The Battle of the Pharmaceutical Kings: A 20% Discount? Lilly T Drugs Launches a Price War Against Sima Pharmaceuticals? | Insight Research

美国药品回扣,比想象的更多。

在减肥药市场上,礼来的替尔泊肽正式获批,命名为 Zepbound,准备与诺和诺德的 Wegovy 展开正面的较量。

来自福利咨询巨头 Aon 的最新报告透露了这样一则趣闻:在最近的一个季度里,美国的老板们每个月要掏出 27 美元给员工的 GLP-1 类药物治疗,这种花销相较于上一季度飙升了 97%。

用途怎样分配呢?有 76% 的份额是用来对付糖尿病的,剩下 24% 则全给了减肥。这类药物的热销以及减肥药品需求的飞速增长,让老板们为员工的健康保险贴单的价格也跟着水涨船高。

Aon 的数据预言,到2024 年,美国雇主为员工健康买单的平均费用将会增加到每人超过 15,000 美元。而这其中,有整整一个百分点——也就是 150 美元的增长,都将归功于 GLP-1 类药物的开支。

面对越来越多的付费方,礼来此次对 Zepbound 的定价比诺和诺德 Wegovy 低了 20%,为什么效果更好的产品,定价低了这么多?

美国药品定价的两个关键 List price 与 Net price

礼来今日宣布,将以每月 1,059.87 美元的标价出售 Zepbound,价格与 Mounjaro 大致相同,比诺和诺德的 Wegovy 的价格低约 20%。这一定价令市场意外,因为通常效果更好的创新药,定价会更高。但礼来这次不按套路出牌。

医药公司的价格主要有两类,通常在终端零售的价格叫List price,也就是终端上市价格。对应礼来此次的终端价格就是 1,059.87 美元。

但这个价格并不会全部进入礼来的口袋。礼来需要向付款人(保险)、PBM(药品福利管理公司)、美国政府和其他供应链实体(批发、分销商)支付回购和折扣。除去这部分成本之后,剩余金额才会进入礼来口袋,而这个剩余金额就叫作 Net price(净价格)。

因此 Net price=List price-流通 - 回扣,由于流通成本较低,因此可以近似等于 Net price=List price-回扣,这样再乘以用量就是厂商的毛利(Net sales)。

美国药品流通体系复杂,但整个回扣和折扣成本大头都在 PBM(药品福利管理公司)方,渠道折扣可以忽略不计。因此,PBM(药品福利管理公司)对药企最终价格有决定性影响。

PBM 拥有审核医生处方、制定处方集、药物价格谈判等多项权力。数据显示,美国前三大药品福利管理公司控制着美国 85% 的处方药销售。

而美国普享药协会(AAM,也称原仿制药协会)数据表明:“美国仿制药(小分子仿制药物)和生物类似药(大分子仿制药物)占所有处方药的 91%,但仅占处方药支出的 18.2%。

由此可见,对于创新药定价这么大的市场,PBM 在其中起的作用毋庸置疑。

此次,礼来选择将产品效果更好的 Zepbound 定价相较诺和诺德的 Wegovy 低 20%,可能一方面因为礼来是美国药厂,获得的折扣返点更低,因此可以通过更低的定价获得足够的净价格,另一方面,礼来通过更低的定价可以吸引更多的终端患者,尤其是首次使用患者。

由于这个回扣的变动需要根据产品用量和市占率来谈判,PBM 的需求就是一个适应症下,所有产品总价最低,回扣利益最大。因此每个产品的定价因素中将包括整个适应症下,各产品效果、未来一段时间内的市占率、销售增长情况等多种因素。

PBM 的每款药品回扣都是商业机密,无法具体得知,此前市场认为一般 Net price 与 List price 之间差别会有 20%-30%,但这一比例在 2022 年排名前十的主流药厂可能已经超过 50%,意味着在美国销售药品的制药商以不到一半的价格出售自己的商品(礼来披露达到 65%,下文有详细讨论)。

杨森在 2022 年的一份报告中详细披露了自己在 2022 年支付惊人的 390 亿美元回扣、费用和折扣的具体情况,可以窥见美国药品回扣的冰山一角。

美国药品市场回扣价格近年快速上涨

所以List price 上涨未必对应着 Net price 上涨,甚至近年来也出现二者价差逐渐增大的趋势,这意味着涨价的价差全部被 PBM 回扣吃掉,甚至还出现较上一年更多的回扣。

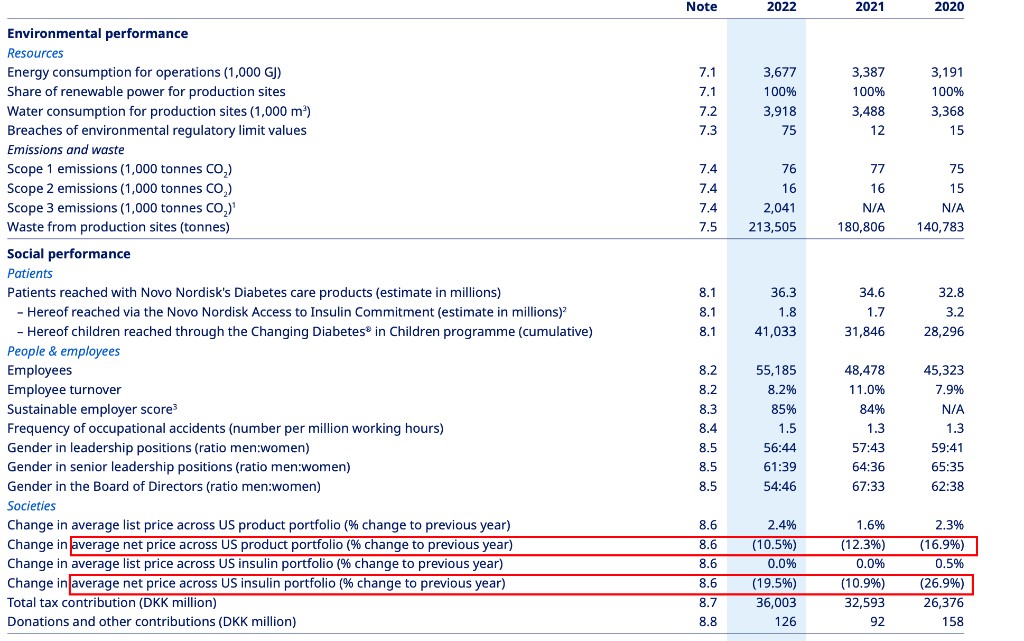

这里用礼来与诺和诺德在 2022 年 ESG 报告中披露的 Net price 与 List price 总体差异和变动来看其关系。(美国上市药企需在 ESG 报告中,披露公司在美国销售产品中的两者价格差异变动,以反映商业透明度问题)

诺和诺德 2022 年全部在美国销售产品的List price 提升了 2.4%,但是 Net price 下降了 10.5%;而其胰岛素产品因为竞争更加激烈,2022 年 List price 没有变动,但 Net price 下降了 19.5%。

这充分说明诺和诺德的胰岛素面临激烈竞争,只能通过更高的回扣来维持销售。而全部产品 Net price 下降程度小于胰岛素,意味着司美格鲁肽议价能力更大。但作为欧洲厂商,其在面临产品竞争时,仍有可能相对于美国厂商有劣势。

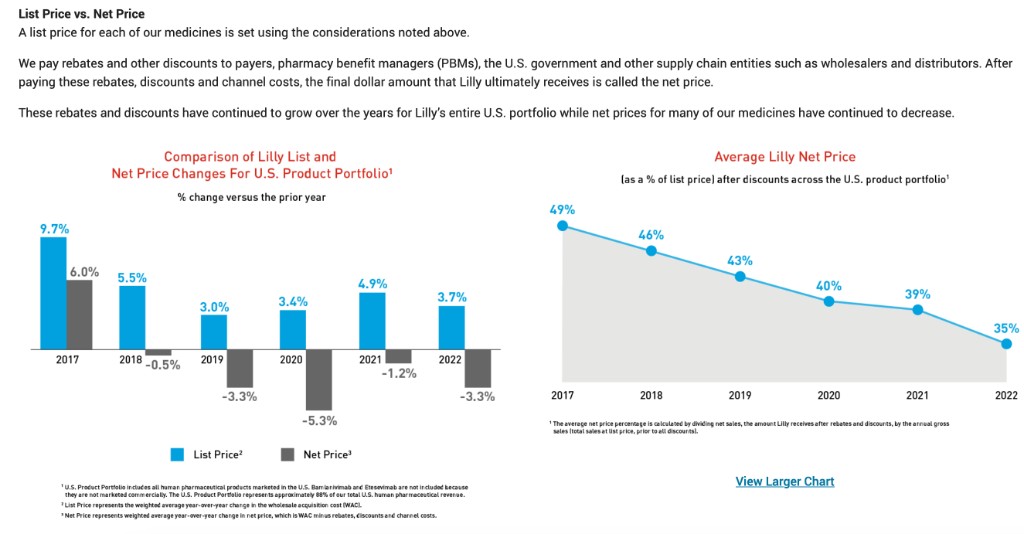

以下这张图是礼来 2022 年 ESG 报告中 Net price 与 List price 变动情况。礼来在 2022 年List price 上涨了 3.7% 的同时,Net price 依然下降了 3.3%,仍然是不仅涨价部分全部被回扣吃掉,还多吃了 3.3 个百分点。

同时,礼来也披露了平均净价格百分比=(净销售额/总销售额)×100(The average net price percentage is calculated by dividing net sales, the amount Lilly receives after rebates and discounts, by the annual gross sales (total sales at list price, prior to all discounts)),而这一比例已经由 2017 年的 49% 下降到 2022 年的 35%(意味着回扣占比已经达到总收入的 65%)。

礼来在同一份公告中阐述了公司如何考虑定价:基于价值的方法,同时考虑到以下几点:

客户观点——药物可以满足患者和护理人员的未满足的需求,以及人们如何负担得起地获得治疗。

公司考虑因素——为客户提供研究、开发、制造和支持服务的成本;商业趋势和其他经济因素;以及药品的潜在市场规模、专利寿命和在我们更大的药品组合中的地位。

竞争格局——与替代药物相比,我们的药物的好处,我们的药物适合治疗条件和付款人与竞争对手之间的现有合同。

促成因素——如卫生系统变化和政策指导方针。还根据上述因素以及对支持药物使用的临床数据进行产品生命周期的价格调整。

因此,对于礼来而言,用低于诺和诺德的 Wegovy 20% 的价格出售 Zepbound,基于 PBM 回扣极大影响着定价。

而其中更多具体数据,要等到两个巨头 2023 年年报中的细节披露了。