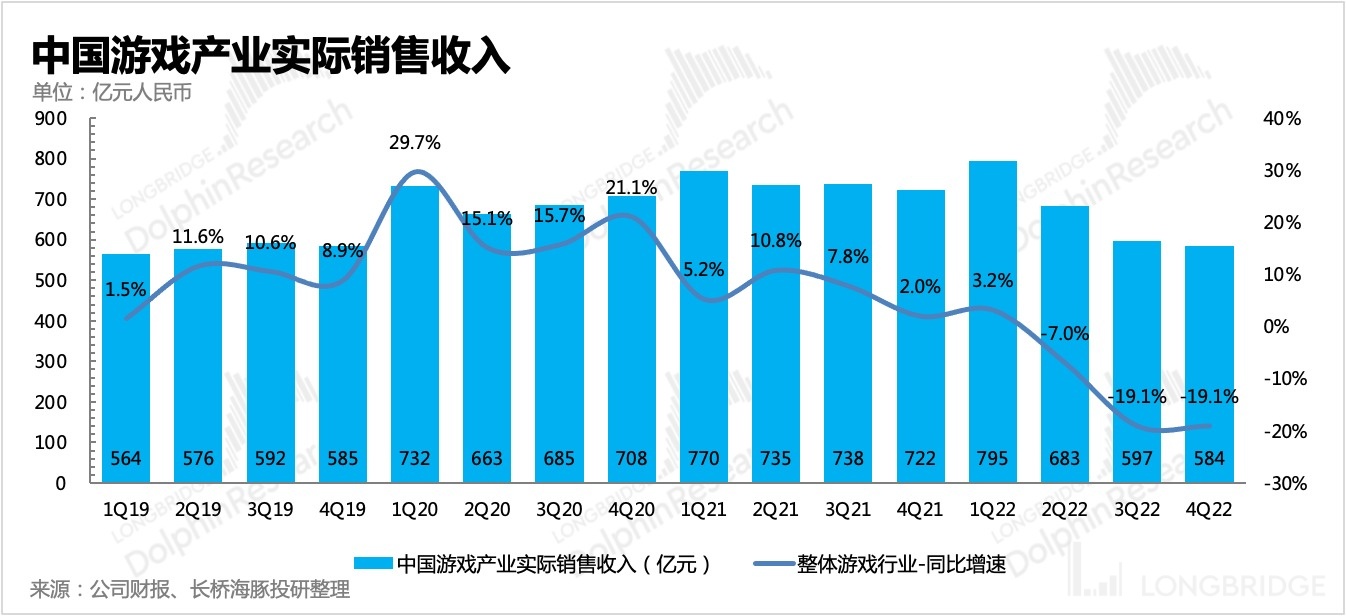

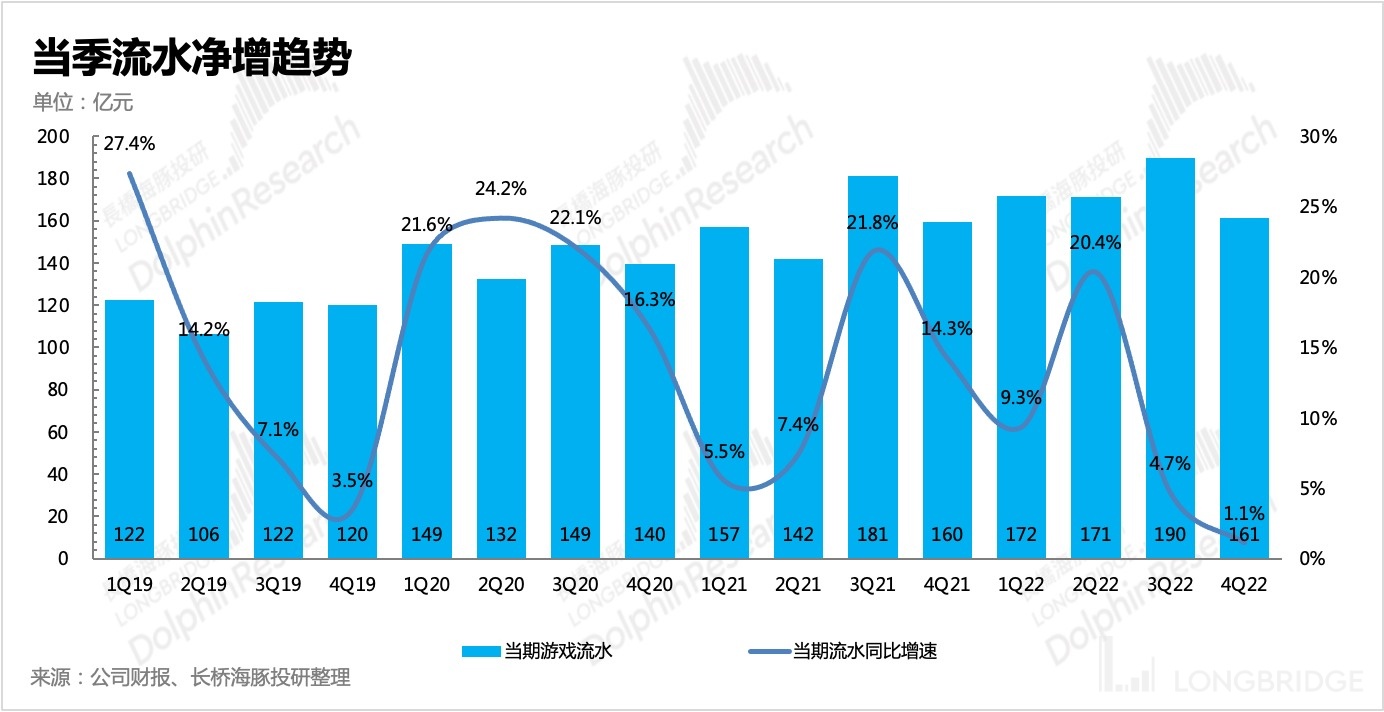

1. The high base pressure of mobile games is greater than expected: The game business that accounts for 70% of total revenue is the core factor affecting Netease's valuation. Because the high base of "Harry Potter" and "Eternal Abyss" in the fourth quarter of last year has a pressure on growth, it is expected. However, in this quarter, mobile games, which contributed 66% of revenue, declined by 2% year-on-year, which is weaker than the market's expectations. The performance of PC games is more stable, with a year-on-year growth of 7%. Of course, in the entire industry, the PC game market is relatively resistant.

2. But there is no need to worry too much about short-term pressure:

a. On the one hand, the issuance of permits has become normal, and Netease has also continuously obtained some permits in recent months. According to the current issuance pace, several popular projects reserved by Netease are expected to be obtained as scheduled, as long as the development progress is ensured.

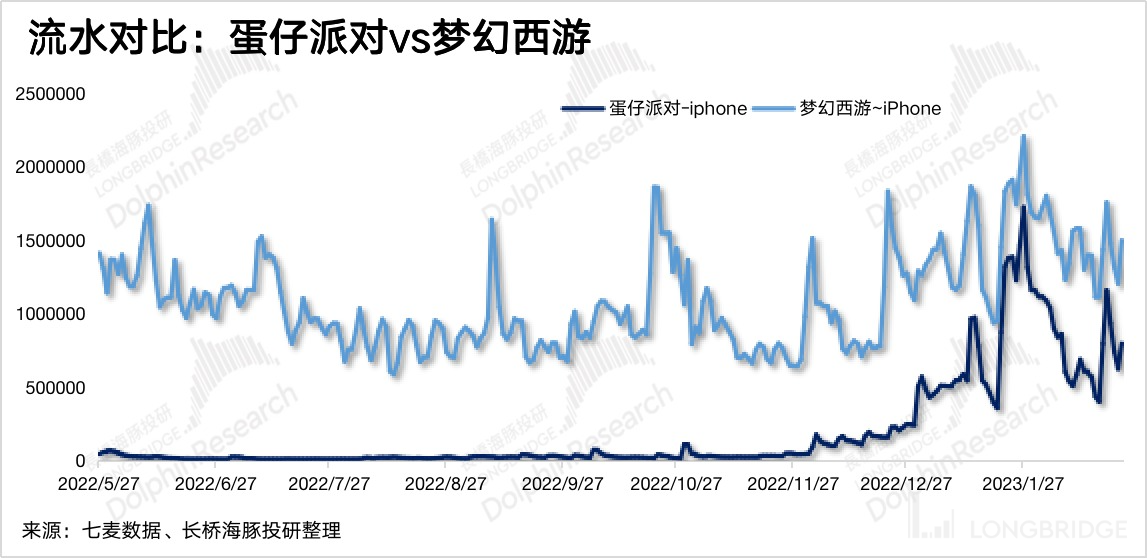

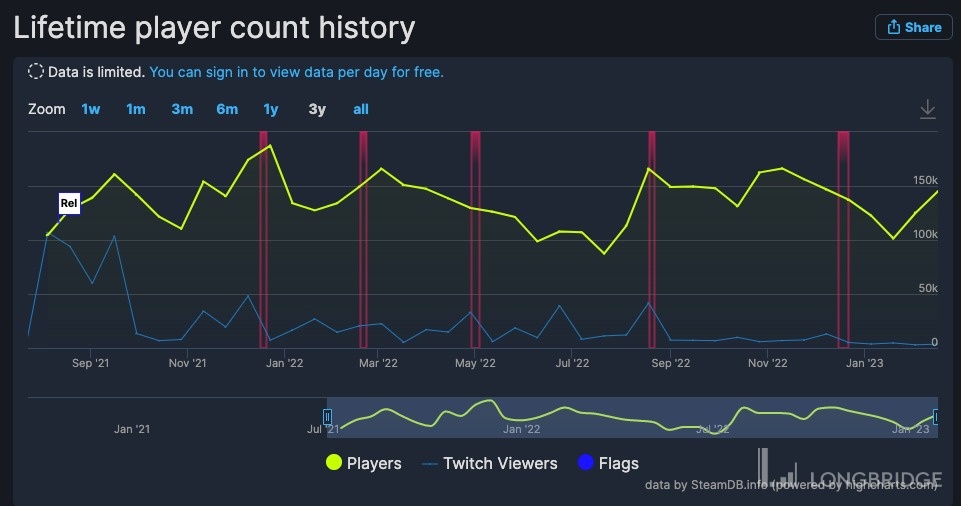

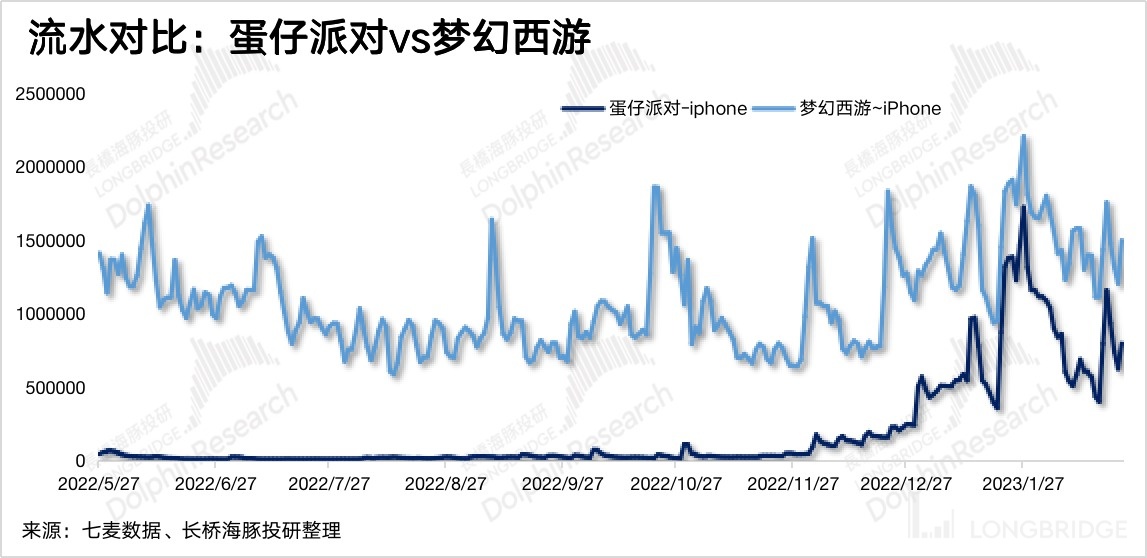

b. On the other hand, "Egg Party", which has been online for half a year at the end of last year, suddenly became popular. Judging from the revenue in January and February, it can reach about half the scale of "Fantasy Westward Journey", accounting for about 5% of the company's game revenue. This game directly brought 3.5% of the increase to the total revenue from less than 1% Contribution has expanded.

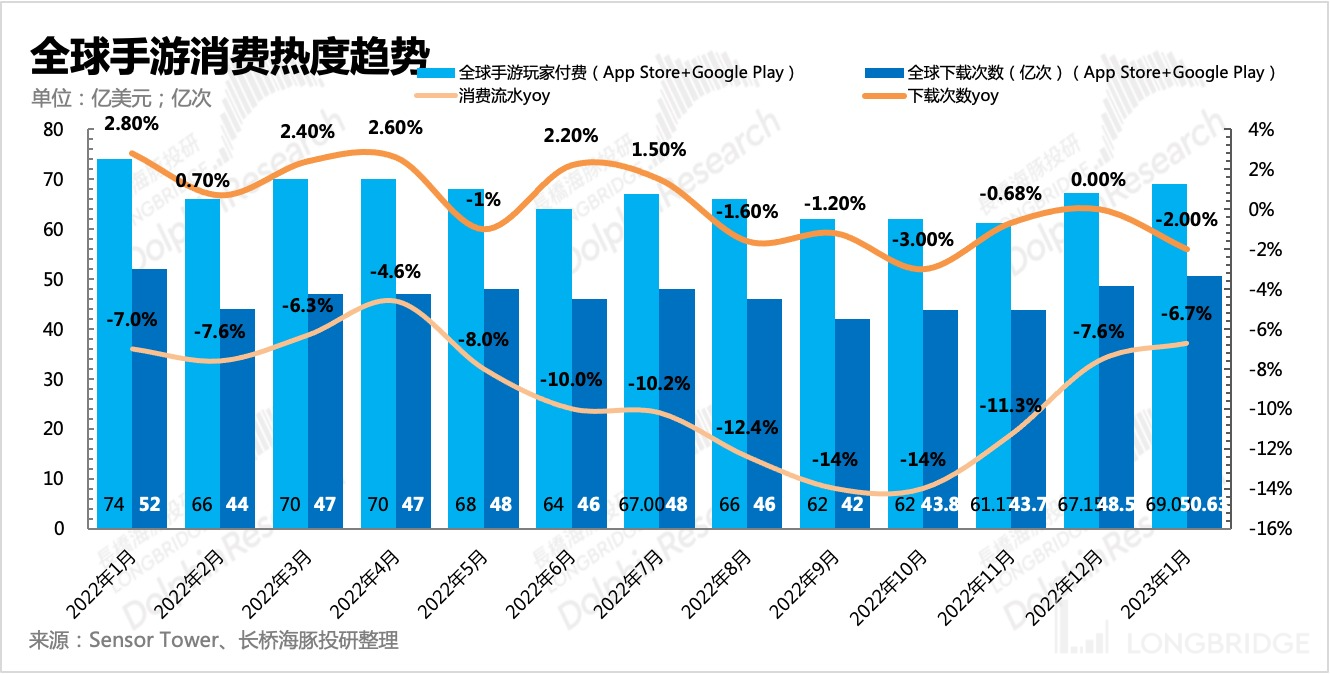

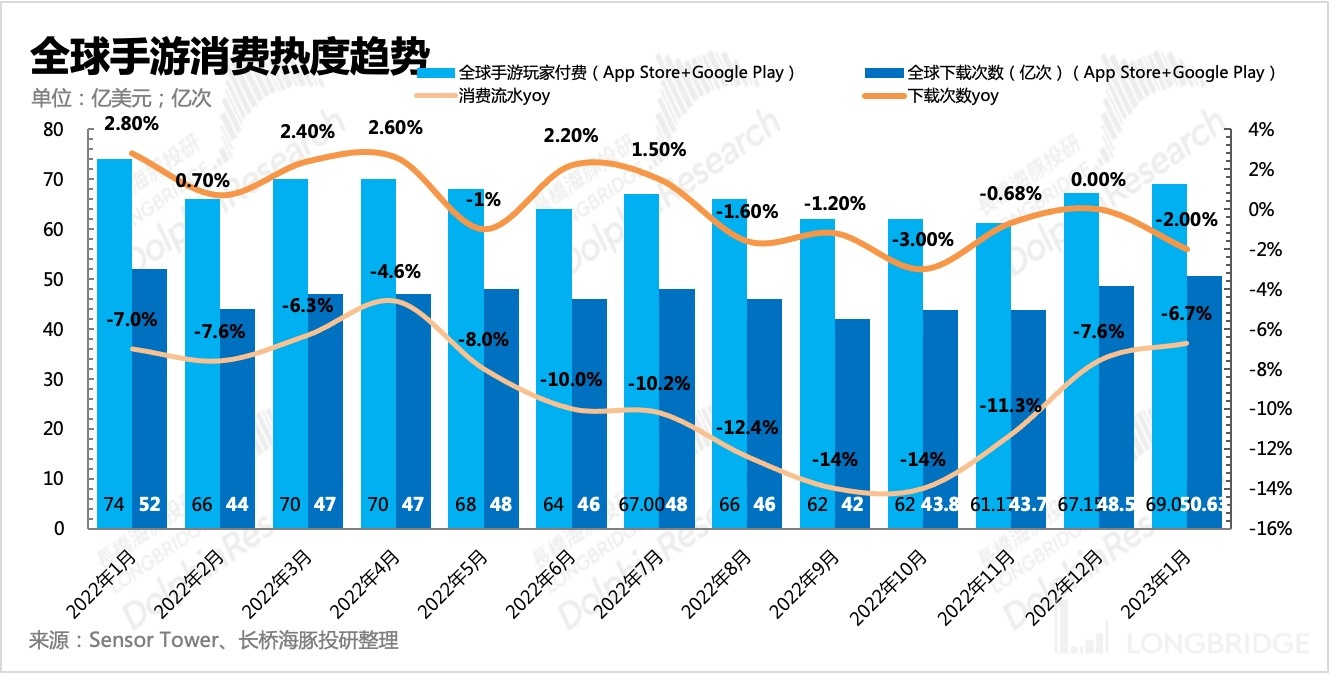

c. Finally, from the industry’s perspective, after experiencing the most thrilling period of the October landslide, the mobile game payment heat gradually recovered from November to January. I believe that the industry’s cycle recovery will also drive Netease to overcome the period of growth pressure.

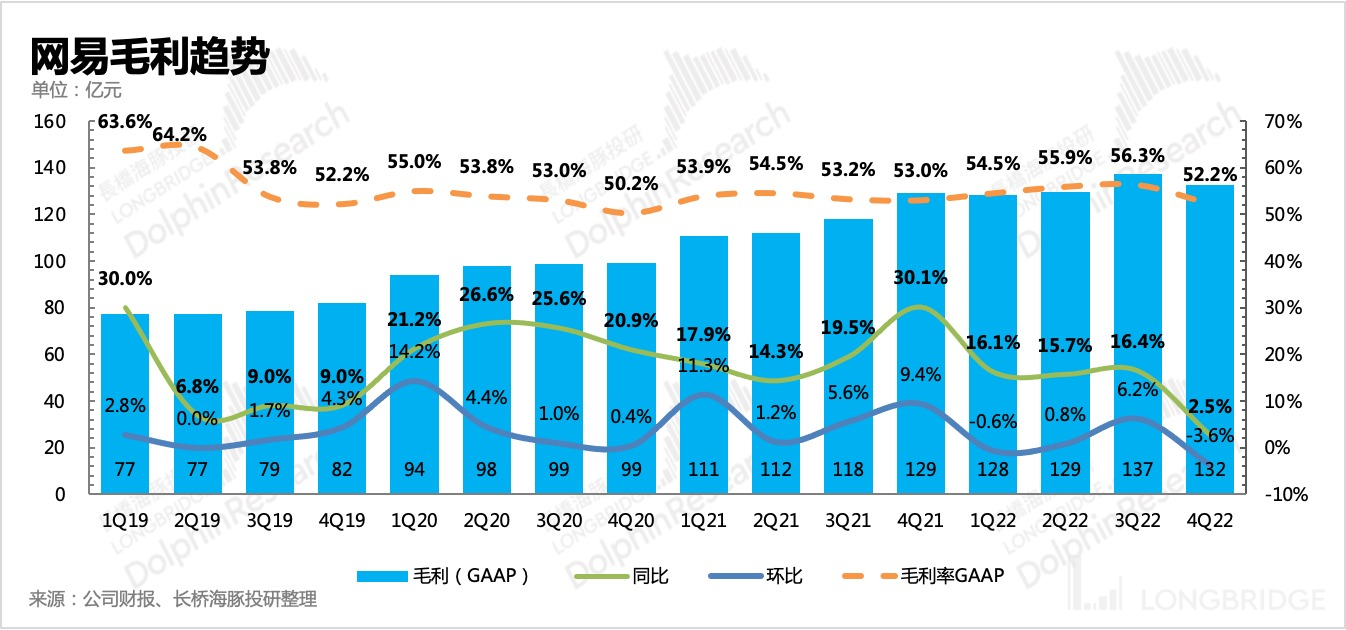

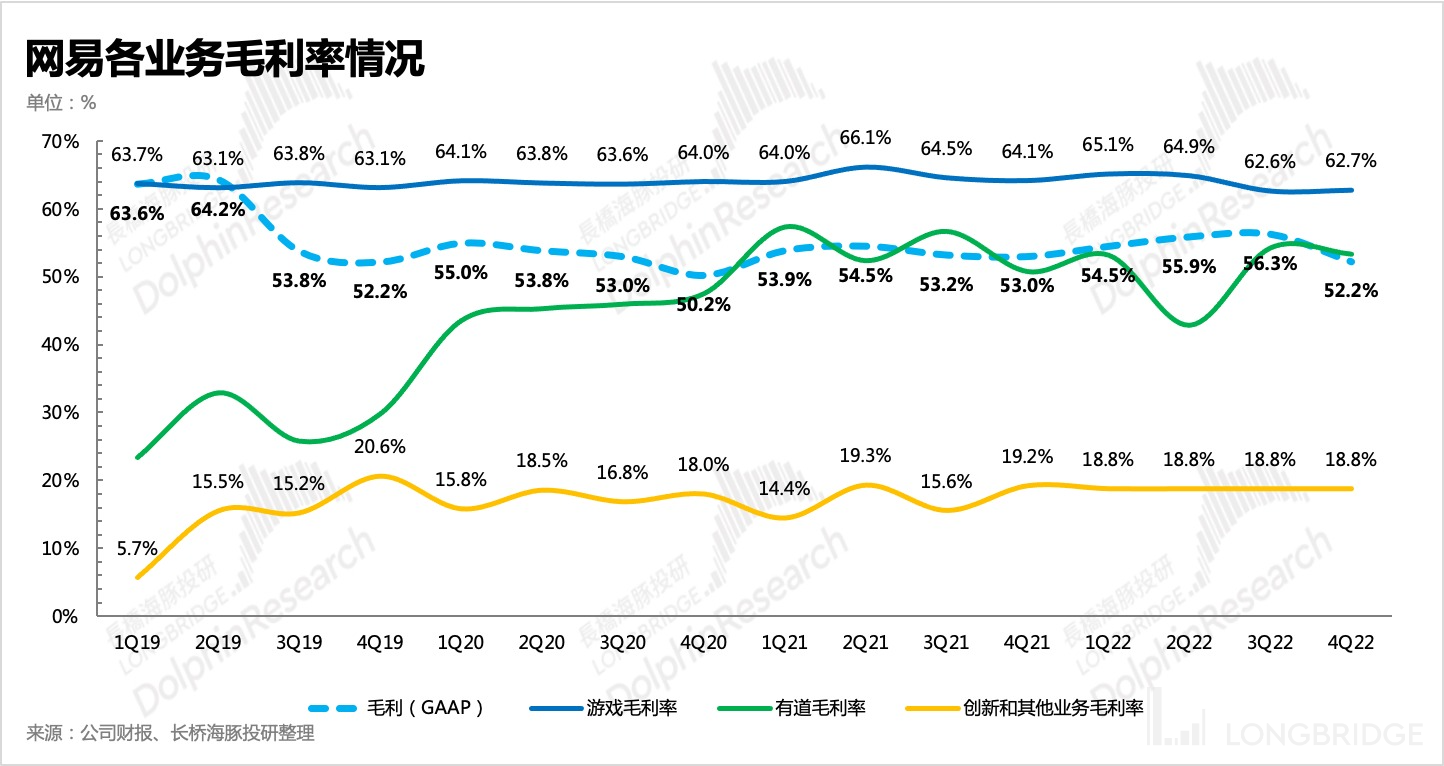

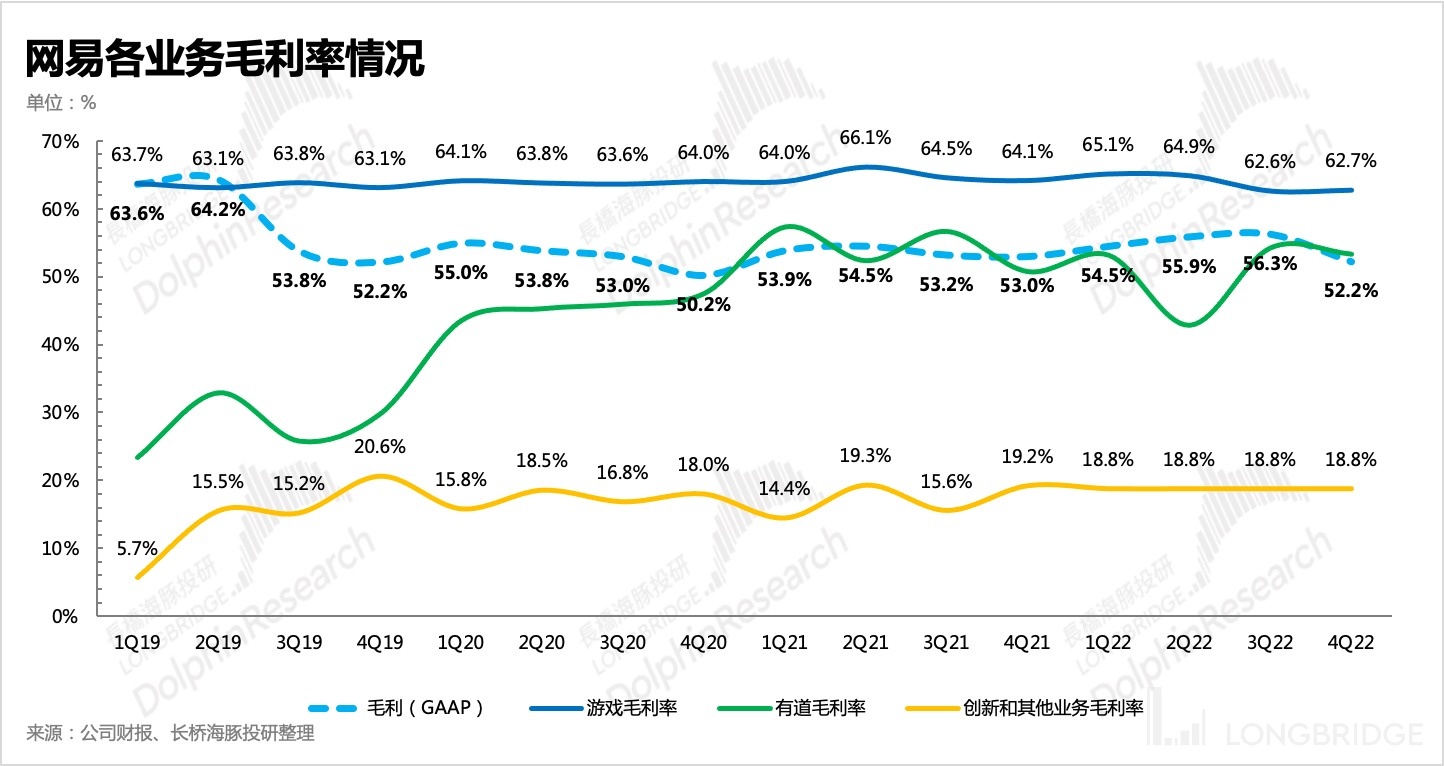

3. The high royalty split of "Diablo" has reduced the gross profit margin: "Diablo" mobile game launched at the end of July, and a lot of revenue is included in the fourth quarter. The copyright fee of "Diablo" is relatively high, and it is once again recognized as a cost in the current period, affecting the game's quarterly gross profit margin. The market expectations did not consider this factor.

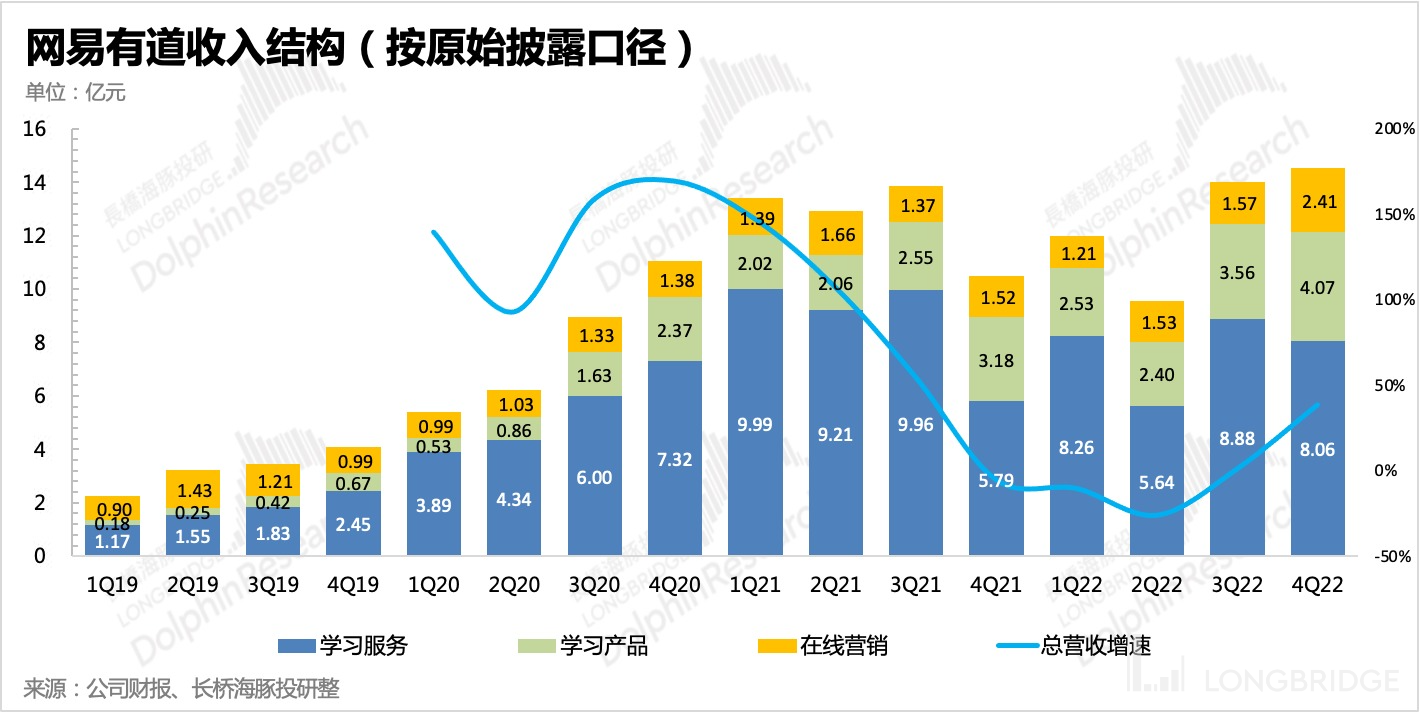

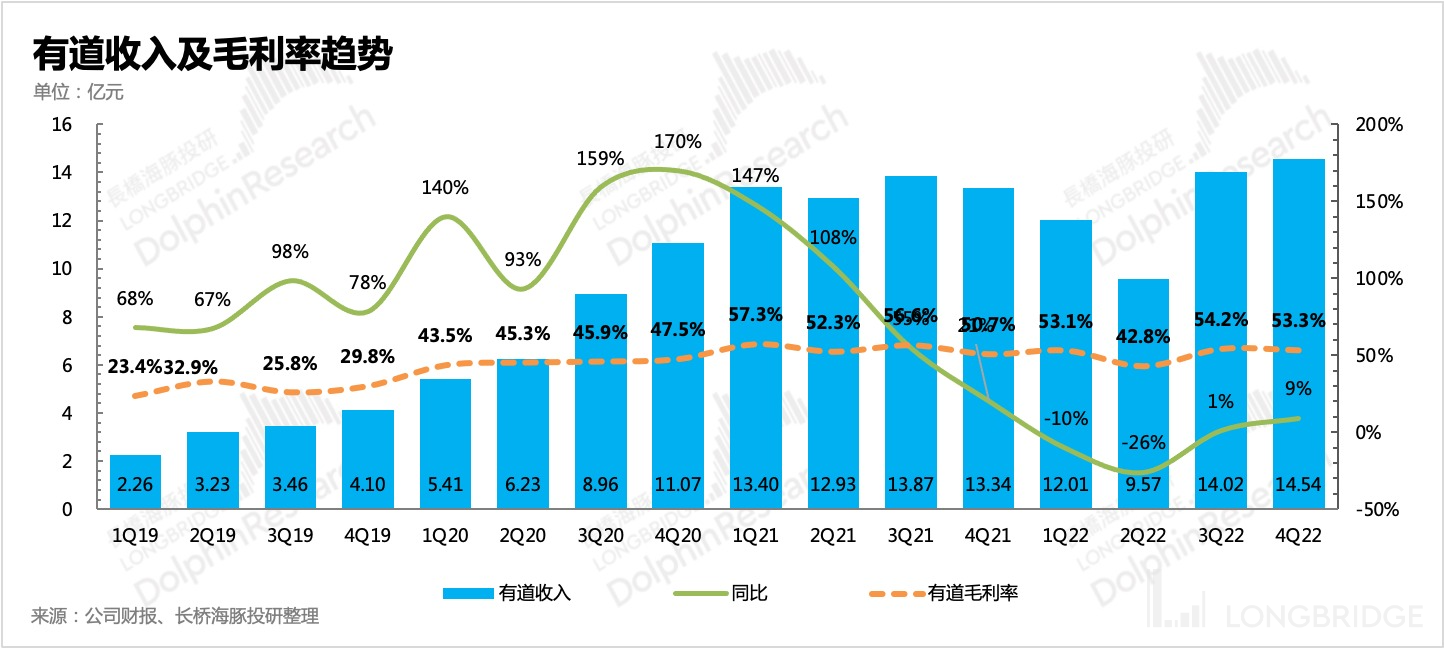

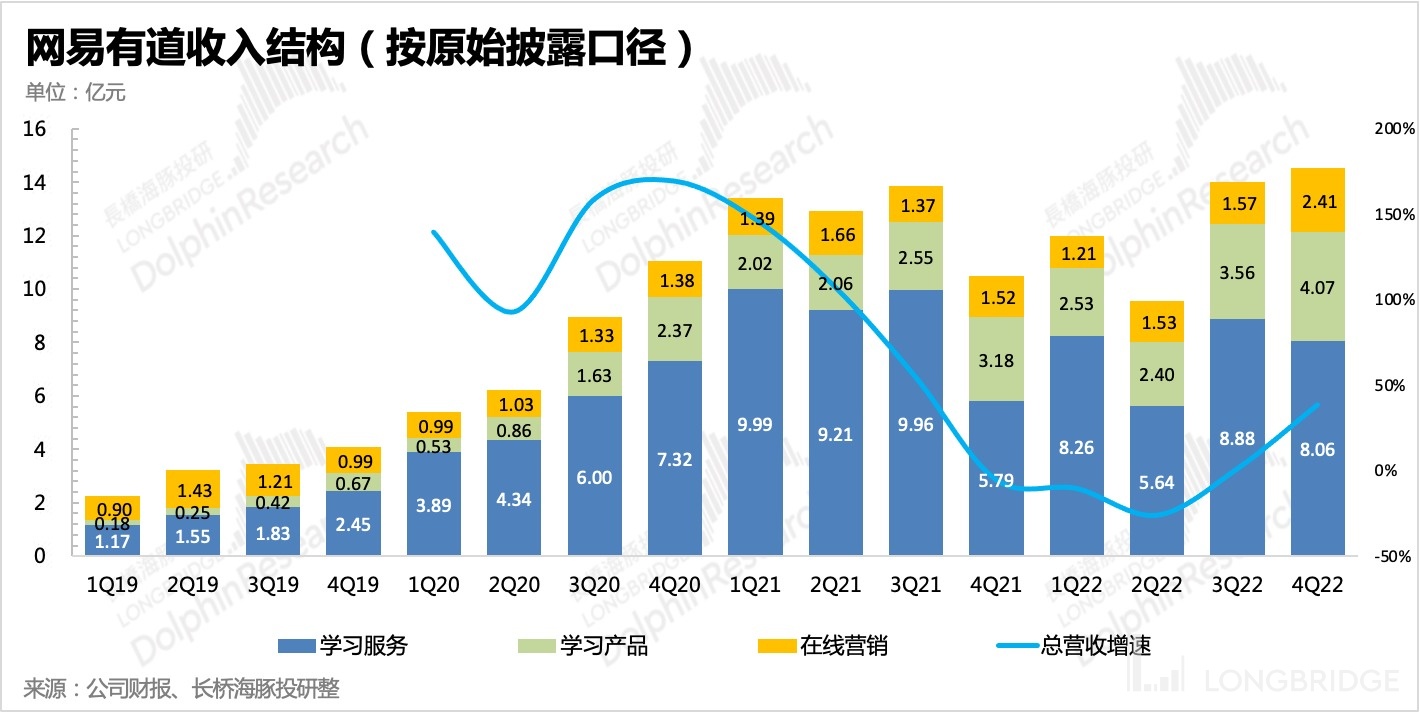

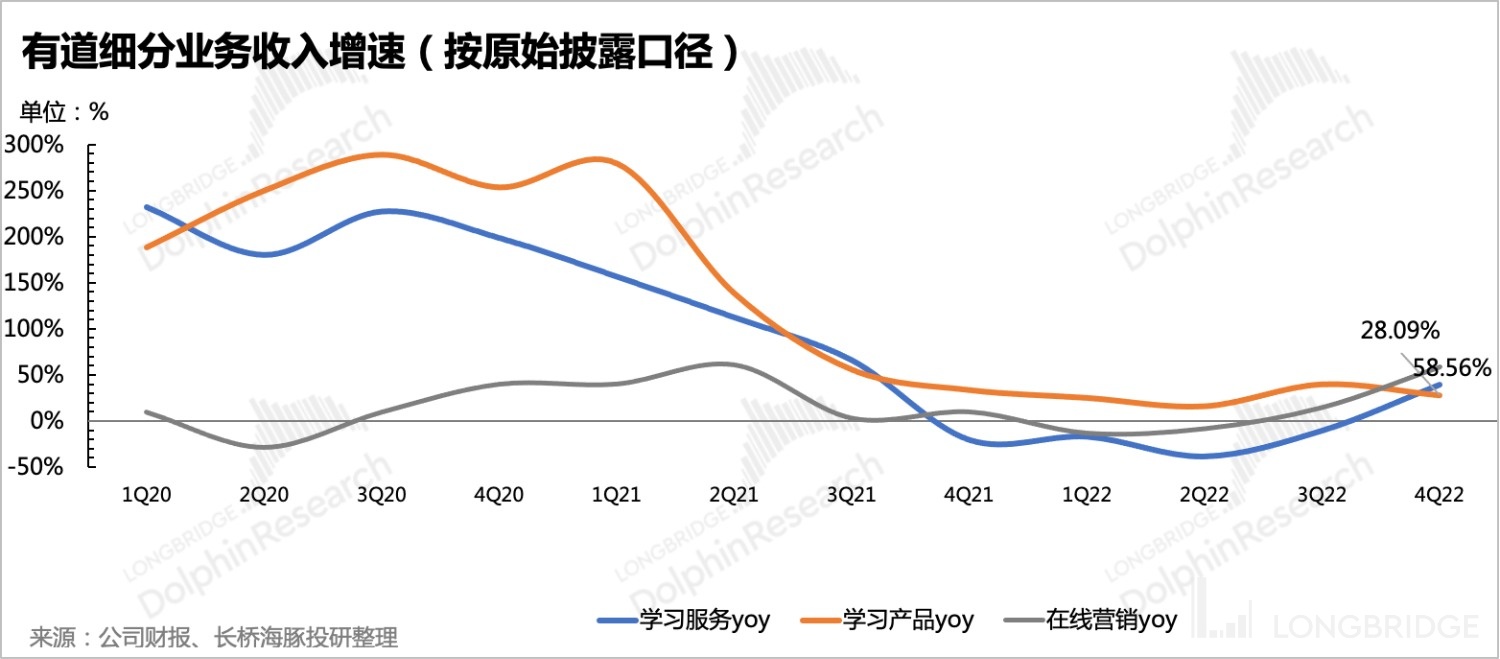

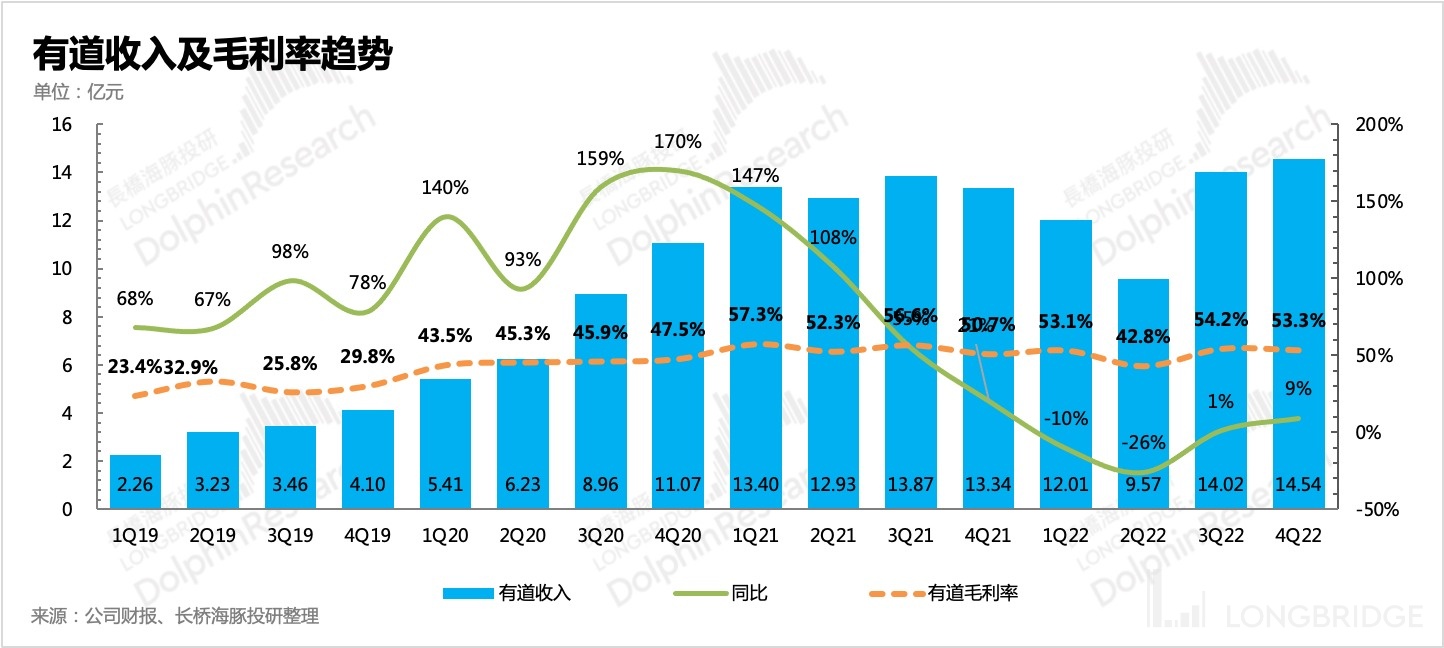

4. Youdao still repaired better than expected under the epidemic: Originally, due to the epidemic in the fourth quarter, the offline service was suspended, which would affect hardware sales like in the second quarter. Market expectations were also relatively conservative, but the company easily exceeded expectations with a year-on-year growth of 9%. Hardware sales not only did not slack off, but also maintained high growth.

The general gross profit margin of hardware is lower than that of course services, so the structure slightly lowered the comprehensive gross profit margin of Youdao.

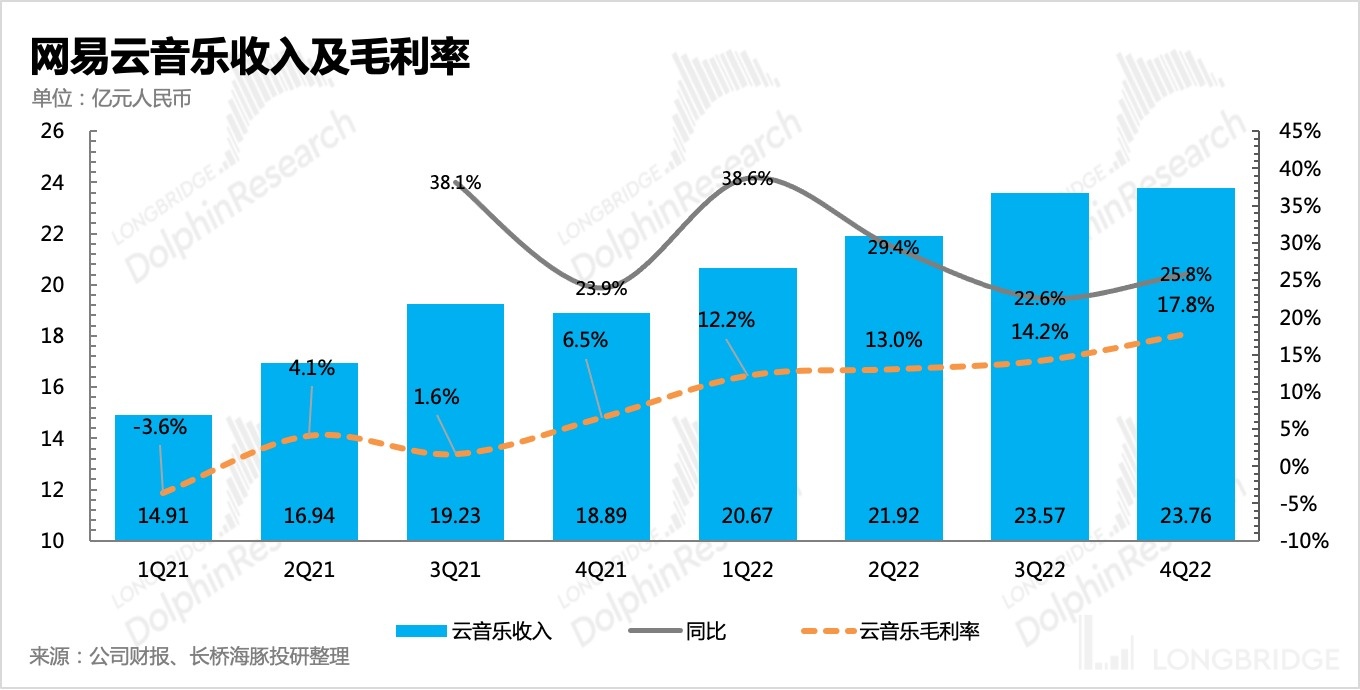

5. Cloud music maintains steady and high growth, and the trend of optimizing gross profit margin has not changed: In the fourth quarter, cloud music continued to maintain a high year-on-year growth of 26%. After the exclusive copyright was released, cloud music accelerated its signing and authorization with various record companies, enriched its music library, and attracted more users to become paid members.

After losing exclusive copyright, the premium of copyright costs was broken. Therefore, whether it is for Cloud music or Tencent music, the profit model of their membership business can be gradually improved. 6. For other innovative businesses, such as Yanxuan and advertising, the company is committed to constantly improving gross profit margins.

-

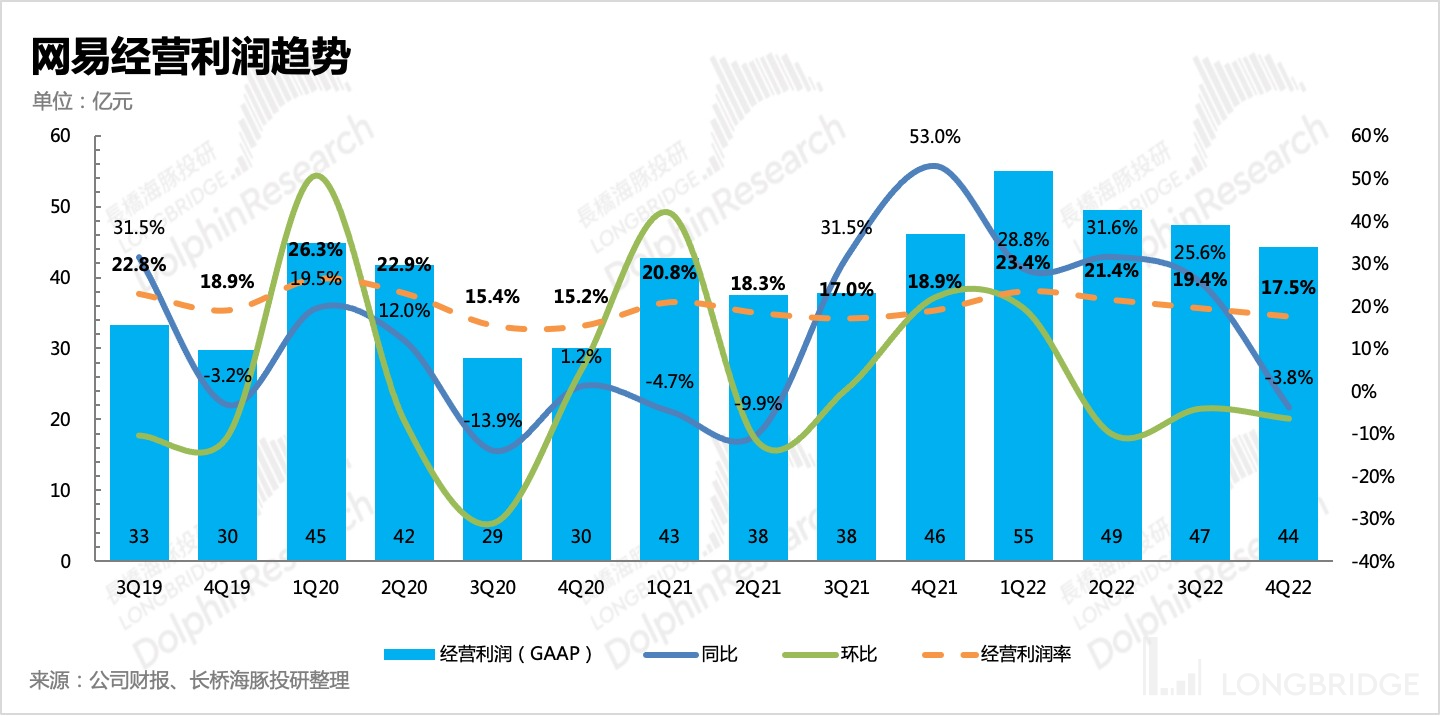

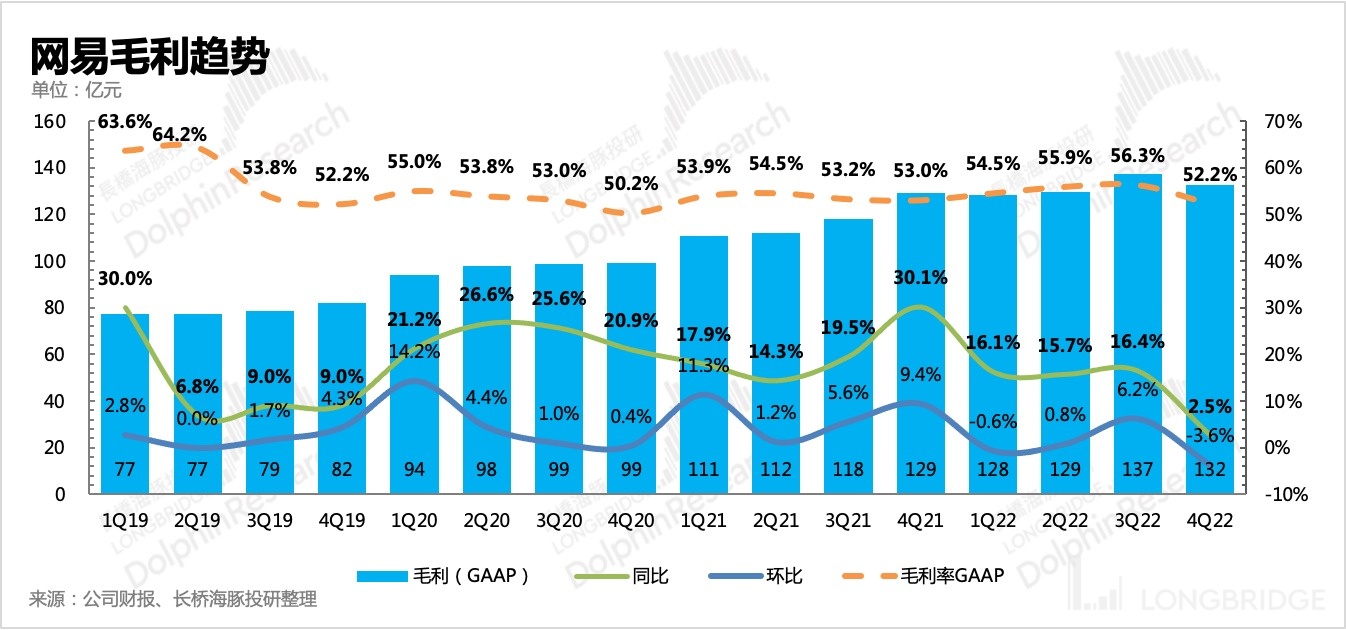

The group's total revenue for the year was RMB 25.45 billion, a year-on-year increase of 4%, which was basically in line with market expectations. Due to the low gross profit margin of mobile games compared to previous periods, operating profit was RMB 700 million lower than market expectations. However, due to the fact that the gross profit of both Youdao, NetEase Cloud Music and innovative businesses were higher than expected, if it weren't for one-time copyright fees, operating profit is expected to exceed expectations based on the previous gross profit margin for mobile games (an increase of RMB 1 billion).

-

In terms of share repurchases: The 2-year USD 3 billion share repurchase plan for 2021 was completed by January of this year, adding a total of USD 500 million repurchased in the fourth quarter. NetEase used USD 3 billion to repurchase 33.6 million ADR shares.

In January, the 3-year USD 5 billion share repurchase plan that was announced last quarter began to be implemented.

- Net cash has increased again: As of the end of the fourth quarter, NetEase's short-term cash assets (cash, short-term investments, and short-term fixed deposits) were approximately RMB 120.2 billion. After deducting short- and long-term borrowings, the net cash was RMB 95.6 billion (24% of the current market value), an increase of RMB 1 billion from the previous quarter. Net operating cash inflow for the fourth quarter was RMB 9 billion, which increased both YoY and MoM. However, it is not related to the main business and is mainly due to investment losses and exchange losses.

Dolphin Analyst will release the summary of the performance conference call on the Longbridge app and user investment research group as soon as possible. Friends who are interested in investing in NetEase can add the WeChat account "dolphinR123" to join the group to get the summary.

Dolphin Analyst's Viewpoint

The performance of the fourth quarter was average, but not particularly bad. Revenue met expectations, but it may be slightly disappointing not to exceed expectations as in the past. The weaker-than-expected profits were mainly due to the reduction in gross profit margin caused by the one-time recognition of copyright fees for mobile games, which led to a larger gap with market expectations in terms of overall profit.

However, Dolphin Analyst believes that NetEase is expected to accelerate its digestion under factors such as the easing of regulations beyond expectations, surprises in the operation of stock games and a rebound in the industry at the bottom brought by the impact from its own product cycle and the regulatory environment. With several reserve projects with intellectual property licenses including "Nishuihan" being launched, and the launch of "Harry Potter" in the Japanese, Korean, European and American markets, Dolphin Analyst can see NetEase's accelerating period of performance in advance.

Combined with market expectations for this year, NetEase's current valuation is basically in a neutral position slightly below the average. Dolphin Analyst believes that if several heavyweight intellectual property licenses are approved and there are no problems with subsequent development, there is still the possibility of further raising growth expectations this year. At the same time, the success of "Egg Party" also confirms Dolphin Analyst's view of NetEase's competitive advantage in long-term operations. Therefore, it is recommended to pay attention to NetEase. Interpretation of the Financial Report of this Quarter

I. Online Gaming: High base number impact within expectations, high copyright fees dragging profitability

NetEase Games (excluding related value-added services) revenue for the fourth quarter was RMB 17.5 billion, a year-on-year flat figure. Although there was some revenue recognition from the annual game "Diablo Immortal", last year's high base number, relative to the blockbuster sales of "Revelation: Eternal Love" and "Harry Potter", caused a slowdown in growth. In the face of global industry headwinds, NetEase's multi-product strategy, which continuously introduces new and old products, contributes to its ability to barely keep up with the industry.

(1) Mobile games declined 2% year-on-year in the fourth quarter. The incredible lifecycles of two old games in the "Journey to the West" series, as well as "Sky", "Land and Border", and others that have been online for many years, continue to rejuvenate these games through version updates, anniversary activities, and other means.

NetEase's ability to operate for the long-term has always been recognized by the industry. As long as the products that the company recognizes as worthy of long-term operation are given a chance, they have the potential to suddenly explode at some later point. For example, last quarter's "Endless Lagrange" also continued shining for a while.

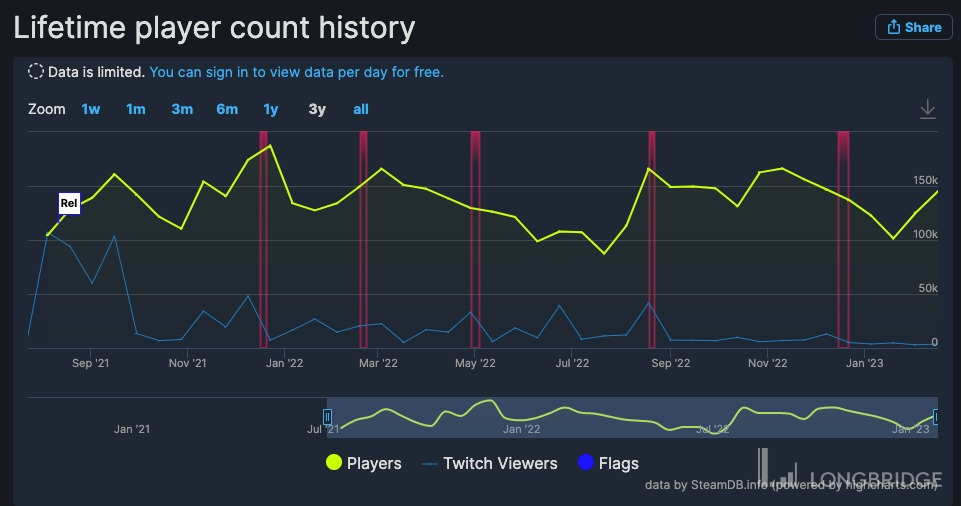

"Party of Eggs" at the end of last year was similar. After the public beta in May, it continued to perform poorly. However, after product version updates, changes in product concepts, and new marketing strategies by NetEase, "Party of Eggs" established a social platform for strangers, with innovative content enriched by UGC+PGC, game anchors, short videos, and other marketing methods. This temporarily increased the popularity of the entire party series of games, such as "Goose and Duck Kill" and "Animal Party".

"Party of Eggs" is a success for NetEase in the field of big DAU, low ARPU games they were previously not good at, thus becoming the game with the highest number of daily active users in NetEase's history.

(2) Client games are relatively stable, with a 6.7% year-on-year growth in the fourth quarter. "Revelation: Eternal Love" ranks 11th on Steam's Hot Play list, and the long-lasting old game "Fantasy Westward Journey" is still shining.

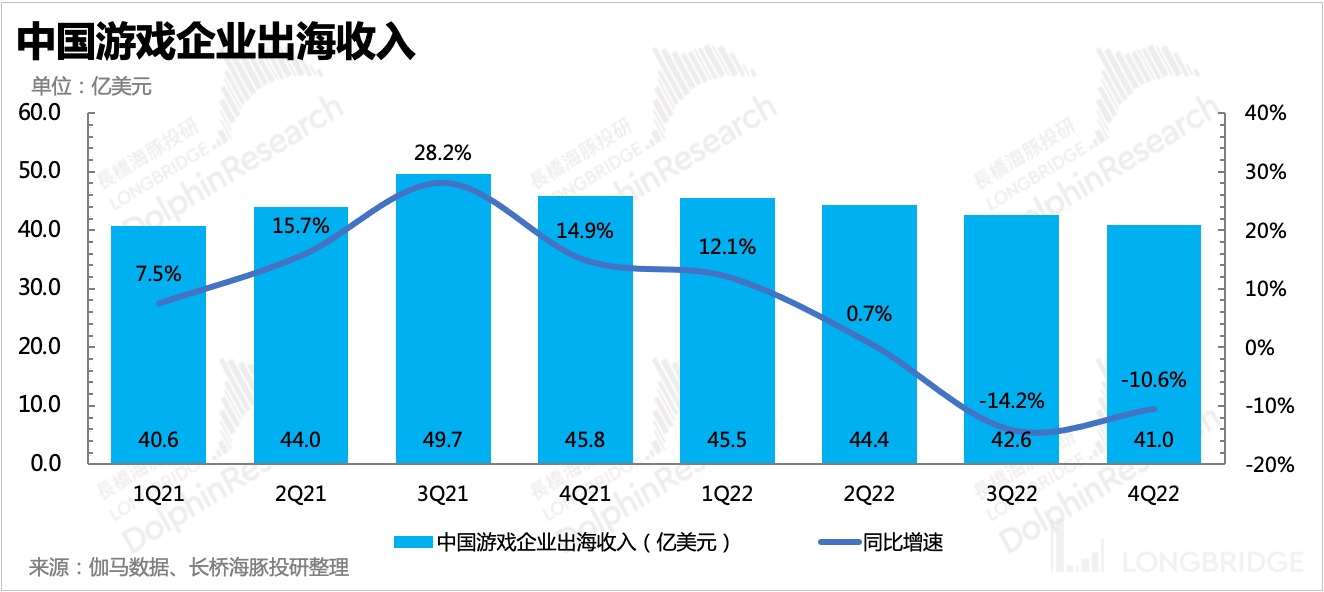

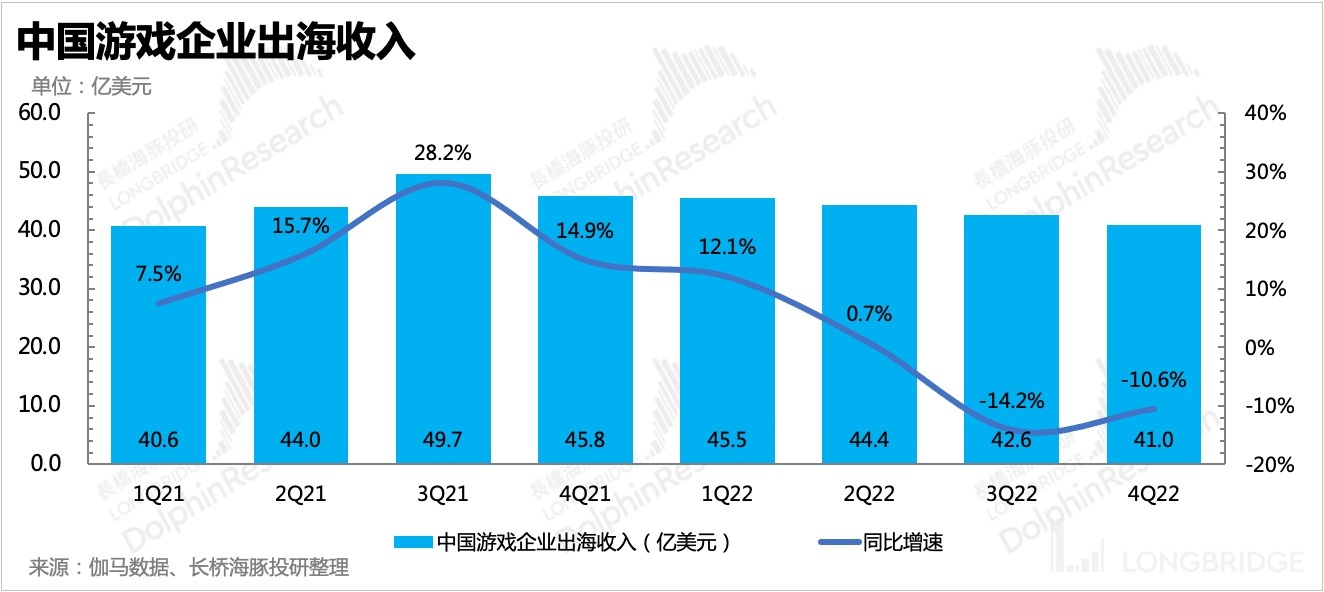

Compared to the industry, NetEase still retains its position as a leader. Regardless of domestic games, Chinese game companies going overseas, or global games, NetEase is still weathering the strong headwinds.

However, if we look at the monthly situation in detail, the trend of gradually slowing down month by month in the past four months is already very apparent. We expect to see industry growth rates return to above the water level gradually, such as in the second half of the year.

!

Charts, bar chart description generated automatically

!

Charts, bar chart description generated automatically

Looking Forward:

1) The success of "Egg Party" in the first quarter will be reflected in revenue, and the impact of the high base will also be reduced, so mobile games should not have difficulty returning to positive growth. For the whole year, as the approval of the game version number accelerates, and with a relatively sufficient reserve after obtaining several version numbers in a row, the remaining issue is the progress of game refining.

Since the update version logic and marketing of "Egg Party" changed greatly in December last year after being online for half a year, it has expanded the user range and enhanced user stickiness by stimulating the demand for socialization with strangers. Judging from the revenue in January and February, it is about half the size of "Fantasy Westward Journey", accounting for about 5% of the company's game revenue. This game has directly brought 3.5% of the total revenue increment from less than 1% contribution.

In addition, since the fourth quarter last year and the first two months of this year, except for October, game version numbers were normally approved, and the number increased month by month. Large game companies have not been significantly restricted in obtaining version numbers as rumored before. In the past four months, NetEase got version numbers for five self-developed mobile games and two imported games.

Among them, "Asura" has the highest popularity, and the market has the highest expectation for its revenue capability. The early launch of the PC version has also become a small phenomenon with high IP value. In addition, there are some positive expectations in the market for "Peak Speed" and "Extraordinary Pioneer".

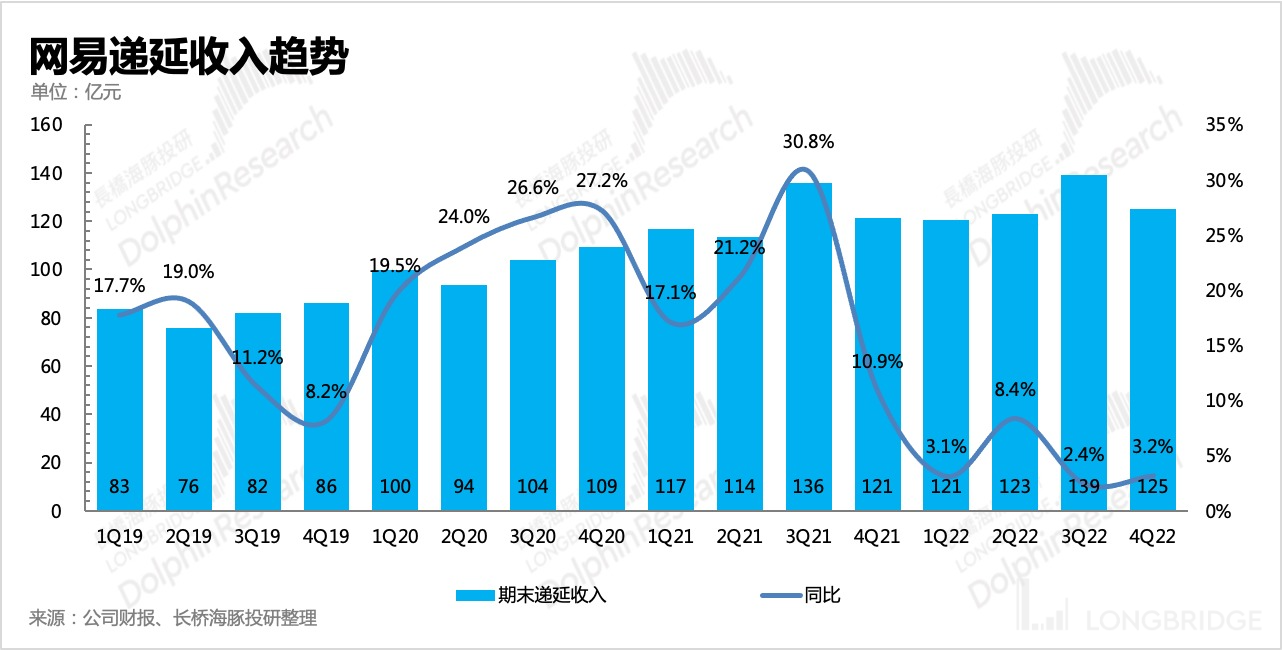

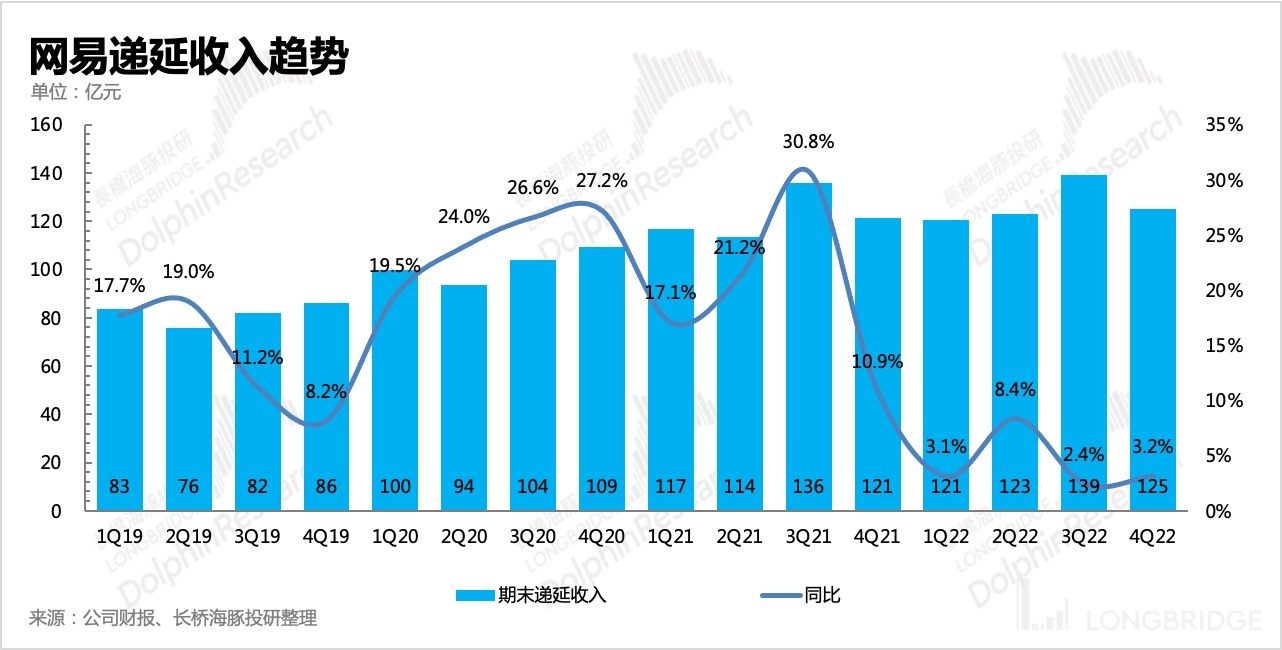

- In the fourth quarter, the deferred income carried forward declined month on month, and the current revenue was flat year on year without significant growth. However, "Egg Party" only officially broke out in January, so the deferred income and revenue indicators in the fourth quarter did not reflect the success of "Egg Party".

- On January 23, due to the lack of a chance to make concessions, NetEase officially stopped operating Blizzard's games, and Shanghai Wangzhiyi (a company specializing in operating and agenting Blizzard games) had been continuously downsizing since the beginning of the year. Before that, Dolphin Analyst had discussed the love-hate relationship between Netease and Blizzard and analyzed that the short-term impact on Netease was limited in Netease: How can they Build on Growth after Breaking up with Blizzard?. The main impact in the medium and long term is on the convenience of cooperation in authorized IP derivative research and development. However, this time, Blizzard clearly suffered a big loss, and there is no news of a suitor for now. Therefore, even if Netease hopes to seek authorization of Blizzard's IP in the future, there will be no obstacles between the two parties due to this breakup. But does Blizzard's IP still have value worth investing in in China? Dolphin Analyst is skeptical, but ultimately it depends on Netease's own ideas.

2. Youdao Education: Unexpectedly Weathered the Storm in Suffering from the Pandemic

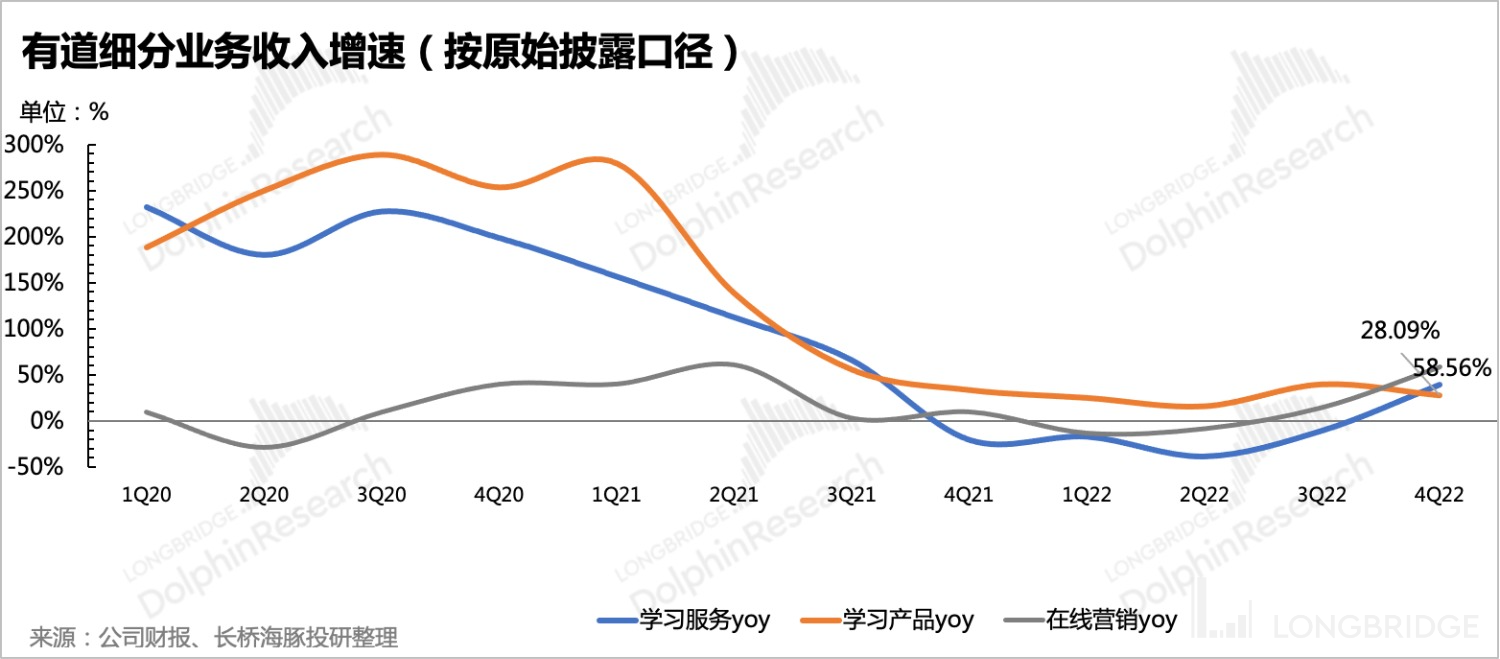

In the fourth quarter of the year, the national epidemic was severe, and the market originally thought that Youdao Education would be greatly affected, especially in the logistics distribution of hardware sales. But this quarter, hardware sales were still good, maintaining a 28% year-on-year growth rate (according to the original caliber). In addition, advertising and online course services have both seen significant recovery, with high-speed year-on-year growth.

Because the gross profit margin of learning products and other hardware sales is inherently low, after their revenue increases in proportion, the overall gross profit margin will be indirectly lowered.

3. Netease Cloud Music: Rapid Growth with Steady Improvement in Profit

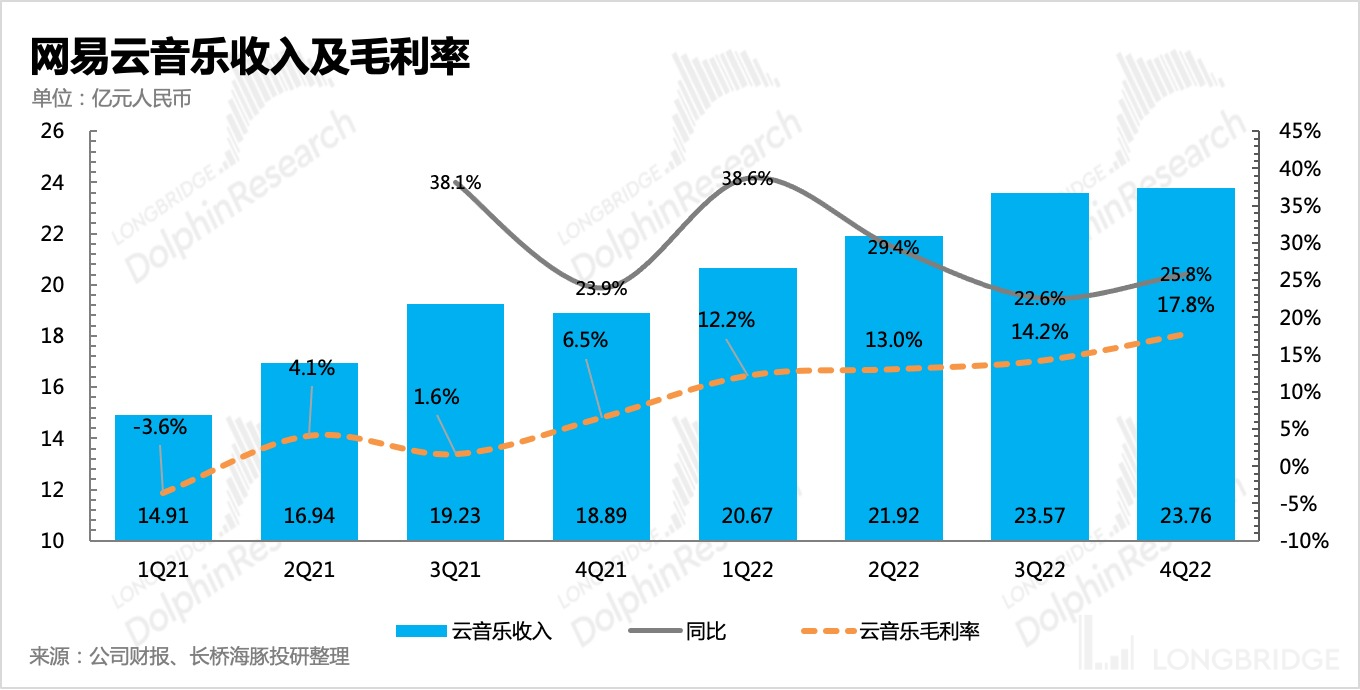

Netease Cloud Music's revenue growth in the fourth quarter was still impressive, with a year-on-year growth of 26%. Although the pressure is not so great because the base number is not high, it is still not easy to maintain its growth rhythm under the macro environment of last year.

In addition to the expansion of paid member user scale driving subscription revenue growth, the social entertainment business is also growing with the overall revenue driven by user penetration. However, as the number of users expands, it is difficult to maintain high average payment per user. Compared with Tencent Music, the single-user payment power of Netease Cloud Music is higher, with an ARPPU of 322 yuan/month in the second half of last year, while Tencent Music's average monthly ARPPU is around 170 yuan.

At the same time, benefiting from the relaxation of exclusive copyright restrictions, while accelerating the enrichment of its music library, Netease Cloud Music's profit model has also been significantly optimized. Since the second half of 2021, after the gross profit margin turned positive, it has gradually increased to 18%, approaching the level of 30% of its counterpart Tencent Music.

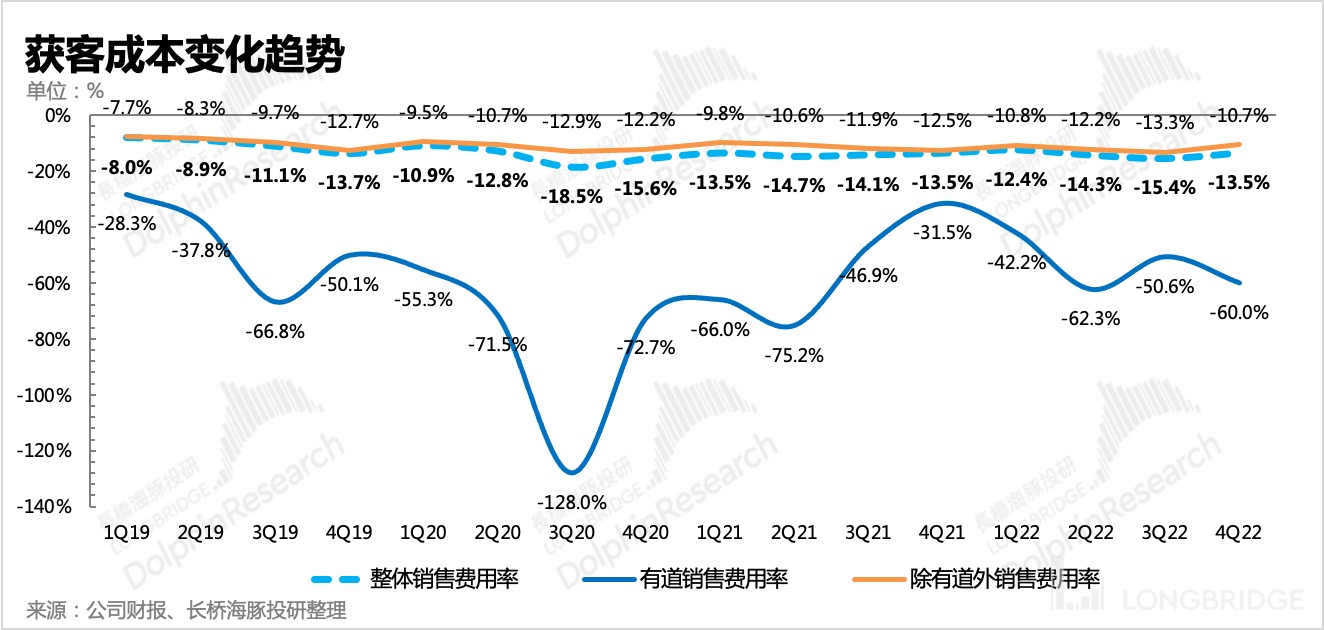

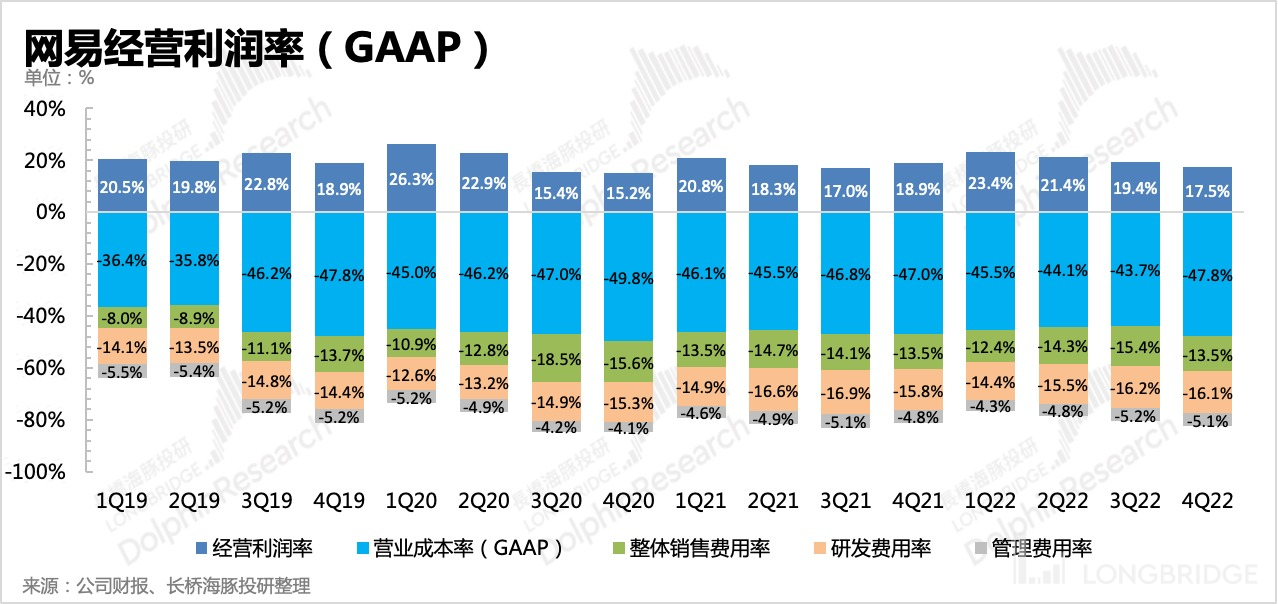

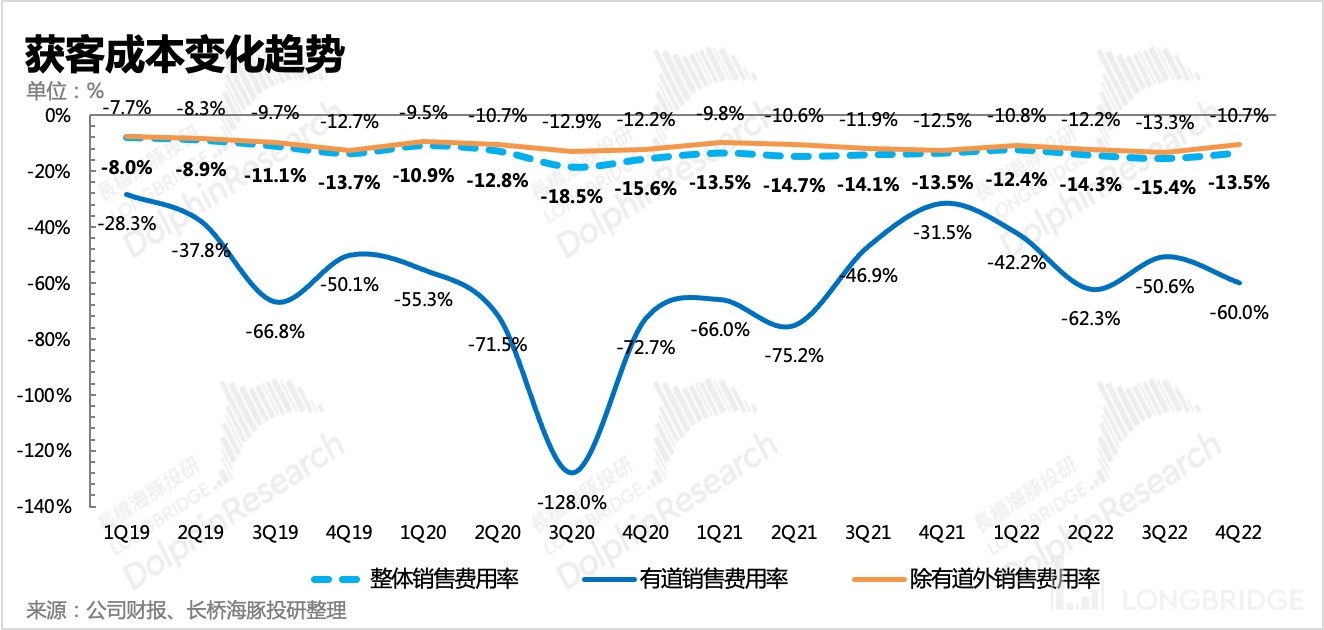

4th, Keep Stable Expenditure

Sales expenses declined slightly in the fourth quarter. Sales expenses are generally related to the timing of product launches and event operations for NetEase, so the main reason for the decline in the fourth quarter is related to the decrease in the volume of new games or old game activities.

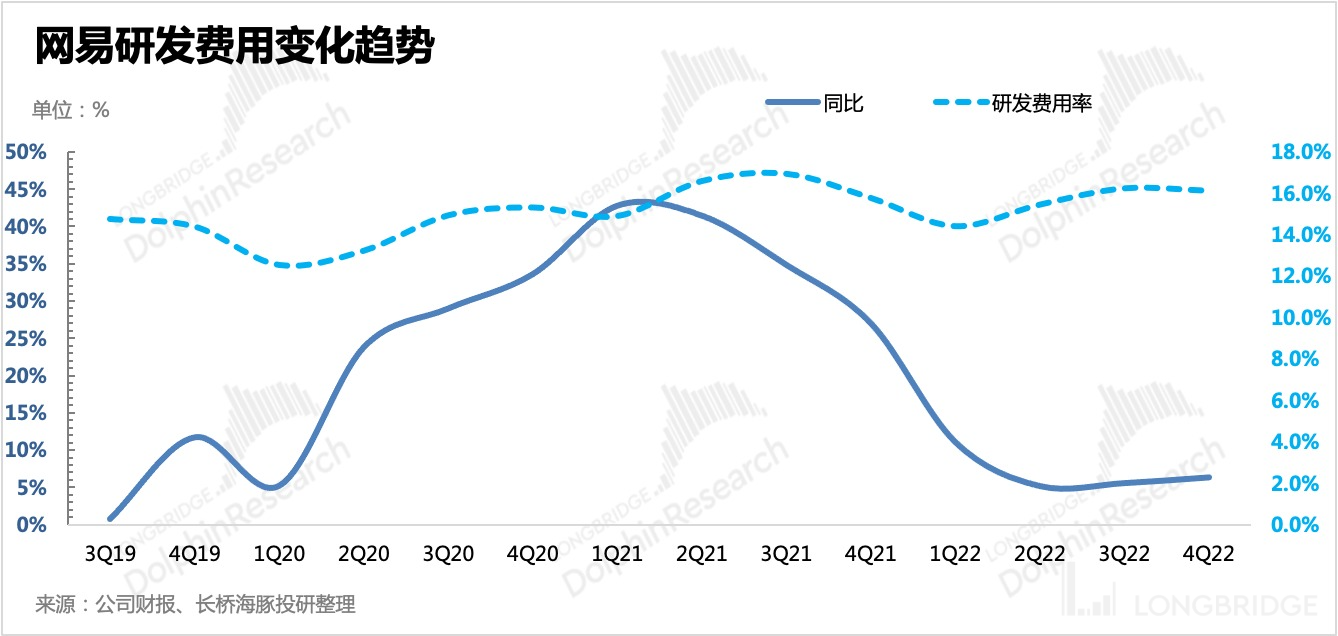

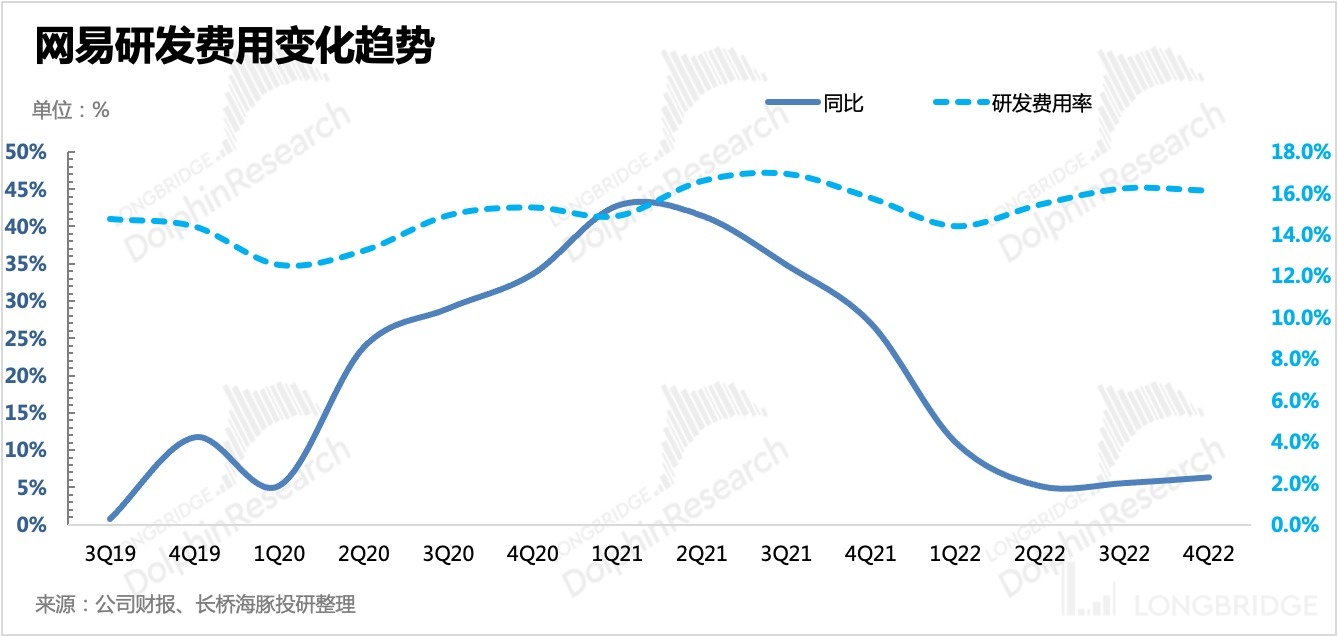

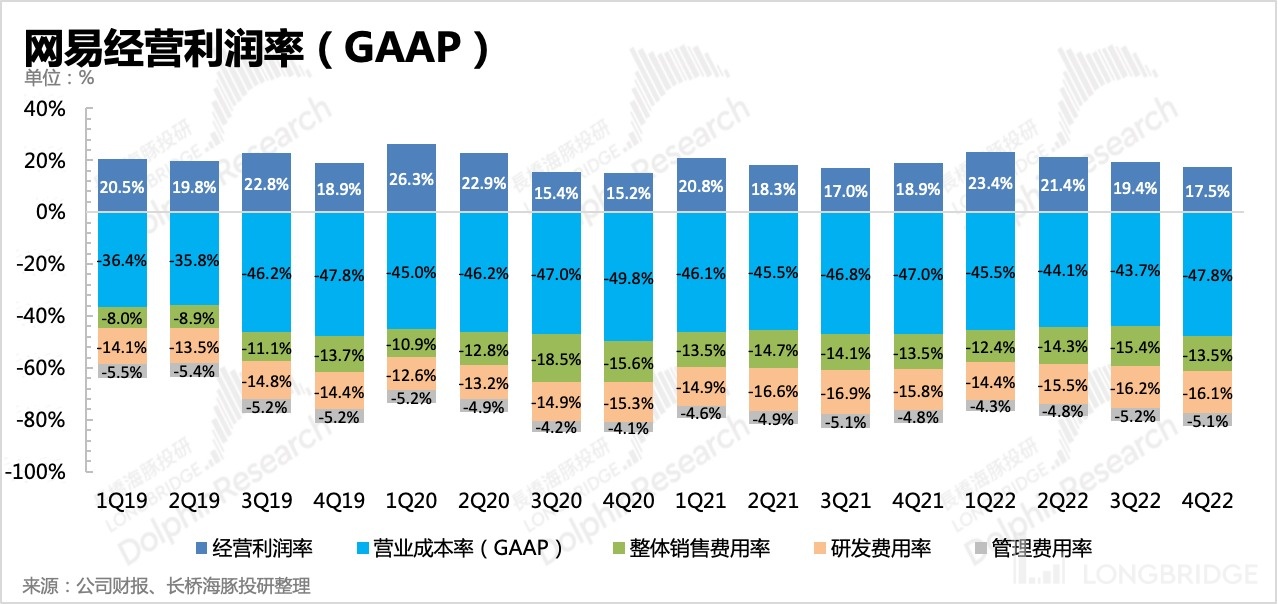

Research and development costs and management expenses remained stable. Therefore, the 2-point decrease in profit margin on a month-on-month basis is basically due to the decrease in the high gross profit margin caused by copyright sharing.

Finally, the Non-GAAP net profit attributable to the mother in the fourth quarter reached RMB 4.8 billion, a sharp decline of 27% year-on-year. However, the main difference compared to the same period last year is caused by non-operating gains and losses, such as investment gains and losses, exchange rate effects, etc. These are one-time non-operating gains and losses and cannot reflect the true operating situation.

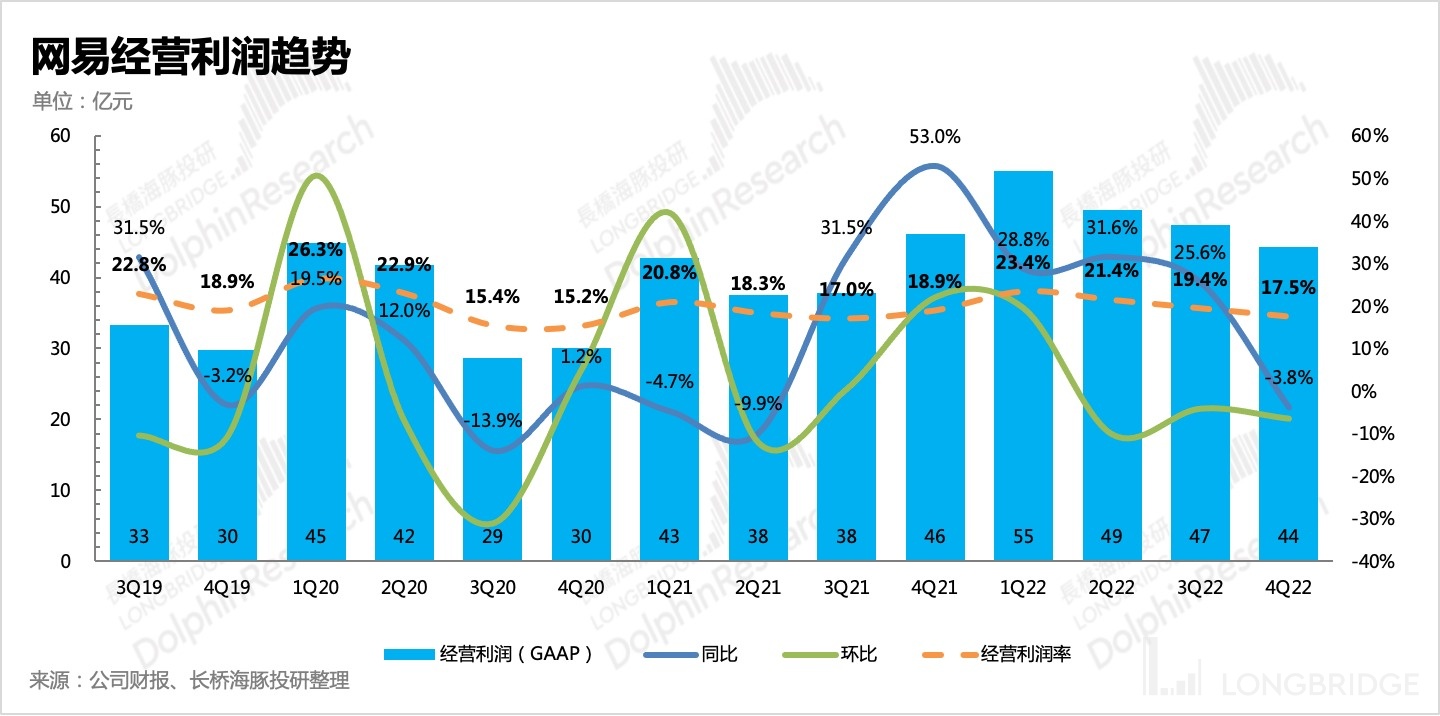

To simply look at the actual profitability of the main business, pay attention to the operating profit indicator. The operating profit in the fourth quarter was RMB 4.433 billion, a year-on-year decrease of 3.8%. Research and development and sales expenses were relatively restrained, except that management expenses may have increased slightly, mainly due to the reasons for gross profit margin mentioned many times before. Compared with the same period last year, the gross profit margin has decreased by more than 1 point, thereby affecting the release of main business profits.

Dolphin Analyst "NetEase" historical article:

Financial Report Season

November 17, 2022 Telephone Conference Minutes: "NetEase: "Fearless of the Cycle, Staying Healthy" (3Q22 Telephone Conference Minute)"

-

17th November 2022 Financial Report Review: NetEase: With the help of product lifecycle, what gives NetEase the confidence to break up with Blizzard?

-

18th August 2022 Conference Call: NetEase: Focusing on Overseas Market is a Must-Make Strategic Option (2Q22 Call Summary)

-

18th August 2022 Financial Report Review: NetEase goes black at the opening? It is really irrelevant to its performance.

-

25th May 2022 Conference Call: Little Benefit from Pandemic Control, But Old End-Game Flow Hits New Record Highs (NetEase Conference Call Summary)

-

25th May 2022 Financial Report Review: The pig cycle continues, and NetEase once again achieves "steadily happy"

-

24th February 2022 Conference Call: NetEase's future focuses: Overseas Markets, Overseas Talent, and Collaboration with Overseas Teams (Conference Call Summary)

-

24th February 2022 Financial Report Review: NetEase: How Long Can Its Spring Last During the Difficult Winter?

-

16th November 2021 Conference Call: Metaverse? Management said: "Enough said, NetEase will surely emerge in it" (NetEase Conference Call)

-

16th November 2021 Financial Report Review: After the "Harry Potter" King, what other cards does NetEase have?

-

31st August 2021 Conference Call: [NetEase 2Q Call Summary: Revenue from minors' games accounts for less than 1%, looking forward to "Harry Potter"] (https://longbridgeapp.com/topics/1101849?invite-code=032064)

-

31st August 2021 Financial Report Review: NetEase: Will the Super Pig Cycle of Pig Farming be Affected by the Regulation? On May 18th, 2021, Review of Financial Report: "NetEase Games Finally Outperforms the Market, Youdao Online Education is Also Making Progress?"

On February 26th, 2021, Telephone Meeting: "NetEase Conference Call Transcript: 'Onmyoji' IP Valued at 10 Billion USD".

On February 25th, 2021, Review of Financial Report: "Dolphin Investment Research | Veteran Game Companies Brave the Storm, NetEase Education Accelerates its Growth".

Depth

On June 25th, 2021, "NetEase: The Super "Pig Cycle" of Pig Farms I Dolphin Analyst".

Risk Disclosure and Statement for this Article: Dolphin Investment Research Disclaimer and General Disclosure