Counterpoint: In 2023, China's smartphone sales volume decreased by 1.4% year-on-year.

2023 年中國智能手機銷量同比下降 1.4%,為兩年多來首次實現季度增長。蘋果和華為銷量居前,蘋果第四季度銷量同比下降 9.0%,而華為銷量增長了 71.1%。榮耀保持強勁增長。預計中國市場將於 2024 年錄得自 2018 年以來首次低個位數同比增長。美國智能手機市場在 2023 年第四季度復甦,蘋果市場份額創下 2019 年以來的新高。Android 手機銷量下滑,美國運營商升級率和設備銷售額下滑。印尼智能手機出貨量同比下降 1%。中端和高端市場增長。傳音集團同比增長 34%。2023 年 5G 智能手機出貨量同比增長 10%。預計泰國消費者信心改善。

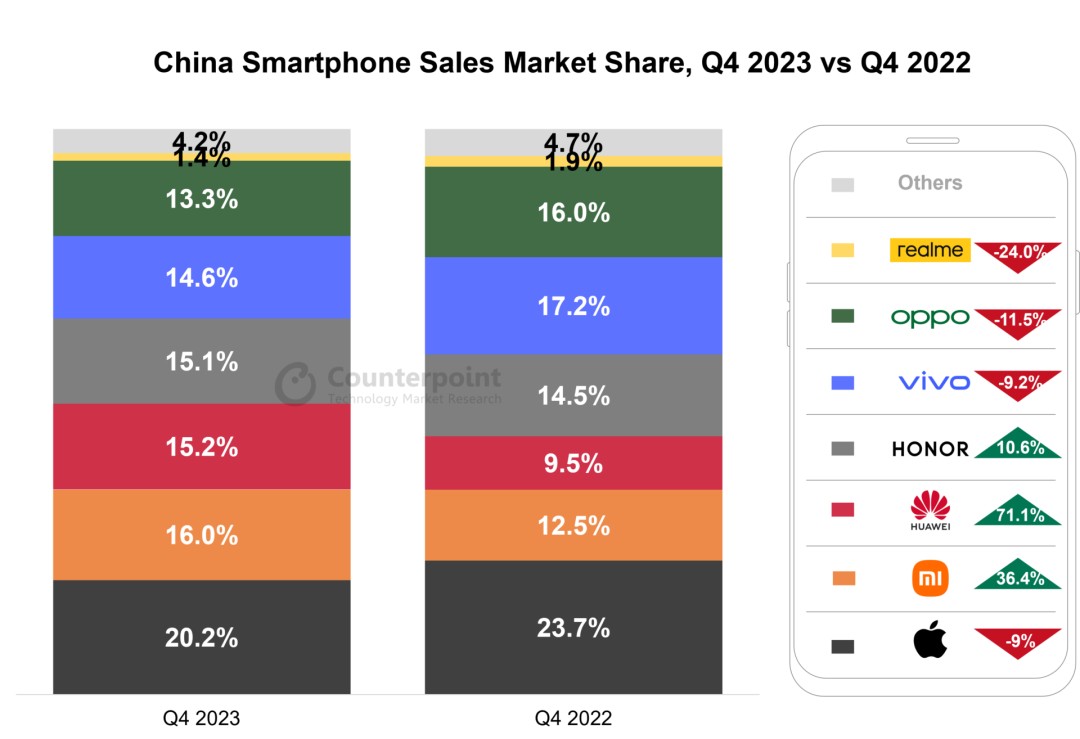

智通財經 APP 獲悉,近日,Counterpoint Research 發佈 2023 年各市場智能手機出貨量報告匯總。2023 年,中國智能手機銷量同比下降 1.4%,而 2022 年同比下降 13.9%。2023 年第四季度,中國智能手機銷量同比增長 6.6%,為兩年多來首次實現季度增長。蘋果佔據榜首,華為緊隨其後。蘋果第四季度銷量同比下降 9.0%,而華為銷量在其 5G 芯片的推動下增長了 71.1%。第三季度至第四季度,榮耀保持着強勁增長。預計中國市場將於 2024 年錄得自 2018 年以來首次低個位數同比增長。

美國智能手機市場在 2023 年第四季度復甦,蘋果市場份額創下 2020 年第四季度以來的新高

2023 年第四季度,蘋果的銷量份額飆升至 64%,為 2020 年第四季度以來的最高水平。由於低端原始設備製造商 (OEM) 需求疲軟,Android 手機的銷量在第四季度出現下滑。美國運營商 AT&T、T-Mobile 和 Verizon 均報告了升級率和設備銷售額下滑。隨着經濟回暖,預計美國智能手機市場將在 2024 年實現低個位數增長。

印尼 2023 年智能手機出貨量下降 6%

印尼 2023 年智能手機出貨量下降 6%

與 2023 年上半年的 10% 下降相比,印尼 2023 年下半年的智能手機出貨量同比下降 1%。2023 年下半年,中端(400-600 美元)和高端(>600 美元)細分市場分別增長 13% 和 11%。傳音 (688036.SH) 集團在 2023 年繼續保持強勁勢頭,同比增長 34%。2023 年 5G 智能手機出貨量同比增長 10%。

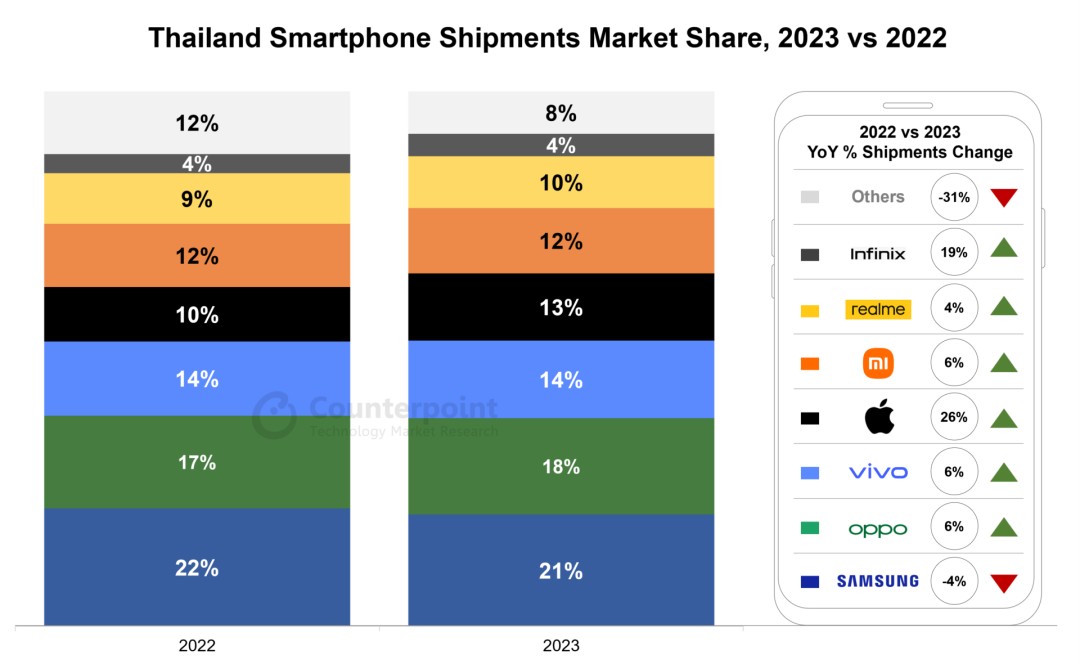

受年底消費者信心改善影響,泰國 2023 年智能手機市場同比增長 2%。2023 年,低於 200 美元 的廉價手機細分市場同比增長 17%,而其他所有價位段均出現下滑。三星以 21% 的市場份額位居泰國智能手機市場首位,但整體品牌出貨量下降 4%。低於 200 美元 的細分市場中,5G 智能手機增長了 139%。

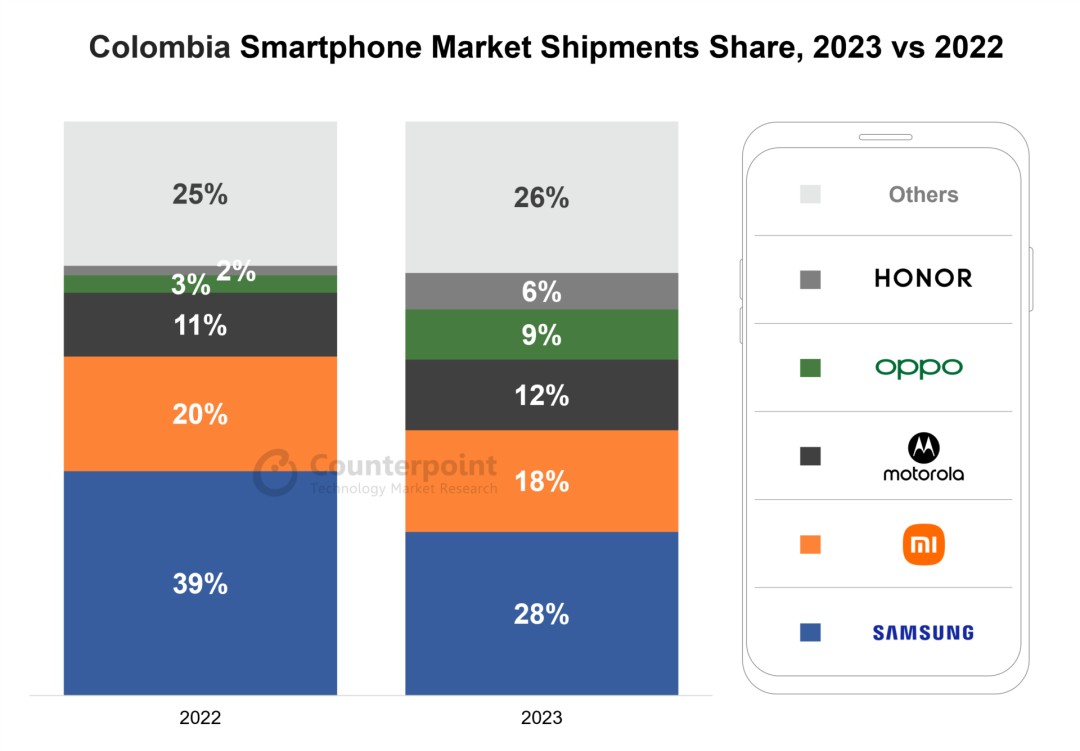

哥倫比亞 2023 年第四季度智能手機出貨量同比下跌 8.4%,為 2020 年以來最低

2023 年第四季度哥倫比亞智能手機出貨量同比下降 8.4%,是 2020 年以來同期表現最低的一年。儘管出貨量同比減少近一半,三星仍以 21% 的市場份額保持市場領導地位。榮耀在 2023 年第四季度同比增長 225%,達到歷史最高出貨量,全年市場份額為 6%。

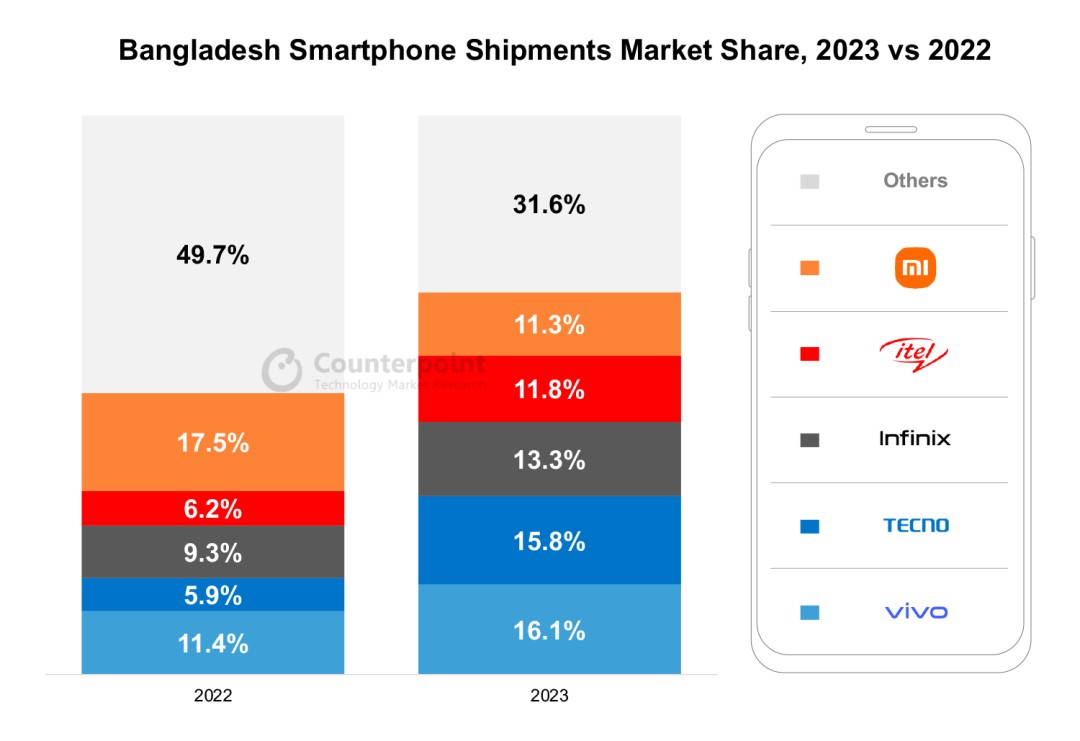

2023 年孟加拉智能手機出貨量同比下降 25%,vivo 奪得市場頭把交椅

由於經濟不利因素,2023 年孟加拉智能手機出貨量錄得史上最大年度跌幅,同比下降 25%。vivo 以 16.1% 的市場份額首次蟬聯智能手機市場榜首。TECNO 以 15.8% 的份額位居第二,其年增長率幾乎翻了一番。綜合手持設備市場(包括功能手機)方面,Symphony 在 2023 年排名第一,其次是 itel。未來幾年,隨着安裝基數的擴大、經濟壓力的緩解、當地貨幣升值以及數字化進程的推進,孟加拉智能手機市場有望回暖。

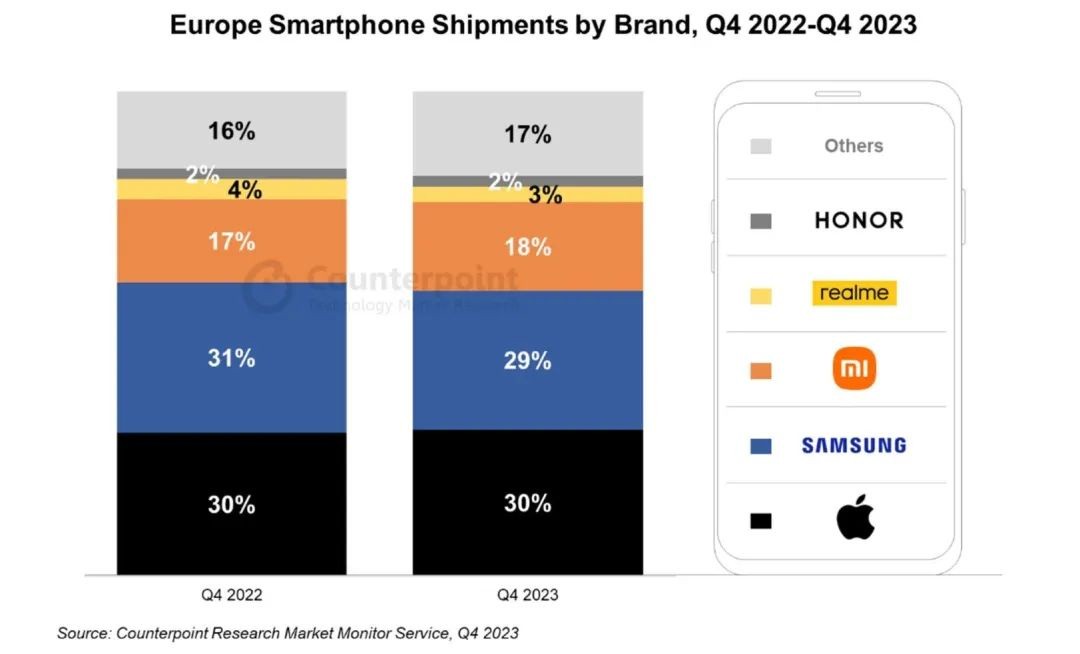

2023 年第四季度歐洲智能手機出貨量同比下降 3%,復甦跡象顯現

2023 年第四季度,歐洲智能手機市場同比僅下降 3%,這是自 2021 年第四季度以來首次出現個位數的出貨量下降,表明市場可能即將復甦。OPPO 和 vivo 與諾基亞達成的 5G 專利協議應該會開啓這兩家廠商的復甦之路,儘管它們都失去了大量市場份額。

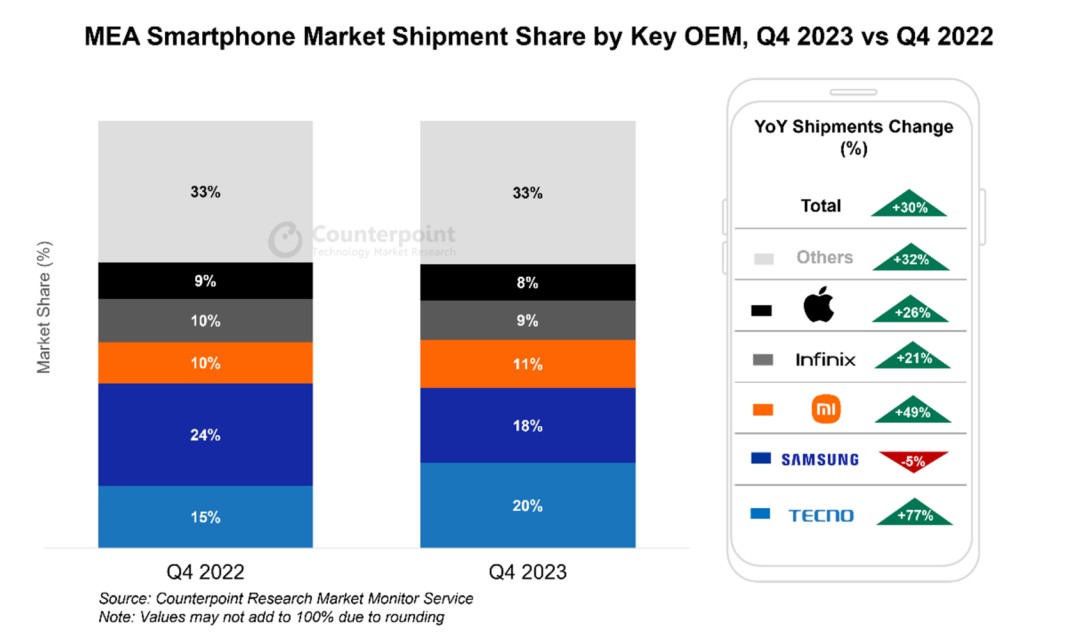

中東和非洲 (MEA) 地區智能手機市場強勁增長,TECNO 首次超越三星登頂

2023 年第四季度,中東和非洲 (MEA) 地區智能手機出貨量同比增長 30%,環比增長 9%。2023 年全年出貨量同比增長 11%,反映出市場需求不斷增長和消費者信心改善。本季度 5G 智能手機出貨量同比增長 60%,主要由三星和蘋果驅動。TECNO 在第四季度同比增長 77%,首次超越三星成為市場領導者。榮耀憑藉在不同價位段推出多款新品,成為 2023 年第四季度同比增幅最大的品牌。

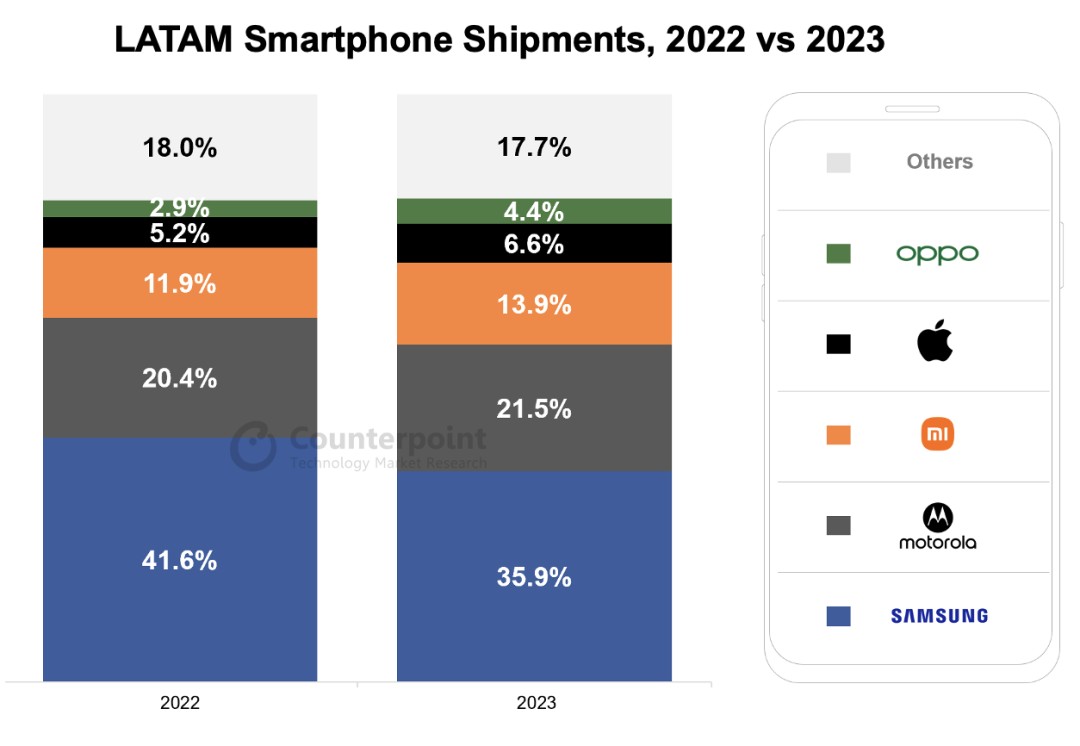

拉丁美洲智能手機市場 2023 年同比下降 3%,但隨着競爭加劇,市場預計將有所增長

Counterpoint 預測該地區智能手機潛在市場總額 (TAM) 將在 2024 年實現低個位數百分比增長。2023 年第四季度智能手機出貨量同比增長 4.2%,是該地區連續第二個季度出現增長。三星仍保持該地區第一的排名,2023 年第四季度的市場份額為 30.5%,低於 2022 年第四季度的 39.2%。蘋果取得了有史以來最好的季度,市場份額為 7.7%。榮耀在 2023 年第四季度排名第五,市場份額為 4.6%,是其歷史最高水平。

2023 年印度智能手機市場繼續表現平穩,蘋果出貨量首次突破一千萬部

三星在 2023 年以 18% 的份額位居榜首,自 2017 年以來首次登頂。vivo 在 2023 年以 17% 的份額位居第二,並以 33% 的份額領跑入門級高端機市場(30,000 至 45,000 印度盧比)。蘋果出貨量突破一千萬部大關,助力該公司首次奪得該自然年營收榜首。2023 年 5G 智能手機出貨量份額超過 52%,同比增長 66%。