Before the heavyweight PCE inflation, the Dow fell for the third consecutive day, AI concept cooled down, BIDU-SW dropped by 8% after the earnings report, and Bitcoin rose above $60,000.

道指納指收創一週新低;科技巨頭 “七姐妹” 盤中曾再度齊跌,谷歌收跌近 2%,而特斯拉收漲超 1%;芯片股指跌超 1%、跑輸大盤,英偉達跌超 1%;AI 概念股回落,週二漲近 20% 的 SoundHound 一度超 10%,但 C3.ai 財報後跳漲、盤後漲超 10%;比特幣概念股大漲,MicroStrategy 收漲超 10%,嘉楠科技漲近 6%。中概股指跌超 1%,終結五連漲,小鵬汽車跌近 7%,蔚來、京東跌超 5%,理想汽車跌超 1%,公佈財報以來首跌。德股五日連創歷史新高,ASML 跌超 1%,告別歷史高位。美國 GDP 後,美債收益率下行、刷新日低。美元指數反彈至一週高位,GDP 後回吐多數漲幅。離岸人民幣五連跌,盤中失守 7.22 創逾一週新低。比特幣盤中暴拉超 7000 美元、上逼 6.4 萬美元,兩年多來首次漲破 6 萬美元。美油盤中轉跌,跌落逾一週高位,布油即月合約勉強收漲,創三個月新高。GDP 後黃金轉漲,期金最終收跌。倫銅回落至逾一週低位,倫鎳兩連漲至三個月新高。更新中

週四公佈重磅通脹指標 PCE 物價指數開年表現之前,週三出爐的美國經濟數據喜憂參半:四季度實際 GDP 年化小幅下修至 3.2%,低於預期,當季個人消費支出依舊強勁,但庫存水平下修,去年全年經濟增長 2.5%,增速超出年初華爾街的預期;四季度核心 PCE 意外小幅上修至 2.1%,凸顯通脹壓力依然存在。

美國 GDP 修正數據公佈後,歐美國債價格上漲,收益率震盪下行、刷新日低,連日回升的基準十年期美債收益率本週首度回落,未繼續靠近上週所創的兩個多月來高位;此前反彈至一週來高位的美元指數回吐盤中多數漲幅,全天總體反彈勢頭不改。分析師預計,1 月 PCE 物價指數將較 12 月加快增長,和兩週前公佈的 1 月 CPI 與 PPI 呈現的美國通脹升温跡象一致。

主要美股指全線低開,英偉達等科技巨頭 “七姐妹” 盤中曾再度齊跌。週二高漲的部分 AI 概念股也熄火,英偉達持股的 SoundHound.ai 曾跌超 10%。中概股也回落,理想汽車公佈財報以來首日下跌,結束連日兩位數大漲之勢;公佈 AI 技術推動營銷業務而四季度營收同比增長 6%、但 AI 投入拖累盈利、淨利潤超預期下降 48% 後,百度股價跌落一個多月來高位。

而比特幣繼續狂歡,兩年多來首次盤中突破 6 萬美元大關,一度暴拉超 7000 美元,進入本週以來持續創逾兩年新高。比特幣概念股由此水漲船高。一個多月前比特幣現貨 ETF 在美國正式上市交易後,多家機構有意發行新的加密貨幣 ETF,將導致供應增長放緩的減半比特幣 4 月將至,害怕錯過這波行情的 FOMO 心理,都是比特幣這輪大漲的推手。

大宗商品中,連日反彈的國際原油盤中轉跌,美油跌落週二所創的一週多來高位。投資者擔心美聯儲緩慢降息,且美國能源部公佈的上週美國 EIA 原油庫存超預期增長約 420 萬桶,連增五週,釋放需求低迷的信號,也打擊了油價,抵消了 OPEC+ 可能將自願減產延長至二季度的消息影響。EIA 庫存公佈後,盤中轉漲的油價回吐漲幅,美油重回跌勢,布油即月合約最終勉強繼續收漲。黃金在美國 GDP 公佈後轉漲,現貨黃金此後保住漲勢,但黃金期貨最終收跌,未能繼續靠近上週五所創的兩週來高位。

道指納指收創一週新低 芯片股指跑輸大盤 AI 概念股回落 比特幣概念股逆市走高

三大美國股指集體低開,盤中保持跌勢。早盤刷新日低時,納斯達克綜合指數跌近 0.7%,道瓊斯工業平均指數跌約 230 點、跌近 0.6%,標普 500 指數曾跌近 0.4%,最終。本週第二日集體收跌,道指連跌三日,週二反彈的標普和納指回落。

道指收跌 23.39 點,跌幅 0.06%,報 38949.02 點,納指收跌 0.55%,報 15947.74 點,均刷新 2 月 21 日上週三以來收盤低位。標普收跌 0.17%,報 5069.76 點。

價值股為主的小盤股指羅素 2000 盤初曾跌 0.8%,收跌 0.23%,跌落連漲四日刷新的 2 月 15 日以來收盤高位。科技股為重的納斯達克 100 指數收跌 0.54%,衡量納斯達克 100 指數中科技業成份股表現的納斯達克科技市值加權指數(NDXTMC)早盤曾跌超 1%,收跌 0.91%,均未能繼續逼近上週四所創的收盤歷史高位。

標普 500 各大板塊中,週三有四個收跌,谷歌所在的通信服務跌逾 0.9%,英偉達等芯片股所在的 IT 跌超 0.5%,醫療跌約 0.5%,能源跌 0.2%,收漲的七個板塊中,房產漲超 1%,期銅板塊漲不足 0.4%。

包括微軟、蘋果、英偉達、谷歌母公司 Alphabet、亞馬遜、Facebook 母公司 Meta、特斯拉在內,七大科技股連續四個交易日盤中曾齊跌。而在 CEO 馬斯克電動跑車 Roadster 將於年底推出後,特斯拉基本保持漲勢,僅早盤曾短線轉跌,早盤刷新日高時漲約 2.8%,收漲近 1.2%,連漲三日至 1 月 24 日以來收盤高位。

FAANMG 六大科技股中,被 32 家傳媒集團指控谷歌數字廣告業務造成其損失、被捲入 23 億歐元官司後,Alphabet 午盤跌超 2%,收跌 1.9%,回落至 1 月 5 日以來低位;午盤跌超 1% 的蘋果收跌近 0.7%,逼近週一刷新的 2023 年 11 月 6 日以來收盤低位;Meta 收跌 0.6%,亞馬遜跌收跌 0.2%,奈飛收跌近 0.9%,而微軟微幅收漲。

芯片股總體繼續下跌,且跑輸大盤,費城半導體指數和半導體行業 ETF SOXX 均收跌 1.1%,連跌兩日至 2 月 21 日以來一週低位。英偉達早盤曾跌 2%,早盤尾聲時曾轉漲,收跌 1.3%,連續兩日跌離週一所創的收盤歷史高位;收盤時,Arm 跌近 3%,應用材料跌超 2%,英特爾跌 1.7%,AMD 跌 0.8%。

AI 概念股總體回落,週二大漲的部分概念股大跌。 週二收漲近 20% 的 SoundHound.ai(SOUN)盤初曾跌超 10%,收跌 7.6%,週二收漲 38% 的 BigBear.ai(BBAI)盤初也曾跌超 10%,收跌 8.5%,週二逆市跌近 3% 的超微電腦(SMCI)收跌超 4%,週二漲超 4% 的 Palantir(PLTR)盤中多次轉跌,收跌近 0.5%,Adobe(ADBE)收跌 0.1%;而週二漲超 4% 的 C3.ai(AI)早盤跌超 3%,收跌近 1.4%,盤後公佈第三財季營收超預期增長 18% 後,盤後迅速轉漲,漲超 10%。

比特幣概念股逆市走高,美國最大加密貨幣交易所 Coinbase(COIN)盤中曾漲超 6%,收漲 0.8%;持有比特幣最多的上市公司之一 MicroStrategy Inc. (MSTR) 盤中曾漲近 16%,收漲約 10.5%;比特幣礦機巨頭嘉楠科技(CAN)盤中曾漲 13%,收漲 5.7%。

熱門中概股追隨大盤總體回落。連漲五個交易日的納斯達克金龍中國指數(HXC)收跌近 1.7%,告別週二刷新的 2023 年 12 月 29 日以來收盤高位。中概 ETF KWEB 和 CQQQ 分別收跌約 3.1% 和 4.7%。個股中,到收盤,盤前公佈財報的百度跌約 8%,跌落週二所創的 1 月 11 日以來收盤高位,小鵬汽車跌近 7%、B 站跌超 6%,蔚來汽車、京東跌超 5%,阿里巴巴、騰訊粉單跌近 4%,拼多多跌超 2%,週一和週二分別收漲近 19% 和 12% 的理想汽車跌約 2%,自週一公佈財報以來首次下跌,網易跌近 0.8%。

公佈財報的個股中,四季度營收下降幅度低於預期、今年擬大幅削減成本的人造肉巨頭 Beyond Meat(BYND)收漲 30.7%;宣佈將股息上調 0.02 美元、新增回購 20 億美元后,電商 eBay(EBAY)收漲 7.9%;四季度營收和盈利高於預期的時尚零售商 Revolve(RVLV)收漲 22.1%;而四季度 EPS 意外報虧、一季度盈利指引遜於預期、宣佈裁員 350 人後,約會 App Bumble(BMBL)收跌 14.8%;四季度營收和盈利低於預期的疫苗股諾瓦瓦克斯(NVAX)收跌 26.7%;四季度虧損低於預期、但一季度和全年指引遜色的保險公司 Lemonade(LMND)收跌 27.7%;收漲不足 0.1% 的雲軟件公司 Salesforce 盤後公佈第四財季營收高於預期、但本財年指引遜於預期,盤後曾跌 7%;公佈一季度產品營收指引低於預期、CEO 將離休後,收跌 1.7% 的雲計算數據公司 Snowflake(SNOW)盤後跌超 20%

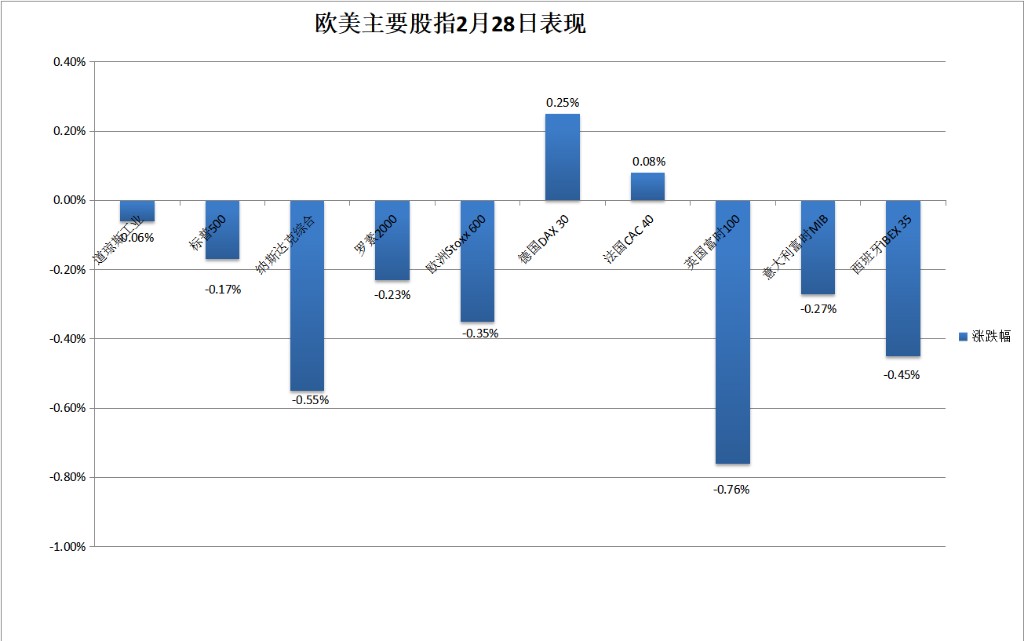

歐股方面,泛歐股指回落,本週第二日收跌。歐洲斯托克 600 指數刷新上週三以來收盤低位。主要歐洲國家股指漲跌各異。德股連續五個交易日收創歷史新高,法股連日反彈,繼續靠近上週五所創的收盤歷史高位,而英股和西股分別連跌三日和兩日,週二反彈的意股回落。

各板塊中,房產收跌逾 1.8% 領跌,受累於公佈年度利潤下降、今年建房將減少後,倫敦上市的 Taylor Wimpey 收近 4.8%;科技板塊跌 1.4%,荷蘭上市的歐洲市值最高芯片股 ASML 跌 1.1%,在週二創收盤歷史新高後回落;個人與家庭用品跌 1.2%,主要源於因中東業務受調查後四季度同店淨銷售遜於預期的英國快消品巨頭利潔時(Reckitt)跌 13.3%,創 1999 年 12 月以來最大日跌幅。

美國 GDP 後 美債收益率下行 刷新日低

歐洲國債價格齊漲,收益率追隨美債下行。到債市尾盤,英國 10 年期基準國債收益率約為 4.18%,日內降約 1 個基點;2 年期英債收益率約為 4.32%,日內降約 1 個基點;基準 10 年期德國國債收益率約為 2.46%,日內降約 1 個基點;2 年期德債收益率約為 2.91%,日內降約 1 個基點。

美國 10 年期基準國債收益率在亞市早盤曾上測 4.31% 刷新日高,美股盤前美國 GDP 公佈後,先曾下測 4.27% 刷新日低,後反彈上測 4.71 刷新日高,美股開盤後持續回落,未繼續靠近上週五上逼 4.35% 刷新的 2023 年 12 月 1 日以來高位,美股尾盤下破 4.27%,到債市尾盤時約為 4.26%,日內降約 4 個基點,在連升兩日後回落。

對利率前景更敏感的 2 年期美債收益率在亞市早盤刷新日高時上測 4.70%,美國 GDP 公佈後加速下行,美股尾盤下破 4.64%,繼續脱離上週五升破 4.74% 刷新的去年 12 月 11 日以來高位,到債市尾盤時約為 4.64%,日內降逾 5 個基點,連降兩日,最近六個交易日內第三日下降。

美元指數反彈至一週高位 GDP 後回吐多數漲幅 比特幣兩年多來首次漲破 6 萬美元

追蹤美元兑歐元等六種主要貨幣一籃子匯價的 ICE 美元指數(DXY)在亞市盤初迅速轉漲,此後保持漲勢,歐股盤前曾漲破 104.20,刷新 2 月 20 日以來高位,日內漲近 0.4%,美股盤前美國 GDP 公佈後加速回吐漲幅,美股臨近午盤時曾回到 103.90 下方,日內漲幅不足 0.1%,午盤漲幅略有擴大。

到週三美股收盤時,美元指數略低於 104.00,日內漲 0.1%;追蹤美元兑其他十種貨幣匯率的彭博美元現貨指數漲近 0.2%,反彈至 2 月 19 日以來同時段高位。

非美貨幣中,日元未能保住週二的反彈勢頭,美元兑日元在美股早盤曾漲破 150.80,刷新週一所創的 2 月 13 日以來高位,日內漲逾 0.2%,美股收盤時漲逾 0.1%;歐元兑美元在歐股早盤曾跌破 1.0800,刷新上週三以來低位,日內跌超 0.4%,美股收盤時跌不足 0.1%;英鎊兑美元在歐股盤中曾接近 1.2620,日內跌近 0.5%,未再靠近上週四所創的 2 月 2 日以來高位,美股收盤時跌近 0.2%。

離岸人民幣(CNH)兑美元 在亞市早盤曾刷新日高至 7.2115,亞市早盤轉跌後歐股盤前曾跌至 7.2203,2 月 16 日以來首次盤中失守 7.22,較日高回落 88 點,歐股盤中多次轉漲,美股早盤轉跌後保持跌勢。北京時間 2 月 29 日 5 點 59 分,離岸人民幣兑美元報 7.2141 元,較週二紐約尾盤跌 2 點,在連漲六日後連跌五日。

比特幣(BTC)在美股盤前漲破 6 萬美元,自 2021 年 11 月以來首次突破這一大關,後進一步走高,美股盤中曾漲破 6.39 萬美元、上逼 6.4 萬美元,連續三日創兩年多來盤中新高,較亞市早盤 5.67 萬美元下方的低位暴拉超 7000 美元、漲超 10%,後回吐過半漲幅,午盤曾跌破 5.9 萬美元,後重上 6 萬美元,美股收盤時處於 6 萬美元上方、6.1 萬美元下方,最近 24 小時漲超 5%。

美油跌落逾一週高位 布油即月合約勉強收漲 創三個月新高

國際原油期貨盤中轉跌。歐股盤前刷新日低時,美國 WTI 原油跌破 77.80 美元,日內跌近 1.4%,布倫特原油主力合約跌破 81.60 美元,日內跌超 1.3%,美股盤前轉漲後美股早盤刷新日高時,美油漲破 79.60 美元,日內漲近 1%,布油漲破 83.10 美元,日內漲近 0.6%,美國 EIA 原油庫存公佈後持續回落,早盤尾聲時轉跌。

最終,原油收盤漲跌互見。連漲兩日的 WTI 4 月原油期貨收跌 0.42%,報 78.54 美元/桶,跌落週二刷新的 2 月 16 日 79.19 美元以來收盤高位。布倫特 4 月原油期貨收漲 0.03 美元,漲幅 0.04%,報 83.68 美元/桶,連漲三日,刷新 2023 年 11 月以來收盤高位。而主力合約布倫特 5 月原油期貨收跌 0.6%,報 82.15 美元/桶。

美國汽油和天然氣期貨繼續漲跌不一。連漲兩日的 NYMEX 3 月汽油期貨收跌 3.1%,報 2.271 美元/加侖,刷新 2 月 7 日以來收盤低位;週二回落的 NYMEX 4 月天然氣期貨收漲 4.26%,報 1.885 美元/百萬英熱單位,刷新 2 月 9 日以來高位。

倫銅回落 倫鎳兩連漲至三個月新高 GDP 後黃金轉漲 期金最終收跌

倫敦基本金屬期貨週四多數下跌。週二小幅反彈的倫銅回落到一週多來低位。倫鋅和倫鉛繼續小幅跌離各自週一所創的將近三週來和兩週多來高位。週二走出 1 月下旬以來低位的倫鋁微跌。而倫鎳和倫錫兩連漲,倫鎳刷新上週五所創的去年 11 月以來高位,倫錫創逾一週新高。

紐約黃金期貨在歐市盤初曾跌至 2033.4 美元刷新日低,日內跌逾 0.5%,美國 GDP 公佈後曾轉漲,美股盤前刷新日高至 2047.4 美元,日內漲近 0.2%,未到美股開盤已重回跌勢。

最終,COMEX 4 月黃金期貨收跌 0.07%,報 2042.70 美元/盎司,在週二反彈後回落,未能繼續靠近上週五刷新的 2 月 7 日以來收盤高位。

現貨黃金在歐股早盤曾跌至 2024.60 美元下方,刷新本週三日低位,日內跌近 0.3%,美國 GDP 公佈後轉漲,美股盤初漲破 2037.90 美元刷新日高,日內漲近 0.4%,美股早盤和午盤均曾轉跌,尾盤又轉漲,收盤時處於 2033.50 美元一線,日內漲逾 0.1%。