Surging 59% this year! AI "shovel seller" NVIDIA's market value approaches $2 trillion, causing short sellers to lose $3 billion overnight.

英偉達將成為第一家估值達到 2 萬億美元的半導體公司。週五美股盤前,英偉達股價上漲了 2.7%,前一交易日大漲逾 16%,市值猛增 2770 億美元至 1.96 萬億美元,並創下美股史上單日最高市值增幅。英偉達股價自今年年初以來上漲了 59%,這將鞏固其作為全球市值第四大公司的地位。英偉達此前公佈了井噴式的業績,強化了華爾街對其人工智能技術潛力的押注。

智通財經 APP 獲悉,英偉達 (NVDA.US) 將成為第一家估值達到 2 萬億美元的半導體公司,這是該公司在過去一年成為人工智能 (AI) 熱潮最大受益者後的又一個里程碑。

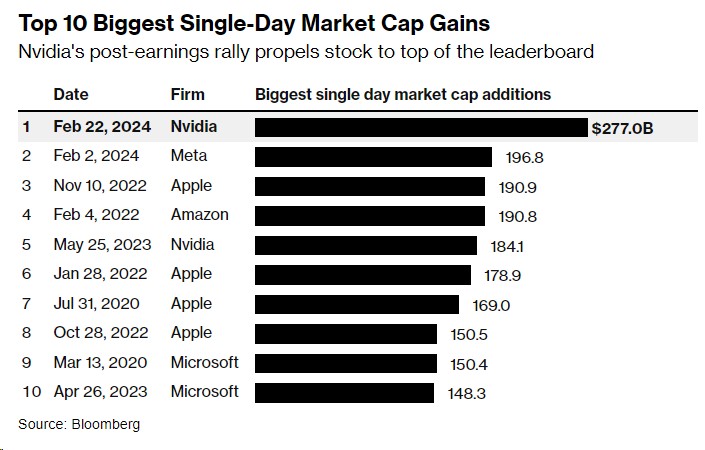

週五美股盤前,英偉達股價上漲了 2.7%,前一交易日大漲逾 16%,市值猛增 2770 億美元至 1.96 萬億美元,並創下美股史上單日最高市值增幅。英偉達股價自今年年初以來上漲了 59%,這將鞏固其作為全球市值第四大公司的地位。英偉達的市值僅次於微軟、蘋果和沙特阿美。

英偉達此前公佈了井噴式的業績,強化了華爾街對其人工智能技術潛力的押注。受微軟和 Meta 等大客户的人工智能支出推動,這家芯片製造商的業績指引也超出了預期。

最新業績和指引證明,英偉達仍然為全球人工智能領域當之無愧的 “最強賣鏟人”。

英偉達創下美股史上單日最高市值增幅

空頭慘遭 “暴打”

根據 S3 Partners LLC 的分析報告,英偉達股價週四飆升,空頭帶來了約 30 億美元的賬面損失,該公司稱這是看跌交易員的 “人工智能噩夢”。

根據 S3 的數據,英偉達是美國第三大被做空的公司,已經借入和賣出的股票達 183 億美元。

S3 預測分析部門董事總經理 Ihor Dusaniwsky 在報告中寫道:“對於許多在英偉達財報發佈後尋求減倉的空頭來説,賬面損失是不可避免的。”“空頭可能會等待一段時間,尋找更有利的退出點。”

英偉達股價的上漲帶動了整個美股芯片行業的普遍上漲。S3 數據顯示,空頭在半導體股上的單日賬面損失達 43 億美元。半導體是今年以來空頭表現最差的行業,2 月按市值計損失達 72 億美元。

一些投資者表示,英偉達的鉅額收益將鞏固人們對人工智能支出強勁的樂觀情緒,證明股價大幅上漲是合理的。

費城半導體指數在 2023 年上漲了近 65%,今年又上漲了 12%。