NVIDIA's further decline drags down the NASDAQ Composite Index, while the S&P continues to rise, hitting its longest weekly gain in five months. Chinese concept stocks shine, with BIDU-SWR's earnings report showing a remarkable surge of over 10% for the week.

感恩節休市一日後,美股在 “黑色星期五” 提前收市。三大股指漲跌不一,但一個月來保持單週累漲勢頭。部分個股受報道影響波動,傳出延遲在華推出新芯片消息的英偉達跌入兩週來低谷,領跌藍籌科技股,延續發佈財報後周三的跌勢,雖然第三財季業績碾壓預期,但在四季度營收指引低於華爾街高端預期、且預警當季對華銷售大幅下滑後,股價未能得到財報提振。

感恩節休市一日後,美股在 “黑色星期五” 提前收市。三大股指漲跌不一,但一個月來保持單週累漲勢頭。

部分個股受報道影響波動,傳出延遲在華推出新芯片消息的英偉達跌入兩週來低谷,領跌藍籌科技股,延續發佈財報後周三的跌勢,雖然第三財季業績碾壓預期,但在四季度營收指引低於華爾街高端預期、且預警當季對華銷售大幅下滑後,股價未能得到財報提振。而百度在公佈財報向好後持續上漲,且一再跑贏大盤,全周兩位數大漲。

“黑色星期五” 拉開假日購物季序幕,Adobe 預計,美國週五銷售額 96 億美元。零售巨頭沃爾瑪反彈,而電商巨頭亞馬遜險些未能保住漲勢、跌落歷史高位。感恩節假日銷售季伊始,亞馬遜的倉庫工人和司機在美國、英國、德國、意大利、西班牙多國罷工,要求漲薪。

美債週五也將提前收市。週四歐債因擔憂德國政府將增加舉債的擔憂而下跌,週四休市的美國國債價格追跌歐債,收益率在週三 V 形反彈後進一步回升。基準十年期美債收益率不但進一步脱離週三所創的兩個月低位,而且盤中升至一週來高位,抹平本週內累計降幅轉升。本週歐美國債價格齊回落,英債收益率帶頭回升,主要源於週四公佈英國 11 月 PMI 意外升至擴張區間後,一日升至少 10 個基點。

匯市方面,歐洲 PMI 回暖繼續推動歐元和英鎊走強,美元指數進一步回落,逼近週二所創的 8 月末以來低位,本週繼續累跌,但跌勢較大幅回落的上週緩和。評論稱,本週公佈的一些經濟數據疲軟,促使投資者押注美聯儲會轉向更偏鴿的立場。人民幣盤中幾度轉跌,離岸人民幣曾失守 7.16,雖然未能繼續逼近 7 月末以來高位,但連續第二週累漲。

大宗商品中,美元走軟的支持下,黃金反彈,紐約期金本週二度站上 2000 美元整數位心理關口,又創 10 月末以來新高,保持單週漲勢,巴以衝突以來僅上上週累跌。在 OPEC+ 宣佈推遲討論產油政策的會議至下週末、卻未透露具體緣由後,國際原油連續第三日下跌,延續一個月來周跌勢頭。不過本週原油總體跌幅較此前緩和。評論指出,最近消息顯示,推遲會議並非源於主要產油國沙特有意改變減產的立場,沙特看來仍願意負擔 OPEC+ 成員中大部分減產的份額。

三大美股指連漲四周 標普納指均創五個月最長連漲 英偉達財報後連跌 中概指數兩連漲

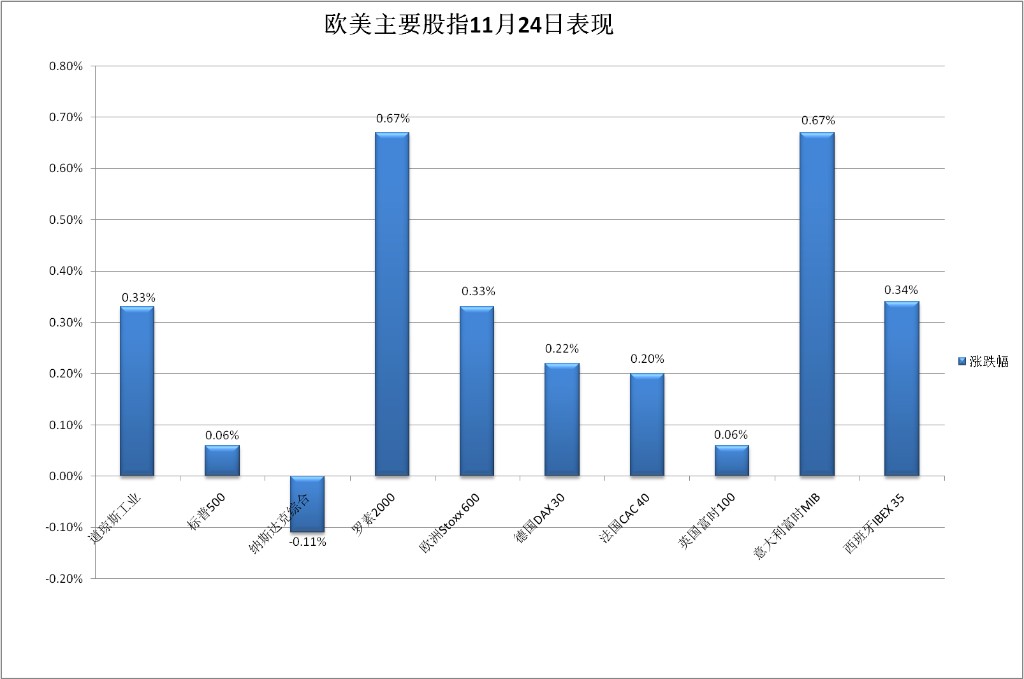

三大美國股指早盤表現不一,高開的道瓊斯工業平均指數保持漲勢,早盤刷新日高時漲近 130 點、漲近 0.4%,低開的標普 500 指數盤初轉漲後不止一次小幅轉跌。而低開的納斯達克綜合指數保持跌勢,刷新日低時跌近 0.4%。最終,三大指數未能繼續集體收漲。納指將在週三反彈後回落,道指和標普連續兩個交易日收漲。

納指收跌 0.11%,報 14250.85 點,未再逼近週一刷新的 7 月 31 日以來收盤高位。道指收漲 117.12 點,漲幅 0.33%,報 35390.15 點,刷新 8 月 7 日以來高位。標普收漲 0.06%,報 4559.34 點,連續兩個交易日刷新週一所創的 8 月 1 日以來高位。

價值股為主的小盤股指羅素 2000 收漲 0.67%,連漲兩日至 9 月 20 日以來高位。科技股為重的納斯達克 100 指數收跌 0.12%,未能繼續靠近週一五連漲所創的去年 1 月以來高位。衡量納斯達克 100 指數中科技業成份股表現的納斯達克科技市值加權指數(NDXTMC)收跌 0.44%,未繼續靠近週一反彈所創的收盤歷史高位,但本週累漲 0.5%,連漲四周。

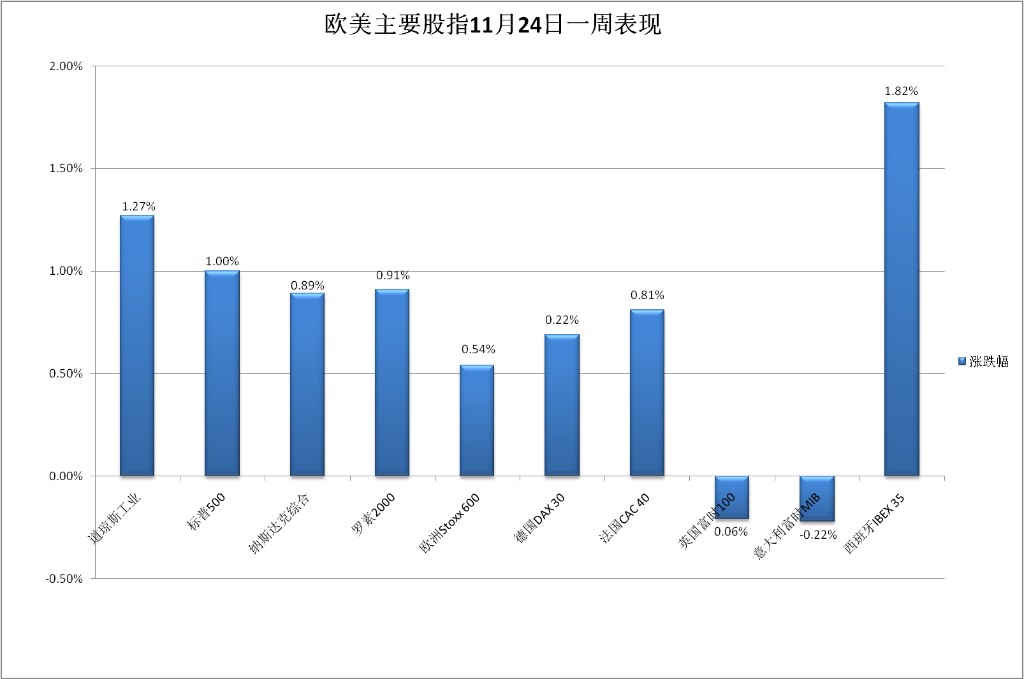

主要美股指本週均繼續累計上漲,漲幅都不及上週。標普累漲 1%,道指漲 1.27%,納指漲 0.89%,納斯達克 100 漲 0.91%,都連漲四周。標普自 6 月 16 日以來首次連漲四周。納指和納斯達克 100 連續兩週創 6 月 16 日以來最長周連漲。羅素 2000 累漲 0.54%,連漲兩週。

標普 500 各大板塊中,週五只有科技股相關的兩個板塊收跌,Meta 和谷歌所在的通信服務跌近 0.7%,英偉達和微軟所在的 IT 跌逾 0.3%。收漲的九個板塊中,漲幅最大的醫療也只漲逾 0.5%,特斯拉所在的非必需消費品漲逾 0.1%,漲幅墊底。

本週各板塊繼續全線累漲。醫療漲超 2% 領跑,通信服務、必需消費品和房產漲超 1%,金融漲約 1%,漲幅最小的能源漲近 0.3%,受到原油下跌影響。

龍頭科技股多數下跌,而特斯拉收漲 0.5%,本週只有跌近 3% 週三一日收跌,但累計漲近 0.5%,漲幅遠不及上週的及 9.2%。FAANMG 六大科技股中,週三連漲三日至 10 月 24 日以來高位谷歌母公司 Alphabet 收跌 1.3%;Facebook 母公司 Meta 收跌近 1%,跌落週三反彈刷新的 2021 年 12 月以來高位;蘋果收跌 0.7%,未繼續逼近週一反彈刷新的 8 月 2 日以來高位;週三反彈的微軟收跌 0.1%,未能繼續刷新週一所創的收盤歷史高位;而亞馬遜微幅收漲,繼續刷新週三反彈所創的歷史高位;奈飛收漲 0.3%,連漲四日,兩日刷新去年 1 月以來高位 。

本週這些科技股都累計上漲。奈飛漲近 3%,微軟在 OpenAI內鬥、一度招攬其 CEO 加入公司的一週漲超 2%,亞馬遜漲超 1%,Alphabet 漲約 1%,Meta 漲近 1%,蘋果漲近 0.2%。

芯片股總體有望連續兩個交易日收漲,費城半導體指數和半導體行業 ETF SOXX 收漲不足 0.1%,仍未能接近週一刷新的 8 月 1 日以來高位,本週微跌。收盤時,Arm 漲 3.4%,英特爾漲近 0.7%,用材料漲近 0.6%,高通漲 0.2%,而 AMD 跌近 0.2%,英偉達跌 1.9%,進一步跌離財報公佈前一日週一所創的歷史高位,在財報後後持續下跌,創 11 月 9 日以來收盤新低,本週累計跌近 3.1%。

AI 概念股未能繼續集體反彈。截至收盤,BigBear.ai(BBAI)漲超 5%,C3.ai(AI)漲 0.3%,SoundHound.ai(SOUN)跌近 0.5%,而 Palantir(PLTR)跌 2.5%,Adobe(ADBE)跌不足 0.1%。

熱門中概股總體繼續上漲,跑贏大盤。納斯達克金龍中國指數(HXC)收漲 1.6%,連續兩個交易日收漲,本週累漲近 3.4%。中概 ETF KWEB 和 CQQQ 早盤分別漲超 1% 和 0.1%。個股中,到收盤,好未來漲超 15%,小鵬汽車漲超 6%,百度漲 2.7%,自週二公佈財報以後持續跑贏大盤,本週累計漲近 14.2%,京東、拼多多、理想汽車漲超 1%,B 站漲近 1%,騰訊粉單漲 0.8%,而網易跌超 1%,蔚來汽車跌近 1%,阿里巴巴跌 0.6%。

零售股漲跌各異,到收盤,沃爾瑪漲 0.9%,塔吉特漲 0.7%,百思買漲近 2.2%,Nordstrom 漲 5.9%,On Holding 漲 3.3%,而 Kohls 跌不足 0.1%;電商 eBay、Shopify 分別跌近 0.4% 和 0.9%。

銀行股指數連續兩個交易日小幅反彈。整體銀行業指標 KBW 銀行指數(BKX)收漲 0.3%,仍未能逼近上週五刷新的 8 月 14 日以來高位,本週累跌 0.6%;地區銀行指數 KBW Nasdaq Regional Banking Index(KRX)收漲近 0.2%,地區銀行股 ETF SPDR 標普地區銀行 ETF(KRE)收漲逾 0.1%,均繼續脱離週二刷新的 11 月 13 日上週一以來低位,本週分別累跌近 1.7% 和 1.8%。

波動較大的個股中,媒體稱歐盟反壟斷監管機構將無條件批准亞馬遜將其收購後,機器人公司 iRobot(IRBT)收漲近 39.1%;幣安與美國司法部達成和解、CEO 趙長鵬認罪並卸任後,美國最大加密貨幣交易所 Coinbase(COIN)收漲 5.8%;宣佈推遲遞交季度報告以及財務管理人員變動後,電動汽車生產商 Fisker(FSR)收漲 5.2%;在 Colt CZ Group 提議以每股 30 美元估值進行戰略性合併後,户外運動和娛樂產品公司 Vista Outdoor(VSTO)收漲 3.9%。

歐股方面,PMI 公佈次日泛歐股指繼續走高,連漲三日。歐洲斯托克 600 指數連續三日刷新週一所創的 9 月 20 日以來收盤高位。主要歐洲國家股指繼續齊漲。各板塊中,零售收漲 0.9% 領跑,化工漲逾 0.8%,受益於媒體稱阿布扎比國家石油公司考慮可能收購旗下能源公司 Wintershall Dea 後,德國化工巨頭巴斯夫漲 1.8%。

本週斯托克 600 指數連漲兩週,漲幅不及上週的 2.82%。各國股指未能繼續齊漲,德股和西股連漲四周,法股連漲兩週,而上週反彈的英股和意股回落。全周零售板塊漲超 2% 領漲,傳媒漲近 2%,而對利率敏感的房產跌近 0.3%,在上週大漲近 6% 後,和上週漲超 6% 領漲的基礎資源均回落,基礎資源跌逾 0.2%。

十年期英債收益率一週回升 18 個基點 十年期美債收益率兩連升至一週高位

歐洲國債價格總體繼續齊跌,收益率續升。到債市尾盤,英國 10 年期基準國債收益率收報 4.28%,日內升 3 個基點;基準 10 年期德國國債收益率收報 2.64%,日內升 3 個基點。

在歐央行官員放鷹、德國政府據稱將突破舉債規模上限、歐洲 PMI 回暖的本週,歐債收益率齊反彈,英債收益率全線 10 升超個基點領跑,源於週四一日至少升 10 個基點。上週回落約 23 個基點的 10 年期英債收益率累計升約 18 個基點;上週降約 13 個基點的 10 年期德債收益率累計升約 6 個基點。

美國 10 年期基準國債收益率在歐股盤前曾下破 4.44% 刷新日低,後持續上行,美股盤初曾逼近 4.50%,刷新 11 月 16 日以來高位,日內升近 9 個基點,到債市尾盤時約為 4.47%,日內升近 7 個基點,在上週大幅回落降約 21 個基點後,本週反彈,累計升約 3 個基點。

對利率前景更敏感的 2 年期美債收益率在美股盤中曾上逼 4.96%,連續兩個交易日刷新 11 月 14 日公佈美國 CPI 超預期放緩後美債收益率大跳水當天以來高位,日內升近 6 個基點,到債市尾盤時約為 4.95%,日內升約 5 個基點,和 10 年期美債收益率均連升兩日,在上週回落約 17 個基點後,本週累計升約 6 個基點。

美元指數兩連跌 逼近 8 月末以來低位 離岸人民幣一度失守 7.16 仍連漲兩週

追蹤美元兑歐元等六種主要貨幣一籃子匯價的 ICE 美元指數(DXY)連續第二日全天保持跌勢,美股盤中跌破 103.40 刷新日低,逼近週二跌破 103.20 刷新的 8 月 31 日以來低位,日內跌超 0.5%。

到往常美股收盤時,美元指數略低於 103.40,日內跌約 0.5%,在上週跌約 1.9% 後本週跌約 0.5%;追蹤美元兑其他十種貨幣匯率的彭博美元現貨指數跌近 0.3%,刷新 8 月 30 日以來同時段低位,本週累跌約 0.5%,和美元指數都連跌兩日、連跌兩週,但跌幅遠不及跌近 1.7%、創 7 月 14 日以來最大周跌幅的上週。

非美貨幣中,歐元和英鎊在回暖的歐洲 PMI 公佈後繼續走強,歐元兑美元在美股早盤曾接近 1.0950,日內漲近 0.4%,逼近週二漲破 1.0960 刷新的三個多月高位;英鎊兑美元在美股盤中曾漲破 1.2610,刷新 9 月 5 以來高位,日內漲近 0.7%;日元險些連跌三日,美元兑日元在歐股盤前曾跌破 149.20 刷新日低,和週二跌破 147.20 刷新的 9 月 14 日以來低位仍有距離,後反彈,歐股和美股盤中都曾轉漲,到往常美股收盤時處於 149.50 下方,日內微跌。

離岸人民幣(CNH)兑美元在亞市早盤曾漲至 7.1426 刷新日高,此後不止一次轉跌,歐股盤中和美股早盤都曾失守 7.16,歐股早盤刷新日低至 7.1609,較日高回落 183 點,美股開盤後持續反彈。北京時間 11 月 25 日 5 點 59 分,離岸人民幣兑美元報 7.1493 元,較週四紐約尾盤漲 29 點,連漲兩日,本週累漲 680 點,連漲兩週。

比特幣(BTC)在美股早盤漲破 3.8 萬美元后一度上測 3.84 萬美元關口,刷新 11 月 9 日逼近 3.8 萬美元所創的去年 5 月以來高位,較亞市盤中的日低漲近 1200 美元、漲超 3%,午盤跌落 3.8 萬美元,往常美股收盤時處於 3.78 萬美元一線,最近 24 小時漲超 1%,最近七日漲近 4%。

原油自 OPEC+ 推遲會議後三連跌 連跌五週

國際原油期貨繼續下挫。週四假日無收盤報價的美國 WTI 1 月原油期貨收跌 1.56 美元,跌幅 2.02%,報 75.54 美元/桶,連續三個交易日收跌,向上週四報 73.09 美元刷新的 7 月 10 日以來收盤低位靠近;布倫特 1 月原油期貨收跌 0.84 美元,跌幅 1.03%,報 80.58 美元/桶,連續三日收跌,連續兩日刷新 11 月 16 日上週四以來收盤低位。

本週美油累跌 0.66%,布油跌近 0.04%,跌幅不及上週的至少 1%。至此,原油連跌五週,巴以衝突爆發七週來,原油只在前兩週累漲,此後持續累跌。

美國汽油和天然氣期貨齊跌。NYMEX 12 月汽油期貨收跌 3%,報 2.1651 美元/加侖,連跌兩個交易日,刷新 11 月 16 日以來低位,本週累跌 0.89%,連跌五週;週三反彈的 NYMEX 12 月天然氣期貨收跌 1.45%,報 2.855 美元/百萬英熱單位,逼近週二刷新的 10 月 2 日以來低位,本週累跌 3.55%,連跌三週。

倫鎳創兩年半新低 連跌五週 倫銅連日反彈 連漲兩週 黃金重上 2000 美元 反彈至近五週高位

倫敦基本金屬期貨週五多數下跌。領跌的倫鎳跌約 2.9%,繼週三之後本週第二日創 2021 年 4 月以來新低,和倫鋁均回落,倫鋁未能靠近週二所創的近兩週高位。跌超 2% 的倫錫連跌三日,創一個月來新低。倫鉛連跌三日,一週多來首次收盤跌穿 2200 美元。而倫銅連續兩日反彈,逼近週二所創的 9 月初以來高位,倫鋅繼續脱離近三週低位。

本週基本金屬多數累跌。倫鎳跌超 4.5% 領跌,連跌五週,此前連漲五週的倫鉛也跌超 4%,連漲兩週的倫錫跌近 4%,倫鋅微跌,連跌兩週;而倫銅漲近 2%,連漲兩週,連跌兩週的倫鋁漲 0.4%。

週四因休市無收盤報價的紐約黃金期貨延續週四盤中反彈勢頭。COMEX 12 月黃金期貨收漲 0.52%,報 2003.00 美元/盎司,刷新週二所創的 10 月 30 日以來收盤高位,繼週二之後本週二度收盤突破 2000 美元。

本週期金累漲約 0.92%,連漲兩週,巴以衝突以來僅上上週一週累跌,漲幅不及上週的逾 2.4%。和上週一樣,本週期金走高也並非源於巴以衝突助力,主要來自美元因美聯儲已完成加息的預期而走軟。