"Wall Street's number one" rarely faces criticism! Odeon Capital downgrades JPMorgan Chase's rating.

I'm PortAI, I can summarize articles.

Odeon Capital 分析師 Dick Bove 將摩根大通評級從 “買入” 下調至 “持有”。

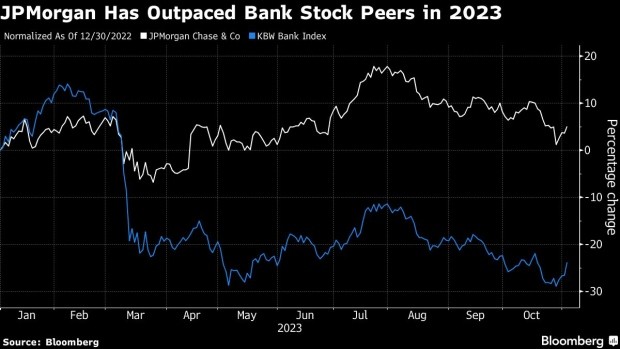

智通財經獲悉,Odeon Capital 分析師 Dick Bove 認為,到目前為止,摩根大通 (JPM.US) 的股價在 2023 年表現穩健,但好日子可能不會持續下去。該分析師指出,隨着監管提案和盈利風險對銀行業所謂的巨頭構成挑戰,該股面臨嚴峻的阻力。在該股今年上漲超過 5% 之後,Bove 將其評級從 “買入” 下調至 “持有”,稱該銀行在這些問題上已經儘可能坦率,但他建議在情況進一步明朗之前保持觀望。

Bove 寫道:“近期負面因素太多,無法表明該銀行的股票在未來一年將表現強勁。我仍然認為,這是美國最好的銀行,它應該成為銀行投資組合中的核心資產。”

摩根大通是今年 KBW 銀行指數中僅有的兩隻有望上漲的股票之一,該指數迄今已累計下跌 24%。自年初美國銀行業危機以來,該公司的的業績也相較同行更為亮眼。

今年 5 月,在摩根大通收購破產的第一共和銀行後,Bove 轉為看漲該股,但現在,在摩根大通首席執行官 Jamie Dimon 本人就風險發出警告後,他下調了評級。除了該公司上個月的盈利外,這位首席執行官還表示,業績 “得益於淨利息收入和低於正常信貸成本的超額盈利,這兩項都將隨着時間的推移而正常化”。

儘管如此,大多數華爾街分析師都看好該公司,有近 24 位分析師維持 “買入” 評級,只有 9 位分析師給予其 “持有” 評級。根據數據,沒有分析師給出 “賣出” 評級。