Weixiaoli welcomes its fourth competitor | Jianzhi Research

Q3 零跑銷量、營收同創新高

二線造車新勢力也開始進入毛利率轉正的階段,蔚來、理想和小鵬也終於正式迎來了自己的第四位競爭對手——零跑汽車。

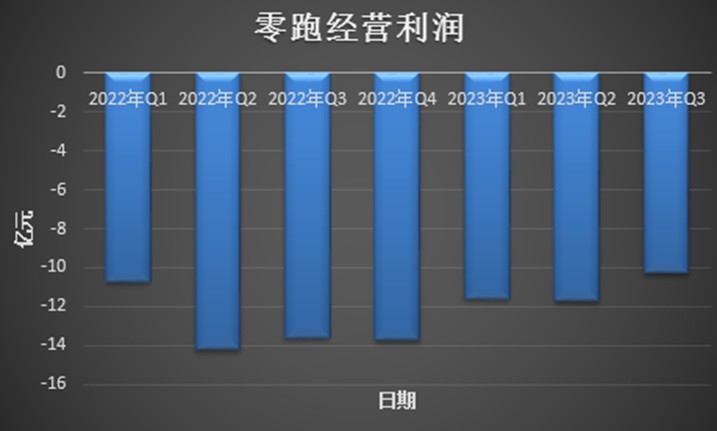

10 月 16 日晚,零跑汽車公佈三季度業績。今年第三季度,零跑汽車實現了營業收入 56.56 億元,同比增長 31.9%,環比增長 29.4%;經營活動現金流持續為正,達到 14 億元;毛利率水平首次轉正達到 1.2%;經營虧損的擴大趨勢也有所收斂,達到 10.25 億元,同比降低 24.7%,環比降低 12.7%。

第三季度,零跑汽車彰顯出營業收入和汽車銷量同創季度新高,毛利率更是首度轉正,提前達成目標,經營虧損也出現收斂,零跑汽車終於熬出頭了?

1、銷量、營收同創季度新高

今年第三季度,零跑汽車的總銷量高達 4.43 萬輛,同比增長 24.5%,環比增長 30.4%,作為國內的二線造車新勢力,該銷量不僅創下了自己的季度新高,還超越小鵬的 4 萬輛和哪吒的 3.5 萬輛。 對於第四季度,零跑汽車也相當樂觀,表示以目前訂單量預計有望在交付量上再創新高。

對於第四季度,零跑汽車也相當樂觀,表示以目前訂單量預計有望在交付量上再創新高。

除開銷量增長原因,零跑第三季度銷量主力已經逐步從單價 10 萬元以下的 T03 車型轉為 15-30 萬元的 C11 和 C01 車型,這也穩住了零跑汽車的單車收入。

今年三季度,零跑汽車的低價 T03 車型銷量同比大幅度下滑 51.5% 至 8622 輛,而 C11 車型和 C01 車型卻分別同比增長 58.6% 和 1384% 至 27378 輛和 8325 輛。顯然,純電動和增程式雙動力佈局的兩款車型,更能滿足消費者多元化需求,得到市場認可。

這也使得零跑汽車的三季度單車收入達到 12.8 萬元左右,一改二季度下滑態勢,零跑汽車此前的全系降價的不利影響已經逐步消除(最高降幅達到 5.9W)。

2、毛利率首度轉正,營業虧損出現收斂

作為國內二線造車新勢力的前沿廠商,儘管銷量水平屢屢逼近一線造車新勢力,但此前年度零跑汽車淨虧損擴大,毛利率長時間為負讓市場頗為詬病。今年第三季度,零跑終於打破了市場質疑,首度實現了毛利率轉正,達到 1.2%,同比增長 10.1 個百分點,環比增長 6.45 個百分點。

此前,零跑汽車本着降價保量的策略,盡全力擴大自己的銷量規模,儘管隨着規模效應的逐步釋放,毛利率水平的確是在逐步提升,從 2019 年的-95.7% 一路降至 2022 年的-15.43%,但是依舊沒有擺脱虧本賺吆喝,賣一輛虧一輛的尷尬局面。

好在,零跑新老車型的交替較為順利,旗下的高價位車型 C11 和 C01 等車型

逐步進入了發力週期,在整體的交付量佔比中也是提升明顯,此前的低價車型 T03 車型已經從此前的 65% 左右迅速跌至如今的 15%,零跑已經徹底將產品從 T 系列推進到 C 系列,也將毛利率拉動至 1.2%。 此外,零跑汽車經營虧損也並未繼續擴大,第三季度 10.25 億元,同比降低 24.7%,環比降低 12.7%。

此外,零跑汽車經營虧損也並未繼續擴大,第三季度 10.25 億元,同比降低 24.7%,環比降低 12.7%。

在今年殘酷的新能源汽車價格戰的影響下,零跑汽車保持了經營虧損收斂。

3、研發投入增長不是大問題,短期彈藥足夠

作為堅持全域自研,同時研發製造三電核心零部件,並提供基於雲計算的車聯網解決方案的造車新勢力,零跑汽車研發投入的增長仍將持續。

今年三季度,零跑汽車的研發開支達到 4.74 億元,同比增長 17.3%,環比增長 15.6%。好在,研發開支的增長也的確匹配零跑汽車銷量和營收的增長,以及零跑汽車純電動和增程式 “雙動力” 的佈局,並不是大問題。

但相較其零跑汽車競爭對手們小鵬、理想和蔚來每季度 10-30 億元的研發投入,零跑汽車的研發支出水平也並不算高。

此外,由於零跑汽車連續兩個季度實現了經營活動現金流轉正(今年二三季度經營活動現金流分別為 27.6 和 14 億元),也讓零跑汽車的流動性問題得到了部分緩解,截止第三季度末,零跑汽車的現金及現金等價物、受限制現金和銀行定期存款的金額為 116.3 億元,連續兩個季度是增長,相比二季度增長了 14.3 億元。

儘管作為改善的主要因素是政府的新能源汽車補貼,隨着後續補貼的消失,這種改善較難持續,但是也算短期內讓零跑汽車緩了口氣。

零跑汽車三季度業績迎來了明顯改善,也給了市場更多的期待,但是能否真的徹底走出來,市場期待零跑汽車用實際行動證明,三季度是成功的開始。